Today I would like to summarise recent additions to my Library and briefly share the areas I am focusing on to find new investment opportunities.

How to turn $50k into $900 million

Most investors would easily name the best stock pickers such as Graham, Lynch, Buffett, Fisher, Templeton. Until recently, my picks would be similar, perhaps, with the only addition of more modern investors (Klarman, Greenblatt, Sleep, Miller, Tillinghast, Nygren, Hawkins).

But earlier this year, I was fortunate to stumble upon a new name which was the biggest surprise. I think this investor is one of the biggest secrets in the market despite an almost 70-year track record (combined with the investment experience of his son and grandchildren).

The name of this investor is Shelby Davis.

In fact, it is the Davis family. Shelby Davis started investing at the age of 38 when his wife inherited $50k. By 1994, 50 years later, his fortune amounted to $900 million. Davis managed to teach his son, Shelby, key investment principles, who later launched his own fund, now known as Davis Funds which is now run by his two sons, Christopher and Andrew.

Besides such an incredible track record which is also a multi-generational one (I know very few famous investors whose children succeeded their parents in investing), what makes the Davis family outstanding is a narrow sector focus. Most fortunes were made within the insurance industry with occasional investments in another financial sector – banking.

I have summarised key investment principles, including 10 tenets and the Checklist in my review, which I posted in the Library. There are two more points about the Davis investment experience that I found useful.

One is investing during the inflationary period of the 1970s when stocks failed to protect investors’ portfolios and eventually declined. I think it is worth keeping in mind in today’s inflationary period.

Here is the quote from the book:

"The stockholding masses had shrugged off the rising inflation of the 1960s on the theory that inflation was ruinous to bonds but healthy for equities. For years, the steady inflationary uptick hadn't stopped the bull market, strengthening the popular conviction that inflation was no threat to portfolios. The assumption that companies could raise prices in lockstep with inflation, and thus preserve their profit margin, proved fallacious in the 1970s, and once Mr. Market realized this, equities were repriced accordingly".

The second point is about investing in strong markets after a long phase of growth. The lesson here is to set expectations accordingly and be much more selective focusing on individual stocks rather than the broader market:

"Whatever happens, Shelby expected stocks to stop racing ahead and revert to their customary canter. "If the Dow continued to rise at the same pace it's risen over the past two decades, it would stand at roughly 100,000 two decades from now," he said. "But we're certain that won't happen. Even if the rise slows to 7 or 8 percent a year, the Dow could reach 40,000 to 50,000. So a lot more wealth can still be created long-term. On the other hand, the surge in corporate profits and P/E ratios that created the 1990s bonanza isn't likely to continue. It won't surprise me if the market is stuck in a trading range for the next five to ten years. Good stock pickers will make money, but the averages may not show much movement."

You can read the full review of the book here.

Reasons why individual investors underperform, What works in investing and 3 more useful materials

I have also added 5 materials that I found useful to the Library.

1. What Has Worked in Investing (Summary of Studies of Investment Approaches Associated With Exceptional Returns). One of the oldest US Value Investment Firm, Tweedy, Browne has put together a 60-page White Paper which describes over 50 academic studies on investment strategies with exceptional long-term results.

2. Active Share and Mutual Fund Performance (Antti Petajisto). Stock pickers with higher active shares have outperformed their benchmark indices even after fees and transaction costs. In contrast, closet indexers or funds focusing on factor bets have lost their benchmarks after fees.

3. The Behavior of Individual Investors (Brad Barber and Terrance Odean). A 38-page paper is summarising key mistakes made by individual investors and reasons for their underperformance.

4. Rate of Return for Most Asset Classes for Key Countries. Quite useful and comprehensive 100+ history of investment returns by the Federal Reserve Bank of San Francisco.

5. A Memo by Slack’s Co-founder on product niche and marketing. An internal memo by the co-founder of Slack on two phases in start-up development, the importance of finding your product niche and the role of marketing/sales in the product's success. Need to put yourself in your customer's shoes.

You can find all of them here.

What I am thinking about these days

‘Money never sleeps’ as the famous Wall Street adage goes with pockets of opportunities emerging even during a holiday period like now (early August).

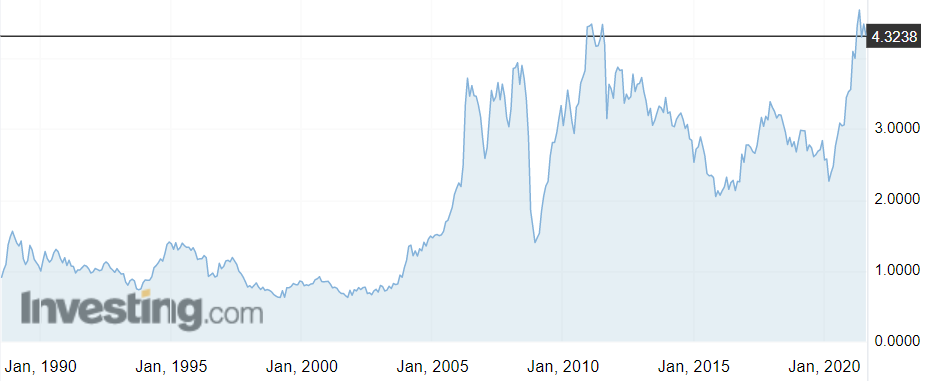

Copper

Earlier this summer, I started analysing opportunities around Climate Change. My intermediate conclusion is that Copper should see a much stronger demand going forward. However, I have not built any large position in a copper producer yet (other than a small position in Glencore).

What holds me back from investing more in Copper?

In the end, copper is a commodity where supply always catches up with demand. It is common to expect supply shortages, but almost always, they do not last permanently. I think COVID had a direct impact on supply as a number of mines were stopped as personnel was evacuated. On top of this, there have been a few strikes at Latin American mines.

One lesson from my commodity experience is that prices are cyclical; they do not rise in a straight line. Current prices (c. $9,500/t or $4.3/lb) are close to all-time highs, having almost doubled from their 2020 lows.

Price of Copper futures ($/lb)

At some point, new sources of supply may emerge, including secondary sources (scrap), alternatives such as aluminium and possibly demand contraction (for example, if house owners slow down their renovation projects).

With regards to Glencore, I am hesitant as I cannot grasp fully the magnitude of possible investigations launched by US authorities as well as a few other countries into their trading and other practices. Most commodity traders face similar investigations, and in most cases, a relatively moderate penalty is imposed, which is not detrimental. Nevertheless, I would like to have better visibility of this matter before committing more money.

Glencore share price (GBP / share)

Source: Google Finance

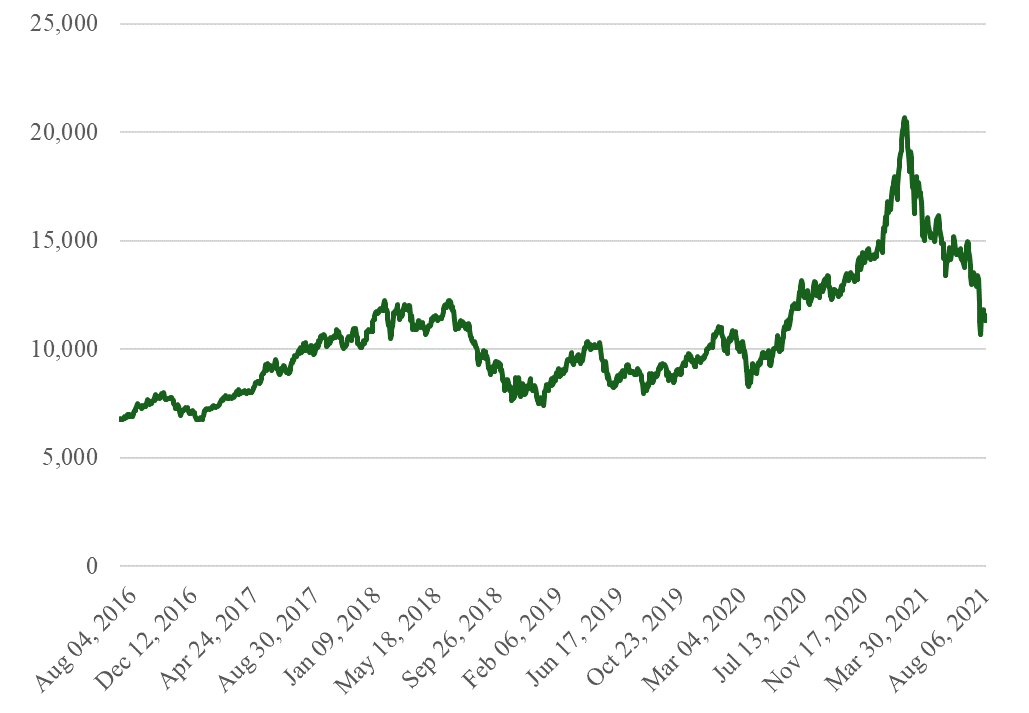

New potential opportunity: Chinese Tech

I think a new potential opportunity has recently emerged – the Chinese Tech sector, which is down 26% year-to-date, while some names are down 90% (like Online education). I passed on Alibaba earlier this year, but now I think there could be a moderate opportunity there.

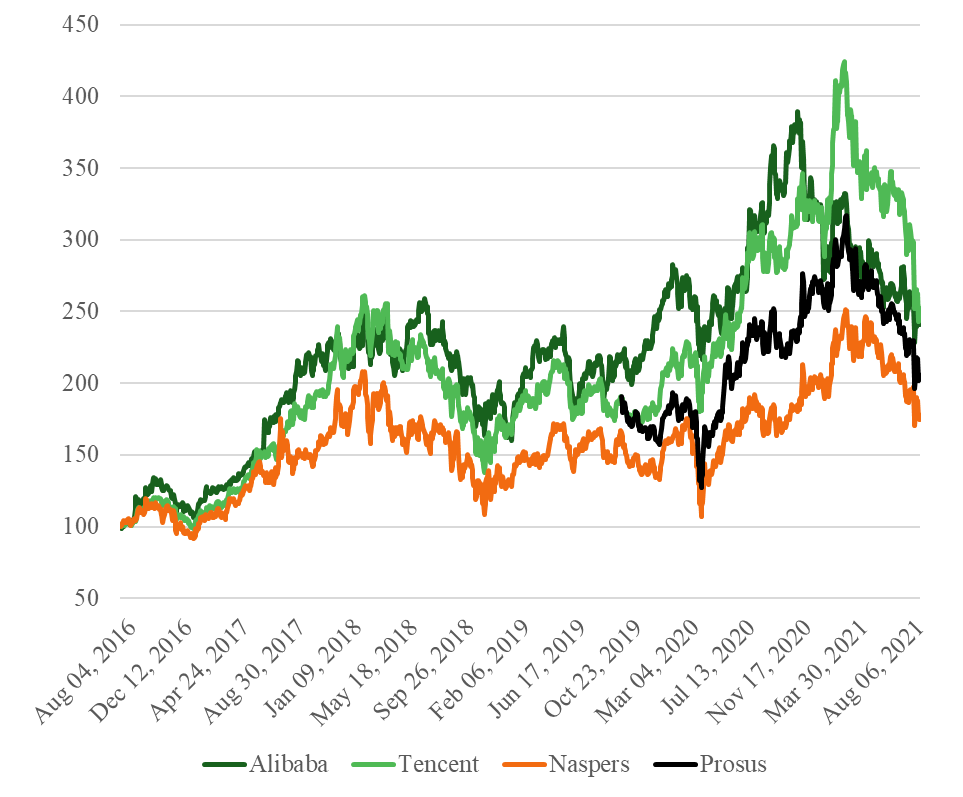

I also think Naspers and Prosus are very interesting as double opportunity – potential narrowing down of a discount between their share prices and market values of their stake in Tencent and recovery of Tencent share price.

NASDAQ Golden Dragon Index performance over the past 5 years

Source: Investing.com

5-year stock performance of Alibaba, Tencent, Naspers and Prosus (re-based to 100)

Source: Investing.com

This looks to be a classic opportunity described in many books on value investing. Generally, strong companies led by great management/founders face temporary issues. The market tends to exaggerate the magnitude of problems and overreacts, with share prices discounting far worse scenarios than how things develop in reality.

I don’t think the Chinese government wants to ‘kill’ those business. Some changes of rules of the games may impact economics, but not the business models of these leading companies.

What holds me up from investing in Chinese tech?

I am at the beginning of my learning process. I want to better understand the motivation behind China’s state actions. I also want to learn more about the competitive landscape in the sector. Alibaba, for example, is facing competition from younger players like JD.com and Meituan. The first one is the market leader in logistics, which Alibaba has historically not developed in-house, while Meituan appears to be the leader in e-grocery and fast last-mile delivery.

I also lack any real knowledge of the behaviour and preferences of local consumers and have to rely on third-party opinions.

The sector has been a stellar performer for many years, and even after the recent correction,s the sector is only back to 2020 levels.

Finally, and perhaps most importantly, I have not had a chance to learn about the business models of those companies in detail. In other words, I don’t fully understand how they make money, what exactly they charge their customers for, who their customers are, what cost structure these companies have, how much capital they need to invest back into the business and so on.

The reason I provide these arguments, including factors that hold me back, is to show the importance of knowing your circle of competence. It is also important to focus on downside risks before thinking about the upside too much.

Second-quarter results

Two of my core holdings, Berkshire and Loews, have reported quite strong second-quarter results last week, benefiting from economic recovery. I plan to share my key thoughts in the next few days in the My Portfolio section of the website.

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.