12 March 2023

This is an unusual post as I am going to comment on the latest news, which I usually don't do.

Throughout my 20-year career, I have learnt to pay little attention to headlines. Big events with long-lasting consequences are rare. Having just lived through COVID, it is unlikely that another major Black Swan would happen.

I invite you to vote in a poll that I am running on Twitter on what you plan to do tomorrow when markets open.

At a minimum, posing this question may make you think deeper about the situation. It can also help you keep the score of your reasoning, which is essential for making even better decisions in the future. You may find something helpful while researching the topic or reading the text below.

I, obviously, do not know the correct answer. My intuition tells me that this is not just another bank closure, and the market risks are considerably higher now. I have about 15% of my portfolio in cash. Some of my positions should be relative winners in this situation, like Berkshire Hathaway (my biggest position). So not too worried about permanent loss of capital for now.

This is an unusual post as I am going to comment on the latest news, which I usually don't do.

Throughout my 20-year career, I have learnt to pay little attention to headlines. Big events with long-lasting consequences are rare. Having just lived through COVID, it is unlikely that another major Black Swan would happen.

I invite you to vote in a poll that I am running on Twitter on what you plan to do tomorrow when markets open.

At a minimum, posing this question may make you think deeper about the situation. It can also help you keep the score of your reasoning, which is essential for making even better decisions in the future. You may find something helpful while researching the topic or reading the text below.

I, obviously, do not know the correct answer. My intuition tells me that this is not just another bank closure, and the market risks are considerably higher now. I have about 15% of my portfolio in cash. Some of my positions should be relative winners in this situation, like Berkshire Hathaway (my biggest position). So not too worried about permanent loss of capital for now.

So what’s all the fuss about?

When I first read that the Silicon Valley Bank collapsed, I thought it was sad but put into a bucket with other recent tech failures and crypto collapses. A bank for startups, which is supposed to lend to them (?), sounds like an oxymoron to me. If the bank goes under because its fundamental business model is flawed, it is logical, even though it is terrible news for its depositors.

But having lived through the Lehman collapse, intuitively, I felt like something was not right and was quite serious. So let’s look at the facts.

But having lived through the Lehman collapse, intuitively, I felt like something was not right and was quite serious. So let’s look at the facts.

What is SVB?

Silicon Valley Bank (SVB) is the 16th largest bank in the USA.

SVB was founded in 1983. Its CEO, Greg Becker, has been running the company since 2011. According to its website, nearly half of US venture-backed technology and life science companies bank with SVB.

The bank has offices in the UK, Germany, Canada, Denmark, Israel, India, and Ireland.

At the end of 2022, the bank had $211.8bn of assets, $74.3bn of loans and $173.1bn of deposits.

SVB was founded in 1983. Its CEO, Greg Becker, has been running the company since 2011. According to its website, nearly half of US venture-backed technology and life science companies bank with SVB.

The bank has offices in the UK, Germany, Canada, Denmark, Israel, India, and Ireland.

At the end of 2022, the bank had $211.8bn of assets, $74.3bn of loans and $173.1bn of deposits.

Why did Silicon Valley Bank collapse?

It looks like its main problem was the asset-liability mismatch exacerbated by rising interest rates and the drying up of funding activities in the tech sector.

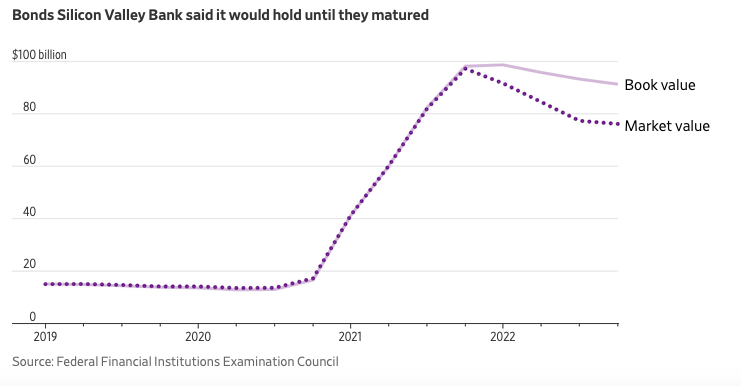

The bank had only 43% of its deposits channelled into loans, while 57% were invested into bonds. As interest rates increased, the bond value declined. The gap between the nominal value of the bond portfolio of SVB and its market value exceeded $17bn by the end of 2022 (for reference, the bank’s equity was just $16bn at that point).

The bank had only 43% of its deposits channelled into loans, while 57% were invested into bonds. As interest rates increased, the bond value declined. The gap between the nominal value of the bond portfolio of SVB and its market value exceeded $17bn by the end of 2022 (for reference, the bank’s equity was just $16bn at that point).

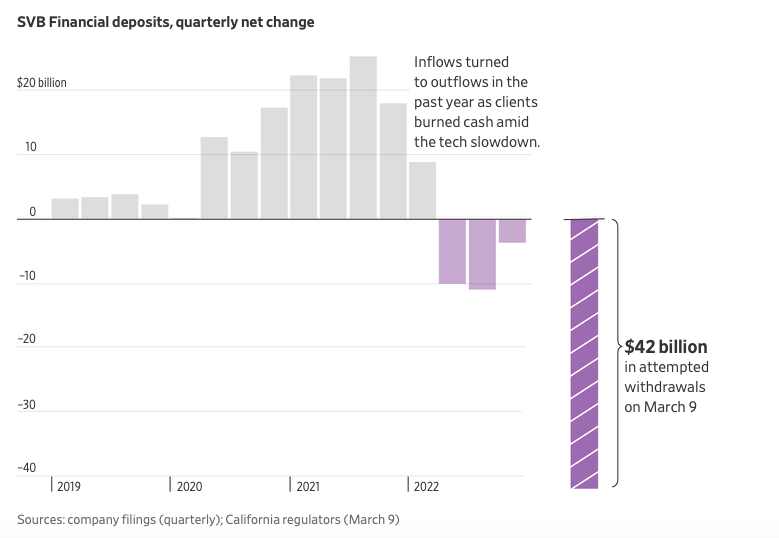

Besides, the inflow of new money deposited with SVB has also reversed as few VC-backed companies raised funds recently.

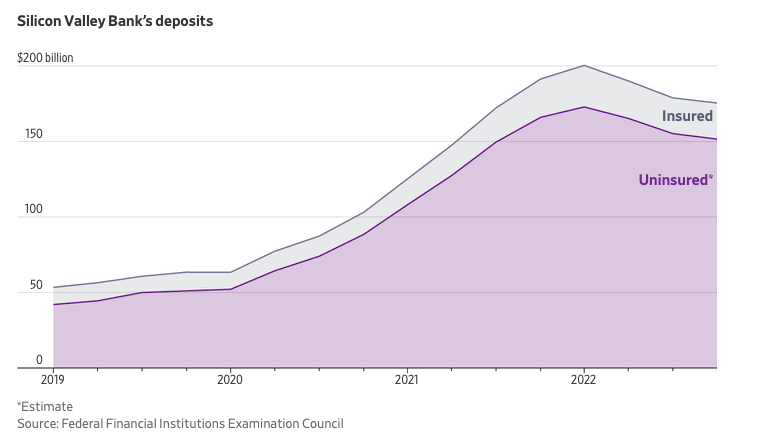

Bank deposits in the US are insured for up to $250,000. This benefits mostly retail customers who rarely have funds more than that. However, most businesses keep larger deposits, so banks which have a higher share of business deposits potentially face higher risk of a bank run. SVB was one of them, with less than 10% of retail deposits, according to JP Morgan. The bank itself said that only 4% of its deposits were insured at the end of 2022.

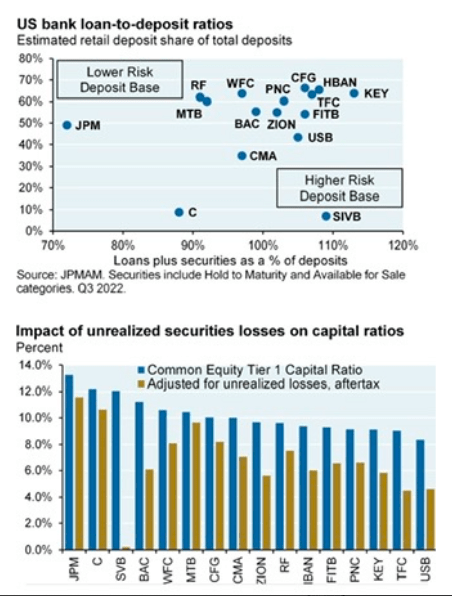

Are there other banks similar to SVB?

It does not look like there is another bank with the same characteristics as SVB. However, a few banks saw their share prices tanking 20-50% intra-day on Friday (10 March 2023), including PacWest, Western Alliance, First Republic, and Signature Banks. Some of them put out press releases highlighting their difference from SVB in terms of asset and depositor base.

Here are some good charts on some US banks' key parameters.

Here are some good charts on some US banks' key parameters.

Which companies may suffer?

The wide majority of SVB’s depositors were small early stage ventures. However, there were several large companies, among them:

1. Circle: $3.3bn

2. Roku: $487mn

3. BlockFi: $227mn

4. Roblox: $150mn

5. Ginkgo Bio: $74mn

6. iRhythm: $55mn

7. Rocket Lab: $38mn

8. Sangamo Therapeutics: $34mn

9. Lending Club: $21mn

10. Payoneer: $20mn

1. Circle: $3.3bn

2. Roku: $487mn

3. BlockFi: $227mn

4. Roblox: $150mn

5. Ginkgo Bio: $74mn

6. iRhythm: $55mn

7. Rocket Lab: $38mn

8. Sangamo Therapeutics: $34mn

9. Lending Club: $21mn

10. Payoneer: $20mn

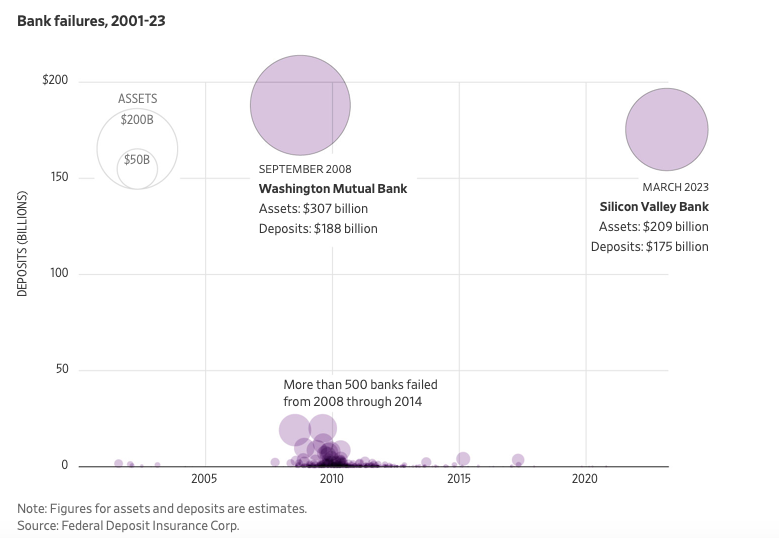

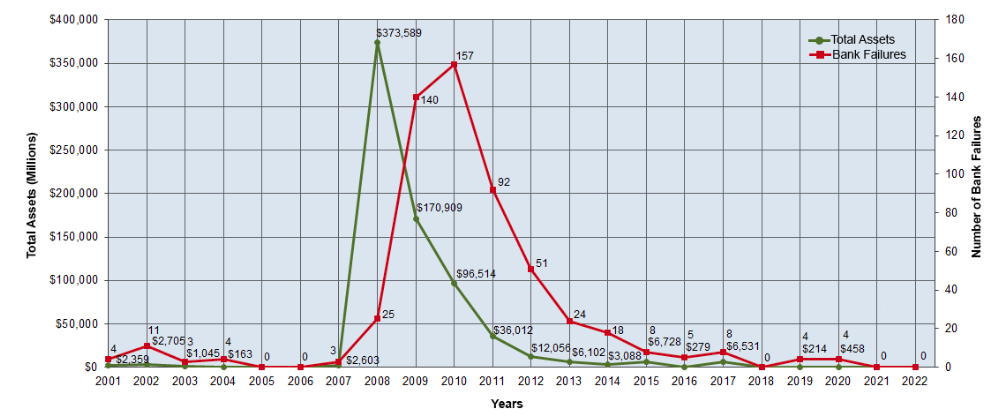

How common is bank failure in the US?

Bank failures in the US happen almost every year and often more than once. However, most of the banks that fail are tiny institutions with little involvement in the broader economy, so they go unnoticed.

The last time a bank collapsed, which was similar in size to SVB, was in 2008 (Washington Mutual Bank).

The last time a bank collapsed, which was similar in size to SVB, was in 2008 (Washington Mutual Bank).

Source: https://www.fdic.gov/bank/historical/bank/

Best course of action?

I encourage you to vote in the poll I am running on Twitter. So far, the second most popular strategy is to Buy Bank stocks, which I am pretty surprised about. Vote to see what is the number one choice so far.

It would be even more exciting to have a discussion below this post, feel free to leave your comment or raise a question. It is quite an extraordinary situation, and we can all benefit from sharing ideas.

To start the conversation, here are some two opposing views. A famous billionaire investor, Bill Ackman, predicts that more bank runs on Monday unless the regulator guarantees all the deposits in the banks.

It would be even more exciting to have a discussion below this post, feel free to leave your comment or raise a question. It is quite an extraordinary situation, and we can all benefit from sharing ideas.

To start the conversation, here are some two opposing views. A famous billionaire investor, Bill Ackman, predicts that more bank runs on Monday unless the regulator guarantees all the deposits in the banks.

Here is a completely different view:

What do you think?

Thank you for reading this piece. I hope it was useful. Please consider sharing it with your friends who may also benefit from this.