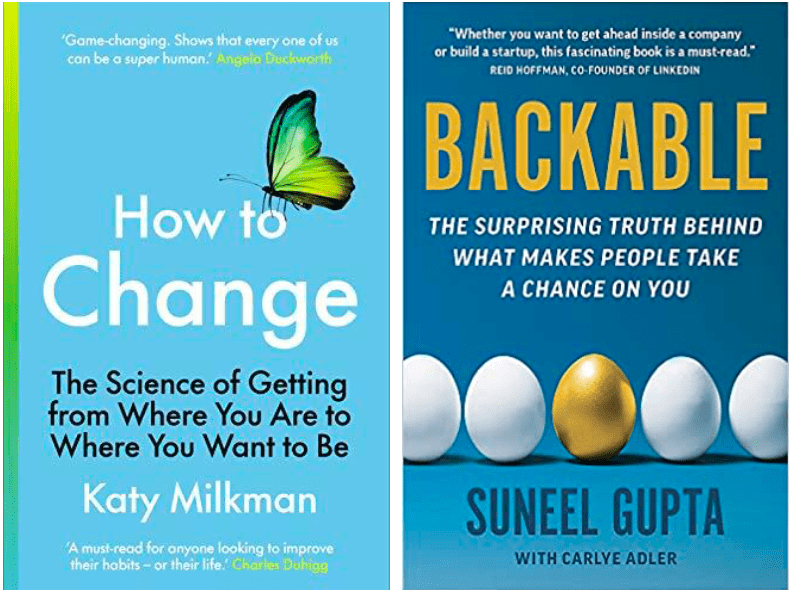

Two new books recommendations

Over the past week, I have added 2 new book recommendations on personal development. One book has practical steps on how to overcome bad habits to achieve more, and the second one provides advice on how to become Backable (get people to believe in your project, get funding etc.). I enjoyed reading both books a lot. Full write-ups on these books are in the Library section of my website.

New stock ideas

I have also added two interesting stock ideas to the Third-party research section of My Portfolio - these are ideas that I have not researched myself, but which I found to be quite useful, especially in the future if the price is right. One is a real-estate brokerage - a potential disruptor - eXp World Holdings. The second idea is just an interesting (albeit a little short) perspective on the US Pharma sector.

Why investing is hard: psychological aspects

The definition of a winning formula in investing (at least that I use) is simple quite. Find a great company and make sure you don’t overpay for it. A bargain (stock priced exceptionally cheap) can also be a great investment as long as business fundamentals remain solid.

Yet, anyone who has invested for a while would agree that it is much harder.

I think the main issue with any formula is that in investing, we deal with uncertainty and insufficient information. A business may have the best product and management team, but how can we be sure that this would be true 20 years later?

There are many other aspects about investing that make it more art than science. In my earlier note, I discussed results of one study showing that just a few stocks account for almost all market gains over the long-term, while over half of stocks underperform bonds. In the same note, I also discussed the difference between geometric and arithmetic mean, which naturally leads to quite uneven distribution of investment results among individuals.

In this note, I focus on the importance of being able to combine two opposite personal qualities to be a successful investor. Here are these strange combinations:

1. Conviction and self-doubt. To be able to buy the stock in a crisis, you have to have conviction in the business and in your analysis. It is especially important after you bought the stock when the company you bought faces some challenges (e.g. downgrading its outlook, cutting dividends). To be able to hold the stock during such challenging times requires lots of conviction.

At the same time, you have to doubt your own beliefs and challenge your assumptions. You need to be able to admit that you could have made a mistake and to be able to fix it. To quote from latest Munger’s interview:

“One thing we learnt is that if it’s clear that something is a mistake, it is to fix it quickly. It doesn’t get better while you wait… leave quickly.”

2. Being arrogant and humble at the same time. Related to the previous point, you have to be arrogant enough to buy a specific stock. You should be aware that you basically call the market and the price it assigns to the stock as both wrongs. Do not forget that there are many smart investors in the market, many have better access to information (industry research, for example) or access to management. On the other hand, you have to stay open-minded and be ready to change your view when new information comes that contradicts your original thesis.

To quote from legendary investor Stanley Druckenmiller:

“Successful investing requires strong opinions, lightly held”.

The key quality here is to stay humble, accepting that there are many things you still do not know about. This pushes you to learn more, seek new information and re-connect the dots, perhaps reversing your thinking process. During the 1996 annual meeting, Buffett and Munger said that “it is not so difficult to learn, it is the un-learning that is so hard”.

3. Patience (Inactivity) vs Staying on alert (Willing to hit quickly). Since great investment opportunities are rare, successful investing requires ‘waiting for the fat pitch’ and just saying ‘No’ to all other opportunities. Buffett used to say that he could make almost everyone a better investor by allowing a person to make only 10 investments in his or her life (a punchcard approach).

At the same time, you cannot shut off all information channels and just watch your investments all the time. You should be watching for opportunities, learning about new businesses and industries. This makes it hard not to act. Especially if you are in a money management business - justifying fees is harder if you make a few trades a year.

Munger likes to quote Pascal, who said that “All of humanity’s problems stem from man’s inability to sit quietly in a room alone”. According to Munger, “Most people are too fretful, they worry too much. Success means being very patient, but aggressive when it’s time”.

Warren Buffett also said that “The trick in investing is just to sit there and watch pitch after pitch goes by and wait for the one right in your sweet spot. And if people are yelling 'swing your bum', ignore them. There is a temptation for people to act far too frequently in stocks just because they are liquid”.

Seth Klarman, the author of one of the most expensive investment books - ‘The Margin of Safety’ focused on the importance of having this unique quality to keep watching the market and follow the news in search of the best idea but act only when you see it and avoid any temptation to buy/sell with general news and millions of signals.

4. Passion vs Dispassion. You have to be passionate about investing overall, to keep looking, researching and not being discouraged by setbacks. Yet, in your analysis, you have to be absolutely disengaged from the business and try to be as objective as possible. Remain cool-headed during the storm, but not just by turning off your screen and still monitoring markets (like in spring 2020), is an important quality to achieve real investment success.

5. Mathematics vs Intuition and Psychology. Decisions should be obviously based on facts and analysis, but there is never enough information to have 100% clarity. Investors always deal with various degrees of uncertainties, and sometimes they have to be rational and use common sense, but sometimes they may have to trust their intuition. The Key is to be aware of which method you rely on in each decision.

A separate issue is deciding which two groups of factors to focus on. On the other hand, your analysis should consider business characteristics such as competitive advantage, which manifests in higher margins, higher returns on capital and/or faster growth. On the other hand, you cannot ignore humans not only in running the business but also in areas around the business (on the customers’ side, among suppliers, regulation, financing of the business).

It is especially important when looking at turnaround opportunities - normally, business performance is weak, a company could be loss-making and/or facing high piles of debt, but top management could play a crucial role in fixing the issues and getting the business back on course.

Finally, I think what all value investors can learn from traders like Paul Tudor Jones, Stanley Druckenmiller or Steve Cohen - is the introspective analysis, learning your own decision-making process, which is often linked to psychology. You have to be honest with yourself and very direct to understand what exactly drives a particular decision. A pure numbers-focused person may be influenced by the same biases, but many not be able to spot it. This can be quite dangerous.

6. Science vs Imagination. Related to the previous point is the need to combine two opposing qualities. You have to have a scientific approach to your analysis, but you should also leave room for some imagination to be able to see where the business would be in 5-10 years. Amazon or Netflix would have always looked unattractive for a dry, science-driven mind, yet - they turned out to be one of the greatest investment opportunities in decades.

7. Contrarian but not ignorant. All legendary investors point out the importance of having a variant perspective, a differentiating view on a stock relative to the rest of the market. Being contrarian is important for spotting new opportunities. But on the other hand, you have to remain open-minded about your positions mainly to receive new information that may occasionally contradict your original views. If you are too stubborn, you run the risk of missing important changes in the business or the sector and your original thesis ceases to be correct. You end up holding to a losing position.

8. Speaking vs Listening. Being able to listen and hear is probably more important for investors than to be able to speak well, although the latter is, of course, also very important, especially if you manage someone else’s money. On the other hand, you need to form an opinion and stick to it despite market volatility. You will face a series of opposite views, and if you are influenced by them too much, you other fail to take action or take too many actions (getting in and out of the stock, most likely at the wrong time and overpay commissions).

Listening but not changing your views immediately is an important quality. You need to speak well (mostly inside yourself) to not be influencedtoo much when listening to others (formulate a clear thesis of why you bought the stock). It may be easy to just ignore others by not listening to them, but it is just too dangerous. There is almost always something to learn from other people if you know how to listen.

9. Protecting downside, but aiming for upside. One of the key tenets of value investing is the Margin of Safety, which is the idea of minimising risks first before thinking about the upside. This mindset requires thinking about bad outcomes and asking questions about various negative events and probabilities.

But on the other hand, you cannot use this mindset to fully dominate your process or else you will stay 100% in cash. To seek adequate investment returns, you need to consider riskier assets, including equities. Often, the best opportunities look least attractive at the moment when you are looking at them. Seeking pure safety would push you away from such opportunities, which may lead to subpar performance.

In conclusion, I would like to share some practical advice on how to handle these needs to combine opposite qualities in investing. I think it is important to:

I. Be ready to say No to almost everything.

II. Develop filters to be able to decide if the opportunity is interesting or not and if you need to spend more time on it or move on.

III. Be honest with yourself about your circle of competence (sectors, regions, products that you may understand better than an average investor). It is hard to be better than average at most things. So no need to be embarrassed if the best thing you know is the high street in your town. You can still achieve extraordinary results - see the example of a billionaire investor John Arrillaga below.

IV. Become a learning machine to expand your circle of competence through reading, a network of contacts and watching (testing products, speaking to customers and suppliers, employees etc.).

V. Learn history and base rates (prior probabilities) rather than trying to predict how the future would look like by coming with your own assumptions and drivers.

VI. Be brutal and fully transparent with yourself and your decision-making process, be aware of numerous biases that may impact your decisions and views.

And now the very last piece - a short example of a billionaire investor with a very narrow circle of competence. It comes from one of Mohnish Pabrai’s presentations in which he talked about John Arrillaga - a friend of Charlie Munger.

He started investing with almost no money about 40 years ago and became a billionaire. He did not invest across the US, California, or a large city like San Francisco. He invested in property which he knew well - an area within a mile of Stanford University, where he lives. He never put on a lot of debt, and when things went down, he bought the property while he sold when everyone got euphoric. That’s all he did. Mohnish Pabrai asks:

“What is John Arrillaga’s circle of competence? Is it real estate? No! Is it California real estate? No! Northern California real estate? No! Only real estate around Stanford. His circle of competence is smaller than the circle on the hand. The good thing about getting wealthy is we don’t need to understand a lot of things!”

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.