19 November 2023

Ridiculously cheap

Alibaba’s shares are down 75% from their 2020 highs. It is ridiculously cheap. Since 2015, its earnings have more than tripled, while the share price has been flat.

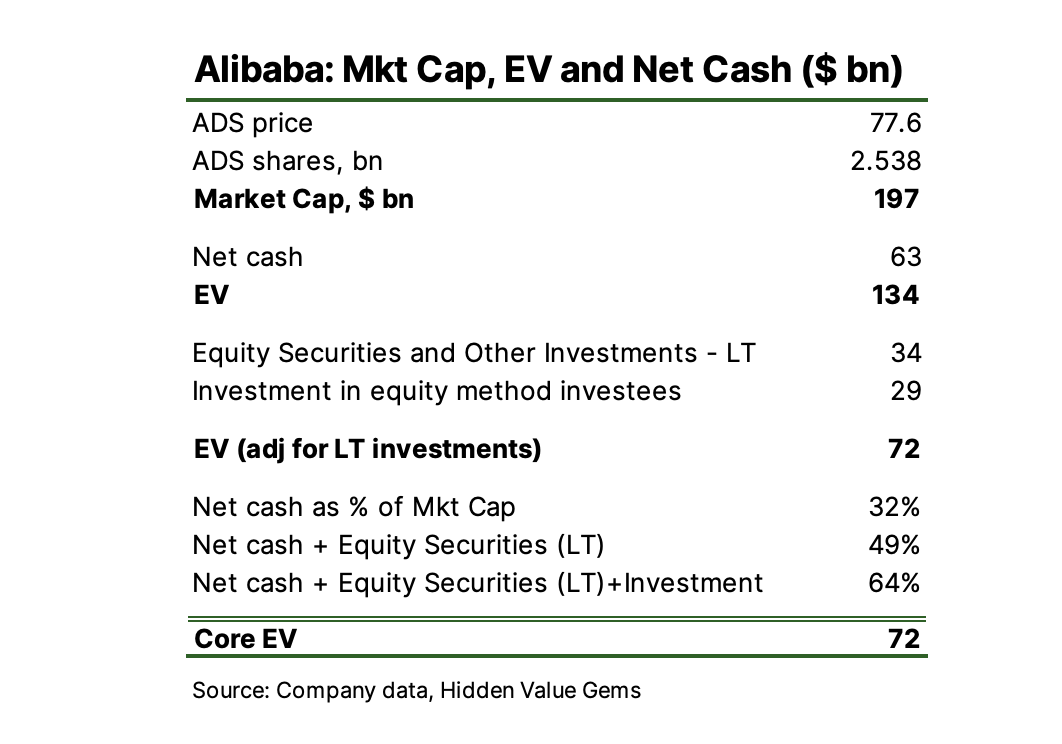

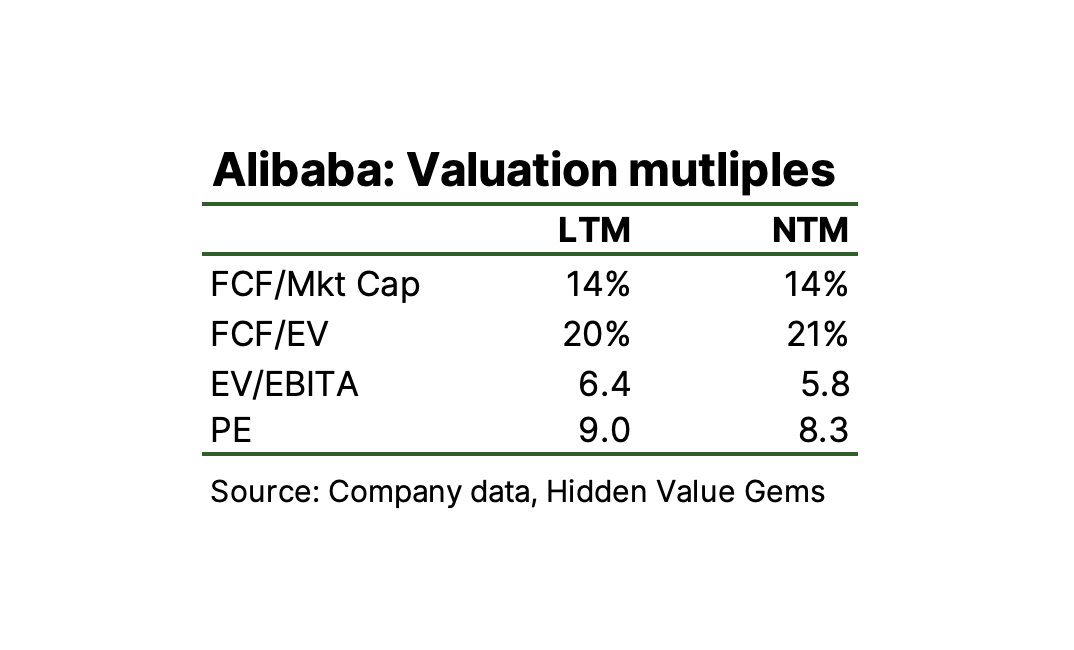

It is trading at 9x trailing P/E (based on the last 12 months adjusted earnings). The company adds back share-based compensation expenses to its earnings(small cheating, which is unfortunately widely common), but even if we reduce earnings for the amount of those expenses (c. $3bn), earnings multiple would still be quite low - around 10x.

Even more importantly, the company sits on a $63bn net cash position (32% of Alibaba’s market capitalisation). Alibaba has a diverse portfolio of equity investments in listed securities (with a market value of $34bn) and minority stakes in private companies ($29bn). Its c. 30% interest in Ant Financial is the main holding in the private segment.

Taken together, net cash and investments have a value of $125bn compared to Alibaba’s market cap of $197nbn. Put differently, 64% of the company’s market value is in cash and investments. The other 36% ($72bn) is the implied value of the core business, which is still the largest e-commerce platform in China, fast-growing international commerce, Logistics, Cloud, and Digital Media.

Even more importantly, the company sits on a $63bn net cash position (32% of Alibaba’s market capitalisation). Alibaba has a diverse portfolio of equity investments in listed securities (with a market value of $34bn) and minority stakes in private companies ($29bn). Its c. 30% interest in Ant Financial is the main holding in the private segment.

Taken together, net cash and investments have a value of $125bn compared to Alibaba’s market cap of $197nbn. Put differently, 64% of the company’s market value is in cash and investments. The other 36% ($72bn) is the implied value of the core business, which is still the largest e-commerce platform in China, fast-growing international commerce, Logistics, Cloud, and Digital Media.

Why this could be the case?

How can such a well-known, liquid stock cannot be so completely overlooked by the market? Surely, I am not the only one who can calculate valuation multiples.

Here are some obvious explanations I thought about:

Here are some obvious explanations I thought about:

- Market saturation. The e-commerce share reached 30% of Chinese retail, above the US and Europe. While Amazon may be facing a similar issue, it has arguably more potential to grow other segments like AWS, Media, and International markets. Alibaba could face more issues expanding in other segments due to a more stringent regulatory regime in China. Its International operations are probably the only segment capable of gaining scale.

- China’s economy. There are deeper issues with China’s economy than previously thought, including hidden leverage, population decline, export restrictions and the most important of them - moving away from pragmatism to ideologising the economy through heavier state interference in private industries.

- Geopolitics, US-China, Taiwan. This is self-explanatory.

- Sum-of-the-parts (SOTP) valuation appears to be no longer relevant. Even if cancelling the IPO of Cloud is just a one-off issue, weak market conditions may prevent listing other businesses on favourable terms.

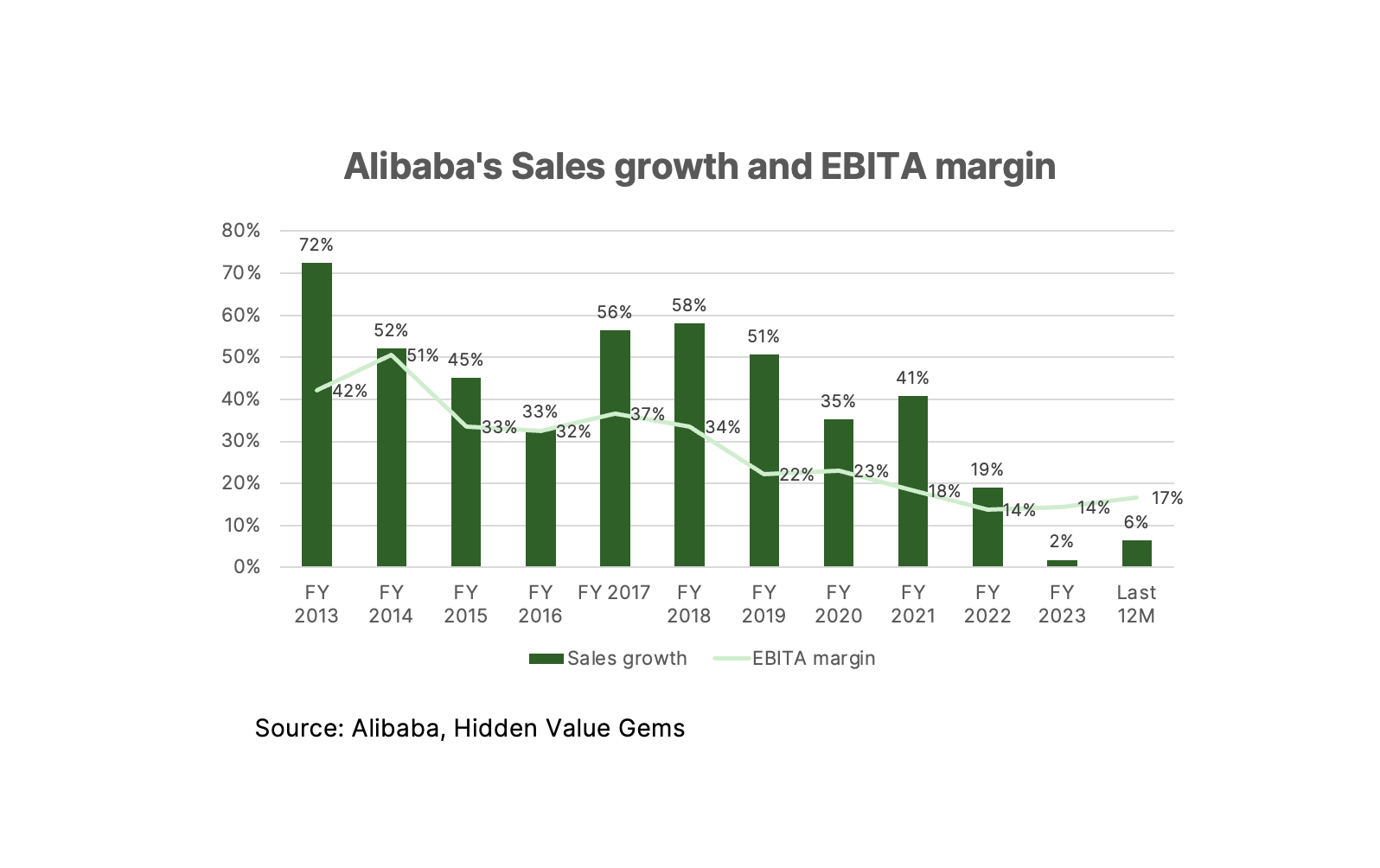

- Stronger competition. This issue has been widely covered, but it is still important. Not only did Alibaba lose some market share in the past two years, mostly to PDD and Douyin, but it also had to reduce its commissions for merchants and offer other incentives to remain competitive. The company had to increase investments to adjust its business model. All this affected sales and profit margins.

- VIE structure. This has been an argument since the first day of listing, but it has become more relevant now. Neither holders of shares nor of ADS own the underlying Chinese operations; they just own a piece of a Cayman company which has contractual arrangements with VIEs registered in China that are owned or controlled by China’s citizens.

- Growth vs Margins. In hindsight, a potential mistake investors made was to look at Alibaba’s growth in aggregate while estimating its profitability at a segment level. What I mean here is that Alibaba was able to report strong double-digit revenue growth even after its core e-commerce segment ran out of steam. The reason has been strong growth in new segments, particularly Cloud and new format retail. However, all the new segments were deep in the losses. Investors preferred to look through this, assuming the losses were temporary. So, the stock benefited from a more generous sum-of-the-parts valuation and a high total growth factored into a consolidated P/E multiple.

- SoTP vs Consolidated multiple. With Cloud IPO cancelled, I think the SoTP valuation approach has become much less relevant. I also question how much value Alibaba’s businesses outside of traditional e-commerce can generate independently. My sense is that their operations are highly intertwined, and in some cases, other segments support the core e-commerce, making it more attractive for merchants and consumers.

Most of those issues have been known for a long time. However, geopolitical risks have been constantly growing and are the most serious issue to my mind. They may explain the bulk of the current discount. They don’t explain a sharp fall this week, though. Besides, most of these risks have so far been beyond management’s control.

Does the current price compensate for the geopolitical risks? I don’t think there is a scientific answer to that. I tend to think yes, since, unlike Russia, China is the second-largest economy and has been more rational historically. But I am not an expert in this and view these risks as very high.

Further observations

There are additional issues which make me more uncomfortable.

Share sale by Jack Ma

Jack Ma’s funds announced a plan to sell 10 million ADS (c. $776mn) from 21 November. Ma later added through his controlled South China Morning Post (SCMP) newspaper that the phased sale was part of a long-standing and long-term “preset conditional plan to do a partial sell-down for the future that was adopted in August and it won’t lead to any reduction of [Ma’s] holding of shares for now”. The statement from the Ma’s office, quoted by the SCMP, also said, “We believe the current stock price is far below its fair value.”

The stake planned for sale represents 11.8% of Ma’s total holding in the company (which was 3.3% at the end of 2021, the latest available filing).

Even if Ma doesn’t sell shares immediately, I still prefer companies where insiders increase stakes and founders remain highly involved in the business.

The stake planned for sale represents 11.8% of Ma’s total holding in the company (which was 3.3% at the end of 2021, the latest available filing).

Even if Ma doesn’t sell shares immediately, I still prefer companies where insiders increase stakes and founders remain highly involved in the business.

Constant management changes

The company replaced its CEO, CFO and heads of business units several times, which is not a good sign from my experience.

A new pivot to AI creates risks to margins and cash flows

The new focus for Alibaba is technology and specifically AI, away from the Internet. I cannot see how this would not lead to more investments. Perhaps, the overall increase will not be material as the company can continue cutting investments in other non-core businesses. But even more importantly, success is not guaranteed. AI remains a highly competitive area. It will most likely be heavily influenced by the state.

Before, my original view was that Alibaba was a leading e-commerce platform that faced a short-term hiccup, while the scandal with Jack Ma would not lead to a company’s collapse (it was not a ‘Yukos’ case). Now, I am a shareholder in a company that plans to make a big bet on technology and AI over the next decade, in a country with more signs that the government’s policies undermine the traditional market economy.

Before, my original view was that Alibaba was a leading e-commerce platform that faced a short-term hiccup, while the scandal with Jack Ma would not lead to a company’s collapse (it was not a ‘Yukos’ case). Now, I am a shareholder in a company that plans to make a big bet on technology and AI over the next decade, in a country with more signs that the government’s policies undermine the traditional market economy.

Accounting inconsistency

I noticed that the total sales for the quarter ending in September ’22 have been reported lower in the latest accounts compared to last year. The company has not clearly explained it. As a result, its sales growth may look stronger on a YoY basis. I have not noticed revisions to past operating earnings or balance sheet items, but EPS numbers were still different in a couple of cases in the latest accounts compared to last year.

Buyback is offset by new share issue

This is not unique to Alibaba, but the multi-billion buyback has not had a significant impact on the company’s share count reduction. The issue is share-based compensation, which dilutes existing shareholders. Since March 2021, the company has spent $28.2bn on share repurchases, buying 258.6mn of shares from the market. However, its share count has declined by 175mn only (6.5% net reduction in the share count). The reason is constant dilution. The company issued 84mn new ADS offsetting about 22% of the buyback in the same period.

If the net cash is real, I expect the buyback to be more material

In general, in light of the share price weakness and a strong net cash position, I struggle to understand why Alibaba is not spending more on buybacks. Either it plans more spending on AI, or some cash is not easily available; maybe it is required for regulatory purposes. I have not been able to identify where exactly the company’s cash is held, but it is plausible that given Alibaba’s equity interest in Ant Financial, some of its cash can be held in entities linked to that financial company. It is possible that not all of this cash can be distributed to shareholders. If the buyback is not increased in the current quarter, I would be quite worried.

Inconsistent communication regarding Cloud

An optimist may argue that at the current valuation, cancelling the IPO of the Cloud business is not a big deal. “It is not in the price, anyway.” Probably, that is a correct statement.

But what I am more concerned with is the inconsistent communication. On the same call this week, management spoke about the growth potential of its Cloud / Technology business and, at the same time, referred to US restrictions as hindering future growth. “We believe that these new restrictions may materially and adversely affect Cloud Intelligence Group’s ability to offer products and services and to perform under existing contracts, thereby negatively affecting our results of operations and financial condition. These new restrictions may also affect our businesses more generally by limiting our ability to upgrade our technological capabilities.”

Management has not provided the details on how the restrictions could affect its Cloud business and what it was planning to do about it.

From my experience, changes in communication, inconsistencies, lack of clear explanation - are all signs that something is not right in the company.

But what I am more concerned with is the inconsistent communication. On the same call this week, management spoke about the growth potential of its Cloud / Technology business and, at the same time, referred to US restrictions as hindering future growth. “We believe that these new restrictions may materially and adversely affect Cloud Intelligence Group’s ability to offer products and services and to perform under existing contracts, thereby negatively affecting our results of operations and financial condition. These new restrictions may also affect our businesses more generally by limiting our ability to upgrade our technological capabilities.”

Management has not provided the details on how the restrictions could affect its Cloud business and what it was planning to do about it.

From my experience, changes in communication, inconsistencies, lack of clear explanation - are all signs that something is not right in the company.

I could find more issues to add to the list. The critical question is whether the price discounts all of this already. There are two sides to the argument.

The more traditional value group would point out that genuine bargains are found in situations where everyone is pessimistic, it is uncomfortable to own a particular stock and it is embarrassing to talk about it at a cocktail party. The study I like to refer to has identified the best investors who either sell immediately or add on weakness.

I used to be in the first group, but I have adjusted my approach since. Investing is more art than science. There is no single winning algorithm. Price is an important factor, but not the only one. I wrote before that a successful investment should have a combination of a 1) great product, 2) strong business economics (growth, margins and ROIC), 3) low leverage, 4) management with skin in the game, and 5) an attractive price.

Another key element is conviction, which comes from knowing a company and an industry ‘inside out’, more than an average investor.

Having an edge is almost impossible in a liquid and well-covered stock like Alibaba. Emotional edge (patience, long-term thinking) pays off when a company’s product remains strong, and its management continues to have faith in the company. Those two points are less evident in the case of Alibaba. Insiders are not buying its stock. The founder is less involved and plans to reduce his stake further, while the competitive advantage of its product has eroded.

The more traditional value group would point out that genuine bargains are found in situations where everyone is pessimistic, it is uncomfortable to own a particular stock and it is embarrassing to talk about it at a cocktail party. The study I like to refer to has identified the best investors who either sell immediately or add on weakness.

I used to be in the first group, but I have adjusted my approach since. Investing is more art than science. There is no single winning algorithm. Price is an important factor, but not the only one. I wrote before that a successful investment should have a combination of a 1) great product, 2) strong business economics (growth, margins and ROIC), 3) low leverage, 4) management with skin in the game, and 5) an attractive price.

Another key element is conviction, which comes from knowing a company and an industry ‘inside out’, more than an average investor.

Having an edge is almost impossible in a liquid and well-covered stock like Alibaba. Emotional edge (patience, long-term thinking) pays off when a company’s product remains strong, and its management continues to have faith in the company. Those two points are less evident in the case of Alibaba. Insiders are not buying its stock. The founder is less involved and plans to reduce his stake further, while the competitive advantage of its product has eroded.

Can it be the Meta (Facebook) moment?

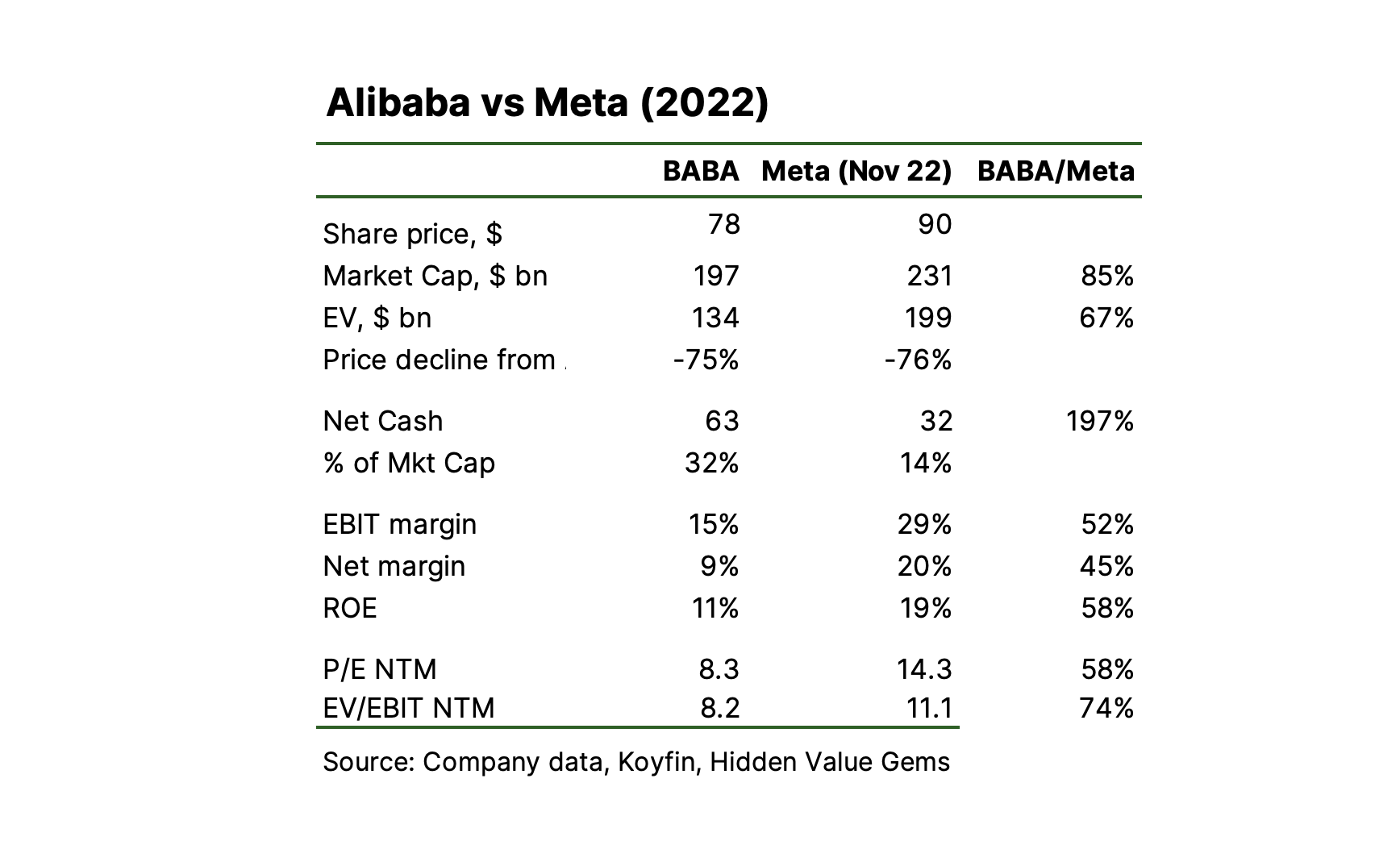

I saw a few comments on Twitter/X that almost exactly a year ago, Meta (Facebook) was in a similar situation.

I put together key metrics for Alibaba today and Meta in November 2022. Indeed, both companies saw almost the same collapse in stock prices (75-76% from all-time highs). Alibaba today is cheaper than Meta in absolute and relative terms, having a higher cash pile. Its margins and return on equity are lower, however.

I put together key metrics for Alibaba today and Meta in November 2022. Indeed, both companies saw almost the same collapse in stock prices (75-76% from all-time highs). Alibaba today is cheaper than Meta in absolute and relative terms, having a higher cash pile. Its margins and return on equity are lower, however.

But there are some more significant differences:

While there are many similarities, I think the level of uncertainty is higher at Alibaba.

- Meta is based in the US

- Investors own a piece of the underlying assets, not an interest in a Cayman entity

- The founder, Mark Zuckerberg, remains the largest shareholder and did not announce plans to sell his shares

- Meta did not have such a high turnover of executives

- In hindsight, Meta’s problems had an easy fix through scaled-down investments into the Metaverse. Alibaba, on the other hand, has to keep investing in its core platform and, on top of that, is planning a new pivot to Technology & AI

While there are many similarities, I think the level of uncertainty is higher at Alibaba.

‘Good’ and ‘Bad’ Reasons for selling and holding a stock

I have seen completely opposite views on Alibaba. Quite often, it is not just pure financial analysis that leads to the best investment decision, but the ability to make a judgement in an uncertain world and adjust your views based on the new incremental information.

I just want to remind my readers of some ‘bad’ reasons to hold onto a stock. I like to go through that list each time I have to make a decision.

I just want to remind my readers of some ‘bad’ reasons to hold onto a stock. I like to go through that list each time I have to make a decision.

‘Bad’ reasons to hold onto a stock

- Sunk cost. ‘I have spent so much time and effort studying this company; selling it now would mean that I wasted so much time’

- Ego (expert curse). For many people, it is more important to be (and appear) right than to win or lose money. Experts, in particular, will do everything to defend their views. As a result, they seek information that confirms their thesis, refute counter-arguments, do not engage with people who hold different views

- Loss aversion. Daniel Kahneman has shown that a loss has roughly twice as big an impact on our emotions as a win. Since we fear losses much more than we enjoy gains, we defer selling. An unrealised loss is not a real loss until you sell a stock, there is always a chance it comes back.

- Fear of looking inconsistent. There is a social value in being consistent. People trust those who stick to their opinions through thin and thick.

‘Good’ reasons to sell

From my experience, it is not bad to sell a stock in three situations:

Its price has gone too far. There is no precise formula here, but if you bought a stock at 15x P/E, its earnings continued to grow at 10-15% a year, but the stock went up 300% in just two years, then it is probably time to take profits.

The thesis has changed. For example, a company is not a market leader any more. You lost faith in management. You learned something new about potential risks. Regulation changed the situation entirely.

There are more attractive opportunities. There is an opportunity cost to holding a specific stock. If you come across an alternative business that is in a stronger position, growing faster, has higher insider ownership and is attractively priced, you may need to sell one of your positions to purchase this new business.

‘Would I buy the stock today?’ test. Many people prefer to defend their existing holdings but do not want to buy them with ‘fresh’ money at the same prices.

Its price has gone too far. There is no precise formula here, but if you bought a stock at 15x P/E, its earnings continued to grow at 10-15% a year, but the stock went up 300% in just two years, then it is probably time to take profits.

The thesis has changed. For example, a company is not a market leader any more. You lost faith in management. You learned something new about potential risks. Regulation changed the situation entirely.

There are more attractive opportunities. There is an opportunity cost to holding a specific stock. If you come across an alternative business that is in a stronger position, growing faster, has higher insider ownership and is attractively priced, you may need to sell one of your positions to purchase this new business.

‘Would I buy the stock today?’ test. Many people prefer to defend their existing holdings but do not want to buy them with ‘fresh’ money at the same prices.

Conclusions

- Alibaba is priced fantastically attractive, especially considering its cash and investments.

- However, this is widely known, and there are reasons why the market may be discounting the stock.

- Emotional edge (willingness to hold a stock longer despite short-term pain) works in situations when a company’s underlying business remains in good shape.

- In the case of Alibaba, there are signs that stronger competition and adverse regulations have eroded its competitive advantage.

- Insiders are not buying the stock.

- Price is an important but the only factor in deciding whether to buy or sell a stock.

In my portfolio, I reduced my position in Alibaba because of these factors. I view it as a more speculative, deep-value opportunity rather than a high-quality compounder.

In deep value situations, it is the method that works over the long term (buying various highly discounted stocks and selling when they reach higher prices). It is not a bet on a single business like in the case of ‘great’ companies with plenty of reinvestment opportunities and are led by founders with ‘skin in the game’.

I also think that Alibaba will unlikely go under or disappear, as some pessimists are forecasting. Its value will likely rise in the future. However, the potential returns may not be as high as in the case of my other positions. I think there are other more interesting options based on the risk/reward profile. If Alibaba doubles in 10 years, that is only a 7.2% annual return, while US government bonds offer close to 5% now.

I do not have a crystal ball. But I learnt that one can learn a lot by communicating with other investors. We will all benefit from the discussion here. So I welcome your comments, different points of view, questions and anything else you have to say in the discussion section below.

Thank you for reading this article.