I have been a shareholder in Exor since spring 2020. It is a holding company of the Agnelli family, the founders of Fiat.

Its stock is up a moderate 27% since I bought it (+17% in USD terms). I am convinced there is even more upside now. Here is why.

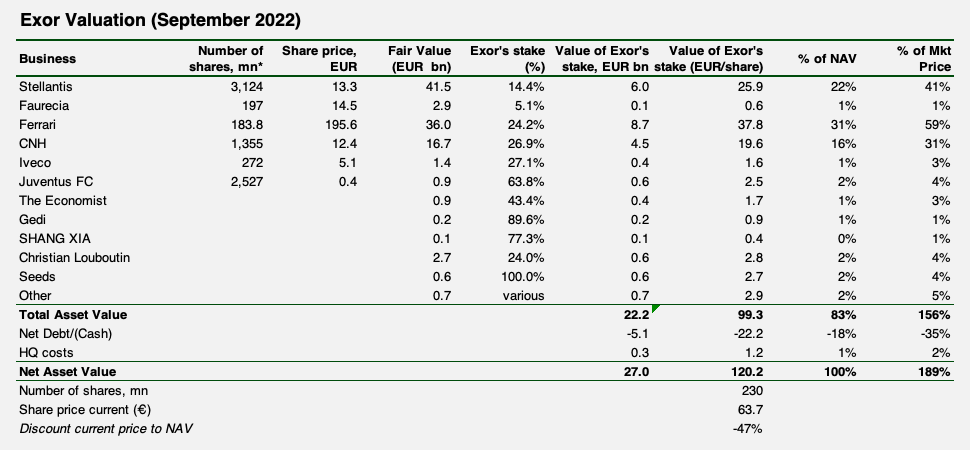

Exor's market cap is €14.7bn, of which net cash is €5.1bn. This leaves €9.6bn for the value of all businesses in its portfolio. Note that just Exor's stake in Ferrari is worth €8.7bn, which implies that the market is valuing all other assets almost at zero.

At the current price of €63.7, investors in Exor only pay for a 24.2% interest in Ferrari (€37.8), net cash (€22.2), Seeds and Other minor investments, while all other businesses in Exor’s portfolio come on top of this for free (including 14.4% stake in Stellantis worth €25.9 at current prices, 26.9% interest in CNH - €19.6 as well as stakes in Iveco, Juventus, The Economist, Gedi, Shang Xia and Christian Louboutin).

Moreover, most of its publicly listed businesses are trading at discounted multiples and are down about 30% from their peaks. This offers an additional upside.

Essentially, Exor is trading 47% below the value of its assets, offering almost 100% upside. Historically, Exor has traded at an average discount of 30% to its NAV, with the discount being as low as 2% in 2015 and as high as 51% in 2009. This is the widest discount in more than ten years. Even in March-April of 2020, the discount was smaller (40%, on my estimate).

I think there are potentially four reasons why the market is so sceptical about Exor:

- Exposure to Europe

- Exposure to cyclical sectors

- ‘Negative surprisers’

- Lack of ‘exciting headlines’.

I disagree with all four points. I explain why I believe the market is wrong on Exor and discuss in more detail its valuation as well as the historical discount of its share price to the NAV of the company in My Portfolio.

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.