03 September 2023

I have finally decided to pull the trigger with JD Wetherspoon. I presented the stock in my July MSIL edition.

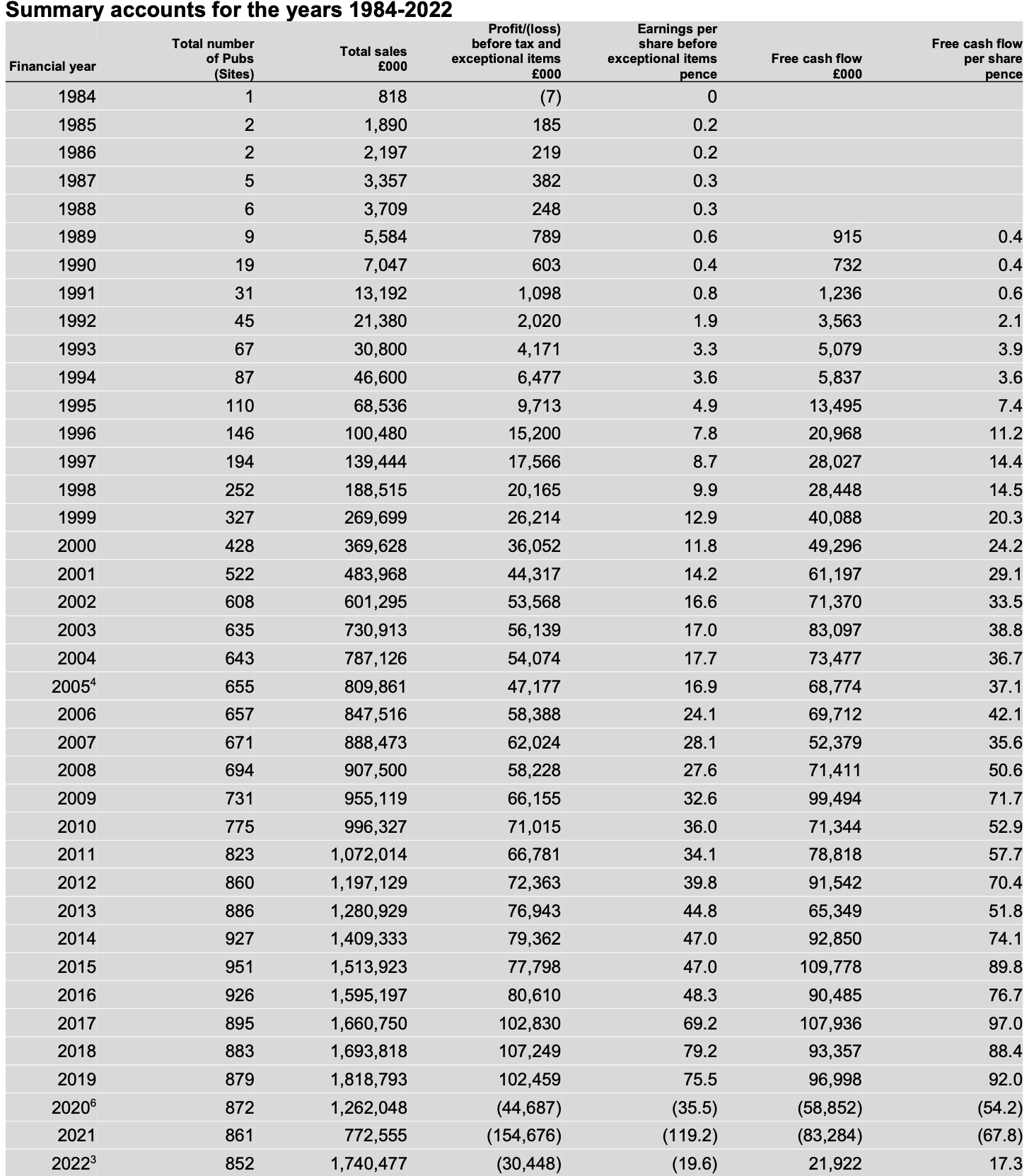

In brief, it is a founder-led pub business that has outperformed its peers by focusing on costs and value to its customers. Pre-COVID, the company was generating close to £1 of FCF per share and trading at £13-15 a share (c. 7% FCF yield). During 1986-2019, it has increased its sales and pre-tax profits by 23% and 20% annually. Since 2004, the growth has slowed down to 6% per year, while pre-tax profit margins have settled at a 6% level. Until 2020, the company never had an annual loss.

Source: JD Wetherspoon Annual Report 2022

COVID, however, dealt a significant blow to the company’s performance, causing it to operate at a loss and forcing it to seek additional funding through a share issue (7% of new shares raising £91.5mn). The company’s leverage has reached a critical level in FY-21, with EBITDA turning negative, followed by 25.6x by April 21 and falling to 6.2x by April 2023. Net debt fell further to £688mn as of 9 July 2023 from £738mn as of 30 April 2023 and £805mn at the end of 2022.

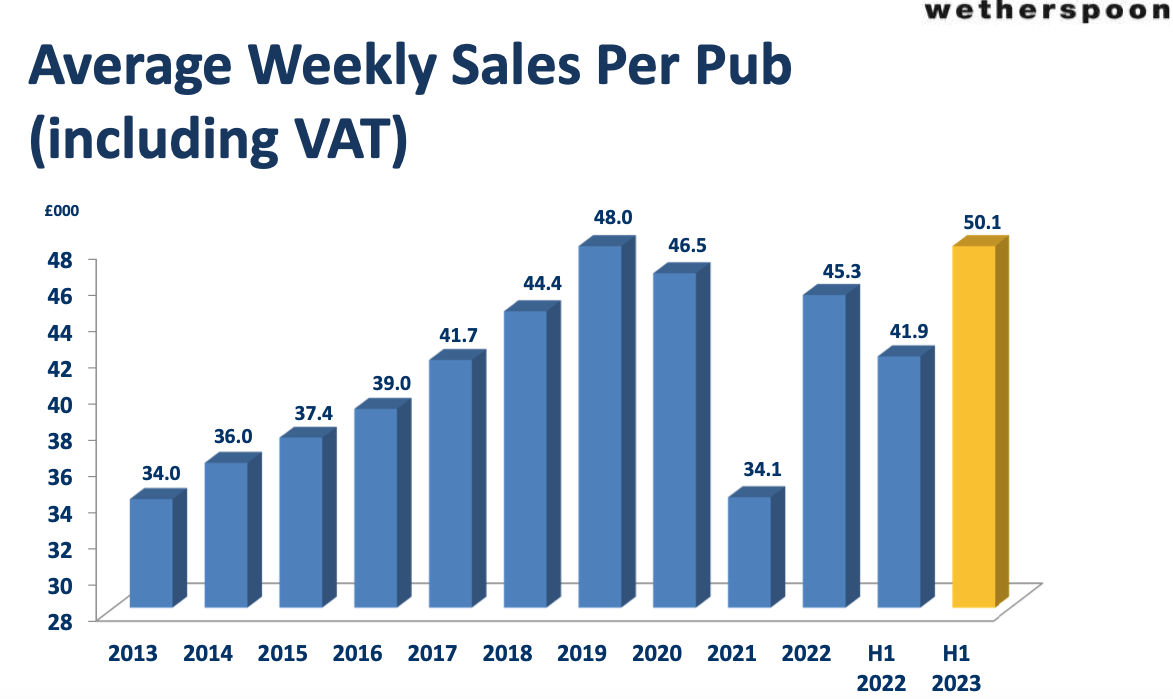

As COVID has receded, the company’s performance has started to normalise. Weekly revenue per pub exceeded 2019 levels of £48k in the first six months of FY-23, reaching £50.1k. Full-year revenue in FY-23 is on track to finally exceed pre-COVID sales of £1.8bn.

COVID, however, dealt a significant blow to the company’s performance, causing it to operate at a loss and forcing it to seek additional funding through a share issue (7% of new shares raising £91.5mn). The company’s leverage has reached a critical level in FY-21, with EBITDA turning negative, followed by 25.6x by April 21 and falling to 6.2x by April 2023. Net debt fell further to £688mn as of 9 July 2023 from £738mn as of 30 April 2023 and £805mn at the end of 2022.

As COVID has receded, the company’s performance has started to normalise. Weekly revenue per pub exceeded 2019 levels of £48k in the first six months of FY-23, reaching £50.1k. Full-year revenue in FY-23 is on track to finally exceed pre-COVID sales of £1.8bn.

Source: JD Wetherspoon Investor Presentation

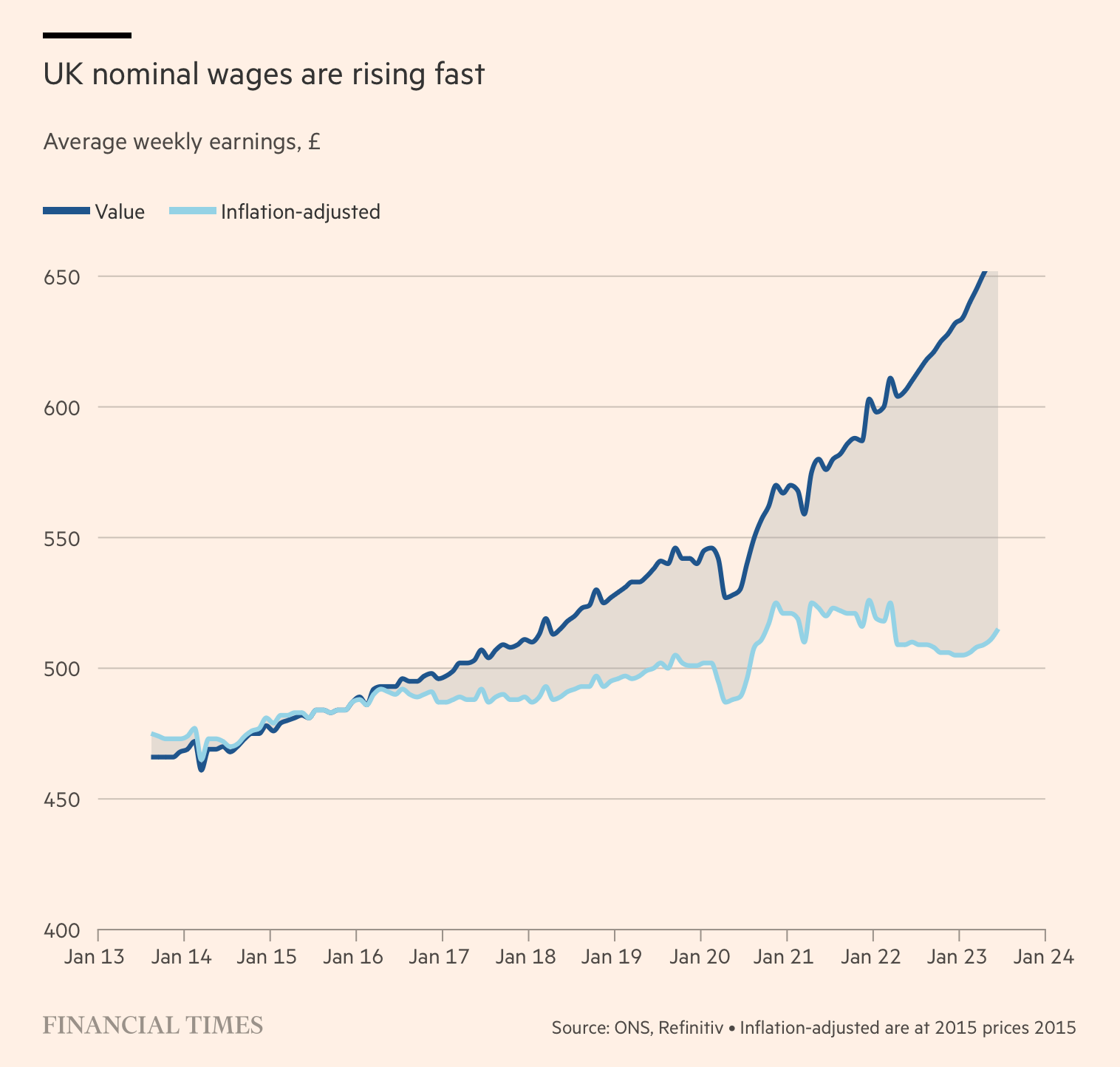

There are still two issues that hold back profitability from returning to historical levels: inflation and drinking habits.

I am not too worried about inflation. The UK is a market economy where inflation can go up or down. I admit it may take a little longer this time. Still, pubs should be able to pass through inflation via price hikes. Importantly, UK wage growth has started to rise, which should make it easier for pubs to sustain higher prices.

The second factor (drinking habits) emerged during COVID as consumers started buying more beer and other alcohol in supermarkets and consuming it at home. Frankly, as a non-native and cost-conscious resident, I always struggled to justify paying 2-3x more for a pint of beer compared to its retail price. So I guess some of the volumes might have been lost permanently.

However, it is even more difficult for me to see how the British people stop going to pubs. Moreover, pubs have been adding more options to their menus. JD Wetherspoon, for example, has seen the share of food in its sales mix rise from 18% in 2020 to 38% in H1 ’23. The company also has a small hotel business and operates slot machines in some of its pubs.

JDW is trading at about 13x forward PE, but if profitability and cash flow fully normalise, valuation multiples would be around 9x PE and 14% FCF yield compared to historical valuation of 15-20x PE and 7% FCF yield. The stock could rise more than 100% to match earnings recovery and improved valuation multiples.

It is also encouraging that the company's founder and chairman, Tim Martin, increased his interest in the company purchasing 11.9mn shares on 1 February 2023 at 457p.

I started with a 1% position but plan to increase it, hoping the price would drop in the near term.