14 January 2023

Content

- What Really Matters in Performance Reviews

- 2023 Investment Results

- Portfolio Management

- Market Outlook

- Summary of Portfolio Companies

What Really Matters in Performance Reviews

This is my 3rd Year in Review (you can also read what I wrote in 2022 and 2021). Unlike many investors, I don’t focus much on just one number - a gain or a loss over one calendar year.

Short-term results are too noisy

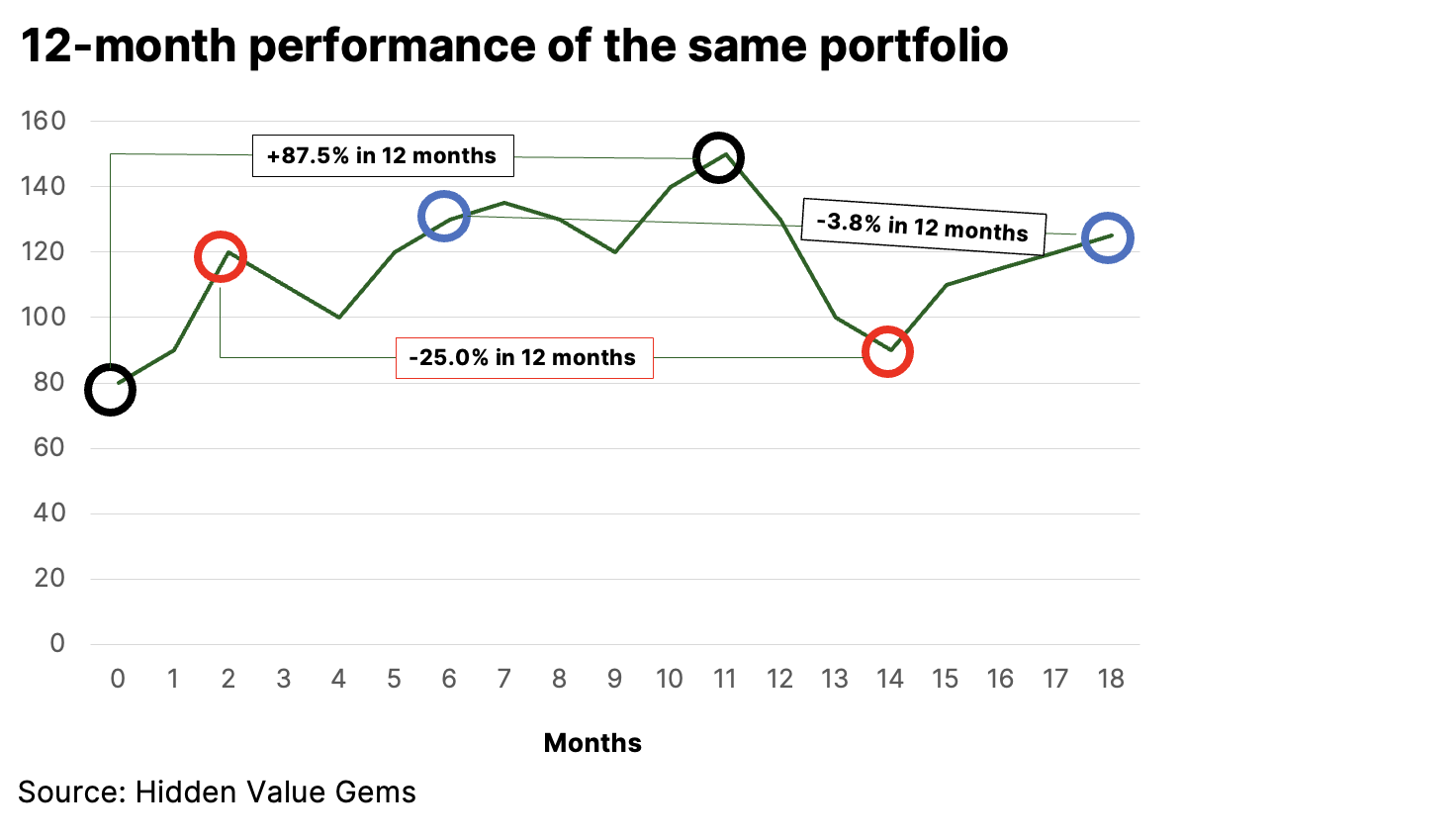

There is too much volatility in the short term. The improved sentiment at yearend can lift all the shares by raising the P/E multiple. This gain will be illusory unless your businesses (that you own via stocks) have improved their operating results. Move your 12-month performance period by a quarter, and your results would look radically different.

What helps in the short term, could kill in the long term

While this focus on the short-term results is understandable (especially if your bonus depends on it), this can lead to weak investment, especially over the long term.

If you want to deliver the best results in one year, you would need to use leverage and make bets on what will be the most popular asset class. But is this sustainable? Will such a strategy work if you want to build wealth over 30 years?

If you want to deliver the best results in one year, you would need to use leverage and make bets on what will be the most popular asset class. But is this sustainable? Will such a strategy work if you want to build wealth over 30 years?

Investing in businesses, not guessing future stock prices

Momentum is the best strategy for trying to predict short-term results. Yet, I do not know many billionaires who have followed this strategy.

The wealthiest people are mainly business owners. They either founded one or acquired one.

So, rather than focusing on the actual percentage change in the value of my portfolio, I use this annual performance ritual as a way to remind myself of what I am actually trying to achieve with my investments and to what extent my actions during the year were aligned with the strategy and principles.

I view the purchase of individual stocks as partnering with real businesses. The company's value grows if it can compound its capital over many years by reinvesting profits in high-return projects. So, during my year-end review, I pay particular attention to the underlying performance of companies in my portfolio, whether they have strengthened their market positions, margins, returns on capital and balance sheets.

I also ask myself whether my portfolio has become stronger compared to a year ago.

A stock portfolio could be viewed as a self-sustained business operating in various segments with different dynamics and plans. It is helpful to ask what your business (portfolio) is investing in. Other questions I focus on include:

How promising are new growth areas? How vulnerable is this business (any particular segment, stock, facing insolvency risks)? What is the source of funding? How stable are these ‘cash cows’?

The wealthiest people are mainly business owners. They either founded one or acquired one.

So, rather than focusing on the actual percentage change in the value of my portfolio, I use this annual performance ritual as a way to remind myself of what I am actually trying to achieve with my investments and to what extent my actions during the year were aligned with the strategy and principles.

I view the purchase of individual stocks as partnering with real businesses. The company's value grows if it can compound its capital over many years by reinvesting profits in high-return projects. So, during my year-end review, I pay particular attention to the underlying performance of companies in my portfolio, whether they have strengthened their market positions, margins, returns on capital and balance sheets.

I also ask myself whether my portfolio has become stronger compared to a year ago.

A stock portfolio could be viewed as a self-sustained business operating in various segments with different dynamics and plans. It is helpful to ask what your business (portfolio) is investing in. Other questions I focus on include:

How promising are new growth areas? How vulnerable is this business (any particular segment, stock, facing insolvency risks)? What is the source of funding? How stable are these ‘cash cows’?

Process over outcome, wisdom over data

I also pay a lot of attention to the process of selecting and managing stocks.

I want my process to be clear, replicable, scalable and constantly improving.

Ultimately, it is about accumulating knowledge and getting better every day. As Charlie Munger used to say:

I want my process to be clear, replicable, scalable and constantly improving.

Ultimately, it is about accumulating knowledge and getting better every day. As Charlie Munger used to say:

“Spend each day trying to be a little wiser than you were when you woke up.”

With this aim in mind, I have started a tradition with every annual review to share the most interesting books I have read, the best advice I have seen, and the most useful analytical tools I have learned. This year, I have also added the best podcasts category - all this will be shared in Part II (21 January).

Before diving into the most exciting part of the journey, let’s get the formal stuff (performance) out of the way.

Before diving into the most exciting part of the journey, let’s get the formal stuff (performance) out of the way.

2023 Investment Results

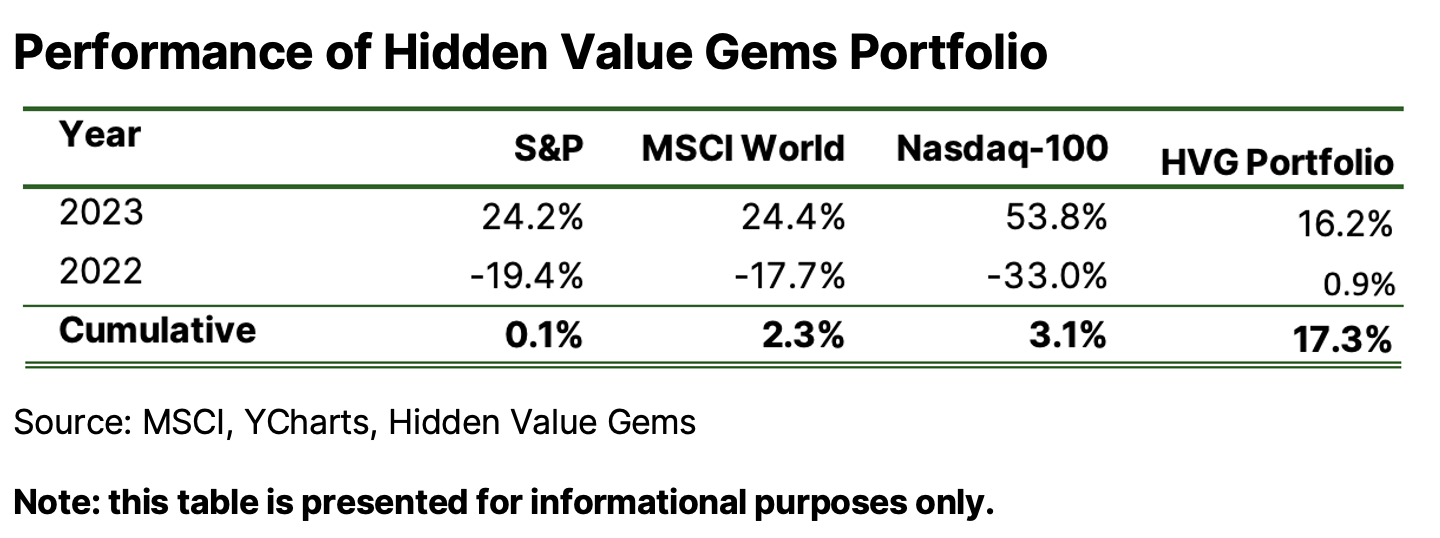

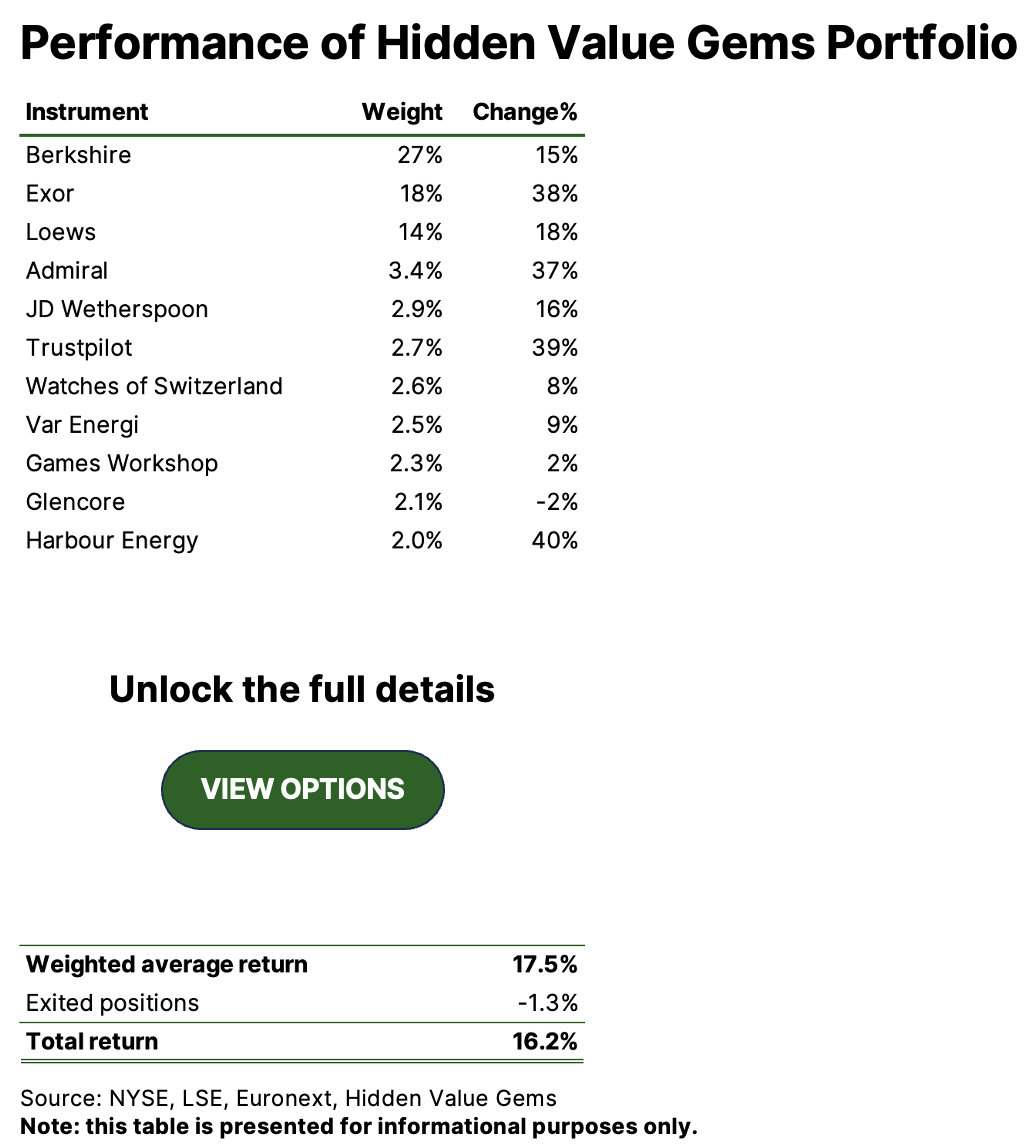

The total return for the Hidden Value Gems Portfolio in 2023 was a satisfactory 16.2%. While it is worse than the gains of the major world indices, my portfolio did much better in 2022 (+0.9%), so on a two-year basis, I am significantly ahead of the market.

Below is the breakdown of key positions with their weights and annual total return (price change + dividends).

Portfolio Management

A few points worth noting here:

- I believe position size should be determined by downside risk, not upside potential. While my largest holdings will not double in the near term, they have low business risks, which is great for compounding capital over the long term.

- I have started to pay more attention to my cash position. With higher rates, cash is no longer a residual of un-invested funds but an asset class of its own. The size of the cash position in my portfolio is a function of two factors. Firstly, I aim to maintain a ‘reasonable’ level of cash balance as a risk management strategy (see my separate post on Cash). Secondly, it depends on how many attractive opportunities I currently see. Cash makes investing easy, as there is always plenty to choose from during a downturn as long as you have some dry powder left. At the same time, the rising value of stocks in the portfolio reduces the weight of cash, which forces you to trim some of your holdings at high prices during the bull market (not sell them at the bottom).

- Since 2022, I have added many more positions than I used to hold. Partly, this has to do with me leaving my full-time employment (no need to go through the compliance approval process and hold a stock for a minimum period of three weeks). I have also decided to allocate 20-30% of the portfolio to ‘experiments’, similar to how Google or Amazon treat employee’s time and own capital. You cannot innovate and come up with revolutionary products unless you are dedicated to experiments. To be successful, you have to try many things but not spend too much on them. I also find that a small position provides good flexibility in terms of either increasing it or “killing” the idea, depending on the results of further analysis. Hopefully, this part of the portfolio will eventually become the source of one or more multi-baggers.

- I also look at my portfolio as one business conglomerate. I am satisfied that this “conglomerate” has added important growth drivers beyond “stalwarts” (Berkshire or Loews) companies like Trustpilot, Games Workshop and Watches of Switzerland. I have also added low-cost energy producers, which can deliver production growth and improved returns in the environment of low-capital investments.

Market Outlook

I generally do not base my investment strategy on what I expect market conditions to be in the next 12 months. One thing I learned over many years is that there will always be a surprise I have not thought about. And most things we tend to worry about do not materialise, at least in the near term.

Nevertheless, here are my key assumptions for 2024:

Nevertheless, here are my key assumptions for 2024:

- The general market environment is more challenging. Last year, I wrote that I would be a net buyer of stocks in 2023 as the market mood was too gloomy. I do not think it will be that easy in 2024. Simply put, markets are higher while the economy is not.

- Geopolitics and military conflicts are rising. This should be partially priced in, given how much this issue is discussed in the media.

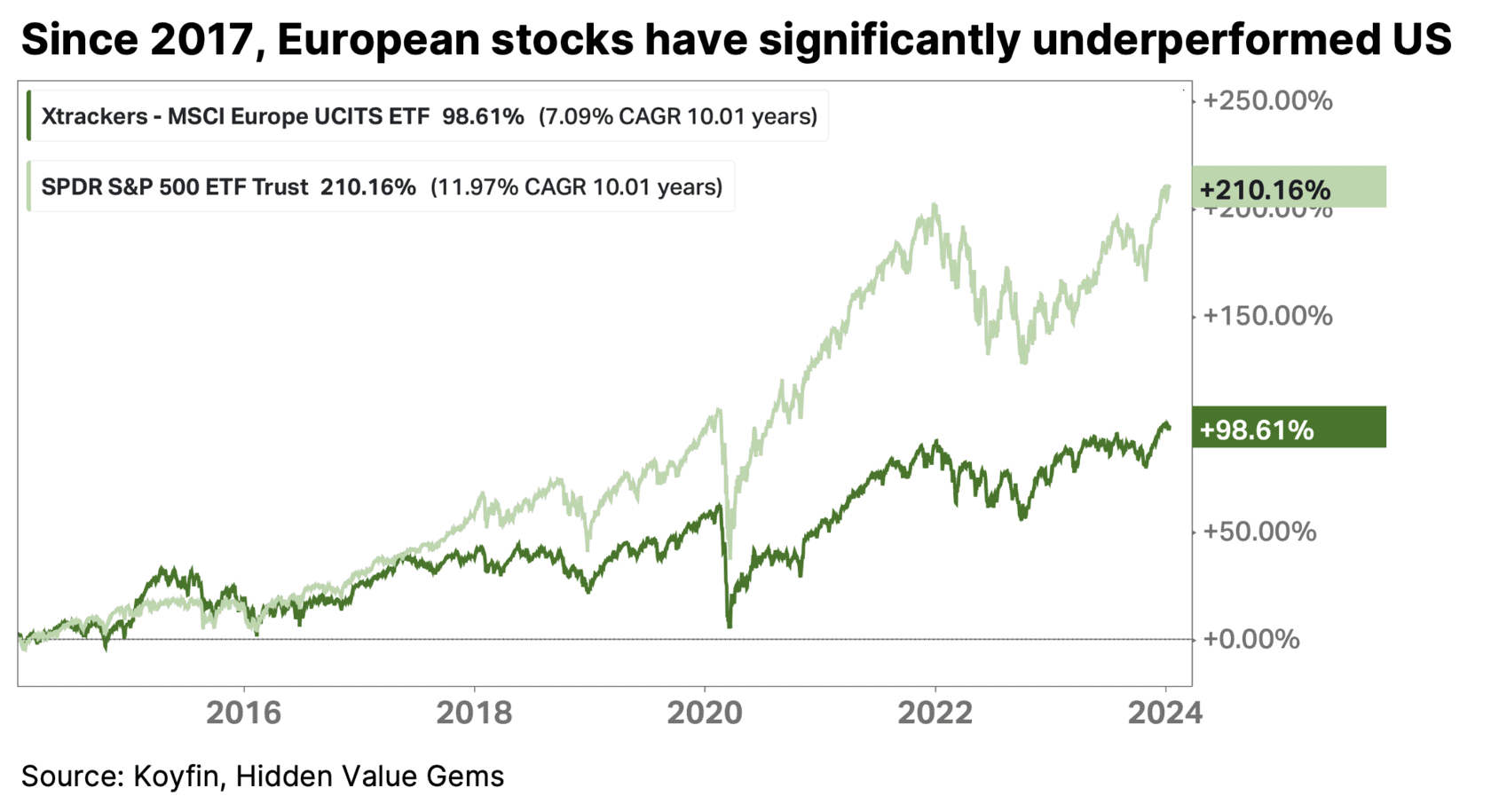

- Active investors can actually benefit in the new environment. The rise of passive ETFs, growing market concentration (the magnificent seven) and increasing focus of the investment community on large and most liquid stocks have led to more inefficiency in the mid- and small-caps. I am particularly excited about Europe, where valuations are lower than in the US, yet many businesses have been successfully growing for decades, and many derive significant revenue from the international markets.

- The environment will likely lead to higher volatility and provide opportunities for more tactical trades, unlike in the 2010s, which was the best time for buy-and-hold ‘bond proxies’, as economic growth was stable and valuation multiples were expanding. Having smaller positions and a bit more cash than in the past is probably worth it since one takes advantage of more volatile stocks by adding to those positions that saw price declines, as long as fundamentals still remain solid.

- The best and final point about the outlook I can make is to state that strong businesses will take advantage of weaker macro by consolidating their positions and reap the benefits during more prosperous times. In other words, identifying truly exceptional companies and buying them at reasonable prices is the best course of action, which should work well under any condition, although not always in the short term.

Summary of Portfolio Companies

- Berkshire - the core business remains strong. The insurance segment is benefiting from higher interest rates, while the so-called inflation hedges (railroads and utilities) are well positioned for the current environment. The sad news about Charlie Munger in November 2023 reminded us yet again of the succession and raised the question of Berkshire beyond Buffett. I think the business model and the top management structure with the four core executives below Buffett are strong enough to deliver adequate results many years ahead. The growing size remains a long-term issue as it limits the investable universe for Berkshire. Short-term falling rates may reduce investment income in the insurance business (but arguably boost other operations). The relative size of Berkshire’s Apple position is also a short-term negative issue. With all that, I plan to stick to my Berkshire position for the foreseeable future, especially since there are meagre holding costs (lower than the ETF) and no tax implications (dividend withholding tax, income tax and others).

- Exor - the company has diversified its portfolio further into the sectors it views as strategic (Healthcare, Luxury and Technology). In particular, Exor spent €2.8bn to acquire a 15% interest in Philips, a market leader in professional medical equipment, facing temporary challenges. Exor also strengthened its financial arm (Lingotto) and continued investing in Exor Ventures. Core businesses continue to deliver strong results. It was also reassuring to learn about the €1bn buyback programme launched last year and partially executed, one of the key steps you expect from a prudent capital allocator. I am comfortable with my current position, as the stock remains inexpensive and the company progresses steadily at building core businesses.

- Loews continues to progress steadily at its core business lines, especially Hotels, Pipelines and Packaging. The listed insurance subsidiary CNA has started to benefit from higher interest rates. Management continues to buy back stock which remains undervalued (relative to the sum of the parts). I see no reason to change anything about this position for now.

- Admiral is a market leader in a highly competitive UK motor insurance industry, expanding into new segments (home and pet) and new countries (Europe, US) with growth projects funded through the P&L, which makes reported earnings look weaker than the core profitability. With higher rates and stronger premiums, the business should enjoy better profits in the future, although the share price seems to reflect this scenario already. I am not too worried about the news on 10 January 2024 about potential FCA penalties, as selling products in instalments seems to be a standard business practice. A minor penalty would not radically change the business model.

- JD Wetherspoon - the case has been unfolding almost exactly as I anticipated, with continued traffic and sales improvements and consequent profit margins uplift. This has triggered the earlier launch of the buyback programme, which is a material near-term catalyst. The sad question is the price/valuation at which I should be prepared to part with this business since it is a ‘stalwart’ to borrow from Peter Lynch. My earlier assumptions suggested that at 100p normalised earnings and 15x PE, this could be a £15/share company, which implies almost 80% further upside. But it would probably take longer to get to both, so some profit taking along that recovery is merited.

- Trustpilot is another success story as the stock surged 39% by year-end (from the time of the purchase in late September 2023) and jumped another 18% this year on stronger operating results and the launch of a £20mn buyback programme. I have trimmed my position by almost a quarter as the stock seems to be running slightly ahead of the underlying growth. Nevertheless, if the business can achieve critical scale, its value could easily be in the billions (compared to a £600mn current Mkt Cap).

- Watches of Switzerland - the company’s operations have been in line with management’s guidance so far in 2023, despite market concerns over tougher macroeconomics and, in particular, the impact of the acquisition of Bucherer by Rolex. The company is trading at 12.1x forward PE, which is reasonable for a retailer but low for a luxury goods company. If my assumption about the unique role of physical retailers in the luxury value chain is correct, the company should re-rate to 15-25x PE while continuing to deliver on an ambitious growth plan (more than doubling adjusted EBIT by FY28 driven by double-digit top-line growth and 50-150bps margin improvement). Of course, a more challenging macro environment, cooling down of demand post 2021 mania in collectables and rising competition from online sales.

- Var Energi - the stock should have a very exciting 2024 as the company launches Balder X into production (scheduled for Q3 ’24), which (together with two smaller projects and completion of Neptune acquisition) should lead to a 100% growth in production by end-2025 and a material reduction in capex (by c. 50% without new growth). The stock is currently trading at an expected P/E of 6.8x (FY23). If it delivers on its growth plans, the company will be worth less than 3x P/E and over 40% FCF yield by the end of 2025.

- Games Workshop - This is the highest P/E stock in my portfolio, but also with very strong customer loyalty, who are often becoming its biggest promoters. The business should benefit from international expansion (especially in the US) and media content agreed with Amazon last year.

- Glencore - I am still trying to figure out the best way to get exposure to the massive changes coming from the energy transition. This should lead to materially higher demand for copper and select other metals; however, with a significant (c. 50%) share of demand coming from China, there is a clear headwind in the near term. With energy markets finding some equilibrium at much lower levels than in 2022, its coal business will become a much less important earnings driver. Trading remains a highly lucrative business in a period of high volatility and long-term shifts in trade flows in the changing geopolitical environment. I plan to summarise the net impact on Glencore from all these critical trends to decide if I should still hold on to the stock or exit (a more likely scenario).

- Harbour Energy - a fairly successful investment so far as well. The company was extremely cheap when I bought it in the summer of 2023, on track to generate $1bn FCF and achieve a zero net debt position by the end of 2023 (over 30% yield). The issue was a short reserve life, falling production and a material increase in the petroleum tax levy in the UK. On the last week of the year, the company announced a reverse takeover with Wintershall Dea, which I discussed in more detail in an article for Premium Subscribers. I used the share price strength to reduce my position by c. 20%, considering the cyclical nature of the deal, the long completion process and the risk of not receiving regulatory clearance.

Continue reading this review with a Premium Subscription. View options.