Summary

I review some of the ideas from the first half of the year. I discuss the importance of having a Watchlist, advantages of quality companies compared to just ‘cheap stocks’, why I didn’t plunge into the energy sector and show examples from the recent 1H22 corporate results that demonstrate the real strength of the quality businesses.

I will share my recent portfolio activity and updates to my Watchlist in the next post.

Reviewing opportunities during the latest market selloff

Cautious on Energy

Energy has been the best performing sector year-to-date. Many energy stocks appeared on value investing blogs.

Yet, I intentionally avoided buying energy stocks. Apart from the fact that I have already had a few energy names in my portfolio (including CNX which I recently wrote about), the main reason was that I wanted to buy businesses that I would be happy to own for the rest of my life. I think the punch card concept recommended by Warren Buffett is very powerful. It raises the bar for any prospective investment and forces you to analyse the business much more intense.

One of the conclusions from this concept is that return on capital (ROIC) generated by the business is more important than the price you pay. For example, if you pay 100x PE for a business that has ROIC of 30% and hold it for 30 years, then even if you sell the business for 15x PE after 30 years (historical multiple for S&P 500 market), you would earn 20% IRR (annual return). If you hold the same business for 100 years and sell at 15x in the end, your return would be over 27%, almost matching ROIC.

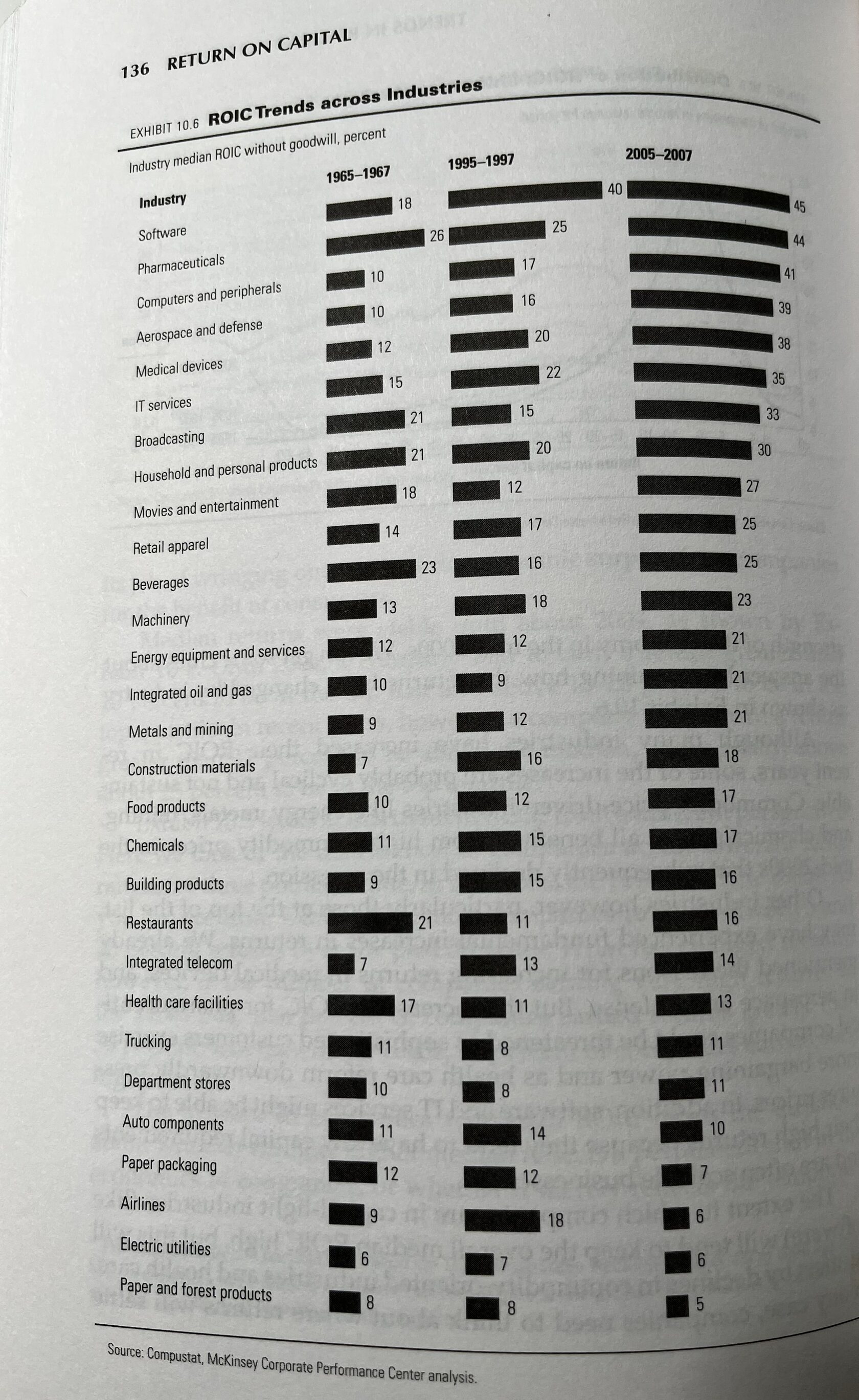

Oil & gas sector is not known for generating exceptional returns through the cycle (in addition to highly volatile earnings and high capital intensity). See below historical sector returns on capital returns from the McKinsey Valuation book:

The second reason why I did not buy new energy names was the stage of the cycle. Valuation is even less relevant for cyclical stocks. In hindsight, the spring of 2020 was the best time to buy the oil companies when oil was heading to a negative value (for the first time in history), and all of them were loss-making (trading at negative PE on a spot basis).

By early 2022, oil stocks had appreciated 50%, on average, over the previous 12 months. I admit they looked cheap (and still look so), but this is with the oil price at record levels.

One thing I am most certain about is that commodity prices never stay at record levels for too long. Either demand is destroyed, or supply picks up. Often both changes happen at once, which leads to another extreme.

Below is what I wrote in a post on 6 March 2022:

“However, I would like to caution from chasing commodity producers now. Rising energy prices are a tax on consumers, while logistical and other issues related to sanctions on Russia increase other risks for the global economy. If there is a general economic slowdown, this could actually be deflationary.

Besides, the world has plenty of commodities; what has been lacking until recently are investments. It may be that rising share prices of commodity producers reflect expectations of higher commodity prices in the future, while actual growth in CAPEX could increase supply at a time when demand starts cooling off.”

Three main conclusions from 1H22

1. Commodities remain highly speculative investment (e.g. most commodities are down from 24 February including oil, gold, iron ore, wheat, key fertilisers). Chances are not that high as they may appear that you will get timing right. Focusing on macro and commodity investments may be a waste of time.

2. Quality businesses are better positioned to withstand high inflation and other economic problems. Provided that you don’t overpay for such businesses, they should be the best long-term investments. Such businesses earn higher margins (sell higher quality, unique products or have substantial cost advantage) and require less capital to run the operations (they need to allocate lower share of profits to capital investments to maintain major producing assets and working capital such as inventories). A ratio of profits generated by the business to a capital deployed in the operations, conventionally referred to as Return on Invested Capital (ROIC), is a good first step to sort companies by the quality of their operations. Of course, a few adjustments need to be made to clean earnings from various one-off and non-operating items. Besides, other factors such as management, capital allocation, sector competition etc need to be taken into account.

3. Having a list of great businesses that are normally sold at high prices is critical during market corrections which happen almost every year and especially large sell-offs that happen once every few years. This requires the right filters to find potential candidates and then doing extra research to learn about the sources of competitive advantage of the company which would ultimately determine how sustainable its profitability and ROIC are as well as getting a sense of a reasonable price to pay for such business.

‘Cheap’ or ‘Quality’ businesses?

One of the reasons I have not taken more advantage of the recent sell-off is that I have not done sufficient research on my candidate stocks, without which I have not developed strong enough conviction. I try to remind myself of the ‘punchcard’ strategy - the advice Warren Buffett gave to new investors:

"I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime."

- Warren Buffett

The second reason was my preference to find businesses with long runways even if potential return in a 6-12 month period is not spectacular. Short-term performance is mostly driven by changes in valuation multiples which in turn depend on expectations of future growth and associated risks.

Occasionally, some stocks may look oversold and extremely cheap (e.g. 20% FCF yield), often due to concerns over the future of the business (e.g. demand for products, costs, competition, regulation). If the business remains sound and investors have over-reacted to short-term news, the stock rebounds to its more normal valuation level (often rising by 50% to even 100%).

But even in that case, once this happens, you have to look for new ideas since going forward, the stock’s return would match company’s ROIC. Unless you bought a business with exceptional returns on capital, forward returns would be quite moderate.

Selling a stock with capital appreciation leads to tax liabilities unless you hold stocks in a tax-free account (e.g. ISA in the UK).

Paying taxes reducing your actual results. Besides, having to find a new idea forces you to stay in cash and exposes you to the risk of finding a value trap or make just a bad investment decision. So, after a successful 6-12 months, your returns drop from initial 50% to possibly zero after you have paid the taxes and invested in a new, less successful company.

On the other hand, a business growing its earnings at 20x PE and not enjoying re-rating (selling at a constant valuation multiple), would be worth 44% more in two years without you having to pay taxes or doing intense research on finding replacements and making decisions on the best time to sell a simple company with a low PE.

Time is on your side when you own a great business as such companies can benefit from returns on capital investments they make. On the other hand, weak businesses may deceptively appear fast-growing during economic boom and even deliver faster growth compared to quality businesses, but when economy runs into troubles, they struggle to keep operations running and shareholders could see the value of their investments in such companies completely wiped out.

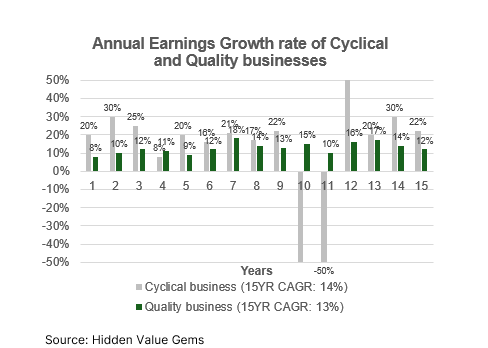

I have shown theoretical annual growth rate of earnings of two companies. One company operates in a cyclical sector without a real competitve advantage. Its earnings growth depends on the macro situation and tends to be very strong during economic growth phase.

The second company has a unique advantage and generates more stable earnings growth which is less dependent on the macro factors.

The cyclical businesss achieves 14% average growth rate over a 15-year period whihc is higher than 13% rate for the quality company (averages are caclulated as simple arithmetic mean, not geometric mean).

At firsst glance, the cyclical business looks more attractive.

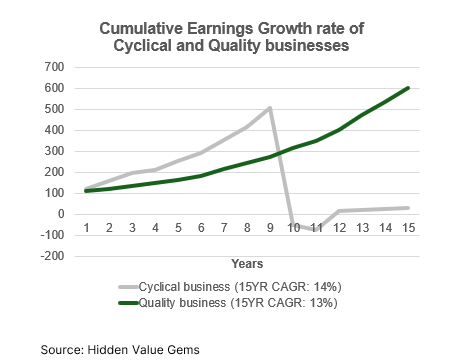

However, if you track earnings trajectory during this 15-year period and assume both companies start with $100 of profits in Year 0, then in Year 15 the earnings of the quality business exceed $600 (!), while the cyclical company barely reaches $29.

The main reason lies with just two 'unlucky' years (10 and 11) when the profits of the cyclical company fall by 110% and 50%, respectively, even though they rebound by 120% the folowing year.

Inflation challenge has shown the real advantages of quality businesses

The latest inflation challenge has exposed businesses with underlying weaknesses and, on the other hand, has proven which companies have real quality business models.

“It's only when the tide goes out that you learn who has been swimming naked.”

- Warren Buffett

I have summarised financial and operating results as well as management’s comments of those companies that have performed better during the first half of 2022. Not surprisingly, a lot of these companies are in the luxury business.

Luxury business is by default based on scarcity. It is also a business where raising prices is much easier as often consumers are buying these types of goods as a way of demonstrating to others that ‘they are rich enough to afford expensive stuff’. Naturally, margins are higher than in other sectors. Capital needs of luxury businesses are extremely low. Many companies are also run by families. Scope for further consolidation provides further non-organic growth opportunities and scope for higher efficiency.

High valuation is the only negative about these companies that easily comes to mind. This is why market corrections are important as all stocks tend to go down without much differentiation between the quality of underlying operations.

LVMH

Organic Sales (2Q22): +19% YoY (Total Sales +27%), of which Wine & Spirits revenue +30%, volumes of Champagne sales +16% in 1H22, Henessy -2% decline. Revenue growth in 2Q22 by key geography: US +22%, Japan +37%, Asia (ex Japan) -8%, Europe +48%.

Profit from recurring operations (1H22): +34%, of which wine & spirits +25%. Operating margin - 27.9% (vs 26.6% in 1H21).

This comes on top of already strong 2021 performance with organic sales up +14% vs 2019 (pre-COVID) and recurring profits +49% vs 2019.

LVMH’s CFO, Jean Jacques Guiony said the company was “optimistic, confident and vigilant” all at once, despite potential headwinds.

Kering

Organic revenue (2Q22): +12% (+27% vs 2019).

Organic revenue (1H22): +16% (+28% vs 2019).

Recurring operating profits (1H22): +26%.

Operating margin (1H22): 28.4% (vs 27.8% in 1H21).

“More favourable trends, which emerged in the second half of 2020, were confirmed in 2021 and in early 2022. Although these trends remain conditioned by developments in the public health situation and associated restrictions across countries, the luxury market has witnessed a significant rebound, driven by consumer appetite for premium goods and a gradual upturn in tourist flows, particularly in Europe.”

Diageo

Organic revenue growth (12 months ended June 2022): +21.4% (same as reported).

Organic volume growth (12 months ended June 2022): +10.3%, price/mix +11.1%. 3-year organic revenue growth +9%.

Operating margin (12 months ended June 2022): 31% (vs 29.8% a year ago).

“Growth reflects continued recovery of the on-trade, resilient consumer demand in the off-trade and market share gains, and was underpinned by favourable industry trends of spirits taking share of total beverage alcohol and premiumisation.”

“Price/mix growth was 11.1 percentage points, reflecting positive mix from strong performance in super- premium-plus brands, and mid-single digit price growth driven by price increases across all regions.”

“Against a backdrop of significant cost inflation and supply chain disruptions, price increases and supply productivity savings more than offset the absolute impact of cost inflation, and mostly offset the adverse impact on gross margin.”

“In an environment of significant cost inflation, and supported by strong marketing investment, we have taken targeted price increases. As an example, in Brazil, we increased prices across our scotch portfolio by an average of 7% in the first half, followed by an additional 10% in the second half. Johnnie Walker grew 52%, while delivering strong double‐digit volume growth and the brand gained market share of both spirits and the scotch category. Price increases offset COGS inflation and contributed to a 350 basis point gross margin improvement for the brand.”

“In Spain, we increased the price of Johnnie Walker Red Label, and reduced price promotions at the point of sale, while also increasing marketing spend to maintain strong brand equity. The variant gained 219 basis points of category market share in the three months following the price increase and has gained 167 basis points of share year‐to‐date.”

FY23 Outlook: “In a challenging inflationary environment, we will continue to focus on revenue growth management, including strategic pricing actions, and everyday efficiency. We continue to expect organic operating margin to benefit from premiumisation trends and operating leverage while investing strongly in marketing.”

“We believe our portfolio is well positioned across geographies, categories and price points. We will use our deep understanding of consumers to quickly adapt to changes in trends and behaviours while investing strongly in marketing and innovation, and leveraging our revenue growth management capabilities, including strategic pricing actions.”

Heineken

Organic revenue (1H22): +24.3%, including the impact from changing prices/mix +15.6%.

Volumes (1H22): +7.6%, premium beer volumes +10.2%.

Operating organic profit (1H22): +24.6%.

Operating margin (1H22): 16%.

“Our actions on pricing, revenue management and productivity offset significant inflationary pressures in our cost base. As a result, operating profit is now firmly ahead of 2019.”

Ferrari

Organic revenue (2Q22): constant FX +21.1% (reported revenue +24.9%).

Shipments (2Q22): +28.7%.

EBITDA & EPS (2Q22): + 15.5% / 22.5% respectively.

EBITDA margin (2Q22): 34.6% lower than in 2Q21 (37.4%)

’22E guidance raised: full-year revenue growth 2 p.p. higher than previously (+14%).

Apple

Revenue June-22 quarter: + 2% YoY. Apple set a June quarter record for both revenue and switchers to iPhone.

Tim Cook addressing the question of macro/inflation impact on the latest quarterly results (28 July 2022):

“When you look at the product categories, on iPhone, there was no obvious evidence of macroeconomic impact during the June quarter besides FX, obviously. Mac and iPad were so gated by supply that we didn't have enough product to test the demand. And Wearables, Home, and Accessories, as you mentioned and as Luca mentioned, we did see some impact there that we would attribute to a macroeconomic environment. When you then look at Services, there were some Services that were impacted, for example, like digital advertising was clearly impacted by the macroeconomic environment.”

“From an aggregate point of view, looking at it worldwide, looking at the data on iPhone for the June quarter, there's not obvious evidence in there that there's a macroeconomic headwind. The data doesn't show it where we can clearly see that in the Wearables, Home and Accessories area. And so I would differentiate those two.”

On next quarter outlook:

“We believe our year-over-year revenue growth will accelerate during the September quarter compared to the June quarter despite approximately 600 basis points of negative year-over-year impact from foreign exchange. On the product side, we expect supply constraints to be lower than what we experienced during the June quarter. Specifically related to services, we expect revenue to grow but decelerate from the June quarter due to macroeconomic factors and foreign exchange.”

Amazon (2Q22)

Net sales: +10% in constant currency terms (+7% reported).

Operating income: -59% (FX adjusted) vs a year ago.

Operating margin: 2.7% vs 6.8% a year ago.

Andy Jassy, Amazon CEO:

“Despite continued inflationary pressures in fuel, energy, and transportation costs, we’re making progress on the more controllable costs we referenced last quarter, particularly improving the productivity of our fulfillment network. We’re also seeing revenue accelerate as we continue to make Prime even better for members, both investing in faster shipping speeds, and adding unique benefits.”

Third Quarter 2022 Guidance:

Net sales are expected to be between $125.0 billion and $130.0 billion, or to grow between 13% and 17% compared with third quarter 2021. This guidance anticipates an unfavorable impact of approximately 390 basis points from foreign exchange rates.

Operating income is expected to be between $0 and $3.5 billion, compared with $4.9 billion in third quarter 2021.

Brian Olsavsky, Amazon’s CFO, on risks of weaker macro for AWS business:

“We're very happy with the growth rate. We're happy with the adoption of the cloud. As you hit a potential rough patch in the economy, I think the last time we saw this was back in 2008-ish, and we started to draw lessons from that, but we did notice that it did help our cloud business at the time because, again, when you're trying to launch a new product or service and you have to face with building your own data center and getting capital for a data center and building it yourself or moving to the cloud and essentially buying incremental infrastructure capacity, cloud computing really shows its value. So we're prepared.”

On Prime fee increase:

“We're happy with the results we're seeing in the Prime program. Prime member membership and retention is still strong. I think that change has been above our expectations positively. And I think the benefit of the program continues to get better and better.

And as I mentioned, in-stock has never been higher. Delivery speed is increasing. So not to mention a lot of the new content, especially on the video side that will be coming in the fall. So we feel good about the program and the state of the Prime members after a very rough couple of years of pandemic turmoil, and we think it's a good base to build upon.”

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.