13 August 2023

In today’s post, I provide short updates on my recent new purchases, signs of a major transformation at Alibaba and why I am more excited about the stock now, more concerns about CNX, especially given the strong stock performance, and thoughts on Berkshire and Altria.

Before going into specific details, I would like to clarify one point on portfolio management. You may have noticed that my portfolio activity has picked up recently, yet the size of an average position has reduced. There are two reasons for that.

I decided to buy small positions in stocks that tick all the boxes and are attractively valued before doing a complete analysis. I noticed that if I spend months researching one stock, I feel more tempted to buy it to justify all the costs. Even worse, I become more biased when I hold it. Admitting mistakes or just changing views in light of new evidence is much harder due to the sunk-cost bias.

Besides, if the stock goes up 20% and I am still researching, I would then just pass on it thinking it has become ‘too expensive’.

The last reason for taking more minor positions is the change in my personal circumstances since I have now left my full-time employment and rely on savings as the primary source to cover my daily expenses.

Alibaba (4% of my portfolio)

My view on Alibaba has changed since I first bought the stock in late 2021. Initially, it was “a great business facing temporary problems”. Later, when more evidence emerged that Alibaba was losing market share to domestic rivals and the stock fell even further, my view transformed into a “normal business selling at a great discount, deep value”.

The problem with holding deep value is timing. You are never sure when the market will recognise the value, and it is even more problematic in the case of Chinese e-commerce with the looming Taiwan conflict.

Over the past few quarters, the company has been focused on profitability, mostly cutting investments in new ventures and raising the efficiency of the core operations. It has been expanding its buyback programme supported by a net cash position and strong FCF generation. I was fine to continue holding it, although the issue of Taiwan was not going away.

However, the results reported by Alibaba on 10 August look to be a game changer. Of course, with last year’s low base effect and the still weak Chinese economy, one should not get too excited by just one strong quarter.

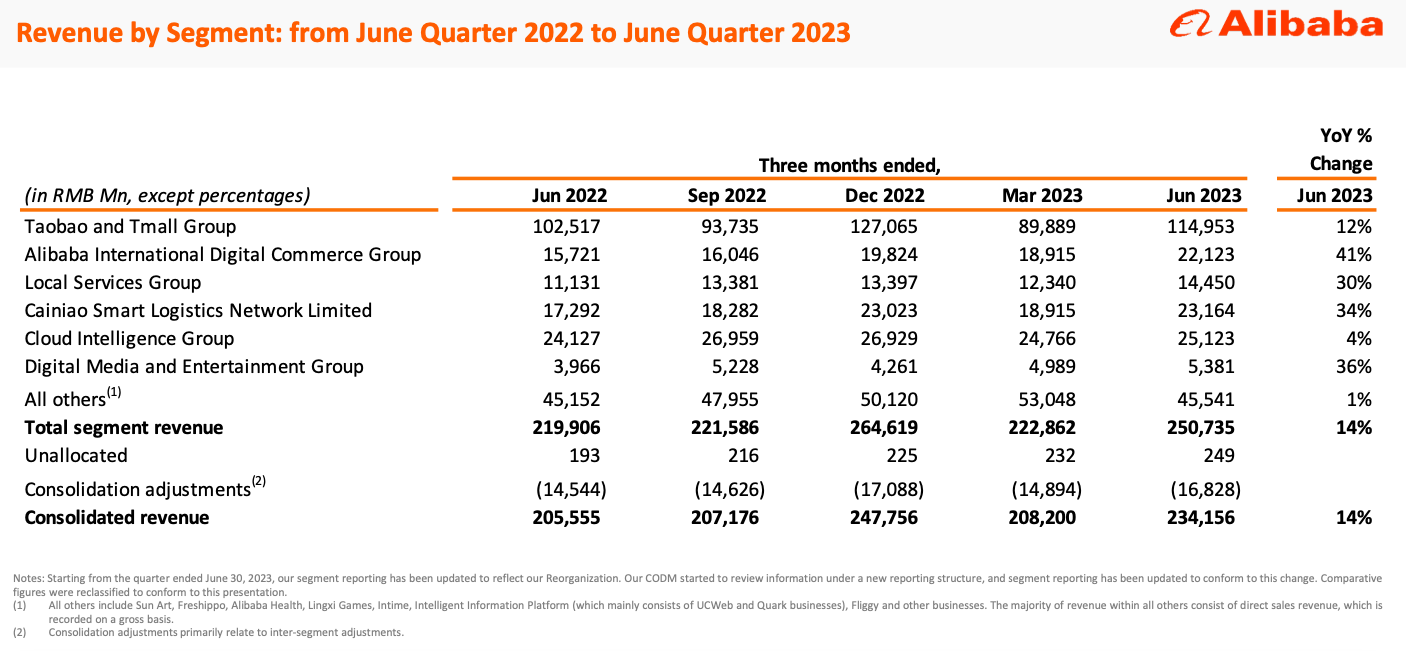

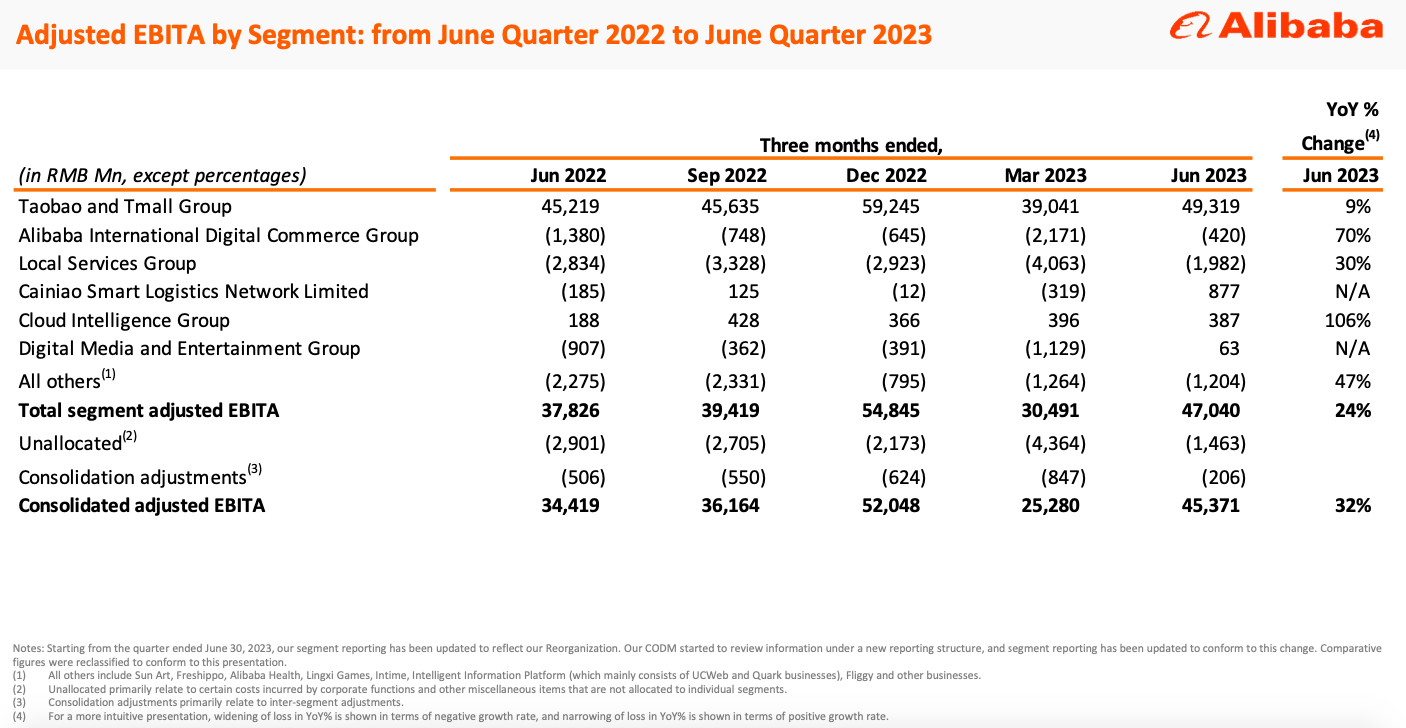

Nevertheless, I have never been more excited about Alibaba stock. The company returned to growth in its core e-commerce segment and further narrowed losses in other segments. Cloud is the only segment that continues to underperform.

I am also excited to see much better disclosure by key segments, especially the revenues and profitability of Taobao and Tmall.

The problem with holding deep value is timing. You are never sure when the market will recognise the value, and it is even more problematic in the case of Chinese e-commerce with the looming Taiwan conflict.

Over the past few quarters, the company has been focused on profitability, mostly cutting investments in new ventures and raising the efficiency of the core operations. It has been expanding its buyback programme supported by a net cash position and strong FCF generation. I was fine to continue holding it, although the issue of Taiwan was not going away.

However, the results reported by Alibaba on 10 August look to be a game changer. Of course, with last year’s low base effect and the still weak Chinese economy, one should not get too excited by just one strong quarter.

Nevertheless, I have never been more excited about Alibaba stock. The company returned to growth in its core e-commerce segment and further narrowed losses in other segments. Cloud is the only segment that continues to underperform.

I am also excited to see much better disclosure by key segments, especially the revenues and profitability of Taobao and Tmall.

Source: Alibaba Investor Presentation

Source: Alibaba Investor Presentation

Based on management’s comments during the call, Alibaba will continue focusing on acquiring and retaining more consumers on its Chinese platforms to make them more appealing to merchants. This means lower profitability in the online segment before more merchants get attracted by a higher customer base and start spending more on promotions and other services.

It is also unclear how quickly and which segment will be IPOed first. With the former Chairman and CEO, Daniel Zhang, taking over the role of Cloud CEO, it is clear that Cloud will get a lot of attention from the Alibaba founders in the future. This is not surprising given the lower penetration level in China compared to the US and all the potential AI offers.

There were some market comments that Cloud could be spun off rather than IPOed, which looks like the best option to me. When a company is undervalued relative to its underlying businesses, the risk is that the discount does not close or even widens after one of the operating subsidiaries goes public. It is easier for shareholders to realise the value of their holdings if they get direct ownership of the underlying businesses.

I was planning to start selling the stock once it approached $130, admitting my original thesis was wrong. That was based on the view that Alibaba’s growth has stalled and the upside mainly comes from stock re-rating. However, if the top line can grow more consistently and margins continue to improve, then the upside could be much more significant.

I believe one strong quarter is not enough to make such a conclusion, but it definitely provides a good reason to be more optimistic.

I considered adding to my position but thought that 4% is not such a small size considering “un-hedgeable” geopolitical risks. I still may buy more if the stock falls.

It is also unclear how quickly and which segment will be IPOed first. With the former Chairman and CEO, Daniel Zhang, taking over the role of Cloud CEO, it is clear that Cloud will get a lot of attention from the Alibaba founders in the future. This is not surprising given the lower penetration level in China compared to the US and all the potential AI offers.

There were some market comments that Cloud could be spun off rather than IPOed, which looks like the best option to me. When a company is undervalued relative to its underlying businesses, the risk is that the discount does not close or even widens after one of the operating subsidiaries goes public. It is easier for shareholders to realise the value of their holdings if they get direct ownership of the underlying businesses.

I was planning to start selling the stock once it approached $130, admitting my original thesis was wrong. That was based on the view that Alibaba’s growth has stalled and the upside mainly comes from stock re-rating. However, if the top line can grow more consistently and margins continue to improve, then the upside could be much more significant.

I believe one strong quarter is not enough to make such a conclusion, but it definitely provides a good reason to be more optimistic.

I considered adding to my position but thought that 4% is not such a small size considering “un-hedgeable” geopolitical risks. I still may buy more if the stock falls.

The Watches of Switzerland Group (1.7% position)

It is a new position for me, which came up as part of my Monthly Stock Idea research. I got attracted to the company because of its strong growth, particularly in the underpenetrated US market, margin expansion and undemanding valuation (13.4x P/E based on ’24 consensus earnings estimates).

I opened a small position in late July and doubled it after Q1 ‘FY24 trading update on 10 August. The company confirmed its full-year guidance of 8-11% growth and flat EBIT margins.

I have two main concerns. One is that recent growth was artificially boosted by the speculative mania that spread to luxury watches. Given that the growth has been consistent for a long time before COVID and a lot of of the growth came from new stores opened in the US (and recently in Europe), it looks like the role of the speculation is fairly limited.

The second concern has to do with competition, primarily online. I noticed a few online platforms are now moving offline (e.g. Watchfinders, which was acquired by Richemont), while other platforms are simply growing and becoming more popular (e.g. Chrono24, Hodinkee, Catawiki, as well as monobrand sites like Breitling).

Watches of Switzerland has an online presence and just recently entered the pre-owned segment. I still think buying luxury watches, especially for the first time, is more of an offline experience. People prefer buying online because of convenience and prices. But retail prices for luxury watches are softly regulated by producers while waiting for your $10,000 delivery at home and being unable to try your watch before buying is hardly a convenient experience.

Buying pre-owned watches may be a different case. There is no single market price and if you know what you want, you don’t need to try it before buying. The risk is that second-hand watches become more popular and Watches of Switzerland fail to gain material presence in that segment.

I opened a small position in late July and doubled it after Q1 ‘FY24 trading update on 10 August. The company confirmed its full-year guidance of 8-11% growth and flat EBIT margins.

I have two main concerns. One is that recent growth was artificially boosted by the speculative mania that spread to luxury watches. Given that the growth has been consistent for a long time before COVID and a lot of of the growth came from new stores opened in the US (and recently in Europe), it looks like the role of the speculation is fairly limited.

The second concern has to do with competition, primarily online. I noticed a few online platforms are now moving offline (e.g. Watchfinders, which was acquired by Richemont), while other platforms are simply growing and becoming more popular (e.g. Chrono24, Hodinkee, Catawiki, as well as monobrand sites like Breitling).

Watches of Switzerland has an online presence and just recently entered the pre-owned segment. I still think buying luxury watches, especially for the first time, is more of an offline experience. People prefer buying online because of convenience and prices. But retail prices for luxury watches are softly regulated by producers while waiting for your $10,000 delivery at home and being unable to try your watch before buying is hardly a convenient experience.

Buying pre-owned watches may be a different case. There is no single market price and if you know what you want, you don’t need to try it before buying. The risk is that second-hand watches become more popular and Watches of Switzerland fail to gain material presence in that segment.

CNX (7% position)

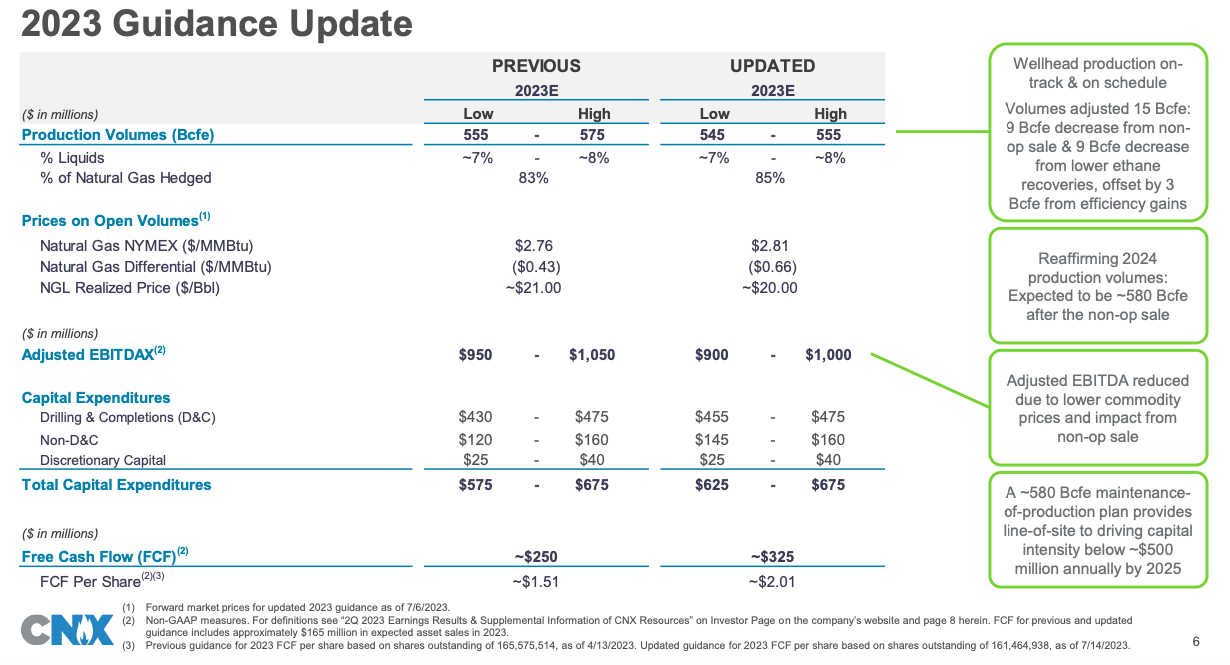

CNX is the next candidate for the sale after Altria (see below). I plan to do more work before pulling the trigger.

Earlier this year, I wrote about my concerns about CNX’s production and rising capex. I took some profits, trimming my position above $16. It is incredible that even though production turned out to be lower and capex higher, the stock has done quite well. What had been priced in before and what the market is expecting now is, of course, more important than what has happened.

Earlier this year, I wrote about my concerns about CNX’s production and rising capex. I took some profits, trimming my position above $16. It is incredible that even though production turned out to be lower and capex higher, the stock has done quite well. What had been priced in before and what the market is expecting now is, of course, more important than what has happened.

Source: CNX Investor Presentation

Source: Google Finance

I am not sure how many market participants are digging deep enough here. Astonishingly, out of the $224mn of FCF that the company reported for H1 ’23, $155mn was a positive contribution from Working Capital, and a further $142mn were the proceeds from asset sales! Adjusted for those two non-recurring items, FCF was actually negative at $(73)mn.

The company’s $325mn FCF guidance for FY23 ($2/share) includes $165mn of expected asset sales during the year. Even if production rises in 2024 to about 580bcf (+5%) and capex drops to the maintenance level of $500mn (-23%) in 2025, the company would need materially higher gas prices to generate an attractive FCF. At $3/mmbtu spot gas prices and $20/bl NGL, the company would generate $2.2/share FCF (c. 10% yield), based on my estimates.

The company’s $325mn FCF guidance for FY23 ($2/share) includes $165mn of expected asset sales during the year. Even if production rises in 2024 to about 580bcf (+5%) and capex drops to the maintenance level of $500mn (-23%) in 2025, the company would need materially higher gas prices to generate an attractive FCF. At $3/mmbtu spot gas prices and $20/bl NGL, the company would generate $2.2/share FCF (c. 10% yield), based on my estimates.

Occidental Petroleum (1.7% position)

This is the least fundamental investment in my portfolio. I have been following Occidental since it purchased Anadarko (which I used to own). I almost pulled the trigger when Oxy fell to around $10 but passed because of leverage concerns.

This time at the start of the summer, I saw upside risks for the oil price. I almost never make investment decisions because of a macro forecast, especially near-term. I thought the reopening of China, the US switching from releasing strategic petroleum reserves to building them, and strong discipline within OPEC should be the key drivers to push the oil price back to at least $80. This comes on top of a long-term trend of falling capex and a focus on FCF vs production growth across most publicly listed oil producers. Also, if you look closer into Saudi Arabia, it becomes obvious that the country has made a pivot towards a growing non-energy sector with a special emphasis on domestic infrastructure and technologies. The enormous spending on new projects (Vision 2030) needs to be funded. It looks to me that Saudi Arabia is ready to sacrifice its share in the global oil market in order to make sure the new projects have enough capital.

So I decided to buy an oil company with minimal operational risks. I realise Oxy is not the cheapest, but from my experience, chasing low valuation can be risky as possible operational failures outweigh the positive impact of rising commodity prices.

Oil wells performance at Oxy is one of the best in North America. Its focus on optimising the balance sheet, including paying off preferred stock owned by Berkshire, acts as another driver for better discipline and minimises risks of misallocation of capital.

Finally, Buffett’s regular buying when the stock falls below $60 provides additional technical support.

So far, the position has worked well, I am up 8% since early July.

This time at the start of the summer, I saw upside risks for the oil price. I almost never make investment decisions because of a macro forecast, especially near-term. I thought the reopening of China, the US switching from releasing strategic petroleum reserves to building them, and strong discipline within OPEC should be the key drivers to push the oil price back to at least $80. This comes on top of a long-term trend of falling capex and a focus on FCF vs production growth across most publicly listed oil producers. Also, if you look closer into Saudi Arabia, it becomes obvious that the country has made a pivot towards a growing non-energy sector with a special emphasis on domestic infrastructure and technologies. The enormous spending on new projects (Vision 2030) needs to be funded. It looks to me that Saudi Arabia is ready to sacrifice its share in the global oil market in order to make sure the new projects have enough capital.

So I decided to buy an oil company with minimal operational risks. I realise Oxy is not the cheapest, but from my experience, chasing low valuation can be risky as possible operational failures outweigh the positive impact of rising commodity prices.

Oil wells performance at Oxy is one of the best in North America. Its focus on optimising the balance sheet, including paying off preferred stock owned by Berkshire, acts as another driver for better discipline and minimises risks of misallocation of capital.

Finally, Buffett’s regular buying when the stock falls below $60 provides additional technical support.

So far, the position has worked well, I am up 8% since early July.

Altria (3%)

This is just to say that I will be selling Altria completely in the following weeks. I will sell faster if I find a better opportunity. The main flaw in my original thesis was that the company had strong pricing power as smokers are not sensitive to cigarette prices. Whether it is a switch to vaping or a general trend for a healthier lifestyle, Altria’s positions have not held up well. It struggles to pass on inflation to its customers without losing too much of a market share, while its vaping products are well behind competitors. After an epic failure with the $12.8bn acquisition of Juul and the decision to end the US partnership with Philip Morris on IQOS, Altria made a new $2.75bn acquisition of an e-vapour producer, NJOY. You would have thought that with Altria’s history, market share and financial resources, the company could have come up with a few leading products in new segments instead of trying to buy out the newcomers.

The stock pays about an 8% dividend yield, one of the highest in the S&P 500, but without organic growth, the total return will not be higher than that. In fact, if the company struggles to offset declining cigarette volumes with price hikes, the dividend would have to be cut.

The stock pays about an 8% dividend yield, one of the highest in the S&P 500, but without organic growth, the total return will not be higher than that. In fact, if the company struggles to offset declining cigarette volumes with price hikes, the dividend would have to be cut.

Berkshire Hathaway (close to 30% of my portfolio)

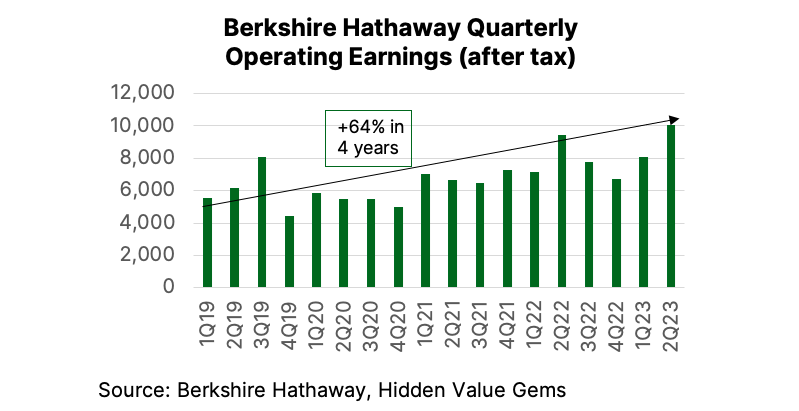

Berkshire stock reached an all-time high this week as the market reacted positively to Q2 earnings results. Berkshire is up +15.6% year-to-date, almost matching S&P 500 (+16.7%). Following a multi-year period of underperformance, the company’s stock is now ahead of the US stock index on 1- and 5-year horizons. It has beaten the S&P 500 by 14.5% over the past twelve months and by 15.5% over the past five years.

The point of buying Berkshire stock is to become a long-term partner of Warren Buffett, benefiting from the earnings power of its operating businesses, a stock portfolio, insurance and, most importantly, capital allocation skills. Buffett stated many times that he would never sell private businesses, while in public investing, he focuses on an extremely long-term horizon.

Given all this, I find little meaning in spending too much time analysing quarterly performance, especially due to the many cyclical factors at play in each quarter.

Nevertheless, since it is my largest position (just under 30%), I thought I should provide a 30-second summary of their performance:

The point of buying Berkshire stock is to become a long-term partner of Warren Buffett, benefiting from the earnings power of its operating businesses, a stock portfolio, insurance and, most importantly, capital allocation skills. Buffett stated many times that he would never sell private businesses, while in public investing, he focuses on an extremely long-term horizon.

Given all this, I find little meaning in spending too much time analysing quarterly performance, especially due to the many cyclical factors at play in each quarter.

Nevertheless, since it is my largest position (just under 30%), I thought I should provide a 30-second summary of their performance:

- Operating earnings (after tax) increased 7% in Q2 ’23 to $10bn compared to the same period last year (YoY); +9% during H1 ’23. Occidental’s earnings were included in the operating results under the Non-controlled category, while in Q2 ’22, they were not included as Berkshire’s stake in the company was under 20%. This consolidation contributed 3 percentage points to the overall 7% growth in operating profits.

- Profits from insurance operations made the biggest contribution, growing by 38%, driven by better underwriting results and higher investment income (due to higher rates). Performance was strong across all insurance segments benefiting from lower underwriting loss ratios and underwriting expenses.

- Insurance float was $166bn by the end of Q2 compared to $164bn at the start of the year.

- Railroads (BNSF), Energy (BHE) and Other controlled businesses earned $5.6bn after-tax operating earnings, almost the same as last year ($5.7bn). Lower earnings at BNSF (-24%) were offset by higher earnings at Other businesses (+8%), while BHE was flat. Other businesses benefited from the consolidation of Pilot Travel Center (fuel stations) earnings which contributed 3 percentage points to the overall 8% growth. BNSF earnings suffered from lower volumes (-11%) and higher compensation expenses (+14%).

- Berkshire’s investments in public stocks were at $353.4bn at the end of Q2 ’23 (14% higher compared to the beginning of the year). 50% of the portfolio was in Apple, while the Top 5 stocks accounted for 78%. Concentration has increased mainly due to the rise of Apple’s stock which accounted for 38.5% at the beginning of the year (the top 5 stocks contributed 75% at the start of the period).

- Net cash increased to $147bn from $130bn at the end of Q1 '23.

- Berkshire was the net seller of stocks in the past two quarters, selling $15.5bn in Q2 '23 and $13.3bn in Q1 '23. It spent $4.6bn on purchasing new shares during Q2 and $2.9bn in Q1).

- Not surprisingly, the company reduced its share repurchase activity to just $1.4bn from $4.4bn in Q1 ’23.

My view on the stock: Berkshire is my core holding: it has the safety qualities of a bank deposit but much better protection against inflation. It benefits from falling asset prices as it can deploy more capital, and it also gains more in a higher interest environment. I have tried to come up with a fair value estimate for Berkshire in my original thesis. However, the way I look at the stock now is that it is better to look at potential returns rather than a fair value, especially if I don’t plan to sell it in the near term. Buffett has been targeting 10%+ returns from recent acquisitions. There is an additional 3-4% gain from income generated by the insurance float. So combined returns should be around 13-14% over the cycle. My main concern is around the high share of Apple (50% of the stock portfolio, 17% of total assets).

Thank you for reading this piece. I hope it was useful. Please consider sharing it with your friends who may also benefit from this.