23 July 2023

Investing is not a binary choice between excellent or mediocre businesses

When do you know that you are in the wrong business? If you must invest billions upfront in producing goods with uncertain and volatile pricing (because you have no control over them) and deal with inevitable output declines shortly after launching the production.

This is how commodity producers operate. In my earlier post, I talked about oil companies that sell their product at a price below the price of premium mineral water, facing all kinds of political, regulatory, financial, and operational challenges.

There are three ways to deal with such situations: ignoring, embracing, and opportunistic. The most obvious is to avoid this “awful” sector. Instead, look for businesses that can continuously re-invest their profits at high returns, operating in a growing market with high barriers to entry. This is similar to what most market participants have been trying to do over the past decade.

The worst strategy is to ignore the risks and invest in this sector as if it is just another industry. Here are the key lessons I have learnt covering the industry for more than a decade:

1. Commodity stocks always look cheap at the peak of the market. If you buy a commodity producer because of its low P/E, chances are high that you are buying at the peak of the market.

2. Prices are (almost) always unpredictable, especially in the short term. Regardless of how much analysis you have done and how much conviction you have, they always surprise you. Just think about the oil prices since the start of 2023 or gold prices in 2021-22 when inflation was increasing.

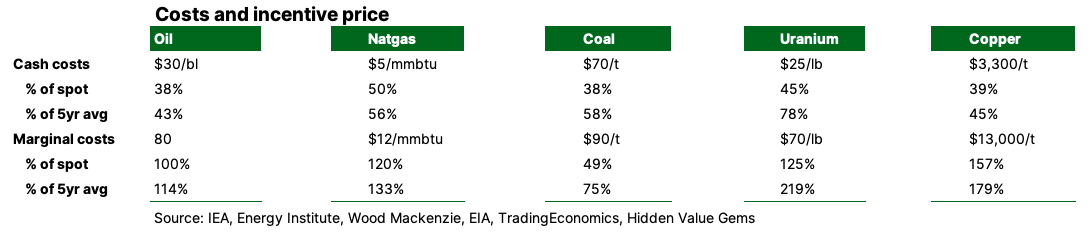

3. Supply is more critical than demand, but demand prospects attract most people. Regardless of how bright the demand outlook is, if there is plentiful low-cost supply to meet it, prices and investment returns will stay low.

4. Price anomalies usually stay longer than in traditional equity markets. When expectations change about a particular business, its share price often reacts simultaneously. In physical commodity markets, prices can stay low even when most participants see a growing supply gap. Financial investors are limited in how much volume of underlying commodities they can buy and hold. Storage capacity is also considerably below annual demand in most cases.

This is how commodity producers operate. In my earlier post, I talked about oil companies that sell their product at a price below the price of premium mineral water, facing all kinds of political, regulatory, financial, and operational challenges.

There are three ways to deal with such situations: ignoring, embracing, and opportunistic. The most obvious is to avoid this “awful” sector. Instead, look for businesses that can continuously re-invest their profits at high returns, operating in a growing market with high barriers to entry. This is similar to what most market participants have been trying to do over the past decade.

The worst strategy is to ignore the risks and invest in this sector as if it is just another industry. Here are the key lessons I have learnt covering the industry for more than a decade:

1. Commodity stocks always look cheap at the peak of the market. If you buy a commodity producer because of its low P/E, chances are high that you are buying at the peak of the market.

2. Prices are (almost) always unpredictable, especially in the short term. Regardless of how much analysis you have done and how much conviction you have, they always surprise you. Just think about the oil prices since the start of 2023 or gold prices in 2021-22 when inflation was increasing.

3. Supply is more critical than demand, but demand prospects attract most people. Regardless of how bright the demand outlook is, if there is plentiful low-cost supply to meet it, prices and investment returns will stay low.

4. Price anomalies usually stay longer than in traditional equity markets. When expectations change about a particular business, its share price often reacts simultaneously. In physical commodity markets, prices can stay low even when most participants see a growing supply gap. Financial investors are limited in how much volume of underlying commodities they can buy and hold. Storage capacity is also considerably below annual demand in most cases.

Stacking the odds in your favour

Finding decent companies that are priced as bad businesses could be rewarding. There are additional benefits if such companies operate in sectors with structural drivers. The best outcomes occur when you can identify the inflexion points (e.g. sector competition changes from price wars to supply discipline).

As for commodity companies, I try to understand what future commodity prices a particular stock reflects (e.g. does a particular company require a $90/bl oil price to justify its current share price). If I have strong reasons to disagree with market expectations, I take a closer look at the business.

As Charlie Munger noted in his 1994 lecture at USC:

As for commodity companies, I try to understand what future commodity prices a particular stock reflects (e.g. does a particular company require a $90/bl oil price to justify its current share price). If I have strong reasons to disagree with market expectations, I take a closer look at the business.

As Charlie Munger noted in his 1994 lecture at USC:

“Any damn fool can see that a horse carrying a light weight with a wonderful win rate and a good post position is way more likely to win than a horse with a terrible record and extra weight. But if you look at the damn odds, the bad horse pays 100 to 1, whereas the good horse pays 3 to 2. Then, it’s not clear which is statistically the best bet using the mathematics of Fermat and Pascal. The prices have changed in such a way that it’s very hard to beat the system.”

Strong reasons not to ignore natural resources today

I can see three major changes in the sector since 2020, which make it potentially much more attractive than during the previous decade:

I am pretty sure that the first two are long-term factors. I have less confidence in operators remaining disciplined in the long run.

ESG has dramatically raised the cost of capital for companies in the sector. It is much harder to raise capital today and justify to your shareholders that you will be trying to extract more stuff from the ground.

The universal focus on reducing CO2 emissions and transitioning to clean energy has removed any remaining confidence among executives about the future demand. If demand for a particular product is 20-30% lower, will you invest in new exploration or extensive infrastructure to ship the commodity?

As a result, from the supply perspective, the outlook for most commodities is much better. Importantly, these are long-term factors. Except for corporate strategies (Value over volume), I cannot see how we could abandon the ESG or Energy transition agenda.

- ESG

- Energy transition (De-carbonisation)

- Value over volume (Capital discipline)

I am pretty sure that the first two are long-term factors. I have less confidence in operators remaining disciplined in the long run.

ESG has dramatically raised the cost of capital for companies in the sector. It is much harder to raise capital today and justify to your shareholders that you will be trying to extract more stuff from the ground.

The universal focus on reducing CO2 emissions and transitioning to clean energy has removed any remaining confidence among executives about the future demand. If demand for a particular product is 20-30% lower, will you invest in new exploration or extensive infrastructure to ship the commodity?

As a result, from the supply perspective, the outlook for most commodities is much better. Importantly, these are long-term factors. Except for corporate strategies (Value over volume), I cannot see how we could abandon the ESG or Energy transition agenda.

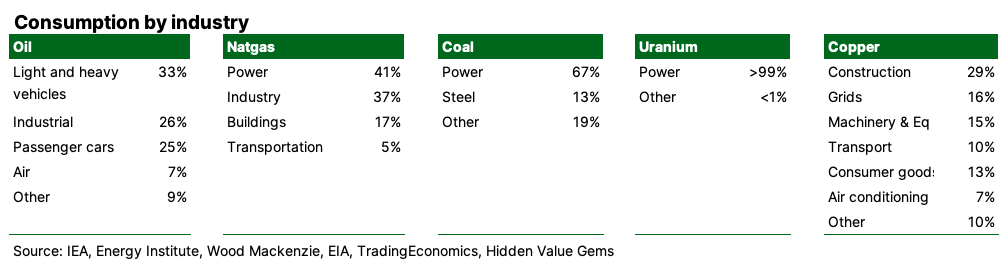

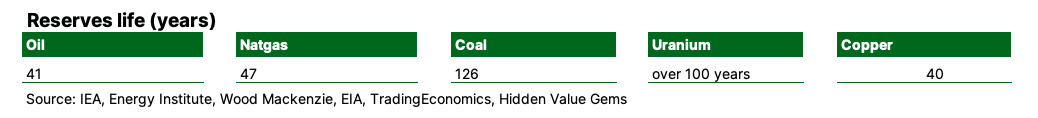

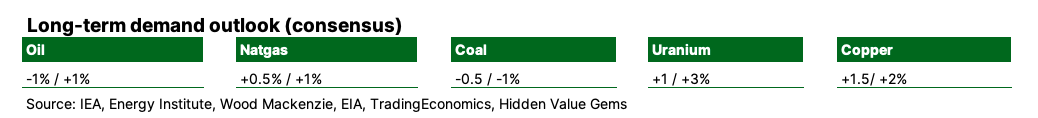

A snapshot of five commodities

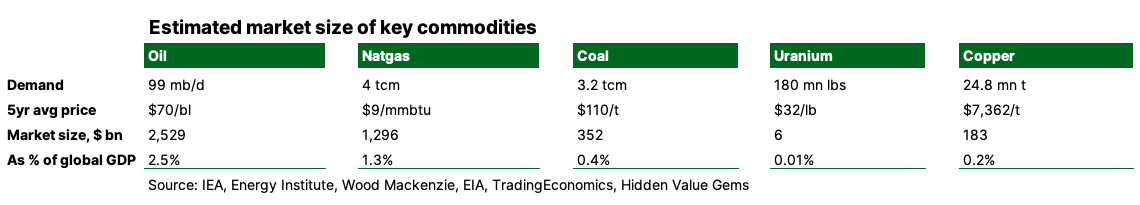

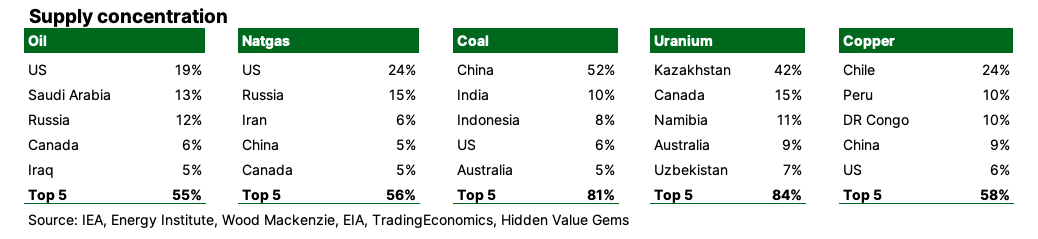

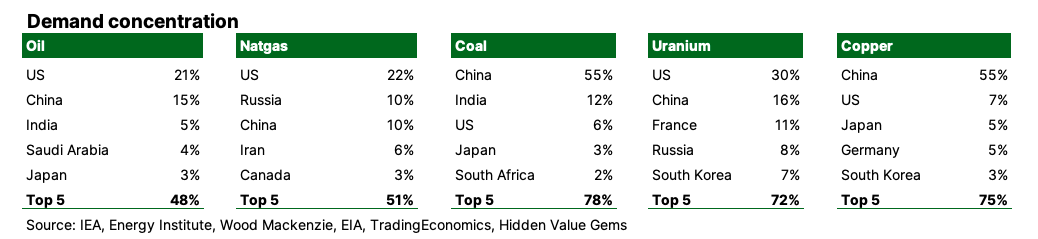

Rather than taking a deep dive into one particular sector, I have decided to make a cross-comparison among the five key commodities. My goal has been to identify commodities that could see the most significant price rise in the long term (5-10 years). I focused on supply concentration, cost structure, demand elasticity, the overall size of the commodity market and a few other parameters.

The selection of sectors is not universal and has been limited by my own experience. I should also warn that I have limited knowledge of the coal and copper industries.

Based on such a rather limited analysis, uranium could see the biggest price rise as its supply is highly concentrated, its role for consumers is critical, the marginal cost of supply is above the current spot price, and it has one of the best demand outlooks. The change in how governments view uranium in the energy transition (from a ‘hazardous’ commodity to one of the critical solutions) and technological breakthroughs that should allow electricity to be produced at compact nuclear power thanks to the development of small modular reactors (SMR).

The second commodity in terms of potential price appreciation is copper. It has a strong demand outlook thanks to its critical role in electrification, a reasonably high supply concentration and a high marginal cost of supply.

Both uranium and copper are also relatively small markets. So even if prices double, their size will remain negligible compared to the global economy.

Oil, on the other hand, is the largest commodity market, which acts as a natural cap to a material price appreciation in the long term.

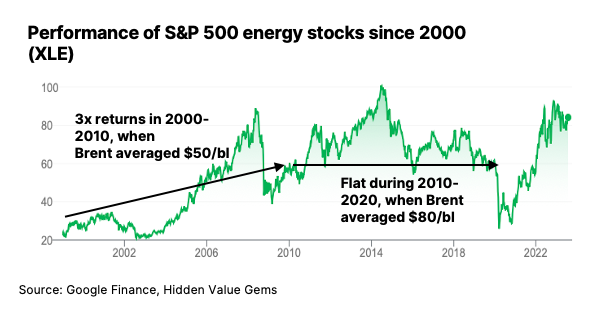

Having said that, it does not mean that investing in oil companies today is not worth it. Let me bring up quite an interesting fact. Brent price averaged about $50/bl during the 2000-09 period, compared to an average price of $76/bl in the following decade (a 52% increase). Yet, if you look at the stock performance, the last decade has been awful for shareholders of oil companies compared to the previous period. Shareholders earned more during a period of lower oil prices!

The selection of sectors is not universal and has been limited by my own experience. I should also warn that I have limited knowledge of the coal and copper industries.

Based on such a rather limited analysis, uranium could see the biggest price rise as its supply is highly concentrated, its role for consumers is critical, the marginal cost of supply is above the current spot price, and it has one of the best demand outlooks. The change in how governments view uranium in the energy transition (from a ‘hazardous’ commodity to one of the critical solutions) and technological breakthroughs that should allow electricity to be produced at compact nuclear power thanks to the development of small modular reactors (SMR).

The second commodity in terms of potential price appreciation is copper. It has a strong demand outlook thanks to its critical role in electrification, a reasonably high supply concentration and a high marginal cost of supply.

Both uranium and copper are also relatively small markets. So even if prices double, their size will remain negligible compared to the global economy.

Oil, on the other hand, is the largest commodity market, which acts as a natural cap to a material price appreciation in the long term.

Having said that, it does not mean that investing in oil companies today is not worth it. Let me bring up quite an interesting fact. Brent price averaged about $50/bl during the 2000-09 period, compared to an average price of $76/bl in the following decade (a 52% increase). Yet, if you look at the stock performance, the last decade has been awful for shareholders of oil companies compared to the previous period. Shareholders earned more during a period of lower oil prices!

How is this reflected in my investment portfolio?

While the uranium sector has the potential for the largest price growth, the stock universe is relatively narrow, and most names have already moved up (except Kazatomprom). It does not mean there are no good stocks, but one has to be more careful in understanding the assets, what the current market valuation implies in terms of future prices, management background and other factors.

I have owned Glencore since mid-2021, mainly because it is one of the world’s largest and lowest-cost suppliers of copper. Besides, it was executing a counter-cyclical strategy about coal. Its large trading business is also unique. The company is taking advantage of price arbitrage rather than making direct market bets. Since 2008, the company has never lost money in its trading operations, generating an average of $2.5-3bn EBIT. It earned a record $6.4bn in 2022, and its lowest EBIT was $1.6bn in 2009.

Its trading business benefits from increased volatility, usually during significant dislocations. In a way, it provides a good hedge against falling commodity prices.

Glencore’s coal business is an important source of cash. The company has been focusing on deleveraging and streamlining its operations, benefiting shareholders. However, my concern now is management’s interest in M&A deals, especially its latest approach to the Canadian copper producer Teck Resources.

I am not panicking yet because I see a strong incentive for its executives to focus on shareholder value. The previous CEO, Ivan Glasenberg, remains the largest shareholder with a 9.6% interest in the company. Its current CEO, Gary Nagle, receives compensation that is significantly dependent on Glencore’s share price performance. He also owns 2 million shares in the company ($12 million).

The company has also introduced a new capital allocation policy with a net debt ceiling of $16bn. Shareholder distributions are made of a $1bn fixed payout from the Marketing segment and 25% of Industrial FCF with additional bonuses and buybacks out of funds not needed in the business. The company is distributing $7.1bn of cash to shareholders in 2023 through regular ($5.1bn), top-up dividends ($0.5bn) and a $1.5bn buyback. This implies a 9.5% shareholder yield.

I have owned CNX since 2021.

I purchased Kistos in June 2023.

I also purchased a small amount of Occidental shares in the past two weeks. This is a straightforward thesis. The company is relatively cheap (at about 10x PE). It has a ‘permanent’ shareholder, Warren Buffett’s Berkshire Hathaway (over 25% stake), who will likely buy more shares over time. Occidental started a buyback programme last year that I expect to grow as they pay back preferred shares issued to finance the previous acquisition (Anadarko).

I am sure there are better companies out there in both the commodities sector and the broader market. I plan to look for more interesting opportunities.

The main message of today’s article is that three primary factors could lead to solid returns for investors in natural resources. Just like globalisation and the rise of China delivered multifold gains for commodities in the decade that followed the 2000 bubble, ESG, energy transition, and capital discipline provide strong conditions for value creation in this sector in the current decade.

If you found it useful, consider subscribing to my Newsletter to receive the next article. As a young author, it would also help me tremendously if you could share this article with others. Thank you for your time and support!

I have owned Glencore since mid-2021, mainly because it is one of the world’s largest and lowest-cost suppliers of copper. Besides, it was executing a counter-cyclical strategy about coal. Its large trading business is also unique. The company is taking advantage of price arbitrage rather than making direct market bets. Since 2008, the company has never lost money in its trading operations, generating an average of $2.5-3bn EBIT. It earned a record $6.4bn in 2022, and its lowest EBIT was $1.6bn in 2009.

Its trading business benefits from increased volatility, usually during significant dislocations. In a way, it provides a good hedge against falling commodity prices.

Glencore’s coal business is an important source of cash. The company has been focusing on deleveraging and streamlining its operations, benefiting shareholders. However, my concern now is management’s interest in M&A deals, especially its latest approach to the Canadian copper producer Teck Resources.

I am not panicking yet because I see a strong incentive for its executives to focus on shareholder value. The previous CEO, Ivan Glasenberg, remains the largest shareholder with a 9.6% interest in the company. Its current CEO, Gary Nagle, receives compensation that is significantly dependent on Glencore’s share price performance. He also owns 2 million shares in the company ($12 million).

The company has also introduced a new capital allocation policy with a net debt ceiling of $16bn. Shareholder distributions are made of a $1bn fixed payout from the Marketing segment and 25% of Industrial FCF with additional bonuses and buybacks out of funds not needed in the business. The company is distributing $7.1bn of cash to shareholders in 2023 through regular ($5.1bn), top-up dividends ($0.5bn) and a $1.5bn buyback. This implies a 9.5% shareholder yield.

I have owned CNX since 2021.

I purchased Kistos in June 2023.

I also purchased a small amount of Occidental shares in the past two weeks. This is a straightforward thesis. The company is relatively cheap (at about 10x PE). It has a ‘permanent’ shareholder, Warren Buffett’s Berkshire Hathaway (over 25% stake), who will likely buy more shares over time. Occidental started a buyback programme last year that I expect to grow as they pay back preferred shares issued to finance the previous acquisition (Anadarko).

I am sure there are better companies out there in both the commodities sector and the broader market. I plan to look for more interesting opportunities.

The main message of today’s article is that three primary factors could lead to solid returns for investors in natural resources. Just like globalisation and the rise of China delivered multifold gains for commodities in the decade that followed the 2000 bubble, ESG, energy transition, and capital discipline provide strong conditions for value creation in this sector in the current decade.

If you found it useful, consider subscribing to my Newsletter to receive the next article. As a young author, it would also help me tremendously if you could share this article with others. Thank you for your time and support!