3 September 2023

Why I am optimistic about the markets

Long-time readers would know that I ignore the macro context and focus on individual companies. Weak macro conditions generally lead to lower share prices, which is a good time for buying stocks. Moreover, as markets are forward-looking, today’s bad macro news was likely already discounted some time ago. I wrote a separate piece on this subject last year.

In reality, of course, we all revert to the big picture, not least when deciding whether to buy a stock we like today or wait for the downturn and buy it later.

There is no shortage of warnings today. I wonder when it is not the case. If the invasion of Taiwan is less discussed today, China’s overall economic slowdown has become more evident now. Surely, it is a reason for concern. FT and The Economist have just added Europe, particularly Germany, to the list of struggling economies. US debt continues to rise. US elections due next year cannot be ignored. The war in Ukraine continues. And on top of that, US markets have staged a remarkable recovery: S&P 500 and NASDAQ are up 26% and 37% from their 2022 lows, respectively, trading at 18-24x forward PE.

I, on the other hand, see at least four reasons to be optimistic.

In reality, of course, we all revert to the big picture, not least when deciding whether to buy a stock we like today or wait for the downturn and buy it later.

There is no shortage of warnings today. I wonder when it is not the case. If the invasion of Taiwan is less discussed today, China’s overall economic slowdown has become more evident now. Surely, it is a reason for concern. FT and The Economist have just added Europe, particularly Germany, to the list of struggling economies. US debt continues to rise. US elections due next year cannot be ignored. The war in Ukraine continues. And on top of that, US markets have staged a remarkable recovery: S&P 500 and NASDAQ are up 26% and 37% from their 2022 lows, respectively, trading at 18-24x forward PE.

I, on the other hand, see at least four reasons to be optimistic.

First, US market valuation is disproportionately influenced by just eight companies.

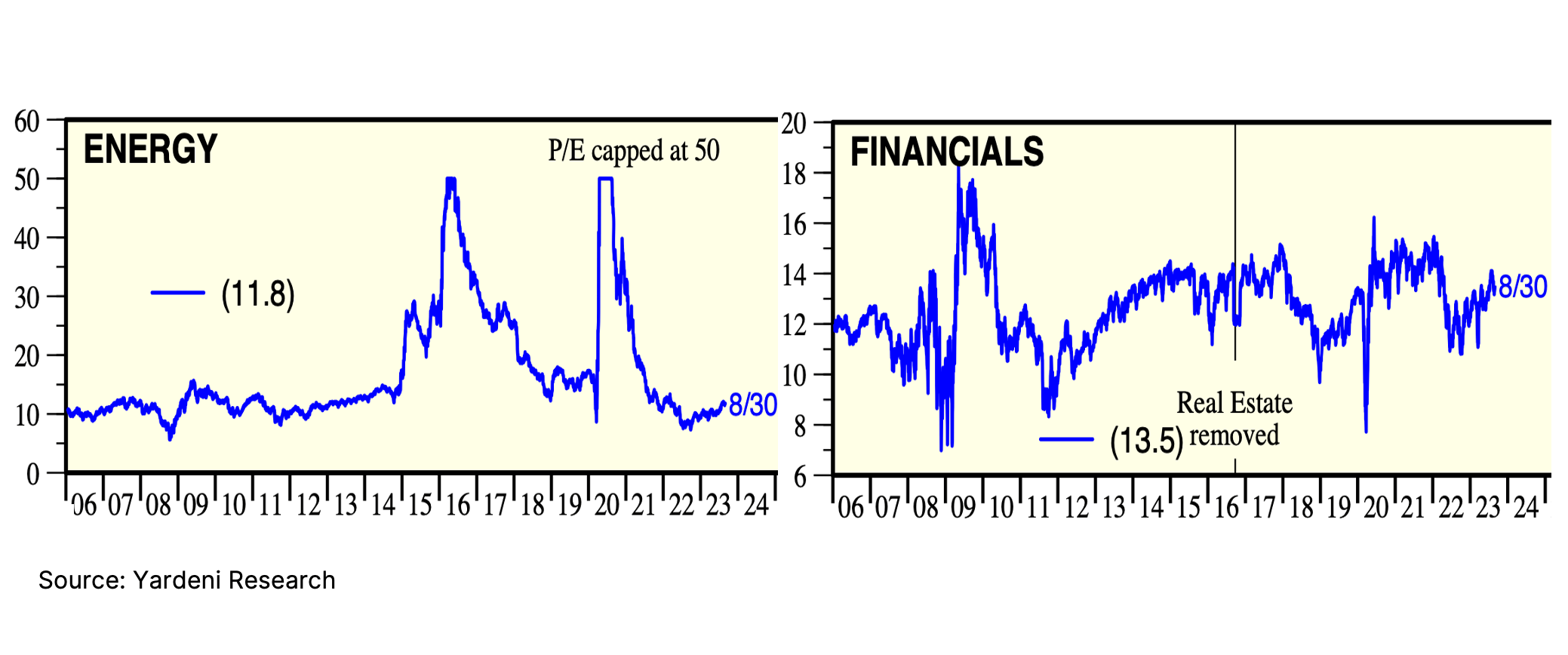

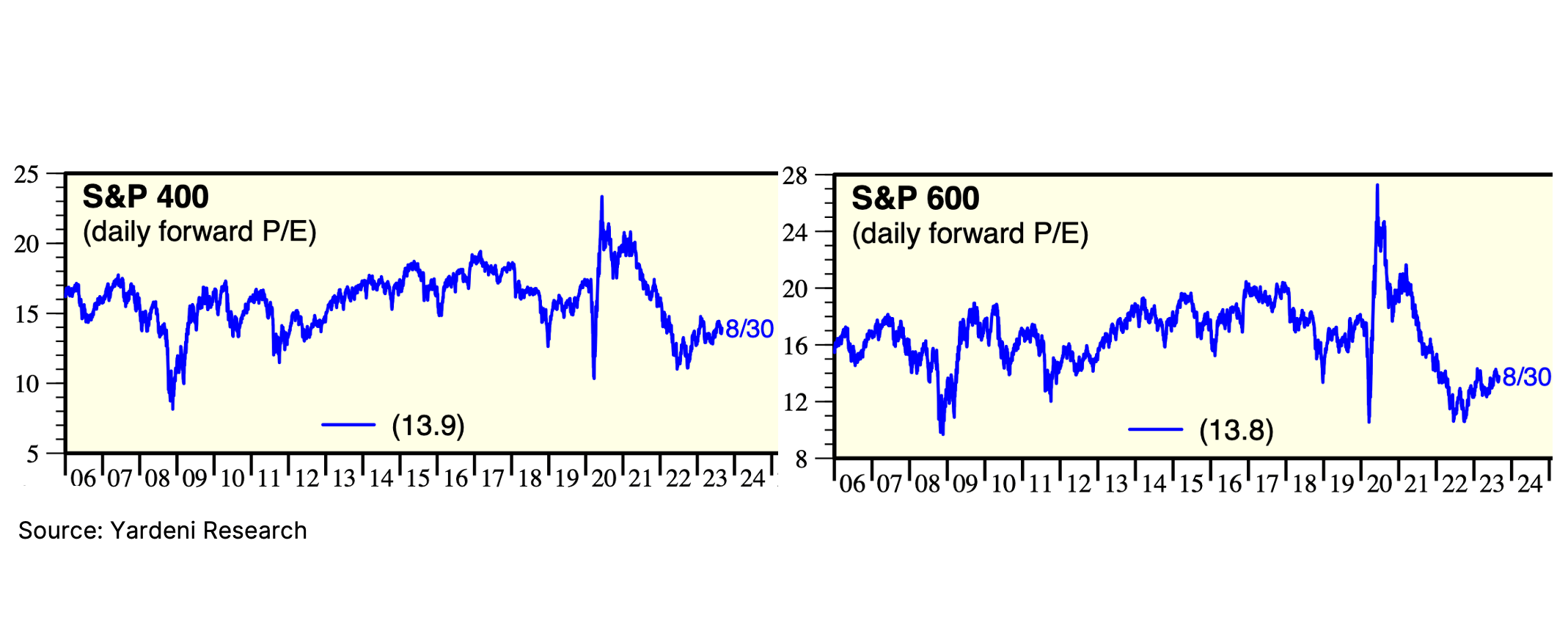

The forward PE multiple for the S&P 500 is 18.8x, according to Refinitv. The eight tech megacaps have a combined market cap of $11 trillion, accounting for 26% of the S&P 500. They trade at 28x PE. This means that 492 companies in the S&P 500 (74% of its market cap) trade at 15.6x - a historical average. Many sectors, not just individual companies, are currently priced below that (e.g. Energy, Banks, Retail).

Moreover, US mid-caps (S&P 400) and small-caps (S&P 600) are priced at 13.9x and 13.8x, respectively.

The second reason is that while all the attention is on the US, many markets have not performed as well, trade at much wider discounts and yet investors tend to avoid them.

For speculative money, these markets are just not ‘hot’ enough; for ordinary people, they are associated with too many problems, while for professional money managers, they are not liquid enough.

Take the UK market, for example. Strikes have become almost a permanent feature now: from teachers and nurses to railway workers and border control officers, workers demand a wage rise. Mortgages are now at 15-year highs, pushing down house affordability. House prices dropped by 5.3% annually in August, the fastest drop since 2009. If this is not enough, consider that Labour has a strong chance of winning the general elections in 2024.

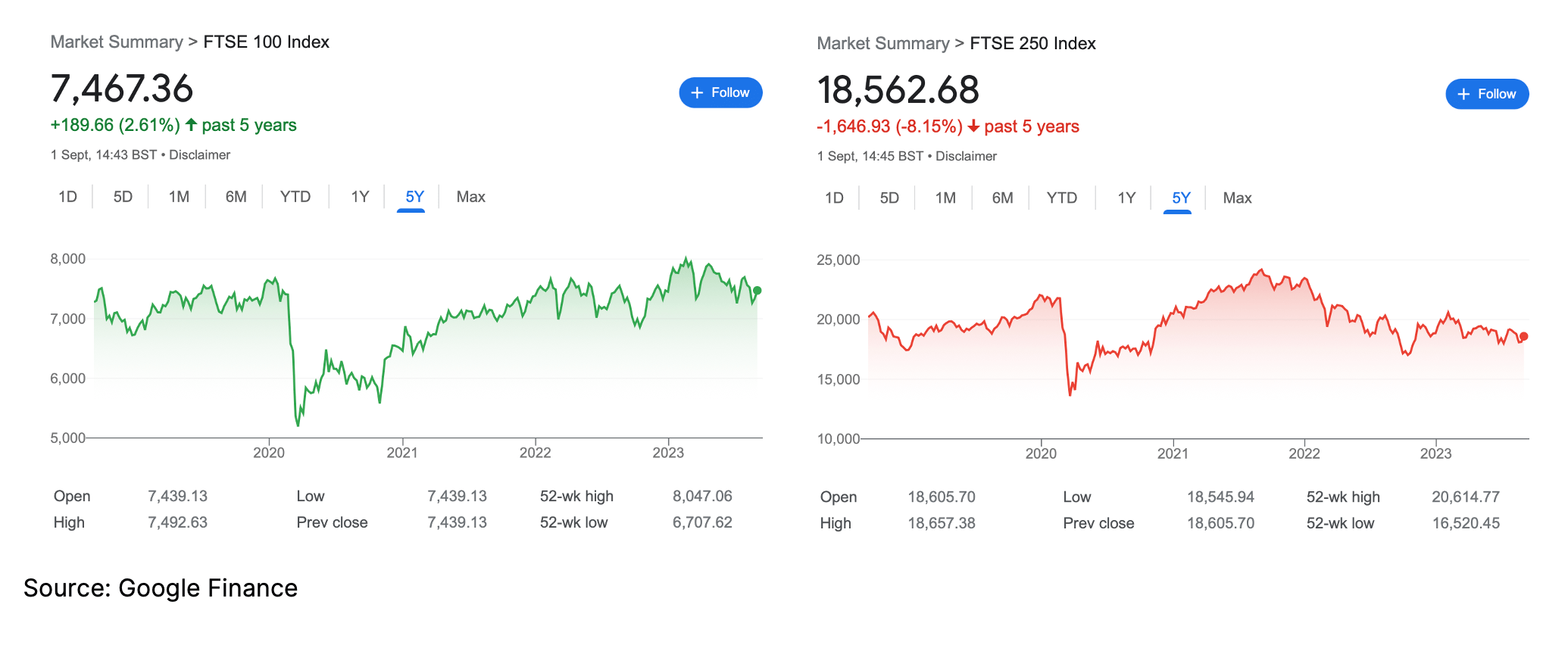

Over the past five years, the FTSE 100 has not done much, while the FTSE 250 (mid-caps) is actually down 8%!

Take the UK market, for example. Strikes have become almost a permanent feature now: from teachers and nurses to railway workers and border control officers, workers demand a wage rise. Mortgages are now at 15-year highs, pushing down house affordability. House prices dropped by 5.3% annually in August, the fastest drop since 2009. If this is not enough, consider that Labour has a strong chance of winning the general elections in 2024.

Over the past five years, the FTSE 100 has not done much, while the FTSE 250 (mid-caps) is actually down 8%!

Moreover, the index is heavily weighted by mature low-return sectors like Banks, Energy and Metals & Mining. High-growth companies choose the US market for listing.

Yet, below the top 20-30 companies, the picture is quite different. There are dozens, if not hundreds, of companies that are run by their founders, operating in one of the most transparent and safe legal environments with generally a pro-market regulator. The UK is home to many new technologies and successful companies such as DeepMind, Arm and many more. The country has many of the world’s best universities and research labs, especially in the Oxford to Cambridge ‘Brain Belt’.

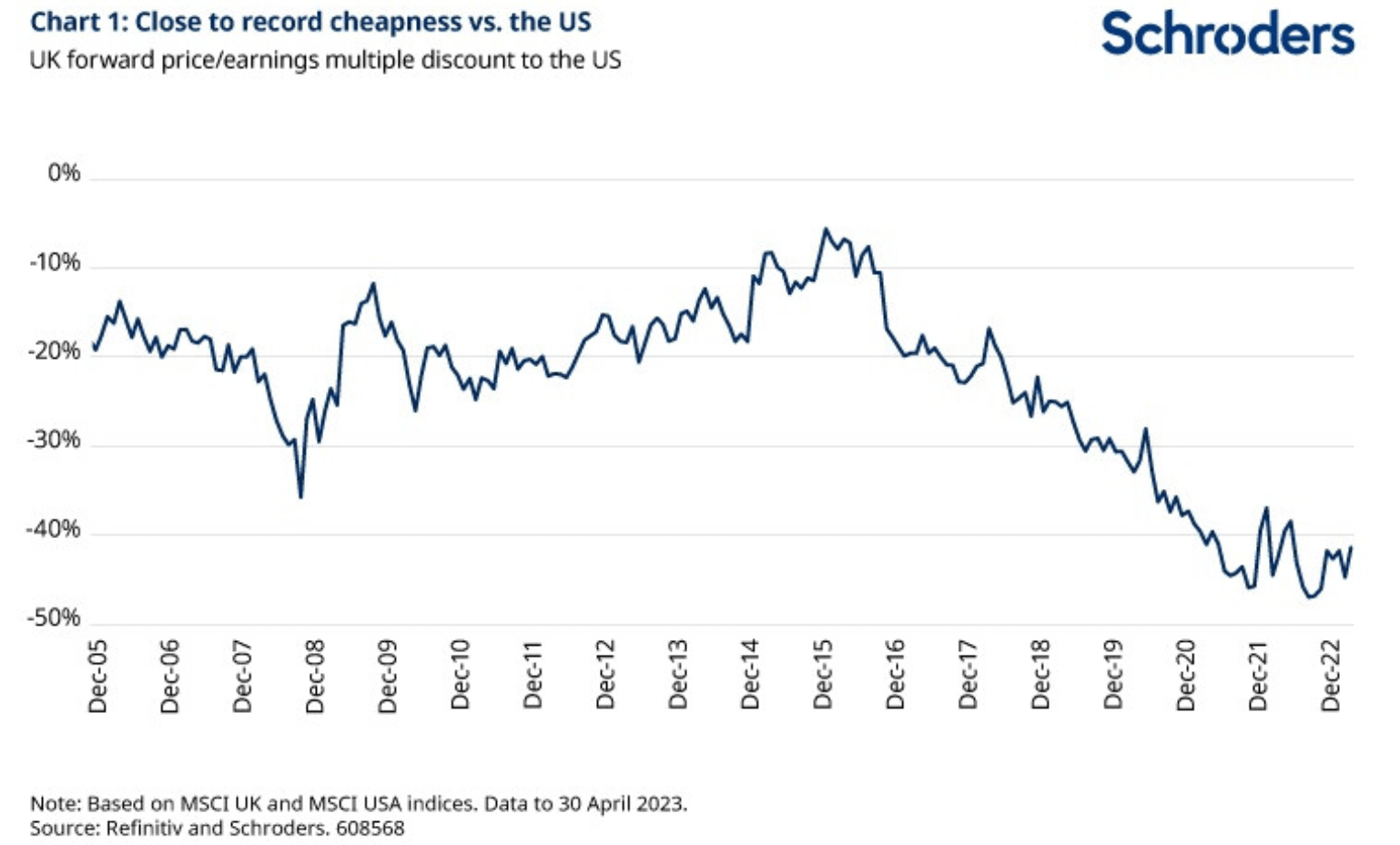

And most exciting about all this is valuation. Except for just a few companies, 15x PE would be considered a high multiple for a UK-based company. Single-digit PEs are common. The chart below was prepared by Schroders: UK stocks were over 40% cheaper than the US market at the start of 2022 (the gap has probably widened given relative performance of the two markets in 2023).

Yet, below the top 20-30 companies, the picture is quite different. There are dozens, if not hundreds, of companies that are run by their founders, operating in one of the most transparent and safe legal environments with generally a pro-market regulator. The UK is home to many new technologies and successful companies such as DeepMind, Arm and many more. The country has many of the world’s best universities and research labs, especially in the Oxford to Cambridge ‘Brain Belt’.

And most exciting about all this is valuation. Except for just a few companies, 15x PE would be considered a high multiple for a UK-based company. Single-digit PEs are common. The chart below was prepared by Schroders: UK stocks were over 40% cheaper than the US market at the start of 2022 (the gap has probably widened given relative performance of the two markets in 2023).

Third reason: with asset managers competing on the size of their assets, they inevitably face a narrowing stock universe as many stocks become too illiquid for them.

The BlackRocks and JP Morgans, who run billions and trillions of assets, cannot buy shares of a $1-3bn market cap company with daily liquidity of $1-3mn (common in the UK).

Finally, many brokers focus on companies that are either big or have the potential to generate IB revenue.

Covering small-cap stocks is just not profitable. As a result, there is more inefficiency in this segment, which is not correlated with the broader market.

If there is one point to take away here, it is that, from my experience, macro concerns should not be a reason to defer buying a great business available at an attractive valuation.

With these thoughts, you will not find it surprising that over the past week, I have purchased two new non-US stocks. You may be surprised that only one of them was a British company. The other one was French. I have also decided to keep Harbour Energy in my portfolio despite writing about my plans to sell it last week.

In the following section, I discuss my recent purchases and the reasons to keep Harbour.

In the following section, I discuss my recent purchases and the reasons to keep Harbour.

Portfolio Updates

Purchase of JD Wetherspoon

I have finally decided to pull the trigger with JD Wetherspoon. I presented the stock in my July MSIL edition.

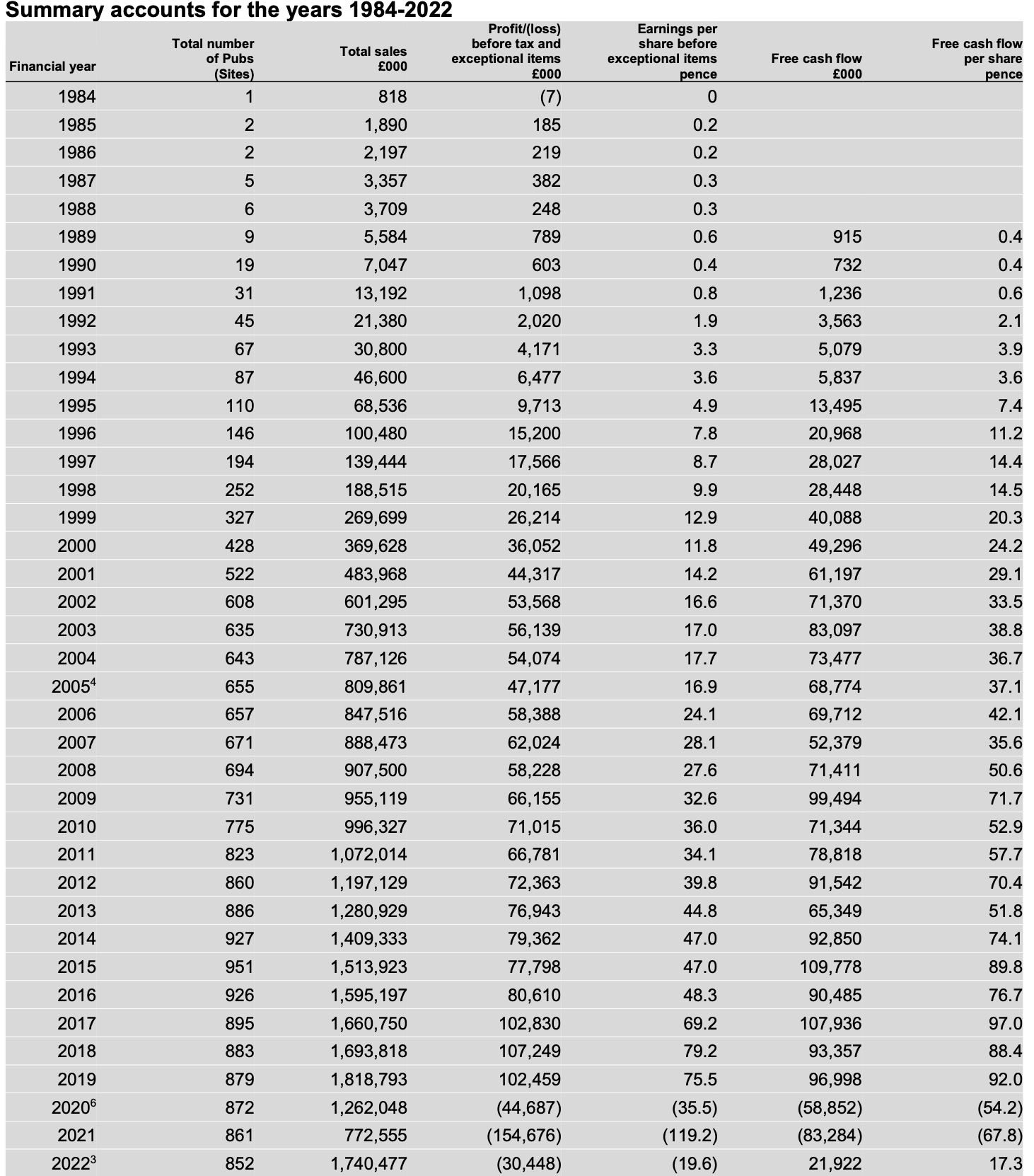

In brief, it is a founder-led pub business that has outperformed its peers by focusing on costs and value to its customers. Pre-COVID, the company was generating close to £1 of FCF per share and trading at £13-15 a share (c. 7% FCF yield). During 1986-2019, it has increased its sales and pre-tax profits by 23% and 20% annually. Since 2004, the growth has slowed down to 6% per year, while pre-tax profit margins have settled at a 6% level. Until 2020, the company never had an annual loss.

In brief, it is a founder-led pub business that has outperformed its peers by focusing on costs and value to its customers. Pre-COVID, the company was generating close to £1 of FCF per share and trading at £13-15 a share (c. 7% FCF yield). During 1986-2019, it has increased its sales and pre-tax profits by 23% and 20% annually. Since 2004, the growth has slowed down to 6% per year, while pre-tax profit margins have settled at a 6% level. Until 2020, the company never had an annual loss.

Source: JD Wetherspoon Annual Report 2022

COVID, however, dealt a significant blow to the company’s performance, causing it to operate at a loss and forcing it to seek additional funding through a share issue (7% of new shares raising £91.5mn). The company’s leverage has reached a critical level in FY-21, with EBITDA turning negative, followed by 25.6x by April 21 and falling to 6.2x by April 2023. Net debt fell further to £688mn as of 9 July 2023 from £738mn as of 30 April 2023 and £805mn at the end of 2022.

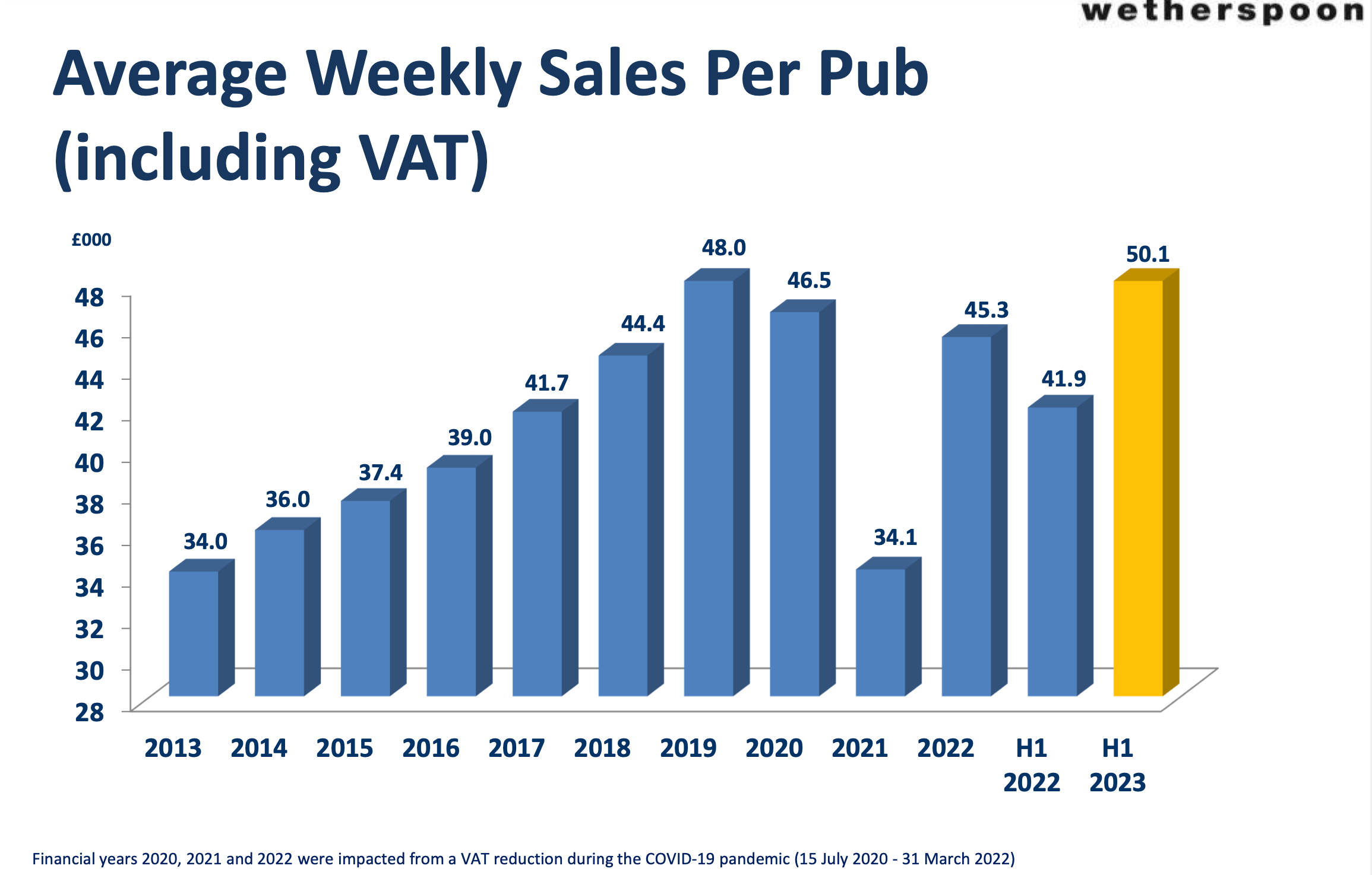

As COVID has receded, the company’s performance has started to normalise. Weekly revenue per pub exceeded 2019 levels of £48k in the first six months of FY-23, reaching £50.1k. Full-year revenue in FY-23 is on track to finally exceed pre-COVID sales of £1.8bn.

As COVID has receded, the company’s performance has started to normalise. Weekly revenue per pub exceeded 2019 levels of £48k in the first six months of FY-23, reaching £50.1k. Full-year revenue in FY-23 is on track to finally exceed pre-COVID sales of £1.8bn.

Source: JD Wetherspoon Investor Presentation

There are still two issues that hold back profitability from returning to historical levels: inflation and drinking habits.

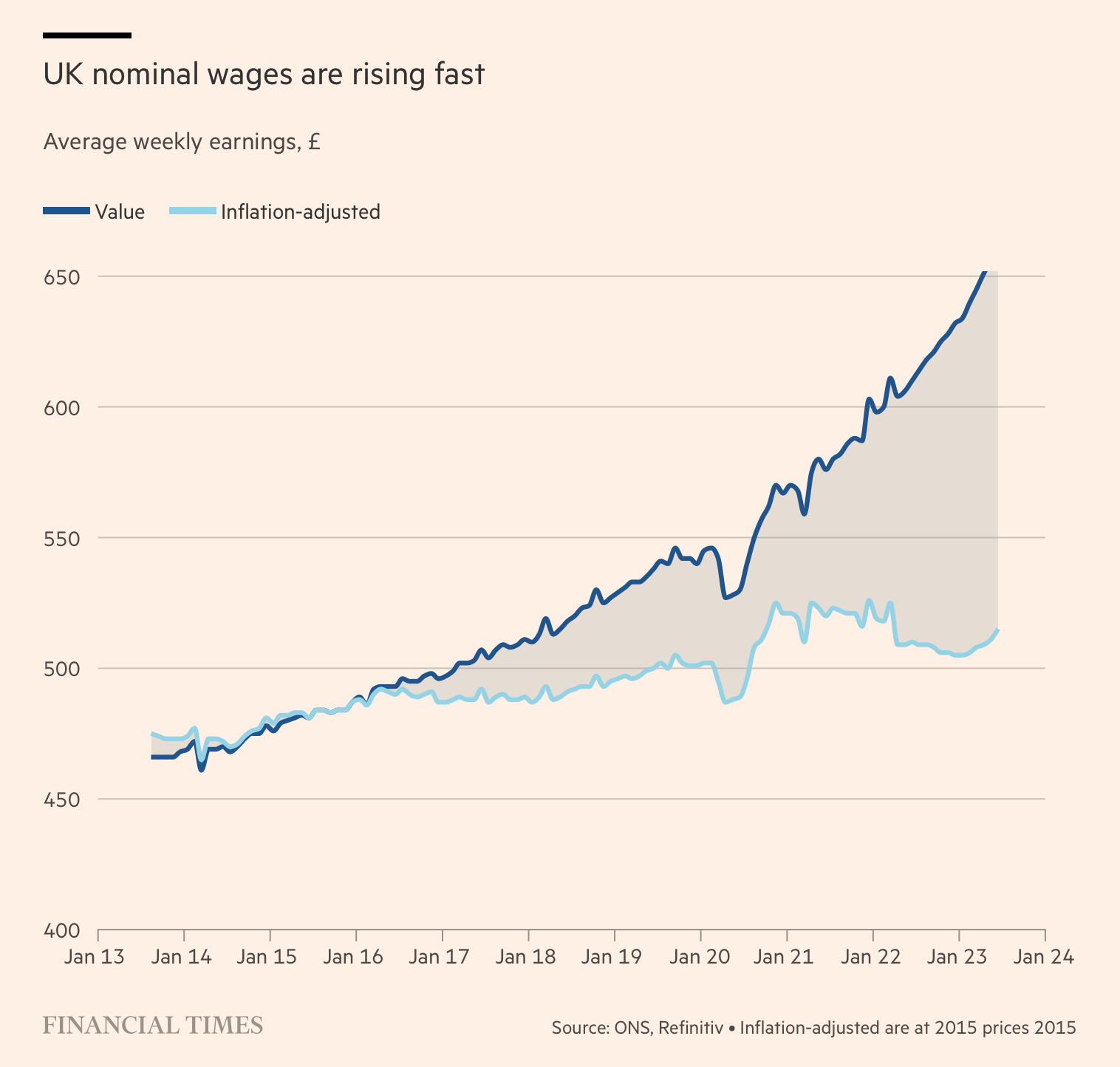

I am not too worried about inflation. The UK is a market economy where inflation can go up or down. I admit it may take a little longer this time. Still, pubs should be able to pass through inflation via price hikes. Importantly, UK wage growth has started to rise, which should make it easier for pubs to sustain higher prices.

I am not too worried about inflation. The UK is a market economy where inflation can go up or down. I admit it may take a little longer this time. Still, pubs should be able to pass through inflation via price hikes. Importantly, UK wage growth has started to rise, which should make it easier for pubs to sustain higher prices.

The second factor (drinking habits) emerged during COVID as consumers started buying more beer and other alcohol in supermarkets and consuming it at home. Frankly, as a non-native and cost-conscious resident, I always struggled to justify paying 2-3x more for a pint of beer compared to its retail price. So I guess some of the volumes might have been lost permanently.

However, it is even more difficult for me to see how the British people stop going to pubs. Moreover, pubs have been adding more options to their menus. JD Wetherspoon, for example, has seen the share of food in its sales mix rise from 18% in 2020 to 38% in H1 ’23. The company also has a small hotel business and operates slot machines in some of its pubs.

JDW is trading at about 13x forward PE, but if profitability and cash flow fully normalise, valuation multiples would be around 9x PE and 14% FCF yield compared to historical valuation of 15-20x PE and 7% FCF yield. The stock could rise more than 100% to match earnings recovery and improved valuation multiples.

It is also encouraging that the company's founder and chairman, Tim Martin, increased his interest in the company purchasing 11.9mn shares on 1 February 2023 at 457p.

I started with a 1% position but plan to increase it, hoping the price would drop in the near term.

However, it is even more difficult for me to see how the British people stop going to pubs. Moreover, pubs have been adding more options to their menus. JD Wetherspoon, for example, has seen the share of food in its sales mix rise from 18% in 2020 to 38% in H1 ’23. The company also has a small hotel business and operates slot machines in some of its pubs.

JDW is trading at about 13x forward PE, but if profitability and cash flow fully normalise, valuation multiples would be around 9x PE and 14% FCF yield compared to historical valuation of 15-20x PE and 7% FCF yield. The stock could rise more than 100% to match earnings recovery and improved valuation multiples.

It is also encouraging that the company's founder and chairman, Tim Martin, increased his interest in the company purchasing 11.9mn shares on 1 February 2023 at 457p.

I started with a 1% position but plan to increase it, hoping the price would drop in the near term.

Eurofins Scientific

Eurofins is another company I discussed in my June ’23 MSIL. Similar to JD Wetherspoon, it is run by its founder, Gilles Martins, who continues to hold a 32.8% stake in the company.

Eurofins is one of the world’s largest testing companies focusing on the Food, Environment, Pharmaceutical and Cosmetic sectors.

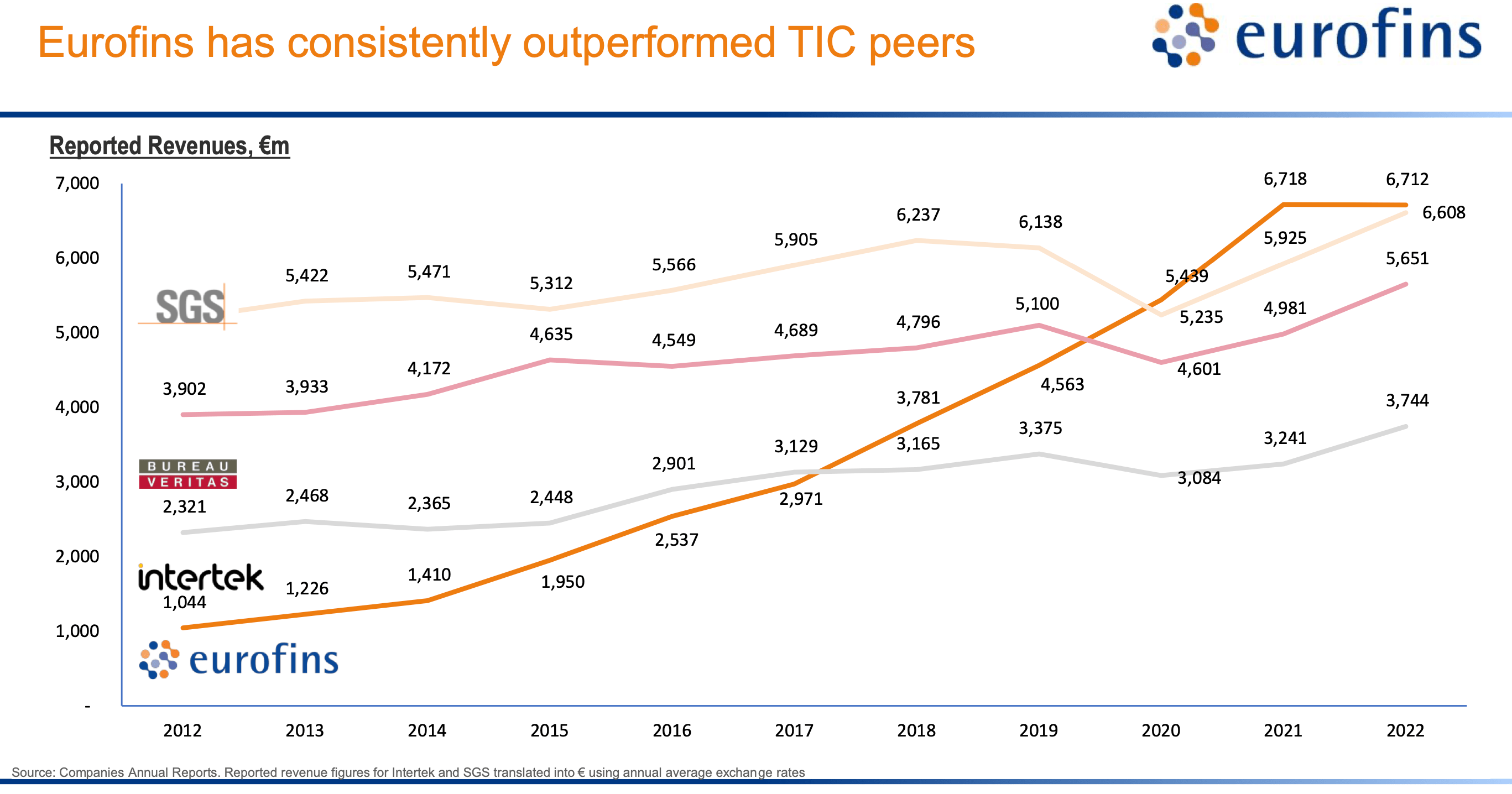

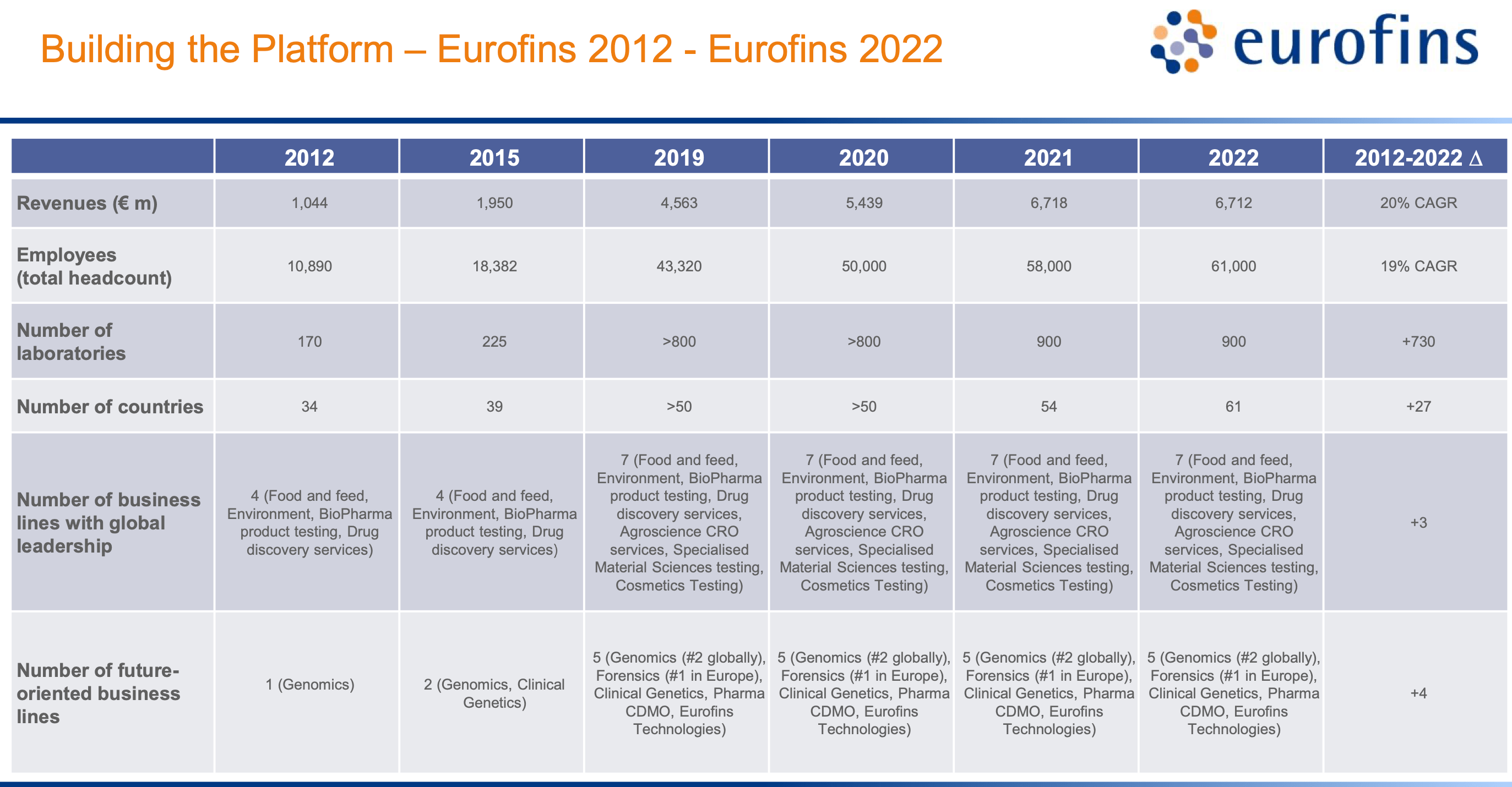

Since its IPO in 1997, the company has increased its sales by 32% a year, on average, to reach €6.7bn in 2022, while its share price has compounded by c. 27%. The sector remains highly fragmented, and there is room for further consolidation.

The company has been the fastest test lab business globally and has outperformed all its peers to take the number one position.

Eurofins is one of the world’s largest testing companies focusing on the Food, Environment, Pharmaceutical and Cosmetic sectors.

Since its IPO in 1997, the company has increased its sales by 32% a year, on average, to reach €6.7bn in 2022, while its share price has compounded by c. 27%. The sector remains highly fragmented, and there is room for further consolidation.

The company has been the fastest test lab business globally and has outperformed all its peers to take the number one position.

Eurofins is a serial acquirer, with M&A being a critical driver in its growth strategy. The company has completed over 490 acquisitions. Its long-term objective for organic growth used to be 5%, but following consistent outperformance during 2010-21, management has raised its target to 6.5%, corresponding to the average organic growth rate during 2010-21.

Source: Eurofins Scientific Investor Presentation

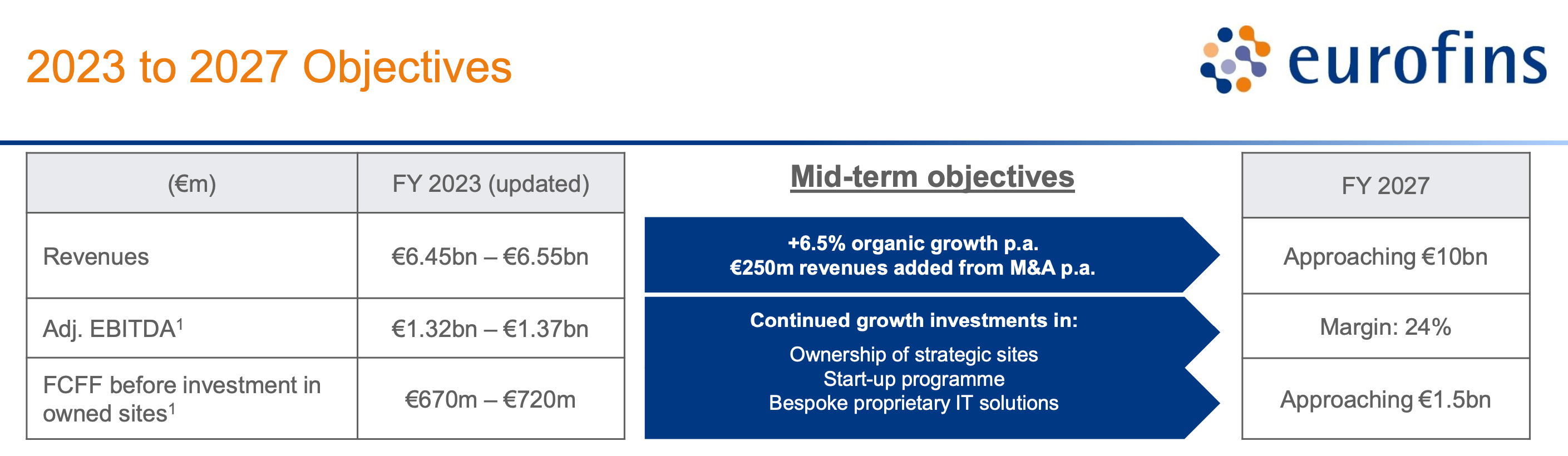

The company targets an EBITDA margin of 22% in '23 (27% in '21, 17% in '19) and plans to increase it to 24% by ’27. With 6-7% organic growth and select acquisitions, management targets an overall revenue growth of 11-12% by ’27. I think it could be higher, especially if Eurofins is successful with its recent focus on Asia.

The stock is down 50% from its '21 peak as the business got a boost from COVID testing, and now it looks like it has stopped growing (high base effect). H1 ’23 revenue was down 5.9% YoY, although excluding excluding COVID testing and reagent sales, revenue was up +7%.

The stock is down 50% from its '21 peak as the business got a boost from COVID testing, and now it looks like it has stopped growing (high base effect). H1 ’23 revenue was down 5.9% YoY, although excluding excluding COVID testing and reagent sales, revenue was up +7%.

Source: Google Finance

The company trades at 6% FCF yield (excluding investment in owned sites) and 9.0x forward EV/EBITDA, which does not look particularly cheap, but assuming the company continues to grow at a double-digit rate and generates close to 20% returns on invested capital, this multiple looks reasonable. At today’s share price (€56.6) and if management achieves its ’27 targets, Eurofins would be trading at 5.6x EV/EBITDA and almost 14% FCF yield.

Source: Eurofins Scientific Investor Presentation

I started with 1.5% position and plan to grow it to at least 3%, possibly 5%.

Harbour Energy: profitability under windfall taxes

Harbour captured my attention when it reported its H1 ’23 results (24 August). Its six-month FCF was a mind-blowing $1.0bn, and the company went to a zero net debt position from $0.8bn net debt at the end of 2022. The company has a growing dividend distribution ($200mn annually) on top of a $240mn buyback programme.

Yet, Harbour’s market cap is just $2.5bn.

I bought a small (1.5%) and decided to do more work later. The two issues immediately came up. First, the company’s 2P reserves life is just 5.9 years, much shorter than the usual 10+ years, which is the minimum level to have stable output without aggressive spending on exploration or M&A to replace current production. At 5.9 years, the company’s production rate is just not sustainable.

The second issue was the tax payments. The company paid zero corporate income tax in H1 ’23 as it overpaid taxes in December 2023, and the next payment is due in H2 ’23 / 2024. In fact, it even received $22.7mn of tax refunds in H1 ’23. For the whole of 2023, it anticipates paying only $400mn profit tax, which would impact its H2 ’23 performance.

Capex spending (which is deducted from operating cash flows, reducing FCF) is also quite uneven during the year. With the overall ’23 capex budget at $1bn, Harbour spent only $0.4bn in H1 ’23, implying a 50% rise (HoH) in the remaining six months of 2023.

Finally, Harbour benefited from the positive impact of Working Capital changes (+$370.9mn), which boosted H1 ’23 operating and free cash flow.

Not surprisingly, the company targets $1bn FCF in 2023, which essentially means zero FCF in H2 ’23. A combination of a $400mn tax payment, partial reversal of working capital and an extra $200mn capex spend will eat into H2 cash flow from operations.

Having done this analysis on Friday and Saturday, I concluded that I should sell the position. The $1bn FCF guidance has been announced at the beginning of the year, while short reserves life and lower FCF on a normalised basis make Harbour not as cheap as it looks at first glance.

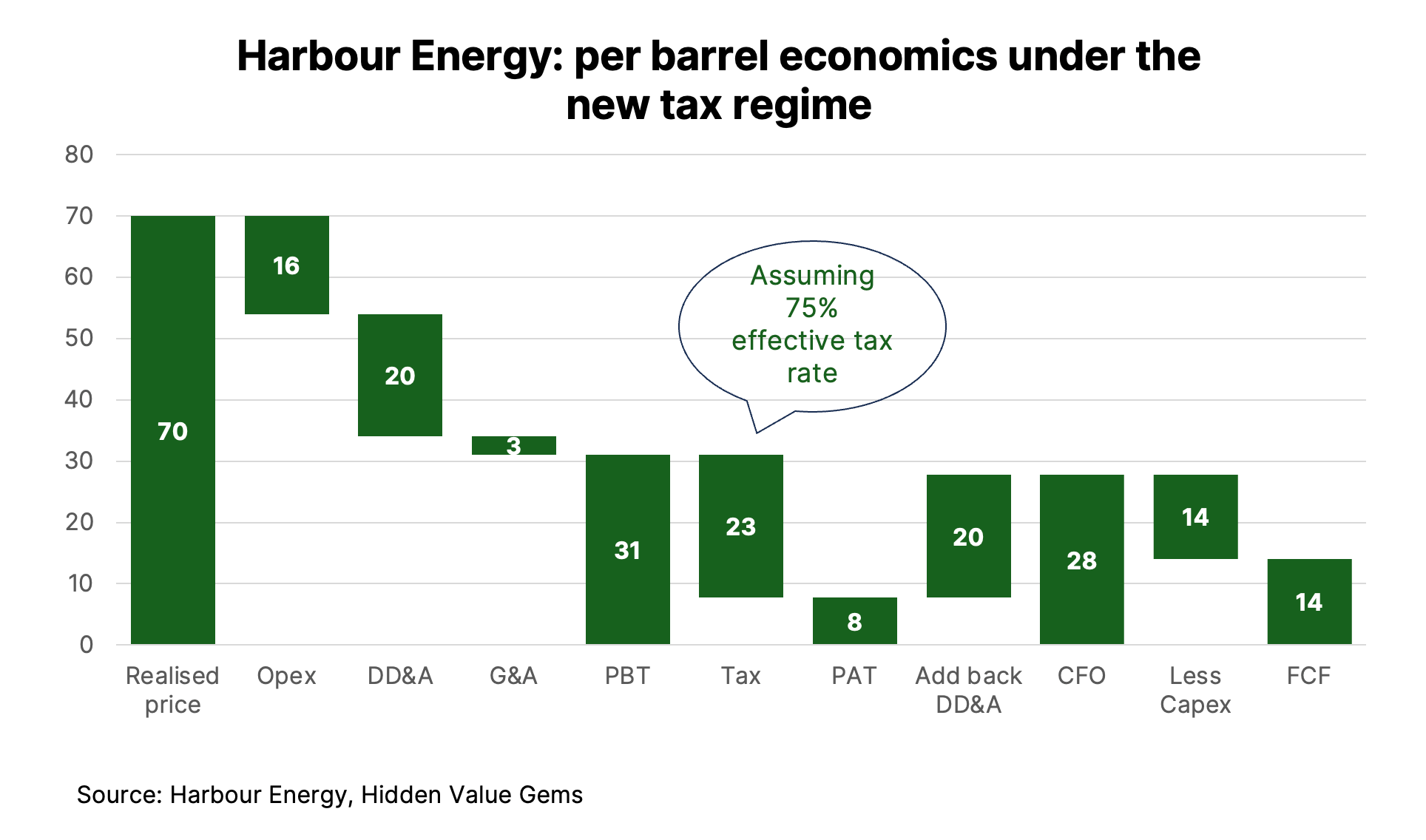

I then went through the key assumptions several times afterwards. This is how the barrel economics started to look, based on my analysis.

Yet, Harbour’s market cap is just $2.5bn.

I bought a small (1.5%) and decided to do more work later. The two issues immediately came up. First, the company’s 2P reserves life is just 5.9 years, much shorter than the usual 10+ years, which is the minimum level to have stable output without aggressive spending on exploration or M&A to replace current production. At 5.9 years, the company’s production rate is just not sustainable.

The second issue was the tax payments. The company paid zero corporate income tax in H1 ’23 as it overpaid taxes in December 2023, and the next payment is due in H2 ’23 / 2024. In fact, it even received $22.7mn of tax refunds in H1 ’23. For the whole of 2023, it anticipates paying only $400mn profit tax, which would impact its H2 ’23 performance.

Capex spending (which is deducted from operating cash flows, reducing FCF) is also quite uneven during the year. With the overall ’23 capex budget at $1bn, Harbour spent only $0.4bn in H1 ’23, implying a 50% rise (HoH) in the remaining six months of 2023.

Finally, Harbour benefited from the positive impact of Working Capital changes (+$370.9mn), which boosted H1 ’23 operating and free cash flow.

Not surprisingly, the company targets $1bn FCF in 2023, which essentially means zero FCF in H2 ’23. A combination of a $400mn tax payment, partial reversal of working capital and an extra $200mn capex spend will eat into H2 cash flow from operations.

Having done this analysis on Friday and Saturday, I concluded that I should sell the position. The $1bn FCF guidance has been announced at the beginning of the year, while short reserves life and lower FCF on a normalised basis make Harbour not as cheap as it looks at first glance.

I then went through the key assumptions several times afterwards. This is how the barrel economics started to look, based on my analysis.

The company carries losses at some of its entities, which could reduce the effective tax rate in the near term.

As for a short reserves life, I think it can be manageable given currently substantial profits. Assuming a blended price of $70/boe for oil and gas, $16/boe lifting costs, some extras on G&A and a 75% super tax on profits, Harbour should earn $8/boe after-tax income and $14/boe FCF.

At 190kboe/d daily output (70mn boe annually), Harbour's annual FCF should be $1.1bn. In the worst case, assuming that the company's organic decline is 20%, which it cannot offset from the existing portfolio, Harbour would need to replace 14 boe of reserves every year to keep production flat. Historically, finding and development costs (F&D) averaged about $10-15/boe, which would require $140-210mn. It is fair to assume higher F&D given the inflation and lack of access to cheaper resources in the Persian Gulf. But even if Harbour spends twice the amount, its capex would rise by a total of $280-420mn. Its FCF should still be at a comfortable $0.7-0.8bn.

Moreover, with many smaller companies trading at about $5/boe reserves multiples, Harbour may find buying existing companies cheaper than drilling for new reserves.

The optimists may also point out international opportunities in Harbour’s portfolio, including 230mn boe of 2C resources in Mexico and Indonesia and almost 10% of existing production outside the UK.

My only remaining concern is limited insider participation in the company's share capital.

Harbour is currently a 1.5% position in my portfolio.

As for a short reserves life, I think it can be manageable given currently substantial profits. Assuming a blended price of $70/boe for oil and gas, $16/boe lifting costs, some extras on G&A and a 75% super tax on profits, Harbour should earn $8/boe after-tax income and $14/boe FCF.

At 190kboe/d daily output (70mn boe annually), Harbour's annual FCF should be $1.1bn. In the worst case, assuming that the company's organic decline is 20%, which it cannot offset from the existing portfolio, Harbour would need to replace 14 boe of reserves every year to keep production flat. Historically, finding and development costs (F&D) averaged about $10-15/boe, which would require $140-210mn. It is fair to assume higher F&D given the inflation and lack of access to cheaper resources in the Persian Gulf. But even if Harbour spends twice the amount, its capex would rise by a total of $280-420mn. Its FCF should still be at a comfortable $0.7-0.8bn.

Moreover, with many smaller companies trading at about $5/boe reserves multiples, Harbour may find buying existing companies cheaper than drilling for new reserves.

The optimists may also point out international opportunities in Harbour’s portfolio, including 230mn boe of 2C resources in Mexico and Indonesia and almost 10% of existing production outside the UK.

My only remaining concern is limited insider participation in the company's share capital.

Harbour is currently a 1.5% position in my portfolio.

If you enjoyed this post, please consider sharing it with friends or colleagues to help spread the word and support the creation of valuable content. Thank you for reading!