5 November 2023

In today’s note, I will explain what I plan to do with Kistos going forward.

Why I bought it?

A good practice to decide whether you should buy a stock after a 20%+ drop is to revisit the initial thesis.

I bought Kistos for the following reasons:

1. Capital allocation. Kistos’ founding team Kistos had delivered 42x returns for shareholders in their previous venture, Rockrose Energy. The strategy was based on acquiring mature oil & gas fields at discounted valuations and extending their life through infill drilling and workovers. Since founding Kistos in late 2020, the company has acquired three producing assets in three countries, spending just €156mn.

2. Management with skin in the game. Andrew Austin, Founder and CEO, owns 17.25% of Kistos. He increased his stake in early 2022, buying 150,000 shares at £3.27. The overall interest of Management and Board members in the company stands at 20.58%.

3. Valuation. Back in May 2023, I estimated that Kistos should be able to raise production to over 25kboe/d in 2026, which would allow it to generate €170mn of FCF at $60/bl and $10/mmbtu oil and gas prices, respectively.

The main risk lay in the depleted assets with limited production potential. The company produced 2.7mn boe of hydrocarbons in 2022, while its year-end 2P (proved and probable reserves) were just 12.7mn boe. This translated into just 4.7 years of reserves life (Reserves/Production) compared to a more typical industry average R/P ratio of 8-12 years.

I bought Kistos for the following reasons:

1. Capital allocation. Kistos’ founding team Kistos had delivered 42x returns for shareholders in their previous venture, Rockrose Energy. The strategy was based on acquiring mature oil & gas fields at discounted valuations and extending their life through infill drilling and workovers. Since founding Kistos in late 2020, the company has acquired three producing assets in three countries, spending just €156mn.

2. Management with skin in the game. Andrew Austin, Founder and CEO, owns 17.25% of Kistos. He increased his stake in early 2022, buying 150,000 shares at £3.27. The overall interest of Management and Board members in the company stands at 20.58%.

3. Valuation. Back in May 2023, I estimated that Kistos should be able to raise production to over 25kboe/d in 2026, which would allow it to generate €170mn of FCF at $60/bl and $10/mmbtu oil and gas prices, respectively.

The main risk lay in the depleted assets with limited production potential. The company produced 2.7mn boe of hydrocarbons in 2022, while its year-end 2P (proved and probable reserves) were just 12.7mn boe. This translated into just 4.7 years of reserves life (Reserves/Production) compared to a more typical industry average R/P ratio of 8-12 years.

What has changed?

1. Capital allocation: There is little new evidence to change my view on capital allocation. However, one interview, which I watched since, made me a little less excited about the company. In the interview, which was recorded earlier this summer, Andrew Austin revealed some details about the process of acquiring Mime. This is subjective, of course, and I can be wrong.

2. Management: Nothing explicit has changed since my publication. However, after reviewing management’s previous guidance and comments regarding future performance, I concluded that management was more consistently optimistic. Even if it was not on purpose, this calls for more conservative estimates in the future, especially regarding contingent resources and any exploration prospects.

3. Valuation: The stock is down 21%, but the production outlook and capex spend on Mime have worsened. I will return to the valuation argument in the following section.

4. Weaker operational performance. The most significant change in the Kistos investment case has been weaker operational performance. The new data released over the summer and September 2023 suggested that the value of the two core assets (Netherlands and GLA) is lower than I had assumed. Even though the company has close to zero net debt, it also means that with a weaker cash flow profile, management is not in a position to pursue new deals of material scale. At least not until its next significant asset (Balder X) starts producing (expected in Q3 ’24).

2. Management: Nothing explicit has changed since my publication. However, after reviewing management’s previous guidance and comments regarding future performance, I concluded that management was more consistently optimistic. Even if it was not on purpose, this calls for more conservative estimates in the future, especially regarding contingent resources and any exploration prospects.

3. Valuation: The stock is down 21%, but the production outlook and capex spend on Mime have worsened. I will return to the valuation argument in the following section.

4. Weaker operational performance. The most significant change in the Kistos investment case has been weaker operational performance. The new data released over the summer and September 2023 suggested that the value of the two core assets (Netherlands and GLA) is lower than I had assumed. Even though the company has close to zero net debt, it also means that with a weaker cash flow profile, management is not in a position to pursue new deals of material scale. At least not until its next significant asset (Balder X) starts producing (expected in Q3 ’24).

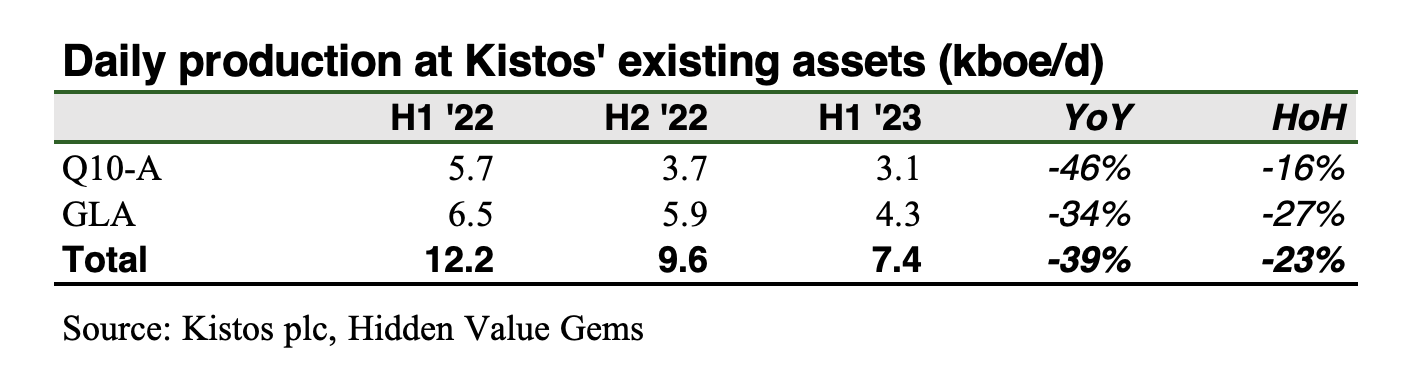

I have summarised the key changes below:

- FID on the Orion oil field has been postponed by at least half a year, and first production is not expected until late 2025 or early 2026 compared to the late 2024 production launch guided previously.

- FID on the Glendronach field in the UK has been postponed for an unclear period. The company plans to launch Edradour West first.

- Costs of developing Balder X (the core field in Mime’s portfolio, the Norwegian asset Kistos acquired in May 2023) have been increased by the operator (Var Energi) by 9% (+ $378mn). This means an extra c. $38mn of capex to be covered by Kistos next year.

- Both producing assets, Q10-A (Netherlands) and the GLA (UK), delivered materially lower volumes than expected from the previous communication. While some mechanical issues and other factors beyond management’s control could have played a role, it also suggests a strong natural decline that the company cannot effectively offset with infill drilling and other measures.

You can read a more detailed review of Kistos' H1 '23 results in my earlier post.

Here is what my new production forecast for Kistos looks like compared to the original estimates.

Here is what my new production forecast for Kistos looks like compared to the original estimates.

Is it cheap?

As a student of value investing, I always remind myself that if I find a stock attractive at 100, I should be even more excited when it is at 80.

"Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

- Warren Buffett, Chairman of Berkshire Hathaway

Following this logic, I should add to the Kistos position since its share price is 21% lower than when I first bought it in June 2023.

However, quite surprisingly, the market has been pretty efficient because, to my mind, the value offered by Kistos today is roughly the same as it was five months ago.

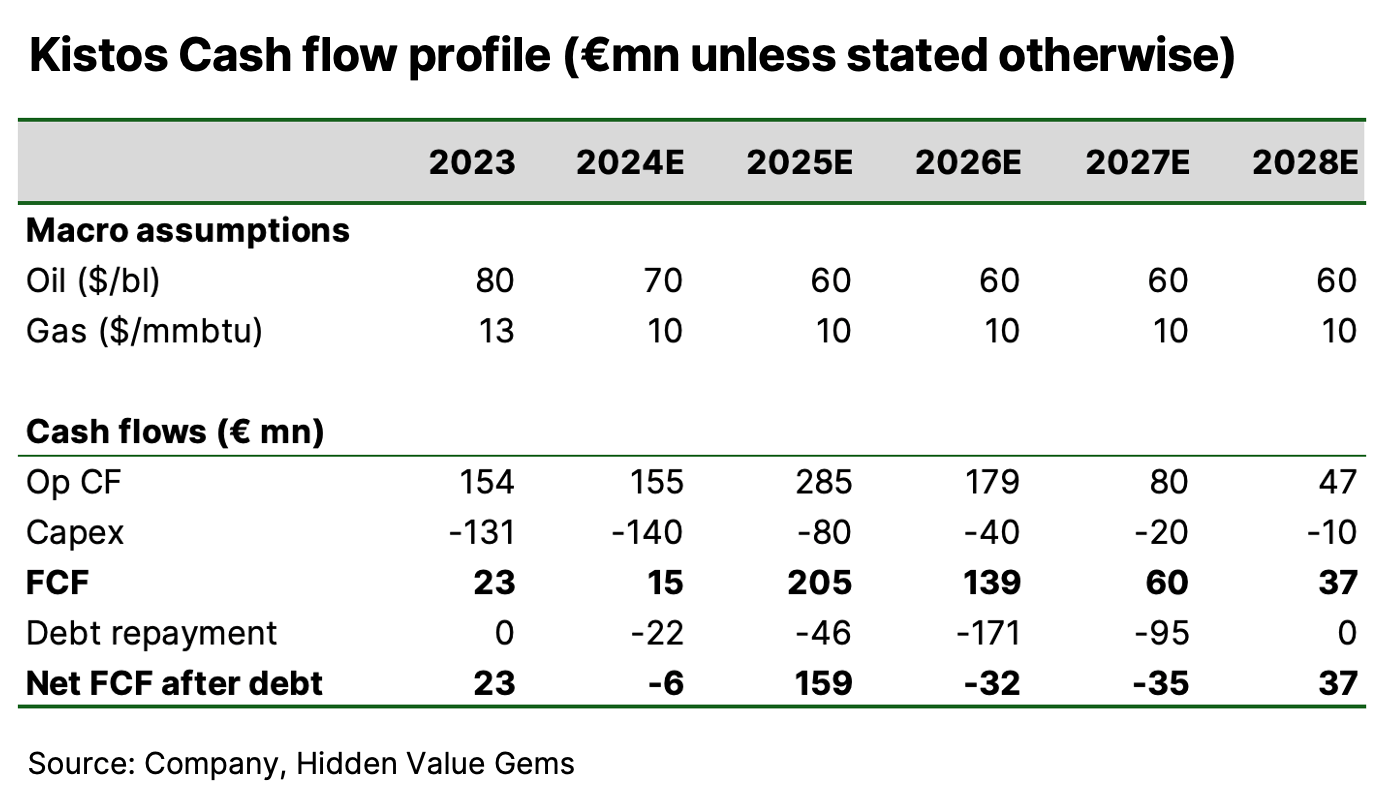

If you buy Kistos at £1.96 today, you essentially pay £162mn for the whole company. For that price, you get a stream of cashflows, which should rise dramatically in the next 2-3 years, peaking at €205mn in 2025 (assuming a $60/bl oil price). At the same time, you take on financial liabilities in the form of bonds (€278mn) less cash (€247mn). There are also €193mn of the so-called abandonment costs related to decommissioning wells and other infrastructure after a field is shut down.

However, quite surprisingly, the market has been pretty efficient because, to my mind, the value offered by Kistos today is roughly the same as it was five months ago.

If you buy Kistos at £1.96 today, you essentially pay £162mn for the whole company. For that price, you get a stream of cashflows, which should rise dramatically in the next 2-3 years, peaking at €205mn in 2025 (assuming a $60/bl oil price). At the same time, you take on financial liabilities in the form of bonds (€278mn) less cash (€247mn). There are also €193mn of the so-called abandonment costs related to decommissioning wells and other infrastructure after a field is shut down.

With all that in mind, I estimate that at today’s price, I could achieve 32% IRR over the next ten years. There are, as always, a few moving parts. Energy prices are the biggest driver. I assumed a gradual decline in oil prices (and relatively stable gas prices), but clearly, there is an upside to this scenario. Any delays or cost overruns could also materially affect the ultimate returns.

Taking into account the incrementally negative operational performance discussed above, I think the current valuation is adequate to continue holding the stock but not sufficiently attractive to increase the position.

Taking into account the incrementally negative operational performance discussed above, I think the current valuation is adequate to continue holding the stock but not sufficiently attractive to increase the position.

Better alternatives out there

Another strong argument against adding to Kistos today is that many more compelling oil & gas companies exist.

VAR Energi is one such company. It is a Norwegian E&P with c. 210kboe/d production on track to double its output in two years. At the same time, it is already paying quarterly dividends (10%+ yield), which are based on 20-30% of operating cash flow. You can imagine the company’s dividend potential if it can afford to pay a double-digit yield going through the peak capex. The company expects its capex to decline from $2.4-2.7bn in 2023 to c. $1.5bn after 2025. At the same time, its production should double. Operating cash flow over the past twelve months has been $228mn.

I have discussed other names in my previous articles (here, here and here). I will just summarise them here:

VAR Energi is one such company. It is a Norwegian E&P with c. 210kboe/d production on track to double its output in two years. At the same time, it is already paying quarterly dividends (10%+ yield), which are based on 20-30% of operating cash flow. You can imagine the company’s dividend potential if it can afford to pay a double-digit yield going through the peak capex. The company expects its capex to decline from $2.4-2.7bn in 2023 to c. $1.5bn after 2025. At the same time, its production should double. Operating cash flow over the past twelve months has been $228mn.

I have discussed other names in my previous articles (here, here and here). I will just summarise them here:

- Arrow Exploration - Canadian-listed E&P with 3kboe/d oil production in Colombia, planning to reach 10kb/d in two years. At current production, the company generates over $50mn of operating cash flow a year and over $20mn FCF (30%+ yield).

- Harbour Energy - UK’s largest North Sea producer with a generous shareholder distribution policy. The company paid a USc 33 dividend for 2022 and USc 12 interim ’23 (over 10% annual dividend yield). Management has also been repurchasing shares, reducing the share count reduced by 9% in the first 9 months of 2023.

- Occidental Petroleum - Warren Buffett is a 26% shareholder, regularly buying in the high 50s - low 60s price range. With $3.5bn sustaining capital and $5.9bn operating cash flow in H1 23, the company offers a 15% normalised FCF yield.

What would make me change my view?

I like to write down conditions that could make me either buy or sell stock as it removes the impact of emotions of a particular moment. People would say they would buy a specific business if it were a little cheaper, but when its stock does fall, they find many negative reasons and expect more problems in the future.

In the case of Kistos, I would be happy to add to my position if the gas market starts to tighten, assuming the stock doesn’t move before that.

Other conditions include the following ones:

- If the two producing assets perform better (e.g. deliver flat volumes or even increase production)

- Favourable tax changes, reduction of the Energy Profits Levy (EPL) in the UK from the current 75% rate (improbable in the near term)

- Value accretive deal with immediate boost to FCF

- The company launches a buyback (unlikely, given existing debt and Balder X capex commitments)

- Kistos stock is down another 20%, with no material change in the macro environment or new production results

DISCLAIMER: This publication is not investment advice. Readers should do their own research before making decisions. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. The author held a position in the stock discussed above at the time of writing. Please read the full version of Disclaimer here.