15 January 2023

Content

- 2022 investment results

- Quick thoughts on stocks in My Portfolio

- Market outlook

- Best books

- Best analytical tool

- Best advice

- Goals for 2023

2022 investment results

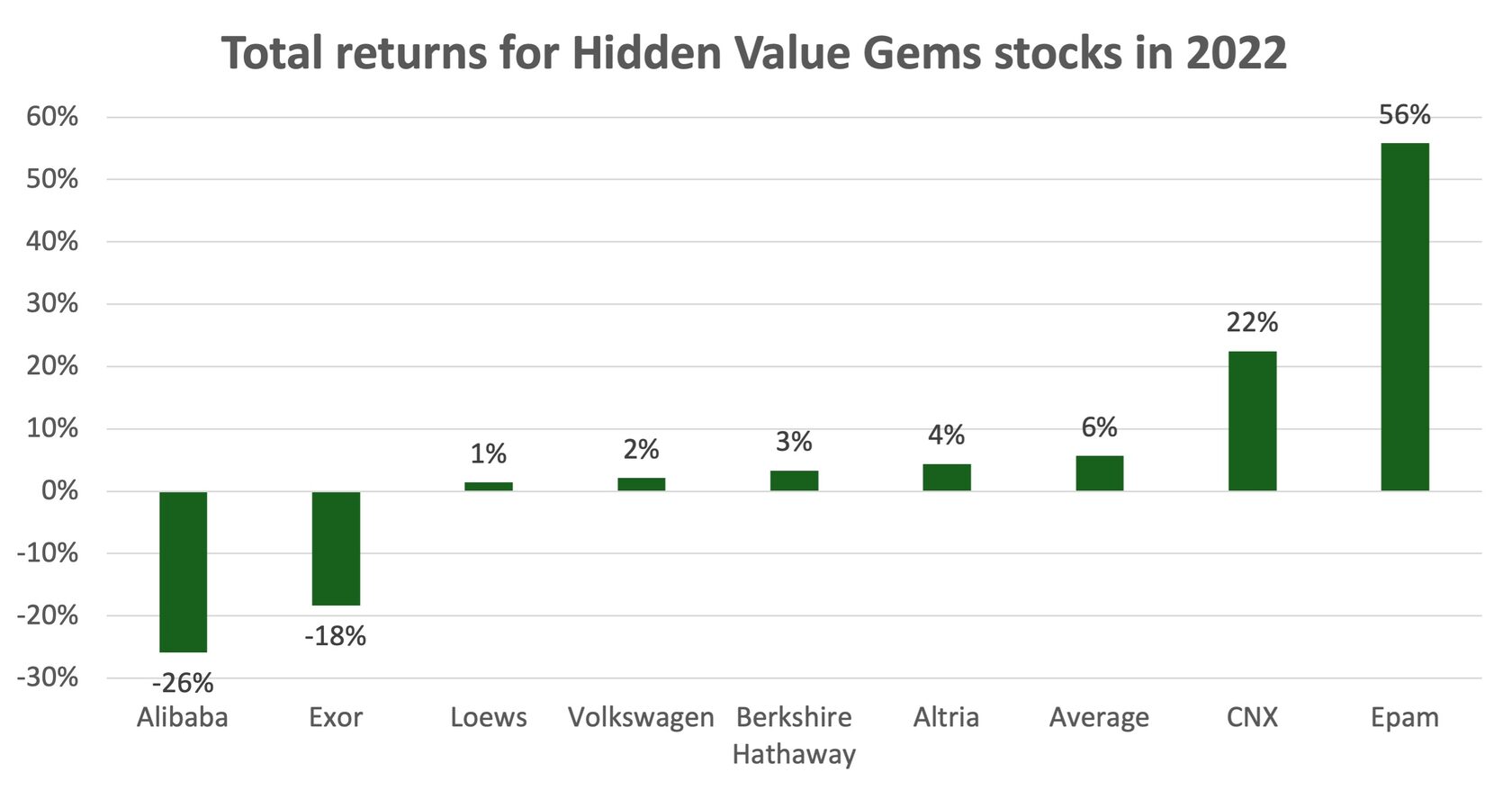

On average, the seven stocks I discussed in the blog’s Portfolio section have returned 6%, beating the S&P 500 and MSCI World indices by 12% and 8%, respectively. This calculation assumes equal weights for all stocks. For EPAM and VW, performance is calculated from the time of purchase, not the start of the year. I also include all dividends.

Notably, 6 out of 8 stocks have delivered positive results.

Source: Google Finance, Hidden Value Gems

The performance of my actual portfolio has been broadly flat. One of the best contributors, which I have not discussed in detail on my blog, was Glencore (+38% in USD terms, including dividends).

The most important point for me in these results is that I have achieved them with one of the lowest turnovers in my career. There was not a single stock that I purchased and sold within a year, for example. Most of the stocks in my portfolio were bought a few years ago.

Over time, I have started to appreciate Warren Buffett’s Punch card concept much more. This may not be a great strategy to build a fund management or an advisory business (how can you justify the fees if you only pitch one stock a year?), but it is a much better way to build personal wealth, in my opinion.

Another point I am happy about is that I have started the year with close to a 10% cash position. I have a similar level of ‘dry powder’ going into 2023, which provides me with a bit of flexibility to look for new opportunities.

There were still four new additions in 2022: EPAM, Volkswagen Group, Moderna and Admiral Group.

I have followed EPAM for about two years and was waiting for a good entry point. I thought the market overreacted earlier in the year and took advantage of it. The company has a market cap of $19.6bn (61% higher than what I paid for), with $1.5bn of net cash. If it continues to deliver 30% annual growth, its revenue should almost reach $10bn in 2025. Assuming its historical net income margin of 10%, EPAM could be generating $1bn of net income. This puts it on 18.1x PE multiple - not very cheap; however, I think it is justified given the qualities of the company and its growth rate. Economic slowdown represents a major near-term risk. I also need to dig deeper to understand how they stand against key competitors and how unique their service is for a customer.

Volkswagen is mostly a valuation call

The company has been cheap for a long time, but I didn’t have time to review its accounts before. I am comfortable with the economics of the company’s core business. In my view, its strategy to unlock value through IPOs of individual businesses and paying special dividends is essential to reduce valuation discount. There may be nuances on the best way to do that (e.g. spin-offs vs IPOs, buyback vs dividends), but they are secondary.

On top of that, the company has a strong track record of growing profits and paying consistent dividends. The major risk is the fast transition to electric vehicles, the segment in which VW lags behind market leaders. So, not only can its market share shrink drastically in the future, but shareholders face a potential risk of wasting money on R&D programmes as VW tries to catch up with rivals. As with most value calls, the time is not on my side, but I hope the valuation discount closes before the challenges become major problems.

Moderna is a low-conviction idea

I bought it as a free option in March 2022. However, I am coming to the conclusion that I lack any visibility on mRNA players. I have realised the space is much more competitive, and Moderna is not unique, so I am considering exiting the position.

Admiral Group

It is more of a tactical trade I made in the autumn of 2022 when the British pound was in free fall. I wanted to buy a quality business at an attractive price. Admiral Group has an exceptional track record of growing earnings and paying dividends. It is a leading car insurer in the UK. The rise in inflation represents a significant short-term risk (higher claim payments). However, they also benefit from rising interest rates. They have been raising their policy prices since early 2022, ahead of major competitors. While near-term results should be weak, I think it should be a good investment over the mid-term.

I did not sell any stock in 2022; however, I trimmed my position in Altria and Glencore.

Quick thoughts on other stocks in My Portfolio

- Berkshire Hathaway remains my core holding. It does not offer much upside, but equally, it has little downside. If we are entering a stock-picker’s market, Berkshire’s capital allocation skills should become especially valuable (e.g. its pivot to energy in 2022, which turned out to be the best-performing sector).

- Loews and Exor. These are bets on capital allocation skills coupled with cheap valuation. Both companies trade at a discount to their holdings, and both are carrying out buyback programmes. Both of them are family-led companies. Loews is purely a US company, while Exor is more international, with a relatively high exposure to Europe and growing exposure to China. There is more uncertainty about Exor. It still has significant exposure to the traditional cars and trucks segment, while its exposure to China is relatively small. Moreover, the company is looking to deploy more cash in the midterm, which adds to the uncertainty.

- CNX. I was lured by the company’s low-cost structure, growing FCF and active buyback programme (10%+ a year). However, in the last couple of quarters, the company has been talking about raising capex without the corresponding increase in gas production. My additional work on the quality of their assets suggests that they may not be as high as I thought before. While I expected the company to be able to grow its production in the future, at this stage, this looks very unlikely (not only because of management’s priorities). With this, CNX's upside is less than I initially expected, and I plan to reduce my position at higher price levels.

- Altria. The company remains a market leader in traditional tobacco in the US, but the overall segment is losing to new smokeless products, and Altria does not seem to be the market leader there. Besides, its pricing power turned out to be weaker than I initially thought. The stock held up well and paid nice dividends, but the upside is limited, and I plan to exit this position.

- Alibaba. I overestimated the fair value of the company, and it is my biggest investment mistake. I purchased the stock in the autumn of 2021, thinking political/regulatory risks were overblown. I can blame the market for the continued overreaction, but the truth is that Alibaba’s local competitive position has deteriorated since then. The company had to reduce take rates and spend more on its products, driving its profits much lower. I am working on an update on Alibaba, which I will publish shortly.

Market outlook

People I consider the smartest investors always say they have no idea where the market will be tomorrow or in one year. I stopped trying to predict the direction, too. However, there are three points I would like to make (two positive, one negative):

1. It is better to buy stocks during times of pessimism. I don’t know if this is the moment of maximum pessimism (probably not), but the mood and business headlines are definitely much more pessimistic than a year ago. So, unless you are fully retired, I would be a net buyer of stocks in 2023.

2. I can imagine a lost decade that many analysts and investors talk about. Following a period of rapid globalisation and easy money, the global economy may be adjusting to new policies, facing structurally higher inflation and interest rates. Without the PE expansion tailwind, with weaker economic growth and higher social pressure, markets may be unable to deliver their historical 10% annual returns (at least based on 100-year US market history).

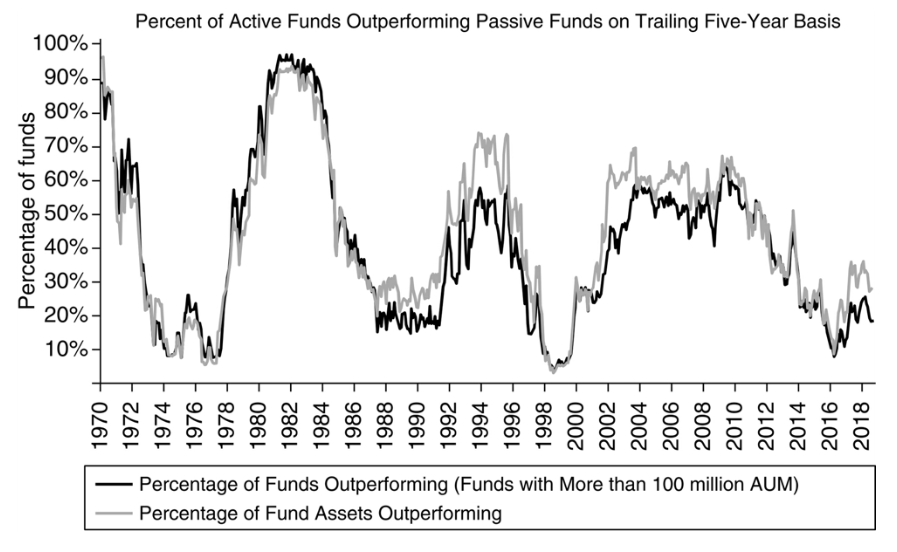

3. I think the conditions for individual stock investors may be better compared to the previous decade. The central point of the past rally was high concentration, both on the geographic and sectoral levels. It was mainly about the US market, and within the US, it was the Technology sector. Growth stocks dominated Value. If the old paradigm of easy money, low inflation, globalisation, etc., is broken, then it is possible that the opportunity set will be more versatile.

Source: Non-Consensus Investing by Rupal Bhansali

Finally, amidst the sea of negativity that is spread in the news and among many commentators, I would like to draw attention to the less-discussed but more critical development - the resilience of market economies and, more broadly, the strength of human nature. Our society has faced several significant challenges in the past few years. One of them was the COVID pandemic. Another was the Russia-Ukraine war, which triggered various sanctions, including restrictions on Russian oil exports. If you asked yourself at the beginning of 2022 what would happen to oil prices if the biggest exporter (10% of global supply) gets sanctioned, you would probably guess prices would be higher by a lot.

And, in fact, many Wall Street analysts did just that. A number of them put a number at $150, and some even $200 per barrel.

What happened was quite amazing. By the end of 2022, Brent was $85.9, just a little higher than on 30 December 2021 ($79.1). It was actually lower by December 2022 compared to 25 February, the day after the invasion ($91.8). Even more remarkable was that European natural gas prices actually declined by the end of the year despite the continent's high dependence on Russian gas (over 30% of the gas supply to Europe came from Russia).

Of course, prices can still rise (and quite possibly will), but this would not dispute the point of how complex and adaptive the market economy is. The ability of mankind to overcome various obstacles, often seemingly unresolvable at first, is truly remarkable. I am even more amazed that a lot of this success happens naturally, without top-down coordination, often when people pursue their individual goals.

The quote from Adam Smith summarises this best.

“Give me that which I want, and you shall have this which you want… and it is in this manner that we obtain from one another the far greater part of those good offices which we stand in need of. We expect our dinner not from the benevolence of the butcher, the brewer, or the baker, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.”

- Adam Smith, The Wealth of Nations

Best books

Similar to last year’s review, I have two favourite books that I am happy to recommend.

The Sleuth Investor by Avner Mandelman

The book made a significant impact on me as it made me think more about moving away from mostly desk research to the real-life due diligence of potential investment opportunities. It was written by a practising money manager and has several helpful case studies. While some of the methods shared by the author may look odd, don’t be put off by them. The guiding principle is super important, in my view.

The book resonates with the idea widely popularised by the legendary Peter Lynch on observing shopping malls, new products, children’s favourite toys and so on. A similar idea was discussed earlier by Phil Fisher in his classic book ‘Common Stocks and Uncommon Profits’ when he described his ‘scuttlebutt’ approach.

Unlike these books, however, The Sleuth Investor puts a particular emphasis on analysing B2B companies. The book illustrates the nuances of purchase processes at corporate clients who may have three different groups involved in the purchase (1. Those who recommend to send checks - product users and vetters; 2. People with the power to decide that checks be sent - decision makers; 3. Those who actually send the checks—paymasters). It also provides more tools for undertaking the actual due diligence and adds other new perspectives.

After reading the book, I started to dig much deeper when analysing a potential investment opportunity. Even if it is only meeting someone who may have worked in a company or a sector, there is still much to learn from them. As a minimum, it will help you make fewer mistakes.

The Power of Now

This is a book on Human Psychology rather than investing. However, successful investing is the product of successful systems, which include the right processes and mindset. You won’t find an outstanding stock just by utilising your willpower. Besides, investing cannot be the end goal in life, even if it is one’s biggest passion. For me, it is a means to freedom to decide how I use my time (where, how, and with what people).

So, I often read books on psychology and broader topics.

The Power of Now is one of those books you start appreciating with time. It is not a straightforward essay with a clear 3-step formula to achieve success. I did not quite appreciate the audio version when I first listened to it. It is easy to miss genuine messages if you reflect on most paragraphs and sentences. Some parts of the book are debatable, but I am generally grateful to it as it teaches us to cherish the current moment and focus on the Now rather than always live in the future or the past. Slowing down, taking a pause, and possibly taking a step back are good habits that I try to develop after reading the book.

I just bought the second book, called Practising the Power of Now, by the same author.

Best books in 2021: Atomic Habits and How to Get Rich

Best analytical tool

A few years ago, I read a book called ‘Capital Returns’ which discusses an investment framework developed by London-based Marathon Asset Management. The book’s core message is to avoid investing in sectors where investment spending is unduly elevated, and competition is fierce and to put one's money to work where capital expenditure is depressed; competitive conditions are more favourable, and, as a result, prospective investment returns are higher. The authors argue that tracking capital flow is often more critical than monitoring demand.

There are a few tools to follow the capital investment cycle. One of the simplest is calculating the Capex-to-Depreciation ratio for all major companies in the sector over 20 years. A period when the ratio is well below 1x will indicate the beginning of improved shareholder returns.

Given what has happened first to the technology sector and media content with almost unlimited investments by numerous players and later what happened to the energy sector, this concept deserves to be called the best analytical tool of 2022.

Best analytical tool in 2021: Capital Returns by Marathon Asset management

Best advice

Throughout the year, I read and listened to many materials on self-improvement. The idea that made the biggest impact on me during 2022 was this.

Goals for 2023

1. Look for more ideas in mid- and small-caps. My current portfolio is reasonably low risk, but it does not have the advantages of a small-sized portfolio, which can have some little-known, fast-growing or deeply undervalued businesses. I want to take more advantage of the small size of my portfolio (relative to institutional investors), as well as a flexible investment policy and long-term focus (no need to provide quarterly performance updates). I am particularly interested in European stocks, also Asian to a lesser extent (I have almost zero edge in that region).

2. Do a quick analysis on more stocks and read more annual reports (at least 50 during a year, about one every week).

3. Improve the system to track and follow up on interesting stock ideas. I come across many stock ideas but often need to follow up. Sometimes, when I do additional analysis, I don’t keep track of it in one place.

4. Read more books (at least 30, ideally spending an hour every day). Over time, I noticed that reading books helps me in investing much more than reading news articles or even listening to podcasts.

I also have a few personal goals, like drinking less coffee (cutting my consumption from 2-3 cups a day to just one).

I plan to record my progress on a board in a living room (make my goals public) and pay my 10-year-old daughter some money at the end of the week when I fail on my goals. For anyone interested in developing good habits, I strongly recommend James Clear’s book Atomic Habits, which I profiled last year in the Best Books category. In his recent podcast with Tim Ferris, James summarised his four-rule approach to changing habits in the following way:

“ If you want to build a good habit, you want to make your habits obvious, attractive, easy, and satisfying. And if you want to break a bad habit, you just do the opposite of those four. So you want to make it invisible, make it unattractive, make it difficult, and make it unsatisfying.”

Thank you for taking the time to read this post. I am interested to hear your feedback, thoughts and suggestions. You can drop me an email at ideas at hiddenvaluegems.com.

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.