17 Sep 2023

Part I. Update on Volkswagen

“Shall we add or get out of the position?”

Back in my early investment career, I worked as an analyst at the time Europe’s Top 10 hedge fund, Centaurus Capital (later sold to Fortress Investment Group). I remember our CIO pushed senior analysts / PMs when one of their positions declined by 15-20% or had been trading sideways by asking them the same question: “Should we add (on weakness) or just get out of the position?”

The second option almost always looked terrible. You effectively admitted that buying a stock was a mistake in the first place. Besides, selling a stock at a lower multiple seemed contrary to fundamental investing, the fund’s philosophy. “It is just one bad quarter, and the stock is down 10%, surely things will get back to normal later”, - was the typical thinking of one of the senior analysts. Or, they may have thought: “The company cut its guidance by just a couple of percentage points, and the stock tanked 20% - it is definitely an overreaction. The market is too short-term focused.”

Adding to a loss-making position seemed like extra psychological pressure. Your decision has eaten into the fund’s performance, and on top of it, your boss wants you to increase its weight so that your stock would have an even bigger impact on the future performance of the fund.

Most analysts were confident the stock would recover eventually but were seldomly ready to add.

As I was pretty young and had almost no positions assigned to me directly, I escaped these tough questions. Yet, I shared sympathy with the CIO since it followed the logic of Ben Graham and Warren Buffett, the gurus I had already known by then.

If you liked the stock at $100, you should like it even more at $80. It is not a direct quote but a message I took away from reading the classic books on value investing.

Fast-forward to 2021. I found further evidence that it was an excellent question in the book “The Art of Execution”. It was based on a study of 45 fund managers. The author, Lee Freeman-Shor, a fund manager at Old Mutual, found out that the best managers either kept adding as the stock continued to slide or exited immediately once it was down 20%. The managers who delivered the worst results stuck to losing positions for too long and did nothing.

Earlier this year, I attended two separate courses on decision-making (by Good Judgement Project and by Annie Duke, a famous poker player and an author). There were other new insights that I started to incorporate into my investing activity. I also plan to share them and my own insights in a special course that I will launch next year.

The point is that this same question I first heard in 2007 is very relevant for some of my positions, especially Volkswagen. The share price is down 20% since I bought it in November 2022, although the total shareholder return was not as bad thanks to the special dividend of €19.06 and an annual dividend of €8.76 paid in H1 ’23. The special dividend was linked to the distribution of 49% of proceeds from the IPO of Porsche AG.

The second option almost always looked terrible. You effectively admitted that buying a stock was a mistake in the first place. Besides, selling a stock at a lower multiple seemed contrary to fundamental investing, the fund’s philosophy. “It is just one bad quarter, and the stock is down 10%, surely things will get back to normal later”, - was the typical thinking of one of the senior analysts. Or, they may have thought: “The company cut its guidance by just a couple of percentage points, and the stock tanked 20% - it is definitely an overreaction. The market is too short-term focused.”

Adding to a loss-making position seemed like extra psychological pressure. Your decision has eaten into the fund’s performance, and on top of it, your boss wants you to increase its weight so that your stock would have an even bigger impact on the future performance of the fund.

Most analysts were confident the stock would recover eventually but were seldomly ready to add.

As I was pretty young and had almost no positions assigned to me directly, I escaped these tough questions. Yet, I shared sympathy with the CIO since it followed the logic of Ben Graham and Warren Buffett, the gurus I had already known by then.

If you liked the stock at $100, you should like it even more at $80. It is not a direct quote but a message I took away from reading the classic books on value investing.

Fast-forward to 2021. I found further evidence that it was an excellent question in the book “The Art of Execution”. It was based on a study of 45 fund managers. The author, Lee Freeman-Shor, a fund manager at Old Mutual, found out that the best managers either kept adding as the stock continued to slide or exited immediately once it was down 20%. The managers who delivered the worst results stuck to losing positions for too long and did nothing.

Earlier this year, I attended two separate courses on decision-making (by Good Judgement Project and by Annie Duke, a famous poker player and an author). There were other new insights that I started to incorporate into my investing activity. I also plan to share them and my own insights in a special course that I will launch next year.

The point is that this same question I first heard in 2007 is very relevant for some of my positions, especially Volkswagen. The share price is down 20% since I bought it in November 2022, although the total shareholder return was not as bad thanks to the special dividend of €19.06 and an annual dividend of €8.76 paid in H1 ’23. The special dividend was linked to the distribution of 49% of proceeds from the IPO of Porsche AG.

Putting VW in the broader context

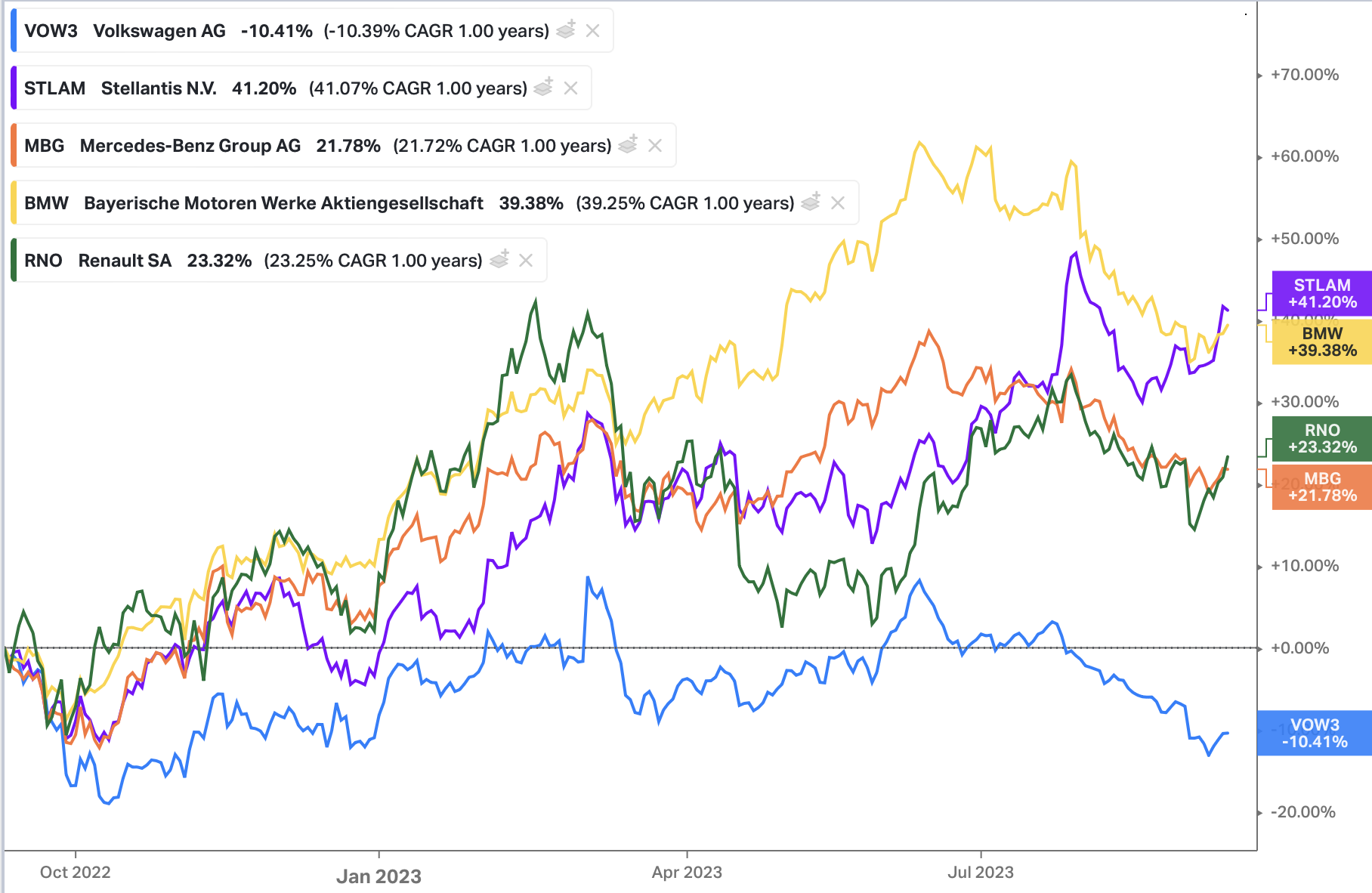

VW preferred shares are down 10% over the past twelve months, including €27.8 dividends paid in 2023. It is the worst performance among European automakers, all of which are up 20-40%.

Source: Koyfin

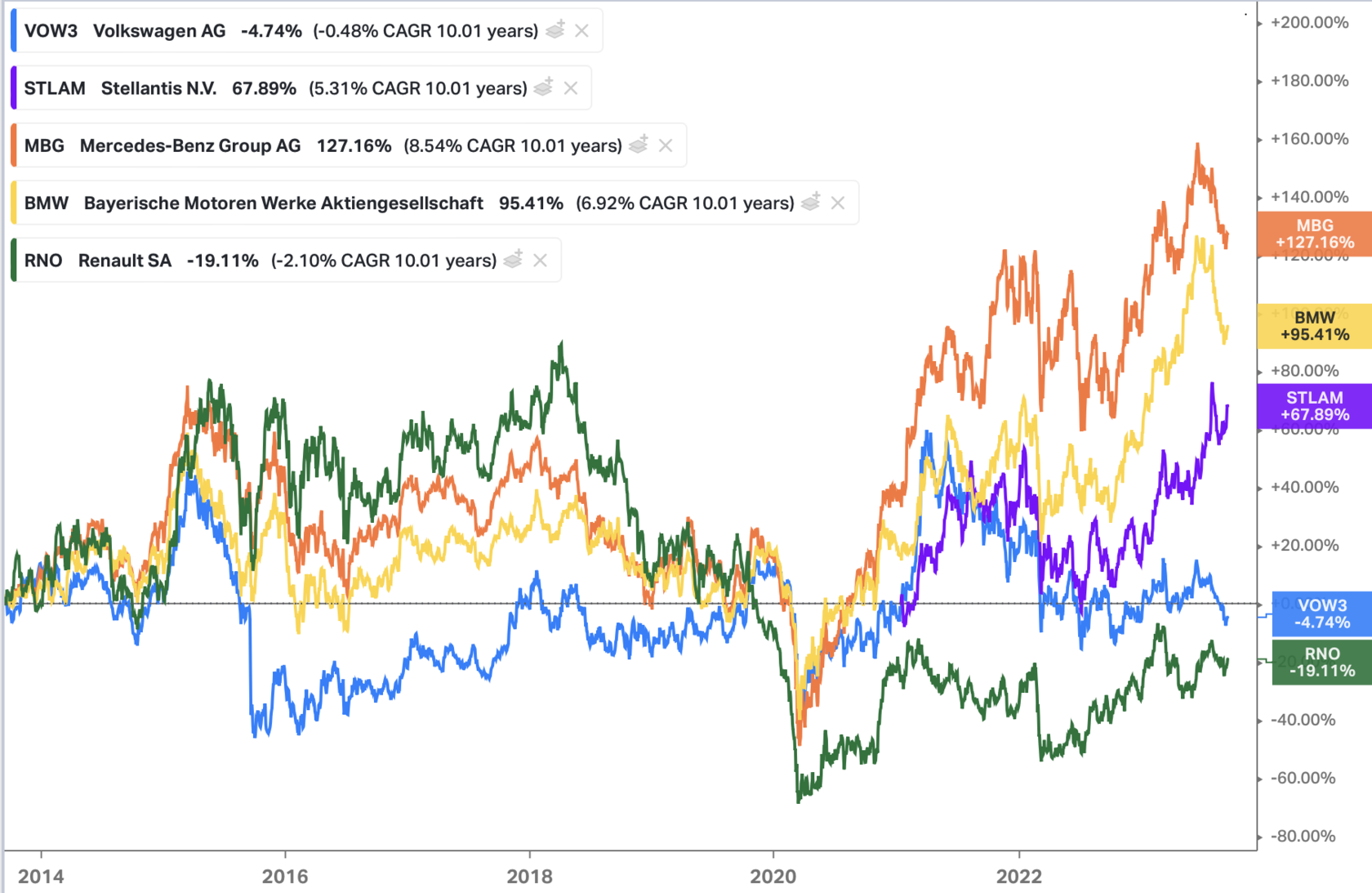

10-year total returns have been equally disappointing. Only Renault performed worse, mostly due to strong exposure to Russia. Essentially, VW shareholders missed all the market gains in the past 10 years as their shares delivered -5% total return (including dividends).

Source: Koyfin

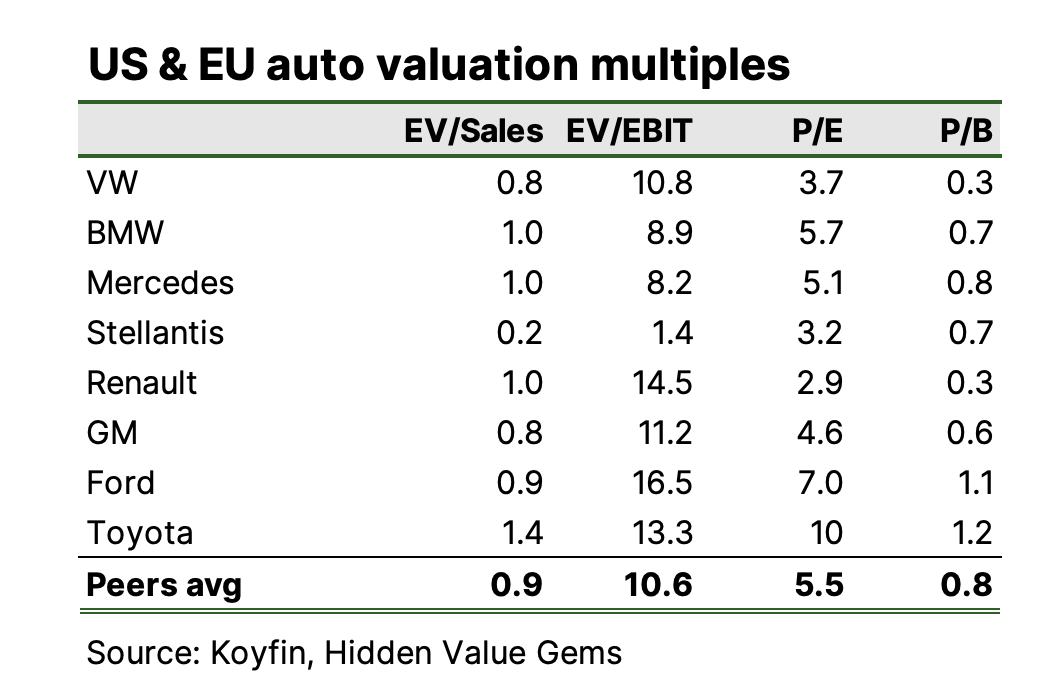

Not surprisingly, VW is now the cheapest stock among its peers.

I have used forward-looking multiples provided by Koyfin. According to the data I collected, VW trades at 3.7x and 10.8x P/E and EV/EBIT multiples. VW is at a 33% discount to its peers on a P/E multiple but in line on EV/EBIT. The latter is less representative because it incorporates the debt of the Financial Division.

I have used forward-looking multiples provided by Koyfin. According to the data I collected, VW trades at 3.7x and 10.8x P/E and EV/EBIT multiples. VW is at a 33% discount to its peers on a P/E multiple but in line on EV/EBIT. The latter is less representative because it incorporates the debt of the Financial Division.

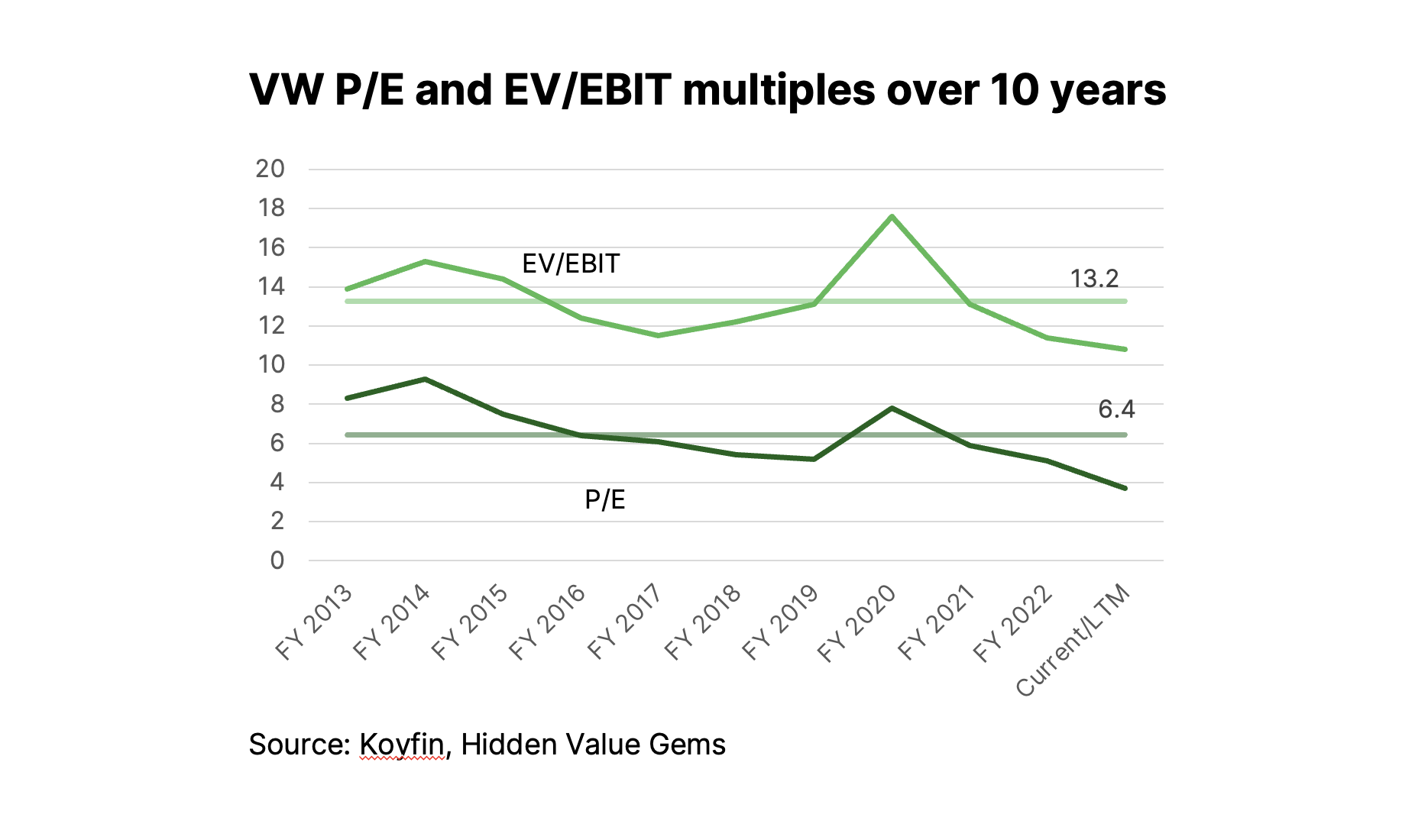

If this is not enough, here is a 10-year chart with historical P/E and EV/EBIT multiples at which VW traded. It is currently valued at 42% and 20% discounts to its historical P/E and EV/EBIT multiples.

VW is so cheap that it is not even funny

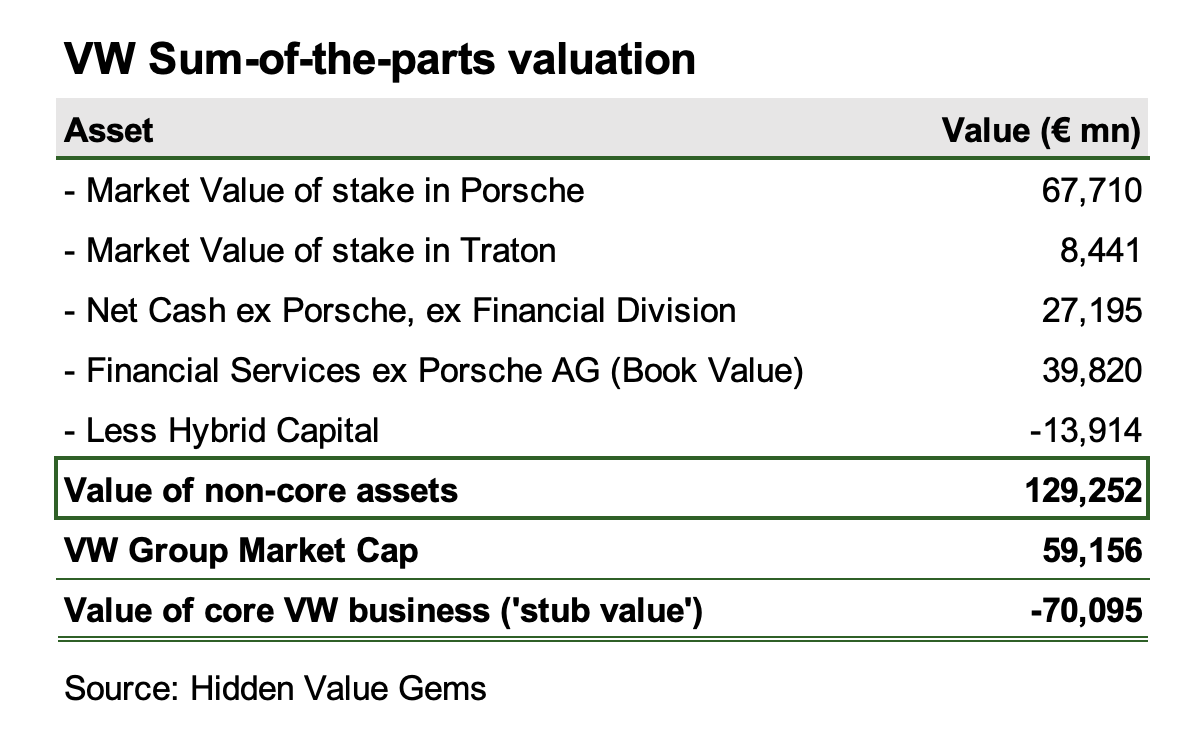

The most ridiculous conclusion comes from the sum-of-the-parts (SoTP) valuation. It is ridiculous because it comes up with a crazy conclusion, it uses market values for two listed entities within VW Group, and VW is so big and well-known, that hardly anyone in the German financial market is not aware of this

Here is the summary of the SoTP valuation.

Here is the summary of the SoTP valuation.

VW holds a 75% interest in Porsche AG, which has a market capitalisation of €90.3bn, which means that VW’s stake in Porsche is worth €67.7bn. Arguably, Porsche AG market value should be higher because only part of its preferred shares are listed, while all ordinary shares (50% of the share capital) are held privately by VW and Porsche SE (a holding company).

VW also owns 89.7% of Traton, a listed truck manufacturer, which is a combination of Scania, Man and Navistar. This is worth €8.4bn based on Traton’s latest market cap.

Then, there is €27.2bn of net cash in the Automotive segment, excluding the net cash of Porsche AG and the Financial division.

VW also owns a captive bank which mostly provides financing to its customers. Its book value is €39.8bn (excluding Porsche AG Financial Division).

Finally, I have deducted Hybrid capital (€13.9bn) as it represents a form of liability and represents claims of holders of part of VW’s profits before they can be distributed among common and preferred shareholders.

The combined values of VW’s stakes in Porsche AG, Traton, cash, bank less Hybrid capital is €129.3bn.

VW’s market cap is only €59.2bn.

This means that all other businesses within VW Group (‘stub’)are not only worth zero, but actually have negative values (-€70.1bn).

This sounds crazy at first glance. The market is ready to pay you €70.1bn to own VW.

How can this happen, what is wrong here?

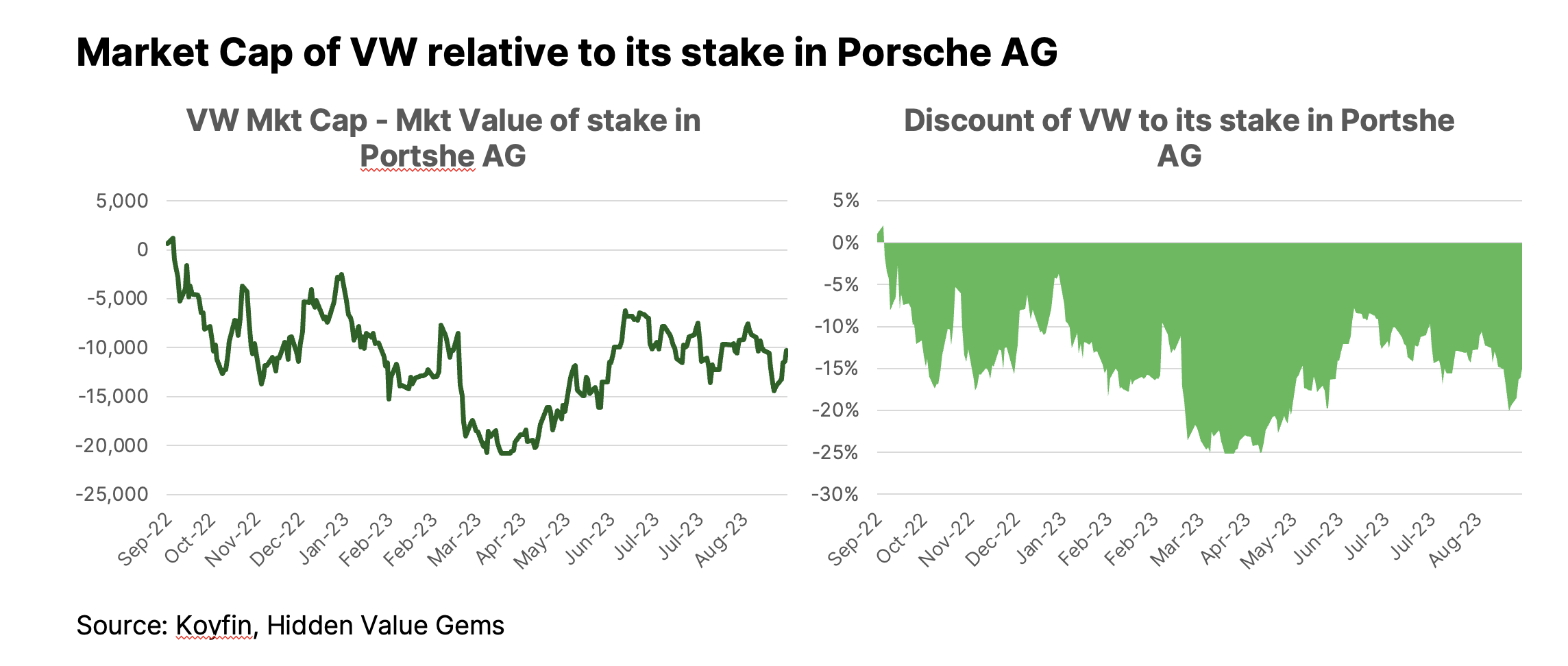

Well, firstly, there is nothing new. Such valuation disconnect has been present for quite a while.

Below is the chart of VW’s ‘stub’ value since Porsche AG went public last year.

VW also owns 89.7% of Traton, a listed truck manufacturer, which is a combination of Scania, Man and Navistar. This is worth €8.4bn based on Traton’s latest market cap.

Then, there is €27.2bn of net cash in the Automotive segment, excluding the net cash of Porsche AG and the Financial division.

VW also owns a captive bank which mostly provides financing to its customers. Its book value is €39.8bn (excluding Porsche AG Financial Division).

Finally, I have deducted Hybrid capital (€13.9bn) as it represents a form of liability and represents claims of holders of part of VW’s profits before they can be distributed among common and preferred shareholders.

The combined values of VW’s stakes in Porsche AG, Traton, cash, bank less Hybrid capital is €129.3bn.

VW’s market cap is only €59.2bn.

This means that all other businesses within VW Group (‘stub’)are not only worth zero, but actually have negative values (-€70.1bn).

This sounds crazy at first glance. The market is ready to pay you €70.1bn to own VW.

How can this happen, what is wrong here?

Well, firstly, there is nothing new. Such valuation disconnect has been present for quite a while.

Below is the chart of VW’s ‘stub’ value since Porsche AG went public last year.

But even before Porsche’s IPO, the market was aware of its financial results and could have assigned some fair value.

In other words, the market has been sceptical of VW’s non-luxury businesses for quite some time.

So the main question is why VW is valued at such absurd numbers.

In other words, the market has been sceptical of VW’s non-luxury businesses for quite some time.

So the main question is why VW is valued at such absurd numbers.

“Invert, always invert”

Charlie Munger is a fan of inversion and likes to say: “Invert, always invert”. The idea is to solve the problem by going backwards, turning the situation upside down. Instead of looking for the best solution, look for all the worst possible. The ones that you have not identified as the worst would be better options.

This is a similar idea I picked up from the decision-making classes that I took earlier this year. We were told to write pre-mortems on the forecasts we were to make. Essentially, we had to imagine that our forecast was wrong, and then we would need to write a short thesis outlining the reasons for why we failed.

Here is how I would apply such an approach to VW.

This is a similar idea I picked up from the decision-making classes that I took earlier this year. We were told to write pre-mortems on the forecasts we were to make. Essentially, we had to imagine that our forecast was wrong, and then we would need to write a short thesis outlining the reasons for why we failed.

Here is how I would apply such an approach to VW.

1. Valuation: is it really cheap?

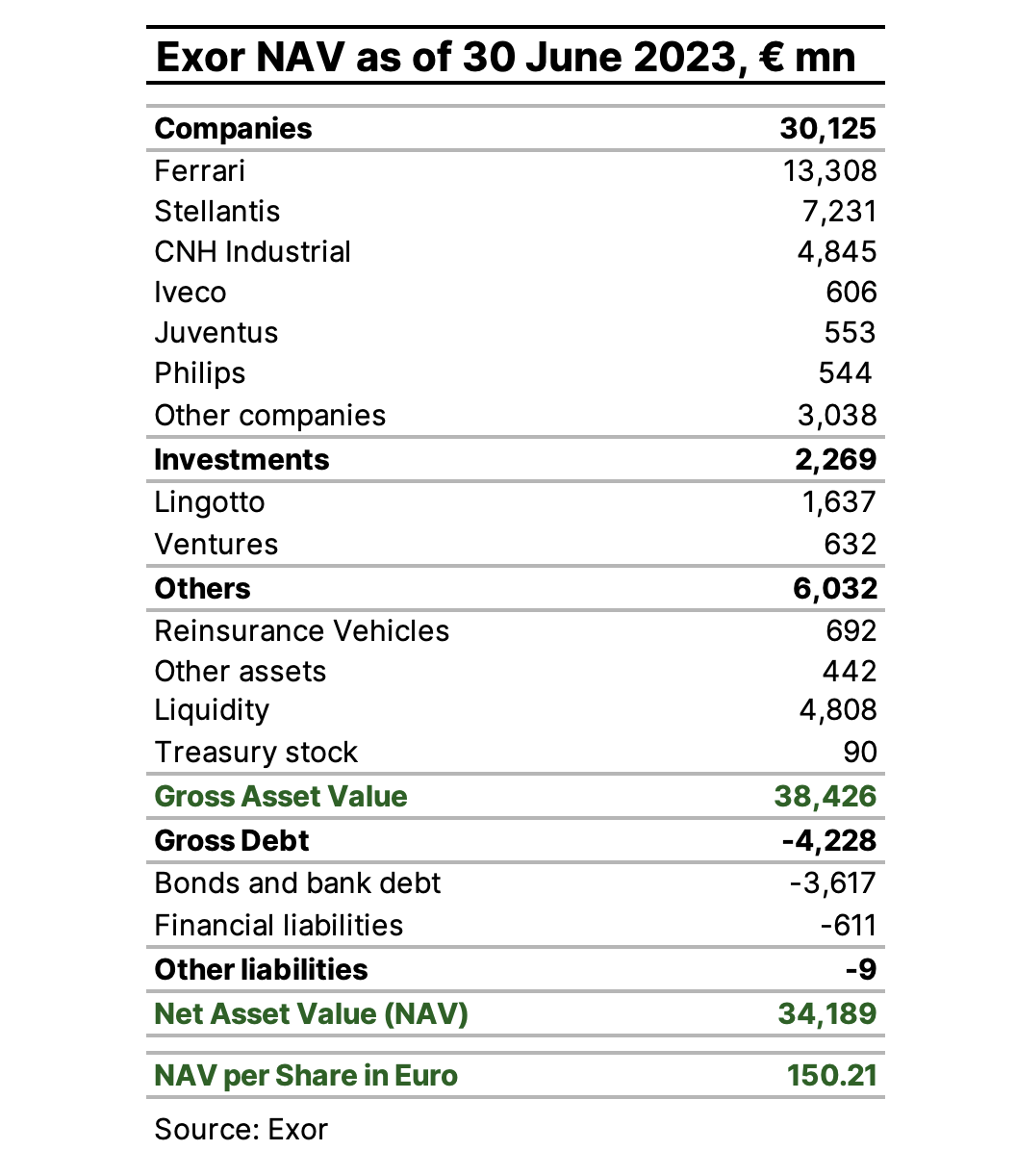

Practically all holding companies trade at a discount to the sum of their individual assets. Exor, one of my core positions, is a good example. The discount can reflect tax implications for the parent company if it disposes of its holdings, holding costs, risks of misallocation of capital, future uncertainty about the performance and valuation of individual assets and other issues.

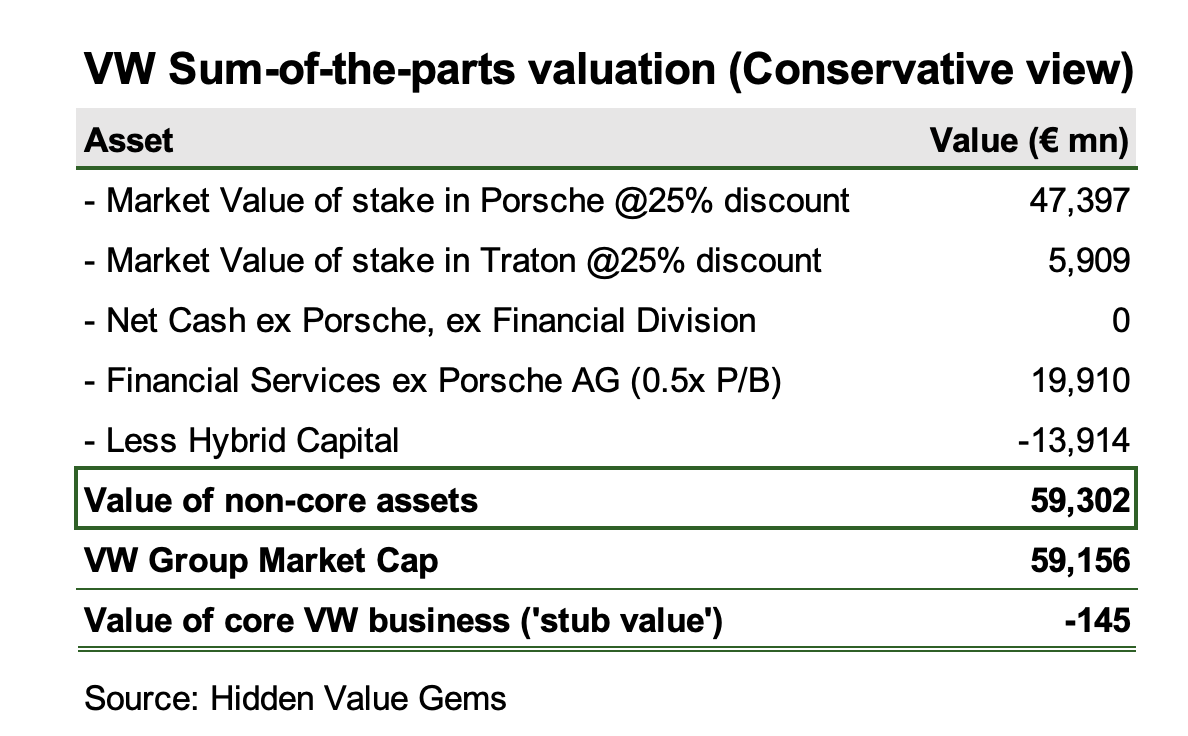

So, to follow this logic, let us apply a 30% discount to the value of Porsche AG and Traton.

Let us also take Financial services at only 0.5x P/B multiple since most European banks trade below book, and in the case of VW, we take more sector risks.

Let us also assume that missing the EV revolution, VW decides to make up for the lost time by ploughing all available resources to catch up with rivals. The weaker performance of its core ICE models could also drain its financial resources. In other words, €27bn net cash position in the Automotive segment goes to zero.

With these more conservative assumptions, the value of listed subsidiaries and other non-core assets comes at c.€59bn, matching VW’s market cap.

In other words, the market is arguably applying a 30% discount to VW’s stakes in Porsche AG and Traton, assumes zero net cash and applies 0.5x P/B multiple to value its Financial Services business. Conservative assumptions, but not impossible.

So, to follow this logic, let us apply a 30% discount to the value of Porsche AG and Traton.

Let us also take Financial services at only 0.5x P/B multiple since most European banks trade below book, and in the case of VW, we take more sector risks.

Let us also assume that missing the EV revolution, VW decides to make up for the lost time by ploughing all available resources to catch up with rivals. The weaker performance of its core ICE models could also drain its financial resources. In other words, €27bn net cash position in the Automotive segment goes to zero.

With these more conservative assumptions, the value of listed subsidiaries and other non-core assets comes at c.€59bn, matching VW’s market cap.

In other words, the market is arguably applying a 30% discount to VW’s stakes in Porsche AG and Traton, assumes zero net cash and applies 0.5x P/B multiple to value its Financial Services business. Conservative assumptions, but not impossible.

2. What if you owned the stock forever?

The problems for hardcore value investors stem from too much focus on valuation multiples. In simple terms, the thesis that a stock is at 5x PE and should be at least 10x rarely works on its own. I like to ask myself the following question: “Would I be happy to own the business for the rest of my life?” Or if they closed down the stock market and there would be no stock price quoted every second, what returns would I achieve from owning a particular business?

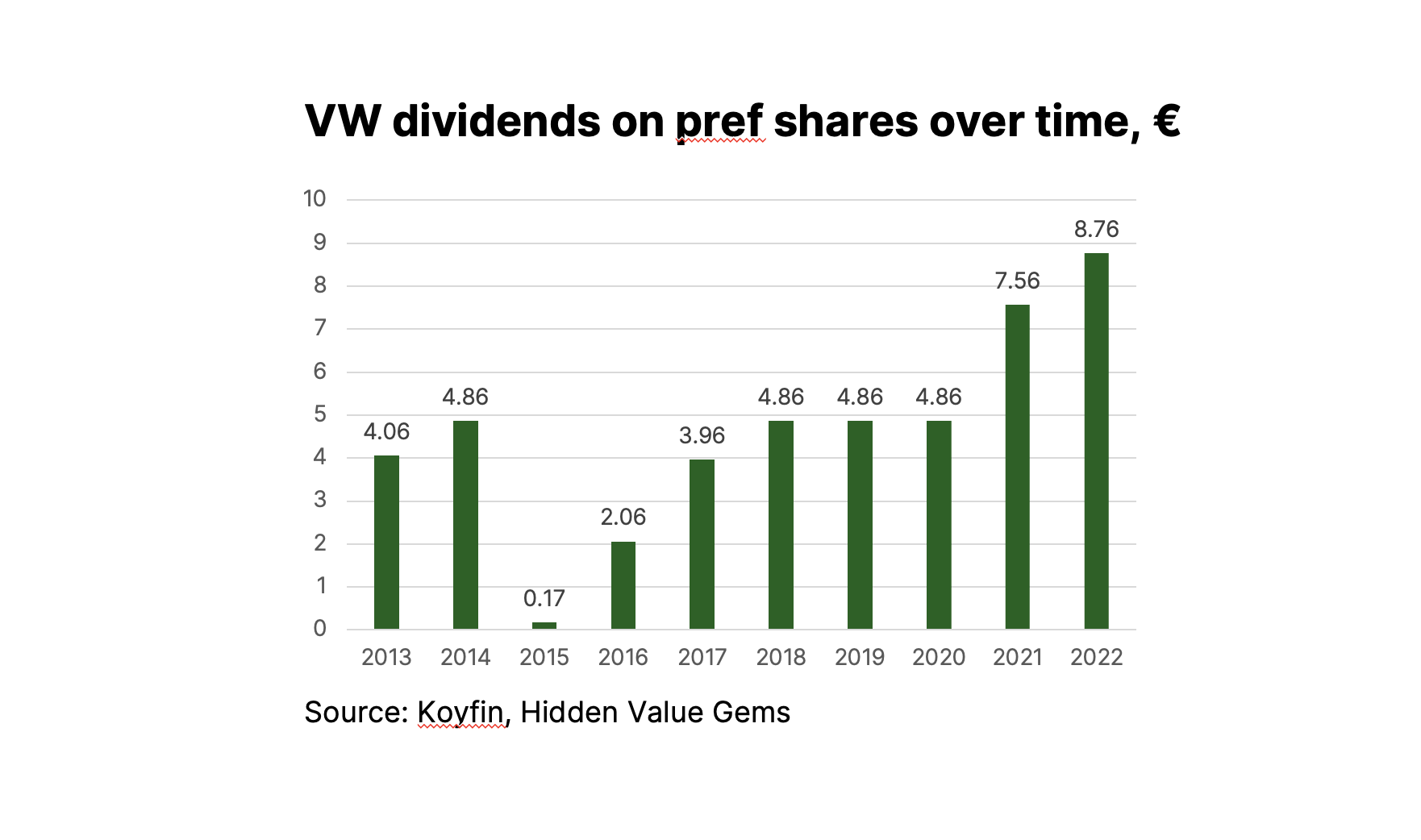

Volkswagen has been paying annual dividends for more than twenty years in a row. Dividend payments in 2015-17 suffered from the 'Diesel' scandal.

Volkswagen has been paying annual dividends for more than twenty years in a row. Dividend payments in 2015-17 suffered from the 'Diesel' scandal.

The company’s policy is based on continuous dividend growth aiming for at least a 30% payout ratio. Historically, the payout was often lower (29.4% in 2022 and 25.4% in 2021).

So assuming no radical change to corporate structure (e.g. spin-offs, disposals etc.), the company would be able to increase its dividends only if it can grow the consolidated earnings. The latter is a function of revenue (Units x Price) less Costs. I will share my more detailed thoughts on VW’s earnings potential next week. So far, given the challenges faced by the company on the EV front and taking into account that profits of the past two years benefited from abnormal price rises, it would be fair to assume minimal earnings growth going forward.

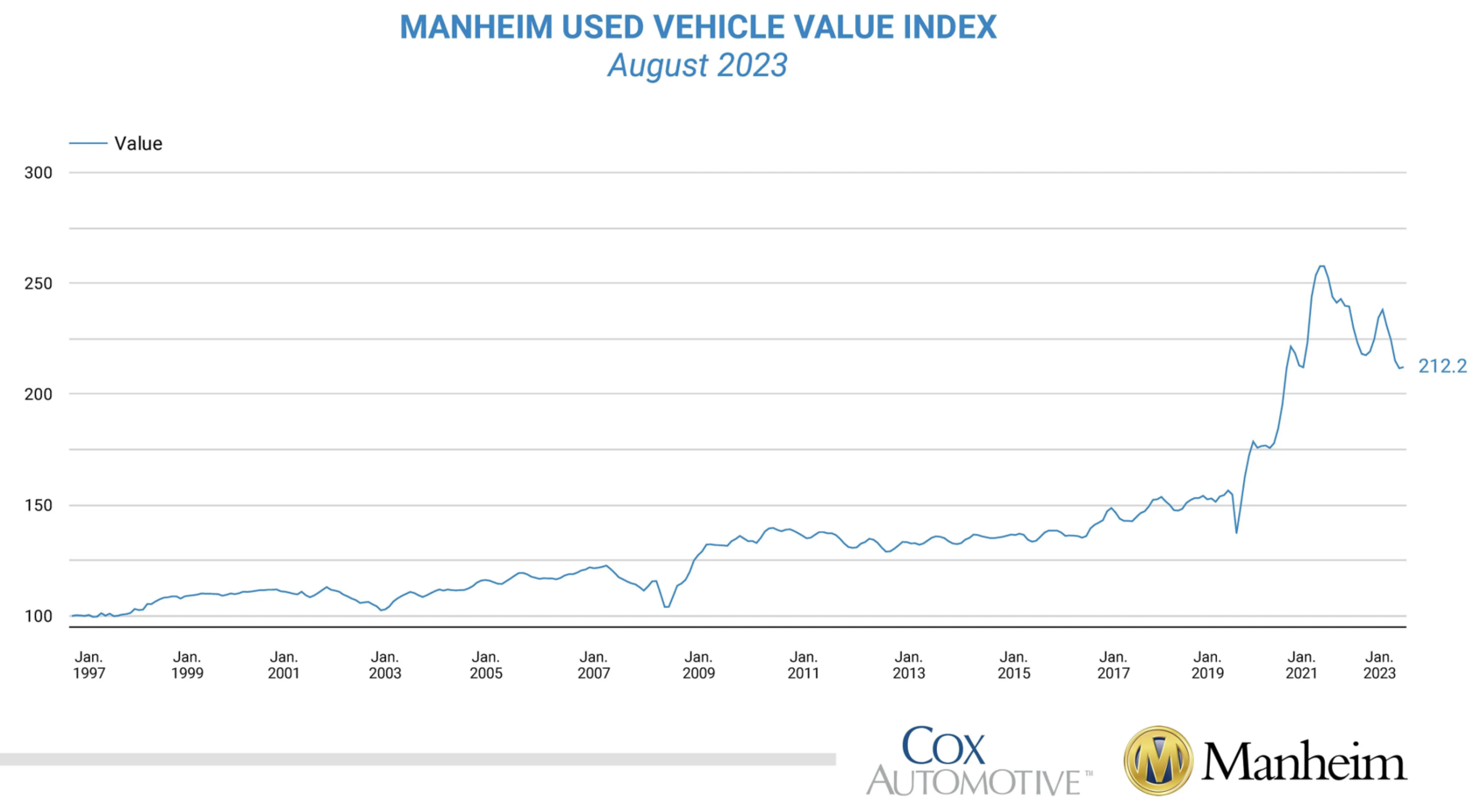

Indeed, an average car became almost 70% more expensive as consumers got richer thanks to various COVID paychecks and savings made during 2020. Supply chain disruptions led to further deficits and price rises.

So assuming no radical change to corporate structure (e.g. spin-offs, disposals etc.), the company would be able to increase its dividends only if it can grow the consolidated earnings. The latter is a function of revenue (Units x Price) less Costs. I will share my more detailed thoughts on VW’s earnings potential next week. So far, given the challenges faced by the company on the EV front and taking into account that profits of the past two years benefited from abnormal price rises, it would be fair to assume minimal earnings growth going forward.

Indeed, an average car became almost 70% more expensive as consumers got richer thanks to various COVID paychecks and savings made during 2020. Supply chain disruptions led to further deficits and price rises.

Source: Manheim

So, the potential return I should expect from holding VW pref shares is about 8% (current dividend yield + expected growth of 0%). No growth scenario assumes the luxury sports car (Porsche) continues to grow while traditional business declines as it loses to more advanced competitors. Not a great return.

This is not the final verdict. There is a scenario in which VW increases its dividends if it can successfully navigate in the new generation era, partially supported by its still market-leading positions in Europe, support from Germany and the EU and its general engineering prowess.

This is not the final verdict. There is a scenario in which VW increases its dividends if it can successfully navigate in the new generation era, partially supported by its still market-leading positions in Europe, support from Germany and the EU and its general engineering prowess.

The crux of the matter

VW’s investment case boils down to how successfully the company can pivot its strategy in the new EV era. This depends on how good its models are relative to the competition and how much financial resources are required to close the gap. But importantly, the legacy business (cars with internal combustion engines, or ICE) also continue to generate cash in the meantime. With the current EU plans to ban ICE sales from 2035, VW has more than 10 years to respond to the new challenges and re-position its business.

The market seems to assume that the business will struggle to adjust. It seems to me that VW's investment case could follow two different paths. One is mature declining businesses such as coal or tobacco, where volume decline did not stop companies from growing FCF and buying back their own shares, which has ultimately led to spectacular shareholder returns.

Another path is a less successful collapse of previous industry leaders such as RIM (producer of Blackberry).

I am not ready to give my final verdict on the stock today. As those senior analysts and PMs who often dodged the question from the CIO in the fund I used to work 15 years ago, I leave you with only half of the answer. However, I do promise to come back quite soon with a more definitive response and actions.

The market seems to assume that the business will struggle to adjust. It seems to me that VW's investment case could follow two different paths. One is mature declining businesses such as coal or tobacco, where volume decline did not stop companies from growing FCF and buying back their own shares, which has ultimately led to spectacular shareholder returns.

Another path is a less successful collapse of previous industry leaders such as RIM (producer of Blackberry).

I am not ready to give my final verdict on the stock today. As those senior analysts and PMs who often dodged the question from the CIO in the fund I used to work 15 years ago, I leave you with only half of the answer. However, I do promise to come back quite soon with a more definitive response and actions.

Part II. New purchase - Arrow Exploration

I attended the Proactive Investors conference on 7 September. It was my fifth time, I think. One company that particularly impressed me was Arrow Exploration. I bought its shares in the following few days, allocating about 1% of my portfolio.

Its shares are listed in London (ticker: AXLA LN). The company has a market cap of £49.2mn ($61mn) and a net cash position of $10mn, giving it an EV of $51mn. Its main producing assets are in Colombia, with small production in Canada. The combined output is just under 3kb/d. Management targets 10kb/d within the next three years. There is an 8-14% royalty on the company’s properties and a 40% corporate profit tax (for small-scale producers), although the company has accumulated losses which offset its corporate tax liability for the following two years.

Assuming 3kb/d oil production, Arrow Exploration should produce over 1mn bls in one year. At $80/bl, this implies an annual revenue of $80mn and operating cashflow of c. $60mn (after 12% royalty, $5/bl opex and a 5% discount to realised price). Even adjusting for small amounts of gas production and 10% output from Canada with lower realised prices, Arrow can comfortably generate $50mn of operating cash flow in the following 12 months.

Its ’23 investment programme assumes drilling 10 wells as well as shooting and processing 3D seismic for the main block (Tapir North) for a total cost of $32mn. Next year’s budget has not been discussed but should be close to 2023 spending. Management plans to drill 11 wells.

So the company should generate almost $20mn of FCF. Its capex includes growth investments as management targets 10kb/d output within 3 years.

Management holds a 6.2% interest in the company, while Canacol, a large independent Canadian-listed oil & gas company, owns 19.5%.

I only have 1% of my portfolio in this company because it is based in a fairly high-risk country, remains an early-stage operator, I do not know management well enough, and there are 46.3mn warrants exercisable until October and November at 9p a share.

The company's Sep 2023 Investor Presentation provides a good summary of its strategy, operations, shareholders and management.

Its shares are listed in London (ticker: AXLA LN). The company has a market cap of £49.2mn ($61mn) and a net cash position of $10mn, giving it an EV of $51mn. Its main producing assets are in Colombia, with small production in Canada. The combined output is just under 3kb/d. Management targets 10kb/d within the next three years. There is an 8-14% royalty on the company’s properties and a 40% corporate profit tax (for small-scale producers), although the company has accumulated losses which offset its corporate tax liability for the following two years.

Assuming 3kb/d oil production, Arrow Exploration should produce over 1mn bls in one year. At $80/bl, this implies an annual revenue of $80mn and operating cashflow of c. $60mn (after 12% royalty, $5/bl opex and a 5% discount to realised price). Even adjusting for small amounts of gas production and 10% output from Canada with lower realised prices, Arrow can comfortably generate $50mn of operating cash flow in the following 12 months.

Its ’23 investment programme assumes drilling 10 wells as well as shooting and processing 3D seismic for the main block (Tapir North) for a total cost of $32mn. Next year’s budget has not been discussed but should be close to 2023 spending. Management plans to drill 11 wells.

So the company should generate almost $20mn of FCF. Its capex includes growth investments as management targets 10kb/d output within 3 years.

Management holds a 6.2% interest in the company, while Canacol, a large independent Canadian-listed oil & gas company, owns 19.5%.

I only have 1% of my portfolio in this company because it is based in a fairly high-risk country, remains an early-stage operator, I do not know management well enough, and there are 46.3mn warrants exercisable until October and November at 9p a share.

The company's Sep 2023 Investor Presentation provides a good summary of its strategy, operations, shareholders and management.

Part III. What else is happening

Exor announced €750mn tender offer, stock reached all-time high

As a shareholder of Exor, I am happy to flag that the company announced €750mn tender offer for its shares as part of a new €1bn buyback programme. During the conference call, the CFO of Exor, Guido de Boer, said that the tender offer mechanism was chosen due to its speed. In other words, it would take Exor about three years if it spent the same amount buying shares on the open market. The offer opened on 14 September 2023 and will end on 12 October 2023. Qualifying shareholders will be able to select the price at which they wish to tender their ordinary shares in a price range extending from a discount of 3% up to a premium of 10% over the reference volume-weighted average price (VWAP). You can find all the details of the offer in the announcement.

Slightly disappointing, however, was the announcement that Giovanni Agnelli BV would tender €250mn worth of shares “with the objective of reducing its net debt position”.

In general, Exor continues to trade at a significant discount (over 40%) to its NAV.

Slightly disappointing, however, was the announcement that Giovanni Agnelli BV would tender €250mn worth of shares “with the objective of reducing its net debt position”.

In general, Exor continues to trade at a significant discount (over 40%) to its NAV.

Interestingly, the company has been quickly transforming over the past few years. Even though the auto sector makes up the bulk of its portfolio, it no longer owns PartnerRe (reinsurance business). It has spent over €1.6bn to expand in the healthcare sector. Management remains committed to investing in three key sectors: Healthcare, Luxury and Tech.

In short, Exor deserves a new update which I plan to publish soon.

In short, Exor deserves a new update which I plan to publish soon.

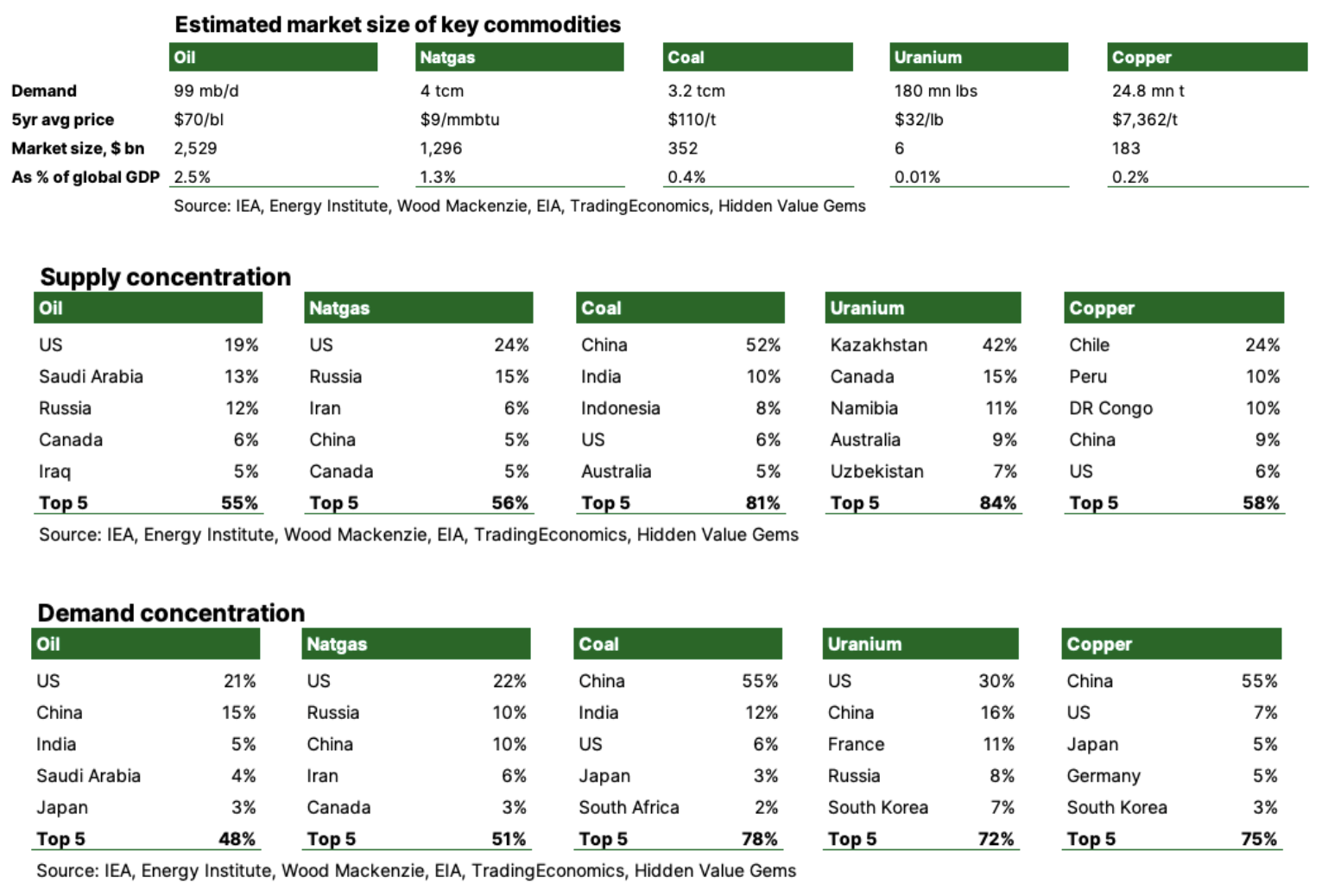

Uranium prices hit 12-year high - Financial Times

Back in July, I highlighted that both uranium and copper have the key ingredients for a strong price rally. To arrive at such a conclusion, I have analysed five commodities focusing on supply concentration, demand elasticity and future growth drivers, marginal costs, reserves life and other parameters. Some of the parameters are provided in the following table:

This was my conclusion:

Based on such a rather limited analysis, uranium could see the biggest price rise as its supply is highly concentrated, its role for consumers is critical, the marginal cost of supply is above the current spot price, and it has one of the best demand outlooks. The change in how governments view uranium in the energy transition (from a ‘hazardous’ commodity to one of the critical solutions) and technological breakthroughs that should allow electricity to be produced at compact nuclear power thanks to the development of small modular reactors (SMR).

You can check other conclusions in this post.

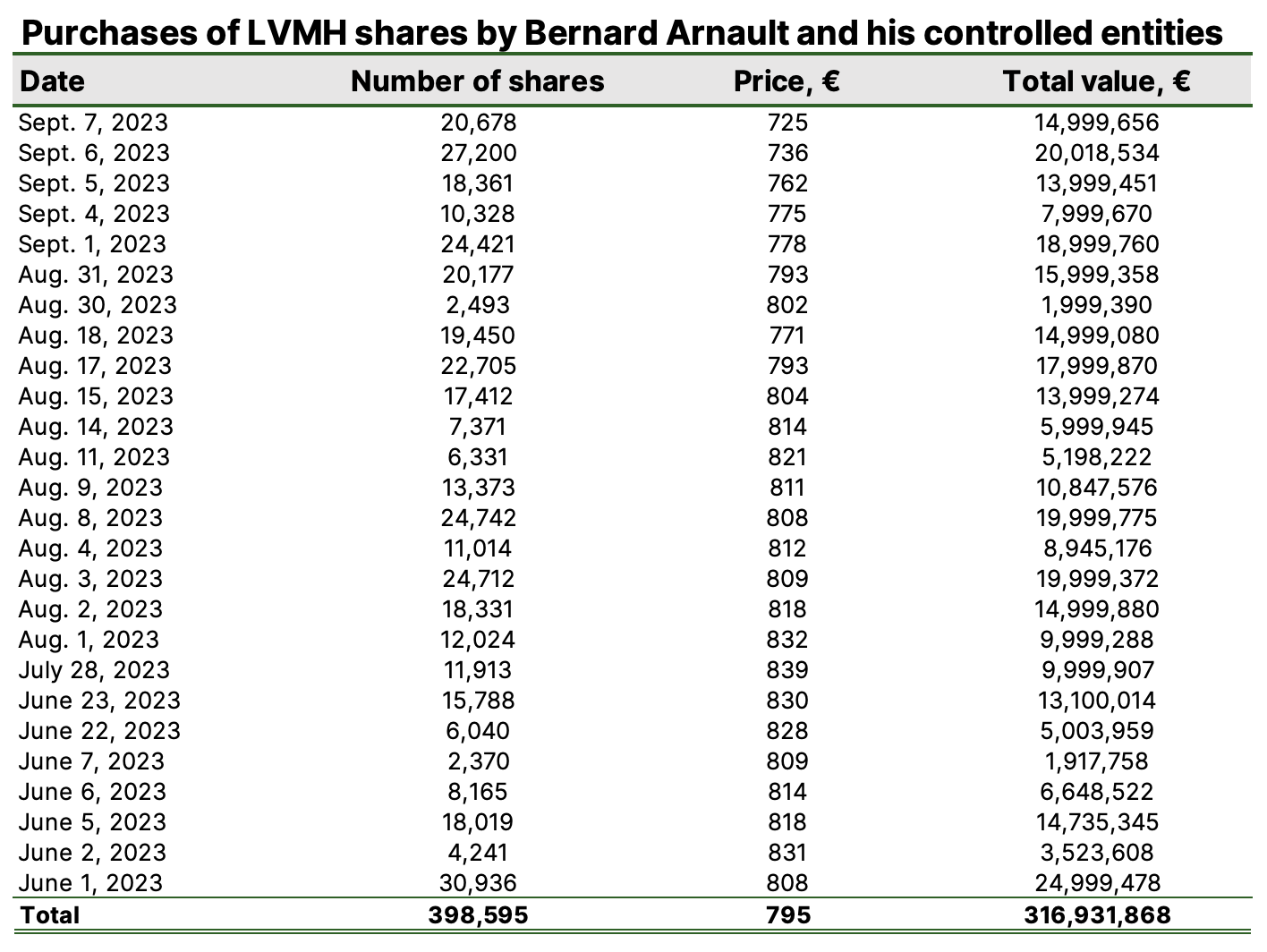

Bernard Arnault has been buying LVMH shares

Luxury stocks have been recently underperforming as concerns over China rise. Interesting that despite those concerns, oil price hit year highs this week. Clearly, there are other factors at play in the oil market, not least the supply situation. As many readers know, I turned more positive on the oil stocks this summer, buying new positions like Occidental, Harbour Energy and now Arrow Exploration.

I have also been following the luxury goods sector for quite some time. LVMH looked expensive to many for many years trading close to 30x PE. I have started focusing on Kering, which was almost 50% cheaper at about 15x. However, its high exposure to China and a single brand, Gucci, which itself turned into a hit-and-miss, were my concerns stopping me from buying the shares.

However, with strong results and relatively weak share price performance, LVMH is now trading at 22x forward P/E. Not that high for a business with superior economics, strong pricing power and long-life assets.

I have also been following the luxury goods sector for quite some time. LVMH looked expensive to many for many years trading close to 30x PE. I have started focusing on Kering, which was almost 50% cheaper at about 15x. However, its high exposure to China and a single brand, Gucci, which itself turned into a hit-and-miss, were my concerns stopping me from buying the shares.

However, with strong results and relatively weak share price performance, LVMH is now trading at 22x forward P/E. Not that high for a business with superior economics, strong pricing power and long-life assets.

Source: Google Finance

It gets even more exciting as the founder and largest shareholder, Bernard Arnault, has been started buying more shares on the market. Since the start of summer 2023, he has spent €317mn purchasing almost 400 thousand shares at an average price of €795.

The New York Times has recently published a long read on LVMH, its background, strategy and future direction. What caught my eye was that LVMH has become the premium sponsor of the 2024 Olympic Games to be held in Paris. Chaumet, one of its group companies, will design the Olympic medals. With this move, LVMH could try to enter the sports events segment. Besides, with its luxury hotels operations, it is already expanding in a broader experience category, not just physical goods.

If you enjoyed this post, please consider sharing it with friends to help spread the word and support the creation of valuable content. Thank you for reading!

If you enjoyed this post, please consider sharing it with friends to help spread the word and support the creation of valuable content. Thank you for reading!