28 May 2023

This is the second edition of the Monthly Idea Lab. Every week, I come across a dozen stocks that look initially interesting. I find them through sector research, reading the financial press, other investor blogs and letters, annual reports, listening to podcasts, speaking to fellow investors, doing periodical screens, and other sources.

I filter them to keep just one or two with the best risk/reward profiles. By the end of the month, I have between 5 to 10 stocks that I add to my watchlist. I wait for a better price or a stronger conviction depending on a particular case, before deciding to invest in a company. In most cases, a stronger conviction usually comes from a deep dive that I do later or if I address the critical issue behind the share price drop.

Before I share the top five names I selected in May, I wanted to provide a quick update on the previous seven ideas I introduced last month.

I filter them to keep just one or two with the best risk/reward profiles. By the end of the month, I have between 5 to 10 stocks that I add to my watchlist. I wait for a better price or a stronger conviction depending on a particular case, before deciding to invest in a company. In most cases, a stronger conviction usually comes from a deep dive that I do later or if I address the critical issue behind the share price drop.

Before I share the top five names I selected in May, I wanted to provide a quick update on the previous seven ideas I introduced last month.

Kistos Plc

I have not bought any new shares. Kistos looks the most interesting. Its stock is down almost 20% since I last wrote about it. So far, it has been following European gas prices. Gas storage in Europe is currently 66% full, which is well above historical norms for this time of the year. Warmer and windy winter earlier this year, as well as weaker Chinese growth, are the key factors. I recently read that some traders do not exclude European gas prices turning negative later this summer. While this is all temporary and unsustainable, it can still drag the stock further down.

As a result, the market has completely ignored a new acquisition of Mime Petroleum which was made on quite attractive terms, in my view ($111mn consideration for 24mn boe of 2P reserves plus 30mn boe of 2C resources). Kistos will not pay cash to shareholders. It will repay $75mn of debt and assume the remaining $225mn of the remaining debt. The company expects to receive tax refunds in December 2023 ($80mn), which, together with $109mn of cash on Mime’s balance sheet, would reduce the total deal consideration to $111mn. Kistos has also issued 2.4mn warrants to Mime shareholders subject to operational success and exercisable into Kistos shares at 385p.

As a result, the market has completely ignored a new acquisition of Mime Petroleum which was made on quite attractive terms, in my view ($111mn consideration for 24mn boe of 2P reserves plus 30mn boe of 2C resources). Kistos will not pay cash to shareholders. It will repay $75mn of debt and assume the remaining $225mn of the remaining debt. The company expects to receive tax refunds in December 2023 ($80mn), which, together with $109mn of cash on Mime’s balance sheet, would reduce the total deal consideration to $111mn. Kistos has also issued 2.4mn warrants to Mime shareholders subject to operational success and exercisable into Kistos shares at 385p.

Charles Schwab

I did some further work on Charles Schwab and concluded that the risk/reward was not attractive. If things go well, the stock goes back to $80 (+54% upside), but there is a high risk of material impairment of the earnings power as the broker has to replace cheap depositing funding with more expensive funds. What made $NFLX and $META such great trades last year was that both companies had strong funding and were highly profitable. They were also down 70% from ATH. $SCHW is down 46% so far despite facing arguably bigger risks.

Barrick Gold

Barrick continues to look attractive, especially since many leading investors with entirely different backgrounds, such as macro and value, keep highlighting the need to hedge against sovereign risks and inflation. I have not bought it yet because I want to minimise stock-picking risks. Other alternatives are buying Gold as a commodity or a gold stocks ETF. I also think that an investor with a small portfolio should be able to find bargains in small-cap space that would deliver spectacular returns offsetting inflation.

If any of my previous ideas pass further tests, you will find them in the Portfolio section of the website.

If any of my previous ideas pass further tests, you will find them in the Portfolio section of the website.

New ideas (May-April 2023)

Biglari Holdings

Ticker: BH.A US / BH US

Price: $1,006 / $207

Mkt Cap: $636mn

EV: $146mn

This is the most interesting company I have come across in at least one year. It was founded in 2008 by a young businessman, Sardar Biglari (45), who currently owns 70.4% of voting rights (66.2% economic interest). The way Biglari describes the company’s strategy is very similar to the philosophy of Warren Buffett:

“We endeavour to build upon this collection with companies possessing excellent economics, operated by exceptional management.”

Biglari Holdings owns seven businesses, a cash position ($37.5mn), marketable securities ($69.5mn) and an investment in a Lion Fund, managed by Mr Biglari ($383mn). Total investments amount to $490m (81% of the market cap).

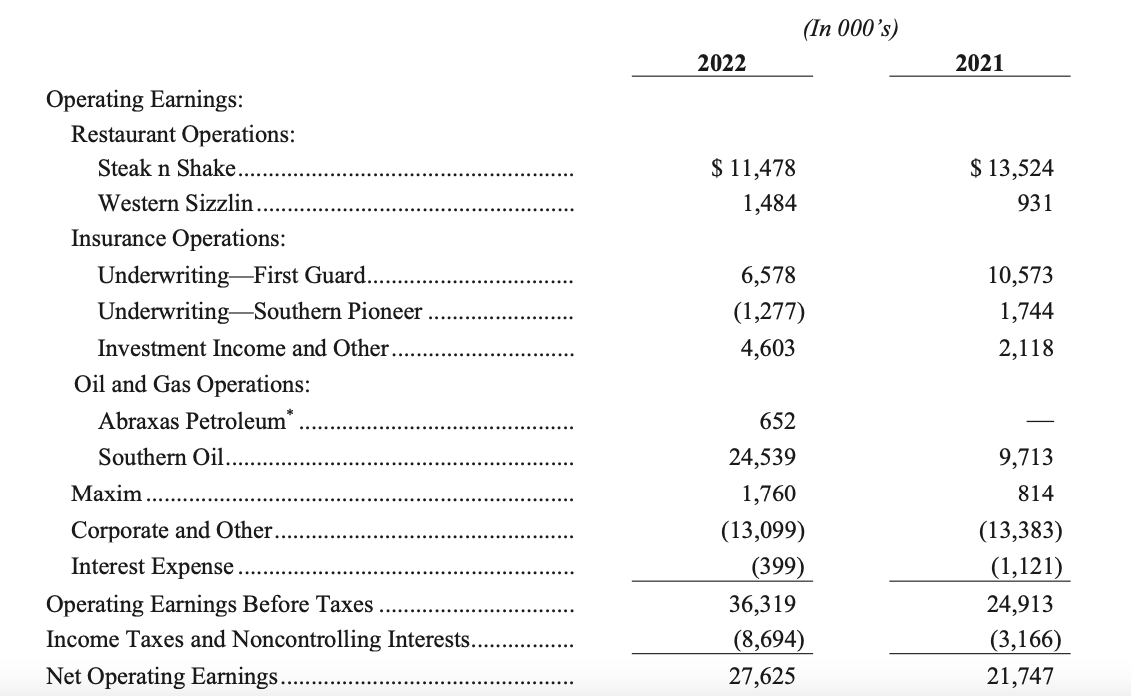

The residual value ($146mn) could be attributed to the operating business which consist of two restaurant chains (Steak n Shake and Western Sizzlin), two insurance businesses, two oil companies and Maxim magazine.

These businesses collectively earned $27.6m of net operating profit in 2022.

Price: $1,006 / $207

Mkt Cap: $636mn

EV: $146mn

This is the most interesting company I have come across in at least one year. It was founded in 2008 by a young businessman, Sardar Biglari (45), who currently owns 70.4% of voting rights (66.2% economic interest). The way Biglari describes the company’s strategy is very similar to the philosophy of Warren Buffett:

“We endeavour to build upon this collection with companies possessing excellent economics, operated by exceptional management.”

Biglari Holdings owns seven businesses, a cash position ($37.5mn), marketable securities ($69.5mn) and an investment in a Lion Fund, managed by Mr Biglari ($383mn). Total investments amount to $490m (81% of the market cap).

The residual value ($146mn) could be attributed to the operating business which consist of two restaurant chains (Steak n Shake and Western Sizzlin), two insurance businesses, two oil companies and Maxim magazine.

These businesses collectively earned $27.6m of net operating profit in 2022.

Source: Companies Annual report

The way Sardar Biglari arranged his compensation is also quite interesting. His base salary is $900k, but his main compensation comes from growing the company’s book value. He receives the bonus only if the book value in a given year exceeds the previous high-water mark level by 6%. The bonus would amount to 25% of the incremental book value created above the high-water mark plus 6%.

Given that he is the largest shareholder of the company, such a compensation structure looks too generous, in my view. This would be one reason for the stock to trade at a discount. Needless to say, the richest investor Warren Buffett continues to receive just $100k annual salary with no bonus whatsoever, as 99% of his net worth is locked in Berkshire Hathaway shares.

My next steps are to understand the evolution of the company’s per-share NAV since 2008, more specific reasons for the past acquisitions and the subsequent performance of the acquired businesses. I also want to read more background information on the founder, his incentive arrangement, the Lion Fund and its investment strategy, as well as the evolution of the share count.

Given that he is the largest shareholder of the company, such a compensation structure looks too generous, in my view. This would be one reason for the stock to trade at a discount. Needless to say, the richest investor Warren Buffett continues to receive just $100k annual salary with no bonus whatsoever, as 99% of his net worth is locked in Berkshire Hathaway shares.

My next steps are to understand the evolution of the company’s per-share NAV since 2008, more specific reasons for the past acquisitions and the subsequent performance of the acquired businesses. I also want to read more background information on the founder, his incentive arrangement, the Lion Fund and its investment strategy, as well as the evolution of the share count.

Boston Omaha Company

Ticker: BOC US

Price: $19.4

Mkt Cap: $608mn

EV: $506mn

This is quite a controversial company. It is either a small Berkshire Hathaway or a potential disappointment. The company was founded by two young investors, one of whom (Alex Rozek) is a relative of Warren Buffett (he is the grandson of Buffett’s sister). The company publishes very thoughtful letters referring to the same principles that Buffett speaks about. The difference is that management also has stakes in various underlying assets. The company has had several equity raises since 2015, and it is generally harder to analyse the company due to its corporate structure.

The two co-CEOs collectively own 25% of BOC’s shares (and 44% of voting rights).

Management states that:

“Boston Omaha’s focused objective is growing intrinsic value per share at an attractive rate while seeking to maintain an uncompromising financial position.”

The company operates three businesses: a Billboard company, Insurance, and Broadband. In addition, it runs several investment funds with a combined AuM of $157mn. It also has about $52.5mn of cash and no debt at the parent level (just $29mn non-recourse debt at a subsidiary level).

My concerns:

Price: $19.4

Mkt Cap: $608mn

EV: $506mn

This is quite a controversial company. It is either a small Berkshire Hathaway or a potential disappointment. The company was founded by two young investors, one of whom (Alex Rozek) is a relative of Warren Buffett (he is the grandson of Buffett’s sister). The company publishes very thoughtful letters referring to the same principles that Buffett speaks about. The difference is that management also has stakes in various underlying assets. The company has had several equity raises since 2015, and it is generally harder to analyse the company due to its corporate structure.

The two co-CEOs collectively own 25% of BOC’s shares (and 44% of voting rights).

Management states that:

“Boston Omaha’s focused objective is growing intrinsic value per share at an attractive rate while seeking to maintain an uncompromising financial position.”

The company operates three businesses: a Billboard company, Insurance, and Broadband. In addition, it runs several investment funds with a combined AuM of $157mn. It also has about $52.5mn of cash and no debt at the parent level (just $29mn non-recourse debt at a subsidiary level).

My concerns:

- co-CEOs seem to have interests in other businesses, and unlike Buffett, they don’t keep 90% of their net worth in one company (BOC)

- The company pays high professional fees ($7mn in 2021 vs revenue of $57mn and total assets of $807mn; in 2022: $5mn vs revenue of $81mn)

- Operating loss of $5.2mn, $23.8mn and $4.99mn in 2022, 2021 and 2020, respectively

- Management has been regularly raising new shares and diluting its interest, although other directors have been buying shares in the market.

Smith-Midland Corporation

Ticker: SMID US

Price: $15.9

Mkt Cap: $83.6mn

EV: $85.6mn

A family-run business founded in the 1960s. Key products include Highway barriers, SlenderWall Cladding, Noise absorbing walls and other construction products.

The business has partially pivoted to rentals which improved economics (relative to the sale of manufactured products).

There are natural barriers to entry as concrete parts are heavy and are not economical to transport long-distance; local manufacturers are mini-monopolies. SMID is a leader in a few South-East locations in the US.

The business seems to be quite cyclical with fairly high fixed costs, as was evidenced in 2022 when a slight decline in revenue led to a negative net income. Operations also require high working capital, which negatively affects the FCF.

Price: $15.9

Mkt Cap: $83.6mn

EV: $85.6mn

A family-run business founded in the 1960s. Key products include Highway barriers, SlenderWall Cladding, Noise absorbing walls and other construction products.

The business has partially pivoted to rentals which improved economics (relative to the sale of manufactured products).

There are natural barriers to entry as concrete parts are heavy and are not economical to transport long-distance; local manufacturers are mini-monopolies. SMID is a leader in a few South-East locations in the US.

The business seems to be quite cyclical with fairly high fixed costs, as was evidenced in 2022 when a slight decline in revenue led to a negative net income. Operations also require high working capital, which negatively affects the FCF.