13 August 2023

I plan to do more work before pulling the trigger.

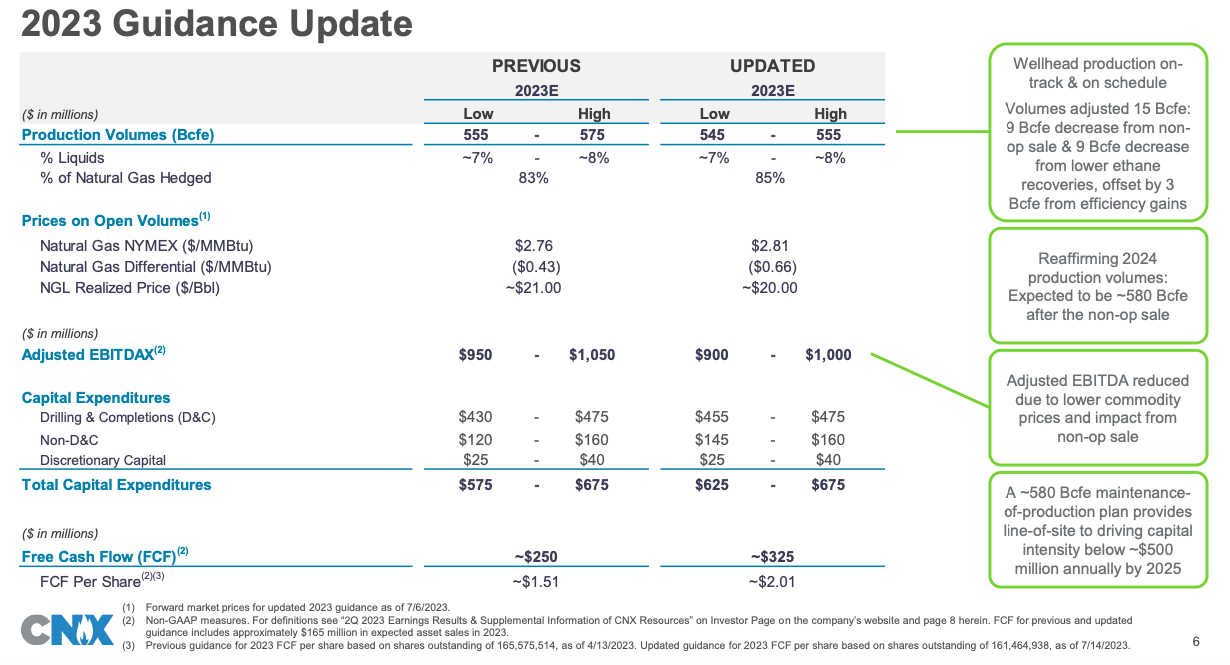

Earlier this year, I wrote about my concerns about CNX’s production and rising capex. I took some profits, trimming my position above $16. It is incredible that even though production turned out to be lower and capex higher, the stock has done quite well. What had been priced in before and what the market is expecting now is, of course, more important than what has happened.

Earlier this year, I wrote about my concerns about CNX’s production and rising capex. I took some profits, trimming my position above $16. It is incredible that even though production turned out to be lower and capex higher, the stock has done quite well. What had been priced in before and what the market is expecting now is, of course, more important than what has happened.

Source: CNX Investor Presentation

Source: Google Finance

I am not sure how many market participants are digging deep enough here. Astonishingly, out of the $224mn of FCF that the company reported for H1 ’23, $155mn was a positive contribution from Working Capital, and a further $142mn were the proceeds from asset sales! Adjusted for those two non-recurring items, FCF was actually negative at $(73)mn.

The company’s $325mn FCF guidance for FY23 ($2/share) includes $165mn of expected asset sales during the year. Even if production rises in 2024 to about 580bcf (+5%) and capex drops to the maintenance level of $500mn (-23%) in 2025, the company would need materially higher gas prices to generate an attractive FCF. At $3/mmbtu spot gas prices and $20/bl NGL, the company would generate $2.2/share FCF (c. 10% yield), based on my estimates.

DISCLAIMER: This publication is not investment advice. The primary purpose of this publication is to inform and educate readers about the stock market. Readers should do their own research before making decisions and always consult with professional advisors. Information provided here may have become outdated by the time you read it. All content in this document is subject to the copyright of Hidden Value Gems. Please read the full version of the Disclaimer here.