19 January 2025

In this 5th edition of HVG Investment notes, I want to share a few reports on consumer trends.

The interesting points that caught my eye are the consumers’ willingness to spend more on travel, potentially more robust Chinese demand and more worrying signs for the luxury sector. At the end of this email you will also find interesting research on a former HVG portfolio stock as well as a Value Investor Calendar for 2025.

The interesting points that caught my eye are the consumers’ willingness to spend more on travel, potentially more robust Chinese demand and more worrying signs for the luxury sector. At the end of this email you will also find interesting research on a former HVG portfolio stock as well as a Value Investor Calendar for 2025.

I. Travel still in demand, with a particular focus on local experiences

Travel remains the top category in many countries consumers would like to spend more money on, at least according to this study by AlixPartners.

Another study by Hilton has identified that 1 in 4 travellers plan to seek unique experiences, with almost 50% of travellers booking restaurant reservations before their flights.

While such data points alone are not sufficient to make a case for buying a particular stock, they fit the narrative of travel executives, including Airbnb, which is re-launching Experiences later this year as an additional way to monetise their platform.

While such data points alone are not sufficient to make a case for buying a particular stock, they fit the narrative of travel executives, including Airbnb, which is re-launching Experiences later this year as an additional way to monetise their platform.

II. State of Luxury: more cautious outlook

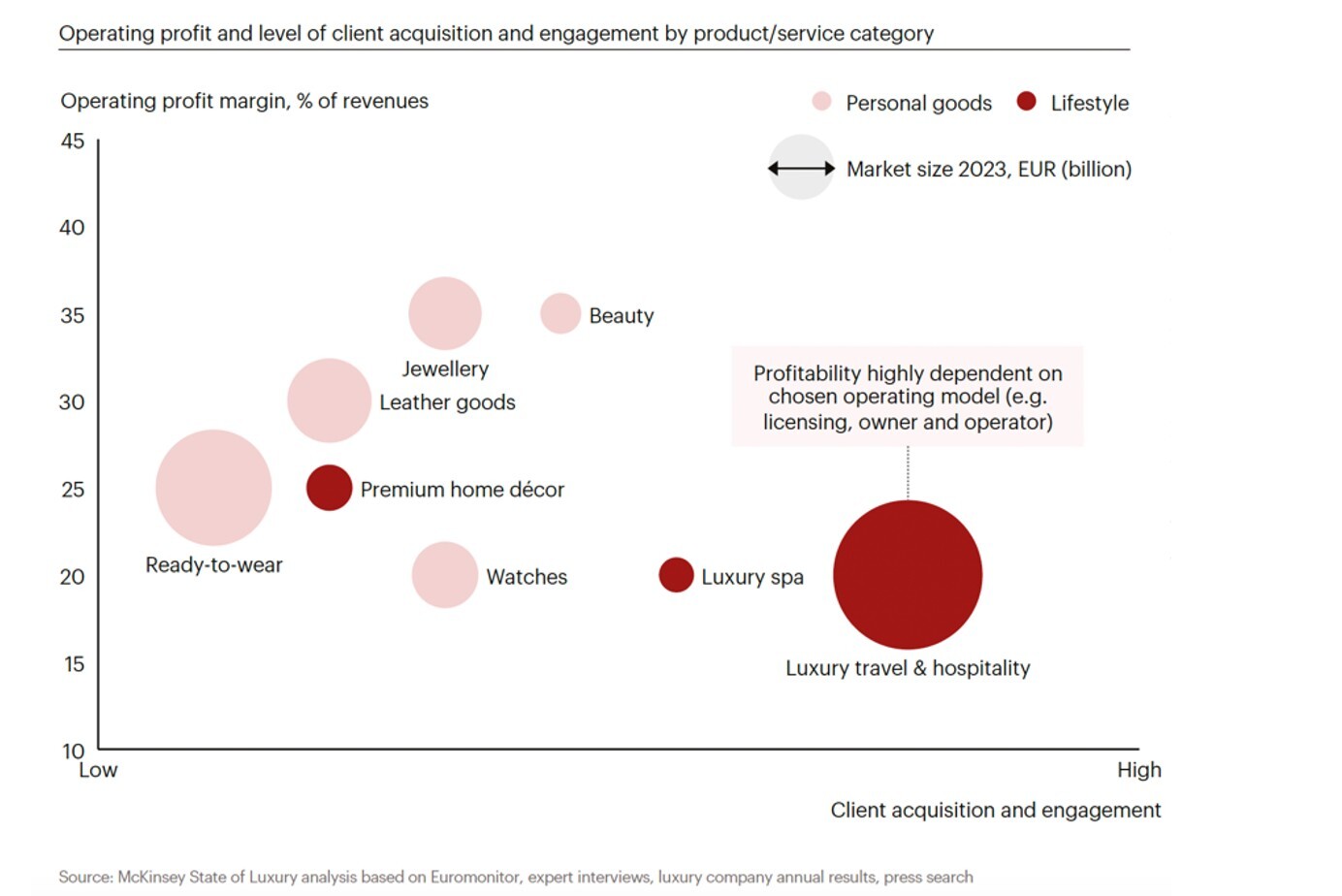

McKinsey has published a 53-page study on the Luxury Market, highlighting growing cautiousness among consumers.

My takeaways:

My takeaways:

- Following steep price rises, customers are questioning whether luxury products are worth their high price tags.

- Among Ultra High Net-Worth customers ‘there is a shared feeling that they have “overconsumed” since the pandemic. As much as 64% of them plan to spend more on travel and hospitality and less on luxury goods this year.'

- Luxury sales in China fuelled around 40% of global luxury goods growth from 2019 to 2023, while the US drove around 30% and Europe around 10%. The US is expected to be luxury’s growth engine, thanks to favourable economic factors.

III. Luxury Watches: Buying Online Directly from a Brand

The study by Deloitte on the Luxury Watches sector echoes McKinsey's findings: consumers seem to be more focused on Price/Value rather than Brand reputation (see below).

The real worrying issue (for traditional retailers such as Watches of Switzerland) is that the younger the consumer, the more likely they are to buy watches directly from the brand rather than from a physical shop.

It is worth noting that after exploding in FY-21 (+120.5%), WOSG’s e-commerce sales growth has considerably slowed down to 5% and 3% in FY-22 and FY-23, respectively and a decline of -11% and -10% in FY-24 and H1 FY-25.

IV. China: a setup for a positive surprise?

In the above-mentioned study by AlixPartners, the following chart stood out for me. Out of 9 countries surveyed, China came second by the proportion of people planning to spend more money in 2025 than in 2024. About a third of Chinese consumers plan to spend more this year, while less than a quarter plan to spend less. Compare this to the US, where almost 40% plan to cut spending and less than 20% plan to spend more.

Of course, the details of the survey matter. So, I would not rely on this single chart for long-term investment decisions, but it is an important signal, nevertheless.

If you add to that the imminent demand stimulus and improving capital allocation, especially at larger companies (e.g., Alibaba and Tencent), it may be time to take a closer look at that market.

Li Lu, one of the best Chinese investors and Munger’s protégé, has recently spoken on the issues faced by China and the need to focus on demand and domestic consumption instead of supply-led growth.

Finally, if you are still sceptical about China, I suggest you watch this panel discussion hosted by a brilliant Switzerland-based investor, Rob Vinall, to get a fresh perspective. There is a bit of a selection bias as all the panellists are invested in China, so by default, they do not support the ‘China is Uninvestable’ thesis. Nevertheless, it never hurts to listen to a variety of voices.

If you add to that the imminent demand stimulus and improving capital allocation, especially at larger companies (e.g., Alibaba and Tencent), it may be time to take a closer look at that market.

Li Lu, one of the best Chinese investors and Munger’s protégé, has recently spoken on the issues faced by China and the need to focus on demand and domestic consumption instead of supply-led growth.

Finally, if you are still sceptical about China, I suggest you watch this panel discussion hosted by a brilliant Switzerland-based investor, Rob Vinall, to get a fresh perspective. There is a bit of a selection bias as all the panellists are invested in China, so by default, they do not support the ‘China is Uninvestable’ thesis. Nevertheless, it never hurts to listen to a variety of voices.

V. Stock Idea

Will Thomson, the founder of Massif Capital, has shared his report on Harbour Energy, a UK-listed E&P. As some readers know, we used to own HBR but sold it after a strong performance following the announcement of a deal with Dea Wintershall.

VI. Value Investor Calendar

As Value Investing is becoming more niche, the opportunity to meet like-minded investors is becoming more valuable. I have compiled a list of some conferences and events for 2025, which I hope you find useful.

This is not an all-encompassing list. If you think I missed an important event, please send me an email.

This is not an all-encompassing list. If you think I missed an important event, please send me an email.