7 January 2024

This is the ninth edition of the Monthly Stock Idea Lab (MSIL #9).

The focus is on companies that meet the following five key criteria:

Two of the four companies in December MSIL are well-established family-owned businesses, one is a monopoly with a 70%+ EBIT margin, and another is enjoying strong demand exceeding pre-COVID levels, while its stock is still 19% below 2019.

Let's dive in.

The focus is on companies that meet the following five key criteria:

- quality of business

- financial performance

- low leverage

- insider ownership

- attractive valuation

Two of the four companies in December MSIL are well-established family-owned businesses, one is a monopoly with a 70%+ EBIT margin, and another is enjoying strong demand exceeding pre-COVID levels, while its stock is still 19% below 2019.

Let's dive in.

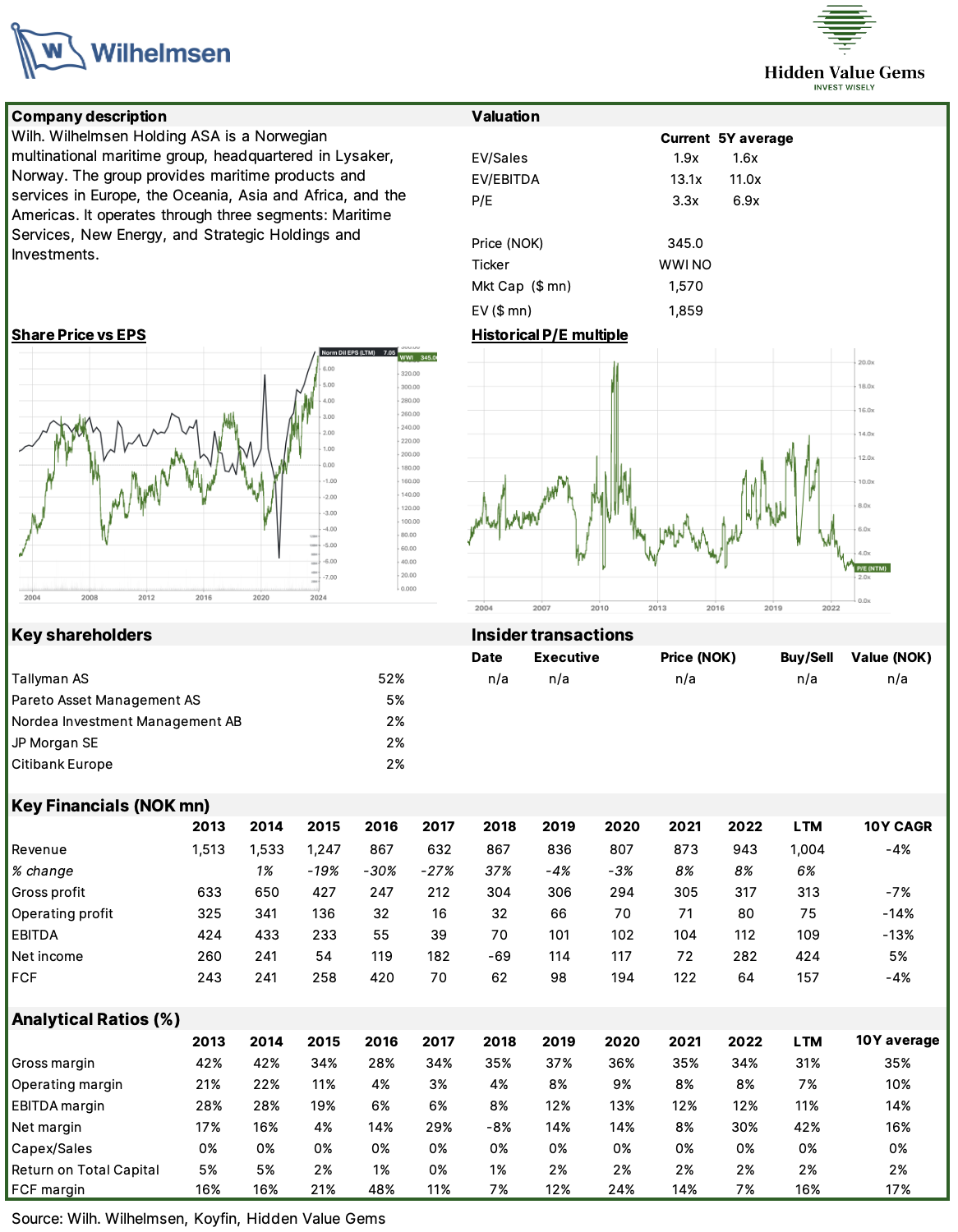

Wilh. Wilhelmsen Holding ASA

Wilh. Wilhelmsen (WWI) is a Norwegian maritime holding company founded in 1861 by Morten Wilhelm Wilhelmsen. It is majority owned by the Tom Wilhelmsen's Foundation (52%) and is managed by the grand-grandson of the founder, Thomas Wilhelmsen, who is currently the CEO of the company.

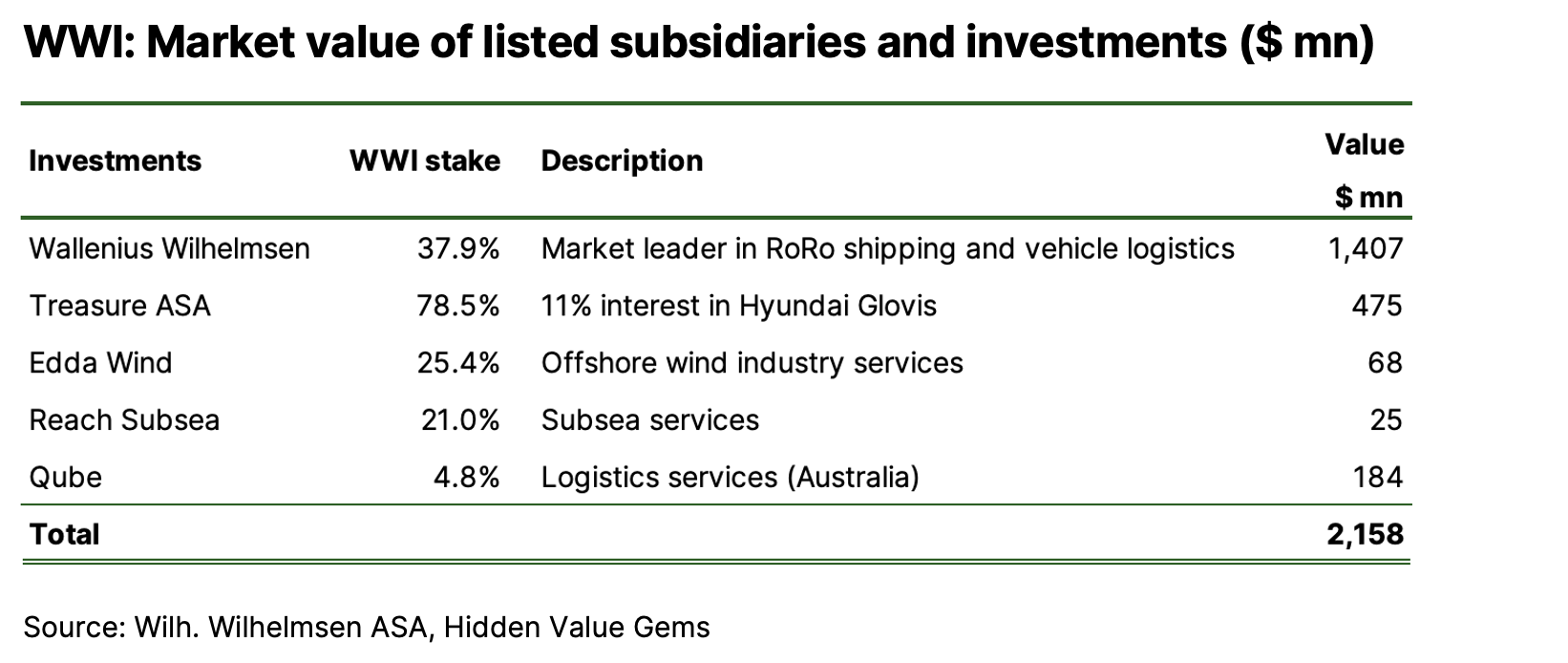

The company’s market cap is less than the combined value of its net cash and public investments. In other words, the value of its private operations has an implied negative value (-$299mn) despite generating $82mn of EBITDA in 9M ’23.

Put differently, WWI is trading at a c. 40% discount to its NAV (if private operations are valued at 7x EV/EBITDA).

The company’s market cap is less than the combined value of its net cash and public investments. In other words, the value of its private operations has an implied negative value (-$299mn) despite generating $82mn of EBITDA in 9M ’23.

Put differently, WWI is trading at a c. 40% discount to its NAV (if private operations are valued at 7x EV/EBITDA).

The company has three strategic and fully-owned businesses: Port Services, Ships Service and Ship Management. In addition to that, Wilhemsen owns stakes in five publicly listed companies with a combined market value of $2.2bn.

Its largest investment is a 37.9% interest in Wallenius Wilhelmsen, a market leader in the shipping of cars and trucks (the segment is commonly referred to as RoRo logistics). This business is also listed in Norway with a market cap of $3.7bn.

The second largest investment is an indirect stake (8.6%) in Hyundai Glovis, a Korean logistics company with a market cap of $5.5bn.

A few other stakes are held in private companies, including several joint ventures. All businesses operate within marine services and recently added a New Energy segment (e.g. offshore wind).

It is worth noting that the core operations are generally cyclical and have recently benefited from the strong market environment. The normalised earnings are lower than the recent performance. This may explain why the market values Wilhemsen at a discount, but it is still excessive, in my view.

The company pays stable dividends of about 20% of FCF (c. $20-35mn annually), which corresponds to c. 1.5% dividend yield. Occasionally, Wilgemsen carries out small share repurchases.

Most of FCF is spent on bolt-on acquisitions in the maritime sector.

Its largest investment is a 37.9% interest in Wallenius Wilhelmsen, a market leader in the shipping of cars and trucks (the segment is commonly referred to as RoRo logistics). This business is also listed in Norway with a market cap of $3.7bn.

The second largest investment is an indirect stake (8.6%) in Hyundai Glovis, a Korean logistics company with a market cap of $5.5bn.

A few other stakes are held in private companies, including several joint ventures. All businesses operate within marine services and recently added a New Energy segment (e.g. offshore wind).

It is worth noting that the core operations are generally cyclical and have recently benefited from the strong market environment. The normalised earnings are lower than the recent performance. This may explain why the market values Wilhemsen at a discount, but it is still excessive, in my view.

The company pays stable dividends of about 20% of FCF (c. $20-35mn annually), which corresponds to c. 1.5% dividend yield. Occasionally, Wilgemsen carries out small share repurchases.

Most of FCF is spent on bolt-on acquisitions in the maritime sector.