22 September 2024

My ideal investment is a company with a 1) great product offering, which translates into 2) solid financial performance (high margins, cash generation, ROIC); 3) does not rely on debt (low leverage); 4) is run by management with ‘skin in the game’ with proven capital allocation skills and adequate rewards for shareholders; 5) is attractively valued.

Such a combination is rare, especially among well-covered large caps. This is why I spend more time hunting in less crowded markets, particularly UK/European mid and small caps.

However, such opportunities occasionally emerge even in the large-cap space, especially during significant dislocations (e.g. 2008, 2020), but you can find them even in more ‘quiet’ periods.

Today, I will share Part I of my analysis of Airbnb and discuss whether it meets any of the above five criteria.

Unique service

Airbnb meets a clear customer need from both sides of the market. It provides travellers with unique accommodation and allows landlords to earn extra income from their properties.

While guests may find many other lodging options on online travel agent websites (e.g., Booking or Expedia), Airbnb has more unique properties and historically was considerably cheaper than traditional hotels.

For property owners, it is also unique as it enables them to rent out for a short period of time, avoiding long-term commitments. This is especially relevant today when mortgage and other housing costs are high (insurance, utilities, taxes), forcing landlords to seek extra income.

Besides, it enables landlords to monetise some unique features of their properties (e.g., attic space, guest house in the garden, an isolated room), which they could not do on other platforms.

On the demand side, there is a growing category of ‘nomads’ who work from different locations depending on the time of the year, project or other factors. With more ‘hybrid’ work options, traditional employees are quickly embracing the lifestyle of a small minority of people. Working during summer in a different location from a private property is much more convenient and often cheaper than working from a hotel.

Airbnb differs from traditional rental services not just by rent duration but also by eliminating a human agent. The company charges just 3% of booking fees from landlords, which primarily covers payment fees. Landlords pay 10-15% fees to other platforms, like Booking.com.

It is unique in its ability to facilitate all transactions through an online platform, minimising the time and effort to market their properties for landlords. Of course, you can book or list a property on other online platforms, but your property has to be essentially a hotel rather than a unique bungalow, summer house, or loft.

While guests may find many other lodging options on online travel agent websites (e.g., Booking or Expedia), Airbnb has more unique properties and historically was considerably cheaper than traditional hotels.

For property owners, it is also unique as it enables them to rent out for a short period of time, avoiding long-term commitments. This is especially relevant today when mortgage and other housing costs are high (insurance, utilities, taxes), forcing landlords to seek extra income.

Besides, it enables landlords to monetise some unique features of their properties (e.g., attic space, guest house in the garden, an isolated room), which they could not do on other platforms.

On the demand side, there is a growing category of ‘nomads’ who work from different locations depending on the time of the year, project or other factors. With more ‘hybrid’ work options, traditional employees are quickly embracing the lifestyle of a small minority of people. Working during summer in a different location from a private property is much more convenient and often cheaper than working from a hotel.

Airbnb differs from traditional rental services not just by rent duration but also by eliminating a human agent. The company charges just 3% of booking fees from landlords, which primarily covers payment fees. Landlords pay 10-15% fees to other platforms, like Booking.com.

It is unique in its ability to facilitate all transactions through an online platform, minimising the time and effort to market their properties for landlords. Of course, you can book or list a property on other online platforms, but your property has to be essentially a hotel rather than a unique bungalow, summer house, or loft.

Strong competitive advantage (‘Wide Moat’)

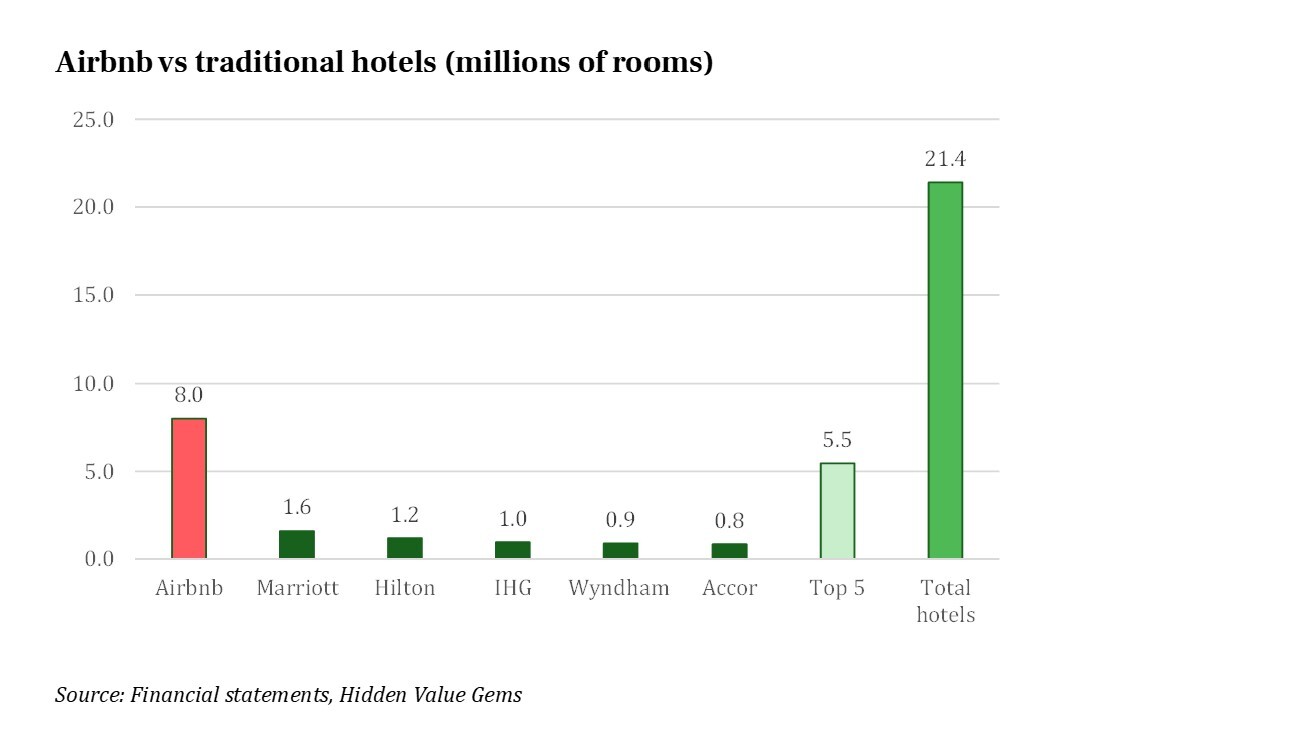

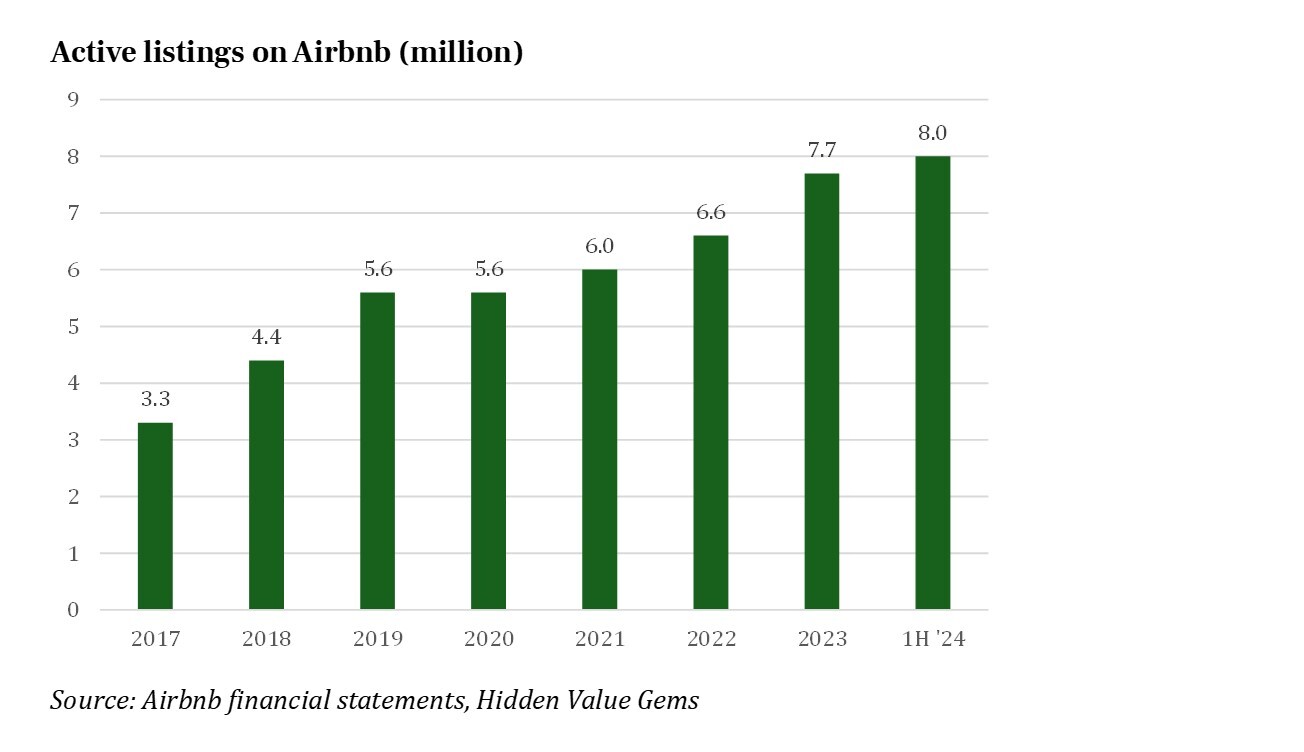

Airbnb provides guests with the largest selection of room/property options, most of which are unique. As of H1 ’24, it had more than 8 mn active listings (equivalent to rooms for hotels), which was almost 50% bigger than the Top 5 hotel chains. The world’s largest hotel network, Marriott, has only 1.6mn rooms.

Airbnb service is available in 220 countries and 100,000 cities, servicing over 150 million users who have booked more than 1.5 billion stays. There are over 5 million hosts with 8 million active listings.

While other players compete with Airbnb (e.g. Booking Holdings, Expedia), it is unlikely that a new platform can emerge to challenge the company's dominant position. It is not just the capital that would be required, but the trust built over many years that today allows two complete strangers to transact on its platform and for the host to hand over the keys to their guests.

It took many years to build guest verifications, review systems and other vital elements to create this trust on the platform. A new competitor will not be able to make the same platform overnight.

The company has also spent years working with regulators in different countries and cities to deal with various legislations. Airbnb has partnered with multiple cities to promote tourism and make legislation more friendly for short-term rents. This is another form of competitive advantage compared to potential new entrants.

While other players compete with Airbnb (e.g. Booking Holdings, Expedia), it is unlikely that a new platform can emerge to challenge the company's dominant position. It is not just the capital that would be required, but the trust built over many years that today allows two complete strangers to transact on its platform and for the host to hand over the keys to their guests.

It took many years to build guest verifications, review systems and other vital elements to create this trust on the platform. A new competitor will not be able to make the same platform overnight.

The company has also spent years working with regulators in different countries and cities to deal with various legislations. Airbnb has partnered with multiple cities to promote tourism and make legislation more friendly for short-term rents. This is another form of competitive advantage compared to potential new entrants.

Business model

Revenue

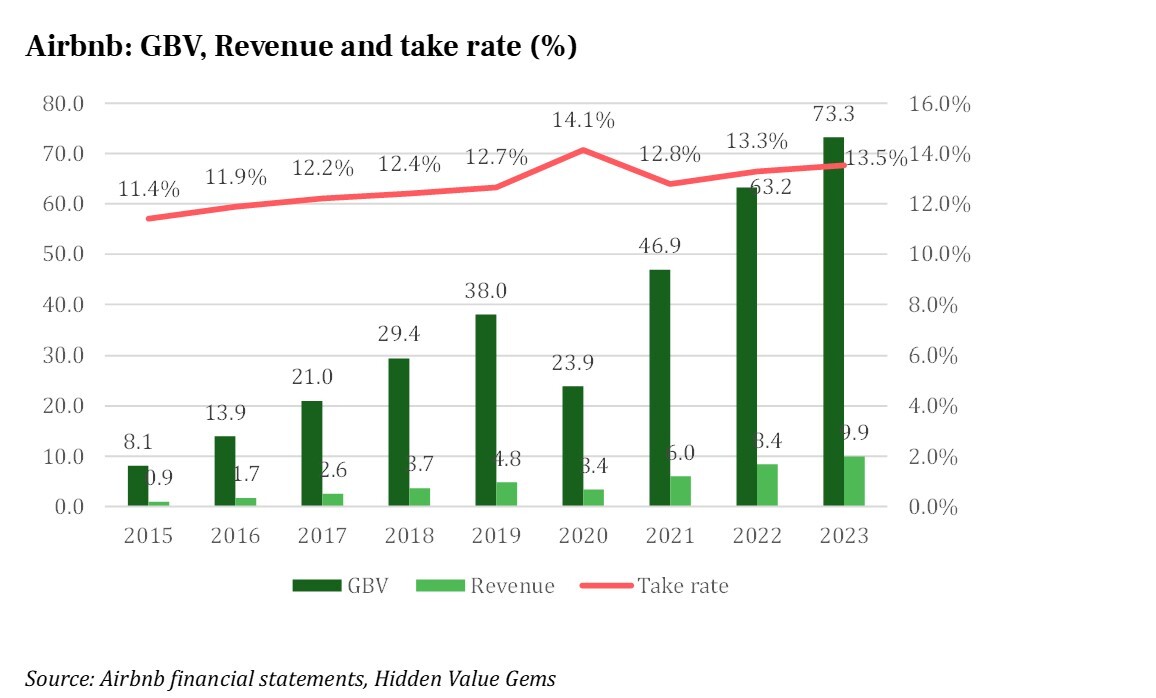

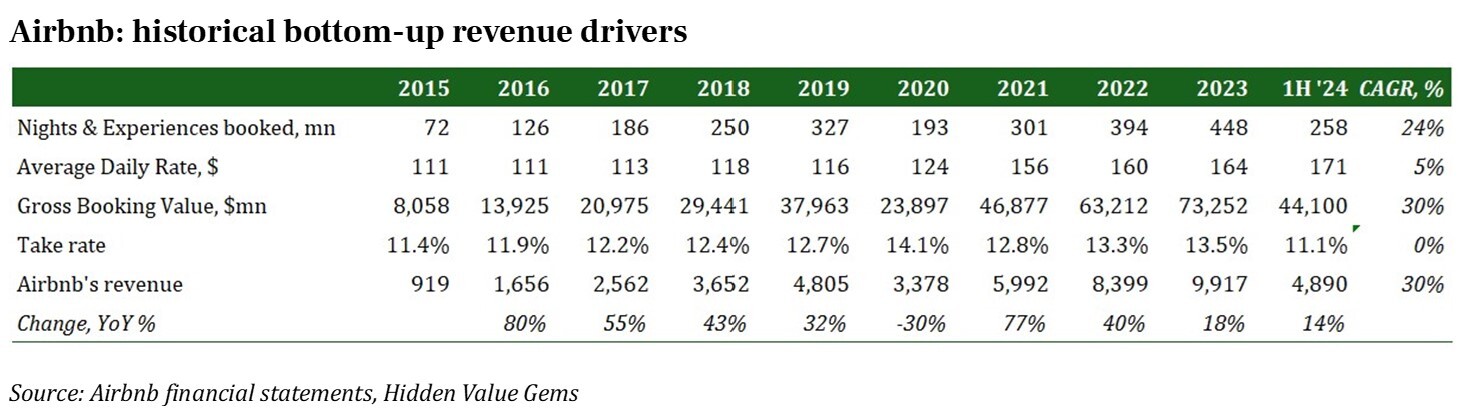

Airbnb connects property owners (hosts) with visitors (guests) by displaying properties and facilitating transactions. In 2023, visitors booked 448mn nights and experiences on Airbnb for a total value of $73.3bn.

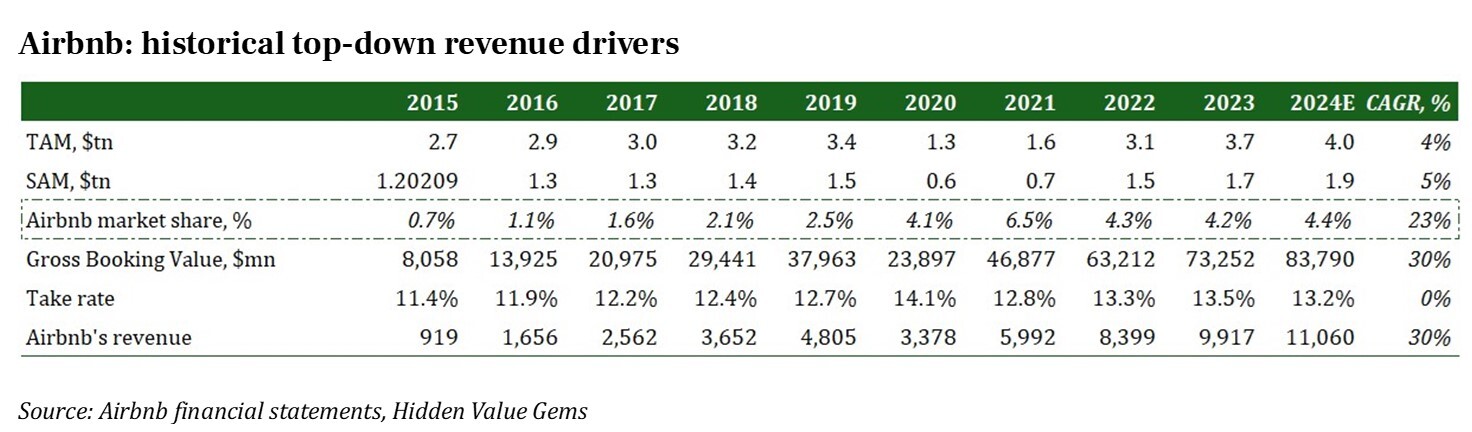

The global market for travel accommodations and experiences is over $4tn (4% of the World’s GDP), of which about half can be serviced by Airbnb. The company accounts for less than 5% of its addressable market.

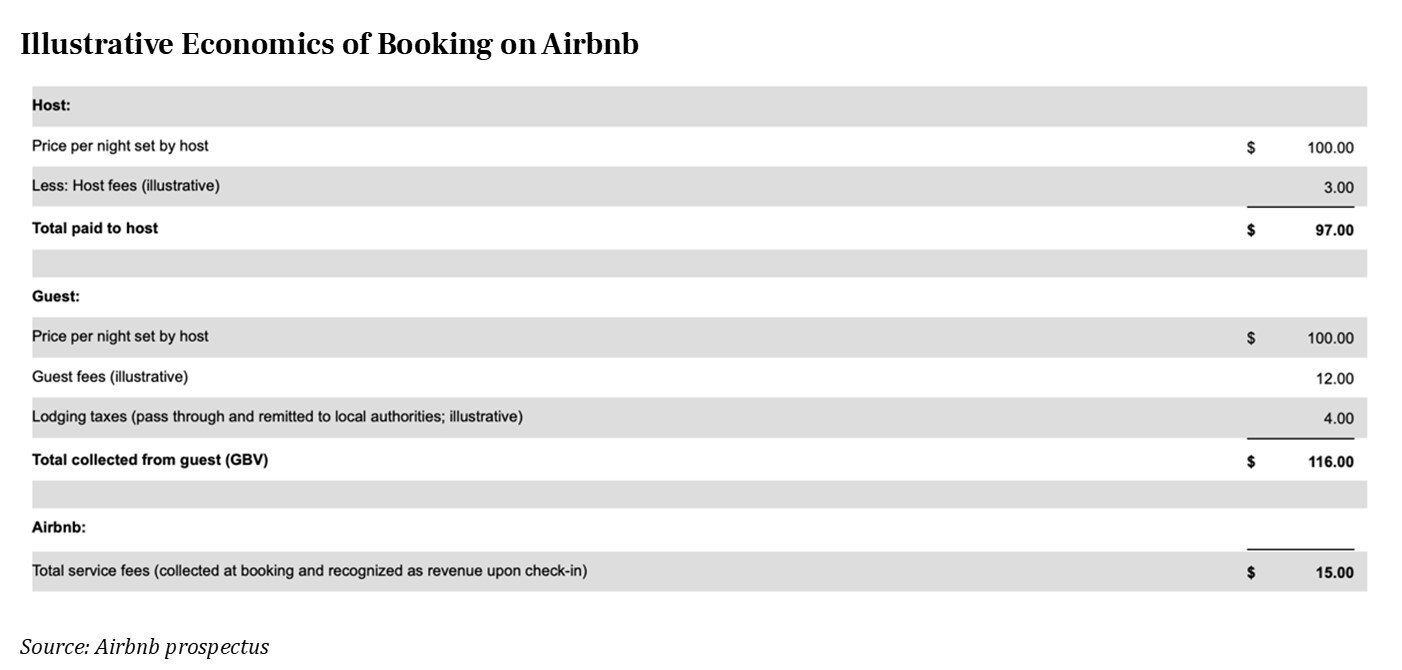

Airbnb generates revenue by charging hosts a 3% fee (of the booking price), and another 12% is charged to the guest, making the total take rate for Airbnb 15% of the price (or 13% of the gross booking value).

The global market for travel accommodations and experiences is over $4tn (4% of the World’s GDP), of which about half can be serviced by Airbnb. The company accounts for less than 5% of its addressable market.

Airbnb generates revenue by charging hosts a 3% fee (of the booking price), and another 12% is charged to the guest, making the total take rate for Airbnb 15% of the price (or 13% of the gross booking value).

Airbnb’s revenue comes from the above fees it charges hosts and guests and has historically accounted for 11-13% of Gross Booking Value (GBV), commonly referred to as ‘Take Rate’.

More recently, the company started charging FX conversion fees and plans to launch other paid services, such as Host services (to be launched in October 2024), enabling professionals to help property owners list their homes and earn extra income, saving them time and hassle.

Airbnb also allows users to book experiences on its platform (from traditional local tours to yoga lessons and cooking classes), but it has not achieved the scale it wanted. The company plans to relaunch this service in 2025.

Other services for guests and hosts will likely be launched in the medium term. Consequently, there is scope for the take rate to rise further over the long run.

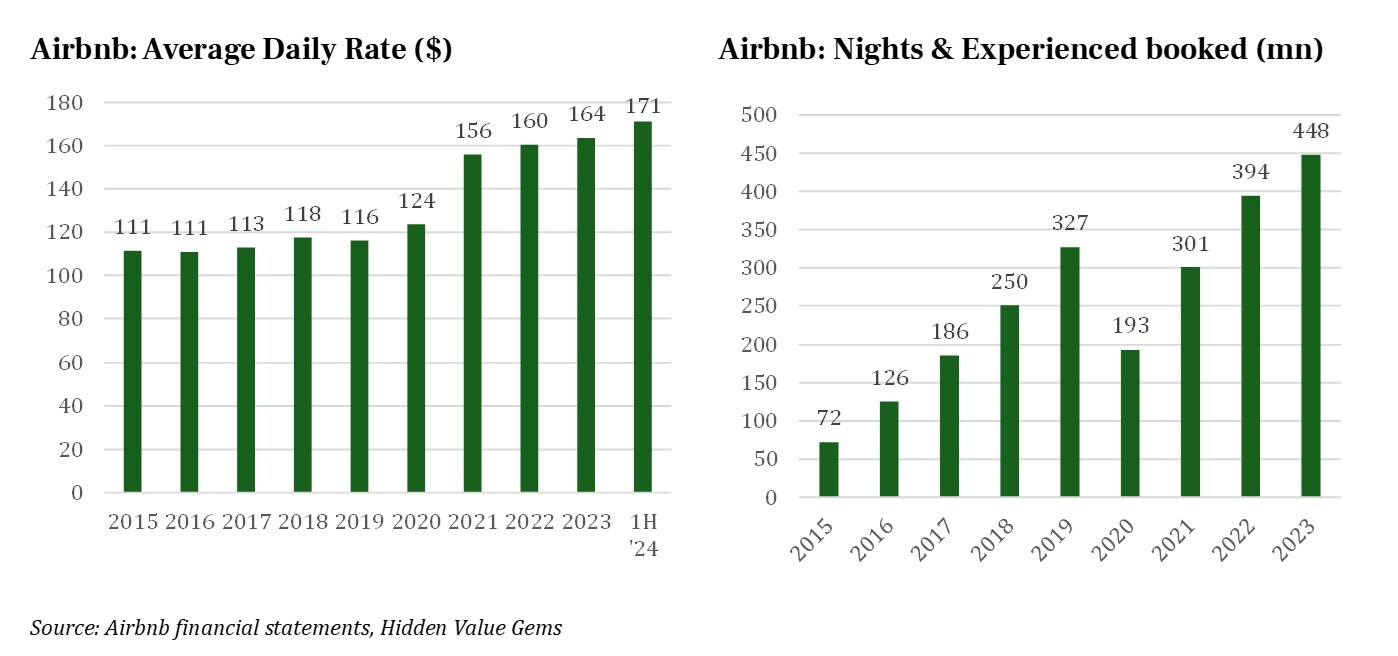

The two ways to estimate a company’s future revenue are bottom-up and top-down. In the bottom-up case, one needs to take a view on future bookings and multiply by the average daily rate (ADR). Then apply a take rate (13% today and potentially higher in the future).

Airbnb also allows users to book experiences on its platform (from traditional local tours to yoga lessons and cooking classes), but it has not achieved the scale it wanted. The company plans to relaunch this service in 2025.

Other services for guests and hosts will likely be launched in the medium term. Consequently, there is scope for the take rate to rise further over the long run.

The two ways to estimate a company’s future revenue are bottom-up and top-down. In the bottom-up case, one needs to take a view on future bookings and multiply by the average daily rate (ADR). Then apply a take rate (13% today and potentially higher in the future).

The alternative method is the top-down approach, starting from the total addressable market (global short and long-term stays and experiences), adjusting it for the share that can be serviced by Airbnb (Serviceable Addressable Market) and multiplying it by the company’s market share.

In my next post, I will share what the company’s revenue could be like in the next 5-10 years under different scenarios and assumptions.

Costs

There are five main cost items: two fully variable (they change with revenue), while the other three grow slower than revenue.

·Cost of revenue: payment processing fees and cloud (linked to revenue).

·Operations & Support: customer services are represented by personnel expenses and third-party costs, plus refunds and credits. These costs should decrease as a percentage of sales in the long term as product quality and awareness improve, reducing the need to contact the support centre. AI-based technologies can also reduce the need for more expensive human-based support.

·Product Development: personnel-related expenses incurred with the development of the Airbnb platform. These costs fluctuated as a share of sales, and the company does not want its share to decline in the medium term, although once the business reaches a steady state, it will likely decrease, in my view.

·Sales & Marketing: brand and performance-based expenses. Historically, the company spent most of its marketing expenses on brand promotion rather than performance-based digital marketing to bring new visitors. Costs as a percentage of revenue have been rapidly declining as awareness of the Airbnb platform has been rising.

·General & Administrative (G&A): head office costs, which have been declining relative to sales.

·Cost of revenue: payment processing fees and cloud (linked to revenue).

·Operations & Support: customer services are represented by personnel expenses and third-party costs, plus refunds and credits. These costs should decrease as a percentage of sales in the long term as product quality and awareness improve, reducing the need to contact the support centre. AI-based technologies can also reduce the need for more expensive human-based support.

·Product Development: personnel-related expenses incurred with the development of the Airbnb platform. These costs fluctuated as a share of sales, and the company does not want its share to decline in the medium term, although once the business reaches a steady state, it will likely decrease, in my view.

·Sales & Marketing: brand and performance-based expenses. Historically, the company spent most of its marketing expenses on brand promotion rather than performance-based digital marketing to bring new visitors. Costs as a percentage of revenue have been rapidly declining as awareness of the Airbnb platform has been rising.

·General & Administrative (G&A): head office costs, which have been declining relative to sales.

The magic of Scale and Network effects

The beauty of the company’s model is that it has achieved this scale without spending a dollar on the actual real estate to create this supply. The company did not exist before 2008.

It reached 3.3 mn active listings by 2017 and continued to grow at a c. 15% compound rate until H1 ’24 (2.4x more than in 2017). Airbnb has grown faster than any large-scale hotel operator, spending much less on the supply of rooms or customer acquisition costs.

It reached 3.3 mn active listings by 2017 and continued to grow at a c. 15% compound rate until H1 ’24 (2.4x more than in 2017). Airbnb has grown faster than any large-scale hotel operator, spending much less on the supply of rooms or customer acquisition costs.

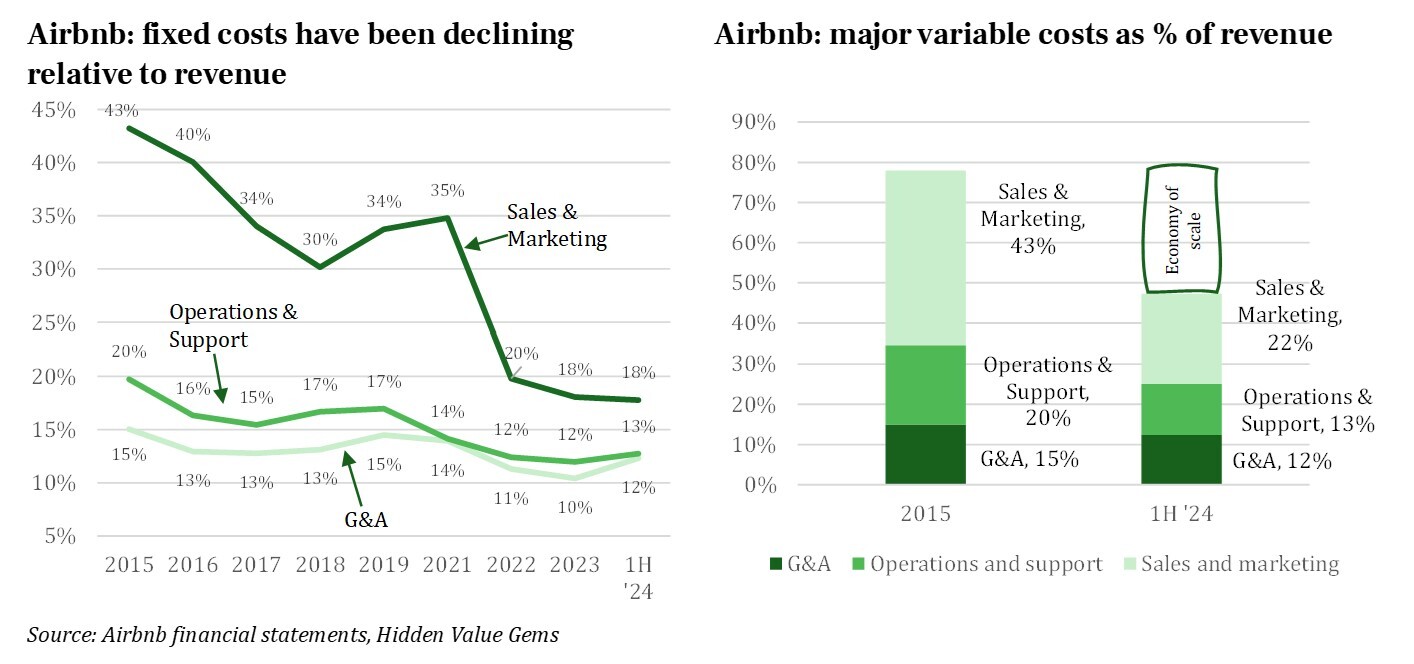

The following charts are the most important, in my view. They show that the company benefits from an economy of scale, with certain costs increasing much slower than revenues (the effect of operating leverage).

The three major cost items (Sales & Marketing, Operations & Support and G&A) accounted for 78% of total revenue in 2015. Today, the same three cost items account for 47% of revenue, expanding operating profit margin by 31p.p.

The three major cost items (Sales & Marketing, Operations & Support and G&A) accounted for 78% of total revenue in 2015. Today, the same three cost items account for 47% of revenue, expanding operating profit margin by 31p.p.

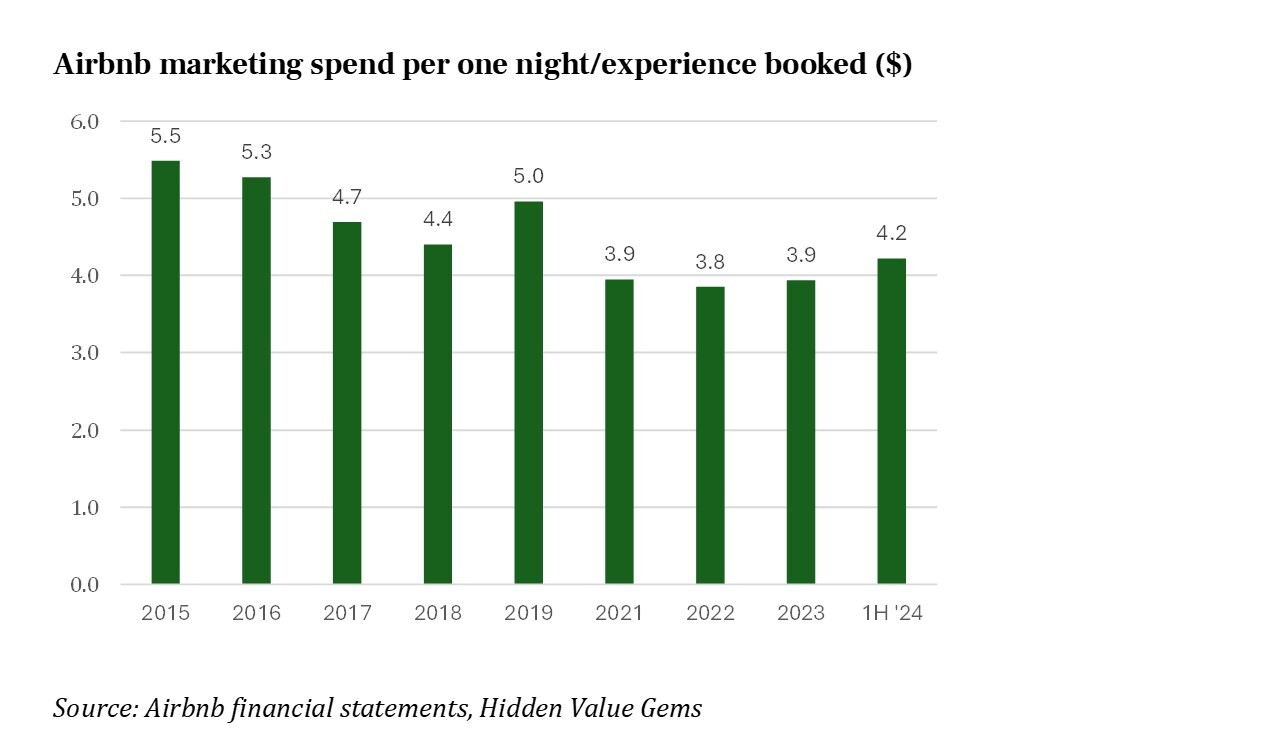

For example, back in 2015, Airbnb spent $5.5 on marketing per one night (or experience) booked on its platform. By 2023, this spending had decreased to $3.9. The saving ($1.6) may not look material, but when multiplied by 515mn bookings (258mn bookings made in H1 ’24 times 2 to get a rough number for the most recent annual bookings), this translates into $824mn of annual savings (c. 1% of the market cap or 8% of 2023 revenues).

The marketing expenses per night have increased in H1 2024, partially due to seasonality and partially due to investments in new regions to bring more hosts to the platform. This cost item will fluctuate and never be a straight line, but it will likely decline further over 3, 5 and 10 years.

The marketing expenses per night have increased in H1 2024, partially due to seasonality and partially due to investments in new regions to bring more hosts to the platform. This cost item will fluctuate and never be a straight line, but it will likely decline further over 3, 5 and 10 years.

Airbnb benefits from the classic network effects, which increase the value of the ‘network’ as more participants join it. The more hosts list their properties, the more guests will come to the platform to find their next place to stay. The more guests book properties, the more hosts will join the platform.

In the early days of Airbnb, the most prominent promoters of the platform were its users, both guests and hosts, who shared their experiences with their friends. It was not uncommon for guests to become hosts after their first trip with Airbnb.

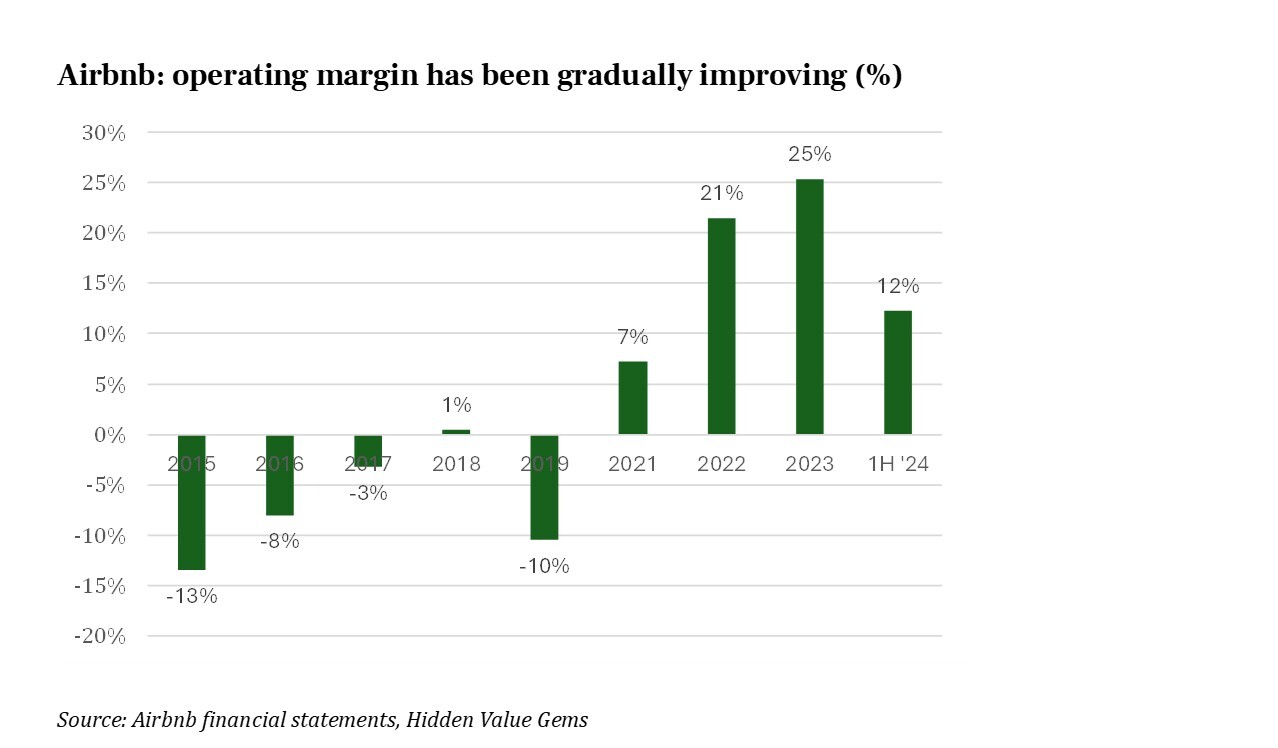

The scale effects have made Airbnb profitable at the operating level (without special adjustments) in 2021, with further margin improvements since then.

In the early days of Airbnb, the most prominent promoters of the platform were its users, both guests and hosts, who shared their experiences with their friends. It was not uncommon for guests to become hosts after their first trip with Airbnb.

The scale effects have made Airbnb profitable at the operating level (without special adjustments) in 2021, with further margin improvements since then.

The company can spread fixed costs over larger volumes, reducing unit costs.

Put differently, every new guest on Airbnb contributes a much higher margin as the company grows. On my estimates, the current contribution margin of new guests in the existing markets (e.g. the US or the UK) is around 90% (assuming payment costs are covered by 3% of the fees paid by hosts).

For reference, Airbnb’s 3.5-year historic operating margin has been 14%.

Put differently, every new guest on Airbnb contributes a much higher margin as the company grows. On my estimates, the current contribution margin of new guests in the existing markets (e.g. the US or the UK) is around 90% (assuming payment costs are covered by 3% of the fees paid by hosts).

For reference, Airbnb’s 3.5-year historic operating margin has been 14%.

Structurally growing market

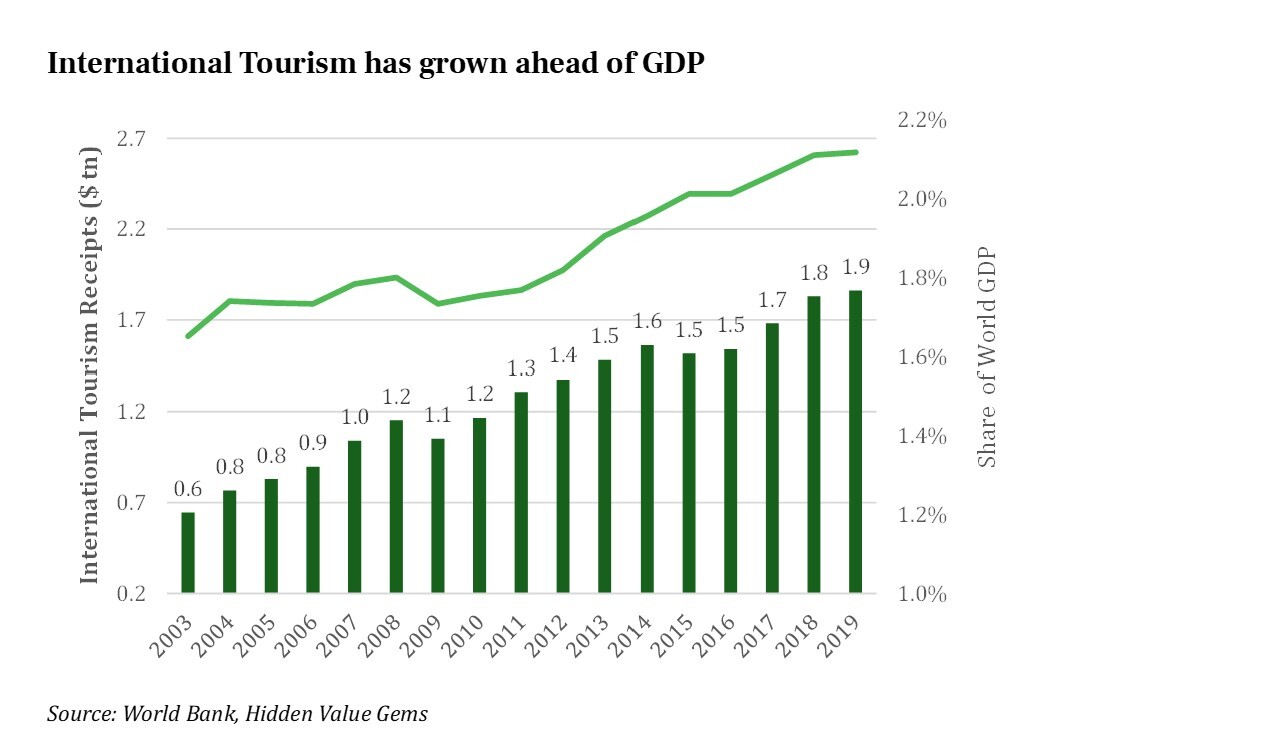

While I try not to make calls on specific markets and industries, I always prefer businesses operating in structurally growing markets. Travel spending has outperformed global GDP growth over the past two decades, which will likely continue.

As more people can meet their basic needs for food, clothes and shelter, they start valuing free time, travel and leisure.

Hybrid work and more IT-related jobs allow people to work in different locations.

Climate changes also push many residents to change their residencies a few times a year (e.g. Middle Eastern residents often leave their homes for most of the summer).

Building new supplies of homes and hotels takes a long time and has usually lagged demand for various reasons. As a result, rent and accommodation costs have often grown above inflation.

The growth of low-cost airlines has made travelling more affordable, which has helped bring more tourists, benefiting businesses like Airbnb.

During 1994-2023, international tourism has increased 3.5x, which corresponds with 5.4% annual compound growth, exceeding world GDP growth by 2 percentage points. Coupled with domestic tourism, which has been growing even faster in certain countries like China or Russia, the overall development of the travel industry has been even faster.

As more people can meet their basic needs for food, clothes and shelter, they start valuing free time, travel and leisure.

Hybrid work and more IT-related jobs allow people to work in different locations.

Climate changes also push many residents to change their residencies a few times a year (e.g. Middle Eastern residents often leave their homes for most of the summer).

Building new supplies of homes and hotels takes a long time and has usually lagged demand for various reasons. As a result, rent and accommodation costs have often grown above inflation.

The growth of low-cost airlines has made travelling more affordable, which has helped bring more tourists, benefiting businesses like Airbnb.

During 1994-2023, international tourism has increased 3.5x, which corresponds with 5.4% annual compound growth, exceeding world GDP growth by 2 percentage points. Coupled with domestic tourism, which has been growing even faster in certain countries like China or Russia, the overall development of the travel industry has been even faster.

Capital light business model, positive FCF and Net Cash

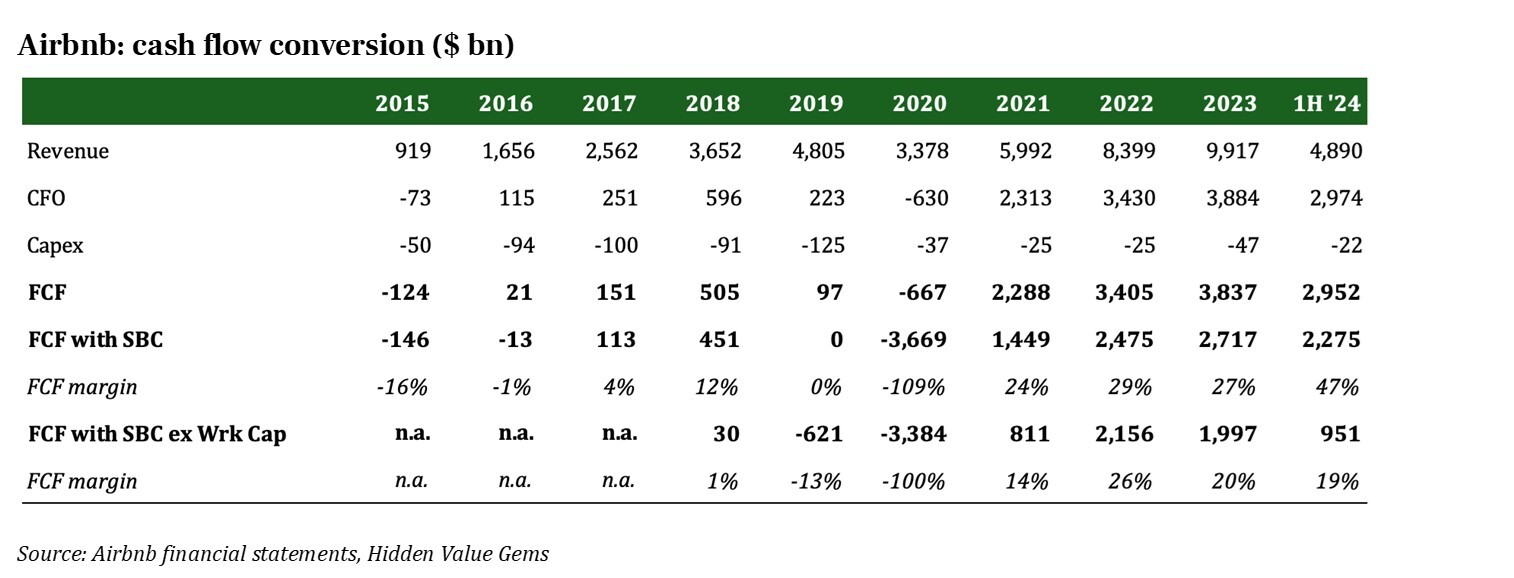

Airbnb requires very little capital to grow as a typical marketplace since its core product is the IT platform with a high share of fixed costs. The company spent just $47mn on capex in 2023 and $0.6bn over 2015-2023. For comparison, Airbnb’s revenue was $9.9bn last year and $41.3bn over 2015-2023.

Consequently, the company is highly cash-generative. It earned $3.8bn FCF in 2023. Even after deducting stock-based compensation (SBC), FCF remained meaningful at $2.7bn. H1 ’24 FCF after deducting SBC was $2.3bn.

I will address the issue of SBC expenses in the second part.

Consequently, the company is highly cash-generative. It earned $3.8bn FCF in 2023. Even after deducting stock-based compensation (SBC), FCF remained meaningful at $2.7bn. H1 ’24 FCF after deducting SBC was $2.3bn.

I will address the issue of SBC expenses in the second part.

Airbnb also benefits from substantial positive Working capital as customers pay for their accommodations at the time of booking, while hosts receive their money only after guests have checked in. Airbnb earns extra interest on the customer funds it holds between booking and checking in.

In 2023, the company generated a positive Working Capital inflow of $720mn and $1.3bn in H1 ’24. The table above shows FCF with and without Working Capital. Even removing the positive effect of Working Capital and after deducing stock-based compensation, Airbnb’s FCF was c. $2bn in 2022-23, translating into 26% and 20% FCF margins, respectively.

The considerable advantage of Airbnb is that it can achieve breakeven at a much lower scale and does not depend on the minimum utilisation rate as the hotel industry. No matter how small and low-cost its operations are, a hotel will struggle to stay profitable if you do not achieve at least a 50% room occupancy rate (utilisation) throughout the year. Just think about all the fixed costs related to the front desk, cleaning, maintenance, interest expenses, heating and electricity and other similar costs.

Airbnb does not need to cover any expenses related to physical properties. It can balance the market through various incentives to bring more hosts if it needs more supply or more guests if its platform has an unusually high number of listings.

There is also a unique characteristic of the service that differentiates Airbnb from traditional hotels. During economic recessions, many tenants face more difficulties paying utility bills and mortgages, so they may be more incentivised to move out and offer their properties on Airbnb. Equally, they may be looking for alternative accommodations on the same platform. While the overall business does not escape the traditional economic cycles, it has some extra cushions during recessions.

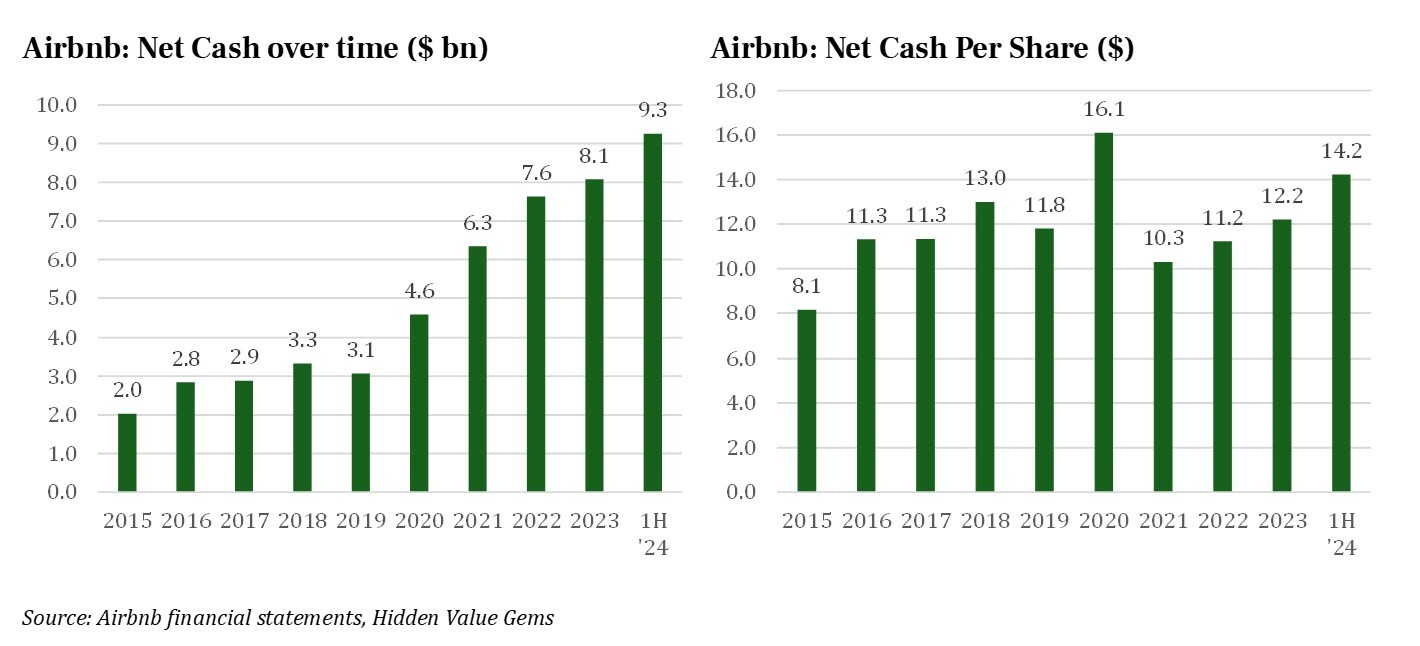

Finally, it is worth highlighting that the company has continuously operated with a net cash position, which exceeded $9bn in H1 ’24, accounting for 11% of the market cap. Given the company's IPO in 2020, with new shares issued and heavy stock issuance as part of management compensation, I have also shown the net cash position per share, which has increased over time, albeit at a slower pace.

In 2023, the company generated a positive Working Capital inflow of $720mn and $1.3bn in H1 ’24. The table above shows FCF with and without Working Capital. Even removing the positive effect of Working Capital and after deducing stock-based compensation, Airbnb’s FCF was c. $2bn in 2022-23, translating into 26% and 20% FCF margins, respectively.

The considerable advantage of Airbnb is that it can achieve breakeven at a much lower scale and does not depend on the minimum utilisation rate as the hotel industry. No matter how small and low-cost its operations are, a hotel will struggle to stay profitable if you do not achieve at least a 50% room occupancy rate (utilisation) throughout the year. Just think about all the fixed costs related to the front desk, cleaning, maintenance, interest expenses, heating and electricity and other similar costs.

Airbnb does not need to cover any expenses related to physical properties. It can balance the market through various incentives to bring more hosts if it needs more supply or more guests if its platform has an unusually high number of listings.

There is also a unique characteristic of the service that differentiates Airbnb from traditional hotels. During economic recessions, many tenants face more difficulties paying utility bills and mortgages, so they may be more incentivised to move out and offer their properties on Airbnb. Equally, they may be looking for alternative accommodations on the same platform. While the overall business does not escape the traditional economic cycles, it has some extra cushions during recessions.

Finally, it is worth highlighting that the company has continuously operated with a net cash position, which exceeded $9bn in H1 ’24, accounting for 11% of the market cap. Given the company's IPO in 2020, with new shares issued and heavy stock issuance as part of management compensation, I have also shown the net cash position per share, which has increased over time, albeit at a slower pace.

Led by still young founders with passion and long-term horizon

Strong evidence shows that founder-led businesses deliver better results than employed managers. Incentive structure, different time horizons and skills play a role.

Airbnb was founded by two university friends (Brian Chesky and Joe Gebbia) in their 20s. They were soon joined by a young software engineer, Nathan Blecharczyk, who was two years younger.

The founders went through various ups and downs. Their idea was rejected by almost everyone, forcing them to save every cent and be creative in finding early capital. One significant funding source was their marketing idea to sell branded cereal boxes at the 2008 US presidential campaign events. They earned between $20,000 and 30,000, selling those boxes for $40 a piece while making just $5,000 from the core business.

Airbnb was founded by two university friends (Brian Chesky and Joe Gebbia) in their 20s. They were soon joined by a young software engineer, Nathan Blecharczyk, who was two years younger.

The founders went through various ups and downs. Their idea was rejected by almost everyone, forcing them to save every cent and be creative in finding early capital. One significant funding source was their marketing idea to sell branded cereal boxes at the 2008 US presidential campaign events. They earned between $20,000 and 30,000, selling those boxes for $40 a piece while making just $5,000 from the core business.

This episode was often the reason a few of the best-known Silicon Valley VCs decided to back the company, crediting its founders for creativity, ability to sell and resilience.

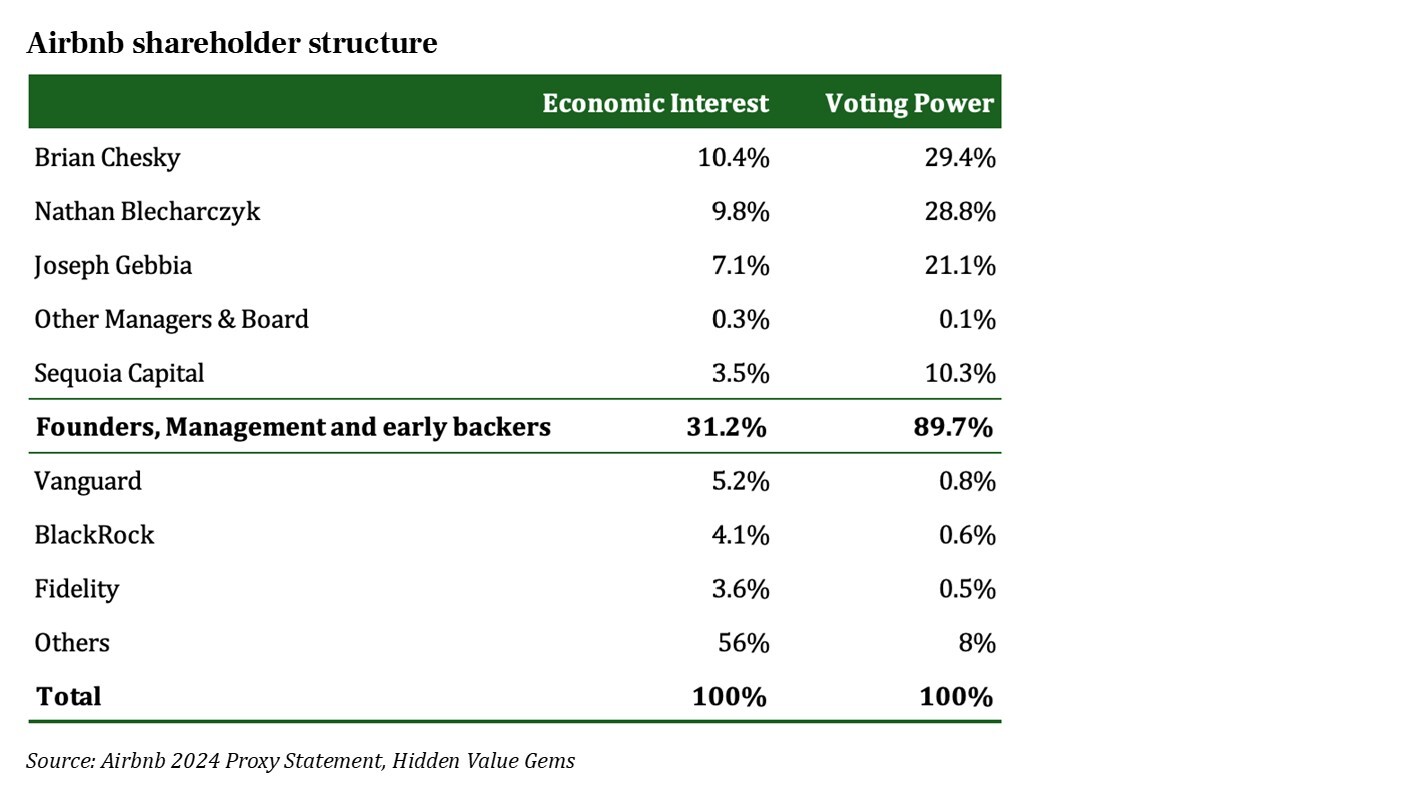

The three co-founders are still in their early 40s. They collectively own 27.4% economic interest in Airbnb and hold 79.3% voting rights.

The three co-founders are still in their early 40s. They collectively own 27.4% economic interest in Airbnb and hold 79.3% voting rights.

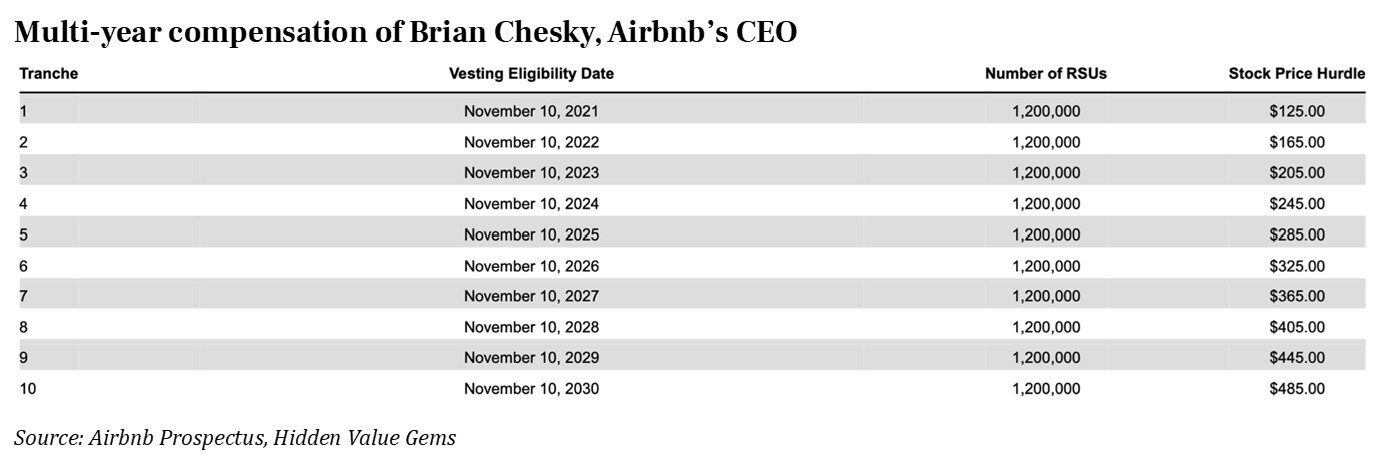

Brian Chesky has remained the company’s CEO since 2008. Since the IPO in 2020, he has received zero base salary and is opting for compensation that is 100% linked to the share price performance. He has a 10-year compensation arrangement, which is made of 10 tranches. The shares become vested only if the stock reaches a specific hurdle price (e.g. for 2024, the hurdle price is $245 per share, 87% above the spot price).

What’s next

The company went public in 2020 at $145, and the stock has been range-bound since then, apart from a high valuation (c. $100bn Mkt Cap for a business that earned just $429mn in operating profit the following year and lost $502mn in 2019), several issues seem to hold the stock back.

They include regulatory pressure, competition from online travel agent (OTA) sites like Booking.com and Expedia, concerns over weakening demand, underlying profitability and cash generation, and concerns over ‘high SBC expenses’.

I will address these issues in Part II of my report on Airbnb, explaining where I am different relative to consensus and whether there is any upside in the stock.

They include regulatory pressure, competition from online travel agent (OTA) sites like Booking.com and Expedia, concerns over weakening demand, underlying profitability and cash generation, and concerns over ‘high SBC expenses’.

I will address these issues in Part II of my report on Airbnb, explaining where I am different relative to consensus and whether there is any upside in the stock.