In today’s note, I am sharing the slides from the presentation I made to the London Value Investing Club on 16 November 2022. I also share my thoughts on how worried we should be about the current macro issues. Having attended a few events organised for and by value investors, I have noticed that the macroeconomic outlook, problems around inflation, the health of consumer demand, interest rates, energy and other issues dominate the discussion. I want to make a few vital points that I believe can help investors achieve better results. If you are only interested in specific stock ideas, scroll down to check the link to the most recent presentation on VW Group.

Macro - important but unknowable

Don’t get me wrong. I absolutely agree that macro factors are important. A company can easily face a 30% drop in profits in a particular year due to a weaker economy. Assuming it continues to trade at the same valuation multiple, its share price would follow profits and fall 30% in one year.

Here is a small example. Assume a company with $100 sales in Year 1 finds itself in a recession next year. As a result, it sells 5% fewer goods, and its revenue drops 5% to $95. The cost of production was $70 in Year 1, with half of the cost base being fixed (e.g., maintenance of production facilities, personnel that cannot be immediately reduced, long-term lease). The company also incurred $20 of Selling, General and Administrative costs (SG&A), which are broadly fixed too. In Year 1, the company achieved a 30% gross margin and an EBIT margin of 10%.

However, as its sales drop 5% the following year, its operating cost base declines only by 2.5% since only half of its costs are variable. Its gross margin drops to 28%, and its EBIT margin declines to 7.1%. Total EBIT falls 33% to $6.8 (from $10 a year before).

But the reality is much more complex, and focusing too much on macro factors can sometimes lead to worse investment results. I see at least four reasons for that:

- Weak evidence that higher GDP growth leads to higher returns

- A market of stocks, not a stock market

- Expectations

- Buy at a time of maximum pessimism

- Investment horizon

I. High GDP equals High stock returns

Historical data does not confirm that a faster-growing economy leads to better stock returns. China is the most striking case. Its GDP in 1990 was just $361bn. By 2021, the economy has increased by 41 times (13% annualised growth rate), reaching $17.7tn and becoming the second-largest in the world. About 900mn people came out of poverty in a short period of time.

Yet its stock market has increased by just 4.7x (5% annualised growth) and is still down more than 50% since its 2007 peak.

Source: Google Finance

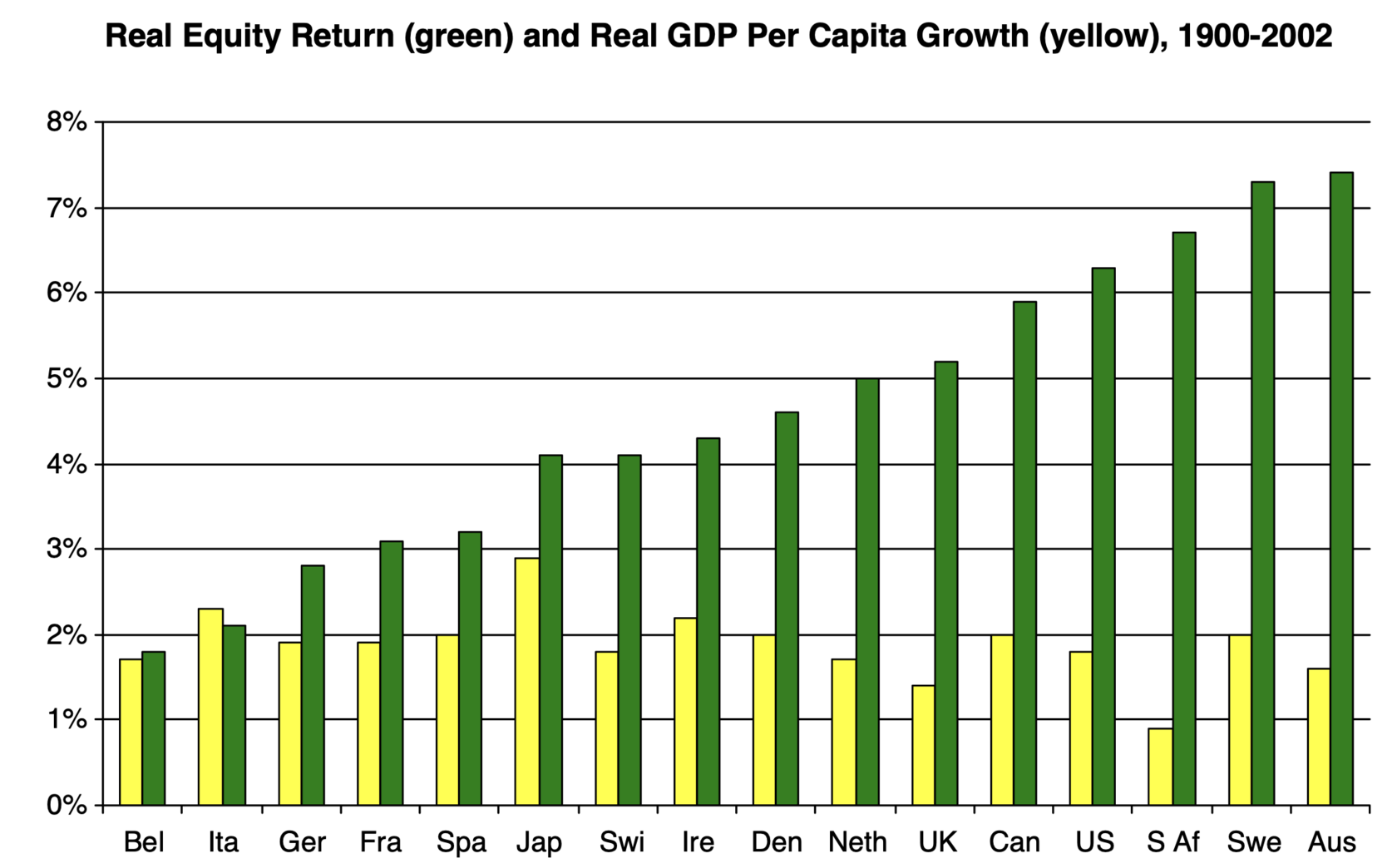

More sophisticated studies have identified low-to-negative correlations between economic growth and stock market returns.

Source: Economic growth and equity returns by Jay R. Ritter, University of Florida

Suppose the growth is fuelled by dilutive equity issuance or is focused on government-led initiatives at the expense of private enterprises. In that case, shareholders cannot fully expect to benefit from rising prosperity. The USSR managed to grow faster than the US after WWII, but this growth did not translate into any profits for private investors.

A more critical macro parameter for shareholder returns is the flow of capital, which Edward Chancellor has brilliantly described in the book Capital Returns: Investing Through the Capital Cycle. Understanding how capital investments drive supply and returns on capital in a sector can create an essential advantage for bottom-up investors. The flow of capital in an industry is probably the most important macro indicator.

II. Market of stocks, not a stock market

Peter Lynch used to say:

‘Behind every stock is a company. Find out what it’s doing.’

It is too convenient to ask, ‘What do you think about markets.’ The discussion could go anywhere from touching all kinds of topics, including political leadership, security, geopolitics, technological breakthroughs and so on.

Any stock market is just a group of dozens and hundreds of companies. Globally, there are over 40,000 stocks, each with its own product, management and strategy. Every company is in a different phase of its life cycle, and its future trajectory will almost certainly be different from the trajectory of the overall economy.

Netflix is a good example. By mid-May 2022, Its share price had dropped 74% from the 2021 peak of $690 to $175.5. Higher competition with other video streaming services and increasing cost of living led to a drop in its subscriber base for the first time in 10 years. Its stock, pricing continued growth from an already inflated 2020 base, plummeted.

However, Netflix’s share price has exploded by 65% since its June 2022 low to $288 by 19 November 2022, even though during that time, the NASDAQ index hit a new low for the year.

III. Expectations

The case of Netflix highlights another vital aspect - market expectations. The market is generally forward-looking, and today’s news may well be reflected in the price already. When I hear investors say they are worried about rising inflation and high energy prices (as a reason not to buy a stock), my first question is: “True, but who does not know about that.” In other words, many negative headlines may already be in the price.

It is not that simple, of course. It could be that a particular stock has not sold off much, despite a weaker economy. Being more cautious in such situations is prudent.

Companies with high leverage should also be treated with extra caution. They are much more vulnerable during recessions.

The two other examples confirm that market expectation and actual macro data could be two different results: Gold performance in 2022 and market rebound on 9 November 2022, following the release of lower CPI data (relative to market expectations).

If you had a time machine back in 2021 and could have visited the year 2022, the first macro parameter you would have noticed would be high inflation. What is considered a good inflation hedge, an asset that has preserved its value through centuries? Gold. But, if you bought Gold at the beginning of 2021, the value of your investment would be 10% lower by now.

Price of Gold ($/ounce)

Source: Macrotrends.net

Was it helpful to know that inflation was picking up? Of course, you could say that this insight could have led you to reduce your Tech investments (higher rates impact the valuation of high-growth businesses more), but this could be a hindsight bias.

In 2021, I heard many comments that Big Tech is an excellent inflation hedge due to their capital-light business models, generally high margins and strong market positions/pricing power. While some of these arguments may be valid, shareholder returns have been different.

More recently, I was surprised that the S&P500 and NASDAQ index gained 5.5% and 7.4% on 10 November, when monthly CPI data came out lower than expected. I understand the logic that falling inflation may indicate that the FED would need to stop its tightening policy. Some can even view this as proof that macro factors are vital factors driving market performance. I agree that this could be the case in the short term.

However, what this example shows is the power of market expectations. Even if you can correctly predict the monthly inflation rate, it is impossible to guess the market reaction.

This leaves me with the last point on expectations. How realistic is it for an individual investor to understand what has been priced into the stock and how the market would react to a specific news piece? Is it not better to spend time analysing a company’s product, its cost structure, current market share, and potential for growth in the long term?

IV. Buy at a time of maximum pessimism

If there is one lesson I learnt from studying the greatest minds of investing and from my own experience is that it is better to buy when things are generally not going well. Weaker profits often lead to lower valuation multiples; many investors leave the market. Competition among investors declines, and there are many opportunities to find great companies at attractive prices. You also benefit from faster earnings growth and multiple expansion when things inevitably change.

Compare the above situation with the market environment in 2021. Even if an average IQ of a market participant dropped last year, the sheer size of capital bidding for stocks reduced your probability of buying businesses well.

Two quotes are particularly noteworthy.

“Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.”

- Sir John Templeton

“Be fearful when others are greedy, and greedy when others are fearful.”

- Warren Buffett

I often go back in memory to a big mistake I made during 2008-2009. I didn’t exit the market, but I mainly kept in cash the incremental income I had been receiving. I was pretty late to start building my equity portfolio. Yet, I did read (and then re-read a few times) Buffett’s New York Times article he published in October 2008: “Buy American. I am.”

I was too concerned about the debt, the housing market, and other macro factors experts like Nouriel Roubini have been talking about (some have continuously discussed various risks for almost 20 years).

As Peter Lynch said, “there's always something to worry about.” It may look like the problems we face today are potent reasons for markets to go down, but if you go back in history, then you will find such ‘enormous problems’ almost every year or two (COVID, trade wars, Trump, Brexit, Arab spring, North Korea).

While March 2020 mini-tear market looked frightening to any investor, in hindsight, it was an excellent time to pick a good business. I am glad I learnt my 2008-09 lessons and added them to my stock portfolio (although mainly in the April-June period).

The last point, even if you have managed to predict 2008 or 2020 bear markets and have sold your stocks, the chances are bleak that you could have timed the bottom in the market correctly to re-enter. More likely, having sold your stocks, you would have missed the rebound and had to buy stocks at higher prices later.

V. Investment horizon

The last reason business fundamentals are superior to macro forecasting is the essence of equity investing. When buying a stock, you become a partner in a specific business and its management. In the end, the results of your investing will depend on how well the company will do. In the short term, the price may fluctuate based on market sentiment (inflation, interest rate, elections, geopolitics). Still, in the long term, it will be about profit growth, which depends on capital returns and reinvestment opportunities.

When investors focus on macro factors deciding whether to buy a specific stock, they inevitably shorten their investment horizon. History has proven that if you identified a great company but did not buy it because of your worries about macro factors, you were wrong. Of course, a warning should be made that great businesses are rare. Most that look exceptional in the short term turn into an average companies later (with subsequent earnings decline and multiple contraction).

A short time horizon may be warranted if you have retired with no other income. Although, in that case, equities are probably the wrong asset class to be invested in.

The longer you hold the stock, the more your investment results match business fundamentals rather than the market environment (interest rates, inflation, political risks).

Conclusion

In conclusion, I would like to highlight that macroeconomics is definitely important for a company’s sales and profits and can lead to very different outcomes in a 1-2 years time period. However, our ability to predict the development of macro factors is minimal. The expectations game further hinders it. It is not enough to correctly predict a specific macro indicator to win in such a game. Still, it is vital to understand what other market participants are forecasting and pricing into stock prices. As Warren Buffett says, macroeconomics is important but unknowable. It is far more productive to spend time finding great businesses and learning all the necessary details to stay ahead of the market.

VW GROUP stock idea

A week ago, I purchased a small position in VW Group (equally split between ordinary and preference shares). I also presented this idea at a London Value Investing Club meeting on 16 November 2022.

In short, VW’s market cap (€86bn) is less than the market value of its stake in Porshe AG (€68bn) and the IPO proceeds (€19.3bn). You essentially get for free all other businesses (with €217bn revenues and €11bn net income) plus a net cash position (€24bn) and Volkswagen’s bank with €40bn book value.

Here is my full 24-slide presentation on VW Group.

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.