26 November 2023

This is the 8th edition of the Monthly Stock Idea Lab (MSIL), where I highlight the most exciting companies I have encountered. As longtime readers would know, I am looking for the best combination of the five factors: product, business economics, low leverage, management with 'skin-in-the-game', and price.

Once a company appears on the list, it has to pass further thresholds to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

I have decided to profile four companies rather than five, as I used to. This should allow for a better balance between depth and variety of ideas. I plan to provide more regular follow-ups to the most interesting ideas.

Before I present the November 2023 stocks, I would like to share my notes after attending the shareholder meeting of JD Wetherspoon ten days ago. JD Wetherspoon was one of the top ideas in MSIL #4 (July 2023) and is now a small position in my portfolio.

Once a company appears on the list, it has to pass further thresholds to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

I have decided to profile four companies rather than five, as I used to. This should allow for a better balance between depth and variety of ideas. I plan to provide more regular follow-ups to the most interesting ideas.

Before I present the November 2023 stocks, I would like to share my notes after attending the shareholder meeting of JD Wetherspoon ten days ago. JD Wetherspoon was one of the top ideas in MSIL #4 (July 2023) and is now a small position in my portfolio.

Thoughts post JD Wetherspoon meeting

It was a great experience. I plan to attend more shareholder meetings, especially of less-known companies.

It was well attended. There were a few equity analysts, PMs, and many retail investors. The formal part was very short, while Q&A lasted about two hours. Everyone could approach management and ask follow-up questions after the meeting was over. I used the opportunity to speak to Tim Martin, the founder and chairman of the company, and Ben Whitley, CFO.

Key takeaways:

I plan to hold on to my position, but at the same time, I admit it is not an easy business. The company is not extraordinarily cheap, but stronger profits are not yet reflected in its valuation. Assuming the company returns to pre-COVID EPS of 70-75p, the stock is around 10x. Historically, it has traded at 15-20x.

It was well attended. There were a few equity analysts, PMs, and many retail investors. The formal part was very short, while Q&A lasted about two hours. Everyone could approach management and ask follow-up questions after the meeting was over. I used the opportunity to speak to Tim Martin, the founder and chairman of the company, and Ben Whitley, CFO.

Key takeaways:

- The business is rapidly recovering after COVID in terms of sales and profitability.

- Management prioritises volumes over mark-ups to keep customers coming back (e.g. instead of raising the price for a pint by 10p, the company would rather sell two pints with a 5p profit to get the same result).

- The company will likely resume dividend payments and possibly buybacks after refinancing its loan next year.

- I got the impression that management is deliberately forgoing higher profits in the near term to strengthen its brand loyalty by keeping prices 25-30% below competitors. Only time will tell if this is the right approach. The counter-argument I see is that consumers in London are much less price-sensitive (at least on a Thursday night in the City), meaning that foregone profits do not add new benefits to Wetherspoon's central pubs. On the other hand, they account for a relatively low share in total sales.

- Importantly, the company has been increasing its market share based on beer volumes sold.

- There is a clear difference in how companies with owner-mentality operate. They are entirely obsessed with the customer, thinking long-term and ignoring short-term temptations to beat profit guidance to earn higher bonuses next year.

I plan to hold on to my position, but at the same time, I admit it is not an easy business. The company is not extraordinarily cheap, but stronger profits are not yet reflected in its valuation. Assuming the company returns to pre-COVID EPS of 70-75p, the stock is around 10x. Historically, it has traded at 15-20x.

Fleetcor

Ticker: FLT US

Share price: $233

Mkt Cap: $16,835mn

EV: $22,672mn

Fleetcor is a global B2B payments provider helping businesses manage their expense-related payments better. The company was founded in 2000 by Ronald Clarke, who remains its chairman and CEO with a c. 2% stake. Fleetcor’s key focus has been on fuel cards and other transportation-related payments, which account for 40% of its revenue (2022). Other segments include Corporate payments (mostly accounts payable automation) - 23%, Tolls (payment transactions via radio frequency identification (RFID) tags affixed to vehicle windshields, currently offered just in Brazil) - 11%, Lodging (Hotels) - 13% and various smaller services - 14%.

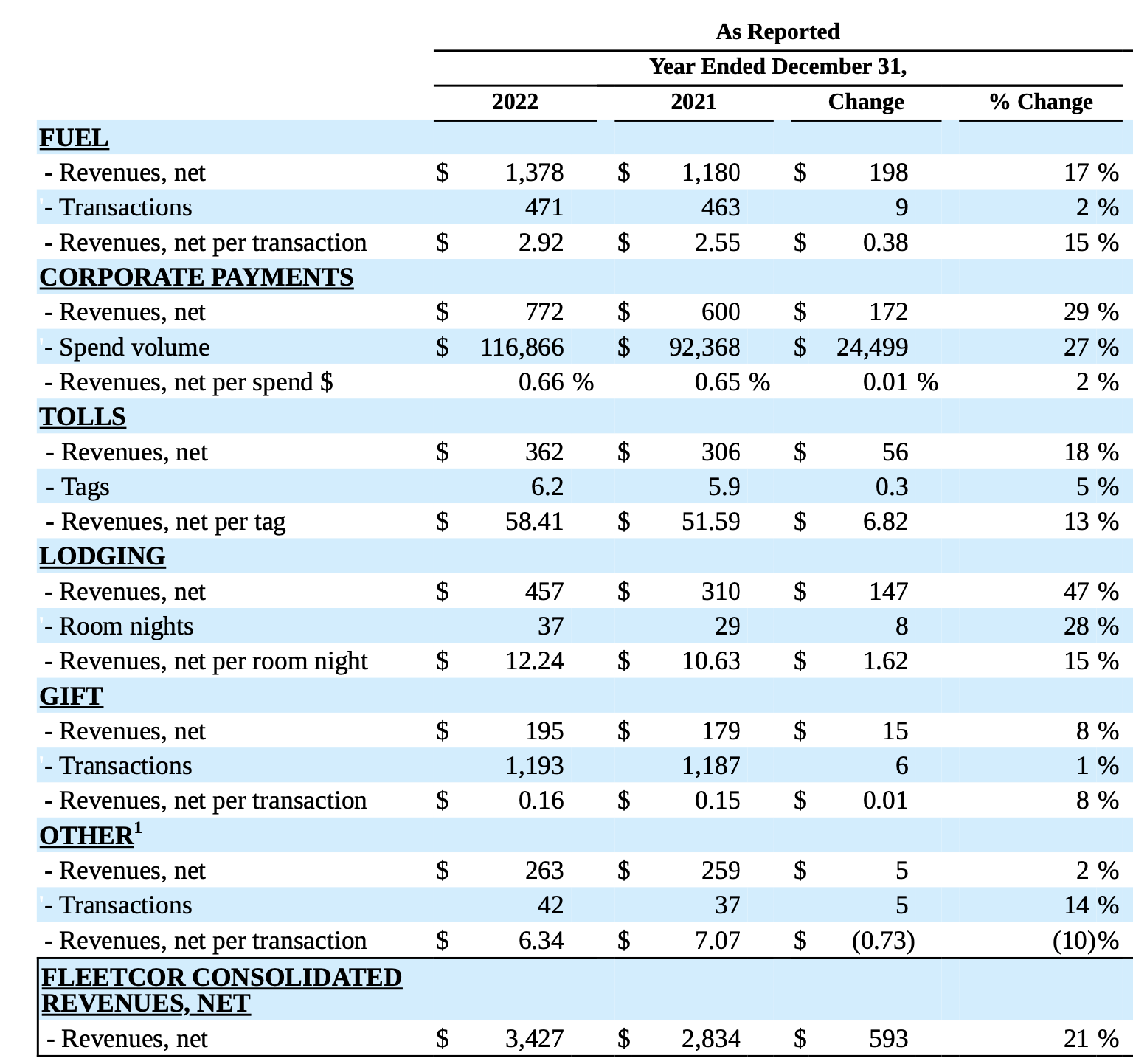

The company generates revenue by charging fees per transaction, card, interchange, and fixed network access fees (toll roads in Brazil). The following table provides further details on fees for different types of payments.

Share price: $233

Mkt Cap: $16,835mn

EV: $22,672mn

Fleetcor is a global B2B payments provider helping businesses manage their expense-related payments better. The company was founded in 2000 by Ronald Clarke, who remains its chairman and CEO with a c. 2% stake. Fleetcor’s key focus has been on fuel cards and other transportation-related payments, which account for 40% of its revenue (2022). Other segments include Corporate payments (mostly accounts payable automation) - 23%, Tolls (payment transactions via radio frequency identification (RFID) tags affixed to vehicle windshields, currently offered just in Brazil) - 11%, Lodging (Hotels) - 13% and various smaller services - 14%.

The company generates revenue by charging fees per transaction, card, interchange, and fixed network access fees (toll roads in Brazil). The following table provides further details on fees for different types of payments.

Source: Fleetcor 10K 2022

Why it is interesting

- Fleetcor is a market leader in a growing vertical focusing on optimising business processes.

- Its fees (0.5-2% of transaction payment) are comparable to traditional payment systems, yet its services add clear value to customers. As someone who has spent 20 years working in various organisations, I have witnessed how labour-intensive corporate payments could be.

- Its focus on a few verticals within B2B segments helps it to achieve higher efficiency and offer more tailored services than general providers.

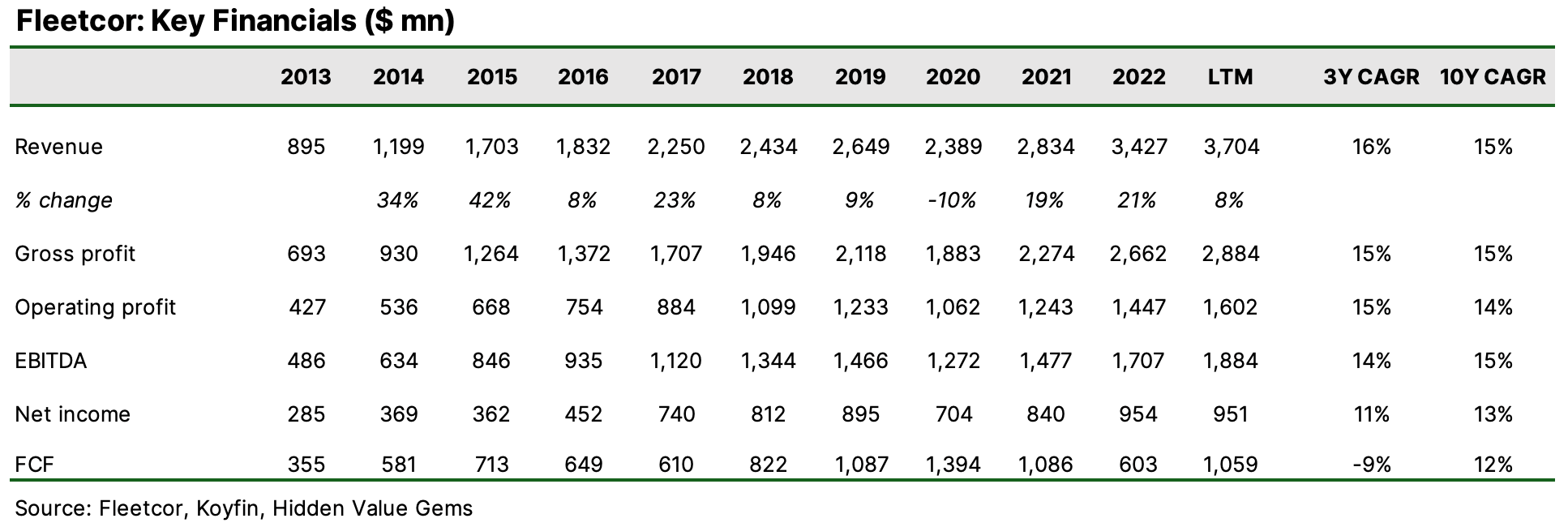

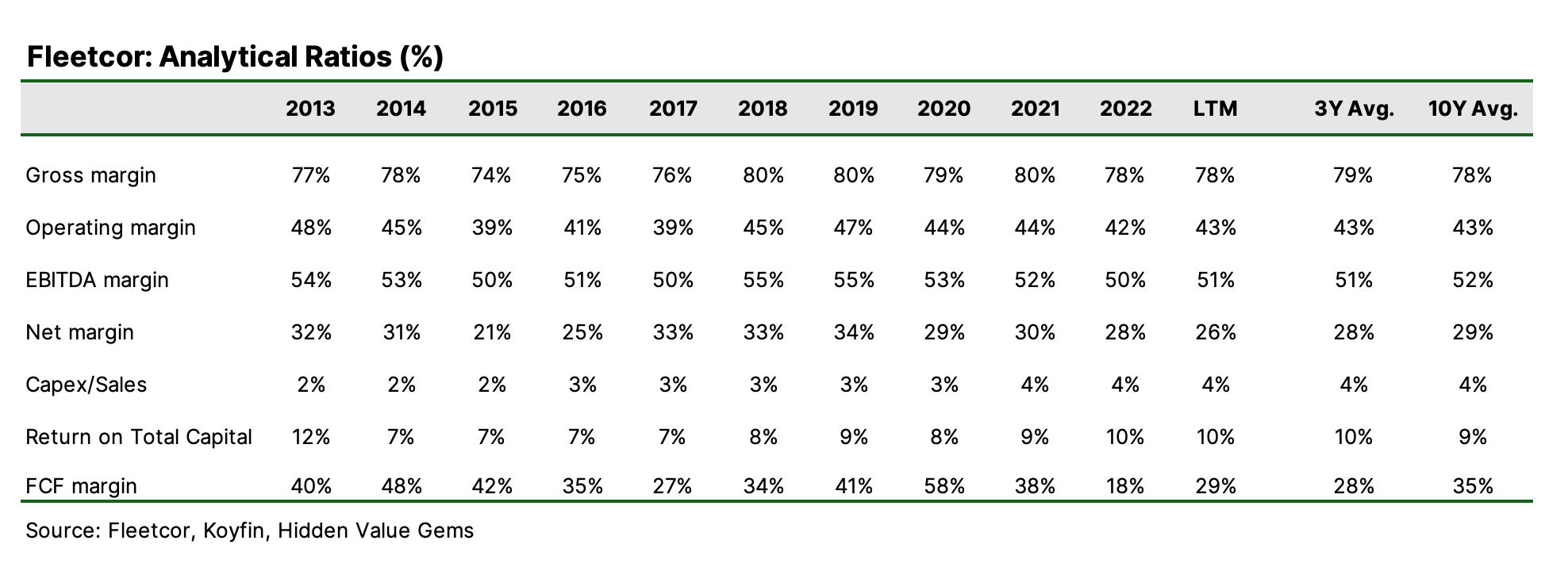

- It is a founder-led business with a strong track record. It has delivered 15% annual revenue growth over the past ten years with an average operating and net income margin of 43% and 29%, respectively.

- The company has been successful at bolt-on acquisitions. Since 2002, Fleetcor has completed almost 100 acquisitions of companies and commercial account portfolios.

- Since 2017, the company has earned $6.1bn of cumulative earnings and deployed $7.7bn of capital, of which 27% has been spent on M&A and 73% on buybacks. The company repurchased 25% of its shares spending $5.7bn (average purchase price is $226 per share, almost the same as the current price).

- The company has proven its success internationally. Starting as a US-focused business, it now generates 40% of its revenue in countries like Brazil (13%), the UK (11%) and others (15%).

- It has achieved critical scale and has been profitable for over a decade. It serves over 800k business and 5M consumer clients and works with over 4M merchants and vendors.

- Management remains committed to long-term targets of 10% revenue growth and faster EPS growth (15-20%).

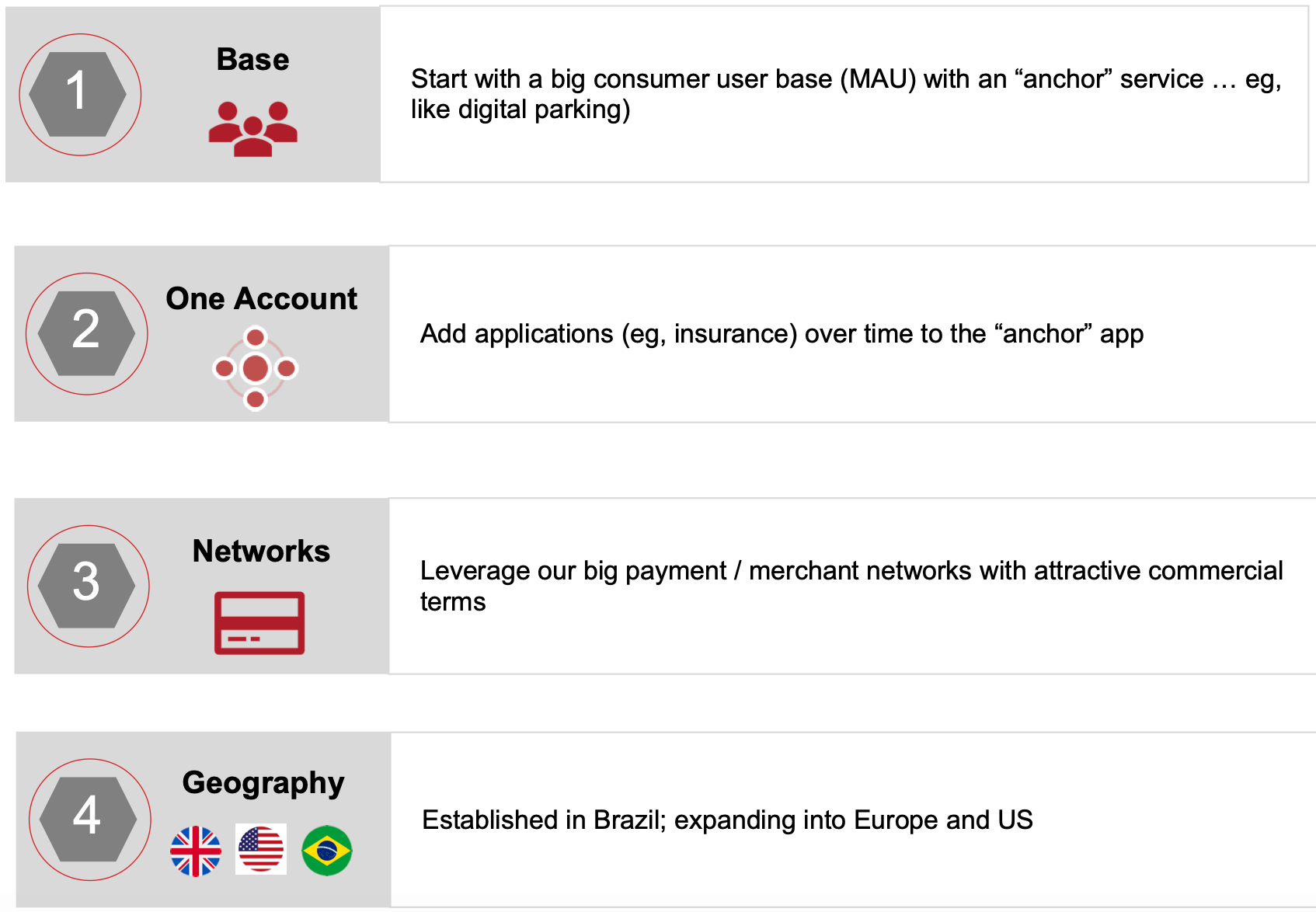

- The company has successfully applied a 4-pronged approach to growing new payment verticals. Below is an example of their strategy to grow the Consumer Vehicle Payment business.

Source: Fleetcor Investor Presentation

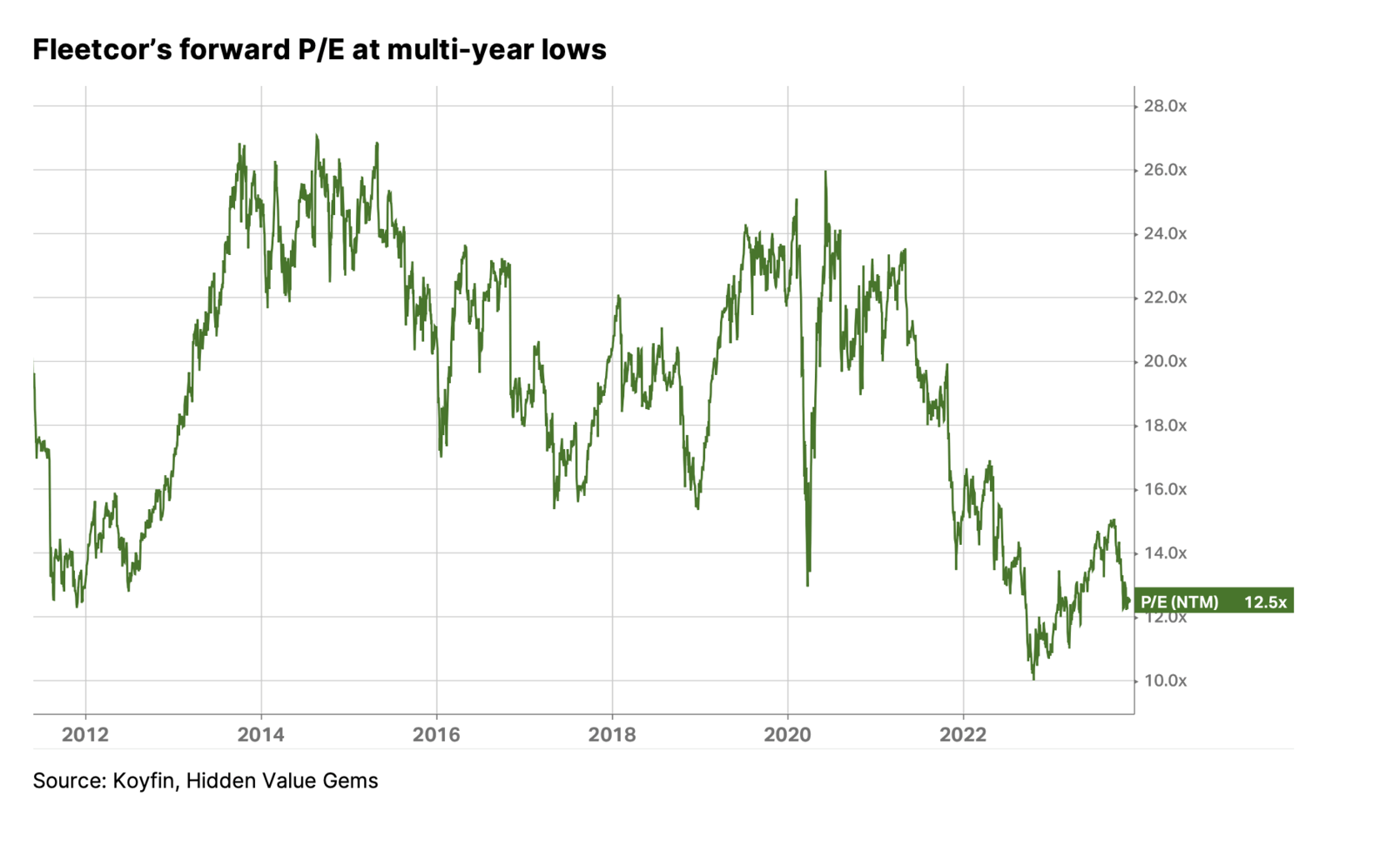

- Despite strong historical earnings growth, the stock has been range-bound since 2018 and is down 27% from its 2020 all-time high price ($330) and down 14% from mid-September.

The company looks inexpensive, trading at a forward consensus P/E of 12.5x.

Fleetcor doesn't pay dividends. It distributes cash via buyback, spending $941mn, $1.4bn and $1.4bn on share repurchases in 2020, 2021 and 2022, respectively. In the first 9 months of 2023, Fleetcor bought an additional $547mn worth of shares. Since the start of the buyback programme in 2016, Fleetcor has repurchased 28mn shares (28% of shares outstanding).

Fleetcor doesn't pay dividends. It distributes cash via buyback, spending $941mn, $1.4bn and $1.4bn on share repurchases in 2020, 2021 and 2022, respectively. In the first 9 months of 2023, Fleetcor bought an additional $547mn worth of shares. Since the start of the buyback programme in 2016, Fleetcor has repurchased 28mn shares (28% of shares outstanding).

Why now?

The share price seems to have lagged earnings growth recently. Fleetcor’s earnings per share (EPS) is up more than 50% since mid-2019, while its share price is down almost 20%.

This has attracted the attention of DE Shaw, a hedge fund, which in March 2023 demanded changes to the Board and optimisation of the company's structure. The company appointed an independent board and confirmed plans to simplify its structure.

The business has slowed down its growth from 15% growth to 10% in 2023 on higher interest rates and a general macro slowdown. Management expects 2024 revenue to be up 9-11%, according to its latest guidance.

Assuming the strength of the business model remains intact, the slowdown is probably temporary. A lower P/E multiple on slower growth provides an interesting opportunity.

This has attracted the attention of DE Shaw, a hedge fund, which in March 2023 demanded changes to the Board and optimisation of the company's structure. The company appointed an independent board and confirmed plans to simplify its structure.

The business has slowed down its growth from 15% growth to 10% in 2023 on higher interest rates and a general macro slowdown. Management expects 2024 revenue to be up 9-11%, according to its latest guidance.

Assuming the strength of the business model remains intact, the slowdown is probably temporary. A lower P/E multiple on slower growth provides an interesting opportunity.

Valuation

Fleetcor is trading at 12.6x forward P/E, which is roughly a third below its 5-year historical average multiple and is close to multi-year lows. The market seems to be concerned by the current macro outlook and credit exposure. Assuming a softer macro causes just a temporary slowdown rather than a permanent disruption of the business, there could be an attractive opportunity.

I also find it interesting that investors have to pay a higher price for American Express (13.8x), which has been a true stalwart (EPS growth of c. 7-8%, about half attributable to buybacks). It is even more exposed to the macro/credit cycle. It may be a safer business due to its 100+ years of history and the fact that 20%+ of its shares are held by Berkshire Hathaway.

Fleetcor is a little more expensive than its smaller peer, Wex (11.1x P/E), but the latter has historically grown at a much slower pace and earned lower returns on capital.

I also find it interesting that investors have to pay a higher price for American Express (13.8x), which has been a true stalwart (EPS growth of c. 7-8%, about half attributable to buybacks). It is even more exposed to the macro/credit cycle. It may be a safer business due to its 100+ years of history and the fact that 20%+ of its shares are held by Berkshire Hathaway.

Fleetcor is a little more expensive than its smaller peer, Wex (11.1x P/E), but the latter has historically grown at a much slower pace and earned lower returns on capital.

Risks

Leverage. The company is quite levered with Net Debt/EBITDA at 2.66x. However, it has come down from 2.8x at the start of the year.

Competition. There are several competitors, although no player competes with Fleetcor in the same verticals. American Express is the largest competitor in Corporate payments and Lodging.

Macro. Fleetcor’s revenue depends on the value of transactions and is modestly sensitive to fuel prices. It is quite a cyclical business.

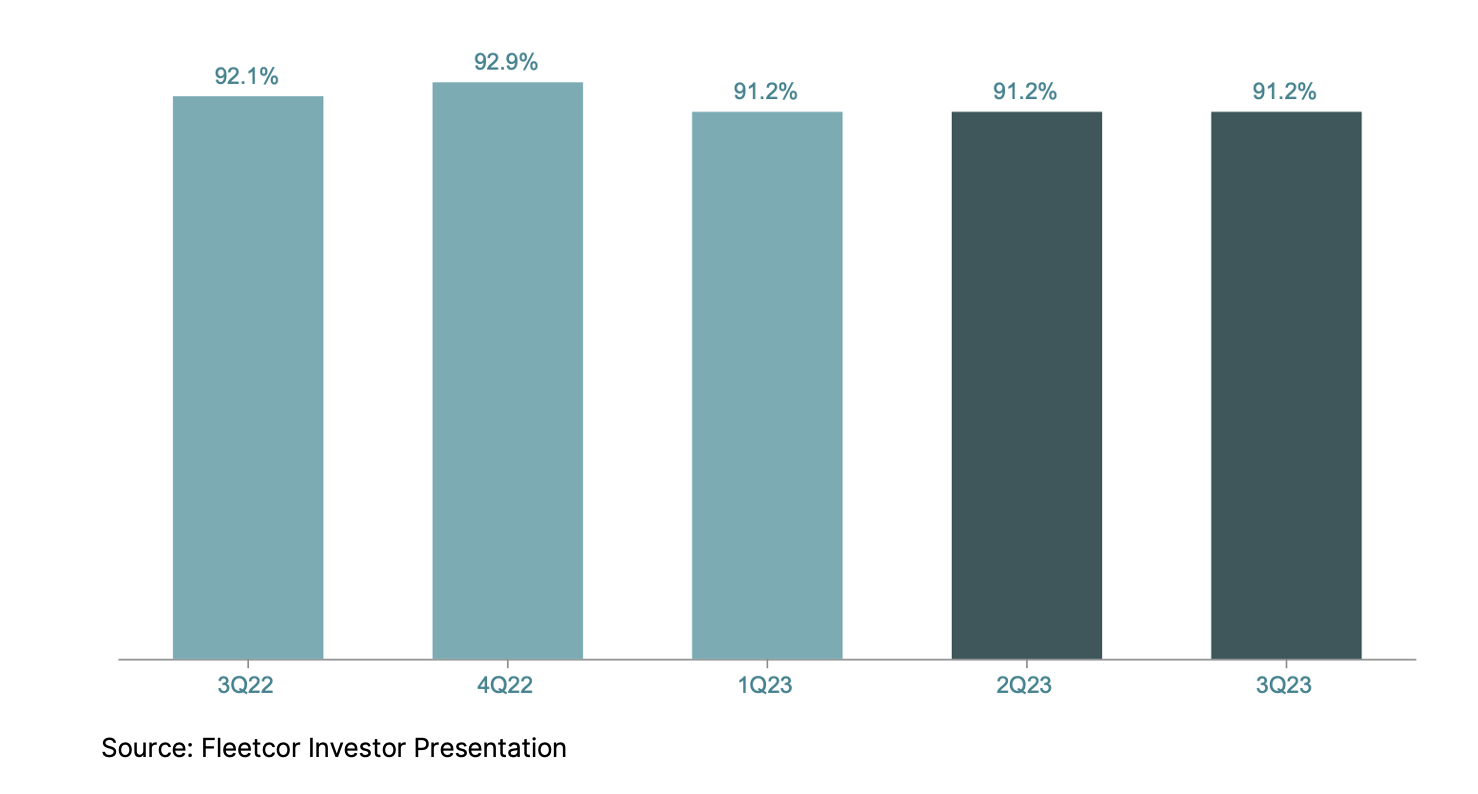

Retention rate is stable but not very high. I haven't benchmarked Fleetcor to Wex or American Express.

Competition. There are several competitors, although no player competes with Fleetcor in the same verticals. American Express is the largest competitor in Corporate payments and Lodging.

Macro. Fleetcor’s revenue depends on the value of transactions and is modestly sensitive to fuel prices. It is quite a cyclical business.

Retention rate is stable but not very high. I haven't benchmarked Fleetcor to Wex or American Express.

FW Thorpe

Source: FW Thorpe Annual Report 2023

Ticker: TFW LN

Share price: £3.56

Mkt Cap: £416mn

EV: £397mn

FW Thorpe is a UK manufacturer of professional lighting equipment founded in 1936 by Frederick William Thorpe. His grandsons and a grandgrandson collectively own a 45% interest in the business. The company’s products are used in public offices, industrial sites, car parks, street lighting and at homes.

Share price: £3.56

Mkt Cap: £416mn

EV: £397mn

FW Thorpe is a UK manufacturer of professional lighting equipment founded in 1936 by Frederick William Thorpe. His grandsons and a grandgrandson collectively own a 45% interest in the business. The company’s products are used in public offices, industrial sites, car parks, street lighting and at homes.

Why it is interesting

As a family business with a long track record, the company has several strong products that benefit from the long-term trend in energy efficiency, clean energy and sustainability.

The company has been actively investing in product innovation and quality. For example, its primary subsidiary, Thurlox, developed special products between 2016 and 2022 which provide colour-tuneable illumination of all four clock faces and balconies on Big Ben.

The company has a 50% interest in Ratio EV Charging JV, which produces and installs EV chargers in the Netherlands and the UK. It is a fairly small business relative to the overall size of FW Thorpe, but it has vast potential.

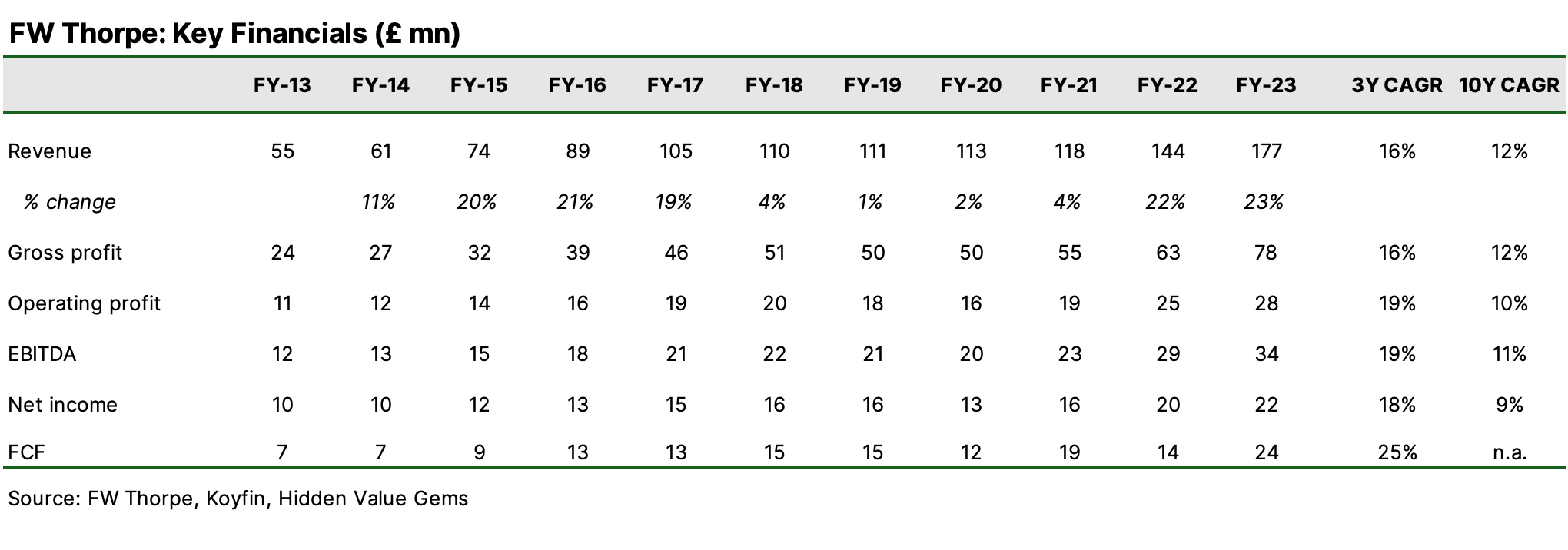

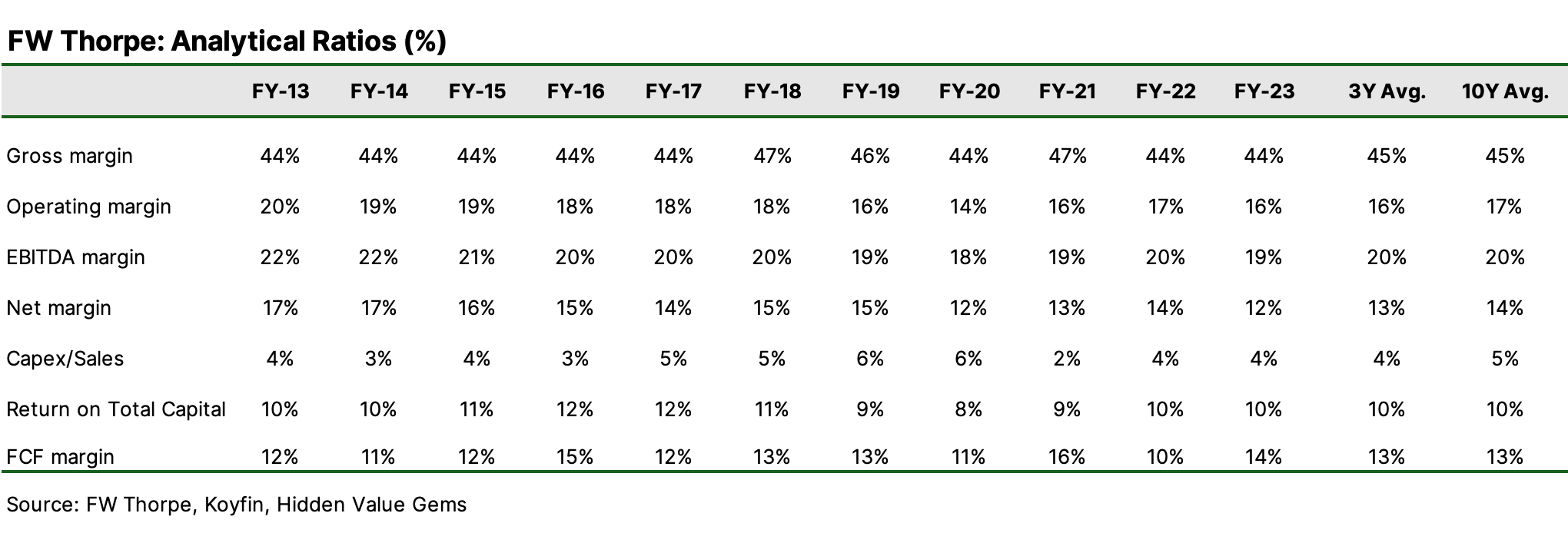

The company delivered a solid 12% 10-year revenue CAGR with 10% and 9% operating and net income margins, respectively (10-year average).

The company is conservatively financed with a net cash position of c. £19mn (5% of the market cap) and no short-term debt.

This quote from the June 2023 financial results speaks volumes of the company’s prudent financial approach:

The company has been actively investing in product innovation and quality. For example, its primary subsidiary, Thurlox, developed special products between 2016 and 2022 which provide colour-tuneable illumination of all four clock faces and balconies on Big Ben.

The company has a 50% interest in Ratio EV Charging JV, which produces and installs EV chargers in the Netherlands and the UK. It is a fairly small business relative to the overall size of FW Thorpe, but it has vast potential.

The company delivered a solid 12% 10-year revenue CAGR with 10% and 9% operating and net income margins, respectively (10-year average).

The company is conservatively financed with a net cash position of c. £19mn (5% of the market cap) and no short-term debt.

This quote from the June 2023 financial results speaks volumes of the company’s prudent financial approach:

“For many years some shareholders have questioned the rationale behind the Group holding large cash reserves. The Board chooses to maintain a large reserve as one never knows what is around the corner, as proven recently by the COVID lockdown.”

Over 50% of sales come from the UK (FY-23 results), 18% and 12% come from the Netherlands and Germany, respectively. The company has started entering international markets which provides it with an important growth potential.

The company distributes about a third of earnings as dividends, offering a modest 1.8% yield. Occasionally, it pays special dividends (e.g. in FY022).

The company distributes about a third of earnings as dividends, offering a modest 1.8% yield. Occasionally, it pays special dividends (e.g. in FY022).

Why now?

The stock has been relatively weak recently, falling -19% in the past year (down -16% YTD).

In 2022, the company’s JV Ratio Electric launched its operations in the UK, making its standalone-style twin 22kW EV charger - the Ratio io7 - available for sale. According to the company, this charger was developed with standard components from a Thorlux outdoor luminaire and is widely recognised as an innovative product suitable for many applications. It mainly targets workplace charging, which matches FW Thorpe’s core market of professional users.

The contribution from the UK operations of the JV should increase in the future.

The contribution from the UK operations of the JV should increase in the future.

The company also made two major acquisitions in Europe in the past two years: Zemper and SchalLED. SchalLED was consolidated only for 9 months in the past financial year.

The company’s production output at various sites has been below capacity due to shortages of chips and other critical components. This is likely a temporary issue suggesting future performance should be stronger.

The company had to build up inventories before, but over the past few months, the inventory level has started to fall, making a positive contribution to future FCF.

The company’s production output at various sites has been below capacity due to shortages of chips and other critical components. This is likely a temporary issue suggesting future performance should be stronger.

The company had to build up inventories before, but over the past few months, the inventory level has started to fall, making a positive contribution to future FCF.

Valuation

FW Thorpe is not cheap at first glance, trading at 18x forward-looking consensus P/E and about 5% FCF yield.

However, it is still below its 5-year average P/E of 21x. Besides, the near-term earnings do not capture the future profits from the Charging JV.

FW Thorpe has seen an acceleration of growth in more recent years as it has just started to expand in the EV segment. International markets also offer an important growth potential.

What caught my attention in historical financials is an incredible stability of the company's profit margins. This says a lot about the quality of its business. Usually, only companies that offer high-quality differentiating products are able to earn stable returns over time.

However, it is still below its 5-year average P/E of 21x. Besides, the near-term earnings do not capture the future profits from the Charging JV.

FW Thorpe has seen an acceleration of growth in more recent years as it has just started to expand in the EV segment. International markets also offer an important growth potential.

What caught my attention in historical financials is an incredible stability of the company's profit margins. This says a lot about the quality of its business. Usually, only companies that offer high-quality differentiating products are able to earn stable returns over time.

Risks

- Recent growth in the EV segment still depends on government policies, which can change in the future. There have been reports of slower adoption of EVs and some delays in targets to achieve 100% electrification of passenger cars.

- The sector remains highly competitive, with many larger players offering more traditional lighting products (e.g. GE, Philips), while Chinese manufacturers benefit from a larger domestic market and cheaper costs.

- 18.3x P/E may be acceptable for a high-return, fast-growing business, but it leaves little room for error.

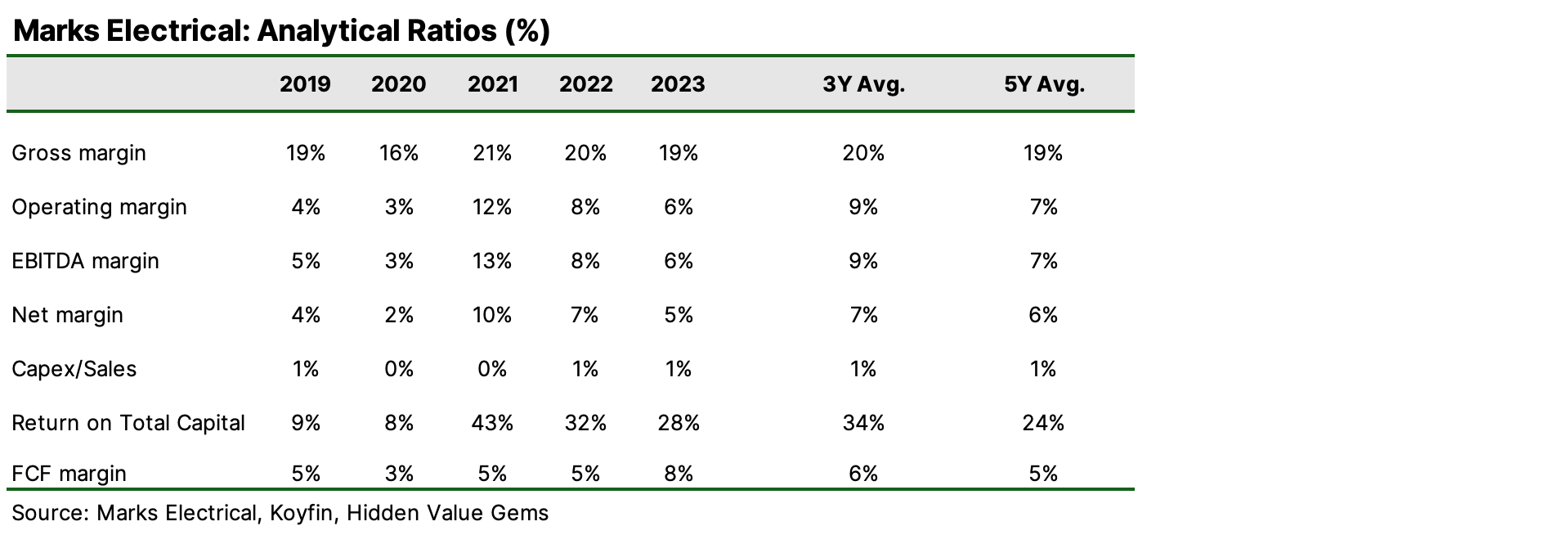

Marks Electrical

Source: Marks Electrical Investor Presentation

Ticker: MRK LN

Share price: £0.88

Mkt Cap: £92mn

EV: £82mn

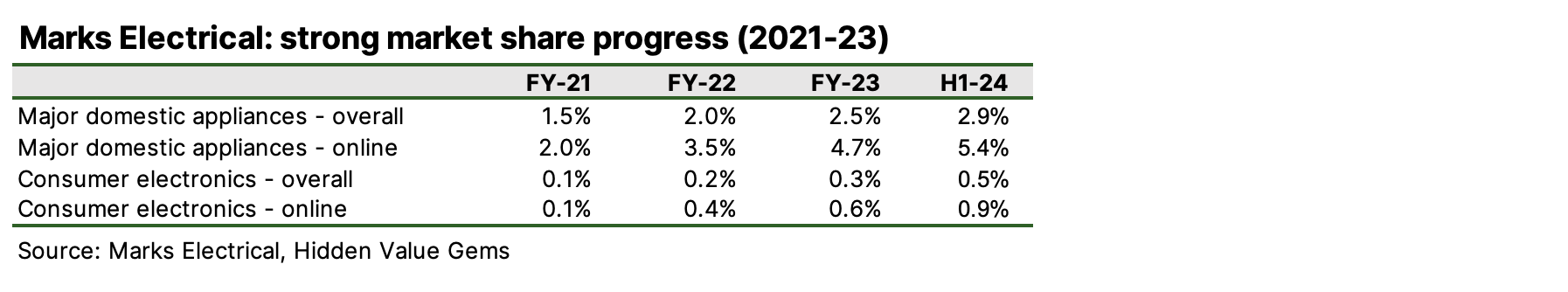

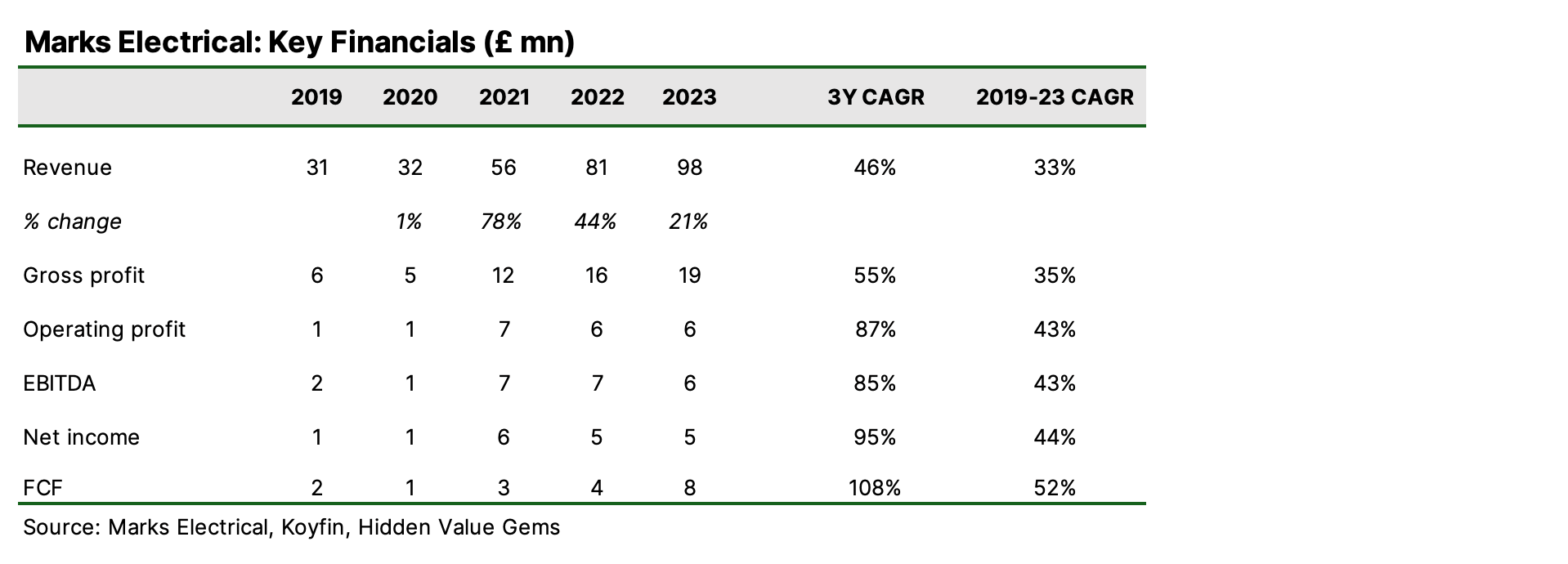

Marks Electrical is a UK home appliance online retailer with a strong focus on costs and customer value. The company was founded in 1987 in Leicester by a 21-year-old entrepreneur, Mark Smithson, as a reseller of used products. Since then, it has become one of the leading national players in the Domestic Appliances industry with a 2.9% market share (5.4% market share in online retail). Mark Smitson continues to run the business as a CEO with a 73.6% stake.

Share price: £0.88

Mkt Cap: £92mn

EV: £82mn

Marks Electrical is a UK home appliance online retailer with a strong focus on costs and customer value. The company was founded in 1987 in Leicester by a 21-year-old entrepreneur, Mark Smithson, as a reseller of used products. Since then, it has become one of the leading national players in the Domestic Appliances industry with a 2.9% market share (5.4% market share in online retail). Mark Smitson continues to run the business as a CEO with a 73.6% stake.

Why it is interesting

The company has a relatively long track of operations and has managed to adapt its business model to the changing environment. While initially operating as a traditional retailer, the company launched its online website only in 2003. However, by 2010, its online sales had reached 80% of revenue.

Like Amazon, its main focus is on customers, not competition or next quarter earnings. Its business philosophy is summarised in its slogan.

Like Amazon, its main focus is on customers, not competition or next quarter earnings. Its business philosophy is summarised in its slogan.

Source: Marks Electrical Investor Presentation

Its free next-day delivery is a significant differentiating factor. Argos, for example, does not offer free delivery, and the average waiting time is several days. Other competitors like AO World occasionally offer next-day delivery, but it is not guaranteed. They charge about £30-35 (for a washing machine) for the next-day delivery unless you are an AO member (which costs £39.99 a year).

Marks growth started first in the regions before the company entered the London market. This pattern is similar to that of many successful companies that begin their operations in smaller niche markets before moving to a bigger market.

The company has been constantly increasing its market share while remaining profitable and generating FCF.

Marks growth started first in the regions before the company entered the London market. This pattern is similar to that of many successful companies that begin their operations in smaller niche markets before moving to a bigger market.

The company has been constantly increasing its market share while remaining profitable and generating FCF.

As a founder-led business, Marks is conservatively financed with a net cash position of £10.9m as of 30 September 2023.

What is also interesting is that the growth has been achieved with relatively low marking spend. The company launched its first-ever TV advertising campaign only in 2021, ahead of its IPO in 2022. It has boosted its marketing expenses to a relatively high 5% level as it started to invest in brand awareness on a national level.

The company has been investing in critical in-house capabilities to deliver the best customer experience, including low prices and fast and convenient delivery. Marks operates from one strategically located central warehouse in Leicester, enabling cost-effective delivery to over 80% of the UK population. This allows to avoid overnight trunking and keeps overheads low.

Additionally, the Group’s headquarters has an on-site fuelling station and full-time mechanic, meaning vehicles can be refuelled and repaired overnight to maximise efficiency and minimise downtime. In addition, the Directors believe that having operations centred in one location eliminates the need for trunking products between satellite warehouses via heavy goods vehicles, thereby reducing overheads and maintaining simplicity in the Group’s operating model and supply chain.

What is also interesting is that the growth has been achieved with relatively low marking spend. The company launched its first-ever TV advertising campaign only in 2021, ahead of its IPO in 2022. It has boosted its marketing expenses to a relatively high 5% level as it started to invest in brand awareness on a national level.

The company has been investing in critical in-house capabilities to deliver the best customer experience, including low prices and fast and convenient delivery. Marks operates from one strategically located central warehouse in Leicester, enabling cost-effective delivery to over 80% of the UK population. This allows to avoid overnight trunking and keeps overheads low.

Additionally, the Group’s headquarters has an on-site fuelling station and full-time mechanic, meaning vehicles can be refuelled and repaired overnight to maximise efficiency and minimise downtime. In addition, the Directors believe that having operations centred in one location eliminates the need for trunking products between satellite warehouses via heavy goods vehicles, thereby reducing overheads and maintaining simplicity in the Group’s operating model and supply chain.

Why now

The UK economy has had many issues recently, including inflation, public sector strikes, disruptions and weaker supply due to labour shortages. The market seems to reflect a lot of ‘doom and gloom’ exacerbated by widely expected Labour victory next year.

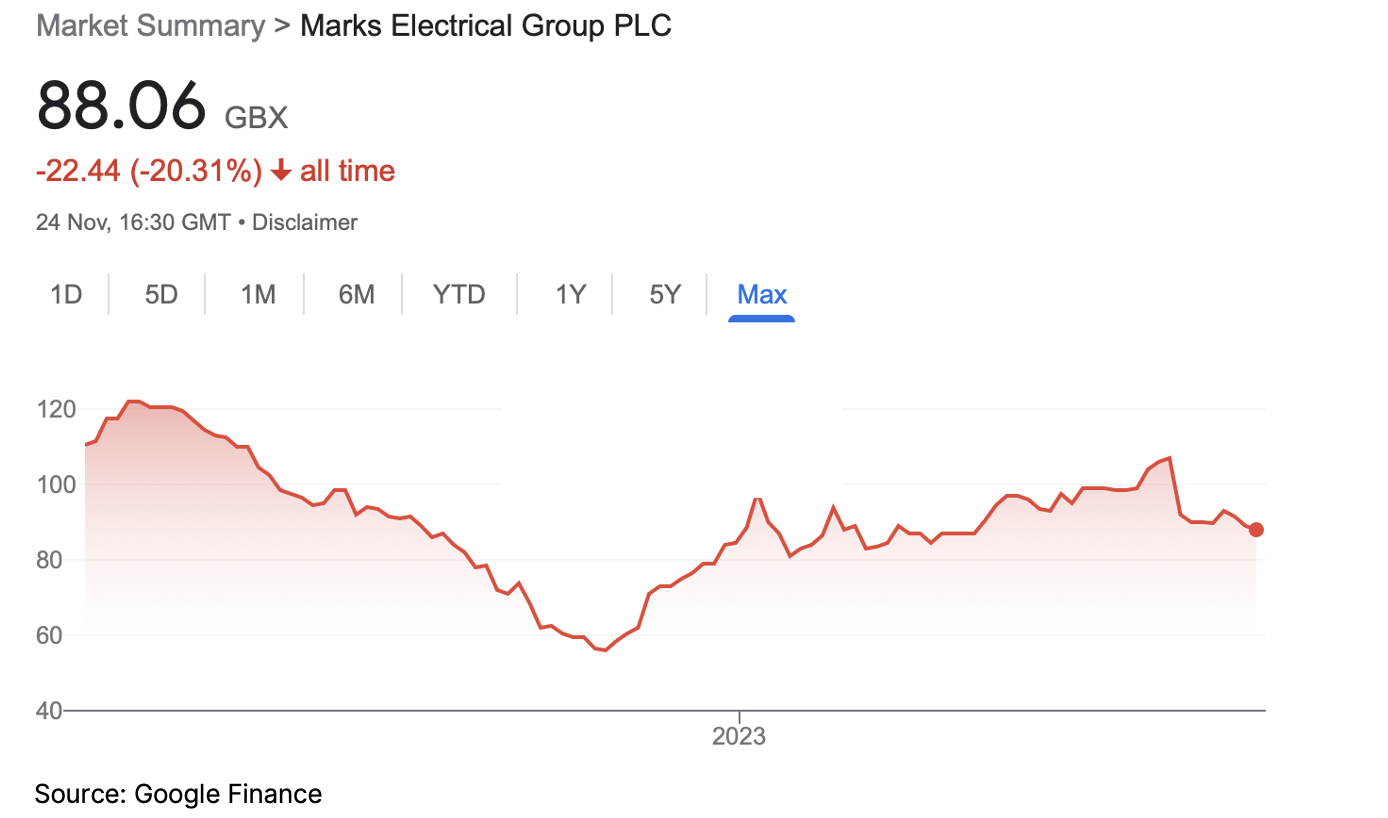

Marks’ share price is down 20% since the IPO and is flat year-to-date despite delivering 33% growth over the past four years.

The market misunderstands the company. Investors particularly didn’t like the interim report released on 12 October 2023. That day, management revealed that it had sacrificed its operating margins to strengthen its premium service, which should help the company win more market share and deliver faster revenue growth. During the period, the company added an in-house installation service to its offering, which immediately increased the cost base while the benefit of stronger sales and, eventually, profits would not be visible in the near term.

Marks’ share price is down 20% since the IPO and is flat year-to-date despite delivering 33% growth over the past four years.

The market misunderstands the company. Investors particularly didn’t like the interim report released on 12 October 2023. That day, management revealed that it had sacrificed its operating margins to strengthen its premium service, which should help the company win more market share and deliver faster revenue growth. During the period, the company added an in-house installation service to its offering, which immediately increased the cost base while the benefit of stronger sales and, eventually, profits would not be visible in the near term.

Valuation

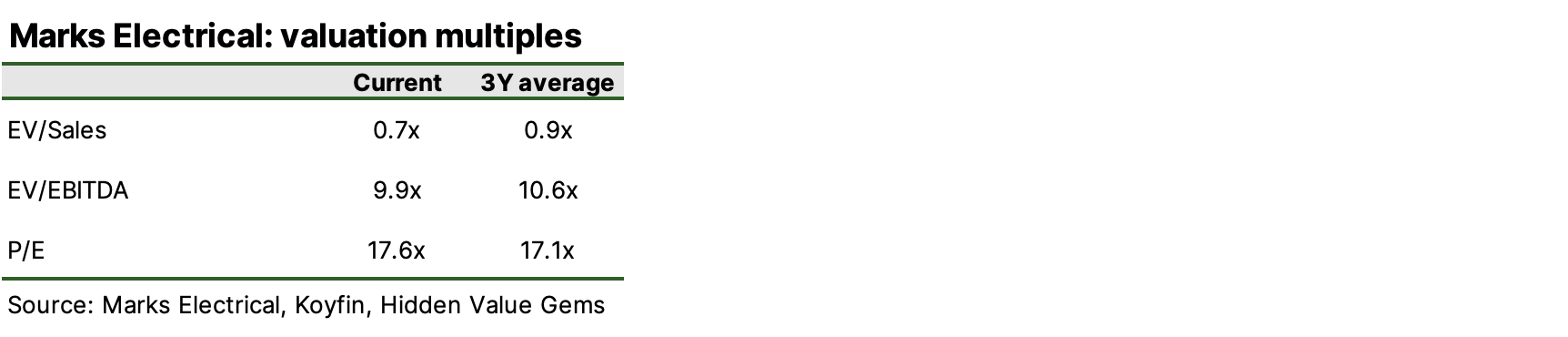

The company is valued at 17.6x P/E, which is clearly expensive in the UK context. However, taking into account a 33% annual growth rate since 2019, a net cash position and the scope to improve margins in the next 1-2 years, the multiple is reasonable.

Risks

- Tough sector. From my experience, the retail sector is much more complex than it appears. Margins are generally thin; consumers are not loyal and either go for big brands or the lowest price. In both cases, retail companies cannot earn high margins. There are, of course, some well-known exceptions, but they represent a tiny share of the overall number of companies in the sector.

- The online format may not work well for consumer electronics. E-commerce has high fixed costs, so to cover expenses on warehouses and fleet, the companies should have high utilisation (i.e. always be delivering). Home appliances are usually purchased once every few years - not too often. On the other hand, their high price relative to the cost of delivery benefits the economics of the business.

- The new phase of growth can prove more challenging. So far, Marks has been growing from a small base in smaller regional markets. It is now entering a bigger national market, facing much larger competitors. This may lead to increased investments with no success guaranteed.

- Macro sensitivity. The company's sales are susceptible to the economic cycle, which seems to be going downhill now. At a minimum, this increases timing risks (risk of buying the stock too early). However, relatively high margins and a net cash position limit downside risks from the weaker macro environment.

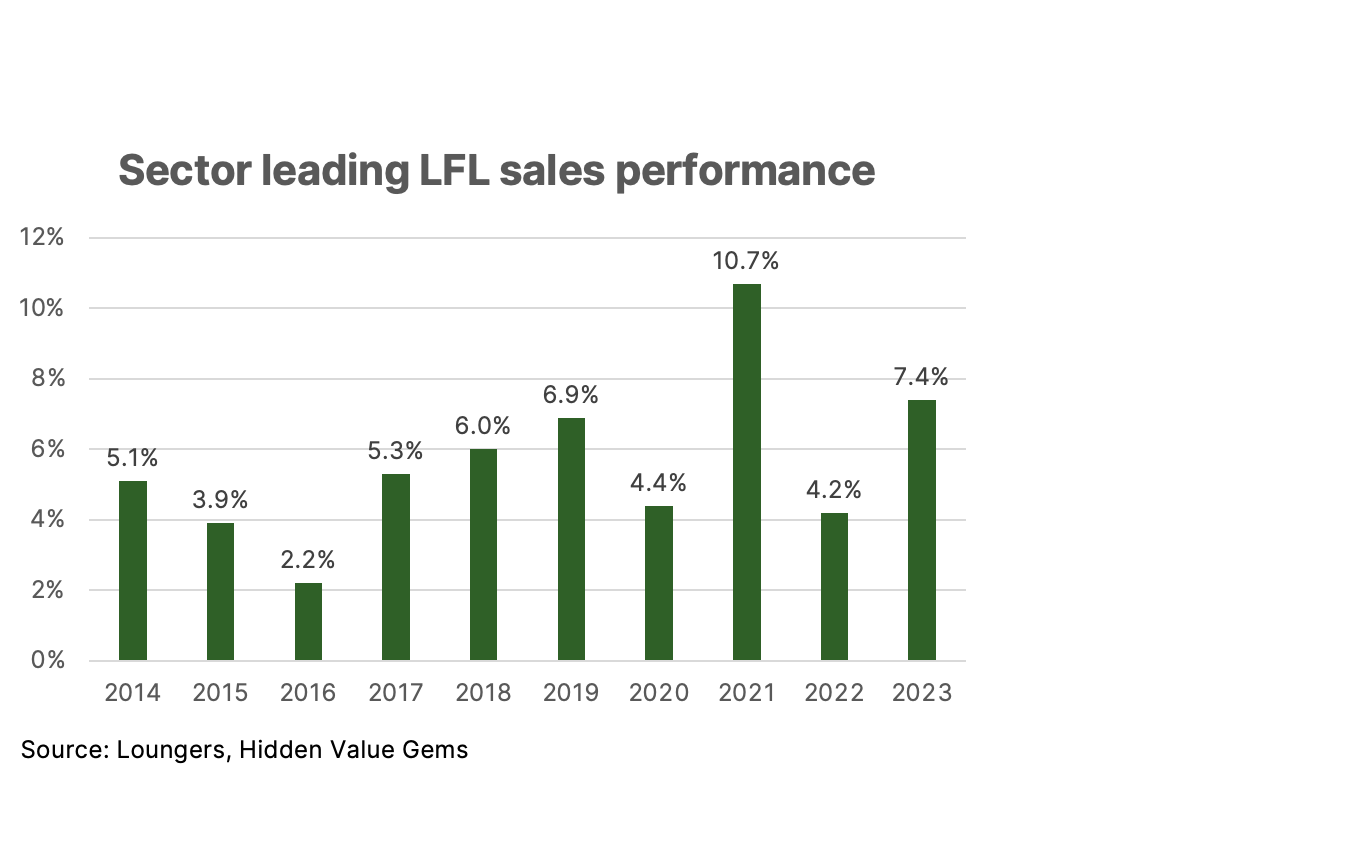

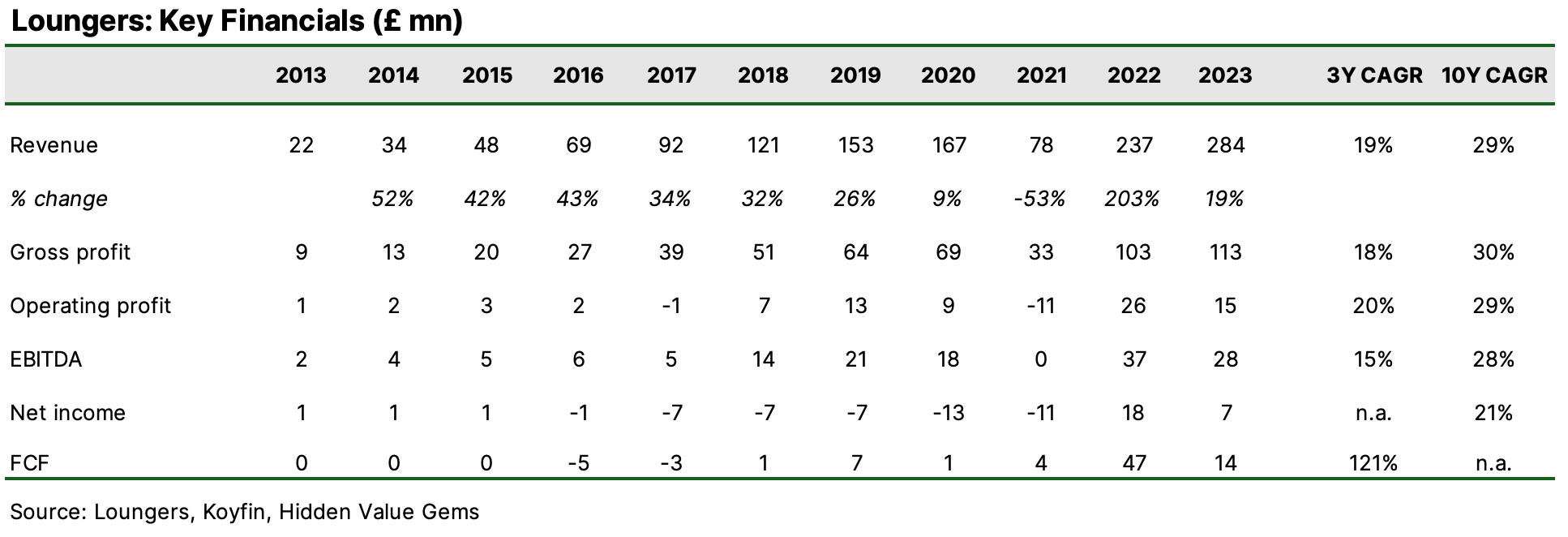

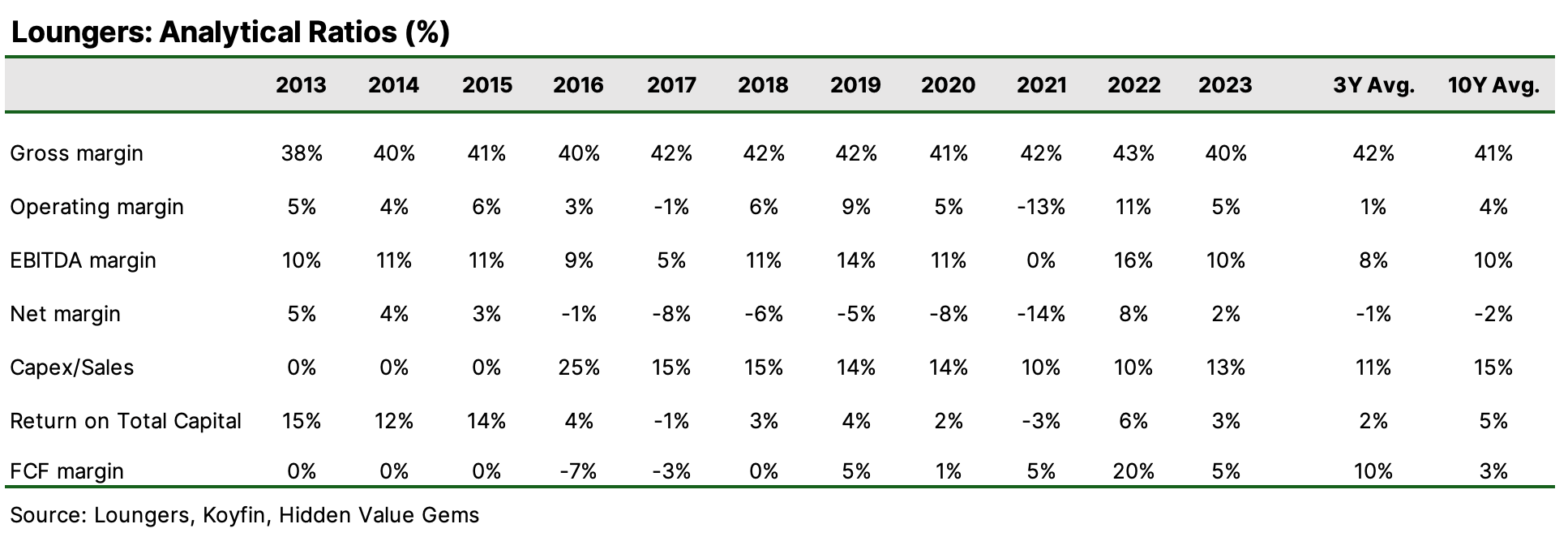

Loungers

Ticker: LGRS LN

Share price: £2.3

Mkt Cap: £239mn

EV: £380mn

Loungers is a UK casual dining restaurant chain. It was founded in Bristol in 2002 by three friends (Alex Reilly, Jake Bishop and Dave Reid) who wanted to create a neighbourhood café-bar that they would want to go to. Alex is currently the executive chairman of the company with a 6.5% stake, while Jake is a director with a 6.3% interest.

That focus on hospitality, comfort and familiarity remains at the core of the Group, driven by an independent culture and focus on the local community.

The company listed on AIM in 2019 for 200p, just 15% below the current price.

The company operates under three brands: Lounge (casual dining), Cosy Club (bars), and Brightside (roadside dining).

As of April 2023, the company had 222 sites (+27 more than the previous year). In terms of brands, there were 186 Lounges, 35 Cosy Clubs and 1 Brightside.

At the latest earnings call, management said they see scope for at least 600 Lounges and 50-65 Cosy Clubs.

Share price: £2.3

Mkt Cap: £239mn

EV: £380mn

Loungers is a UK casual dining restaurant chain. It was founded in Bristol in 2002 by three friends (Alex Reilly, Jake Bishop and Dave Reid) who wanted to create a neighbourhood café-bar that they would want to go to. Alex is currently the executive chairman of the company with a 6.5% stake, while Jake is a director with a 6.3% interest.

That focus on hospitality, comfort and familiarity remains at the core of the Group, driven by an independent culture and focus on the local community.

The company listed on AIM in 2019 for 200p, just 15% below the current price.

The company operates under three brands: Lounge (casual dining), Cosy Club (bars), and Brightside (roadside dining).

As of April 2023, the company had 222 sites (+27 more than the previous year). In terms of brands, there were 186 Lounges, 35 Cosy Clubs and 1 Brightside.

At the latest earnings call, management said they see scope for at least 600 Lounges and 50-65 Cosy Clubs.

Why it is interesting

- The company's restaurants offer a unique combination of a neighbourhood café/bar with elements of a restaurant, British pub and coffee shop culture. Cosy Clubs are more formal bars/restaurants located in city centres, often in heritage buildings.

- At the same time, both brands offer prices at the lower end of the competition, making them affordable for the wider population.

- The company has a differentiating menu, offering rare beer brands and various cuisines that appeal to a more sophisticated public.

- I have seen many pubs and restaurants closing down after just 1-2 years of operations. The fact that Lounges continues to open new sites and achieves positive like-for-like (LFL) sales is pretty remarkable and suggests that the management has found the success formula.

- Over the past ten years, Loungers has never had a year with declining like-for-like sales. The average LFL growth rate has been 5.6%, one of the highest among the larger players. Its total sales growth over the same period was a staggering 29% (10Y CAGR).

- Despite challenges first caused by COVID and later by high inflation and labour shortages, the business has increased its EBITDA by 66% to £47.3mn in the last financial year since its IPO in 2019. If inflation moderates and labour shortages ease, the company's profitability should improve from 16.7% in FY-2023, closer to a pre-pandemic level (19%).

Why now

Loungers could be a play on improving UK macro, although there are risks of taking a position too early.

A more interesting angle is the rising activity of private equity funds. In October 2023, Apollo agreed to take The Restaurant Group Plc, the owner of Wagamana, private for £506mn. Earlier this year, Japan's Toridoll acquired Fulham Shore, the owner of The Real Greek and Franco Manca, for £93.4mn. There have been many deals in the private space.

Industry participants often mention overseas buyers who are particularly attracted by low valuation and cheap currency.

A more interesting angle is the rising activity of private equity funds. In October 2023, Apollo agreed to take The Restaurant Group Plc, the owner of Wagamana, private for £506mn. Earlier this year, Japan's Toridoll acquired Fulham Shore, the owner of The Real Greek and Franco Manca, for £93.4mn. There have been many deals in the private space.

Industry participants often mention overseas buyers who are particularly attracted by low valuation and cheap currency.

Valuation

Unlike most of its peers, Loungers trade at a heft 20.2x forward P/E, which is reasonable for the fastest-growing restaurant chain, but still expensive.

Its EV/EBITDA of 6.4x is more attractive. It is lower than 9x EV/EBITDA paid by Apollo for TRG, but higher than what Toridoll paid for Fulham Shore (4.6x).

Its EV/EBITDA of 6.4x is more attractive. It is lower than 9x EV/EBITDA paid by Apollo for TRG, but higher than what Toridoll paid for Fulham Shore (4.6x).

Risks

- The company has been loss-making (at the bottom line) in six out of the past ten years, although its FCF was negative only in two years.

- The company has a high leverage of 5x Net Debt/EBITDA, although most of the debt is property lease. Excluding the latter, Loungers' net debt is only £6.1mn compared to £28mn EBITDA.

- Restaurants are a tricky business, as evidenced by numerous openings and closures of new sites. It is quite labour-intensive, not easily scalable, with high operating and financial leverage, and pretty cyclical. On the other hand, few businesses that can find their niche and unique proposition achieve extraordinary results for their shareholders. McDonald's, Chipotle, and Domino's Pizza are some examples.

- Insider share sales. The co-founder and chairman, Alex Reilley, has been a net seller of shares, with the last transaction taking place on 12 July 2023 (200k shares for £1.9). Other insiders sold more shares in 2020 and earlier.

- Share overhang. Lion Capital, the private equity fund which bought a 67% stake in the business in 2016 for £137mn, continues to be the largest shareholder with a 25.8% stake. Private equity funds have a limited holding period, meaning at some point, they will start selling shares in the market (unless they find a strategic buyer).

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.