1. Businessman vs Craftsman

I listen to about 10 podcasts a week. There are many interesting facts that I can learn about specific businesses or industries there, but I do not log all my observations unless they are very important. Usually, I use this information to connect the dots when I am researching a company. In the majority of cases, I take no action, and this information remains in my memory until another time.

This time an interesting thought caught my attention which I would like to write about. It came from Fred Liu, a young investor running Hayden Capital, in an interview published by Good Investing Center. It is about the difference between a Businessman and a Craftsman. The former tries to identify what the market needs and then sells it to consumers. The latter, on the other hand, builds what he thinks is worth it and then tries to sell to whoever is interested.

Quite an interesting thought to think about. It has direct implications for fund management and a potential edge that an individual investor can have. Most money is run by institutions (businessmen) who earn profits mostly from the size of assets that they manage (AUM). To earn more, you need to raise AUM. And to achieve that – you want to sell to people what they want.

Most want low volatility and a positive story (e.g. innovation). Besides, people are impatient, so they judge funds on monthly or quarterly performance.

As a result, many money managers are too short-term focused and are overweight well-known, big brand companies (that ‘cannot disappoint’). They are not incentivised to take bold bets as this can add significant volatility to performance and lead to redemptions. As a result, stocks in fewer glamour sectors become available at much more attractive prices, especially to patient investors. Moreover, the lack of fresh capital keeps the competitive landscape healthy and allows such companies to continue to generate attractive returns.

Of course, this is a very high-level principle and should not be used as an automatic rule, but it can still be helpful more often than not.

In fact, this idea about Businessman vs Craftsman is also interesting outside of investing. It can be relevant to your career and even life as a whole. It is important to find the balance between doing what is needed by the market (choosing a career with many job opportunities) and doing what you really believe in (follow your passion). We always face the choice of being judged by others or by your ‘inner scorecard’ (provided that you have one).

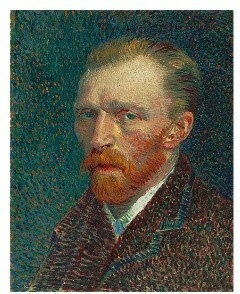

Vincent Van Gogh was probably the extreme example of doing what he believed was right. Just a single painting was sold during his life, and he died in poverty. Eventually, his work has become so appreciated by the market that the collective net worth of his work is now estimated to exceed $1 billion. I apologise for using the monetary criteria for assessing the success of art; it is just a bit easier to discuss in such terms than in more subjective terms of aesthetic pleasure.

I will finish this part with a quote from another maestro, Steve Jobs, who said once that “When you’re a carpenter making a beautiful chest of drawers, you’re not going to use a piece of plywood on the back, even though it faces the wall and nobody will ever see it. You’ll know it’s there, so you’re going to use a beautiful piece of wood on the back. For you to sleep well at night, the aesthetic, the quality, has to be carried all the way through”.

2. Crisis vs Bubble

I came across it in another podcast of Jim O’Shaughnessy (Infinite Loops) when he interviewed the founder and CIO of Verdad Advisers, Dan Rasmussen.

In that interview, Dan shared his thought that it is very easy to say when we are in a crisis – the stock market is crashing, people get scared, we tend to seek any wisdom from gurus and extrapolate recent trends expecting more pain in the future. History tells that even if you cannot time the absolute bottom, buying in such circumstances has led to very strong results within 6-12 months (last year was a great example of this). So an easy action to take during the crisis is just to close your eyes and buy stocks.

On the other hand, to say confidently when we are in a bubble is much harder. And it is even more difficult to act. Nothing can be more painful than shorting stocks during the bubble.

I would use this thought more as a caution to remind myself that just because I don’t know for sure that we are in a bubble and I would not short stocks, a correction could still happen, so thinking about the downside, balance sheet strength, cyclicality of the business, valuation multiples and other factors is quite important especially when things look good.

3. Buffett and Munger CNBC interview

Like many fellow value investors, I was very excited to listen to a fresh interview of both Warren Buffett and Charlie Munger published by CNBC. If you do not have a subscription to CNBC Pro, you can read the transcript here and listen to separate episodes on Squawk Pod podcast here.

As usual, a broad range of topics was covered, but unlike previous interviews, there was no discussion of specific stocks or market outlook. Perhaps, the reason the question about the current stock market was not raised is because Buffett’s answer would likely have been along the same lines: stocks will be higher in the longer term, but it is impossible to know what would happen next year. He probably would have added that as long as long-term rates remain at current levels (1.3%), stocks paying 2-3% dividend yield and annual growth rate above inflation offer much better options.

I hope my prediction is not too far off and all those hours spent listening to previous interviews were not a waste of time.

I have two major takeaways from this interview.

First – surround yourself with good people. As Buffett said in this interview, “You want to have certain people in life that you don’t want to disappoint. You want to have people that make you a better person than you otherwise would be. And Charlie does that for me now, but my dad did it for me early on”. Munger commented about his life in the following way: “It was just a peculiar accident of history, so I was surrounded by a bunch of high-grade people. I deserve no credit at all for; I was just forced to imitate the right people”.

I think this piece of advice is valuable for parents who are thinking of helping their children achieve the most in life (think who their friends are, which in many ways is determined by the school and neighbourhood). It is also worth keeping in mind for professionals when deciding the next career move. Of course, you don’t need to be a parent or change jobs to benefit from it.

For my second takeaway, I would quote Munger, who said in that interview: “One thing we’ve learned is, if it’s clear that something is a mistake, is to fix it quickly. It doesn’t get better while you wait”. You have to “leave quickly”. He referred to department store business which they tried to develop in the late 1970s and early 1980s. Buffett also noted that “you don’t want to put more money into a business that’s destined for failure”.

This goes back to a well known Wall Street adage – “Cut your losses early”.

These are still early days for my project, and I am still trying to find the best balance between content, speed, niche and delight. This is obviously not a professional service, and I am not trying to convince readers to buy or sell certain securities. I would rather look at it as an open journey towards becoming a better investor. I hope that by putting my thinking into writing, I would be able to better think through the key stocks in my portfolio, identify new high-conviction ideas, improve my analytical tools and and make less mistakes, especially those that have to do with human psychology.

I hope this can be useful to you, my reader, and we can share this journey together. One other reason I launched this website was to meet like-minded people, discuss investment ideas and learn together. So if there is anything you would like to share, just drop me a line (ideas@HiddenValueGems.com).

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.