14 February 2024

In this Weekly newsletter, I will try a different format. Rather than discuss a single investment topic, I will cover a few stocks and thoughts. More of a journal format. Hope you enjoy it. Feel free to leave your feedback at the end of this article.

Meta and individual investor's edge

This is not “yet another” quarterly review of Meta’s results here. What I am really thinking about is what Meta’s 3-year performance tells us about private investor’s edge.

In the earlier part of my investment journey, I was mainly focused on US stocks. All the online tools and data sources were readily available, companies presented their numbers in a clear format, hosted great earnings calls and made analysts’ and shareholders’ lives easy. I owned many of the tech titans before, especially those that were easily identifiable as ‘quality’ and/or ‘value’ (Microsoft and Meta are probably the two exceptions, as I have never owned any of the two).

However, since 2020, I have started reducing my exposure to the US. Apart from the general optimism and rising valuation, I was more concerned by the intense competition among investors. I had noticed before that when I bought a cheap retail stock, for example, (e.g., Gap), especially after a share price drop, it was almost inevitable that the following quarterly results would be poor and the stock would sell off further.

Rising stock and expensive valuation were, quite often, the contrary signs.

I felt I was among the last in this information chain with little information or analytical edge.

I did not want to move down the list, looking at smaller market-cap stocks because many of them were local US businesses, and being unable to visit their stores and talk to their suppliers/customers was a significant disadvantage.

So, here we are in early 2024. Some of the biggest moves we have seen over the past three years were in some of the most well-covered and widely followed companies with market caps close to or even above $1 trillion and daily liquidity in the billions of dollars.

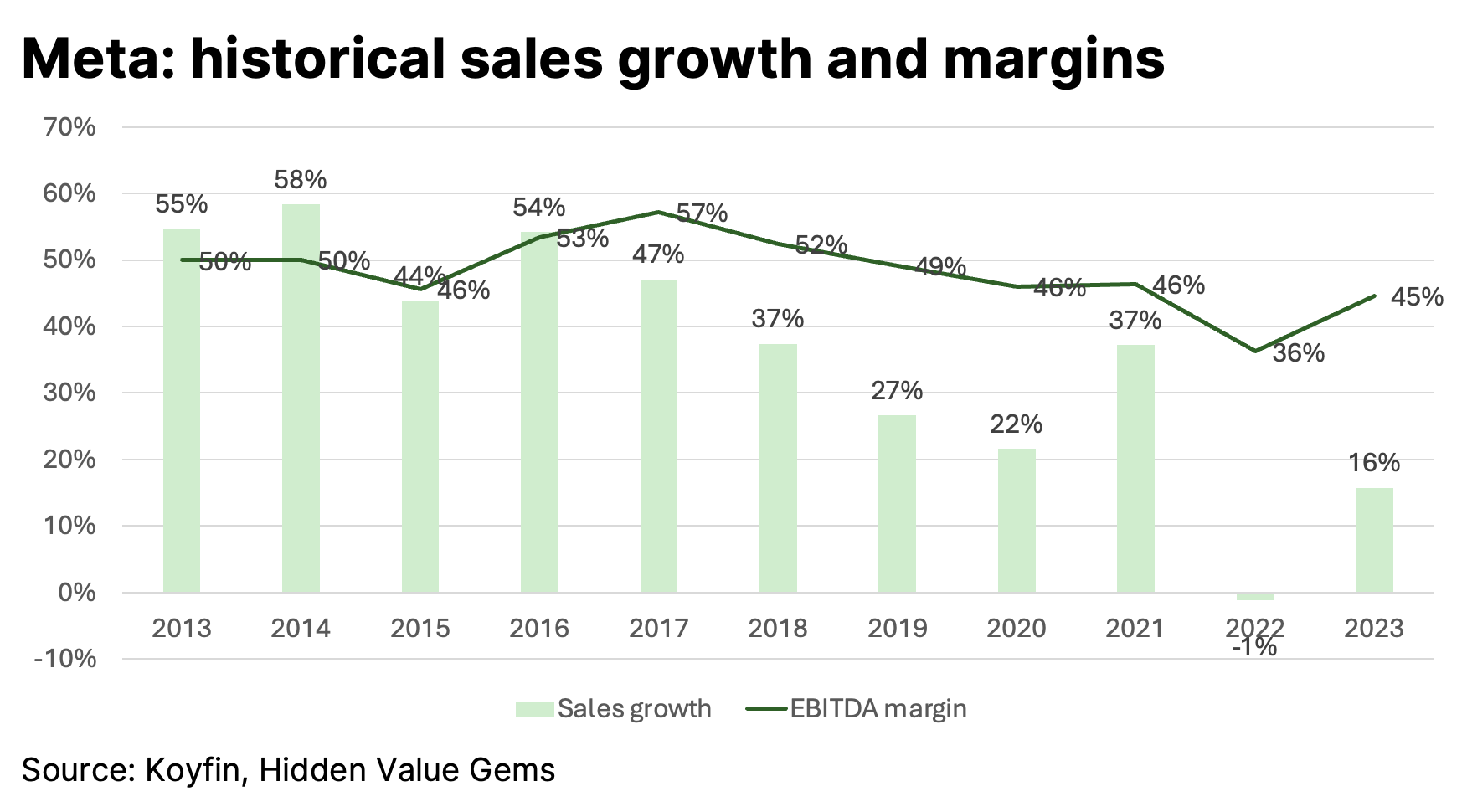

Meta’s stock almost never looked expensive, given its margins and historical growth.

In the earlier part of my investment journey, I was mainly focused on US stocks. All the online tools and data sources were readily available, companies presented their numbers in a clear format, hosted great earnings calls and made analysts’ and shareholders’ lives easy. I owned many of the tech titans before, especially those that were easily identifiable as ‘quality’ and/or ‘value’ (Microsoft and Meta are probably the two exceptions, as I have never owned any of the two).

However, since 2020, I have started reducing my exposure to the US. Apart from the general optimism and rising valuation, I was more concerned by the intense competition among investors. I had noticed before that when I bought a cheap retail stock, for example, (e.g., Gap), especially after a share price drop, it was almost inevitable that the following quarterly results would be poor and the stock would sell off further.

Rising stock and expensive valuation were, quite often, the contrary signs.

I felt I was among the last in this information chain with little information or analytical edge.

I did not want to move down the list, looking at smaller market-cap stocks because many of them were local US businesses, and being unable to visit their stores and talk to their suppliers/customers was a significant disadvantage.

So, here we are in early 2024. Some of the biggest moves we have seen over the past three years were in some of the most well-covered and widely followed companies with market caps close to or even above $1 trillion and daily liquidity in the billions of dollars.

Meta’s stock almost never looked expensive, given its margins and historical growth.

I did not own it, however, because I was not sure whether these margins and growth were sustainable. They are (or at least were) an advertising company, and as such, they could not grow well above the advertising sector, which itself cannot outgrow the GDP. Besides, the changes in the Internet sector are rapid, with new products emerging almost every month.

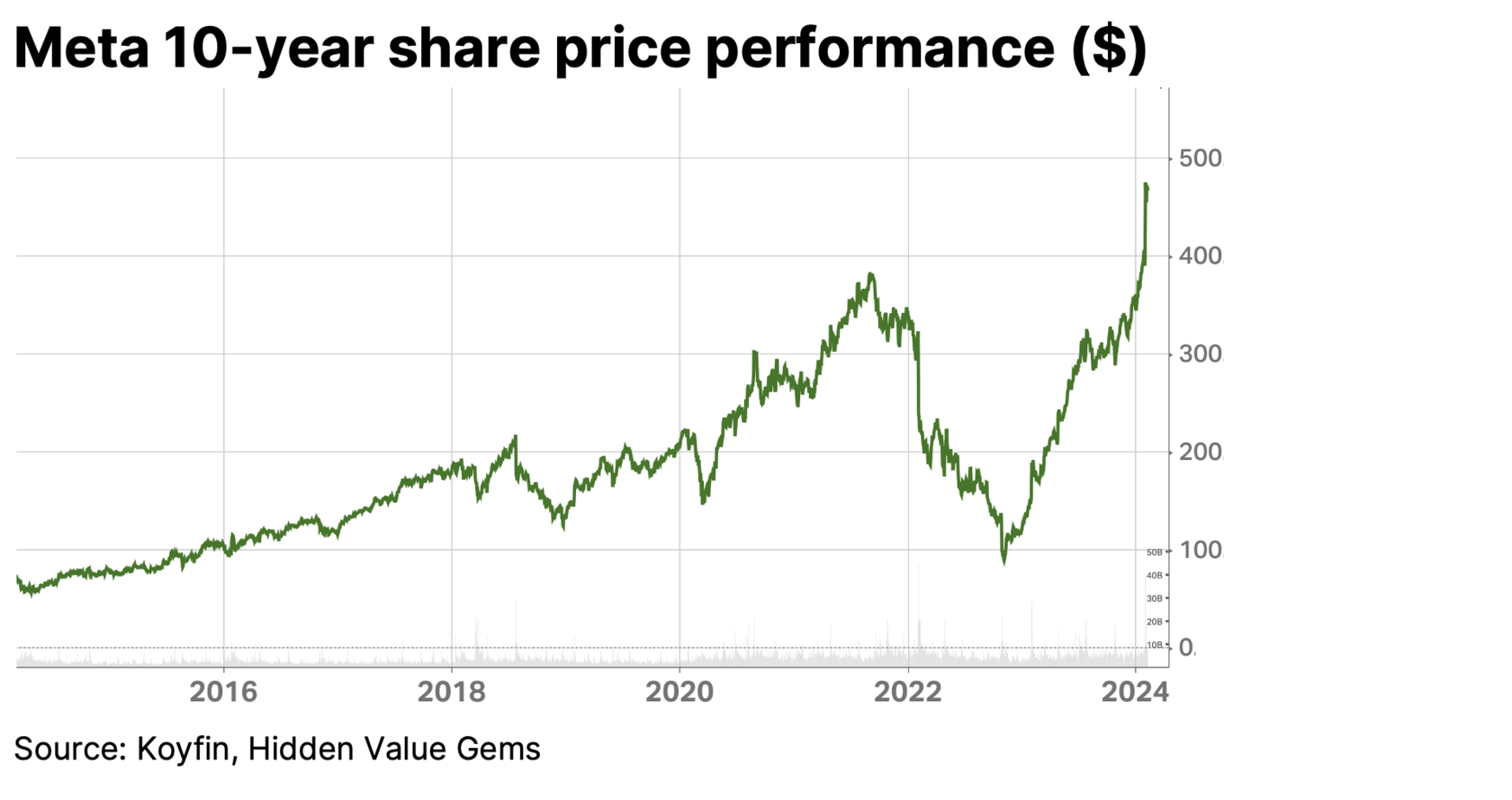

Then the crash happened: a toxic mix of economic slowdown, rising interest rates and changes in Apple’s privacy policy. On top of that, Meta’s founder and CEO, Mark Zuckerberg, decided to radically increase investments in the Metaverse, a high-cost project with unclear economics. So, not only did Meta’s growth profile start to flatten and margins to fall, but its capital allocation became unclear and risky to most investors.

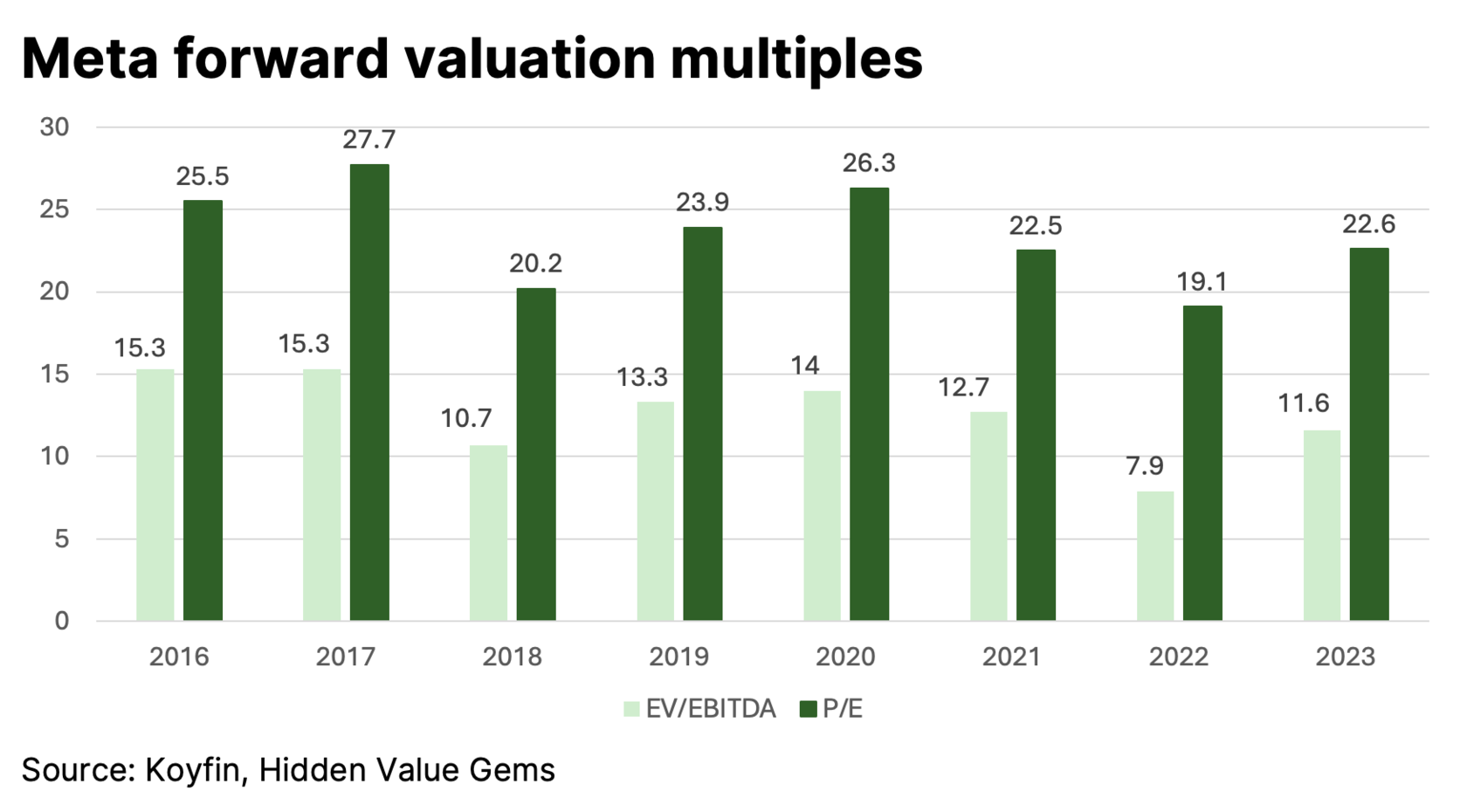

I kept following the case as an outsider, planning to add it to my case studies on how not to lose money until November 2022, when the stock dropped below $90 a share. Net of cash and using the 2021 profitability level, Meta was trading at c. 5x EV/EBIT. This looked too low to ignore. I was close to pulling the trigger, thinking that even if it was not a compounder, long-term growth business, it was at least a deep value stock with upside coming from a re-rating.

Due to my personal circumstances, I was still hesitant to buy it. Then, Zuckerberg announced his decision to reduce investments in Meta Labs, and after that, the company officially announced reduced investment plans. The stock was trading above $180 already in February 2023, more than a 100% gain in just three months. As most investors would admit, buying a stock after such a rally is so much harder, especially if you followed it and missed the bottom. This is a psychological issue, of course — one of the areas that gives machines an advantage over humans.

Then the crash happened: a toxic mix of economic slowdown, rising interest rates and changes in Apple’s privacy policy. On top of that, Meta’s founder and CEO, Mark Zuckerberg, decided to radically increase investments in the Metaverse, a high-cost project with unclear economics. So, not only did Meta’s growth profile start to flatten and margins to fall, but its capital allocation became unclear and risky to most investors.

I kept following the case as an outsider, planning to add it to my case studies on how not to lose money until November 2022, when the stock dropped below $90 a share. Net of cash and using the 2021 profitability level, Meta was trading at c. 5x EV/EBIT. This looked too low to ignore. I was close to pulling the trigger, thinking that even if it was not a compounder, long-term growth business, it was at least a deep value stock with upside coming from a re-rating.

Due to my personal circumstances, I was still hesitant to buy it. Then, Zuckerberg announced his decision to reduce investments in Meta Labs, and after that, the company officially announced reduced investment plans. The stock was trading above $180 already in February 2023, more than a 100% gain in just three months. As most investors would admit, buying a stock after such a rally is so much harder, especially if you followed it and missed the bottom. This is a psychological issue, of course — one of the areas that gives machines an advantage over humans.

One final note is that I have never had an active account on Facebook; I only use WhatsApp. As for Netflix, I used it sporadically for 2-3 months in total. I guess this lack of customer experience (not being able to see the product's value) was one reason I was too slow to move.

So, what are the lessons from the Meta (and Netflix cases)?

Firstly, there is alpha in the large caps, although the time to capture it is rare. It usually happens during a considerable dislocation like the early 2000s, 2008-2009 or 2022. The primary source of alpha is cash or relatively safe assets that you can trade for more beaten down yet quality businesses.

Secondly, not every stock that is down 70-80% is an automatic buy. The advantage of large, well-established companies with strong balance sheets (net cash positions) is that they do not go out of business overnight.

Thirdly, what is the risk that a large-cap is another Nokia? This is a harder question, of course, but in hindsight, it looks like Nokia faced a completely new product: a computer disguised as a phone. Meta, on the other hand, faced some competition, which is inevitable, but a lot of the issues were either external (macro slowdown) or self-inflicted (e.g. multi-billion investments into the Meta Labs).

It is common for a typical S&P 500 stock to fluctuate 50% within 12 months from lows to highs. Here is what Warren Buffett said about this in 2011:

So, what are the lessons from the Meta (and Netflix cases)?

Firstly, there is alpha in the large caps, although the time to capture it is rare. It usually happens during a considerable dislocation like the early 2000s, 2008-2009 or 2022. The primary source of alpha is cash or relatively safe assets that you can trade for more beaten down yet quality businesses.

Secondly, not every stock that is down 70-80% is an automatic buy. The advantage of large, well-established companies with strong balance sheets (net cash positions) is that they do not go out of business overnight.

Thirdly, what is the risk that a large-cap is another Nokia? This is a harder question, of course, but in hindsight, it looks like Nokia faced a completely new product: a computer disguised as a phone. Meta, on the other hand, faced some competition, which is inevitable, but a lot of the issues were either external (macro slowdown) or self-inflicted (e.g. multi-billion investments into the Meta Labs).

It is common for a typical S&P 500 stock to fluctuate 50% within 12 months from lows to highs. Here is what Warren Buffett said about this in 2011:

“If you look at the typical stock on the New York Stock Exchange, its high will be, perhaps, for the last 12 months, 150 per cent of its low, so they’re bobbing all over the place. All you have to do is sit there and wait until something is really attractive that you understand.”

- Warren Buffett, Chairman and CEO of Berkshire Hathaway

Definitely encouraging, but still not so easy.

Definitely encouraging, but still not so easy.

Notable results

Alibaba

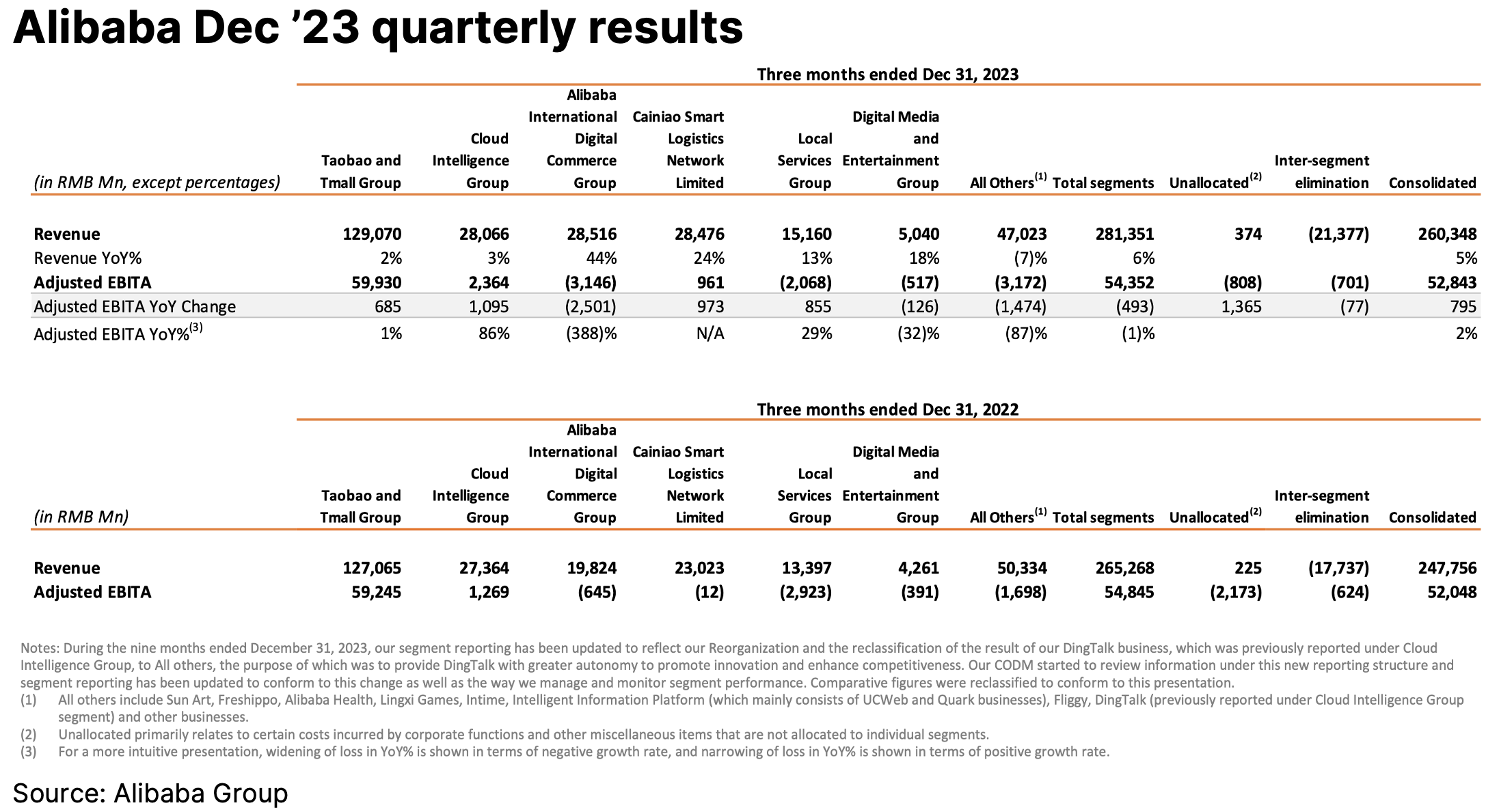

The results were weak. Sales continued to slow down, and the trend of improving margins stalled. Management has not made any new announcements. The company continues to face sharp competition in the local market, not least because some of its competitors are offering more innovative services to consumers. (Geo)political risks continue to loom.

After cutting my position in half, the remaining small position looks even more like "dead money" to me. I know value investing is never comfortable. But there is a difference between buying a cheap stock facing temporary challenges versus a business that is falling behind the competition, without a strong leadership team and in a tough market. There are many other cheap companies with less controversy.

The following tables summarise sales and earnings results quite well.

After cutting my position in half, the remaining small position looks even more like "dead money" to me. I know value investing is never comfortable. But there is a difference between buying a cheap stock facing temporary challenges versus a business that is falling behind the competition, without a strong leadership team and in a tough market. There are many other cheap companies with less controversy.

The following tables summarise sales and earnings results quite well.

Loews

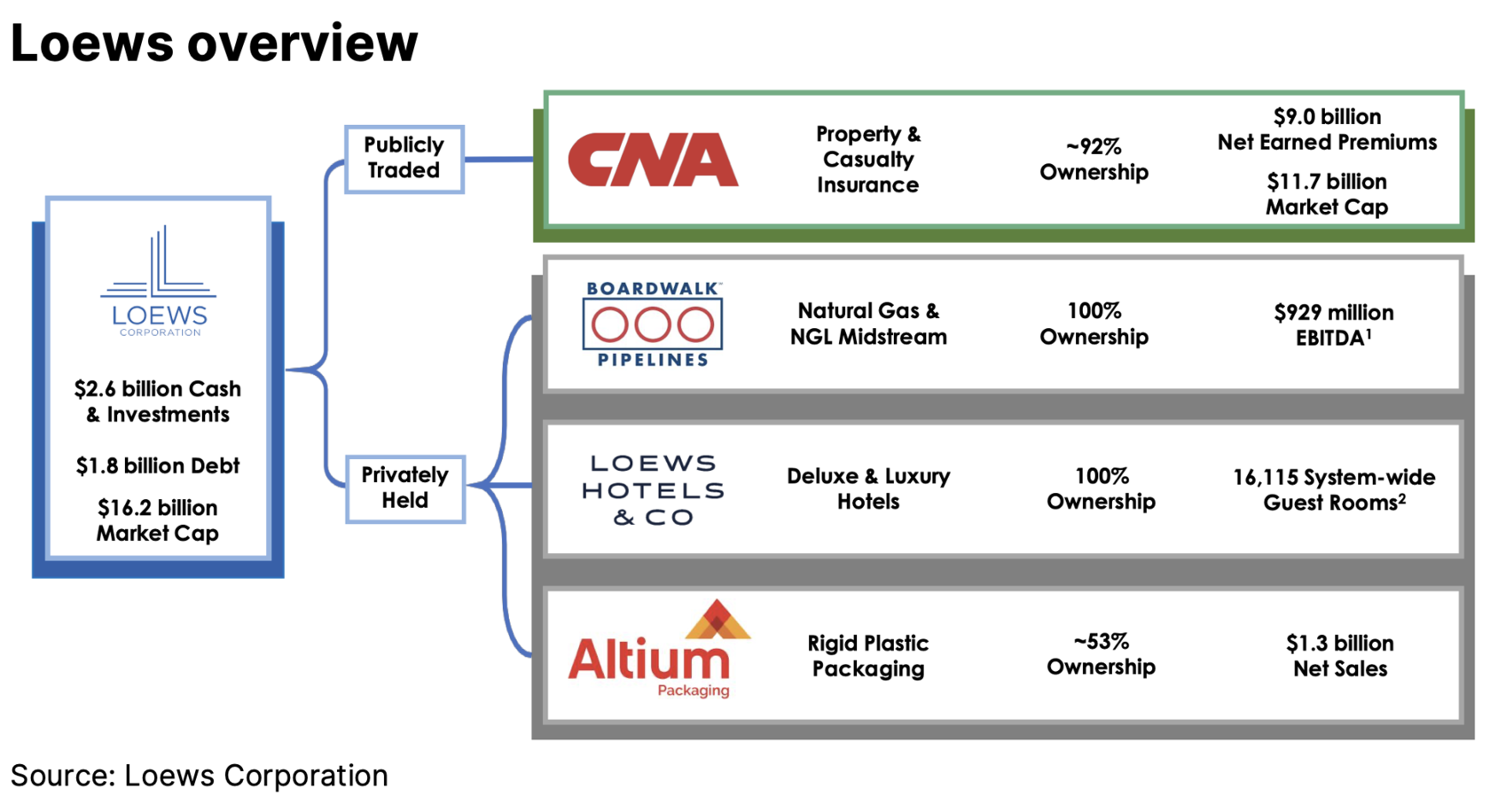

The best part of Loews’ investment case is that not a single analyst covers the stock (compare that to 60+ officially covering Nvdia and thousands of articles on research platforms like Seeking Alpha.) Why is this good? I think it suggests that there is little interest from investors (those who would pay for sell-side research) and that the company is not planning any share issue that would create business for the investment bankers.

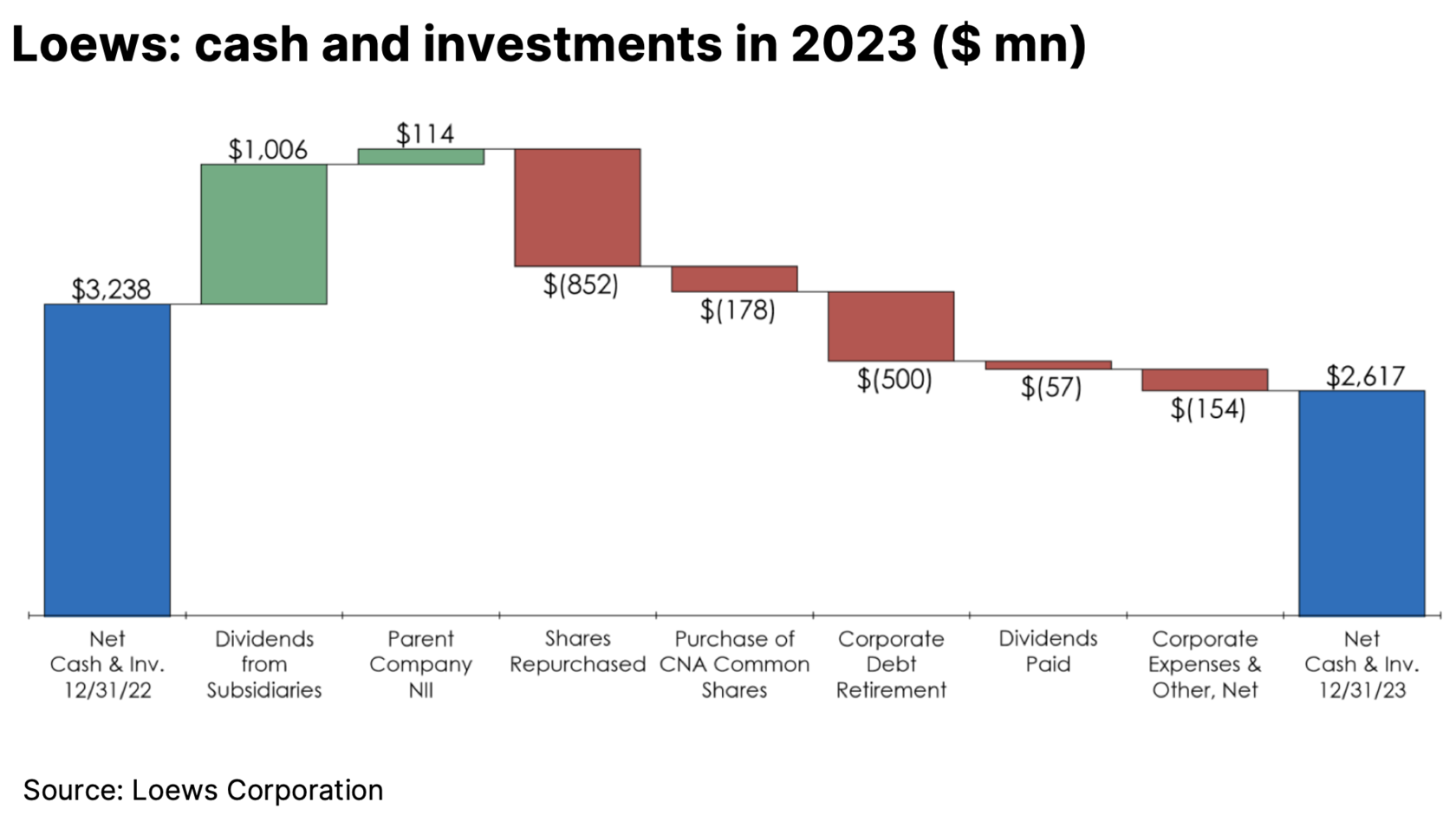

Thanks to little interest, Loews is able to quietly repurchase its shares at 10-20% discount to the NAV. From the end of 2014, the company has spent almost $8bn on buybacks, reducing its share count by 40%. As Buffett would say, without spending a dime, we were able to increase our interest in the company by 67%.

Thanks to little interest, Loews is able to quietly repurchase its shares at 10-20% discount to the NAV. From the end of 2014, the company has spent almost $8bn on buybacks, reducing its share count by 40%. As Buffett would say, without spending a dime, we were able to increase our interest in the company by 67%.

Among notable changes during 2023 is Loews’ increased ownership of its core insurance subsidiary CNA Financial to 92%. Loews spent $178mn on buying 4.5mn shares (2%) of CNA shares during 2023. Loews used to hold an 89% interest until 2021.

The company trades at c. 11% discount to NAV which was 81.9 at the end of 2023, growing 9% YoY. The book value does not fully reflect the market values of the pipeline (Boardwalk), Hotel operations (Loews Hotels) and Altium Packaging, all of which have higher market values than, in my view.

For 2023, for example, Boardwalk increased its adjusted earnings by 14.6% due to re-contracting some of its capacity. In 2023, Boardwalk also purchased an ethane pipeline business, 380-mile-long Bayou Ethane, for $355mn. Over the past three years, Boardwalk spent c. 54% of its total capex on growth projects which should lead to higher overall capacity in the medium-term.

Having bought Loews in the spring of 2020, I am now up over 100%. A lot of the gains were earned through closing the discount to NAV. But going forward, the stock will likely perform in line with changes in the NAV, which will unlikely grow materially above 10%. In other words, I expect moderate market-type returns from Loews in the future. I will be considering alternative opportunities given the limited upside in Loews.

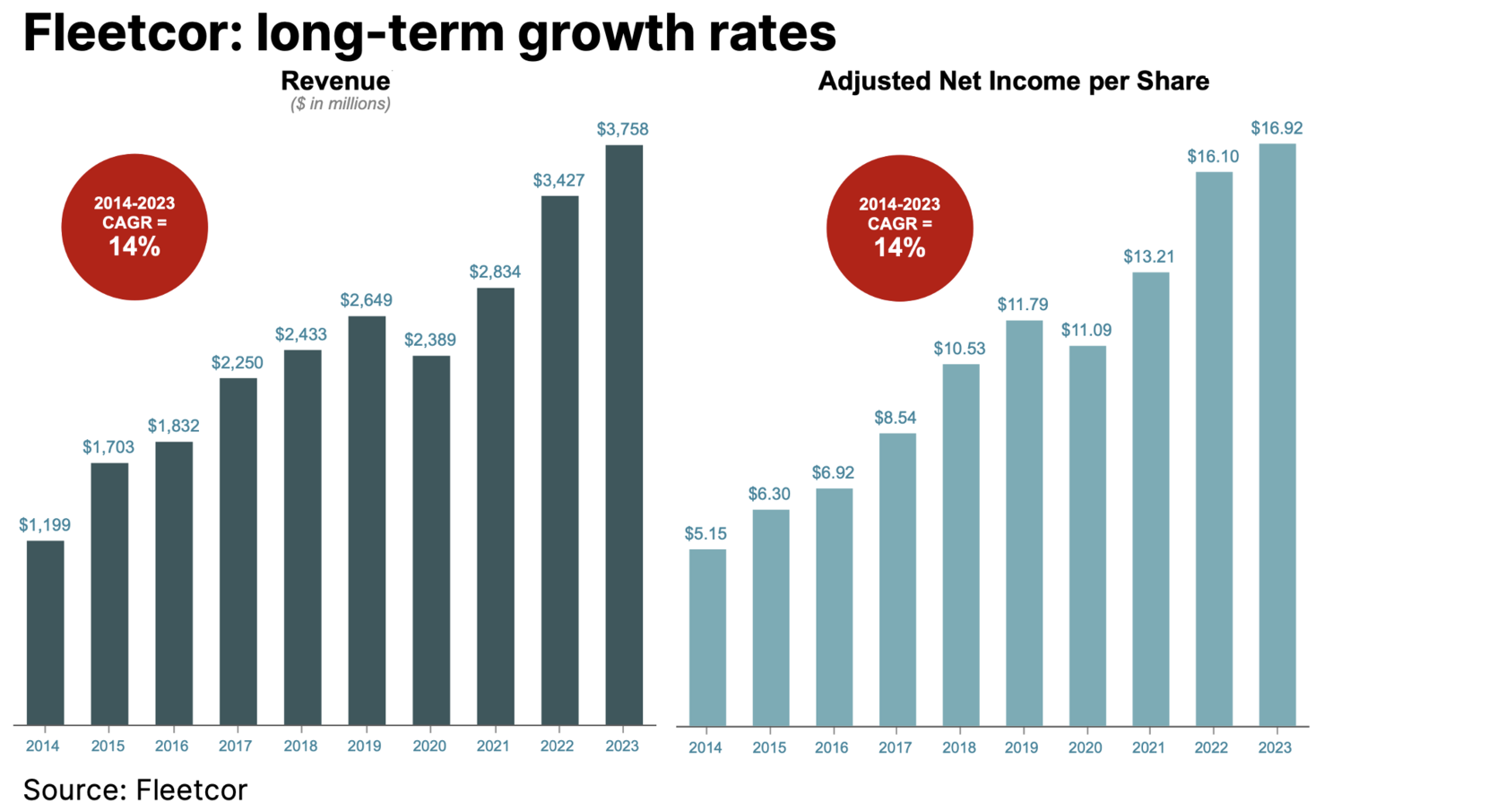

Fleetcor

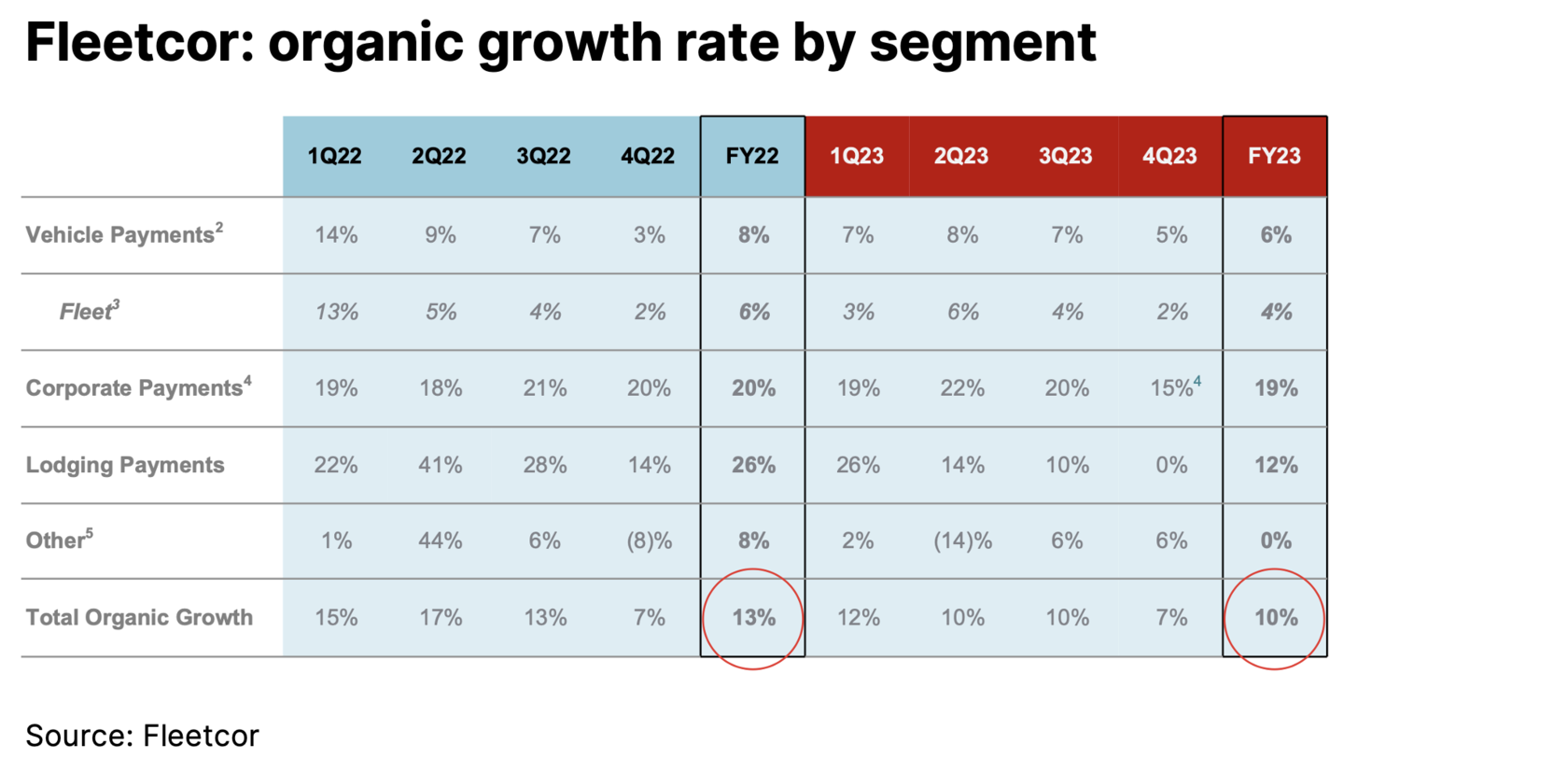

Fleetcor, the company I discussed in MSIL #8, reported weaker-than-expected results, which sent the stock down 8% on 8 February '24. Indeed, I found the revenue growth rate quite soft, but with a number of one-offs and given management's confidence in mid- and long-term growth prospects, I took advantage of the share price weakness and increased my position.

Revenue (Q4 ’23) increased by just 6% YoY (+7% organically) and missed management’s own guidance by 3%. Adjusted EPS increased 10% YoY and was almost in line with the guidance (-1%).

It appears that the softness in the Q4 results was mostly due to a combination of various minor factors rather than structural issues (e.g. delays in gift card shipments, record low airline cancellations, etc.)

Revenue (Q4 ’23) increased by just 6% YoY (+7% organically) and missed management’s own guidance by 3%. Adjusted EPS increased 10% YoY and was almost in line with the guidance (-1%).

It appears that the softness in the Q4 results was mostly due to a combination of various minor factors rather than structural issues (e.g. delays in gift card shipments, record low airline cancellations, etc.)

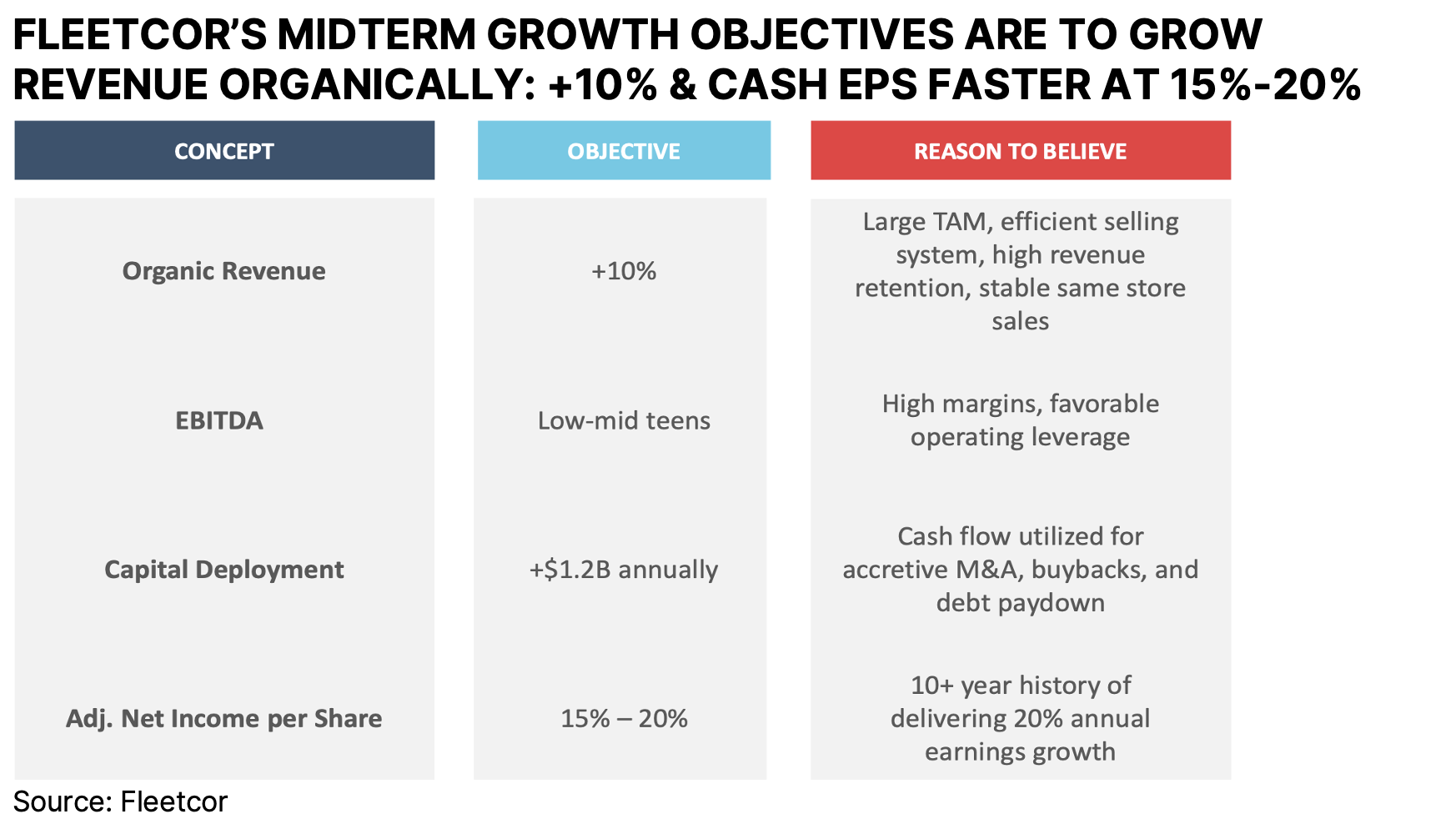

Full-year results were solid, with the third year in a row of 10% organic sales growth. In addition to that, the company came out with an upbeat 2024 outlook:

These targets are in line with or slightly ahead of mid-term goals set by management.

- Revenue growth of 11% (excluding the Russian business sold in 2023)

- EBITDA growth of 14%

- Adjusted EPS growth of 18%

These targets are in line with or slightly ahead of mid-term goals set by management.

The company has historically delivered strong growth driven by organic and M&A activity, entering new geographies and payment verticals.

The only negative point I noted is that 2024 growth targets are skewed towards the second half of the year as the company expects slower growth in the first quarter. This creates a small risk of not meeting the full-year targets.

With a $19.4 EPS target for 2024 (at the mid-point of management's guidance), Fleetcor trades at 13-14x PE despite growing earnings by 18% this year and targeting a 15-20% annual growth rate in the mid-term. The company benefited in the past from higher fuel prices (which increased revenue for its fuel cards segment), and apart from lower oil prices, the market is also concerned by the EV transition. Fleetcor seems to be making substantial progress in EV, suggesting market worries are exaggerated or, as a minimum, investors are compensated by the low valuation of Fleetcor's stock.

With a $19.4 EPS target for 2024 (at the mid-point of management's guidance), Fleetcor trades at 13-14x PE despite growing earnings by 18% this year and targeting a 15-20% annual growth rate in the mid-term. The company benefited in the past from higher fuel prices (which increased revenue for its fuel cards segment), and apart from lower oil prices, the market is also concerned by the EV transition. Fleetcor seems to be making substantial progress in EV, suggesting market worries are exaggerated or, as a minimum, investors are compensated by the low valuation of Fleetcor's stock.

Stockwatch

I cover stocks that I add to my watchlist in the Monthly Stock Idea Lab (MSIL) publication, which is now part of the Premium Membership.

You can find the latest free versions here and here.

Sometimes, things move so fast that it is worth sharing the companies that have caught my eye outside the regular monthly schedule. Here are my unscripted thoughts on some of the names that are worth doing more work on.

You can find the latest free versions here and here.

Sometimes, things move so fast that it is worth sharing the companies that have caught my eye outside the regular monthly schedule. Here are my unscripted thoughts on some of the names that are worth doing more work on.

Prosus

China has proven, even optimists like me, that it is a tough place for private investors. Despite that, many companies still grow thanks to China (luxury goods, for example), and the cashflows they earn in China are valued at well-above-market multiples.

I am not ready to eliminate the Chinese market from my investable universe. I particularly dislike giving labels for assets or countries such as ‘uninvestable’ or ‘this is over’. Such words often draw my attention to the markets to which they are applied.

Also, I think Alibaba’s case is, to a large degree, a self-inflicted problem as it missed the rise of a new generation of competitors.

So, with this in mind, I started thinking more about Prosus, a holding company spun off from Naspers and the largest shareholder of Tencent. Prosus is trading at a c. 30% discount to NAV, which includes a 25% stake in Tencent, itself a highly discounted company. Prosus and Tencent are active buyers of their own stock, so the discount should narrow as long as the core businesses do not deteriorate.

I also think Tencent is not facing the same level of operational challenges as Alibaba, and its market position remains more solid compared to the latter. Tencent reminds me of an investment vehicle with some successful investments, like a 15% interest in PDD or a 20% stake in Sea Ltd.

I am not ready to eliminate the Chinese market from my investable universe. I particularly dislike giving labels for assets or countries such as ‘uninvestable’ or ‘this is over’. Such words often draw my attention to the markets to which they are applied.

Also, I think Alibaba’s case is, to a large degree, a self-inflicted problem as it missed the rise of a new generation of competitors.

So, with this in mind, I started thinking more about Prosus, a holding company spun off from Naspers and the largest shareholder of Tencent. Prosus is trading at a c. 30% discount to NAV, which includes a 25% stake in Tencent, itself a highly discounted company. Prosus and Tencent are active buyers of their own stock, so the discount should narrow as long as the core businesses do not deteriorate.

I also think Tencent is not facing the same level of operational challenges as Alibaba, and its market position remains more solid compared to the latter. Tencent reminds me of an investment vehicle with some successful investments, like a 15% interest in PDD or a 20% stake in Sea Ltd.

Capri Holdings

Capri Holding received a cash takeover bid from Tapestry last year. The offer price is $57, and the deal is expected to close this year. It is subject to regulatory approvals, some of which have already been received. At the latest price ($47), Capri offers c. 21% upside. The market assumes quite a high probability of the deal not closing (c. 50% on my estimates). It looks very high.

Capri is not such a bad business on a standalone basis with brands such as Michael Kors and Versace, among others. Of course, this fashion category has recently suffered more (Burberry is a good example), but generally, they run a portfolio of high-margin products in a sector with long-term tailwinds.

Capri is not such a bad business on a standalone basis with brands such as Michael Kors and Versace, among others. Of course, this fashion category has recently suffered more (Burberry is a good example), but generally, they run a portfolio of high-margin products in a sector with long-term tailwinds.

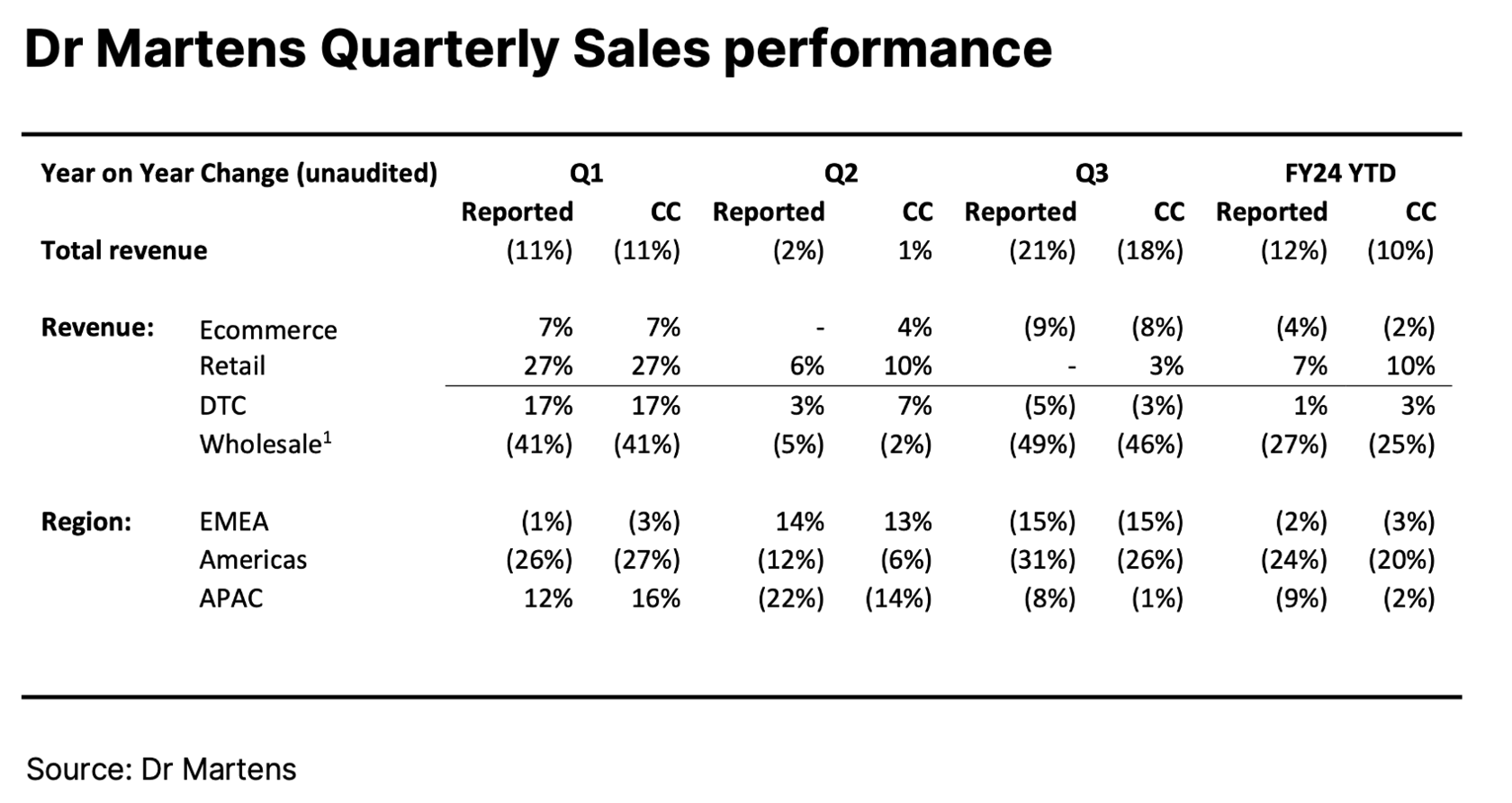

Dr Martens

I covered the stock last summer (MSIL #4). Since that time, Dr Martens' stock price has almost halved.

The main issue has been a weak sales dynamic for several quarters in a row.

The main issue has been a weak sales dynamic for several quarters in a row.

The US market has been the weakest. The company first faced operational challenges (including poor timing of the move of the distribution centre from Portland to LA and a poor marketing campaign focused on sandals and not enough on boots). These operational issues have been overcome by now, according to management. But the market environment has become more challenging.

I think the cycles in premium shoes are unavoidable. Weather, style, work habits and culture - all can lead to a rapid rise of certain products and equally fast pull demad lower. (This is one reason I am cautious about Crocs. The second is that I think it is pretty easy to replicate its product and sell it at 50-70% lower price.)

What I like about them is that the business is growing in new markets like Japan, for example. Dr Martnes has also been growing its direct-to-consumer sales channel. It remains a high-margin business. The brand is quite unique. It is majority-owned by Permira Private Equity (38% interest).

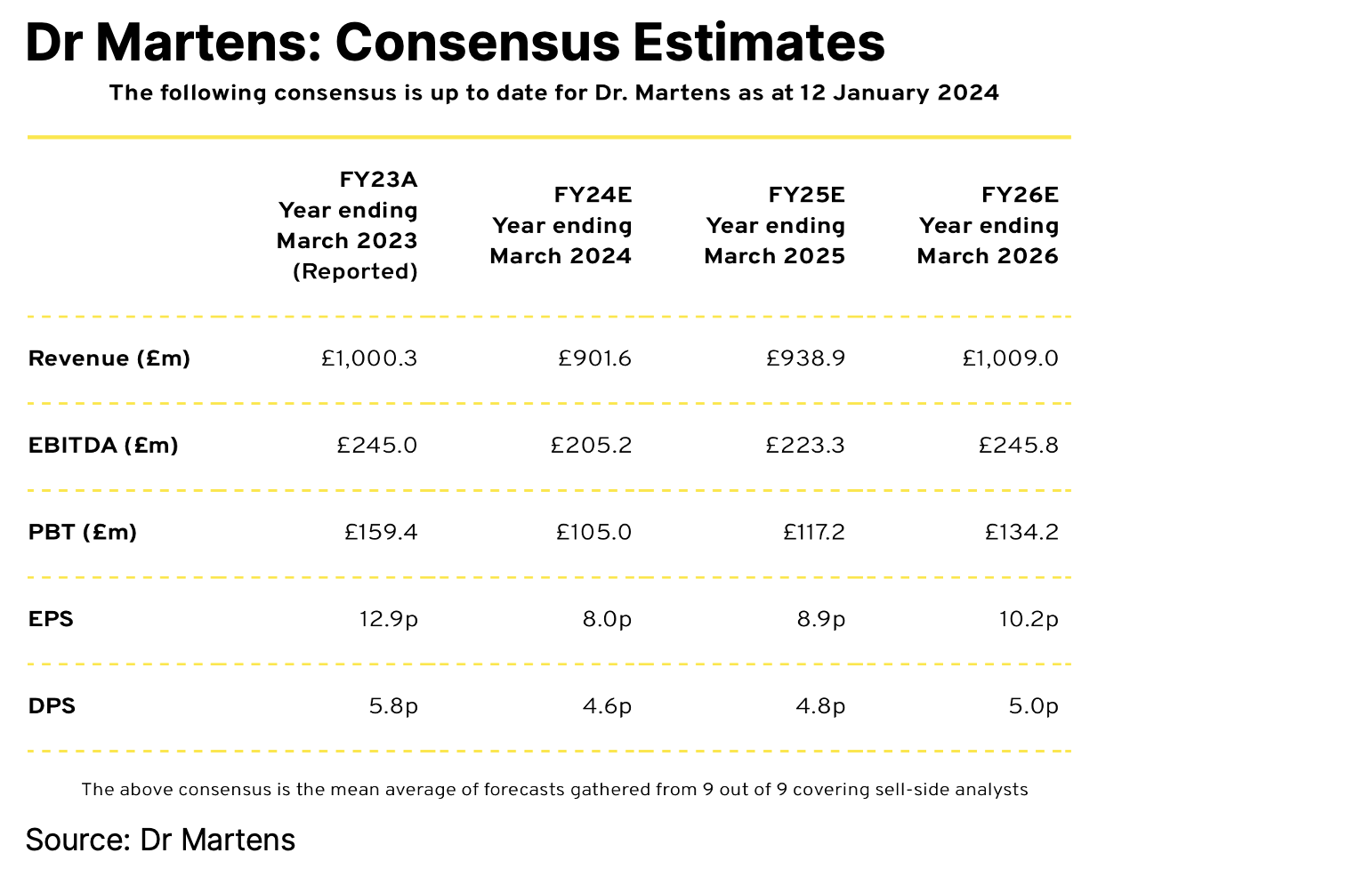

The company's FY-23 dividend represents an solid c. 7% yield, although near-term dividends will likely be lower.

Dr Marten's distribution policy targets a long-term dividend payout ratio of 35%, but actual payments can be different depending on the leverage/excess cash and short-term business performance. For FY-23, for example, the company distributed 45% of its earnings as dividends, paying 5.84p per share. In H1 24 (ended on September 2023), the company paid a flat interim dividend of 1.56p, which corresponded to an 82% payout ratio.

The company has a moderate leverage of c. 1.3x. Its net debt position is £272mn (as of 30 September 2023) against a consensus FY-24 (ending in March 2024) EBITDA of £205mn.

I think the cycles in premium shoes are unavoidable. Weather, style, work habits and culture - all can lead to a rapid rise of certain products and equally fast pull demad lower. (This is one reason I am cautious about Crocs. The second is that I think it is pretty easy to replicate its product and sell it at 50-70% lower price.)

What I like about them is that the business is growing in new markets like Japan, for example. Dr Martnes has also been growing its direct-to-consumer sales channel. It remains a high-margin business. The brand is quite unique. It is majority-owned by Permira Private Equity (38% interest).

The company's FY-23 dividend represents an solid c. 7% yield, although near-term dividends will likely be lower.

Dr Marten's distribution policy targets a long-term dividend payout ratio of 35%, but actual payments can be different depending on the leverage/excess cash and short-term business performance. For FY-23, for example, the company distributed 45% of its earnings as dividends, paying 5.84p per share. In H1 24 (ended on September 2023), the company paid a flat interim dividend of 1.56p, which corresponded to an 82% payout ratio.

The company has a moderate leverage of c. 1.3x. Its net debt position is £272mn (as of 30 September 2023) against a consensus FY-24 (ending in March 2024) EBITDA of £205mn.

The company is trading at c. 10x current year P/E (based on consensus) and 5.3x EV/EBITDA. Importantly, these multiples are based on trough profitability as the company faces declining revenue. So, if the sales trajectory improves, Dr Martens should benefit from the operating leverage. The share price could rise due to a combination of higher earnings and expanded valuation multiple to reflect an improved outlook.

The main call in this case is that the current sales weakness is a temporary issue. If Dr Martens is indeed an iconic brand with strong market position and a loyal customer base, then its sales should recover in the medium term.

I do not think drawing conclusions from a single case is fair, but the ownership of Dr Martens by Permira has not benefited public shareholders. The stock is down 81% since listing in January 2021. Since PEs are not long-term owners and are focused on the sale of a company in the future, they usually make more short-term decisions.

Dr Martens has not matched at least one of the criteria for my stock selection: management with "skin in the game" and strong insider ownership. Management has been receiving shares as part of their compensation for free. And their EPS target for a long-term incentive plan has been recently reduced, which is quite unfair to minority shareholders.

The main call in this case is that the current sales weakness is a temporary issue. If Dr Martens is indeed an iconic brand with strong market position and a loyal customer base, then its sales should recover in the medium term.

I do not think drawing conclusions from a single case is fair, but the ownership of Dr Martens by Permira has not benefited public shareholders. The stock is down 81% since listing in January 2021. Since PEs are not long-term owners and are focused on the sale of a company in the future, they usually make more short-term decisions.

Dr Martens has not matched at least one of the criteria for my stock selection: management with "skin in the game" and strong insider ownership. Management has been receiving shares as part of their compensation for free. And their EPS target for a long-term incentive plan has been recently reduced, which is quite unfair to minority shareholders.

Watches of Switzerland (WOSG)

Speaking of PEs, WOSG is another company that has experience of being owned by a PE fund. The company was acquired by Apollo Global Management in 2013 and was run by this private equity firm until the IPO in May 2019.

I have a small position in WOSG. Similarly to Dr Martens, the company’s share price has been weak, declining 73% from 2021 highs (although up 28% since going public in 2019). Two factors put pressure on the stock over the past six months.

First, there was a purchase of a large Swiss retailer, Bucheron, by Rolex in August 2023. This caused the market to panic that Bucheron could get preference access to Rolex watches, which would weaken WOSG's competitive position. The more recent issue arose last month when the company cut its FY-24 (April 2024) sales guidance, citing softer Christmas sales in the UK and other regions.

The new guidance assumes 2-3% revenue growth in FY-24 (on a constant currency basis, CC) and 8.7-8.9% EBIT margin. Previously, the company expected 8-11% growth and c. 10.7% EBIT margin.

The company is trading at 10x P/E based on consensus earnings estimates for FY-24. It is worth noting that estimates were cut by almost 30% in the past two months. Management has reiterated its mid-term goals (announced in November 2023). They assume more than doubling of EBIT in five years (FY-23 EBIT was £165mn) driven by margin expansion (by 50-150bps to c. 11.7%) and revenue growth in the US (+20-25% CAGR), the UK (+8-10% CAGR) and Europe (4-6% CAGR).

If the company achieves its targets, the company would be valued at less than 2.9x EV/EBIT (FY-28) and 3.3x P/E. It is possible that management has extrapolated strong COVID demand far into the future, but even assuming a lower EBIT margin of 10% and only 7% sales annual growth (mostly driven by new store openings), the stock would be at 4.3x EV/EBIT multiple in FY-28.

Two additional factors make me optimistic about WOSG. The company has a net cash of £16mn (as of 29 October 2023). And management has been buying shares recently.

Newly re-appointed CFO Anders Romberg purchased 26,666 shares for £3.9/share (£104k) on 9 February '24. And the day before, on 8 February, the company’s chairman, Ian Carter, bought 50k shares for £3.77 (£188.4k).

I have a small position in WOSG and have not increased it yet.

I have a small position in WOSG. Similarly to Dr Martens, the company’s share price has been weak, declining 73% from 2021 highs (although up 28% since going public in 2019). Two factors put pressure on the stock over the past six months.

First, there was a purchase of a large Swiss retailer, Bucheron, by Rolex in August 2023. This caused the market to panic that Bucheron could get preference access to Rolex watches, which would weaken WOSG's competitive position. The more recent issue arose last month when the company cut its FY-24 (April 2024) sales guidance, citing softer Christmas sales in the UK and other regions.

The new guidance assumes 2-3% revenue growth in FY-24 (on a constant currency basis, CC) and 8.7-8.9% EBIT margin. Previously, the company expected 8-11% growth and c. 10.7% EBIT margin.

The company is trading at 10x P/E based on consensus earnings estimates for FY-24. It is worth noting that estimates were cut by almost 30% in the past two months. Management has reiterated its mid-term goals (announced in November 2023). They assume more than doubling of EBIT in five years (FY-23 EBIT was £165mn) driven by margin expansion (by 50-150bps to c. 11.7%) and revenue growth in the US (+20-25% CAGR), the UK (+8-10% CAGR) and Europe (4-6% CAGR).

If the company achieves its targets, the company would be valued at less than 2.9x EV/EBIT (FY-28) and 3.3x P/E. It is possible that management has extrapolated strong COVID demand far into the future, but even assuming a lower EBIT margin of 10% and only 7% sales annual growth (mostly driven by new store openings), the stock would be at 4.3x EV/EBIT multiple in FY-28.

Two additional factors make me optimistic about WOSG. The company has a net cash of £16mn (as of 29 October 2023). And management has been buying shares recently.

Newly re-appointed CFO Anders Romberg purchased 26,666 shares for £3.9/share (£104k) on 9 February '24. And the day before, on 8 February, the company’s chairman, Ian Carter, bought 50k shares for £3.77 (£188.4k).

I have a small position in WOSG and have not increased it yet.

Kistos

The company has been hit by the softer gas market, which has surprised many, including myself. With high infrastructure costs, gas supply has relatively low marginal costs. This means that its price can be quite volatile and deviate significantly from the long-run marginal cost of supply.

Balder X, a large offshore oil project, is scheduled to be launched into production in Q3 '24. Kistos acquired a 10% interest in this project last year. The company did not pay any cash to shareholders of the asset (Mime Petroleum) and just assumed the corporate debt. The asset should reach peak production of 100 kboe/d in two years. Kistos will be entitled to 10kboe/d production (10% interest), which would double its current output.

Importantly, the project is going to diversify the company's portfolio, adding a third country and reducing fiscal risks, as Norway has been notoriously consistent with its tax regime.

With the stock down c. 40% since I purchased it last year and given the imminent launch of Balder X, the company's prospects look much more attractive. I have not added to my position yet.

Balder X, a large offshore oil project, is scheduled to be launched into production in Q3 '24. Kistos acquired a 10% interest in this project last year. The company did not pay any cash to shareholders of the asset (Mime Petroleum) and just assumed the corporate debt. The asset should reach peak production of 100 kboe/d in two years. Kistos will be entitled to 10kboe/d production (10% interest), which would double its current output.

Importantly, the project is going to diversify the company's portfolio, adding a third country and reducing fiscal risks, as Norway has been notoriously consistent with its tax regime.

With the stock down c. 40% since I purchased it last year and given the imminent launch of Balder X, the company's prospects look much more attractive. I have not added to my position yet.

Var Energi

Var is a mid-sized Norwegian E&P (210kboe/d) which plans to double its production in the next two years. This should boost operating cash flow and reduce capex from c. $2.5bn to less than $1.5bn. The company pays 20-30% of operating cashflows as dividends.

Historically, the stock has suffered due to delays and cost overruns at Balder X. More recently, its two peers (Equinor and Aker BP) reported earnings below consensus estimates. The market also punished VAR and saw its shares briefly fall below NOK29. I used this as an opportunity to increase my position by about 50%.

VAR's own results reported yesterday (13 February) were mixed. A nice dividend (NOK1.136 per share for Q4 '23 and the same dividend for Q1 '24) was offset by another delay in the launch of Balder X until Q4 '24 (from Q3 '24). On an annualised basis, this dividend represents a 15% dividend yield.

Following the completion of Neptune (as of 31 January '24) with 66 kboe/d production in 2023, VAR now guides for 280-300 kboe/d production (from 213 kboe/d in 2023). This means that it expects minimum impact from Balder X production this year. But with the target to distribute 30% of operating cash flow as dividends, higher production should translate into an even better dividend.

Historically, the stock has suffered due to delays and cost overruns at Balder X. More recently, its two peers (Equinor and Aker BP) reported earnings below consensus estimates. The market also punished VAR and saw its shares briefly fall below NOK29. I used this as an opportunity to increase my position by about 50%.

VAR's own results reported yesterday (13 February) were mixed. A nice dividend (NOK1.136 per share for Q4 '23 and the same dividend for Q1 '24) was offset by another delay in the launch of Balder X until Q4 '24 (from Q3 '24). On an annualised basis, this dividend represents a 15% dividend yield.

Following the completion of Neptune (as of 31 January '24) with 66 kboe/d production in 2023, VAR now guides for 280-300 kboe/d production (from 213 kboe/d in 2023). This means that it expects minimum impact from Balder X production this year. But with the target to distribute 30% of operating cash flow as dividends, higher production should translate into an even better dividend.

Portfolio changes

Apart from increasing my VAR and Fleetcor positions, I opened two new positions, closed two and added to a couple of existing positions.