Learning about Buffett’s and Munger’s views on the latest developments (specifically, post-COVID recovery, signs of inflation, investing through a period of ultra-low rates), more specific comments about various sectors and companies as well as general investment wisdom - are the key points which I try to focus on.

'American system works'

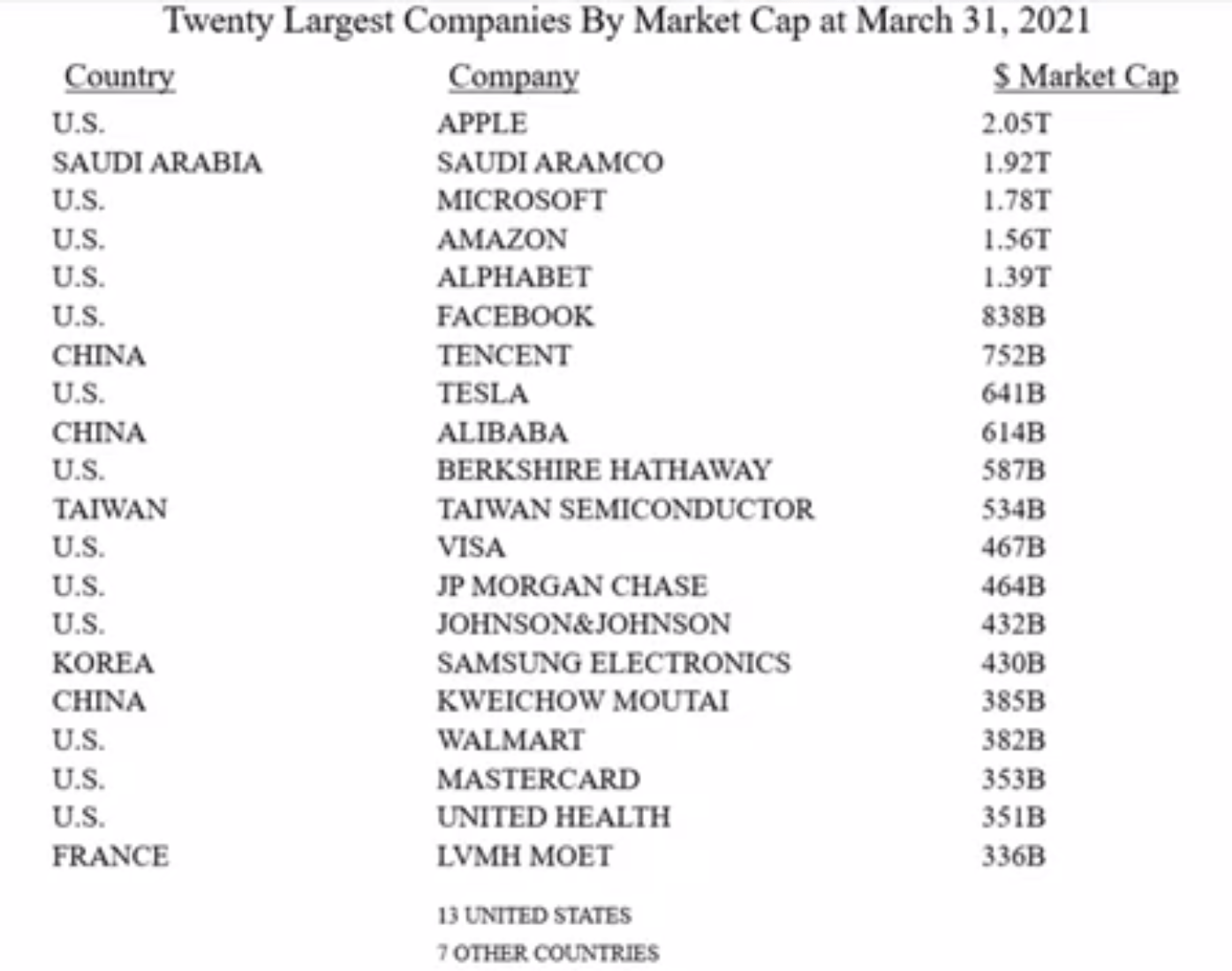

While this is a recurring message which Buffett has been referring to over many years both - at live meetings as well as in his shareholder letters, it is still worth taking note of. It is particularly useful to remind yourself of this point next time the market sells off on concerns about US politics or concerns about its long-term economic future. This time Buffett used the example that 5 out of 6 world’s largest companies (by market cap) are US (and 13 out of the Top 20 are also the US). He reminded that just in 1790, the US population (3.9mn of which 600k were slaves) was 0.5% of the world, Ireland had a bigger population than the US, Russia was 5x more, Ukraine was 2x more. This was to suggest what remarkable progress the US has achieved in a relatively short historical period which serves as evidence that the overall system has worked ‘unbelievably well’.

'Many unusual things can happen in the future'

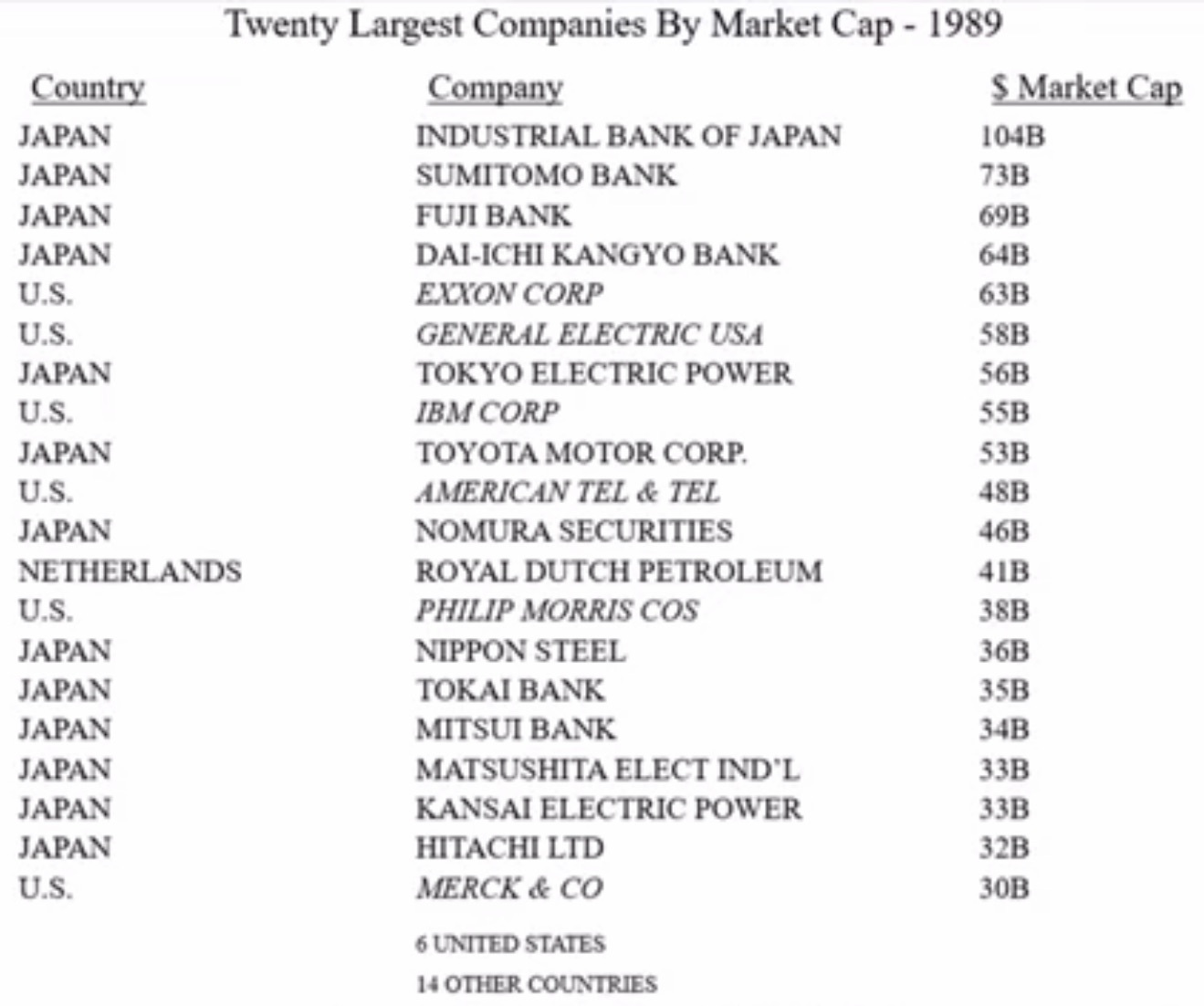

I think it is important to stay humble and be aware of our limited forecasting abilities, especially when trying to extrapolate exceptional performance far in the future. Buffett used the example of the current 20 largest companies by market cap to pose a question to a virtual audience: how many of those 20 would remain on the list in 30 years? For reference, he provided the same list of the Top 20 largest companies a little over 30 years ago - as of 1989. Interestingly enough, none of those Top 20 companies from the 1989 list made it to the latest list.

At the very end of the meeting, when answering one of the questions, Buffett also noted that ‘We always operate with the idea that stranger things will happen in the future. While this is not directly linked to the point of corporate changes, I think it is an important reminder of the importance of focusing on the downside and minimising risks before forecasting potential upside in detail.

Buffett also said that if Munger is in charge of culture at Berkshire, then Buffett’s main job is ‘Chief Risk Officer’ - implying that protecting the company from heavy losses and ensuring it can operate for decades ahead is his main goal. This comment was made in relation to the question of why Berkshire did not buy more stocks in spring 2020.

‘There is a lot more to picking stocks than just figuring out what is going to be a wonderful industry in the future’

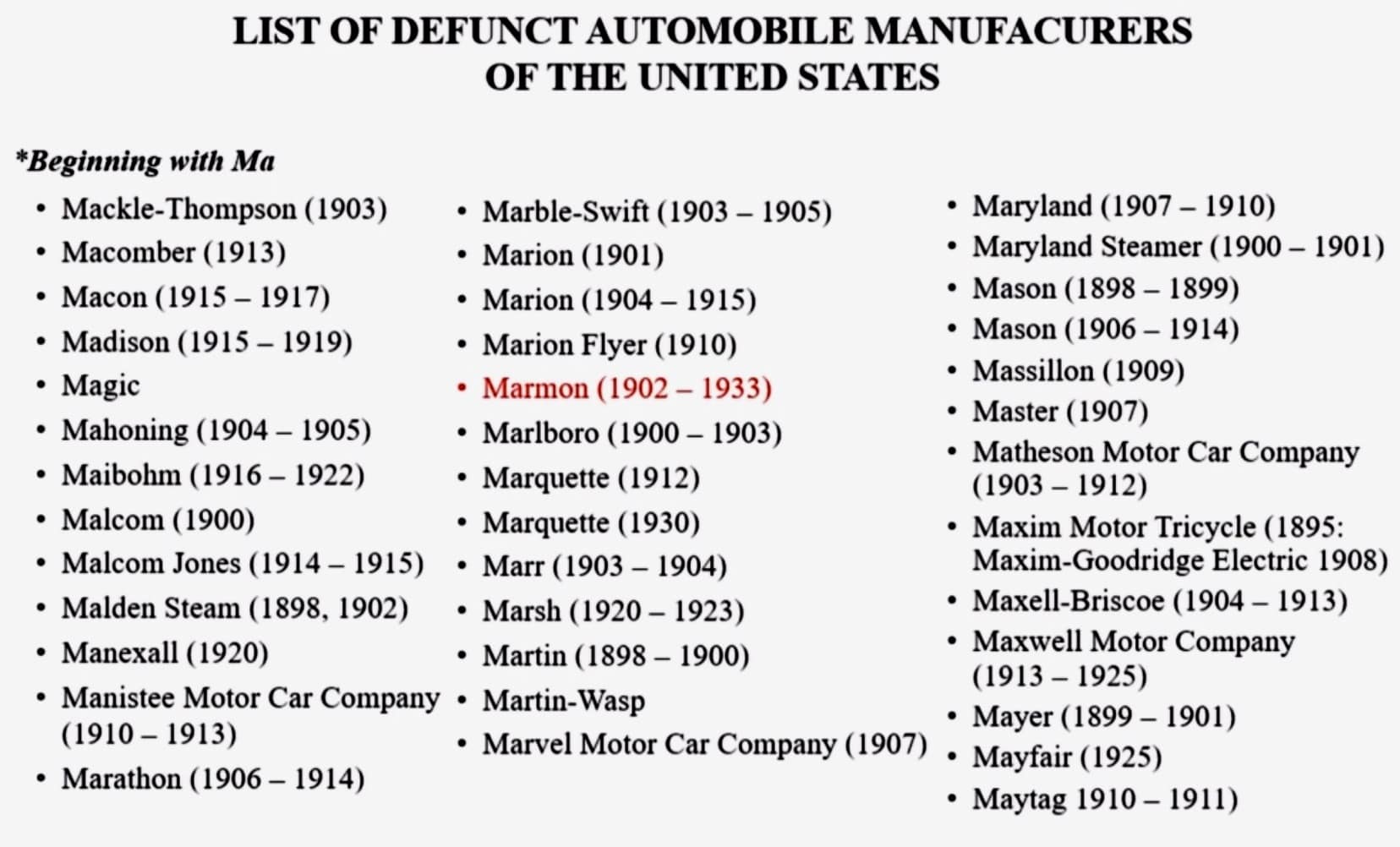

Buffett provided another table of various auto manufacturers that operated back in 1903 - when the transportation industry was about to change dramatically with the rapid rise of automobiles. Since there were over 2,000 such companies, the list only included 38 companies whose names started with ‘Ma’. None of them exists today. While this may sound obvious, it is still an important reminder today when investors are getting excited about various new sectors (e.g. cannabis, crypto, electric cars etc.).

Strong momentum in US economy, inflation accelerating

Perhaps the most positive message from the meeting about the current state of affairs was that the US economy is in very good shape. ‘People have much more money and are eagerly spending. Moreover, Buffet mentioned that they were raising products for many services/products sold by Berkshire’s subsidiaries and these higher prices had no impact on demand. Vice-Chairman and future successor of Buffett, Greg Abel, also noted that they see a shortage of certain products and raw materials with corresponding price rises. Both Buffett and Munger were surprised how could official CPI data look so low.

I think Berkshire is well-positioned for an inflationary environment. About 10% of its earnings come from power utilities, where consumers automatically pass inflation through. Insurance (a quarter of profits) should also benefit from higher interest rates and rising policy rates. Many other segments are made up of well-known brands, including home builders as well as c. $300bn stock portfolio, which has Apple as the biggest position as well as other big brands (e.g. Coca Cola, American Express, Kraft Heinz) and Bank of America which should do better with higher interest rates. Berkshire’s recent $4bn investment in Chevron should also benefit from higher inflation.

Before the start of the meeting, Berkshire’s long-term director, Ron Olson, noted in an interview with Yahoo Finance that Berkshire’s business operations are doing terrific, and they see strong growth across the board.

Outside of Berkshire, I think maintaining healthy exposure to equities should be fine as the economic recovery and rising inflation should be the strong backdrop for earnings. However, eventually, valuation multiples could contract if rates rise considerably (so important to be mindful of the prices paid).

Other points

Buffett also reiterated his conviction in Apple and even mentioned that he regretted selling a small portion in late 2020. He repeated his cautious outlook on airlines which caused him to sell out of all his positions in early 2020. Buffett did not have any outright issues with oil & gas companies following Berkshire’s purchase of Chevron in Q3 2020.

At the same time, Berkshire is actively developing its renewable energy portfolio with over $30bn already spent. Buffett noted that transmission is the key area that should allow expanding renewable power in the future.

According to its Vice-Chairman Ajit Jain, Berkshire set up just $1.6bn in COVID related reserves within its Insurance business, while the whole industry has created $25-30bn in reserves. The net amount could be lower as there were also benefits (e.g. few car accidents), although overall payouts related to COVID would likely be more than $1.6bn (according to Ajit Jain). Berkshire is not going to be in the Top 5 payers (on COVID related losses) - which is encouraging. In general, Buffett noted that unlike in some other countries (e.g. UK), US insurers would not face huge payouts due to the way policies were written, while court decisions have generally been favourable to insurers.

Munger made his previous comment on a few easy opportunities available these days, not least because of low-interest rates. He also said that ‘Bernie Sanders’ had eventually won as the difference between the rich and the poor in the new generation would be eventually much less. ‘With everything booming and interest rates so low, the millennial generation will have a hell of a time getting rich compared to our generation’.

The level of ‘idle’ cash seems to have dropped in relation to the company’s assets. According to Buffett, the minimal level of cash that Berkshire would always keep on its books to back its insurance business has risen from long-held $20bn levels. Total cash now accounts for about 16% of its assets. About $70bn of cash is the amount that Buffett would like to ‘put to work’.

Did you find this article useful?

If you want to read my next article right when it comes out, please subscribe to my email list.