I have outlined the key ideas that I learned in 2021 in this post.

They are presented by key categories: Books, Valuation, Scientific concepts, A question to think about in 2022 and a New Year Resolution.

Most important books

Atomic Habits by James Clear

Most self-help books teach you what you need to do to succeed in life. This book gives concrete tips on how to improve.

Atomic Habits teaches you a crucial skill: making good actions effortlessly by turning them into a habit. James Clear’s point is that your willpower is like your physical muscles. You can use your muscle power for a short period only. Eventually, you will ‘overexercise’ and stretch your muscles. You cannot always push yourself to do certain things by constantly using your willpower.

Instead, things that we do naturally, without overthinking (brushing teeth or holding a spoon when eating), do not cost us anything in terms of energy or attention. The secret is turning the right activity into a habit (e.g. exercises, writing, learning a new stock every day, speaking to your friends from whom you can learn new stuff). Identify the actions needed to become successful and make them your habits.

The crucial point is that the book has a practical set of recommendations on how to achieve it. Glad that I read it and highly recommend it.

How to Get Rich by Felix Dennis

The author tells his own story of how he got rich, including practical steps he took as well as the feelings and doubts he had along the way. Many other books written by self-made people have similar stories (identifying an opportunity early, not being afraid of failing, being persistent, finding great partners and so on).

The two biggest takeaways are that wealth does not make you happy and that time is probably the most precious resource. Granted, both points are almost

This book made me appreciate time as one of the most valuable resources and a reason to be happy, enjoying what I have now rather than living in the future. Felix Dennis thought that young people had the best chances of succeeding. “You have stamina far, far beyond those who are twenty or thirty years older… You have no idea how much the stamina of the young is envied by the rest of us… Young, penniless and inexperienced - nothing to lose. Believe it or not, I envy each and every one of you”.

I quote directly from several parts of the book:

“If I had my time again, knowing what I know today, I would dedicate myself to making just enough to live comfortably (say £30 or £40 million), as quickly as I could - hopefully by the time I was thirty-five years old. I would then cash out immediately and retire to write poetry and plant trees”.

“Happiness? Do not make me laugh. The rich are not happy. I have yet to meet a single really rich, happy man or woman - and I have met many rich people. The demands from others to share their wealth become so tiresome, and so insistent, they nearly always decide they must insulate themselves. Insulation breeds paranoia and arrogance. And loneliness. And the rage that you have only so many years left to enjoy rolling in the sand you have piled up”.

“Am I happy? No. Or, at least, only occasionally, when I am walking in the woods alone, or deeply ensconced in composing a difficult piece of verse, or sitting quietly with old friends over a bottle of wine. Or feeding a stray cat”.

“What are riches anyway, compared to health or the peace of mind that even a modicum of contentment brings in its wake? In and of itself, great wealth very rarely, if ever, breeds contentment”.

“Only you can know the song of your inner demons. Only you can know if you are willing to tread the narrow, lonely road to riches. No one else can know. No one else can tell you either to do it or to refrain from the attempt. When the going gets tough, when all seems lost, when partners and luck desert you, when bankruptcy and failure are staring you in the face, all that can sustain you is a fierce compulsion to succeed at any price”.

Two new factors when evaluating a company

Recently, I have started to appreciate the importance of the Culture and Product of a company, even more than management, margins, valuation multiples and growth prospects.

Both Culture and Product are still out of reach of AI, which is much better than humans at detecting all other, mostly numeric qualities (e.g. a low-PE or a high-ROIC screens).

A retail investor can also have an advantage at both of these factors over an established asset management firm. An individual who has friends working for a particular company and who has used its product would know more about the business than a portfolio manager who has to manage a 100+ stock portfolio and rely on recommendations of his analyst studying spreadsheets and poring over sell-side research reports.

The right Culture can lead to success even when chances seem low. After reading books on Netflix and Amazon, I think their success was largely due to culture, which encouraged innovation. Not trying was a much bigger sin than failing at both of these companies. In his autobiography, Charles Schwab writes about his constant focus on helping his client (an average person in the street) pay less for quality service. He also maintained a long term focus (similar to Amazon and Netflix), ignoring the impact of his decisions on subsequent quarter earnings or market reaction.

I plan to learn about the culture at my potential investment opportunities in the future by checking online forums like Glassdoor and ideally speaking professionals who work there or for direct competitors (as was described in the Sleuth Investor book).

My experience of holding low PE stocks whose product was losing market position has also taught me to learn more about the product before investing. No product can be great all the time. But with the right culture, a company has good chances to overcome short term problems and come up with a better product eventually.

If there is a choice between a company with an average product and a very attractive valuation multiple, on the one hand, and another company with an outstanding product, but a high multiple, I would go for the second. There are many examples that I have come across over time, for instance, Abercrombie & Fitch vs GAP, TJ Maxx vs Macy’s, BMW vs Renault, Franklin Templeton vs T Rowe Price, McDonald’s vs Wendy’s.

Analysing a product is easy if you use it yourself. You can also ask your friends, wife, children. For B2B products, a professional would tell you immediately what supplier is the best and why.

This is a Peter Lynch approach which I have had the opportunity to appreciate more with time. My firm belief is that a company with a great product is almost always a better investment opportunity than a company with a low PE.

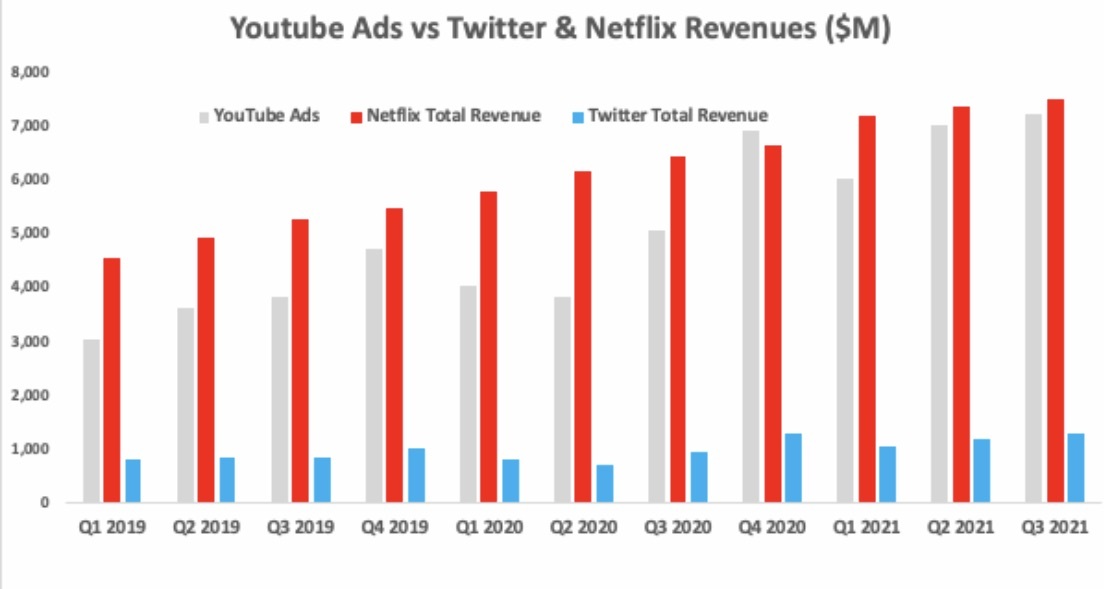

To finish with this point, let me bring two points on Alphabet. Firstly, YouTube ad revenue has almost caught up with the total revenue of Netflix, despite not paying for content generation compared to Netflix.

The second point is that Alphabet has been catching up in the Cloud business, which is now expected to be the biggest business line outside of online advertising (currently 80% of sales). Consensus expects revenue of Google Cloud to grow 50% this year to over $19bn, according to Wall Street Journal.

These two points illustrate that companies with great cultures and products can deliver spectacular returns for their shareholders.

Culture and product quality are more important than the price you pay, especially over the long term.

Two new science concepts applicable in Investing

Geometric vs Arithmetic Mean

This concept seems easy for anyone who studied maths at school. You use geometric mean to calculate compound return (CAGR) and arithmetic mean to calculate your monthly spending average, for example. But it was not until I read Fortune’s Formula by William Poundstone and Alchemy by Rory Sutherland that I came to realise the importance of Geometric Mean in investing. I wrote an essay on this issue called Why Most People Lose Money in the Stock Market. The Big Math Secret.

There are at least two key implications of this for investing.

Firstly, when choosing between scenarios with multiple outcomes, go for the one without a total loss. For example, you decide what roulette is better to play. One has four sections with the following outcomes: 2, 4, 0, 6. The other has different outcomes: 1, 2, 3, 5. On the one hand, the first roulette has a higher average payoff (3) than the second roulette (2.75), so the first option looks preferable.

However, if you plan to play many rounds, the best option is the second roulette: its geometric mean is 2.34, higher than the geometric mean of the first roulette (0).

The geometric mean concept also encourages to reduce downside before thinking about upside (similar to a Margin of Safety concept). For example, a 3-year return pattern of +40% (Year 1), +40% (Year 2) and -50% leaves you with less capital at the end of Year 3 than when you started investing. Two years of 40% gains each year (96% cumulative gain) are reduced to 0.98 in year 3 with a 50% decline. Any pattern without a loss, no matter how modest the gains are in each year, would have produced a better outcome. A pattern with +10%, +10% and -10% would also leave you better off (+8.9%). Avoiding large losses is much more important than maximising your gains, especially over the long term. This is one of the reasons I have a large position in Berkshire Hathaway.

Secondly, geometric mean highlights how challenging is investing in the stock market despite its strong performance on aggregate. A broad stock market index goes up by 7-10% a year, on average, based on past performance. But a median stock (a typical stock) delivers worse results than the group of stocks on average. Put differently, stock returns are positively skewed, which in math language means that a handful of stocks are responsible for most of the market gains. The same can be said about individual investors: only a select few become super rich (e.g. Warren Buffett), while the majority achieve modest gains or end up losing money.

This point has been confirmed by several studies made by Hendrik Bessembinder from Arizona State University. I discussed them in one of my earlier posts here. According to the Bessembinder study, 57% of US stocks have delivered results below short-term government bonds (T-bills). Moreover, just 4% of all stocks have accounted for the entire market gains (since 1926).

This year has been similar, with just five stocks accounting for over half of all S&P 500 gains since April, according to Goldman Sachs. These stocks are Apple, Microsoft, Nvidia, Tesla and Alphabet. More than 1,300 stocks within NASDAQ Composite (3,097 stocks in total) are down 50 per cent or more from their peaks within the past 12 months.

A new investment philosophy has become popular on the back of recent studies. You just need to find the next Amazon and hold it for the next 30 years. But don’t fool yourself - finding the next Amazon (or Google) is not easy at all. Until recently, Amazon had been a small, loss-making company with unproven business trading on ludicrous multiples.

Bayes’ theorem

The second math tool that I rediscovered last year was the Bayes’ theorem which helps to estimate the probability of an event based on the prior knowledge of conditions that might be related to the event. It is also called conditional probability. Put differently, it helps you estimate the likelihood of an event if a specific condition is in place.

Even though I studied this concept at university, I have never thought of its practical implications. Here is a simple example of how the Bayes formula can be applied in real life. Your friend meets a girl he describes as "shy and introverted”, and he tries to assess how likely it is that she works as a librarian. You need three inputs:

1) the Base Rate (the share of librarians in the population)

2) How common are the described characteristics are among all librarians? Essentially, we need to understand what proportion of librarians are women who are also ‘shy and introverted’.

3) The proportion of the population who are not librarians is also shy, introverted women.

I have discussed this case here. Note that a typical answer (about a 20-30% chance) is wrong.

I had also applied this approach to investing when I purchased Alibaba shares. So far, the experiment has generated a negative result (down almost -30%), but I remain optimistic. I have discussed my original thesis and an updated view here and here.

Question for 2022

Looking back, I have observed that it is relatively easy to invest when stocks are down 20-30%. The sentiment is quite negative, and it is not easy emotionally to push yourself to commit more capital. But if you have discipline and focus on fundamentals, you realise that stocks have become quite attractively valued. I try to normalise financial results (estimating recurring profits in normal conditions) and have a rough estimate for how long it would take for these ‘normal’ conditions to take place.

Suppose the logic of buying solid companies at highly discounted prices during a cyclical downturn makes sense to you. In that case, the next logical question becomes this: How can you ensure that you have sufficient funds to invest in stocks during the downturn?

One school of thought is to be fully invested at all times and not try to time the market. Peter Lynch and Warren Buffett are famous proponents of such an approach. In this case, when the downturn happens, you cannot increase exposure to stocks. All you are left with is potentially rotating out of more defensive names into more cyclical stocks, which would have fallen more.

The second school of thought suggests keeping 10-15% of your portfolio in cash, allowing you to take advantage of periodic drawdowns. The problem with such an approach is that you would likely underperform in a rising market (that it is for most of the time), and the challenge is to make up for this underperformance in a short period of a market correction. If you miss your window of opportunity, the underperformance gap widens more.

A partial solution to this dilemma is to consider your stage of life. A young professional would do better by maximising his stock holdings early on. His earnings will allow him to earn enough savings in the future and invest more during downturns.

Another option is to have a regular investing plan, i.e. investing a fixed percentage of your salary every month/quarter/year. This way, you buy fewer stocks when they are expensive and more stocks when they are cheaper. You also avoid the risk of being influenced by emotions when you are seduced to buy more when things look great and sell or not buy during the correction.

A mix of stocks and bonds could also be an option, at least theoretically. However, bonds normally underperform stocks in the long term. Besides, in the current environment, when inflation is accelerating, and bond yields are close to record lows owning bonds does not seem right. Increasing allocation to stocks that are at an all-time high now also does not seem like an obvious choice.

I have slightly increased the share of cash in my portfolio during the past year by not investing my salary savings into stocks, keeping the dividends and exiting some holdings like Alphabet and Charles Schwab. The last step made me wonder if I take too much risk by selling great businesses trying to time the market. From the fundamental point of view, both companies are valued generously but not extremely expensive.

Another option to address this issue is to own companies with a strong capital allocation track record. This is a reason I hold Berkshire, Exor and Loews in my portfolio. All these companies hold cash that they can deploy depending on what opportunities are available to them.

So the question I want to think more about in the new year is the adequate level of cash in a stock portfolio and how to reach it practically.

New Year Resolution

Finally, the New Year Resolution. It is well known that New Year resolutions hardly work (about 9-12 per cent of people stick to them for the entire year). Still, behaviour experts suggest that committing to goals at a special time of the year increases your chances to achieve them. This is one of the tips I found in Katy Milkman’s book ‘How to Change’.

I try to keep a list of key goals, monitor my progress, and periodically adjust those goals. My focus is on making necessary activities my natural habits as per the fantastic book Atomic Habits which I have already mentioned here.

And while I do not have one specific New Year Resolution, I have recently found the following concept quite appealing and worth thinking about:

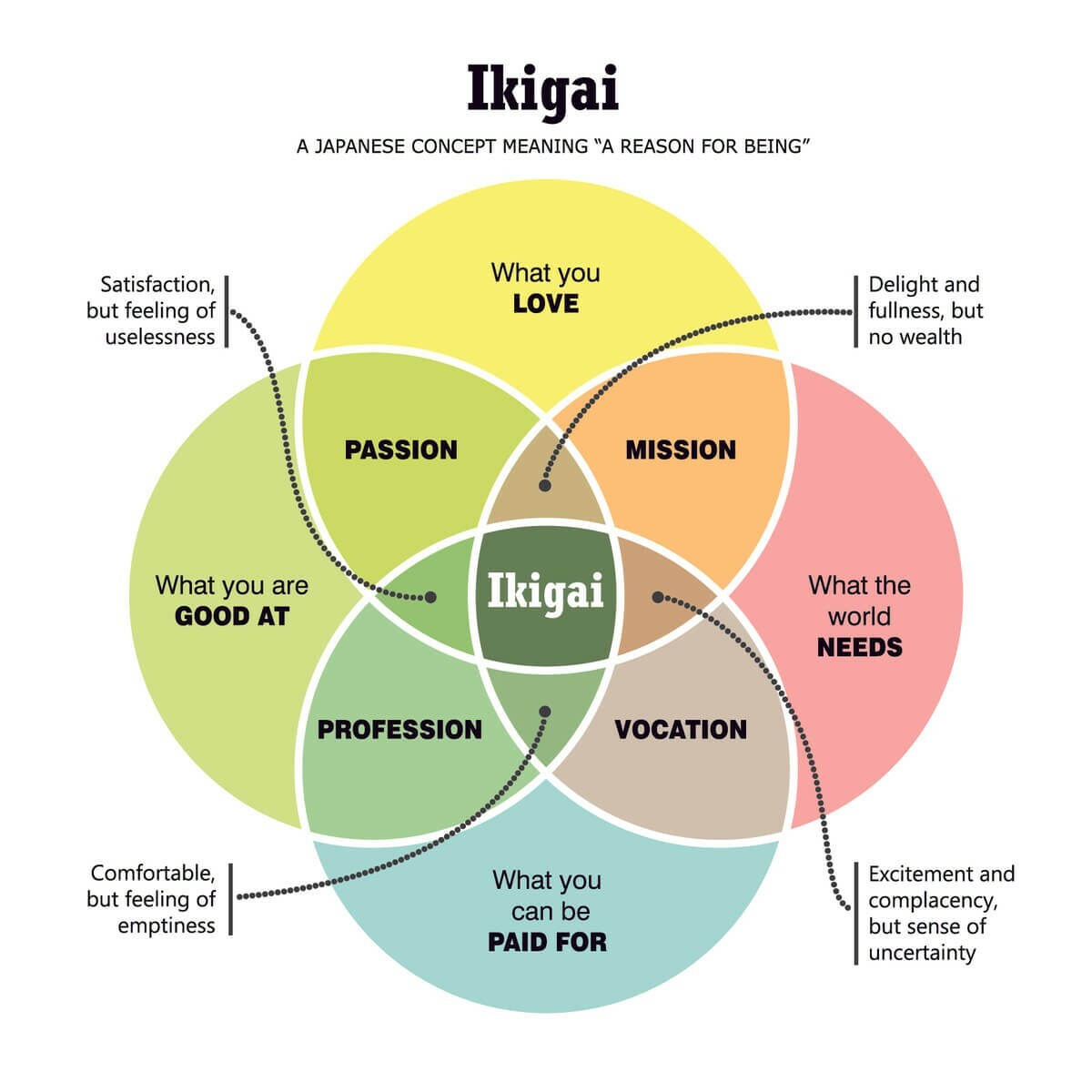

The concept of Ikigai

I have come across the concept on Twitter. The Ikigai philosophy suggests looking for activities that sit at the intersection of four things:

1) What we love to do

2) What we are good at doing

3) Can be paid for

4) Can benefit the world

I like how the concept is presented graphically and how many ideas can be drawn from it.

Thank you for reading this post.

Best wishes for 2022!

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.