18 February 2024

About once every quarter, I share the most interesting materials I find online. Continuous learning is the default mode for successful investing. Sharing valuable materials and exchanging views is the next stage. As usual, the resources I share are intended to provide food for thought and highlight new perspectives. You can always find all the materials in the Library.

They are not opinions I always agree with or view as an immediate investment opportunity. And, of course, this is not investment advice. I hope you enjoy today’s post and learn something new from it.

Feel free to leave a comment at the end of the post.

"Coming Fiscal Horror Show"

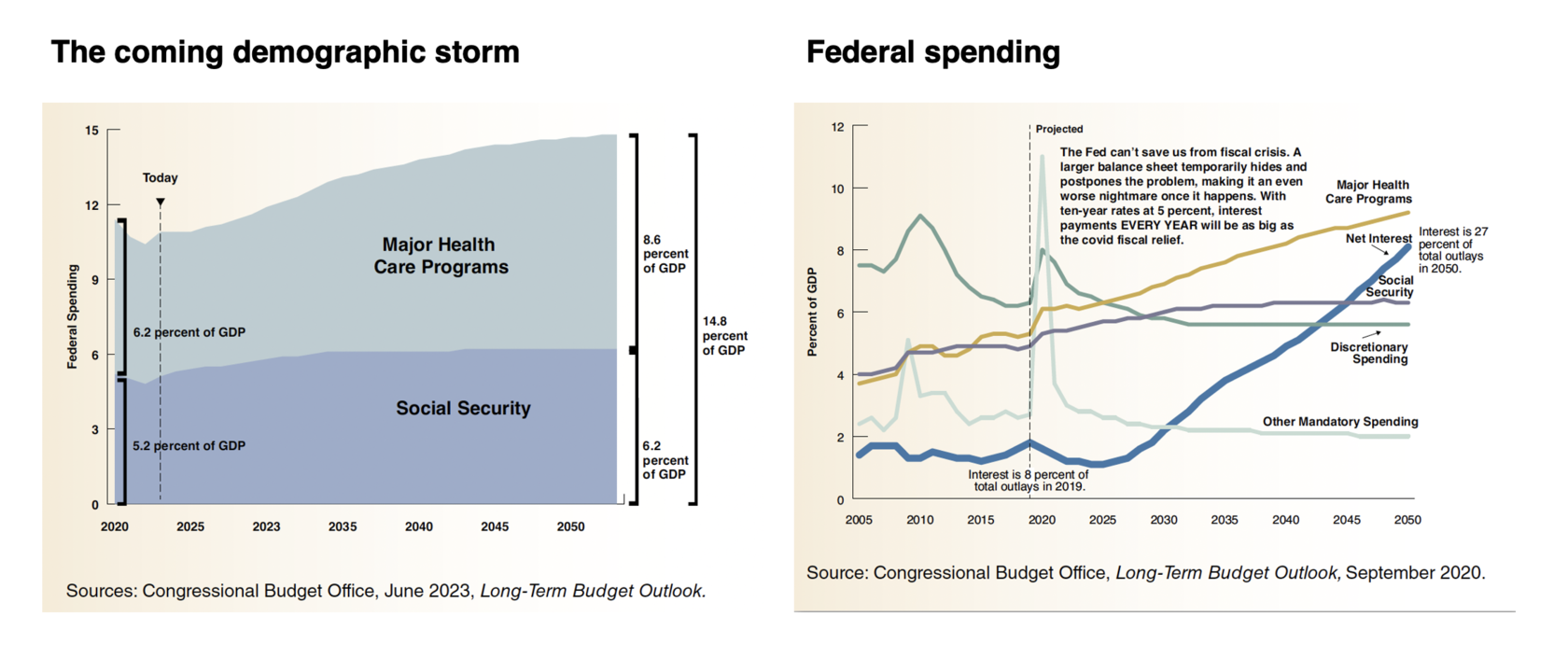

The first article was written by a legendary investor, Stanley Druckenmiller. Even though it was written last year, it covers the issues of the next several decades and makes a big call about extremely dire fiscal conditions in the United States.

“Today we spend six times more per senior than per child in the United States. Think Social Security versus education. Almost 60 percent of all our tax revenues are spent on seniors, and this trend is only starting.”

“During the last decade, U.S. debt grew from $15 trillion to $31 trillion today, a level of indebtedness only comparable to that after World War II. In the 1950s…actual debt was a reasonable measure of the country’s indebtedness. Not anymore. There are credible estimates that if you assume the government will pay the same to seniors in the future as it is paying today, the present value of that debt approaches $200 trillion.”

Stanley Druckenmiller

Sadly, what Druckenmiller has identified in the US has partially played out in Japan after the 80s boom and is currently faced by some other ‘developed’ countries like the UK.

I want to stress that this should not be viewed as a call to short US (or other) stocks or take any other radical action. Firstly, owning great companies (with strong pricing power and attractive returns on capital) should be the best hedge against inflation and other macro issues in the long term. Secondly, even Druckenmiller himself admitted in one of his interviews that he always kept his long-term and big-picture views of the world from dominating his day-to-day investing.

It is also worth reminding that Druckenmiller has been sceptical about the macro conditions since at least 2018. Ultimately, all great investors start by focusing on the downside risks.

I want to stress that this should not be viewed as a call to short US (or other) stocks or take any other radical action. Firstly, owning great companies (with strong pricing power and attractive returns on capital) should be the best hedge against inflation and other macro issues in the long term. Secondly, even Druckenmiller himself admitted in one of his interviews that he always kept his long-term and big-picture views of the world from dominating his day-to-day investing.

It is also worth reminding that Druckenmiller has been sceptical about the macro conditions since at least 2018. Ultimately, all great investors start by focusing on the downside risks.

So, is 100% stocks the best strategy?

A few days after I published my piece on Capital Allocation, essentially saying that stocks are the best investment options over the long term, a famous ‘value quant’ Cliff Asness, published a short piece called Why Not 100% Equities. The article was based on his original work published in The Journal of Portfolio Management in 1996.

While Asness commented on another paper, his first point feels as if it is aimed at my article. Here are his own words:

While Asness commented on another paper, his first point feels as if it is aimed at my article. Here are his own words:

“Equities winning long term vs. bonds isn’t a surprise result, it’s exactly what is supposed to happen and is entirely consistent with very long-established theory (which holds up pretty darn well, BTW). It just ain’t interesting to show the higher expected return asset has generally a higher realized return with the probability of winning (by some margin) increasing with your time horizon. It’s finance 101. It’s actually just math 101. Yet every few years someone writes a paper and gets a lot of attention by showing the higher expected return asset has, wait for it, a higher average realized return.”

I first felt like a student who did his test completely wrong and had to meet his professor again for re-examination. However, after reading the reference materials, I am comfortable with my view.

The key argument in Asness’ thesis is the modern portfolio theory concept that returns should be measured against risk (measured as the standard deviation of returns).

He goes further to emphasise the importance of breaking down the question of ‘where to invest’ into two separate ones: 1) What is the best return-for-risk portfolio? and 2) what risk should we take?

The concept of risk as the stock’s volatility is good for mathematicians as it can be easily measured and tested. The problem, though, is that the real risk is that the business you own faces permanent impairment of its earnings power (erosion of competitive advantage, remember Nokia?) or is headed by a CEO with an awful capital allocation track record or is so highly valued that a slightly disappointing earnings release sends the stock downhill to a new P/E of 16x (from previous 35x).

My examination did not finish here, as one of my subscribers and friends shared a very interesting piece by Artemis Capital Management, published in 2020, called The Allegory of the Hawk and Serpent. How to Grow Your Wealth for 100 Years. The main point is that a portfolio of stocks (and bonds) mixed with assets with negative correlation (e.g. gold) would outperform pure stocks over the long term.

This piece breaks down historical market conditions into two types. Different asset classes perform quite oppositely depending on the type of conditions. It is similar to the All-Weather Portfolio approach popularised by Ray Dalio (also called Risk-Parity, although it identified four market regimes, not two).

Artemis defines Serpent assets as those that derive steady gains during periods of stability and growth (1947-1963; 1984-2007). They include the most common assets like Equity and Credit, and the buy-and-hand strategy best describes this approach.

Hawk assets deliver exponential gains during periods of change (1928-1948; 1964-1983; 2007-2008). The changes could be deflationary or inflationary. They include traditional hedges like Gold and Volatility (options).

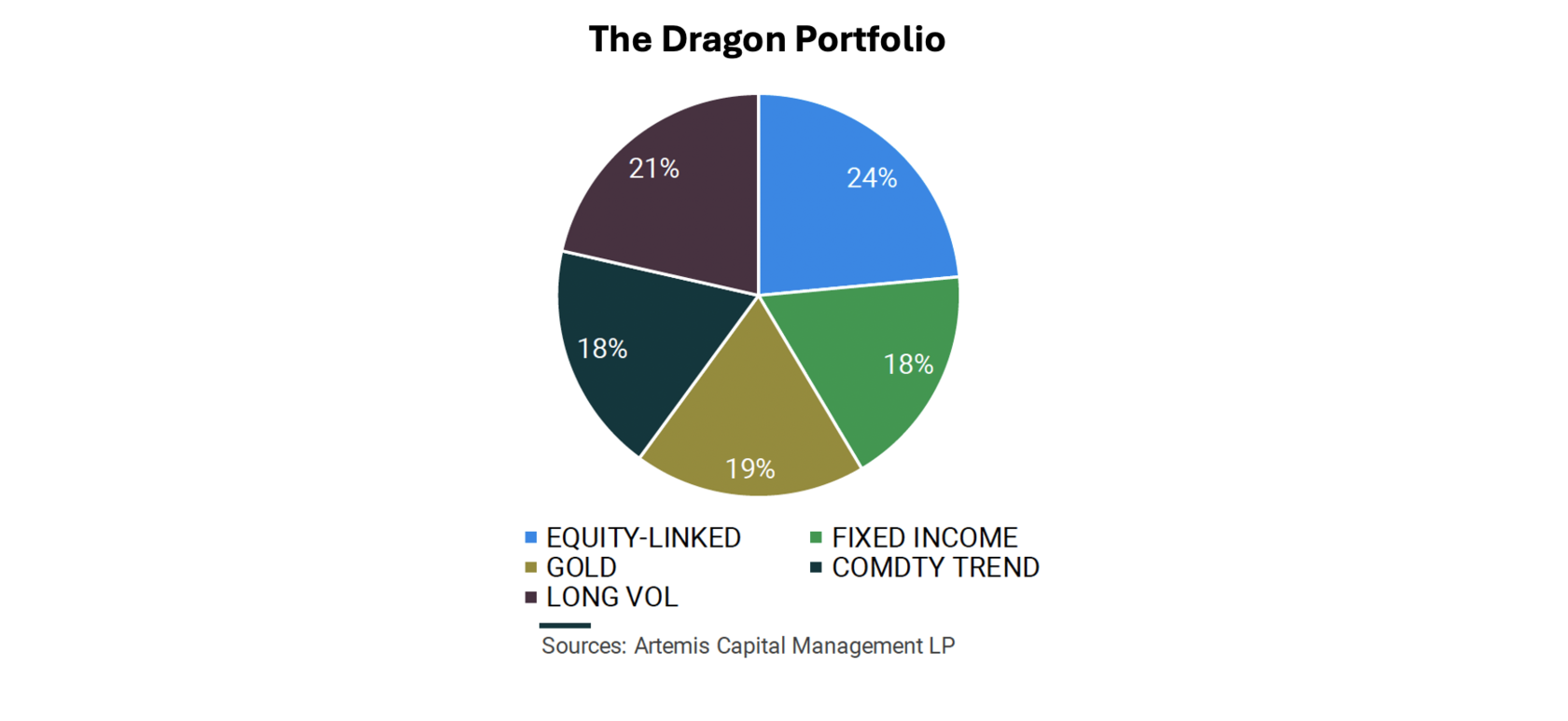

Artemis goes one step further and proposes a combination of two assets to create what they call a Dragon Portfolio.

In addition to the classic equities and bonds with 24% and 18% weights, the firm puts Gold, Commodity Trend Following (CTA) and Long Volatility into the same portfolio.

The key argument in Asness’ thesis is the modern portfolio theory concept that returns should be measured against risk (measured as the standard deviation of returns).

He goes further to emphasise the importance of breaking down the question of ‘where to invest’ into two separate ones: 1) What is the best return-for-risk portfolio? and 2) what risk should we take?

The concept of risk as the stock’s volatility is good for mathematicians as it can be easily measured and tested. The problem, though, is that the real risk is that the business you own faces permanent impairment of its earnings power (erosion of competitive advantage, remember Nokia?) or is headed by a CEO with an awful capital allocation track record or is so highly valued that a slightly disappointing earnings release sends the stock downhill to a new P/E of 16x (from previous 35x).

My examination did not finish here, as one of my subscribers and friends shared a very interesting piece by Artemis Capital Management, published in 2020, called The Allegory of the Hawk and Serpent. How to Grow Your Wealth for 100 Years. The main point is that a portfolio of stocks (and bonds) mixed with assets with negative correlation (e.g. gold) would outperform pure stocks over the long term.

This piece breaks down historical market conditions into two types. Different asset classes perform quite oppositely depending on the type of conditions. It is similar to the All-Weather Portfolio approach popularised by Ray Dalio (also called Risk-Parity, although it identified four market regimes, not two).

Artemis defines Serpent assets as those that derive steady gains during periods of stability and growth (1947-1963; 1984-2007). They include the most common assets like Equity and Credit, and the buy-and-hand strategy best describes this approach.

Hawk assets deliver exponential gains during periods of change (1928-1948; 1964-1983; 2007-2008). The changes could be deflationary or inflationary. They include traditional hedges like Gold and Volatility (options).

Artemis goes one step further and proposes a combination of two assets to create what they call a Dragon Portfolio.

In addition to the classic equities and bonds with 24% and 18% weights, the firm puts Gold, Commodity Trend Following (CTA) and Long Volatility into the same portfolio.

It is a thought-provoking piece, and I am grateful to the kind person who shared this with me.

Here are some questions I would like to ask the Artemis team:

As a side note, I am generally cautious about papers written as stories with eye-catching characters.

In short, while Artemis claims a 100-year test, many of the inputs were based on their own assumptions, making the whole thesis less robust.

Here are some questions I would like to ask the Artemis team:

- The price of gold used to be fixed (in US dollars and other major currencies) with rare upward adjustments until 1971 - so it generated close to zero nominal returns since 1928 (probably negative if you include holding costs) and definitely negative if adjusted for inflation. Artemis assumed zero storage costs for gold.

- How did they estimate the historical performance of Long Volatility and Commodity trends following periods before 1986?

- How did they account for the costs of implementing such strategies, as none seems to be a cheap option?

As a side note, I am generally cautious about papers written as stories with eye-catching characters.

In short, while Artemis claims a 100-year test, many of the inputs were based on their own assumptions, making the whole thesis less robust.

Two other pieces

An interesting study by Goldman Sachs on ‘Quality Stocks’. While this category is often associated with the past period of low interest rates, I think there are inherent factors making these businesses attractive investment options. The paper focuses on the factors that help identify them based on past financial performance and analyst estimates. One of the findings is that Quality companies tend to deliver above-average results over a longer time, defying the inevitable reversion to the mean.

Another piece is a comprehensive study on serial acquirers, looking into the drivers of their success. The study was published by the Norwegian REQ investment management firm. There are many interesting takeaways and charts in the study. The first and most obvious is the actual list of serial compounders, especially in Scandinavia - about 50 (!) names in a fairly small region. Exciting news for investors seeking differentiating ideas outside of the mainstream.

Finally, let me share three exciting stock pitches I came across on the Internet over the past few weeks.

Another piece is a comprehensive study on serial acquirers, looking into the drivers of their success. The study was published by the Norwegian REQ investment management firm. There are many interesting takeaways and charts in the study. The first and most obvious is the actual list of serial compounders, especially in Scandinavia - about 50 (!) names in a fairly small region. Exciting news for investors seeking differentiating ideas outside of the mainstream.

Finally, let me share three exciting stock pitches I came across on the Internet over the past few weeks.

Laurent-Perrier

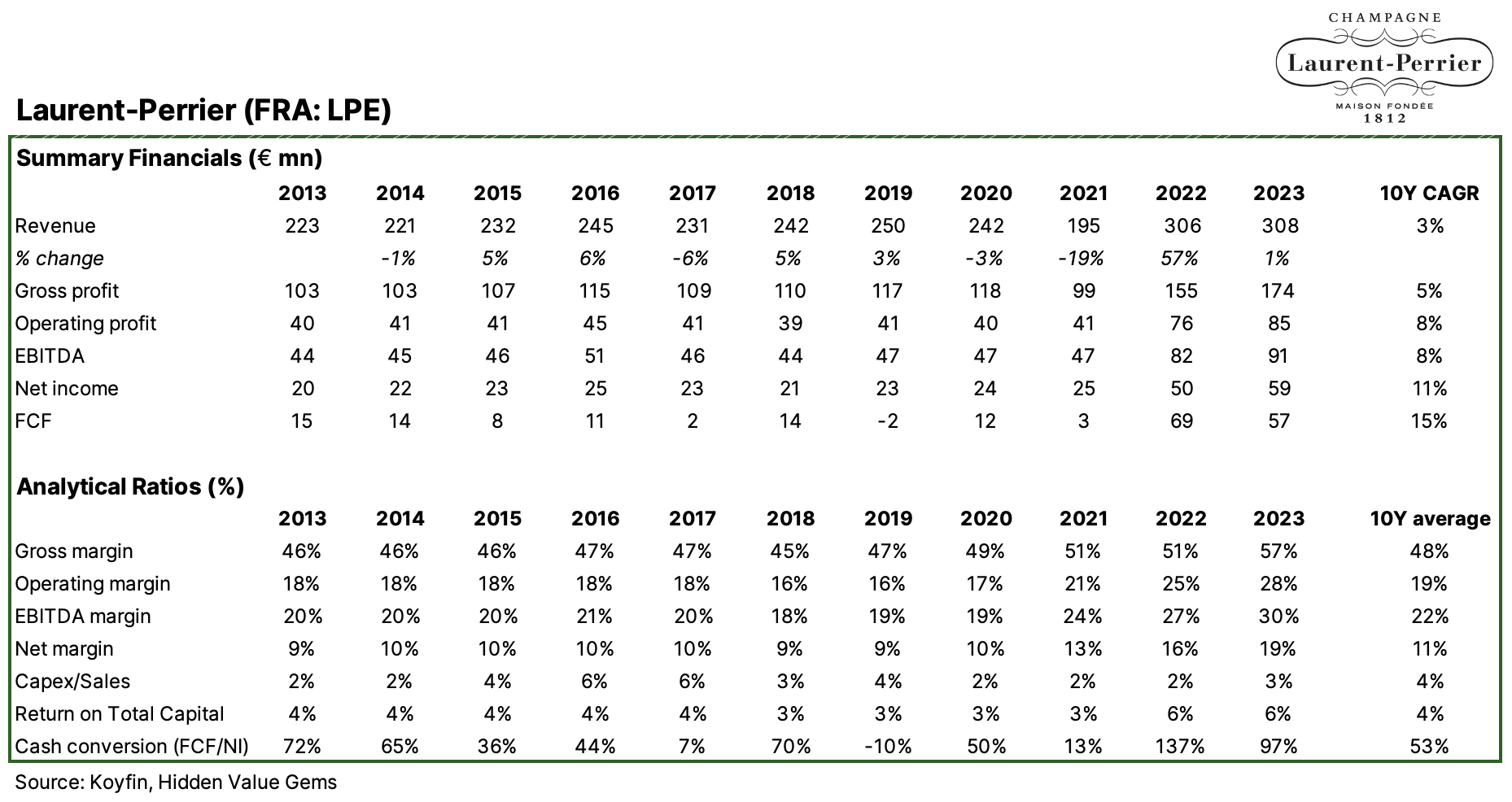

A €730mn market cap champagne producer, trading at 12.6 P/E (based on the next 12 months consensus estimates). The company is controlled by the Nonancourt family (62%).

Laurent Perrier produces champagne (Nestle owns the water brand). The Champagne brand was founded in 1812 and is over 200 years old.

Sparkling wine can only be labelled ’Champagne’ if produced in France’s Champagne region. This limits the supply of the product. Coupled with the association of luxury lifestyle, champagne producers enjoy stronger than usual pricing power.

However, the overall market for champagne has been stagnant in volume terms and was rising primarily due to price increases.

Laurent-Perrier achieved only a 3% revenue CAGR over the past ten years. However, on average, it has increased its net income by 11% per year due to its focus on premiumisation.

The company has historically distributed 25% of its earnings as dividends.

Laurent Perrier produces champagne (Nestle owns the water brand). The Champagne brand was founded in 1812 and is over 200 years old.

Sparkling wine can only be labelled ’Champagne’ if produced in France’s Champagne region. This limits the supply of the product. Coupled with the association of luxury lifestyle, champagne producers enjoy stronger than usual pricing power.

However, the overall market for champagne has been stagnant in volume terms and was rising primarily due to price increases.

Laurent-Perrier achieved only a 3% revenue CAGR over the past ten years. However, on average, it has increased its net income by 11% per year due to its focus on premiumisation.

The company has historically distributed 25% of its earnings as dividends.

Here is the link to the full write-up.

Korn Ferry

Korn Ferry has traditionally been an executive search company.

Over the past ten years, the company has significantly diversified its revenue streams into less cyclical segments like consulting and digital, comprising ~40% of sales currently. In comparison, Executive Search has declined from ~70% of sales 10 years ago to ~30% of sales.

The market has not given any credit to this transformation as the company is still trading at around 7.5x forward EV/EBITDA (lower than its 10-year average multiple - 8x). The company is expected to generate $235mn of FCF in the next 12 months (analyst consensus), which translates into c. 7% FCF yield.

You can read the full thesis here (requires a free registration).

Over the past ten years, the company has significantly diversified its revenue streams into less cyclical segments like consulting and digital, comprising ~40% of sales currently. In comparison, Executive Search has declined from ~70% of sales 10 years ago to ~30% of sales.

The market has not given any credit to this transformation as the company is still trading at around 7.5x forward EV/EBITDA (lower than its 10-year average multiple - 8x). The company is expected to generate $235mn of FCF in the next 12 months (analyst consensus), which translates into c. 7% FCF yield.

You can read the full thesis here (requires a free registration).

Auction Technology Group

Auction Technology Group (ATG.LN) is a leading online platform for auctions across Europe and the US.

The business started in 1971 as a weekly trade publication. The company launched its first live bidding website in 2006. Through a series of M&A and partnerships, the company launched eight marketplaces in two main verticals: Arts & Antiques (A&A) and Industrial & Commercial (I&C). It connects bidders from over 160 countries. ATG is the leader in the US I&C market and the UK A&A market and is a meaningful player in most markets in which it is present.

ATG was listed on the LSE in 2021. As its reported results came below the high expectations set during the COVID boom, the share price tanked over 60% from its 2021 highs.

ATG provides auctioneers the technology and infrastructure most can’t invest in themselves. It focuses on adding value for auctioneer clients by raising the selling price (Total Hammer Value) through timed auctions, payments, and other services that improve the buyer experience.

The company earns commissions (take rate) from auction houses, which range between 1-3% of the purchase price for the I&C segment and 4-5% for the A&A segment.

The key argument for the bull case is the increase in the take rate closer to the level of other classified peers. In addition to that, the growth should be supported by the rising share of online auctions and the market share gains by ATG. All this could lead to 10-15% annual growth at the top line and much stronger earnings growth due to high operating leverage.

The company is trading at 13x forward EV/EBITDA and 18x P/E multiples based on consensus estimates.

A global Private Equity firm, TA Associates, holds 17% of the shares.

You can read the full thesis here (requires a free registration).

The business started in 1971 as a weekly trade publication. The company launched its first live bidding website in 2006. Through a series of M&A and partnerships, the company launched eight marketplaces in two main verticals: Arts & Antiques (A&A) and Industrial & Commercial (I&C). It connects bidders from over 160 countries. ATG is the leader in the US I&C market and the UK A&A market and is a meaningful player in most markets in which it is present.

ATG was listed on the LSE in 2021. As its reported results came below the high expectations set during the COVID boom, the share price tanked over 60% from its 2021 highs.

ATG provides auctioneers the technology and infrastructure most can’t invest in themselves. It focuses on adding value for auctioneer clients by raising the selling price (Total Hammer Value) through timed auctions, payments, and other services that improve the buyer experience.

The company earns commissions (take rate) from auction houses, which range between 1-3% of the purchase price for the I&C segment and 4-5% for the A&A segment.

The key argument for the bull case is the increase in the take rate closer to the level of other classified peers. In addition to that, the growth should be supported by the rising share of online auctions and the market share gains by ATG. All this could lead to 10-15% annual growth at the top line and much stronger earnings growth due to high operating leverage.

The company is trading at 13x forward EV/EBITDA and 18x P/E multiples based on consensus estimates.

A global Private Equity firm, TA Associates, holds 17% of the shares.

You can read the full thesis here (requires a free registration).

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.