8 October 2023

Earlier this year, I started publishing my Monthly Stock Idea Lab at the end of every month. This is the sixth edition. The idea behind this product is to improve the investment results by focusing on better companies while eliminating businesses with “inherent” problems (no competitive advantages, no alignment of interests between key stakeholders, unsustainable earnings, poor returns on capital and capital allocation track record, weak balance sheets).

Since spotting a great business is relatively easy, I prefer to look for companies facing temporary issues that can mask their inherent strengths and make them look just like ordinary businesses. In an ideal case, there are two drivers for the future upside: 1) improved financial performance and 2) stock rerating once the market becomes aware of the operational progress.

Looking for ideas in less crowded places (e.g. small caps) or out-of-favour markets (e.g. resources, emerging markets) can increase the odds and allow one to purchase good businesses priced as mediocre ones.

The flip side is that it can take longer to fix the problems or that these problems become permanent. The fact that a company joins the list does not mean it is an automatic BUY signal. Instead, it suggests that a company is worth researching further since it has the necessary attributes to make it a successful investment.

Since spotting a great business is relatively easy, I prefer to look for companies facing temporary issues that can mask their inherent strengths and make them look just like ordinary businesses. In an ideal case, there are two drivers for the future upside: 1) improved financial performance and 2) stock rerating once the market becomes aware of the operational progress.

Looking for ideas in less crowded places (e.g. small caps) or out-of-favour markets (e.g. resources, emerging markets) can increase the odds and allow one to purchase good businesses priced as mediocre ones.

The flip side is that it can take longer to fix the problems or that these problems become permanent. The fact that a company joins the list does not mean it is an automatic BUY signal. Instead, it suggests that a company is worth researching further since it has the necessary attributes to make it a successful investment.

Recent portfolio changes

I have sold more CNX shares this week, cutting position weight to less than 2%. I have written about my concerns before.

I used its proceeds and some spare cash to initiate two new positions.

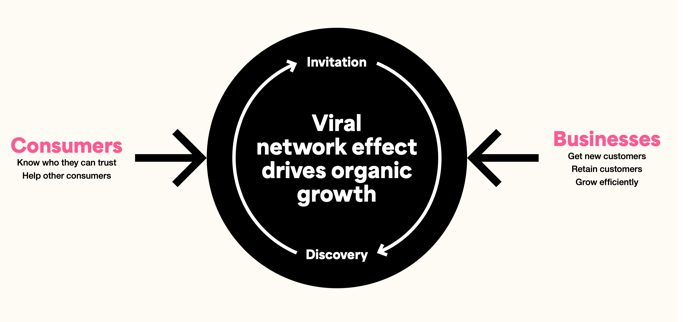

The first new position is Trustpilot. It currently barely makes any profit, but I think it is mainly because of 'growth investments'. The company follows a 'triple win' business model, creating value for consumers, businesses and shareholders. The business model has a strong network effect and is capital-light. Businesses are incentivised to send more review invitations to customers, while customers benefit if more reviews are written on a particular product.

My second purchase is Team Internet (former CentralNic). The company has grown revenues at 78% CAGR over the past ten years. It is now trading at 6x PE and 14% FCF yield.

In today's edition I provide more detailed write-ups on both companies as well as three other names that came on my radar.

I used its proceeds and some spare cash to initiate two new positions.

The first new position is Trustpilot. It currently barely makes any profit, but I think it is mainly because of 'growth investments'. The company follows a 'triple win' business model, creating value for consumers, businesses and shareholders. The business model has a strong network effect and is capital-light. Businesses are incentivised to send more review invitations to customers, while customers benefit if more reviews are written on a particular product.

My second purchase is Team Internet (former CentralNic). The company has grown revenues at 78% CAGR over the past ten years. It is now trading at 6x PE and 14% FCF yield.

In today's edition I provide more detailed write-ups on both companies as well as three other names that came on my radar.

Trustpilot

Ticker: TRST LN

Share price: £1.09

Mkt Cap: £457.8mn

EV: £391.7mn

Share price: £1.09

Mkt Cap: £457.8mn

EV: £391.7mn

Background

Trustpilot is the opposite of a deep value opportunity. In just four years (2018-22) it grew its revenue 2.4x (24% CAGR). It is not cheap on headline numbers (2.4x EV/Sales and 100x P/E based on consensus estimates for 2024). However, if it can reach more customers by proving to them its value, its earnings can rise dramatically quite quickly. Valuation could look cheap already in 2025 if it decides to slow down its growth and focus on margins.

The company was founded in 2007 by then-25-year-old Peter Holten Muhlman in his parent’s garage. I am sure you have seen the Trustpilot logo in various ads or product reviews. I personally left a few reviews myself.

The company was founded in 2007 by then-25-year-old Peter Holten Muhlman in his parent’s garage. I am sure you have seen the Trustpilot logo in various ads or product reviews. I personally left a few reviews myself.

Trustpilot's business model

The company’s goal is to help consumers make confident, informed decisions while allowing businesses to fill the trust gap and gain insights to improve their services. It reminds me of one of those rare 'triple-win' businesses when all parties win if the product gets better. For example, the more consumers leave reviews, the more informative these reviews become, benefiting new consumers. Businesses benefit from rising product awareness, trust and insights, which encourages them to invite more consumers to leave reviews. As the product grows, other stakeholders (employees and shareholders) benefit from improving financial performance.

Most traditional business models face a tradeoff when making customers happy implies selling products below market prices, punishing employees and shareholders.

The beauty of this flywheel business model is that it is fairly capital-light as a lot of efforts to grow the business are carried out by business customers or consumers. Moreover, it creates strong network effects, which act as barriers to entry for new players.

The company runs a subscription-based business model where businesses pay a monthly fee to collect reviews and gain access to additional insights. In 2022, Trustpilot achieved a 100% retention rate with an average contract value of $6k.

Most traditional business models face a tradeoff when making customers happy implies selling products below market prices, punishing employees and shareholders.

The beauty of this flywheel business model is that it is fairly capital-light as a lot of efforts to grow the business are carried out by business customers or consumers. Moreover, it creates strong network effects, which act as barriers to entry for new players.

The company runs a subscription-based business model where businesses pay a monthly fee to collect reviews and gain access to additional insights. In 2022, Trustpilot achieved a 100% retention rate with an average contract value of $6k.

Source: Trustpilot Investor Presenatation

How big is the business?

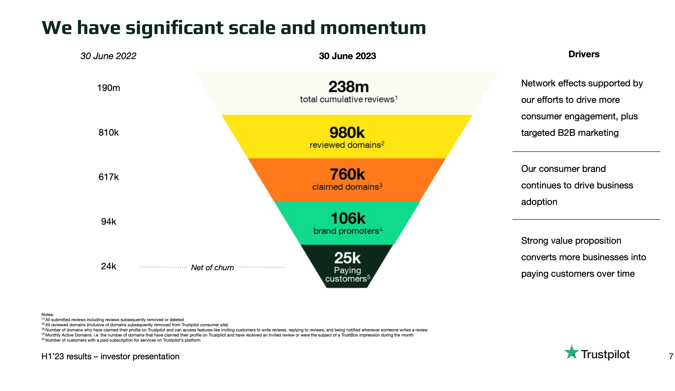

By the end of June 2023, Trustpilot had exceeded 238.4 million total cumulative reviews (+ 25% YoY), with an average of 52.4 million monthly unique users and close to 9.3 million consumers leaving their first review on Trustpilot in the period. The company had 980 thousand reviewed web domains (+21%) and 106 thousand monthly active businesses on the Trustpilot platform (+13%). Of these businesses, 25 thousand are paying customers, subscribing to Trustpilot’s software tools to collect, manage and get insights from reviews – a net increase of 4% YoY (after churn).

During the first half of the year, the business customers sent 368.2 million review invitations (H1’22: 317.6 million), an average of 61.4 million per month (H1’22: 53 million). TrustBox had achieved 9 billion monthly impressions (+15% YoY to an annualised run-rate of 112 billion).

During the first half of the year, the business customers sent 368.2 million review invitations (H1’22: 317.6 million), an average of 61.4 million per month (H1’22: 53 million). TrustBox had achieved 9 billion monthly impressions (+15% YoY to an annualised run-rate of 112 billion).

Source: Trustpilot Investor Presenatation

On 5 October, Trustpilot announced the launch of reviews for Salesforce on Salesforce AppExchange. The latter is an enterprise cloud marketplace that connects customers to ready-to-install or customisable apps and Salesforce-certified consultants. Businesses in the UK and the US will benefit from every customer interaction by initiating automatic review invitations and generating feedback responses. This, in turn, should enable businesses to better spot areas of high performance as well as those that need improvement.

Financials and valuation

The business was listed in March 2021 at 265p. In just six months, the stock surged to 460p. Since then, it has been on a downhill falling to 60p in September 2022 and almost touching this level again in summer 2023. Trustpilot was banking with SVB, so it suffered earlier this year when SVB was bailed out with HSBC taking over the UK operations of the bank. There was no obvious impact from the SVB collapse on Trustpilot. The same month, its founder announced his decision to leave the CEO position to remain as a non-executive director. He committed to continue working closely with the business focusing on its brand and leadership in transparency and trust.

Trustpilot is hardly a bargain using traditional valuation metrics. It barely makes any profit. However, over half of its revenue is still going into growth expenditure, which would be treated as capex and reported in cash flows from investments for a traditional business. Trustpilot expenses practically all of its IT, marketing and admin costs. Importantly, the share of these costs as a percentage of sales has been constantly declining.

The gross margin of Trustpilot was 82% in H1 ’23.

I think the underlying profitability of the company (excluding growth investments) could be over $50mn (9.6x EV/EBIT) if management decided to stop growing. More exciting is how far the business can grow and what it can earn in the medium term.

Another important point is that Trustpilot often receives the full contract payment while it books revenue over the life of the contract. In other words, reported revenue (and profits) is lower than the cash received in a period. In some way, the business gets free funding from its customers (similarly to a float at insurance companies).

The company has been growing close to 20%, but assuming a 15% sales growth for the next 5 years, its annual recurring revenue can double to $360mn. Assuming a 25% operating margin, Trustpilot could be earning $90mn. This would put the company on just 5.3x EV/EBIT.

My return could be around 15% (annualised) if the company trades at 10.6x EV/EBIT. There is a risk of dilution as part of management compensation is paid via shares.

The gross margin of Trustpilot was 82% in H1 ’23.

I think the underlying profitability of the company (excluding growth investments) could be over $50mn (9.6x EV/EBIT) if management decided to stop growing. More exciting is how far the business can grow and what it can earn in the medium term.

Another important point is that Trustpilot often receives the full contract payment while it books revenue over the life of the contract. In other words, reported revenue (and profits) is lower than the cash received in a period. In some way, the business gets free funding from its customers (similarly to a float at insurance companies).

The company has been growing close to 20%, but assuming a 15% sales growth for the next 5 years, its annual recurring revenue can double to $360mn. Assuming a 25% operating margin, Trustpilot could be earning $90mn. This would put the company on just 5.3x EV/EBIT.

My return could be around 15% (annualised) if the company trades at 10.6x EV/EBIT. There is a risk of dilution as part of management compensation is paid via shares.

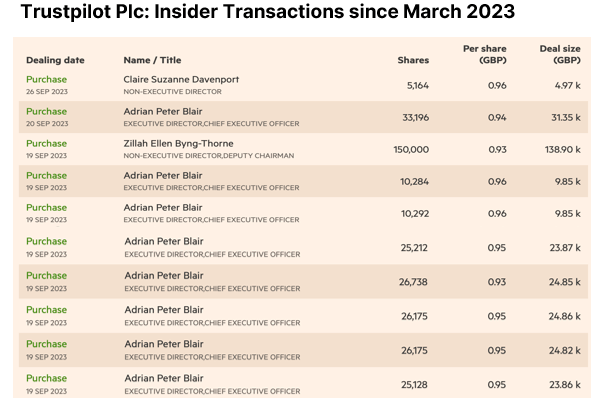

Insider ownership

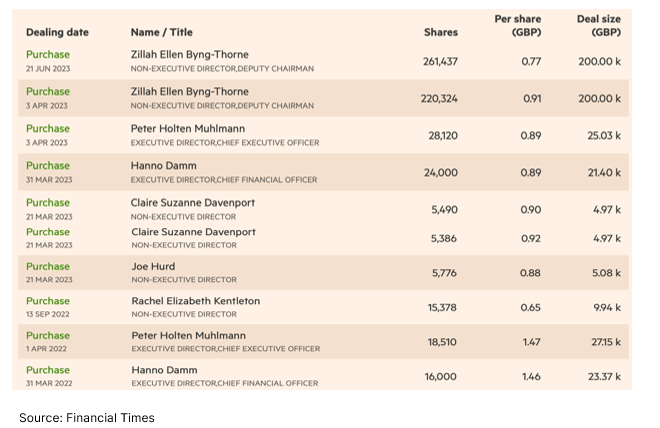

The founder, Peter Holten Muhlmann, holds c. 5% in the company. Two private equity funds, Vitruvian Partners and Northzone Ventures, that funded the business at the early stage, hold 9% and 4%, respectively.

Executives and directors have been actively buying shares on the market (see the table below).

Executives and directors have been actively buying shares on the market (see the table below).

Issues

Some of the issues that I am not fully comfortable with:

- It is predominantly a UK/EU brand, while the digital world is pretty global. There are examples of successful local internet businesses, but gaining large scale for a national player is definitely harder.

- If I run an established business, I do not need Trustpilot to verify the quality of my product. So Trustpilot’s customers are less-known startups. This is a much more cyclical segment. The number of startups is highly dependent on the economic cycle and available funding.

- It is a fairly competitive industry, with Google reviews being the most obvious alternative, although I find Google reviews more relevant for cafes and restaurants (businesses with physical presence) rather than products. But there are many more alternatives, including Amazon reviews. Here in the UK, I occasionally use Which? or Uswitch, although they are more focused on contract-based services such as insurance, broadband, utilities and so on.

- Trustpilot reminds me a little of TripAdvisor. The latter had a great concept with strong network effects, user-generated content and a growing customer base. However, it has always struggled to be profitable. Its current market cap is just $2.2bn.

- The growth of paying customers decreased to just 4% in H1 ’23 compared to 9% in 2022. The first half was influenced by macro concerns and declining funding for startups, so this could be a temporary slowdown.

- With barely any profits earned, it would take a few years for Trustpilot’s valuation to achieve a more reasonable level.

Zoo Digital Group