29 October 2023

As old-time readers of my Newsletter would know, at the end of each month, I summarise the most interesting stock ideas that I come across. A company needs to have more than one of the following five qualities to make it to my list:

Once a company appears on the list, it has to pass further thresholds to make it into a portfolio. I ask myself if I understand the business well enough, whether the sector is predictable or prone to rapid changes. There are many other parameters that I look at before making the final decision.

Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

There is one exception to this rule in this edition of MSIL (Monthly Stock Idea Lab). Earlier this week, I bought one company from this month's list - Games Workshop. It has rarely been cheap, which always stopped me. But I have been doing more channel checks and just observing how people treat craft-related hobbies. It appears to have strong and long-term engagement, which should help with pricing. I also think there is a much bigger demand for this type of activity. The company's operations are tracking ahead of expectations, and an agreement with Amazon could dramatically expand its customer base.

Let's dive into the five ideas in more detail.

- Great product (unique, hard to replace, offering critical value to customers or just a great brand)

- Strong business economics (above-average sales growth, profit margins, ROIC)

- Conservative balance sheet (low leverage, net cash)

- Alignment of interests between management and other shareholders, preference for family-run businesses and/or companies with significant insider buying

- Attractive valuation

Once a company appears on the list, it has to pass further thresholds to make it into a portfolio. I ask myself if I understand the business well enough, whether the sector is predictable or prone to rapid changes. There are many other parameters that I look at before making the final decision.

Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

There is one exception to this rule in this edition of MSIL (Monthly Stock Idea Lab). Earlier this week, I bought one company from this month's list - Games Workshop. It has rarely been cheap, which always stopped me. But I have been doing more channel checks and just observing how people treat craft-related hobbies. It appears to have strong and long-term engagement, which should help with pricing. I also think there is a much bigger demand for this type of activity. The company's operations are tracking ahead of expectations, and an agreement with Amazon could dramatically expand its customer base.

Let's dive into the five ideas in more detail.

Horiba

Source: Horiba Investor Presentation

Ticker: 6856 JP

Share price: Yen 7,604

Mkt Cap: Yen 319bn

EV: Yen 249bn

Horiba is a Japanese family business that produces automotive emission measurement systems, environmental measuring instruments, a wide range of scientific analysers, medical diagnostic analysers, and measuring equipment used in the semiconductor industry.

Share price: Yen 7,604

Mkt Cap: Yen 319bn

EV: Yen 249bn

Horiba is a Japanese family business that produces automotive emission measurement systems, environmental measuring instruments, a wide range of scientific analysers, medical diagnostic analysers, and measuring equipment used in the semiconductor industry.

Why it is interesting

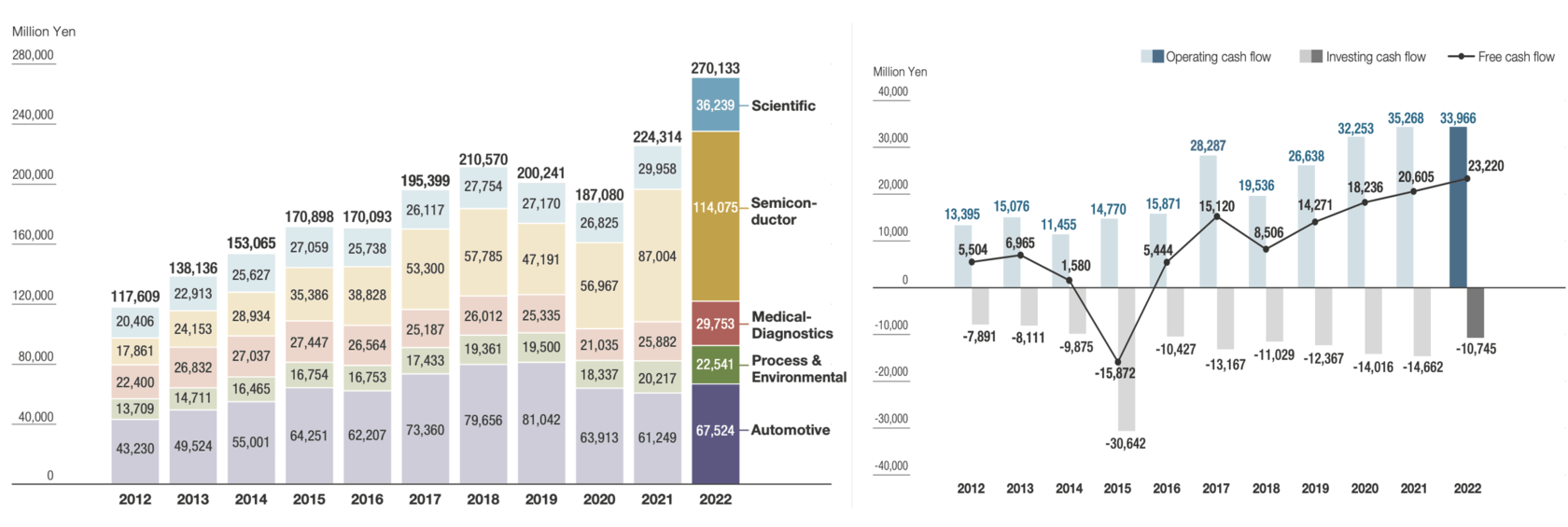

The company played a crucial role in uncovering the VW emission scandal. It is currently a global leader in automotive emission testing equipment with an 80% market share and an equally dominant player in mass-flow spectrometers (precision instruments used to measure and control the flow of liquids and gases in the semiconductor manufacturing process). Its market share in the latter segment is 60%.

It strengthened its position in the automotive sector by acquiring UK-based MIRA, a provider of vehicle testing facilities, in 2015. The deal provided Horiba access to the Nuneaton industrial park, where automotive players test technologies, helping the company gain real-time intelligence.

More recently, the company has been adapting to an EV transition. It has started developing unique instruments to gauge EV battery efficiency.

Horiba was founded by Masao Horiba in 1945. His son Atsushi Horiba (75 years old) joined the family business in 1972 as an engineer and has been the company’s CEO since 1992. Mr. Horiba directly owns 2.58% of the company’s shares.

It strengthened its position in the automotive sector by acquiring UK-based MIRA, a provider of vehicle testing facilities, in 2015. The deal provided Horiba access to the Nuneaton industrial park, where automotive players test technologies, helping the company gain real-time intelligence.

More recently, the company has been adapting to an EV transition. It has started developing unique instruments to gauge EV battery efficiency.

Horiba was founded by Masao Horiba in 1945. His son Atsushi Horiba (75 years old) joined the family business in 1972 as an engineer and has been the company’s CEO since 1992. Mr. Horiba directly owns 2.58% of the company’s shares.

Why now?

There is no specific catalyst that would make the stock particularly attractive today. It is a combination of being a family-run business with market-leading positions in a growing industry, having distinguished R&D capabilities and a strong sales and margin profile.

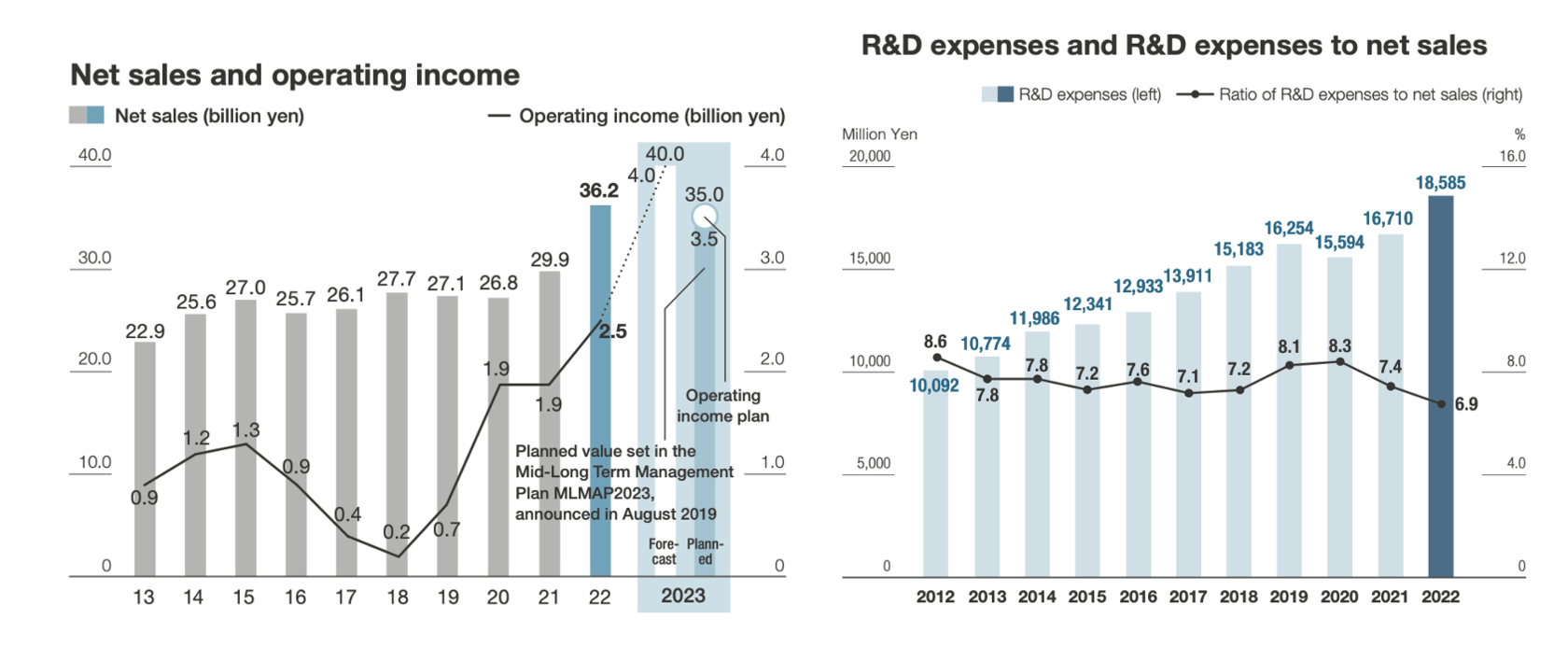

Source: Horiba Investor Presentation

The company delivered a solid 9% 10Y CAGR. At the same time, the company managed to improve its operational margin to 17% in 2022 vs. 10% in 2012. Given the company’s resilient business model and cash-generative characteristics, its business enjoys a $0.5bn net cash position.

Source: Horiba Investor Presentation

Valuation

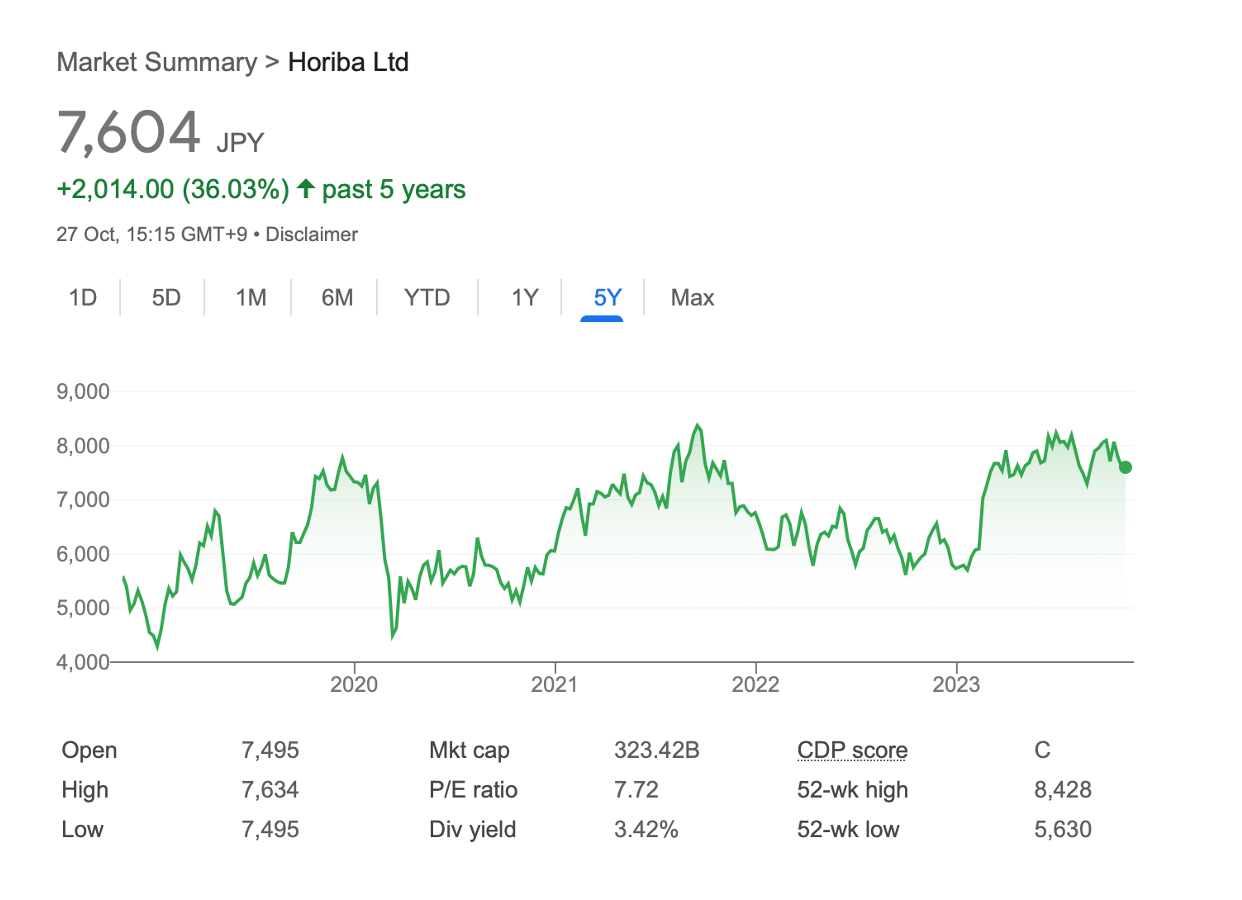

The company is trading at depressed multiples of 7.7x P/E and 5.3x EV/EBIT (last 12 months), although it is almost a norm for Japanese companies to be valued below international peers.

Source: Google Finance

Risks

- It is an R&D-heavy sector with new products and solutions likely to emerge in the future

- The current demand for measurement products is largely driven by increased focus on climate change. This area, in turn, depends on government regulations and policies, which can change in the future

- With the rise of EVs, demand for auto emission testing will fall, although this is a very long-term risk

- Succession. The current CEO is 75 years old

Games Workshop

Source: Internet

Ticker: GAW LN

Share price: £98.4

Mkt Cap: £3.2bn

EV: £3.2bn

Games Workshop designs, manufactures and sells high-quality fantasy miniatures and games-related products. The company has two segments: core (95% of 2022 revenue) and licencing (5% of 2022 revenue). The company is the creator of Warhammer and Warhammer 40,000 IPs and owns a license for Lord of the Rings miniatures.

The company started out in the 70s as three games fanatics selling handmade classic wooden games from their homes in London and, later, a chain of general games shops. The business was listed in 1994. The current CEO, Kevin Rountree, took over in 2015, having been the CFO since 2008 and the COO since 2011.

Share price: £98.4

Mkt Cap: £3.2bn

EV: £3.2bn

Games Workshop designs, manufactures and sells high-quality fantasy miniatures and games-related products. The company has two segments: core (95% of 2022 revenue) and licencing (5% of 2022 revenue). The company is the creator of Warhammer and Warhammer 40,000 IPs and owns a license for Lord of the Rings miniatures.

The company started out in the 70s as three games fanatics selling handmade classic wooden games from their homes in London and, later, a chain of general games shops. The business was listed in 1994. The current CEO, Kevin Rountree, took over in 2015, having been the CFO since 2008 and the COO since 2011.

Why it is interesting

The company has a unique product that appeals to thousands of super-loyal fans. It is in a hobby business where customers don't feel that "they are sold stuff" but rather seek experience and co-create. They feel that they own the product. Monetary costs become a secondary issue which strengthens the company's pricing power.

Given its full control of the IP (Warhammer, Warhammer 40,000 and Warhammer Age of Sigmar), the company can constantly update its lore and create new miniatures, thus maintaining the interest of its loyal fan base. As a result, its business enjoys strong pricing power and profitable growth.

Given its full control of the IP (Warhammer, Warhammer 40,000 and Warhammer Age of Sigmar), the company can constantly update its lore and create new miniatures, thus maintaining the interest of its loyal fan base. As a result, its business enjoys strong pricing power and profitable growth.

The company’s business is about capturing the imagination of miniatures collectors. Customers are ready to pay a relatively expensive price for a high-quality product surrounded by deep lore and stories. As long as the brand name and reputation of the IP are in good hands, loyal fans will be coming back for more.

There are no direct competitors.

GAW has delivered one of the best shareholder returns over the past decade, growing 22x (including dividends).

There are no direct competitors.

GAW has delivered one of the best shareholder returns over the past decade, growing 22x (including dividends).

This may sound anti-analytical, but the company's annual reports stand out from 99% of other UK public companies. It has no photo of a CEO and Board members. It is written in plain language, with no jargon words, minimal comments on ESG (what a relief!), and they don't even use EBITDA (Charlie Munger would be happy). I view this as an important signal of the company's culture, itself a crucial factor for long-term returns for shareholders.

Why now?

In December 2022, Games Workshop announced that it had reached an agreement in principle with Amazon. Under this agreement, Amazon will develop Games Workshop’s intellectual property into film and television productions, and Games Workshop will grant Amazon merchandising rights.

In advance of the actual contracts, Amazon will be commencing certain development activities (e.g. holding preliminary discussions with writers) in order to facilitate the project. GAW plans to initially grant rights to develop the Warhammer 40,000 universe.

The company has not provided further details since suggesting that the final contract has not been finalised yet.

On top of the additional licensing revenue, the Amazon deal could introduce the Warhammer brand to a wider audience and increase its fan base.

In September 2023, GAW released a trading update stating that its performance was ahead of expectations. In the 3 months (to August 27), total revenue grew 14% to £121mn, while licensing revenue doubled to £6mn.

A trailer released last month for the franchise’s cross-platform video game, Warhammer 40,000: Rogue Trader, also revealed the December 7 launch date for the game set for the PC, Mac, Xbox and PlayStation.

Alongside the trading statement, the company declared a 50p a share dividend, taking dividends for the FY-24 to £1.95 so far, compared with £1.20 for the same period last year.

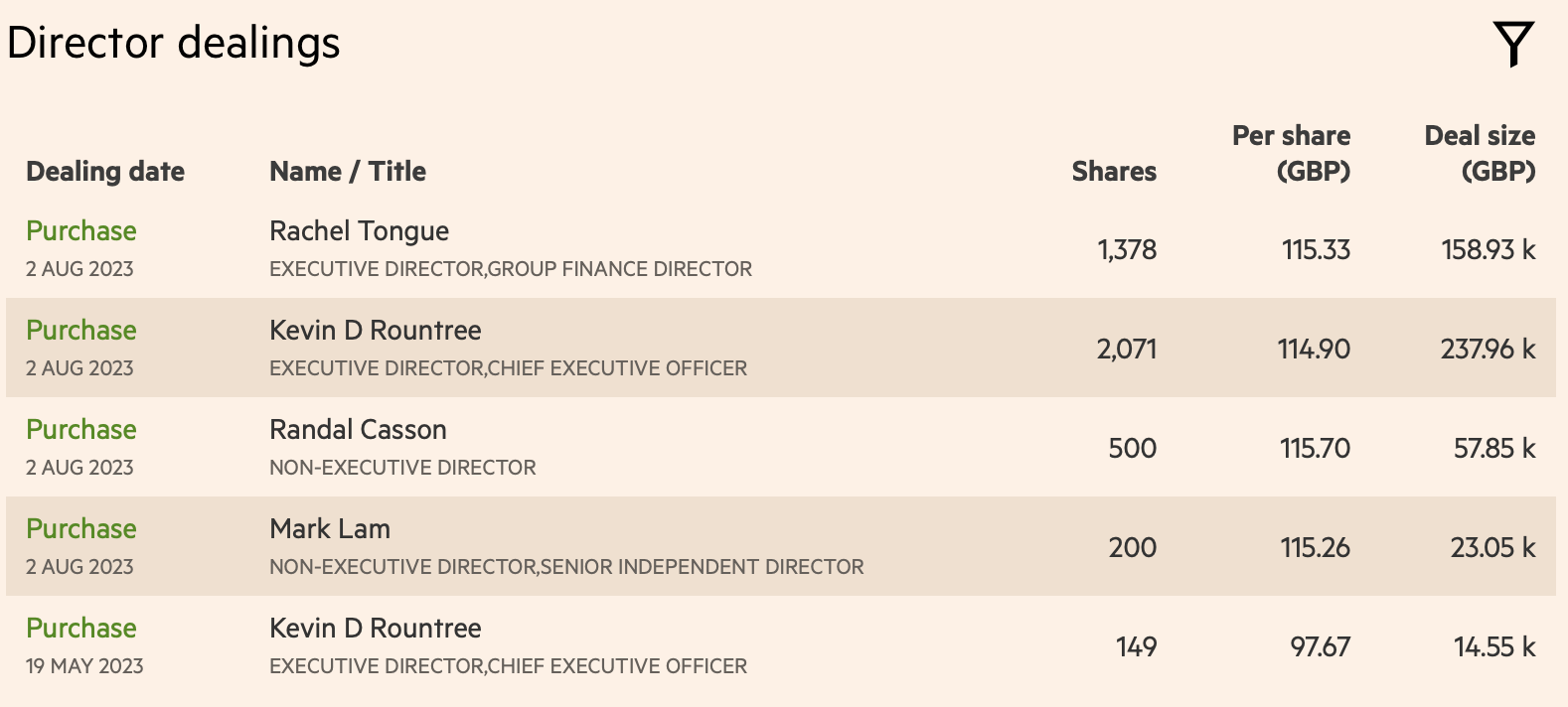

While there is no large insider ownership in the company, it is encouraging to see consistent buying by key executives of the shares.

In advance of the actual contracts, Amazon will be commencing certain development activities (e.g. holding preliminary discussions with writers) in order to facilitate the project. GAW plans to initially grant rights to develop the Warhammer 40,000 universe.

The company has not provided further details since suggesting that the final contract has not been finalised yet.

On top of the additional licensing revenue, the Amazon deal could introduce the Warhammer brand to a wider audience and increase its fan base.

In September 2023, GAW released a trading update stating that its performance was ahead of expectations. In the 3 months (to August 27), total revenue grew 14% to £121mn, while licensing revenue doubled to £6mn.

A trailer released last month for the franchise’s cross-platform video game, Warhammer 40,000: Rogue Trader, also revealed the December 7 launch date for the game set for the PC, Mac, Xbox and PlayStation.

Alongside the trading statement, the company declared a 50p a share dividend, taking dividends for the FY-24 to £1.95 so far, compared with £1.20 for the same period last year.

While there is no large insider ownership in the company, it is encouraging to see consistent buying by key executives of the shares.

Source: Financial Times

Valuation

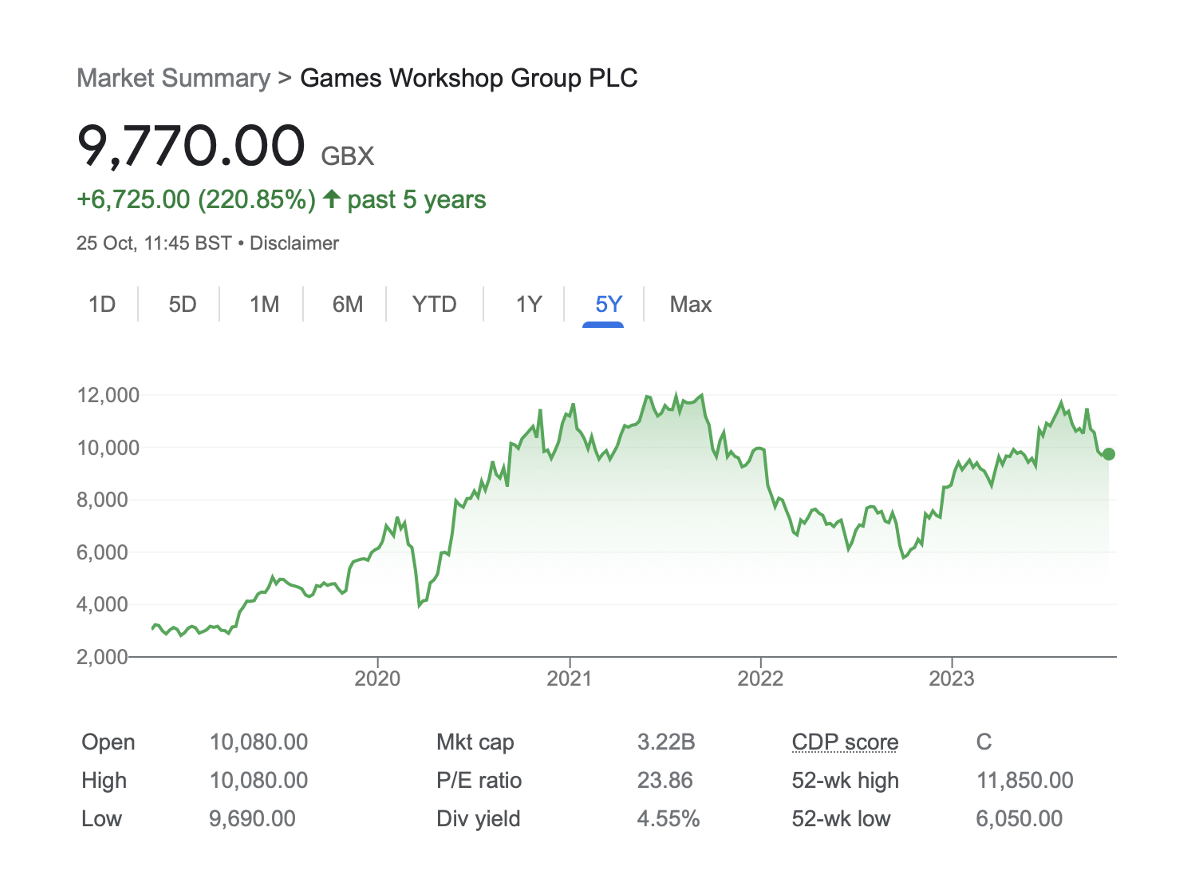

The company doesn't look cheap on headline multiples. It is trading at about 22x forward P/E. However, the Amazon deal should clearly boost revenue and especially profits, reducing the valuation multiple.

Another point to consider is the strong economics and historical growth rates. The company has delivered c. 18% 10-year revenue CAGR and almost 40% CAGR for operating profit.

The company has been rapidly expanding internationally, generating 78% of sales outside of the UK (in FY-23). The company is still quite small and without any direct competitors operating in a market that it has essentially invented, it is plausible that GAW could continue to grow at a high rate before reaching any critical size.

The company is a cash-rich business distributing all cash-flow not used in the business as dividends (+30% CAGR in the past 8 years). Total dividends declared in FY-23 amounted to £4.15 per share (4.2%).

It runs a net-cash balance sheet (£90mn as of May 2023).

It has been generating c. 35% operating margin over the past 10 years. The margin will likely expand following the deal with Amazon.

Another point to consider is the strong economics and historical growth rates. The company has delivered c. 18% 10-year revenue CAGR and almost 40% CAGR for operating profit.

The company has been rapidly expanding internationally, generating 78% of sales outside of the UK (in FY-23). The company is still quite small and without any direct competitors operating in a market that it has essentially invented, it is plausible that GAW could continue to grow at a high rate before reaching any critical size.

The company is a cash-rich business distributing all cash-flow not used in the business as dividends (+30% CAGR in the past 8 years). Total dividends declared in FY-23 amounted to £4.15 per share (4.2%).

It runs a net-cash balance sheet (£90mn as of May 2023).

It has been generating c. 35% operating margin over the past 10 years. The margin will likely expand following the deal with Amazon.

Source: Google Finance

Risks

- Macro. Even though GAW's customers are loyal and passionate, their spending is still dependent on the overall economic cycle.

- Changing consumer preferences. The company's product doesn't solve a critical issue for customers. It is an entertainment product and, as such, is at risk of falling out of love with consumers or struggling to win new customers beyond the existing base. There have been a few negative reviews on YouTube about Games Workshops. It is worth keeping a close eye on how the Warhammer community feels about the company.

- Amazon deal. Perhaps counterintuitively, but there are some downside risks from this deal. Its future depends on how successfully Amazon will adapt the Warhammer. Its recent experience with the Rings of Power has not been particularly strong and received mixed feedback.