24 September 2023

Part I. Follow up on Volkswagen

I was planning to come to the final conclusion on VW this week. Namely, should I add to my small (c. 1%) position or just sell it? Unfortunately, I went deeper and farther into the rabbit hole. Along the way, I started to think that VW was a good example of the illusion of knowledge when more information makes you more confident. As many of my German readers would know, the company holds about 10 investor days every year, accompanied by 100-page slide decks, in addition to detailed quarterly statements and conference calls. The data is so granular that you can track operating profit per key model every year and build spreadsheets with hundreds, if not thousands, of rows.

Another thought that occurred to me as I was researching VW was that value investors are often inconsistent.

On the one hand, we (value investors) praise our long-term time horizon and often critique those who cannot see beyond the next 6 months. In this case, buying VW because it is “optically” cheap is akin to speculation when you focus only on short-term factors such as a low P/E and a high dividend yield.

On the other hand, if you are ready to own VW shares over many years until the market realises its value, you should be confident that the business will successfully transform itself to fit the new EV reality. Time is running out for ICE models. Making a call on whether VW will be successful in its transition is an industry call, not a valuation exercise. And it may not even be possible to have a high conviction call for an auto sector professional since he knows a lot about the past technology while the future will be very different.

I have tried to study various reviews of incumbents’ success rates at adapting to new technologies and have not found anything yet with a definitive conclusion.

Another thought that occurred to me as I was researching VW was that value investors are often inconsistent.

On the one hand, we (value investors) praise our long-term time horizon and often critique those who cannot see beyond the next 6 months. In this case, buying VW because it is “optically” cheap is akin to speculation when you focus only on short-term factors such as a low P/E and a high dividend yield.

On the other hand, if you are ready to own VW shares over many years until the market realises its value, you should be confident that the business will successfully transform itself to fit the new EV reality. Time is running out for ICE models. Making a call on whether VW will be successful in its transition is an industry call, not a valuation exercise. And it may not even be possible to have a high conviction call for an auto sector professional since he knows a lot about the past technology while the future will be very different.

I have tried to study various reviews of incumbents’ success rates at adapting to new technologies and have not found anything yet with a definitive conclusion.

Is VW really cheap?

Two issues made me concerned and delayed my work. The first issue is a big disconnect between strong FCF generation in the Automotive segment and Group FCF. The second issue is that VW is not cheap in the worst-case scenario.

Let me explain both issues in a bit more detail.

I will start with the second one.

My initial view was that there were two distinct types of investors within the same VW group. Those with a long-term perspective were willing to pay 16.6x forward P/E multiple for a great business such as Porsche AG. However, due to fear and lack of patience, another group of investors were not ready to pay much more than 3.7x P/E for the parent of Porshe AG, VW Group, which holds 75% economic interest in Porsche AG.

I wondered why the first group did not want to pay a 78% lower multiple to own the same Porsche AG business through VW shares. Okay, the whole package may not be as attractive as Porsche AG alone, but so what? Even if the legacy, non-Porsche brands eventually disappear - would it matter since you buying Porsche shares at a a fraction of its stand-alone price? And there is a good chance a few of the brands may survive. Audi, Bentley, and Lamborghini are all part of VW’s portfolio.

So to prove this idea, I decided to separate the VW Automotive segment into Porsche AG and non-Porsche business and see what non-Porsche business would look like if Porsche AG delivers, while VW Group as a whole doesn’t improve. Strong performance is something the market expects from Porsche AG based on its valuation, while VW Group prices are in no growth and no real improvement.

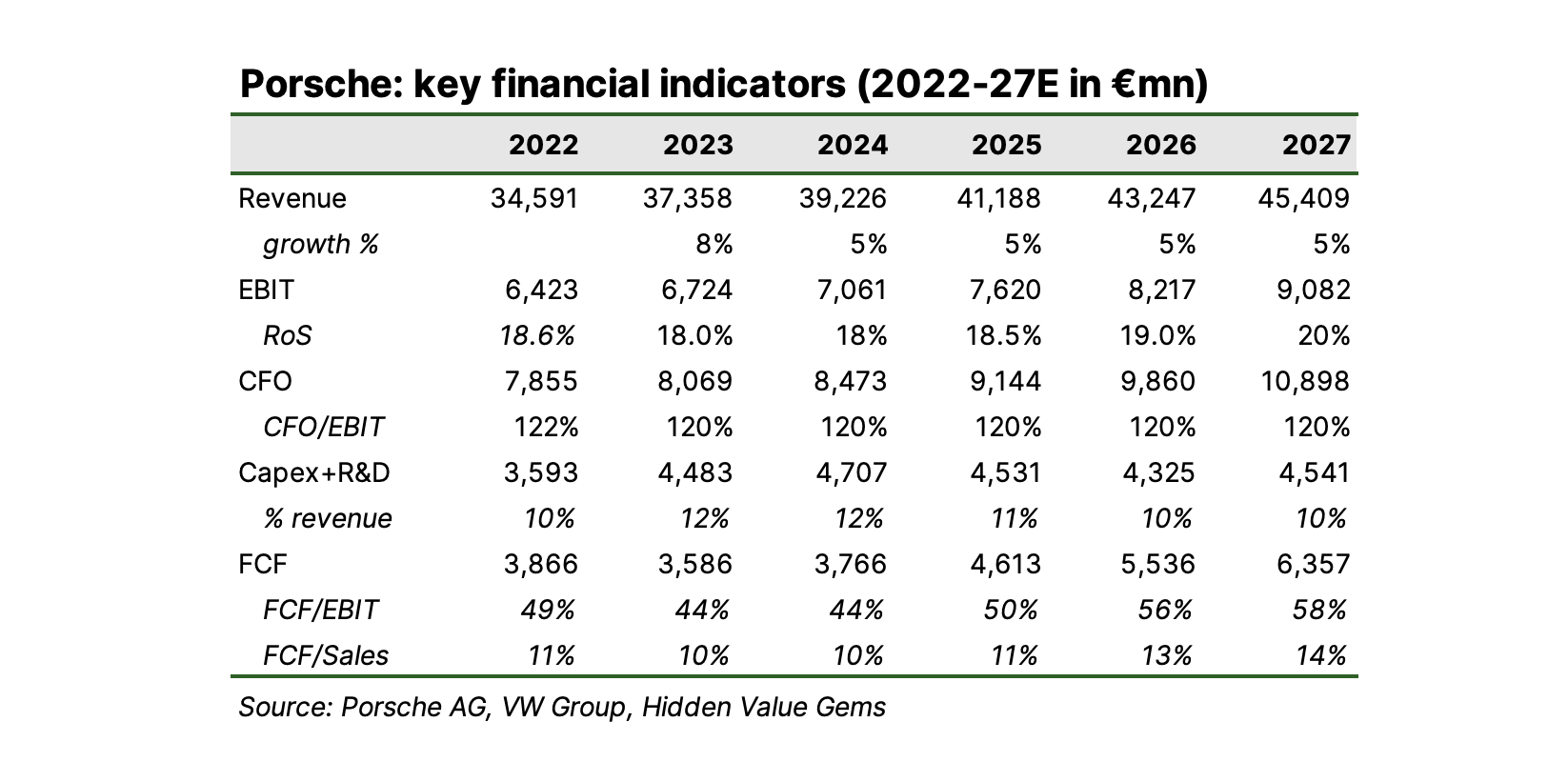

Here is a preliminary set of financial indicators for Porsche AG. I am not making exact forecasts, rather take management’s latest guidance for 2027 and beyond and apply it to other years. These are fairly simple assumptions: top-line growth rate of 5% (GDP + 2-3% inflation) and a small improvement in the operating margin to 20% from 17-19% expected in 2023.

Let me explain both issues in a bit more detail.

I will start with the second one.

My initial view was that there were two distinct types of investors within the same VW group. Those with a long-term perspective were willing to pay 16.6x forward P/E multiple for a great business such as Porsche AG. However, due to fear and lack of patience, another group of investors were not ready to pay much more than 3.7x P/E for the parent of Porshe AG, VW Group, which holds 75% economic interest in Porsche AG.

I wondered why the first group did not want to pay a 78% lower multiple to own the same Porsche AG business through VW shares. Okay, the whole package may not be as attractive as Porsche AG alone, but so what? Even if the legacy, non-Porsche brands eventually disappear - would it matter since you buying Porsche shares at a a fraction of its stand-alone price? And there is a good chance a few of the brands may survive. Audi, Bentley, and Lamborghini are all part of VW’s portfolio.

So to prove this idea, I decided to separate the VW Automotive segment into Porsche AG and non-Porsche business and see what non-Porsche business would look like if Porsche AG delivers, while VW Group as a whole doesn’t improve. Strong performance is something the market expects from Porsche AG based on its valuation, while VW Group prices are in no growth and no real improvement.

Here is a preliminary set of financial indicators for Porsche AG. I am not making exact forecasts, rather take management’s latest guidance for 2027 and beyond and apply it to other years. These are fairly simple assumptions: top-line growth rate of 5% (GDP + 2-3% inflation) and a small improvement in the operating margin to 20% from 17-19% expected in 2023.

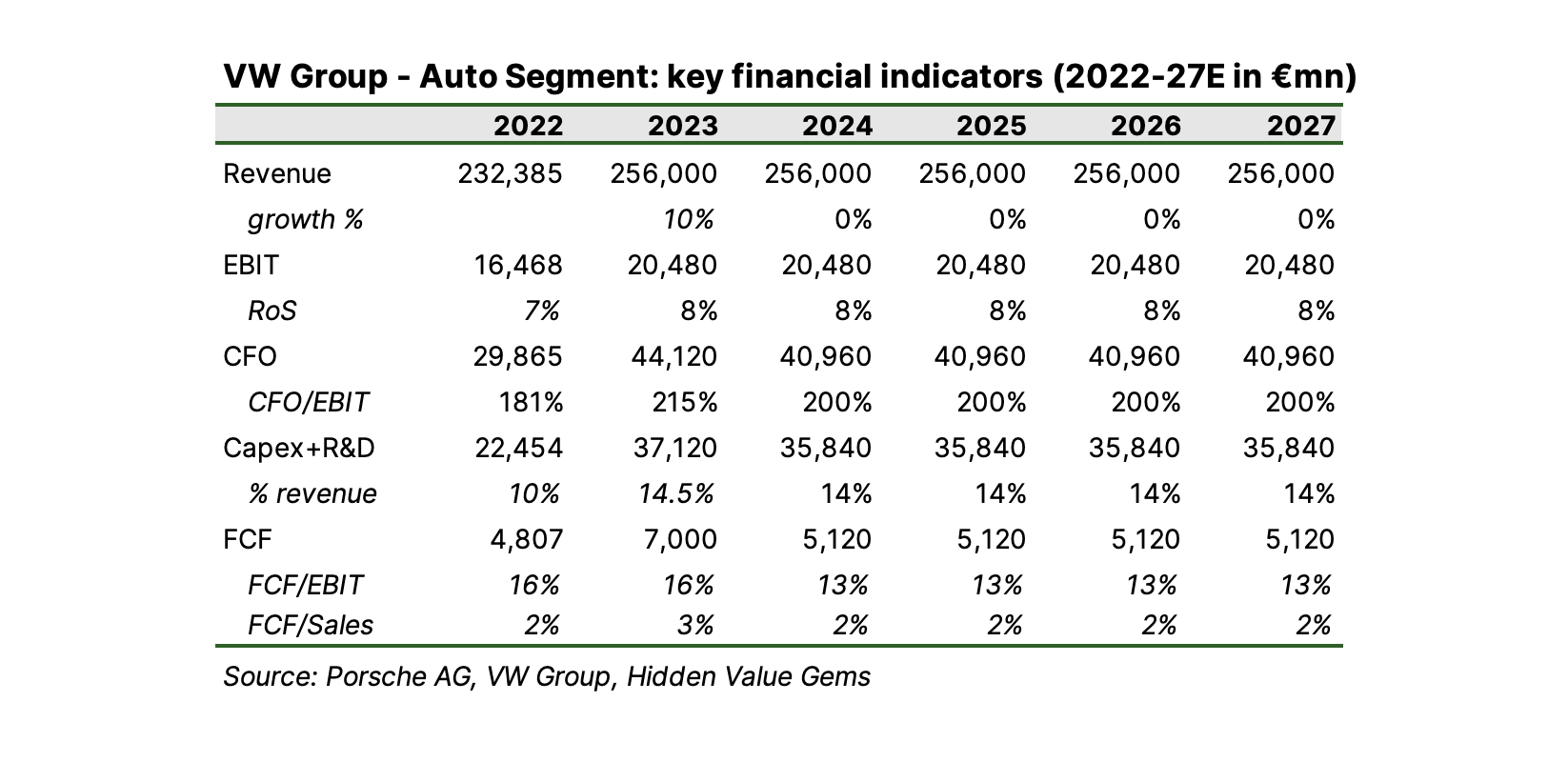

I then assumed a very conservative scenario for the VW group. What if it delivers zero growth and maintains margins below the peer average?

Here is a preliminary version of the “conservative” scenario, which could also be called “no-change”.

Here is a preliminary version of the “conservative” scenario, which could also be called “no-change”.

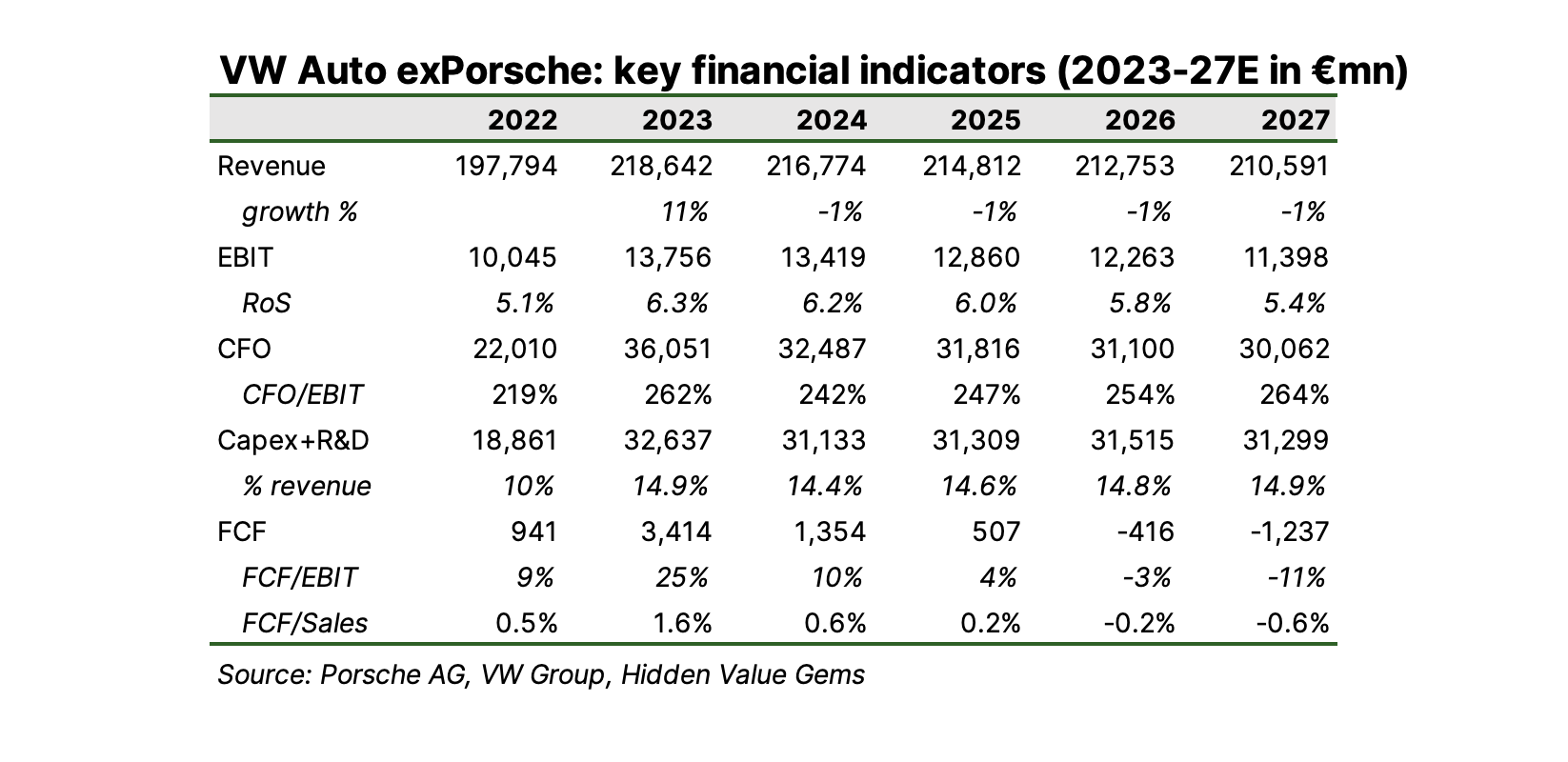

Finally, I have deducted Porsche AG financials from the VW Group to see what the performance of other brands would look like.

The implied results of this Auto segment without Porsche AG do not look ridiculous. I can easily imagine a moderate 1% decline in sales as more customers switch to EVs and VW is not successful with its pivot away from ICE. The company would likely keep investments elevated above 14% of sales compared to the historical 9-10% level.

Of course, the management of VW has much more optimistic targets (why would not they?). Official plans presented this summer include falling investment intensity for the whole group to below 11% by 2027 and to 9% by 2030 and material improvement in operating margins from 3.6% in 2022 (VW brand segment) to 6.5% by 2026 and 8% by 2027.

I prefer situations where I do not have to give management the benefit of the doubt, especially at critical times for the whole industry. It is much better to choose opportunities where the worst case is good enough, and any improvements by management represent an additional upside.

Currently, I do not see a lot of upside outside of Porsche business unless management delivers.

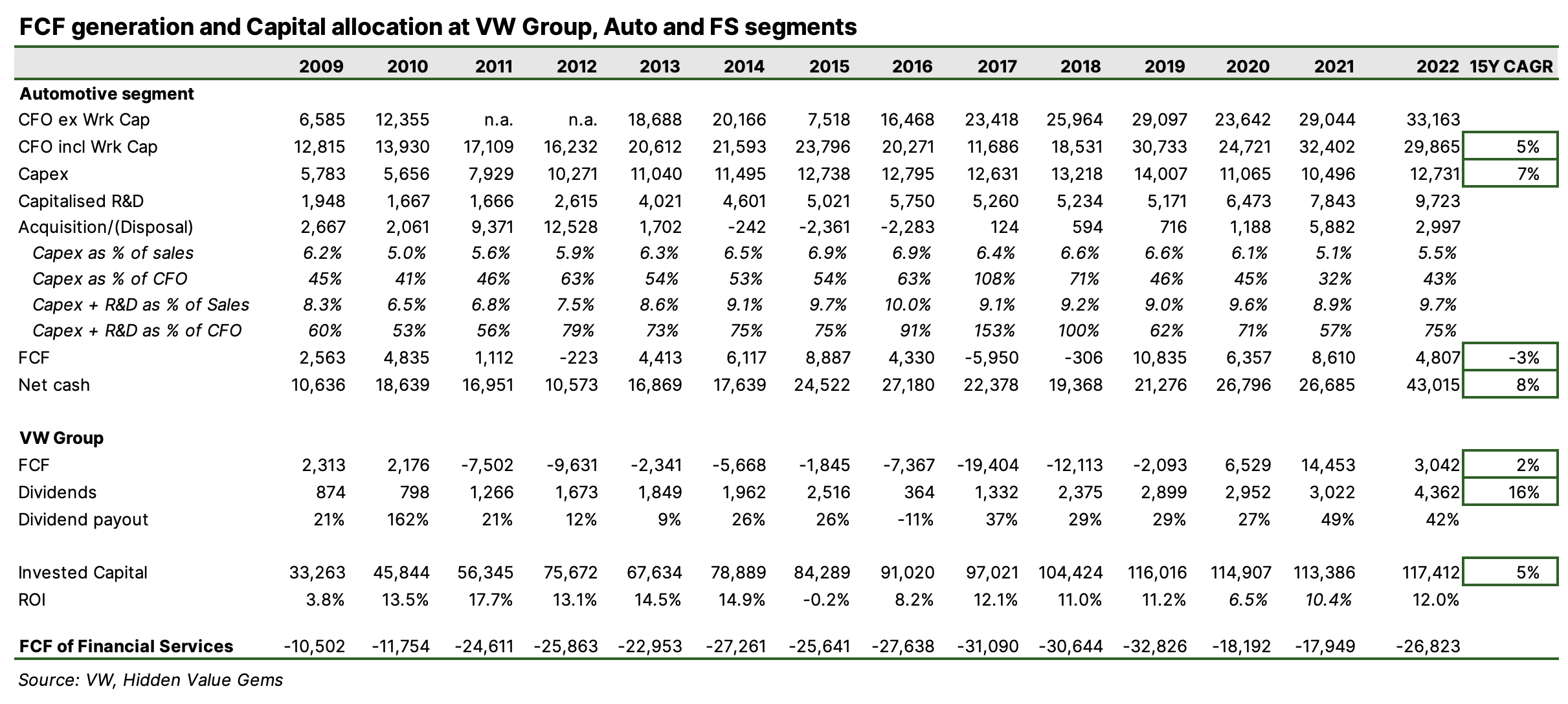

A separate issue is the free cash flow (FCF) generation. Management conveniently separates its accounts into so-called Automotive business and Financial Services, effectively a captive bank. Since a third of the cars produced by VW are financed by its own financial company, the group cash flow profile is very different from the profiles of the two segments.

Of course, the management of VW has much more optimistic targets (why would not they?). Official plans presented this summer include falling investment intensity for the whole group to below 11% by 2027 and to 9% by 2030 and material improvement in operating margins from 3.6% in 2022 (VW brand segment) to 6.5% by 2026 and 8% by 2027.

I prefer situations where I do not have to give management the benefit of the doubt, especially at critical times for the whole industry. It is much better to choose opportunities where the worst case is good enough, and any improvements by management represent an additional upside.

Currently, I do not see a lot of upside outside of Porsche business unless management delivers.

A separate issue is the free cash flow (FCF) generation. Management conveniently separates its accounts into so-called Automotive business and Financial Services, effectively a captive bank. Since a third of the cars produced by VW are financed by its own financial company, the group cash flow profile is very different from the profiles of the two segments.

Professional bank analysts would point out that FCF is not the right industry metric. But my point is that while the Automotive segment remains cashflow positive on paper (€4bn average annual FCF in 2009-22), the Group has, on average, generated a negative FCF of €2.8bn driven by outflows into the Financial Services (contribution to VW Banks capital from the Automotive segment to maintain the bank's loan growth),

I understand that if you sell a car at a price of €100, that costs €90 to produce, you may report an operating profit of €10. However, if the buyer borrows €80 from you, paying only €20 upfront, then your operating cashflow is negative -€70 (€20 cash payment from the customer minus €90 costs to produce the car). FCF could be even lower if you had to invest in fixed assets in that period.

That doesn’t mean it is a bad business. In the long-term, once sales stabilise - FCF should turn positive and reflect the underlying profitability of the operations with a mismatch between when the costs are incurred and when the payments are received disappearing.

In this regard, this year's interview with Todd Combs comes to mind, where he said something along the lines that if you understand an Industrial company's financial arm operations, the rest of the business is easy.

For now, I maintain my c. 1% position in VW and plan to make the final decision in the near term.

I understand that if you sell a car at a price of €100, that costs €90 to produce, you may report an operating profit of €10. However, if the buyer borrows €80 from you, paying only €20 upfront, then your operating cashflow is negative -€70 (€20 cash payment from the customer minus €90 costs to produce the car). FCF could be even lower if you had to invest in fixed assets in that period.

That doesn’t mean it is a bad business. In the long-term, once sales stabilise - FCF should turn positive and reflect the underlying profitability of the operations with a mismatch between when the costs are incurred and when the payments are received disappearing.

In this regard, this year's interview with Todd Combs comes to mind, where he said something along the lines that if you understand an Industrial company's financial arm operations, the rest of the business is easy.

For now, I maintain my c. 1% position in VW and plan to make the final decision in the near term.

Part II. What else is happening

New position

I bought shares in Var Energi, a mid-sized Norwegian offshore oi & gas company with an annual dividend yield of c. 14%. The stock dropped almost 10% intraday on 22 September 2023 after its second-largest shareholder, HitecVision, sold a 6.3% stake at NOK29. On the same day, the company’s CEO bought 371,813 shares at NOK 29 (worth $1 million). Insiders have been consistently buying shares over the past 12 months.

The company has been producing around 210-220kb/d of oil & gas since 2022 and plans to raise by almost 60% by the end of 2025 (350kb/d). It is already the second-largest producer in the Norwegian Continental Shelf after Aker BP. It has a reasonable reserves life of 13 years. Once its $2.3bn acquisition of Neptune Energy is completed, the new company should add 66kb/d of production (+30%) and 265mn boe of 2P reserves (+25%).

Its assets are fairly competitive with about $15/boe operating costs which are likely to go down as production ramps up.

Management expects about $17.5-20bn cumulative operating cash flow (at $70-90/bl) during 2023-27 (5 years). Capex and financing costs are about $12bn, which leaves over $1bn available for shareholder distributions (over 14% FCF yield).

The company distributes 20-30% of operating cash flow on dividends (over the cycle, meaning the payout can be lower in a weak oil price environment which would be made up later if and when prices recover). Management targets a 30% payout for 2023.

The company has been producing around 210-220kb/d of oil & gas since 2022 and plans to raise by almost 60% by the end of 2025 (350kb/d). It is already the second-largest producer in the Norwegian Continental Shelf after Aker BP. It has a reasonable reserves life of 13 years. Once its $2.3bn acquisition of Neptune Energy is completed, the new company should add 66kb/d of production (+30%) and 265mn boe of 2P reserves (+25%).

Its assets are fairly competitive with about $15/boe operating costs which are likely to go down as production ramps up.

Management expects about $17.5-20bn cumulative operating cash flow (at $70-90/bl) during 2023-27 (5 years). Capex and financing costs are about $12bn, which leaves over $1bn available for shareholder distributions (over 14% FCF yield).

The company distributes 20-30% of operating cash flow on dividends (over the cycle, meaning the payout can be lower in a weak oil price environment which would be made up later if and when prices recover). Management targets a 30% payout for 2023.

I am attending the AGM of the smallest company I have ever invested

In August 2023, I acquired a small position in PHSC Plc (PHSC LN). Its market is just £2.3mn. I did not write about it because I doubt many of the readers would be able to buy the shares due to low liquidity. Besides, it is quite an opportunistic move.

PHSC provides safety & security services to regional UK companies. The company has been generating FCF of £200-250k (5.7-7.0% margin). It has no financial debt and a cash position of £750k.

PHSC raised its total annual dividend for 2022 to 1.5p (from 1p for both 2021 and 2020), which corresponds to a 7.5% dividend yield.

On top of it, the company has been carrying out regular share repurchases since 2021, buying back over 3.6mn shares (25% reduction in shares outstanding).

PHSC is still run by its founder, Stephen King, who is now in his late 60s. Together with the second co-founder, Nicola Coote, they own 43.4% of the PHSC. While managers of individual subsidiaries have a certain autonomy, the overall strategy of the business is linked to the two co-founders.

One of the reasons I am attending the AGM is to better Mr King’s view on PHSC strategy over the next 5 years. So far, the only AGM I have attended were the annual meetings of Berkshire Hathaway. PHSC will be my first AGM of the UK company. It is also the smallest company I have ever invested in.

PHSC provides safety & security services to regional UK companies. The company has been generating FCF of £200-250k (5.7-7.0% margin). It has no financial debt and a cash position of £750k.

PHSC raised its total annual dividend for 2022 to 1.5p (from 1p for both 2021 and 2020), which corresponds to a 7.5% dividend yield.

On top of it, the company has been carrying out regular share repurchases since 2021, buying back over 3.6mn shares (25% reduction in shares outstanding).

PHSC is still run by its founder, Stephen King, who is now in his late 60s. Together with the second co-founder, Nicola Coote, they own 43.4% of the PHSC. While managers of individual subsidiaries have a certain autonomy, the overall strategy of the business is linked to the two co-founders.

One of the reasons I am attending the AGM is to better Mr King’s view on PHSC strategy over the next 5 years. So far, the only AGM I have attended were the annual meetings of Berkshire Hathaway. PHSC will be my first AGM of the UK company. It is also the smallest company I have ever invested in.

Meeting with Vitaliy Katsenelson

This Thursday (21 September), I had the pleasure to spend almost two hours with Vitaliy Katsenelson, the author of a few books on value investing and a portfolio manager at a US-based IMA. We covered a wide range of topics, including the evolution of value investors, the issues with concentrated quality investments, international opportunities, Uber’s moat, stoicism and time management.

Interestingly, Vitaliy was quite bullish on the oil stocks, referring to similar arguments I discussed in the past.

Interestingly, Vitaliy was quite bullish on the oil stocks, referring to similar arguments I discussed in the past.

If you enjoyed this post, please consider sharing it with friends or colleagues to help spread the word and support the creation of valuable content. Thank you for reading!