21 January 2024

This is Part II of my Year in Review, where I share the questions I am pondering, discuss some missed opportunities and recommend the best books, podcasts, analytical tools and advice. I hope you enjoy this article!

Content

- Questions I am Pondering

- Missed Opportunities

- Recommendations (Books, Podcasts, Analytical Tools, Advice)

- Post Scriptum

Questions I am Pondering

- Geopolitical risks and complacency. One of my core principles is not to try to predict external factors or not make investments based exclusively on macro/political scenarios. However, looking back at 2020 and 2022, it seems that there were a few flashing signals before the crises unfolded in those years. In 2020, for example, the S&P 500 was marching higher, reaching an all-time high on 14 February, despite the shutdowns in Wuhan being in place since 20 January and rising cases in Italy and other countries. Today, there are already two military conflicts with more countries getting directly involved. The China-Taiwan conflict cannot be entirely ruled out, either. Yet, markets are relatively strong (S&P just hit an all-time high this week), while traditional hedges (e.g. Gold) are not really moving.

- Gold. I bought Barrick Gold as a hedge against geopolitics and inflation in spring 2023 and was up modestly until this week. What I am confused about is why gold is not much higher if all the conditions are there. What would happen to it if we go back to the good old days? Maybe it is the wrong hedge? Or is Barrick the wrong stock in the sector? Is Barrick’s stock pricing at the risk of an expensive acquisition or value-destructive copper project in Pakistan?

- AI. This is one of the biggest technological breakthroughs of the past 40 years, similar to the launch of the Internet. How various sectors and companies will be affected by AI? Will it boost productivity and margins or lead to more social tensions as traditional jobs are replaced by robots? Are we actually overestimating the impact on companies, just like with broad tax changes?

- Tech sector. For many conservative value investors, including me, the recent market performance is reminiscent of the 2000s rally, with few large tech names capturing investors' imagination, leaving real-economy companies in the shadows. But could this moment be more like the early 1980s, with AI having a similar impact on the economy as PCs and, later, the Internet? If AI is the new Big Thing, its consequences can be felt over many years ahead, easily until 2030. So, which playbook should we be using, the one from the 2000s or the 1980s?

- Japan and Korea. The stars seem to be aligning for Japan, and the market is catching a bid. My experience in Japan is that buying individual names in that market is harder due to limited financial information, especially for an outsider. Is buying an ETF a better option? But the general market has already had a strong run. Korea is potentially even more interesting as its regulators seem to follow the Japanese playbook to improve corporate governance and may improve market access for non-residents.

- Insurance. The insurance stocks have benefited from the rise of interest rates, but will they give back the gains if rates fall this year as widely expected?

- Pharma. I know that in one of his last interviews, Munger said that neither he nor Buffett had any edge to tell which pharma company would develop the next blockbuster drug and, hence, never invested in the sector. Still, I see many long-term advantages, especially at well-established brands, including high margins, long history of dividend payments, wide moats in the form of strong R&D and regulations, scale advantages, demographic tailwinds and other factors. As many names have underperformed since COVID, is it the time to look at the sector? Is buying an ETF the best way to get exposure, or is it worth picking the top company?

- Luxury. The sector has equally underperformed but remains a long-term winner with strong pricing power and exceptional economics. What is the best company to buy in the sector, and what is the normalised profitability (excluding the COVID boom and without historically strong demand in China)?

- EM. Many strategists have been pointing out to peak USD and rising attractiveness of EM assets. Does this mean that it is worth looking for more opportunities in EMs, especially if decade-long USD strengthening is reversed?

Missed opportunities

- Mistakes of omission. These are the names I have looked at but have not studied enough to build conviction or found expensive relative to macro outlook. Wise (founder-led, UK challenger bank), Howdens (UK kitchen supplier), NVR (asset-light US home builder that for many years traded at a single P/E and had a strong buyback programme). These stocks are up a lot since the time I looked at them, some more than 100%. One way to reduce such mistakes is to buy companies faster but start with smaller positions.

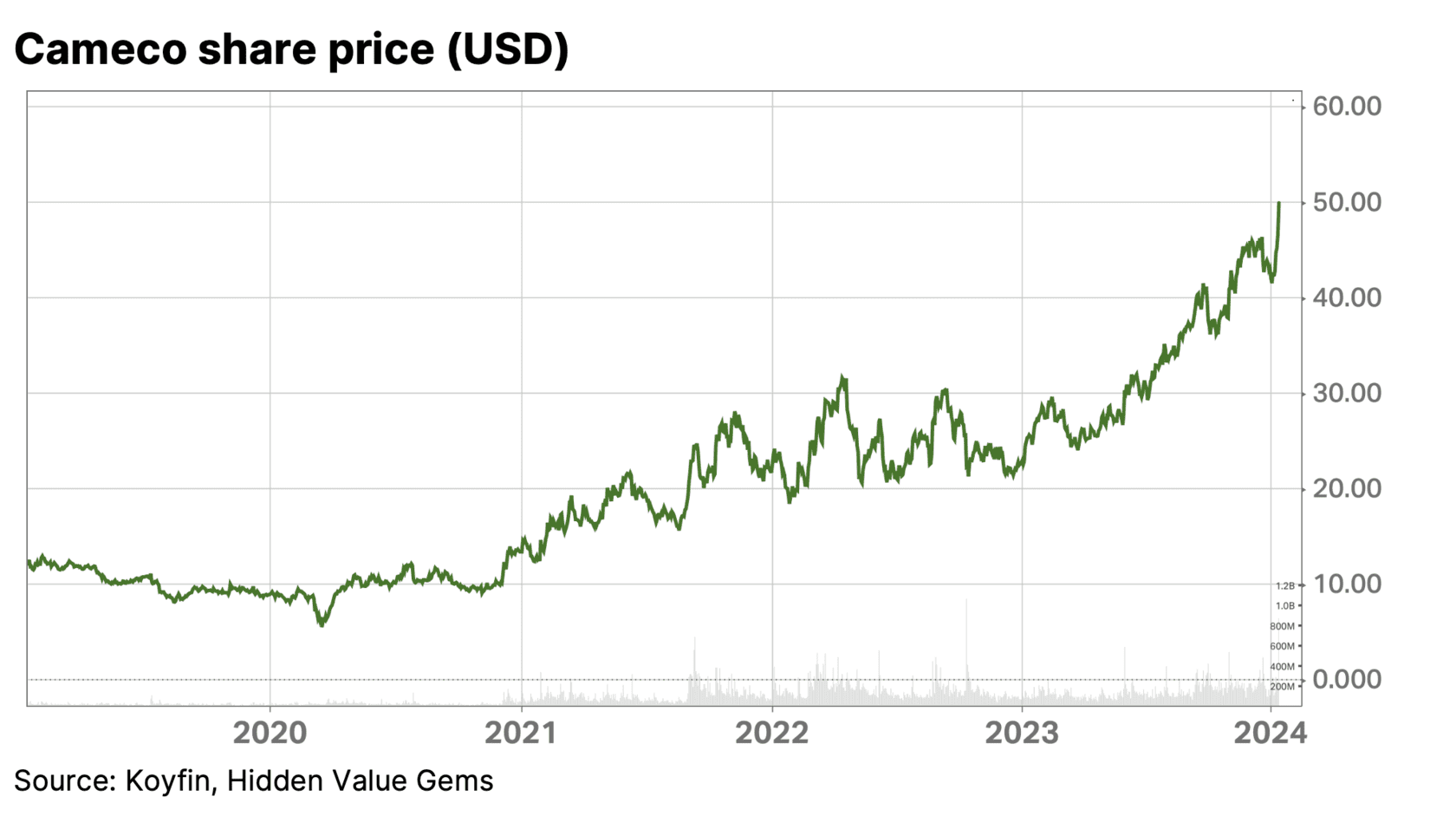

- Uranium. In June 2023, I highlighted that “uranium could see the biggest price rise as its supply is highly concentrated, its role for consumers is critical, the marginal cost of supply is above the current spot price, and it has one of the best demand outlooks.” However, in my personal portfolio, I have decided not to buy any uranium-related stocks because most already reflected higher prices and were not cheap at spot prices. That turned out to be a huge mistake. The largest and most liquid uranium stock, Cameco, is up c. 50% since I published my post, while many smaller names have appreciated even more.

- Epam. In early May 2023, I sold Epam at $242 a share. The price has since appreciated by 27%, closing at $307.7 on 12 January. The reasons why I sold the stock still hold: the business has materially slowed down, yet the valuation remains rich (now 30x forward P/E).

- There were probably more mistakes made during the year, but the consequences have not become obvious yet.

Recommendations (Books, Podcasts, Advice)

Best Books

I have read and listened to about 20 books during the year, more than in 2022 but well below 2020-21. So, one of my New Year’s resolutions is ideally moving to 40 books a year.

I cannot say that in 2023, there was one book that was the best I had ever read (or even the best in 5-10 years). Many of them were good, though. The top three I would recommend, though, are the following ones:

1. Jim Clayton’s First a Dream. Jim Clayton founded Clayton’s Homes, which was eventually acquired by Berkshire. It is an incredible story of a man from rural America who lived on a farm in a log cabin with one main room where all four family members slept at night. It is an inspiring story of entrepreneurial spirit backed by optimism, hard work and obsession with customer needs. I was lucky to buy a second-hand book with Jim’s business card hidden between the pages (did someone use it as a bookmark? or was it an indirect solicitation to make a business enquiry?).

I cannot say that in 2023, there was one book that was the best I had ever read (or even the best in 5-10 years). Many of them were good, though. The top three I would recommend, though, are the following ones:

1. Jim Clayton’s First a Dream. Jim Clayton founded Clayton’s Homes, which was eventually acquired by Berkshire. It is an incredible story of a man from rural America who lived on a farm in a log cabin with one main room where all four family members slept at night. It is an inspiring story of entrepreneurial spirit backed by optimism, hard work and obsession with customer needs. I was lucky to buy a second-hand book with Jim’s business card hidden between the pages (did someone use it as a bookmark? or was it an indirect solicitation to make a business enquiry?).

2. Misbehaving by Richard Thaler. You can learn about many concepts of behavioural economics in various books, but it is the way Thaler presented them that makes the book so interesting. He discusses key concepts as he learned about them during his career, doing experiments with students, debating with fellow professors and applying his learnings in practice (including regulations, marketing and investing). He ended up receiving Nobel Memorial Prize in Economics in 2017.

3. Engines that Move Markets. I decided to read this book to get a fresh perspective on the implications of AI on the investment landscape. The book’s author, Alisdair Nairn, is a portfolio manager at Edingburgh Partners (now part of Franklin Templeton). It has great lessons on how past technological changes impacted various industries and investments.

3. Engines that Move Markets. I decided to read this book to get a fresh perspective on the implications of AI on the investment landscape. The book’s author, Alisdair Nairn, is a portfolio manager at Edingburgh Partners (now part of Franklin Templeton). It has great lessons on how past technological changes impacted various industries and investments.

Best Podcasts

Best Analytical Tool

This year, I would like to introduce an unusual tool. Rather than discuss another financial ratio, I share how to make better judgements about potential investments. There is no lack of financial data of all sorts, but it does not make us better investors, especially if everyone else has the same access. With the increasing speed at which new information becomes available, it is the ability to adjust our original views and even accept contrary viewpoints that are the most valuable skills.

I took two courses on decision-making last year, one organised by Good Judgement Project, the company founded by Philip Tetlock, a professor at Penn University and the author of Superforecasters, and another by Annie Duke, a famous poker player and author.

Here are the basic steps that can help anyone in almost any situation to make better decisions:

The essence of these points is that we are often too quick to judge as we are influenced by emotions and biases. Analytical decisions are often better but take longer. So slowing down helps. Besides, we often get too much “invested” in a particular situation to remain objective. A friend’s opinion can be more balanced. We also notice others’ mistakes much faster than our own. Hence, giving advice to others often leads to better judgements as we take an outside view and are not influenced by emotions as opposed to deciding in the heat of a moment, tackling our ego, fears, and other emotions.

I took two courses on decision-making last year, one organised by Good Judgement Project, the company founded by Philip Tetlock, a professor at Penn University and the author of Superforecasters, and another by Annie Duke, a famous poker player and author.

Here are the basic steps that can help anyone in almost any situation to make better decisions:

- Pause. Whatever the question or the situation, make the first assessment, write down your answer if necessary, then walk away and return to the question the next day or later. Make a second guess. Then, take the average of two estimates and use it as the final answer. On average, your results will beat your first-time answers.

- Ask a friend to get a second opinion. If your friend’s views do not completely convince you, take the average of the two answers. More often, the average will be better than your initial estimate.

- If you are facing a complex situation and hesitate about the best course of action, imagine your best friend asking you for advice. What would you recommend to them? The same should apply to you.

The essence of these points is that we are often too quick to judge as we are influenced by emotions and biases. Analytical decisions are often better but take longer. So slowing down helps. Besides, we often get too much “invested” in a particular situation to remain objective. A friend’s opinion can be more balanced. We also notice others’ mistakes much faster than our own. Hence, giving advice to others often leads to better judgements as we take an outside view and are not influenced by emotions as opposed to deciding in the heat of a moment, tackling our ego, fears, and other emotions.

Best Piece of Advice

I learnt about this idea in 2020 when I read the book Flow by Mihaly Csikszentmihalyi, so it is not the latest idea. However, I have started to appreciate it more as I found myself in new circumstances (managing my own money and not working for anyone). I meet many people who are anxious and not fully satisfied with their lives. The idea I picked up from that book is how to set up your activities to maximise your level of happiness. I also modified some of it later to come up with the following vital ingredients for the activity that you should seek to maximise your happiness:

I also highly recommend the four-step strategy to acquire good habits and eliminate the bad ones. I talked about it in the 2021 review. To summarise, make a good habit 1) obvious (fruits in the centre of the table if you want to eat healthy foods); 2) attractive (nice plate); 3) make it easy (keep them washed and in good supply); 4) make it satisfying (make smoothies).

On the contrary, you can “un-learn” bad habits by making them 1) invisible (no cue), 2) unattractive, 3) difficult, and 4) unsatisfying.

You can learn more about the power of habits in my review of James Clear’s book.

- Clear rules of the game

- Being in control (especially over your actions and time)

- There are clear metrics to measure progress

- There is a strong correlation between actions and outcomes

I also highly recommend the four-step strategy to acquire good habits and eliminate the bad ones. I talked about it in the 2021 review. To summarise, make a good habit 1) obvious (fruits in the centre of the table if you want to eat healthy foods); 2) attractive (nice plate); 3) make it easy (keep them washed and in good supply); 4) make it satisfying (make smoothies).

On the contrary, you can “un-learn” bad habits by making them 1) invisible (no cue), 2) unattractive, 3) difficult, and 4) unsatisfying.

You can learn more about the power of habits in my review of James Clear’s book.

Post Scriptum

Apart from new stocks, I also purchased a ticket and booked a hotel room in Omaha to attend the Berkshire Hathaway 2024 shareholder meeting. This would be my third trip (the other two were in 2017 and 2018).

Following the sad news about Charlie Munger on 28 November 2023, the meeting will be quite different this year without his cutting remarks, nuggets of wisdom, encyclopaedic knowledge of business history and life lessons.

Despite this, I still think it will be a great event not only because we can hear from the new generation of Berkshire’s managers but mainly because the meeting attracts thousands of investors from all over the world. It is a fantastic opportunity to meet old friends and make new ones.

I will be in Omaha from May 1 until May 6, 2024. It would be great to arrange a lunch or dinner for the Hidden Value Gems subscribers on one of those days. If you are interested, please add your email address here, and I will keep you updated on the upcoming logistics.

Following the sad news about Charlie Munger on 28 November 2023, the meeting will be quite different this year without his cutting remarks, nuggets of wisdom, encyclopaedic knowledge of business history and life lessons.

Despite this, I still think it will be a great event not only because we can hear from the new generation of Berkshire’s managers but mainly because the meeting attracts thousands of investors from all over the world. It is a fantastic opportunity to meet old friends and make new ones.

I will be in Omaha from May 1 until May 6, 2024. It would be great to arrange a lunch or dinner for the Hidden Value Gems subscribers on one of those days. If you are interested, please add your email address here, and I will keep you updated on the upcoming logistics.

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.