25 June 2023

I took a small position in Kistos plc (KIST LN) because it was cheap for the wrong reasons. At spot prices, Kistos should earn FCF that equals its current market cap. It has all-in cash costs (including capex and interest expenses) at about $30/boe. Such an attractive opportunity exists because the market is focusing on the wrong side and misses the true value drivers of this business. My position is small because investing in a small oil & gas company is generally riskier than buying a broad-market ETF or Berkshire shares. The stock will likely be volatile, and I may increase my position later.

Kistos: the opportunity and what the market is getting wrong about it

The market views Kistos as a collection of mature assets in a cyclical sector facing growing fiscal pressure. While formally, this is correct, I disagree with the conclusions.

Last week, I already discussed the value of mature oil & gas assets. Here is a 30-second summary.

If you have 100 barrels of oil reserves underground, you want to extract them as quickly as possible. Assuming each barrel costs $30/bbl, you could earn $20-30/bbl at current oil prices (after tax). In one year, producing all your reserves within the first twelve months would generate $2,000-3,000 (in that same year).

On the other hand, if this were a “growing” asset, with production spread across several years, the net value realised from the same quantity of oil would be lower due to the time factor. Add to that development cost, inflation, macro volatility, and operational risks.

In short, an asset with a reserves life of 1 year is worth more than an asset with 10 years of reserves life (assuming the same volume of resources and cost structure).

Oil and gas prices are indeed cyclical. However, following an extended period of falling investments, changing behaviour of industry players, and growing cost of capital, not least due to the ESG pressure, the energy prices will likely stay above the historical trend in the next 3-4 years. Besides, as a fully-funded, low-cost producer, Kistos does not require high prices to remain profitable.

The tax burden has indeed increased. However, this first followed an unprecedented surge in energy prices. Kistos earned €270mn FCF in 2022 (more than its current market cap) as record prices more than offset the tax burden. Besides, the UK tax regime provides investment allowances for up to 91p on each 100p invested. Finally, with its entry into the Norwegian shelf, Kistos has diluted the effect of negative fiscal changes in the UK and the Netherlands.

The market is also missing the exceptional capital allocation skills of the current management team headed by the Executive Chairman, Andrew Austin. Before founding Kistos, he was Executive Chairman at RockRose Energy, delivering 42x returns to its original shareholders. RockRose also focused on mature offshore assets, raising just £13mn from shareholders and paying them back £298mn of cash in four years.

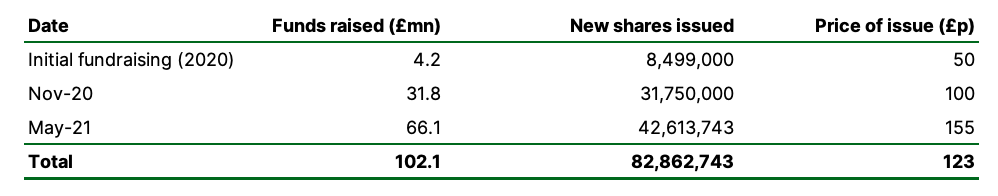

Capital allocation is critical for mature assets which generate massive cash and do not require significant investments. So far, Kistos’ team has raised £102mn from shareholders and spent £129mn on acquisitions of new assets. Of the total amount spent on acquisitions, Kistos used only £86mn of its cash, while the rest was financed with bonds, some of which have been repurchased already. The acquired assets produce over 10kboe/d of oil & gas (mainly gas) and generated €270mn of FCF in 2022 alone.

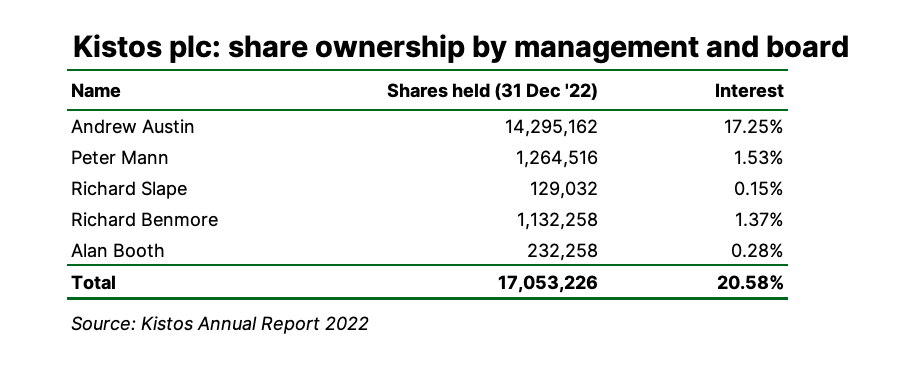

Another crucial point is that Austin personally owns 17.25% of Kistos (investing £12mn of personal money), while overall management & board holds 20.58% interest in Kistos. Not a single executive or board member has sold their shares. The last insider transaction was Andrew Austin buying 150,000 Kistos shares in February 2022 at 327p.

Finally, with barely any sell-side coverage and given its small size, Kistos is below the radars of many large investors, so its share price is more likely to be priced inefficiently compared to larger companies, providing a better opportunity for private investors.

Last week, I already discussed the value of mature oil & gas assets. Here is a 30-second summary.

If you have 100 barrels of oil reserves underground, you want to extract them as quickly as possible. Assuming each barrel costs $30/bbl, you could earn $20-30/bbl at current oil prices (after tax). In one year, producing all your reserves within the first twelve months would generate $2,000-3,000 (in that same year).

On the other hand, if this were a “growing” asset, with production spread across several years, the net value realised from the same quantity of oil would be lower due to the time factor. Add to that development cost, inflation, macro volatility, and operational risks.

In short, an asset with a reserves life of 1 year is worth more than an asset with 10 years of reserves life (assuming the same volume of resources and cost structure).

Oil and gas prices are indeed cyclical. However, following an extended period of falling investments, changing behaviour of industry players, and growing cost of capital, not least due to the ESG pressure, the energy prices will likely stay above the historical trend in the next 3-4 years. Besides, as a fully-funded, low-cost producer, Kistos does not require high prices to remain profitable.

The tax burden has indeed increased. However, this first followed an unprecedented surge in energy prices. Kistos earned €270mn FCF in 2022 (more than its current market cap) as record prices more than offset the tax burden. Besides, the UK tax regime provides investment allowances for up to 91p on each 100p invested. Finally, with its entry into the Norwegian shelf, Kistos has diluted the effect of negative fiscal changes in the UK and the Netherlands.

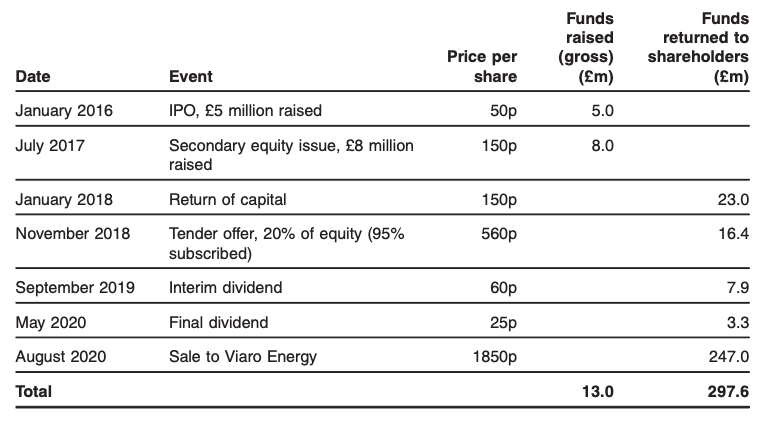

The market is also missing the exceptional capital allocation skills of the current management team headed by the Executive Chairman, Andrew Austin. Before founding Kistos, he was Executive Chairman at RockRose Energy, delivering 42x returns to its original shareholders. RockRose also focused on mature offshore assets, raising just £13mn from shareholders and paying them back £298mn of cash in four years.

Capital allocation is critical for mature assets which generate massive cash and do not require significant investments. So far, Kistos’ team has raised £102mn from shareholders and spent £129mn on acquisitions of new assets. Of the total amount spent on acquisitions, Kistos used only £86mn of its cash, while the rest was financed with bonds, some of which have been repurchased already. The acquired assets produce over 10kboe/d of oil & gas (mainly gas) and generated €270mn of FCF in 2022 alone.

Another crucial point is that Austin personally owns 17.25% of Kistos (investing £12mn of personal money), while overall management & board holds 20.58% interest in Kistos. Not a single executive or board member has sold their shares. The last insider transaction was Andrew Austin buying 150,000 Kistos shares in February 2022 at 327p.

Finally, with barely any sell-side coverage and given its small size, Kistos is below the radars of many large investors, so its share price is more likely to be priced inefficiently compared to larger companies, providing a better opportunity for private investors.

The powerhouse behind Kistos: Andrew Austin and his team

The critical driver for Kistos is its management team, so I will start right there.

Enter Andrew Austin, a 57-year-old oil executive and a former banker. He is the founder of Kistos and currently holds the position of Executive Chairman of the company.

Enter Andrew Austin, a 57-year-old oil executive and a former banker. He is the founder of Kistos and currently holds the position of Executive Chairman of the company.

He spent 17 years in investment banking and six years in management and consulting roles. In 2004, he jointly founded IGas Energy plc, which became a leading onshore oil & gas producer in the UK.

His biggest success so far has been at RockRose Energy, where he served as Executive Chairman from 2016 until 2020. I did not believe it when I first saw it and had to double-check all the details. But this is true: the shareholders of RockRose achieved …42x returns on their money!

The firm raised a total of £13mn, which it spent on counter-cyclical acquisitions of legacy / non-core assets in the North Sea and the wider UK oil and gas sector. During the five years, RockRose returned to shareholders £298mn through distributions, dividends, share buybacks and, ultimately, a sale for cash consideration. RockRose was sold to Viaro Energy in August 2020 for £18.5 per share price (64% premium to the price before the announcement and 37x above the IPO price of £0.5 per share).

Notably, other key executives and directors working at RockRose with Andrew have joined Kistos from the first day. Below is the summary of key individuals:

His biggest success so far has been at RockRose Energy, where he served as Executive Chairman from 2016 until 2020. I did not believe it when I first saw it and had to double-check all the details. But this is true: the shareholders of RockRose achieved …42x returns on their money!

The firm raised a total of £13mn, which it spent on counter-cyclical acquisitions of legacy / non-core assets in the North Sea and the wider UK oil and gas sector. During the five years, RockRose returned to shareholders £298mn through distributions, dividends, share buybacks and, ultimately, a sale for cash consideration. RockRose was sold to Viaro Energy in August 2020 for £18.5 per share price (64% premium to the price before the announcement and 37x above the IPO price of £0.5 per share).

Notably, other key executives and directors working at RockRose with Andrew have joined Kistos from the first day. Below is the summary of key individuals:

Mr Austin is the executive with “skin in the game”, having invested £12mn of personal money into the business. He currently owns a 17.25% interest in Kistos plc. There is only one class of shares. Andrew Austin has not sold a single share since launching the company. In fact, he purchased 150,000 more shares on 15 February 2022 on the market at £3.27 (0.18% interest). Importantly, most other directors and executives have also invested their personal funds into the company.

Management and directors collectively held a 20.6% interest in Kistos at the beginning of 2023.

Management and directors collectively held a 20.6% interest in Kistos at the beginning of 2023.

Before I uncover the details of RockRose's strategy, I also want to highlight that, unlike many executives, Andrew Austin does not hold conference calls for analysts. The company does not have a dedicated IR manager. The latest corporate presentation (as of the time of writing this, on 25 June 2023) published on Kistos’ website is dated 27 August 2021, while the latest earnings presentation was published on 7 September 2022.

Many true value creators spend little time talking to the investment community. Warren Buffett is probably the most famous Chairman and CEO who does not host quarterly earnings calls or make presentations for analysts. Yet, he has been compounding the value of Berkshire Hathaway at about 20% per year for more than 50 years now.

Many true value creators spend little time talking to the investment community. Warren Buffett is probably the most famous Chairman and CEO who does not host quarterly earnings calls or make presentations for analysts. Yet, he has been compounding the value of Berkshire Hathaway at about 20% per year for more than 50 years now.

Capital allocation: past track record

“What is wrong is sitting on cash for long periods of time and not deploying it. And if you cannot find someone to deploy it with, then you should return it to shareholders. It is their money.”

- Andrew Austin, founder of Kistos plc

Andrew Austin and his team have historically focused on acquiring producing oil & gas assets with low geological risks and at attractive prices. They were also successfully managing the assets to improve their overall economic value. The team maintained a flexible approach to acquisitions and was ready to move quickly when they saw the right opportunity (e.g. Arran acquisition from Dana Petroleum).

Below are the details of capital raises by RockRose.

Below are the details of capital raises by RockRose.

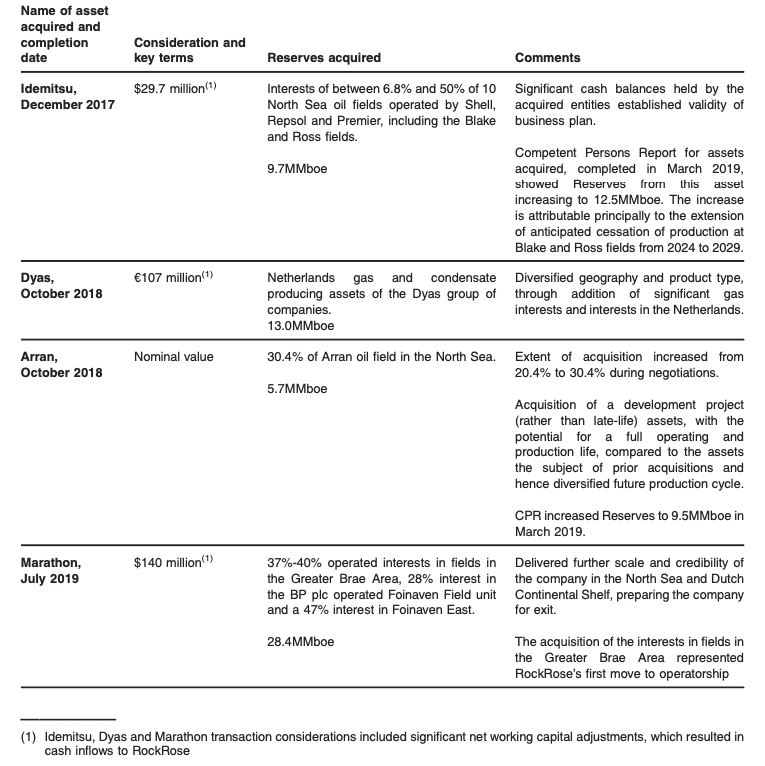

The company raised just £13mn from shareholders and made four acquisitions for a combined consideration of $300mn. The acquired asset had total reserves of 56.8mn boe. Below are the details of RockRose's M&A transactions.

RockRose bought the reserves for about $5.3/boe, well below historical finding & development (F&D) costs in the industry of $10-15/boe. So you may wonder, "How did they acquire assets so cheaply?". I think there were at least four reasons for that:

With the increased pressure from the ESG, the availability of small assets generating cash should still be high today.

I want to spend a moment explaining how significant the uplift in asset valuation could be.

Every operator of an oil field faces abandonment costs at the end of operations. The oil wells have to be plugged in and certain parts of infrastructure removed to minimise environmental impact. Four key drivers of such costs determine the reported value on the balance sheet: engineering solutions, inflation, discount rate and the date when the field ceases to operate.

If the initial assumption was for the field to operate for five more years, but its actual life was extended to ten years, then at a 10% discount rate, the initial provision should have been 40% lower. The life of the field can be extended not just due to a higher recovery factor (increased reserves) but also due to discoveries in the region, which would extend the operations of critical infrastructure (e.g. gas processing plant or Floating Production Storage and Offloading vessel (FPSO)). Besides, over time a more efficient solution can be found to abandon the wells, resulting in additional cost savings.

Let’s look at a theoretical example. Suppose an oil company found a field that it wants to purchase. It estimates 10mn boe of remaining reserves with an NPV of $10/boe ($100mn fair value of remaining reserves). Additional $50mn abandonment costs reduce the purchase price to $50mn. Both parties agree on the price and set the effective economic date on 1 January.

However, the actual deal closes once the regulatory approvals are received, which may be about six months. The actual purchase price is then reduced by the value of oil extracted from the effective date until completion. Let us assume the field produced 1mn boe and generated $25/boe after-tax profit. So the actual purchase price is reduced by $25mn.

Now, as the new team steps over, they focus on improving field operations and extending its life by five more years. They also choose a better abandonment option that saves 20% of the original cost budget. Ultimately, the abandonment provision drops from $50mn to just $25mn. The NAV of the field (value of oil reserves less abandonment costs) is boosted from $50mn to $75mn. The actual purchase price, in the meantime, was reduced from $50mn to $25mn.

The net effect on the IRR could be enormous. At a $50mn purchase price and with only five years of operations, the field should have generated a 10% internal rate of return. In a scenario of a $25mn purchase price and abandonment costs delayed until Year 10, the IRR exceeds 100%.

This calculation does not consider the potential uplift in reserves quantities as the field operates longer.

- There were many forced sellers in 2016-2020. The deals were counter-cyclical.

- The focus was on small assets, which are not strategic for large players who often lack management resources to focus on marginal fields.

- Dedicated teams at small companies like RockRose can extract much more value from those assets.

- Value arbitrage. Mature assets dilute the value of large integrated oil & gas companies, and this is why they assign lower prices to them. Investors value integrateds at traditional metrics like price-to-earnings and dividend yields. If earnings are on a downward trajectory due to falling production (short reserves life), investors assign a low P/E multiple. To improve their valuation, companies seek "growth" assets and try to get rid of declining ones.

With the increased pressure from the ESG, the availability of small assets generating cash should still be high today.

I want to spend a moment explaining how significant the uplift in asset valuation could be.

Every operator of an oil field faces abandonment costs at the end of operations. The oil wells have to be plugged in and certain parts of infrastructure removed to minimise environmental impact. Four key drivers of such costs determine the reported value on the balance sheet: engineering solutions, inflation, discount rate and the date when the field ceases to operate.

If the initial assumption was for the field to operate for five more years, but its actual life was extended to ten years, then at a 10% discount rate, the initial provision should have been 40% lower. The life of the field can be extended not just due to a higher recovery factor (increased reserves) but also due to discoveries in the region, which would extend the operations of critical infrastructure (e.g. gas processing plant or Floating Production Storage and Offloading vessel (FPSO)). Besides, over time a more efficient solution can be found to abandon the wells, resulting in additional cost savings.

Let’s look at a theoretical example. Suppose an oil company found a field that it wants to purchase. It estimates 10mn boe of remaining reserves with an NPV of $10/boe ($100mn fair value of remaining reserves). Additional $50mn abandonment costs reduce the purchase price to $50mn. Both parties agree on the price and set the effective economic date on 1 January.

However, the actual deal closes once the regulatory approvals are received, which may be about six months. The actual purchase price is then reduced by the value of oil extracted from the effective date until completion. Let us assume the field produced 1mn boe and generated $25/boe after-tax profit. So the actual purchase price is reduced by $25mn.

Now, as the new team steps over, they focus on improving field operations and extending its life by five more years. They also choose a better abandonment option that saves 20% of the original cost budget. Ultimately, the abandonment provision drops from $50mn to just $25mn. The NAV of the field (value of oil reserves less abandonment costs) is boosted from $50mn to $75mn. The actual purchase price, in the meantime, was reduced from $50mn to $25mn.

The net effect on the IRR could be enormous. At a $50mn purchase price and with only five years of operations, the field should have generated a 10% internal rate of return. In a scenario of a $25mn purchase price and abandonment costs delayed until Year 10, the IRR exceeds 100%.

This calculation does not consider the potential uplift in reserves quantities as the field operates longer.

Low-cost, cash-generative assets of Kistos

Austin is following his past playbook to build a larger version of RockRose with the same focus on value and returns to shareholders.

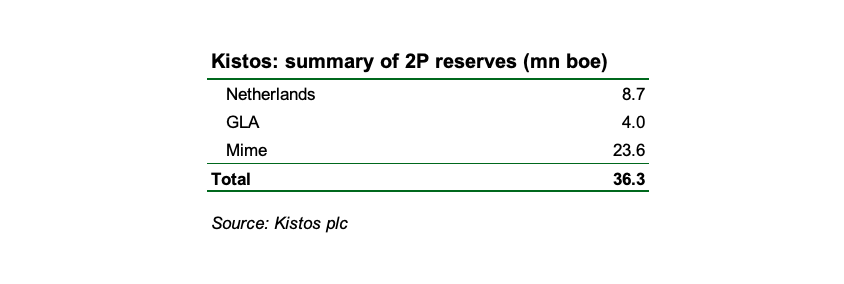

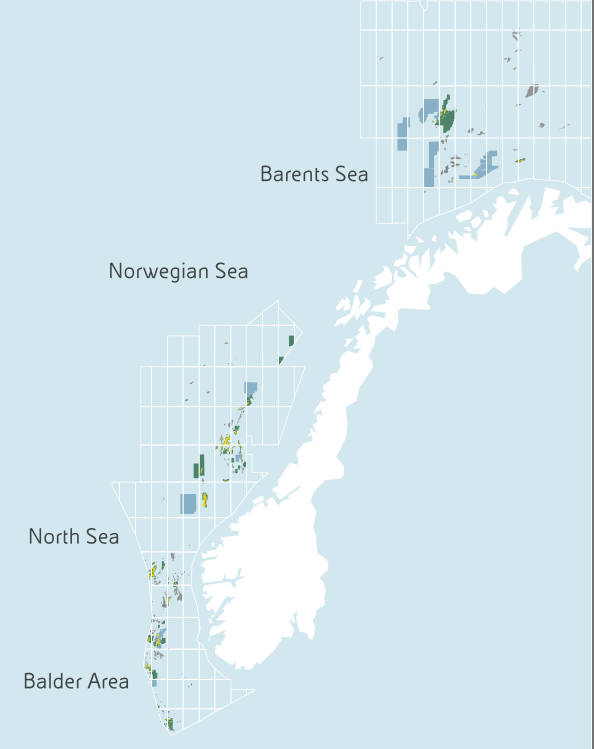

Currently, Kistos has three groups of assets, all producing mostly gas with growing oil production in the Netherlands, UK and Norway. Combined Proved and Probable reserves (2P) are 36.3mn boe with additional Contingent resources of 44mn boe. The company operates the Netherlands assets and is a minority partner with a non-operating role in two other assets.

Currently, Kistos has three groups of assets, all producing mostly gas with growing oil production in the Netherlands, UK and Norway. Combined Proved and Probable reserves (2P) are 36.3mn boe with additional Contingent resources of 44mn boe. The company operates the Netherlands assets and is a minority partner with a non-operating role in two other assets.

Let's quickly review each of the three assets.

Netherlands

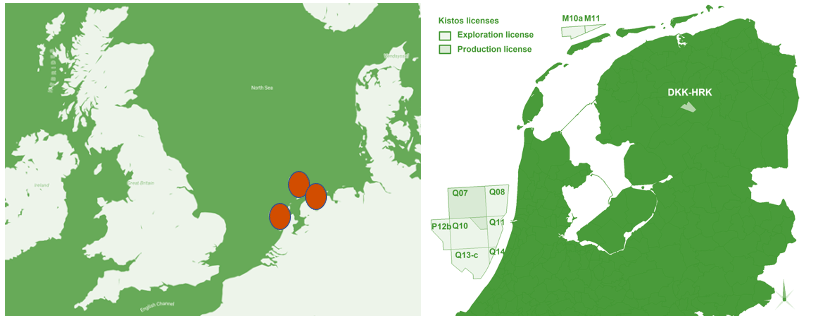

In the Netherlands, Kistos holds a 60% interest in several production and exploration licences in the Dutch sector of the North Sea.

Source: Kistos Investor Presentation

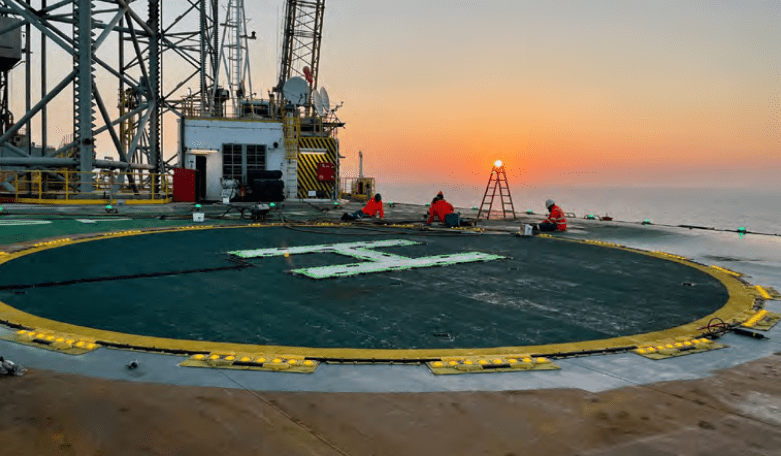

Q10-A is the only gas-producing field in the company’s Netherlands assets. The field straddles the Q7 and Q10-A production licences approximately 20 km offshore Netherlands. Commercial production commenced in February 2019, a little more than a year after the project was sanctioned.

The field produced 5kboe/d of gas in 2021 and 4.7kboe/d in 2022.

The field has five wells in relatively shallow water of approximately 21 metres. The wells are connected to an unmanned platform that is operated remotely. The platform was designed to have as small a carbon footprint as possible, with onboard wind turbines and solar panels providing most of its power. Furthermore, any visits to the platform are carried out by boat rather than by helicopter. Produced gas is exported through a 42 km pipeline to the TAQA-operated P15-D platform, where it is processed for onward transportation to shore.

The field licence expires in 2042. However, due to the decision not to build a new export route, production will likely cease in the 2030s rather than the 2040s as was initially envisaged.

Current Proved and Probably (2P) reserves of the Q10-A gas field are at 8.7mn boe, on my estimates. The field’s 2P reserves were 19.7mn boe when Kistos acquired the asset in early 2021. Since then, production has amounted to 3.3mn boe. More importantly, Kistos downgraded total reserves by 4.0mn boe due to the decision to continue exporting gas via the P15-D platform and by 3.3mn boe due to worse reservoir geology (it turned out to be tighter than anticipated).

The decision not to build a new infrastructure for the Q10-A field was made following adverse tax changes in the Netherlands. This decision would minimise future capital needs and boost NPV under the new fiscal terms.

The Q10-A block also has an oil field discovery (Orion oil field). In 2021-22 Kistos drilled an appraisal well at Orion, which tested at a rate of 3,200 b/d. Management expects to make Final Investment Decision (FID) on this field by the end of 2023.

Other exploration prospects (e.g. Q10-B, Q11-B) did not find sufficient gas, while some (M10/M11) licences expired. Kistos has lodged an appeal and a draft FDP. Currently, it is awaiting further decisions by the authorities. Those assets' combined 2C resource base was 56.2mn boe at the time of acquisition (early 2021).

In January 2023, Kistos was awarded the P12b, Q13b and Q14 licences covering a total acreage of 507 km2 adjacent to the existing Q10 block.

The field produced 5kboe/d of gas in 2021 and 4.7kboe/d in 2022.

The field has five wells in relatively shallow water of approximately 21 metres. The wells are connected to an unmanned platform that is operated remotely. The platform was designed to have as small a carbon footprint as possible, with onboard wind turbines and solar panels providing most of its power. Furthermore, any visits to the platform are carried out by boat rather than by helicopter. Produced gas is exported through a 42 km pipeline to the TAQA-operated P15-D platform, where it is processed for onward transportation to shore.

The field licence expires in 2042. However, due to the decision not to build a new export route, production will likely cease in the 2030s rather than the 2040s as was initially envisaged.

Current Proved and Probably (2P) reserves of the Q10-A gas field are at 8.7mn boe, on my estimates. The field’s 2P reserves were 19.7mn boe when Kistos acquired the asset in early 2021. Since then, production has amounted to 3.3mn boe. More importantly, Kistos downgraded total reserves by 4.0mn boe due to the decision to continue exporting gas via the P15-D platform and by 3.3mn boe due to worse reservoir geology (it turned out to be tighter than anticipated).

The decision not to build a new infrastructure for the Q10-A field was made following adverse tax changes in the Netherlands. This decision would minimise future capital needs and boost NPV under the new fiscal terms.

The Q10-A block also has an oil field discovery (Orion oil field). In 2021-22 Kistos drilled an appraisal well at Orion, which tested at a rate of 3,200 b/d. Management expects to make Final Investment Decision (FID) on this field by the end of 2023.

Other exploration prospects (e.g. Q10-B, Q11-B) did not find sufficient gas, while some (M10/M11) licences expired. Kistos has lodged an appeal and a draft FDP. Currently, it is awaiting further decisions by the authorities. Those assets' combined 2C resource base was 56.2mn boe at the time of acquisition (early 2021).

In January 2023, Kistos was awarded the P12b, Q13b and Q14 licences covering a total acreage of 507 km2 adjacent to the existing Q10 block.

Deal terms

Kistos entered the Netherlands assets by acquiring Tulip Oil Netherlands (TON). The final deal consideration was €155mn. Kistos spent only €60mn of its own cash reserves. It borrowed another €60mn and issued 8.7mn shares to TON shareholders for £1.55 per share (€15.6mn). Another €15mn was agreed as contingent consideration, of which €7.5mn will be paid if Kistos proceeds with the Orion oil field development and the remainder - in case of exploration activities at M10/M11 blocks. The remaining part of the consideration is not applicable since the licence for the two blocks has expired.

TON had a cash balance of €24mn, further reducing Kistos funding needs.

Kistos generated €48mn of operating cash flow from its incorporation on 14 October 2020 until the end of 2021, while TON assets contributed to the results from 20 May 2021 until 31 December 2021 only. In 2022, it repurchased some of its bonds (nominal value of €68.4mn).

Keep in mind that in 2022, Kistos generated €290mn of operating cashflow (capex was only €19mn), of which close to €200mn was generated by the Q10-A gas field. That is more than the entire consideration paid by Kistos for that asset!

The last point worth making is how low the carbon intensity is for TON. The Q10-A platform primarily generates power through solar and wind generation. The facility is a normally unmanned installation, and infrequent visits are conducted solely by boat. As a result, the Q10-A field Scope 1 emissions intensity from production operations was 9g CO2e/boe in 2020 and 17g CO2e/boe in 2019. Following an upgrade of the wind turbines in 2021, the intensity of the renewably powered Q10-A platform declined even further.

These are significantly below the North Sea average of 22 kg CO2/boe.

TON had a cash balance of €24mn, further reducing Kistos funding needs.

Kistos generated €48mn of operating cash flow from its incorporation on 14 October 2020 until the end of 2021, while TON assets contributed to the results from 20 May 2021 until 31 December 2021 only. In 2022, it repurchased some of its bonds (nominal value of €68.4mn).

Keep in mind that in 2022, Kistos generated €290mn of operating cashflow (capex was only €19mn), of which close to €200mn was generated by the Q10-A gas field. That is more than the entire consideration paid by Kistos for that asset!

The last point worth making is how low the carbon intensity is for TON. The Q10-A platform primarily generates power through solar and wind generation. The facility is a normally unmanned installation, and infrequent visits are conducted solely by boat. As a result, the Q10-A field Scope 1 emissions intensity from production operations was 9g CO2e/boe in 2020 and 17g CO2e/boe in 2019. Following an upgrade of the wind turbines in 2021, the intensity of the renewably powered Q10-A platform declined even further.

These are significantly below the North Sea average of 22 kg CO2/boe.

GLA

Kistos announced its second acquisition in early 2022, completing it on 10 July 2022. The company acquired a 20% interest in the Greater Laggan Area (GLA) from TotalEnergies, which remained the operator and retained a 40% interest. Two other partners in the asset are Ineos and RockRose Energy (now owned by Viaro).

The initial cash consideration was reduced from $125mn on 1 January 2022 to just $43mn by the date the deal was closed (10 July 2022). The difference came from the post-tax cashflows generated from the assets between 1 January and 10 July 2022.

Even though it was primarily due to the unique gas market environment, it is still incredible that Kistos ended 2022 with a net cash position of €130.4mn, having €72.7mn of net debt at the start of the year. The net cash position was achieved after paying for the GLA assets and funding a capex programme of €19.5mn.

The initial cash consideration was reduced from $125mn on 1 January 2022 to just $43mn by the date the deal was closed (10 July 2022). The difference came from the post-tax cashflows generated from the assets between 1 January and 10 July 2022.

Even though it was primarily due to the unique gas market environment, it is still incredible that Kistos ended 2022 with a net cash position of €130.4mn, having €72.7mn of net debt at the start of the year. The net cash position was achieved after paying for the GLA assets and funding a capex programme of €19.5mn.

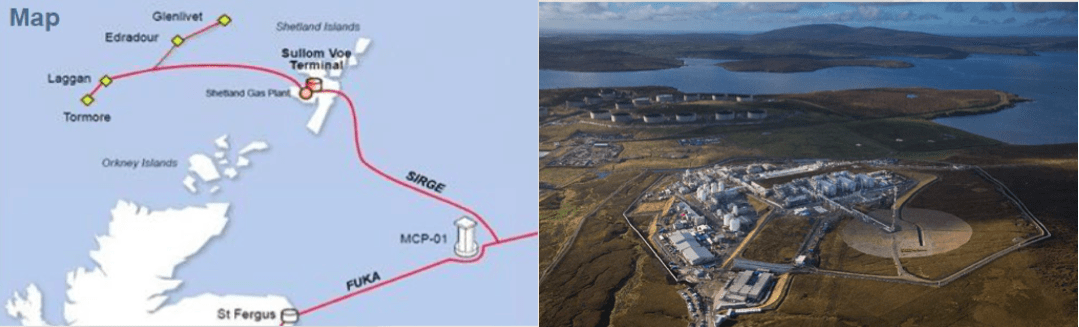

Source: Kistos Investor Presentation

The producing GLA gas fields are in water depths of approximately 300 to 625 metres and are located up to 125km northwest of the Shetland Islands. Development approval was initially granted in 2010, and the first gas was achieved at the Laggan and Tormore fields in 2016. The Glenlivet and Edradour fields received development approval in 2015 and came on-stream in 2017. Meanwhile, the Glendronach field was discovered in 2018, and the development is anticipated to utilise existing infrastructure. This includes the Shetland Gas Plant, where the gas is processed before export to the St. Fergus Gas Terminal in Scotland.

This acquisition more than doubled Kistos’s production to 10.6 kboe/d in 2022 (compared to 4.3 kboe/d in 2021). The acquisition price was fully recouped in less than a year thanks to exceptionally high gas prices.

The asset has two development projects - Edradour West and Glendronach. The company plans to sanction the first project by the end of the year, followed by Glendronach in 2024. Additional production could commence in late 2024. According to the operator's estimates, the assets could produce an additional 2kboe/d of gas and extend the operations of other fields in the GLA area by at least one more year.

GLA also has a considerable exploration potential called Benriach, with 638 Bcf of 2C resources (gross basis). However, the exploration well drilled this year did not find a sufficient commercial amount of gas, according to the preliminary results announced by Kistos on 19 June 2023. The acquired data will be processed, and the final results of the exploration drilling should be announced later this year.

Kistos is also part of a TotalEnergies-led joint venture that has re-applied for six blocks or part-blocks in the GLA as part of the UK Government’s 33rd Offshore Oil and Gas Licensing Round. The acreage covers 24km2 and includes the Ballechin exploration prospect.

In 2022, the CO2 emissions intensity from GLA production (on a Scope 1 and Scope 2 basis) was approximately 12 kg per boe, well below the UK average for offshore gas fields of 22 kg per boe.

This acquisition more than doubled Kistos’s production to 10.6 kboe/d in 2022 (compared to 4.3 kboe/d in 2021). The acquisition price was fully recouped in less than a year thanks to exceptionally high gas prices.

The asset has two development projects - Edradour West and Glendronach. The company plans to sanction the first project by the end of the year, followed by Glendronach in 2024. Additional production could commence in late 2024. According to the operator's estimates, the assets could produce an additional 2kboe/d of gas and extend the operations of other fields in the GLA area by at least one more year.

GLA also has a considerable exploration potential called Benriach, with 638 Bcf of 2C resources (gross basis). However, the exploration well drilled this year did not find a sufficient commercial amount of gas, according to the preliminary results announced by Kistos on 19 June 2023. The acquired data will be processed, and the final results of the exploration drilling should be announced later this year.

Kistos is also part of a TotalEnergies-led joint venture that has re-applied for six blocks or part-blocks in the GLA as part of the UK Government’s 33rd Offshore Oil and Gas Licensing Round. The acreage covers 24km2 and includes the Ballechin exploration prospect.

In 2022, the CO2 emissions intensity from GLA production (on a Scope 1 and Scope 2 basis) was approximately 12 kg per boe, well below the UK average for offshore gas fields of 22 kg per boe.

Mime (Norway)

Kistos announced its third acquisition of Mime Petroleum in April 2023 and completed the deal on 23 May 2023.

Mime holds a 10% interest in the Balder joint venture (comprising the Balder and Ringhorne fields) and a 7.4% stake in the Ringhorne East unit, all operated by Vår Energi A.S.A.

Mime was backed by a specialist PE firm, Blue Water, and had investment commitments from Blackstone Energy Partners.

The total deal cash consideration is $111mn, which is solely comprised of Mime’s net debt. Kistos also agreed to make a contingent payment (up to $45mn) to bondholders if production is launched according to plans or earlier. The actual amount of contingent consideration varies depending on the timing of production start and actual performance. Kistos has also agreed to issue 5.5mn warrants exercisable at 385p price.

According to management, the net cash position of Kistos, following the consolidation of Mime’s debt, would have been at €5mn as of 31 March 2023 (for reference, Kistos’s net cash was €130.4mn at the start of 2023).

Mime holds a 10% interest in the Balder joint venture (comprising the Balder and Ringhorne fields) and a 7.4% stake in the Ringhorne East unit, all operated by Vår Energi A.S.A.

Mime was backed by a specialist PE firm, Blue Water, and had investment commitments from Blackstone Energy Partners.

The total deal cash consideration is $111mn, which is solely comprised of Mime’s net debt. Kistos also agreed to make a contingent payment (up to $45mn) to bondholders if production is launched according to plans or earlier. The actual amount of contingent consideration varies depending on the timing of production start and actual performance. Kistos has also agreed to issue 5.5mn warrants exercisable at 385p price.

According to management, the net cash position of Kistos, following the consolidation of Mime’s debt, would have been at €5mn as of 31 March 2023 (for reference, Kistos’s net cash was €130.4mn at the start of 2023).

Source: Kistos Investor Presentation

The operator of the Balder area is Norwegian publicly-listed Var Energi which had a market cap of $6bn before it announced the acquisition of Neptune assets on 23 June. Var Energy has 2P reserves of 1,070mn boe, which puts it on approx. $6/boe market-based valuation.

Mime, headquartered in Oslo, holds a 10% interest in the Balder joint venture (comprising the Balder and Ringhorne fields) and a 7.4% stake in the Ringhorne East unit, all operated by Vår Energi A.S.A (a bubbly listed company).

Management expects Mime’s share of production from Balder and Ringhorne to be over 2,000 boe/d in 2023. This will increase significantly once the Balder X project is onstream, with output for the enlarged Group expected to be over 15,000 boe/d in 2025 once the Jotun Floating Production Storage and Offloading vessel (FPSO) is onstream. According to Vår Energi, Balder X reached the milestone “Ready for re-float” as planned earlier this year, with a physical re-float planned in Q3.

Scope 1 and Scope 2 CO2 emissions from the Balder Hub are expected to fall by more than 50% to approximately 7.5kg per boe once Balder X is onstream. This is well below both the global and the North Sea averages.

Mime, headquartered in Oslo, holds a 10% interest in the Balder joint venture (comprising the Balder and Ringhorne fields) and a 7.4% stake in the Ringhorne East unit, all operated by Vår Energi A.S.A (a bubbly listed company).

Management expects Mime’s share of production from Balder and Ringhorne to be over 2,000 boe/d in 2023. This will increase significantly once the Balder X project is onstream, with output for the enlarged Group expected to be over 15,000 boe/d in 2025 once the Jotun Floating Production Storage and Offloading vessel (FPSO) is onstream. According to Vår Energi, Balder X reached the milestone “Ready for re-float” as planned earlier this year, with a physical re-float planned in Q3.

Scope 1 and Scope 2 CO2 emissions from the Balder Hub are expected to fall by more than 50% to approximately 7.5kg per boe once Balder X is onstream. This is well below both the global and the North Sea averages.

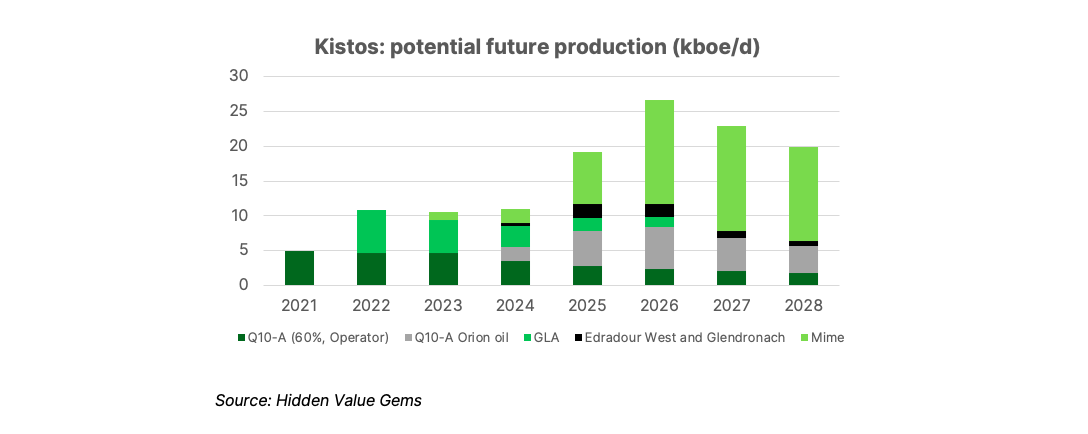

Production outlook

I have summarised the production of key assets in Kistos' portfolio and presented it in the chart below. This is based on the previous Competent Person Reports (CPR), adjusted for the latest results. I tried to be conservative, so there is a chance that actual production would be stronger. No credit was given to any of the exploration assets (only existing discoveries).

Calendar of key operational steps

- Late 2023 - Edradour West development

- Late 2023 - submission of Field Development Plan (FDP) and permitting request on Orion West oil field (Netherlands)

- Early 2024 - FID on Glendronach (GLA)

- Mid-2024 - first gas at Edradour West (GLA)

- Q3 2024 - first oil at Balder X with peak output rising above 15kboe/d vs 2kboe/d now (Mime)

- Late 2024 - first gas at Glendronach (GLA)

- 2025 - Step change in production from c. 10kboe/d to up to 25kboe/d

Other events to watch for:

- May 2024 - UK general elections with possibly further negative UK oil & gas taxation changes. In particular, the Labour Party proposed to scrap the investment relief (currently at 91p for every 100p invested) and ban new projects in the North Sea.

- 2024 - Update on Kistos challenging Dutch Solidarity tax. Kistos believes its Dutch subsidiary is out of scope and should not pay €46.9mn currently reflected as a liability on its balance sheet.

Exceptional asset economics and attractive valuation

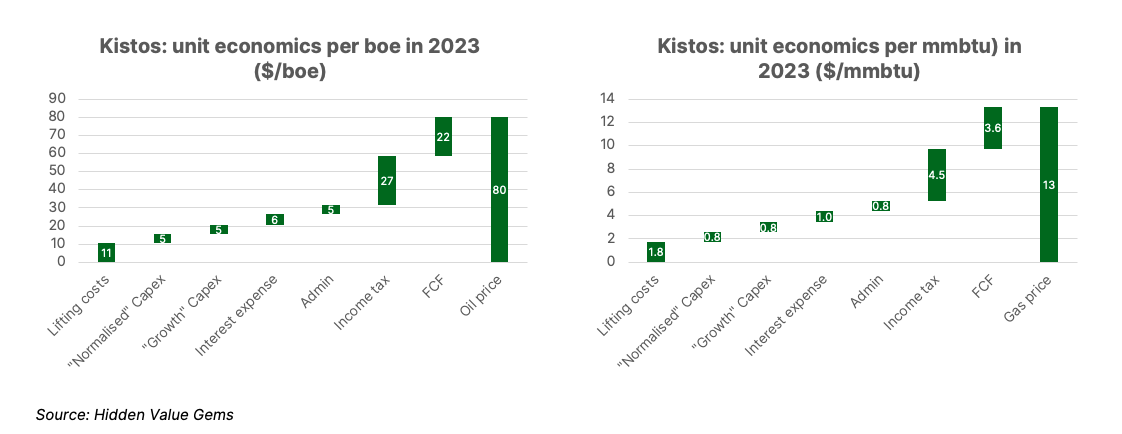

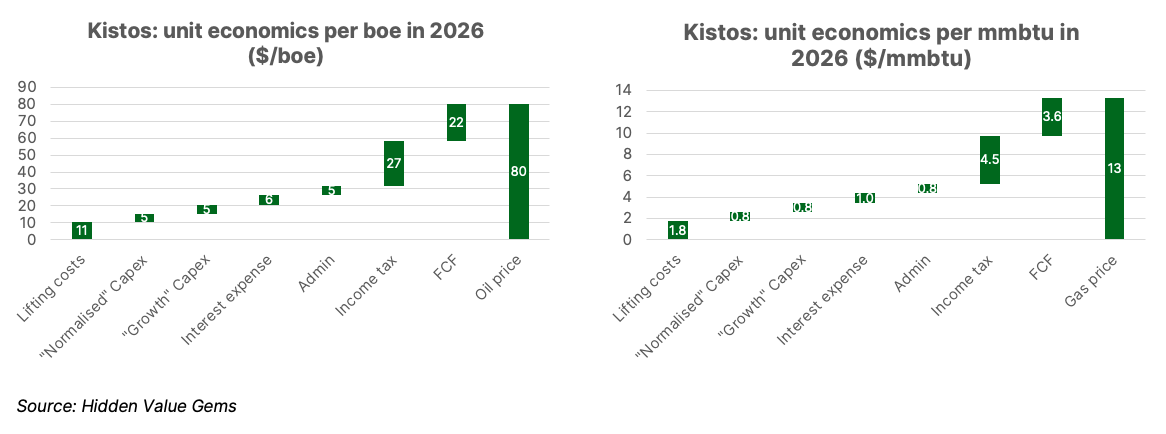

While the oil & gas sector is traditionally known to be highly capital-intensive with unattractive returns on invested capital (see my previous post), Kistos operates low-cost assets with low capital requirements, which makes it very attractive, especially in the current macro environment.

Its cash costs are at about $10-11/boe ($1.6-2/mmbtu) compared to the current oil price of $70-80 and gas price of about $8-10/mmbtu ($50-60/boe). The company spends about $20mn on capex (closer to $40mn this year which includes approximately $25mn of growth capex related to Balder X). This adds an additional $5/boe of “normalised” capex ($10/boe in 2023). Its interest expense was under $3/boe before the acquisition of Mime (which would probably double following the deal).

On my estimates, the break-even price for Kistos is below $32/boe ($5.3/mmbtu) and about $21/boe ($3.5/mmbtu) post the launch of Balder X (from 2025).

Its cash costs are at about $10-11/boe ($1.6-2/mmbtu) compared to the current oil price of $70-80 and gas price of about $8-10/mmbtu ($50-60/boe). The company spends about $20mn on capex (closer to $40mn this year which includes approximately $25mn of growth capex related to Balder X). This adds an additional $5/boe of “normalised” capex ($10/boe in 2023). Its interest expense was under $3/boe before the acquisition of Mime (which would probably double following the deal).

On my estimates, the break-even price for Kistos is below $32/boe ($5.3/mmbtu) and about $21/boe ($3.5/mmbtu) post the launch of Balder X (from 2025).

Kistos has 82.9mn shares outstanding with a quoted price of 250p (as of 23 June), which gives it a market capitalisation of £207mn (€242mn). It has a net cash position of €5mn following the acquisition of Mime. There may be additional contingent payments and €46.9mn of solidarity tax that Kistos disagrees with. However, the company will likely earn more cash before the year-end, with oil and gas prices remaining well above the break-even level.

Essentially, you can buy this company for €237mn (market cap less net cash) and earn €80-100mn of FCF annually in the mid-term, with a likely boost to FCF in 2025 (€130-150mn). The payback on such an investment is less than three years (at spot prices).

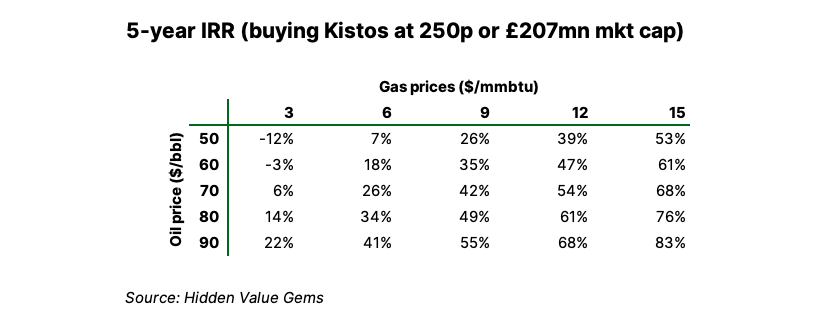

At $8/mmbtu gas price and $75/bbl oil, buying the whole of Kistos could generate an IRR of 42%, assuming production runs until 2027 only. I have added €80mn of abandonment costs in 2027. The company made a €126mn abandonment provision in its 2022 financial accounts, but this was based on a 2.5-3.5% discount rate and 2.5% inflation. Besides, not all assets would require decommissioning in 2027. I have not included abandonment for Baldex X, as its production will likely continue into the 2040s.

If my model is correct (the big “if”, of course), then the IRR would drop to a conservative 7% rate if gas prices are at $6/mmbtu and oil at $50/bl.

Essentially, you can buy this company for €237mn (market cap less net cash) and earn €80-100mn of FCF annually in the mid-term, with a likely boost to FCF in 2025 (€130-150mn). The payback on such an investment is less than three years (at spot prices).

At $8/mmbtu gas price and $75/bbl oil, buying the whole of Kistos could generate an IRR of 42%, assuming production runs until 2027 only. I have added €80mn of abandonment costs in 2027. The company made a €126mn abandonment provision in its 2022 financial accounts, but this was based on a 2.5-3.5% discount rate and 2.5% inflation. Besides, not all assets would require decommissioning in 2027. I have not included abandonment for Baldex X, as its production will likely continue into the 2040s.

If my model is correct (the big “if”, of course), then the IRR would drop to a conservative 7% rate if gas prices are at $6/mmbtu and oil at $50/bl.

In the short-term, gas prices can fall as low as $2/mmbtu. They fell to $1.8/mmbtu in June 2020 during the lockdowns and collapsing energy demand (with oil briefly trading in negative territory). However, the marginal cost of supply for natural gas is much higher. When Russia was a significant supplier to Europe (with about 30% market share), its marginal cost was $3/mmbtu, but it could not grow supply at that price. Without Russia, US LNG is the immediate alternative. With Henry Hub prices at $2-3/mmbtu currently (at the low end of the historical range) and $3.5/mmbtu additional costs to build the terminal and ship LNG to Europe, the price range of $5.5-6.5/mmbtu seems the minimum long-term equilibrium level.

Assuming that Russian gas does not come to Europe and China’s pivot to gas continues, prices will likely rise in the near term before the large-scale expansion of Qatar LNG is complete (closer to 2026).

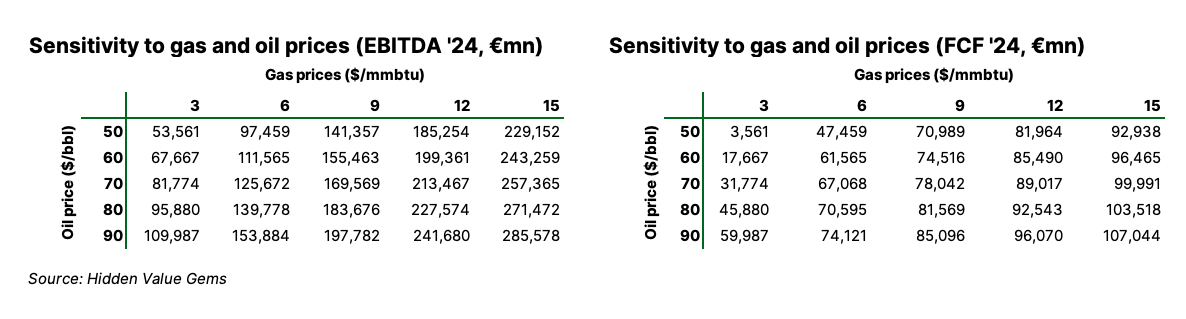

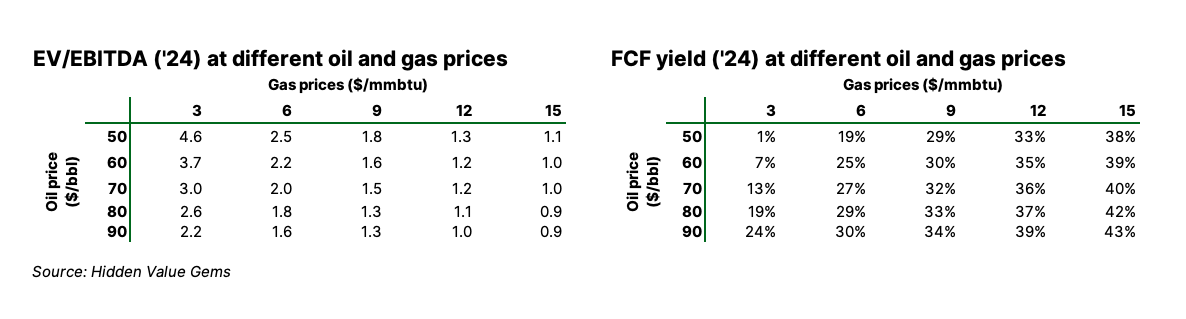

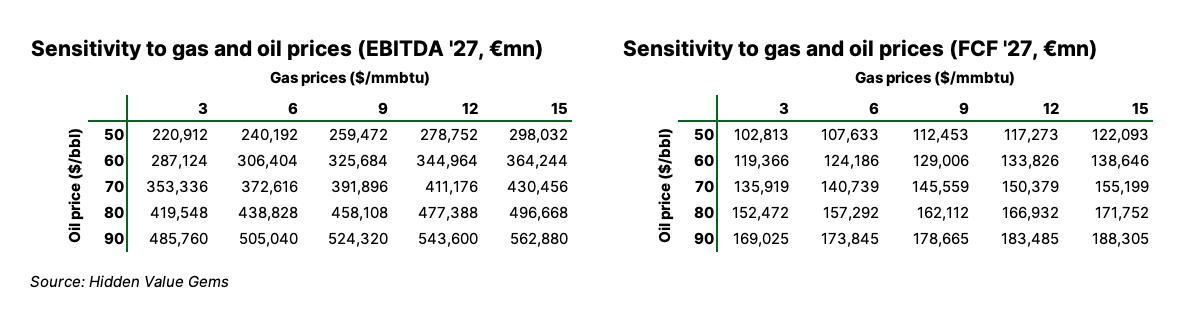

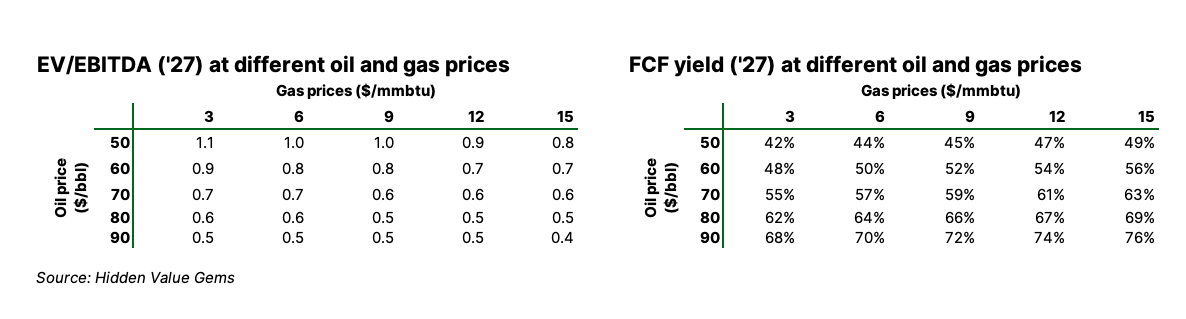

I have provided approximate EBITDA and FCF calculations for 2024 and 2027 and implied multiples. These calculations are only estimates. Specific parameters like exact tax rates, capex and lifting costs may differ from my assumptions. As a result, results in future years will likely differ from the numbers I present below. However, the order of magnitude should be the same.

I estimate the range of Kistos' EBITDA in 2024 from €54mn €286mn. I see the range of €4-107mn for FCF in the same year.

Assuming that Russian gas does not come to Europe and China’s pivot to gas continues, prices will likely rise in the near term before the large-scale expansion of Qatar LNG is complete (closer to 2026).

I have provided approximate EBITDA and FCF calculations for 2024 and 2027 and implied multiples. These calculations are only estimates. Specific parameters like exact tax rates, capex and lifting costs may differ from my assumptions. As a result, results in future years will likely differ from the numbers I present below. However, the order of magnitude should be the same.

I estimate the range of Kistos' EBITDA in 2024 from €54mn €286mn. I see the range of €4-107mn for FCF in the same year.

This implies EV/EBITDA multiples between 0.9x and 4.6x and FCF yield at 1-43%.

With the launch of production at Balder X in 2024-25, Kistos' financials in 2027 should be even better with FCF in €103-188mn range.

This implies an FCF yield of 42-76% and an EV/EBITDA multiple in the 0.4-1.1x range.

The message from these sensitivity tables is that at the current share price, Kistos has a low downside and significant upside.

Capital allocation: track record at Kistos

I have already discussed how Austin achieved 42x returns during 2016-2020 when he was Executive Chairman at small E&P RockRose Energy. He raised £13mn from shareholders and returned £298mn at a time when oil prices were weak and investors generally hated this sector.

This is what he has achieved so far with Kistos, the company he founded right after selling RockRose in 2020.

This time, he raised £102mn capital from shareholders at an average price of 123p. He put £12mn of his own money in Kistos and currently owns 17.25% (his average purchase price is 84p, while the last time he bought shares on the open market at 327p in February 2022.

This is what he has achieved so far with Kistos, the company he founded right after selling RockRose in 2020.

This time, he raised £102mn capital from shareholders at an average price of 123p. He put £12mn of his own money in Kistos and currently owns 17.25% (his average purchase price is 84p, while the last time he bought shares on the open market at 327p in February 2022.

The current share price is almost 3x higher (250p) than the average price at which the funds were raised.

After acquiring Mime Petroleum, the company had a net cash of €130.4mn at the end of 2022 and €5mn at the end of Q1 2023. It is producing over 10kboe/d of hydrocarbons in three countries. Its 2P reserves stand at 36.3mn boe with total potential resources of 80mn boe.

Kistos is on track to generate over €90mn of FCF this year after a record €270mn in 2022.

From Austin’s earlier comments, it is clear that the company continues to actively consider new investment opportunities in the countries of its current operations as well as “two other jurisdictions”.

Earlier this year, when Kistos' cash balance was rapidly growing, management said that unless they found an attractive investment opportunity, they would distribute the cash among shareholders as they had done before at RockRose. I think it will probably happen later, in a couple of years, once all key projects are onstream. In one interview, Austin even mentioned the possibility of buybacks, but given the low liquidity of Kistos' shares, I doubt this will happen.

To finish the topic of capital allocation, do not forget that last year Kistos initiated a merger discussion with Serica, a UK-listed E&P peer. First, Kistos was acting as an acquirer. Then it received a counter-bid from Serica. Both sides considered bids too low, and discussions did not go further.

This proves that Kistos' management and its largest shareholders are actively seeking opportunities to create more shareholder value.

After acquiring Mime Petroleum, the company had a net cash of €130.4mn at the end of 2022 and €5mn at the end of Q1 2023. It is producing over 10kboe/d of hydrocarbons in three countries. Its 2P reserves stand at 36.3mn boe with total potential resources of 80mn boe.

Kistos is on track to generate over €90mn of FCF this year after a record €270mn in 2022.

From Austin’s earlier comments, it is clear that the company continues to actively consider new investment opportunities in the countries of its current operations as well as “two other jurisdictions”.

Earlier this year, when Kistos' cash balance was rapidly growing, management said that unless they found an attractive investment opportunity, they would distribute the cash among shareholders as they had done before at RockRose. I think it will probably happen later, in a couple of years, once all key projects are onstream. In one interview, Austin even mentioned the possibility of buybacks, but given the low liquidity of Kistos' shares, I doubt this will happen.

To finish the topic of capital allocation, do not forget that last year Kistos initiated a merger discussion with Serica, a UK-listed E&P peer. First, Kistos was acting as an acquirer. Then it received a counter-bid from Serica. Both sides considered bids too low, and discussions did not go further.

This proves that Kistos' management and its largest shareholders are actively seeking opportunities to create more shareholder value.

What could go wrong

My thesis so far may create an impression that you cannot lose money in Kistos. Of course, this is not true. Some of the risks that I can think of include the following issues:

- Further negative tax changes.

- Operational issues, production delays, reservoir issues. Kistos has strong capital allocation skills, but they are not outstanding operators of assets.

- Macro risks, especially future prices for oil and gas. Faster transition to EVs, global recession, poor production discipline at OPEC - all this could lead to further price weakness.

Thank you for reading this piece. I hope it was useful. Please consider sharing it with your friends who may also benefit from this.