30 September 2023

Kistos released its H1 ’23 financial and operating results, which were somewhat disappointing. However, given strong underlying FCF generation, a number of one-off factors and strong growth potential in the next 24 months, I think the overall thesis remains. My original assumptions were a little more optimistic on the operational side (but not on macro so far as I expected $80-70-60/bl oil prices for 2023-24-25 and $9-10-10 per mcf gas price).

I have run a new set of more conservative assumptions and still get well above 20% IRR. I will try to publish an updated case on the company in the next couple of weeks.

I have run a new set of more conservative assumptions and still get well above 20% IRR. I will try to publish an updated case on the company in the next couple of weeks.

What exactly I did not like about the results

1. Delays in new field launches

- In its previous communications, Kistos indicated that an FID on the Orion oil field (Netherlands) could be made before the year-end (2023), while now management has guided for the FID in H1 ’24 and the first oil in late 2025 or early 2026.

- In May 2023, Kistos expected FID for the Glendronach field (GLA area in the UK) to be potentially made during H2 ’23, but in its latest statement (29 September) the management has referred to higher costs and adverse tax changes as the reason for prioritising Edradour West field (also in the GLA area). It did not mention when the field could receive FID or launched into production.

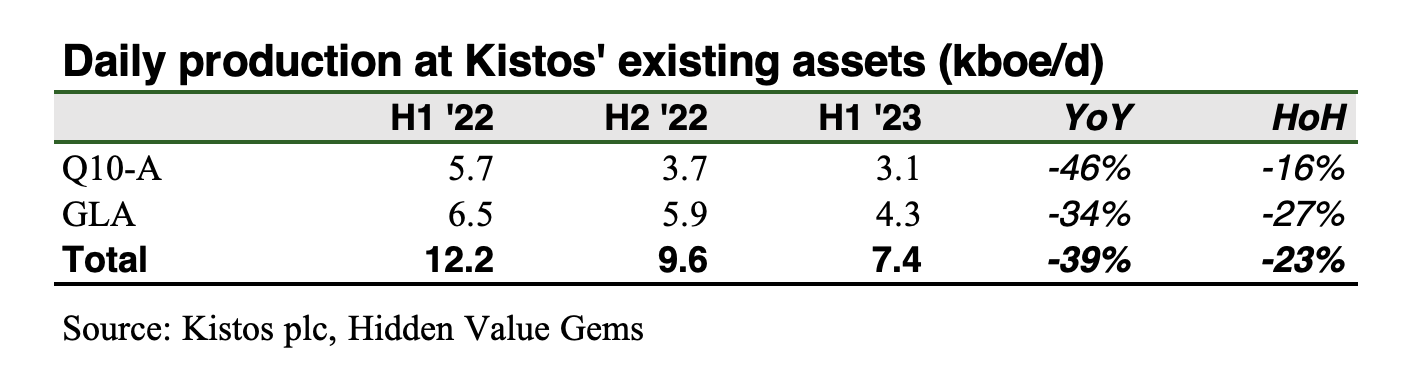

2. H1 '23 production was quite weak

Both Q10-A (Netherlands) and the GLA (UK) saw materially produced materially lower volumes.

In the case of Q10-A, management referred to a planned workover campaign during Q4 ’22 and Q1 ’23 and to a planned maintenance shutdown of the platform from June 2023.

The company explained weaker production at GLA also by a combination of planned and unplanned maintenance of the pipeline and the wells.

The natural decline was also a factor behind the decline at both assets.

Sadly, the company did not provide the impact of those factors individually. I would assume that probably around half of the decline came from natural depletion.

The company explained weaker production at GLA also by a combination of planned and unplanned maintenance of the pipeline and the wells.

The natural decline was also a factor behind the decline at both assets.

Sadly, the company did not provide the impact of those factors individually. I would assume that probably around half of the decline came from natural depletion.

3. Financial results were weak

With a weaker production dynamic, the company faced higher unit costs (almost €20/boe, on my estimates) compared to €10/boe in 2022. The company also incurred higher than usual capex (€46mn) related to the drilling campaign at Q10-A (€20mn), the Benriach exploration well (€12mn), and €13mn in Norway. The latter is not associated with the current production. 80% of costs on Benriach will be used to offset future tax liability making actual costs considerably lower (€3mn in H1 ’23).

For comparison, the company spent just €19mn on capex in 2022.

The good thing is that some of this capex will lead to materially higher production already next year (Norway should add 10kboe/d at peak). Certain capex (including all capex in Norway) will reduce tax payments, so the net impact on FCF is lower than the nominal amounts.

The company does not plan any drilling or intervention in the UK or in the Netherlands for the rest of 2023.

Kistos’ FCF in H1 ’23 was €47.4mn which benefited from €64mn of positive Worling Capital change. Without this effect, FCF would have been negative. However, this mismatch of higher spending and lower production should reverse in the future. The company should receive tax refunds related to the past capex, including €71.7mn in December 2023 related to Mime’s 2022 capex (Norway).

Importantly, the overall capex for 2023 has been maintained at 8.5-10.5kboe/d. I initially expected 10.5kboe/d, but now I think 8.5kboe/d (or just a little higher) is more likely.

For comparison, the company spent just €19mn on capex in 2022.

The good thing is that some of this capex will lead to materially higher production already next year (Norway should add 10kboe/d at peak). Certain capex (including all capex in Norway) will reduce tax payments, so the net impact on FCF is lower than the nominal amounts.

The company does not plan any drilling or intervention in the UK or in the Netherlands for the rest of 2023.

Kistos’ FCF in H1 ’23 was €47.4mn which benefited from €64mn of positive Worling Capital change. Without this effect, FCF would have been negative. However, this mismatch of higher spending and lower production should reverse in the future. The company should receive tax refunds related to the past capex, including €71.7mn in December 2023 related to Mime’s 2022 capex (Norway).

Importantly, the overall capex for 2023 has been maintained at 8.5-10.5kboe/d. I initially expected 10.5kboe/d, but now I think 8.5kboe/d (or just a little higher) is more likely.

Overall thoughts on Kistos

I still think the company can earn €100-200mn of FCF in 2025 when Baldex X reaches its capacity of around 10kboe/d (net to Kistos). The eventual recovery of 78% of capex in Norway should be a material boost to FCF.

There were also positive developments as well such as restoring ownership of M10/M11 licences in the Netherlands, although it will have a limited impact on the company’s operations in the near term.

Finally, capital allocation skills are extremely important in highly capital-intensive industries like oil & gas. And this is why I am invested in Kistos. It is not my only and biggest position in oil & gas, however.

It is not the cheapest and there are operational issues. Other names, like its Norwegian partner Var Energi, pay c. 14% dividend yield and are on track to deliver a 50% production growth in the mid-term. Harbour Energy has zero net debt, $2.5bn Market Cap and generates c. $1bn of FCF annually, distributing it via dividends and buyback. My other investment, Arrow Exploration, is growing production from c. 3kboe/d to 10kboe/d by 2026, generating around $40mn of operating cash flow annually. Its current market cap is around $60mn, while net cash is $10mn.

I plan to update my thesis with a new set of numbers in the next couple of weeks. Subscribe to receive the next update.

There were also positive developments as well such as restoring ownership of M10/M11 licences in the Netherlands, although it will have a limited impact on the company’s operations in the near term.

Finally, capital allocation skills are extremely important in highly capital-intensive industries like oil & gas. And this is why I am invested in Kistos. It is not my only and biggest position in oil & gas, however.

It is not the cheapest and there are operational issues. Other names, like its Norwegian partner Var Energi, pay c. 14% dividend yield and are on track to deliver a 50% production growth in the mid-term. Harbour Energy has zero net debt, $2.5bn Market Cap and generates c. $1bn of FCF annually, distributing it via dividends and buyback. My other investment, Arrow Exploration, is growing production from c. 3kboe/d to 10kboe/d by 2026, generating around $40mn of operating cash flow annually. Its current market cap is around $60mn, while net cash is $10mn.

I plan to update my thesis with a new set of numbers in the next couple of weeks. Subscribe to receive the next update.

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to inform and educate readers about the stock market. Readers should do their own research before making decisions and always consult with professional advisors. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. Please read the full version of the Disclaimer here.