28 January 2024

This is the tenth edition of the Monthly Stock Idea Lab (MSIL #10), where I highlight the most exciting companies I have come across recently.

As longtime readers know, the focus of this publication is on companies that meet the following five criteria:

Once a company appears on the list, it has to pass further filters to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

MSIL is one of the first important steps in the stock selection process, but definitely not the final one. I hope it helps you in your investment process, but by all means, you should not rely solely on this publication. You should do your own research and/or seek professional advice.

As longtime readers know, the focus of this publication is on companies that meet the following five criteria:

- Quality of business

- Financial performance

- Low leverage

- Insider ownership

- Attractive valuation

Once a company appears on the list, it has to pass further filters to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

MSIL is one of the first important steps in the stock selection process, but definitely not the final one. I hope it helps you in your investment process, but by all means, you should not rely solely on this publication. You should do your own research and/or seek professional advice.

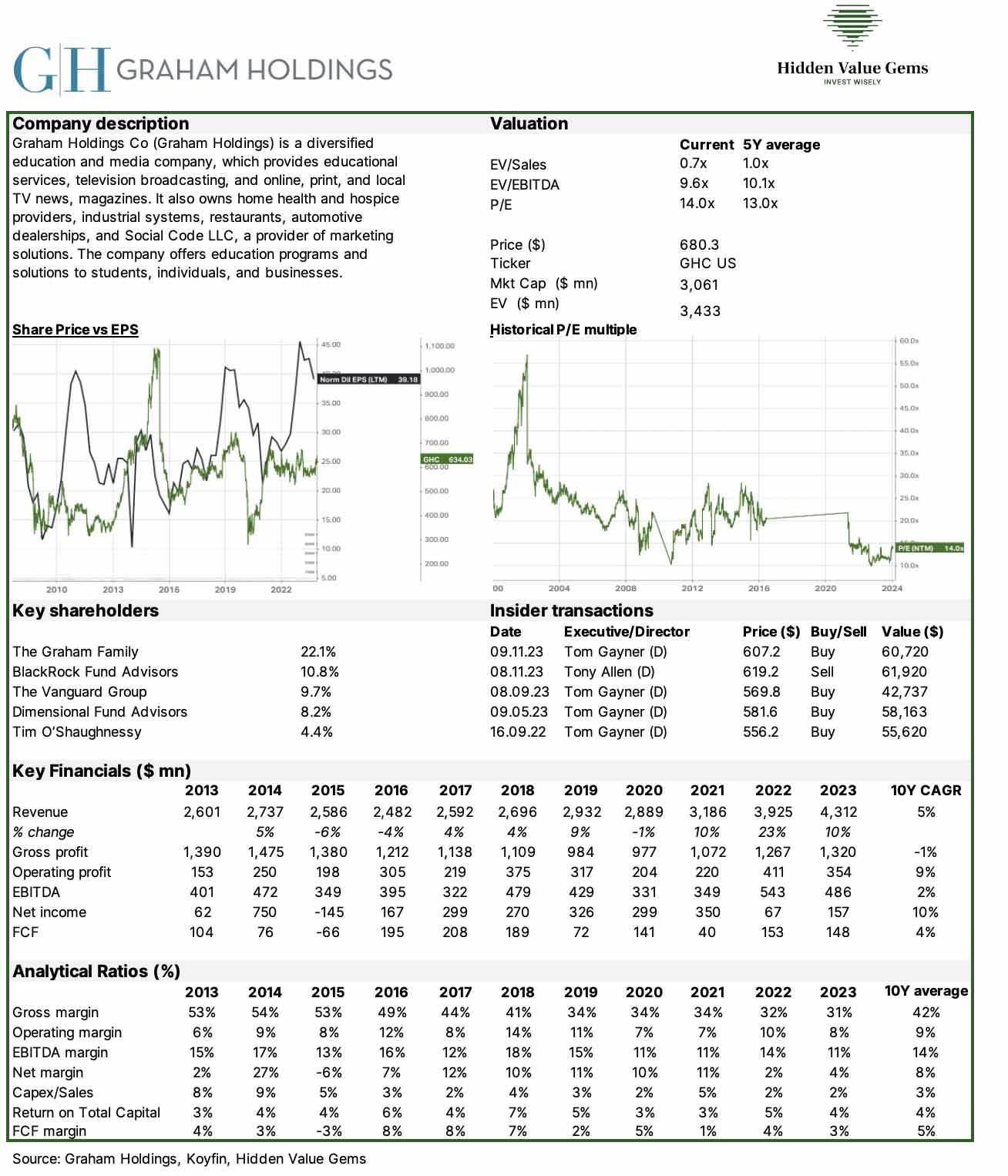

Graham Holdings

Graham Holdings Company (GHC) was on my watch list for many years. After first taking a serious look at it in about 2017, I thought the company was not exceptionally cheap, and the underlying businesses were not unique compounders. So I passed, and in hindsight, it looks like the right decision: the stock has barely moved since then.

This time, I read about it in Barron’s Annual Roundtable, where various fund managers pitch their best ideas. Meryl Witmer, the founder of Eagle Capital and a director of Berkshire Hathaway, put GHC as one of her top picks in 2024.

Graham Holdings used to be The Washington Post Company, which famously counted Warren Buffett’s Berkshire Hathaway as its largest non-controlling shareholder for many years. The newspaper business was seriously hit by the advent of the Internet and digital media. The company sold The Washington Post to Jeff Bezos for $250mn in September 2013.

The business was renamed Graham Holdings, retaining Kaplan Education and a host of local TV channels.

Graham Holdings is controlled by the son and daughter of legendary Katherine Graham, Donald Graham and Elizabeth Weymouth, who own the majority of Class A shares. The family holds a 22.1% economic interest in the company, with the CEO, Tim O’Shaughnessy, holding 4.4%.

The business benefits from top-class stewardship by a team that focuses on value and free cash flow and maintains a long-term focus.

Two famous value investors, Tom Gaynor (co-CEO of Markel) and Chris Davis, Chairman of Davis Selected Advisors, are Board members of the company.

This time, I read about it in Barron’s Annual Roundtable, where various fund managers pitch their best ideas. Meryl Witmer, the founder of Eagle Capital and a director of Berkshire Hathaway, put GHC as one of her top picks in 2024.

Graham Holdings used to be The Washington Post Company, which famously counted Warren Buffett’s Berkshire Hathaway as its largest non-controlling shareholder for many years. The newspaper business was seriously hit by the advent of the Internet and digital media. The company sold The Washington Post to Jeff Bezos for $250mn in September 2013.

The business was renamed Graham Holdings, retaining Kaplan Education and a host of local TV channels.

Graham Holdings is controlled by the son and daughter of legendary Katherine Graham, Donald Graham and Elizabeth Weymouth, who own the majority of Class A shares. The family holds a 22.1% economic interest in the company, with the CEO, Tim O’Shaughnessy, holding 4.4%.

The business benefits from top-class stewardship by a team that focuses on value and free cash flow and maintains a long-term focus.

Two famous value investors, Tom Gaynor (co-CEO of Markel) and Chris Davis, Chairman of Davis Selected Advisors, are Board members of the company.

At Graham Holdings, our true north is growing intrinsic value for shareholders and driving an increase in per share value. While several components can reasonably drive one’s view of value, free cash flow generation is almost certain to be on anyone’s list.

- Timothy O’Shaughnessy, CEO of Graham Holdings

The company is proactively using share repurchases as one of its capital allocation options. However, unlike a typical listed company, it does not set a specific programme to spend a certain amount of money on buybacks within a defined period. It remains opportunistic and acts when the share price diverges materially from the intrinsic value.

It spent $71.4mn on buyback in 2022, paying an average price of $586. In 2020, when the price was down more than 50% from the highs of 2019, the company spent $161.8mn on share buyback, paying just $398 for one share, on average.

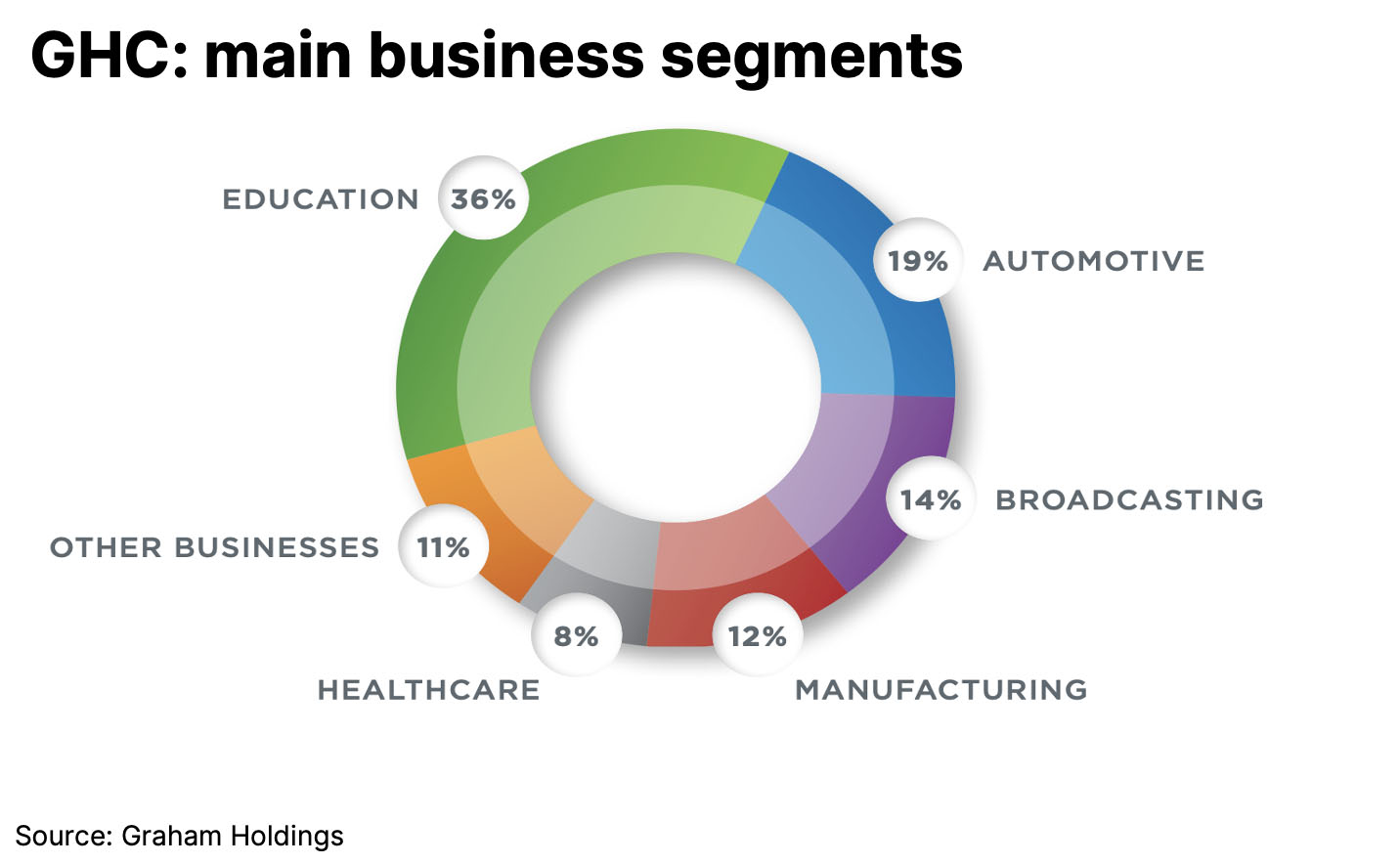

As for the underlying businesses, Graham operates in six main segments.

It spent $71.4mn on buyback in 2022, paying an average price of $586. In 2020, when the price was down more than 50% from the highs of 2019, the company spent $161.8mn on share buyback, paying just $398 for one share, on average.

As for the underlying businesses, Graham operates in six main segments.

Education is the largest segment, with Kaplan International making the bulk of it. Kaplan provides higher education, professional education and test preparation services primarily in the UK, Singapore and Australia. The business has a particularly strong focus on international students, helping them with admissions by fulfilling academic and English fluency requirements. The business has mostly long-term contracts with universities it works with, so revenue tends to be more predictable. Kaplan also owns student accommodation. As a result, the business is more resistant in the face of AI, which puts at risk other educational services.

The business was negatively affected by COVID lockdowns and is now recovering. A potential increase in the tuition fee in the UK (currently discussed) is also an additional growth driver.

I am not going to discuss each segment in detail. The company recently hosted an Investor Day discussing its strategy and performance of each segment.

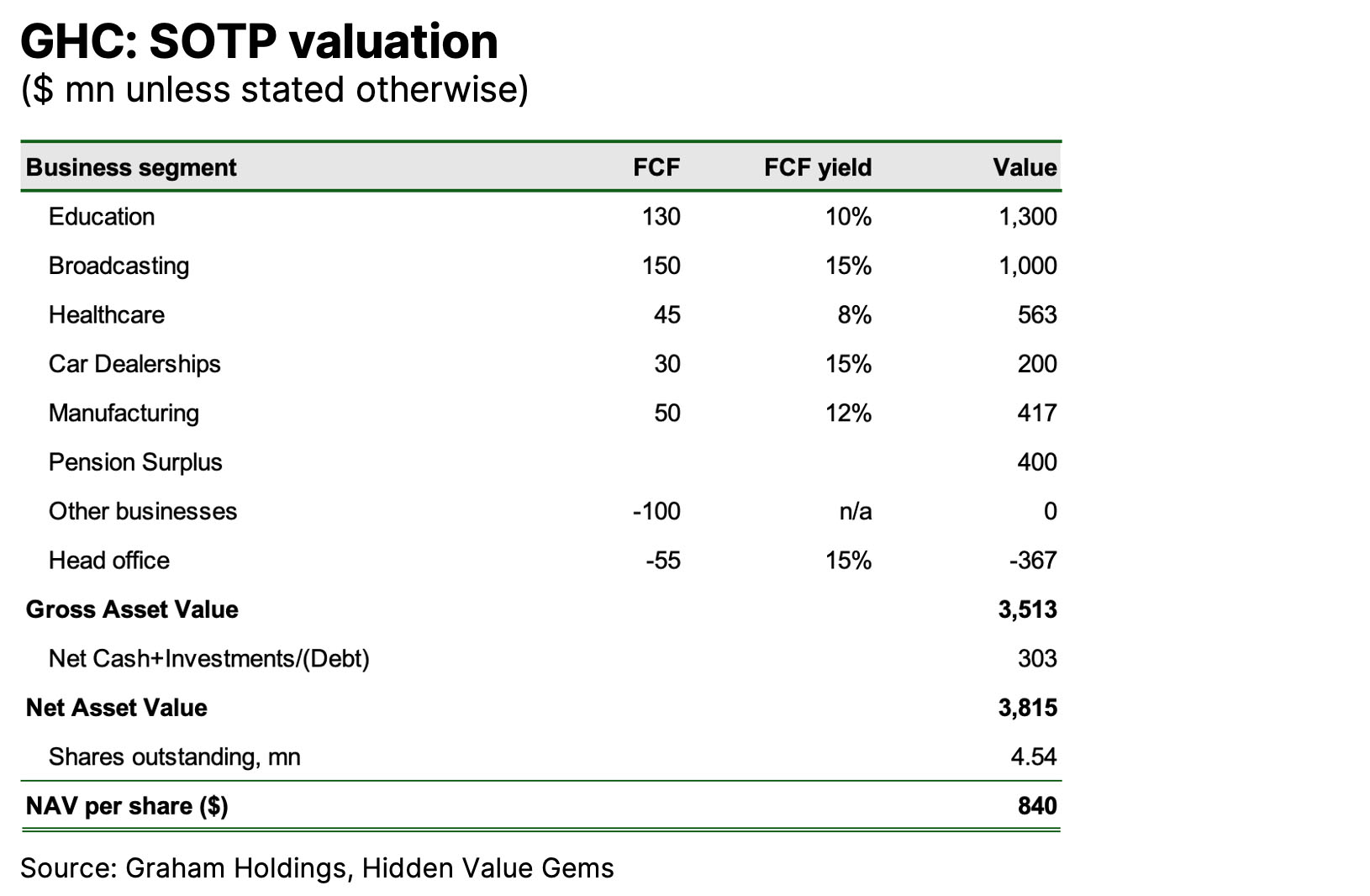

I have applied a simple sum-of-the-parts (SOTP) valuation approach to the company, looking at most recent FCF and normalising where necessary. I then applied an FCF yield that a business deserves, in my view. This valuation is fairly conservative as it does not give any credit to the future growth of FCF or improved valuation metrics. The average FCF yield I have used is quite high -12%.

GHC's portfolio consists of businesses that are either fast-growing (Healthcare and Car Dealerships) or going through a business recovery (Education, Manufacturing, Broadcasting). The past challenges of Education and Broadcasting masked the progress in other segments. The businesses are now in much better shape and enjoy growing FCF, while the stock has been range-bound for almost eight years now

Speaking of potential upside, timely share repurchases, as well as potential bolt-on acquisitions or disposals, should also be considered as future value drivers. The current SOTP valuation of $840 per share implies about a 14% upside to the latest share price. However, taking into account the increasing FCF and value-accretive use of capital on buybacks and M&A/disposals, it is possible that the stock price exceeds $1,000 in the next couple of years (c. 50% upside).

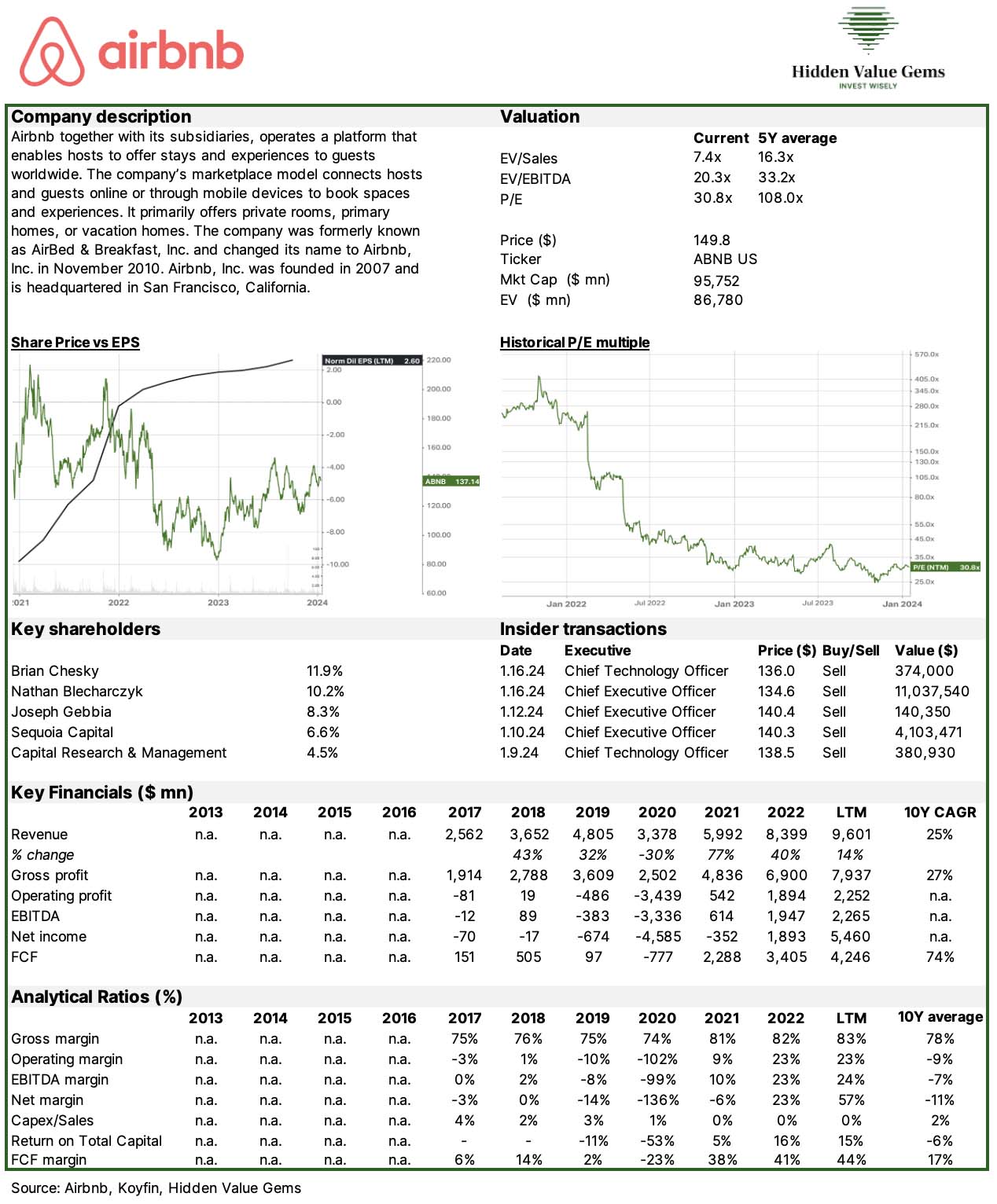

Airbnb

Airbnb is a classical marketplace with some of its usual attributes, such as strong network economics and low capital intensity. Airbnb puts itself into a crucial intermediary role by providing value to both sides (property owners and visitors). However, it has yet to achieve the critical phase of other network businesses, which would create exceptionally high switching costs, for example. Without the entire attributes of a network business, its competitive position may not be as strong as that of other platform companies, which limits its profit potential.

As a leading player in the sector, it has also brought the attention of regulators in specific markets, which creates further problems. However, this is a typical development experienced by other companies like Uber, Amazon, and Google. Historically, regulatory issues used to be overcome as long as the business model provided critical service to all platform members.

It is also important to keep things in perspective. For example, the de facto ban on short-term rentals that went into effect in New York City in September 2023 affects only 1% of Airbnb revenue. About 80% of the largest markets where Airbnb operates already have some form of regulation.

A few factors have drawn my attention to the company. Firstly, as many, I am a user of Airbnb (although not super active). Until recently, I found many alternative opportunities on either Booking.com or direct hotel websites. But in the past few months, I have noticed that the prices of Airbnb are at least comparable with other options, but you usually get much more space for your money. So, the product definitely offers value to consumers.

The company successfully navigated the COVID crisis, a real stress test. It is still a founder-led business - a quality I highly appreciate.

Finally, Airbnb is reasonably valued, especially in the context of US tech.

It is profitable, generates free cash flow and has a net cash position. Its FCF in 2022 was $3.4bn and $3.8bn in 9M23. I should flag that management excludes ‘Taxes paid related to net share settlement of equity awards’, which inevitably inflates FCF calculated as Operating Cashflow less Capex.

After deducting the ‘Taxes’, FCF drops to $2.8bn in both full-year 2022 and 9m'23.

Still, the valuation looks quite interesting. Assuming $3.5bn FCF (normalised), the company is valued at a 4.0% FCF yield with a market cap of $95.8bn and a net cash of $9.0bn.

A 4% yield is quite attractive for a platform-type business with no need to invest or manage physical assets, positive working capital and still capable of growing at a double-digit rate. The growth should come from other international markets and expanding auxiliary services around travel experience (tours, master classes and so on). General inflation should also boost the average price per night, increasing the host’s earnings and, consequently, Airbnb’s revenue.

As a leading player in the sector, it has also brought the attention of regulators in specific markets, which creates further problems. However, this is a typical development experienced by other companies like Uber, Amazon, and Google. Historically, regulatory issues used to be overcome as long as the business model provided critical service to all platform members.

It is also important to keep things in perspective. For example, the de facto ban on short-term rentals that went into effect in New York City in September 2023 affects only 1% of Airbnb revenue. About 80% of the largest markets where Airbnb operates already have some form of regulation.

A few factors have drawn my attention to the company. Firstly, as many, I am a user of Airbnb (although not super active). Until recently, I found many alternative opportunities on either Booking.com or direct hotel websites. But in the past few months, I have noticed that the prices of Airbnb are at least comparable with other options, but you usually get much more space for your money. So, the product definitely offers value to consumers.

The company successfully navigated the COVID crisis, a real stress test. It is still a founder-led business - a quality I highly appreciate.

Finally, Airbnb is reasonably valued, especially in the context of US tech.

It is profitable, generates free cash flow and has a net cash position. Its FCF in 2022 was $3.4bn and $3.8bn in 9M23. I should flag that management excludes ‘Taxes paid related to net share settlement of equity awards’, which inevitably inflates FCF calculated as Operating Cashflow less Capex.

After deducting the ‘Taxes’, FCF drops to $2.8bn in both full-year 2022 and 9m'23.

Still, the valuation looks quite interesting. Assuming $3.5bn FCF (normalised), the company is valued at a 4.0% FCF yield with a market cap of $95.8bn and a net cash of $9.0bn.

A 4% yield is quite attractive for a platform-type business with no need to invest or manage physical assets, positive working capital and still capable of growing at a double-digit rate. The growth should come from other international markets and expanding auxiliary services around travel experience (tours, master classes and so on). General inflation should also boost the average price per night, increasing the host’s earnings and, consequently, Airbnb’s revenue.

The rest of the article is available for Premium subscribers. One of the companies discussed in the Premium section is a founder-led US business operating in a highly fragmented sector. Over the past ten years, the company has achieved exceptionally strong revenue and earnings growth of 28% and 47% per year, respectively. Management is actively buying back stock, reducing the share count by 40% since late 2021. Despite this, the company is valued at just 13.9x P/E.

Another company is a small player in a large market that has recently turned FCF-positive. It has high fixed costs and acts as a platform for creators. By increasing scale and launching additional services, management targets to more than double the EBITDA margin and grow revenue by over 20% a year in the long run. If achieved, the stock would be valued at 3.6x EV/EBITDA in 2027. The founders own more than 30% of the business.

Another company is a small player in a large market that has recently turned FCF-positive. It has high fixed costs and acts as a platform for creators. By increasing scale and launching additional services, management targets to more than double the EBITDA margin and grow revenue by over 20% a year in the long run. If achieved, the stock would be valued at 3.6x EV/EBITDA in 2027. The founders own more than 30% of the business.

Thank you for reading this article. If you found it useful, I would appreciate it if you could share it with your friends. Feel free to post your comment or question in the discussion section below.