12 November 2023

What industry is responsible for creating the most significant financial wealth?

The most common answer would be Technology. At least, it appears so if you measure wealth by the number of millionaires or billionaires created in a particular sector. Definitely, in the past 30 years.

However, if you add the number of people who have tried but failed in IT, the ratio becomes less favourable. If you also track the wealth of “investors” rather than the “founders”, I am afraid the results could be even more disappointing.

I had a different sector in mind. It is the one that encourages long-term thinking and narrow expertise, is rather dull and is not growing at a double-digit rate. In fact, running this business was quite a tough job in the past decade. However, companies run by managers with skin in the game and excellent capital allocation skills have done phenomenally well over many decades.

This sector is insurance. Considered a boring sector, it helped some shrewd operators amass wealth over many decades.

Some of the well-known members of the insurance “billionaires club” include Warren Buffett, Prem Watsa, William Berkley, and the Greenberg family (Maurice Greenberg was the CEO of AIG, while his elder son, Jeffrey, was the CEO of Marsh & McLennan, and his younger son, Evan, is the CEO of Chubb).

Less known is the Davis family. Old-time readers of my newsletters may remember my post, where I wrote how a little-known Shelby Davis started investing at 38 with $50,000 and ended up with $900,000,000 by 1994. He has generated a 23% compound return.

What industry is responsible for creating the most significant financial wealth?

The most common answer would be Technology. At least, it appears so if you measure wealth by the number of millionaires or billionaires created in a particular sector. Definitely, in the past 30 years.

However, if you add the number of people who have tried but failed in IT, the ratio becomes less favourable. If you also track the wealth of “investors” rather than the “founders”, I am afraid the results could be even more disappointing.

I had a different sector in mind. It is the one that encourages long-term thinking and narrow expertise, is rather dull and is not growing at a double-digit rate. In fact, running this business was quite a tough job in the past decade. However, companies run by managers with skin in the game and excellent capital allocation skills have done phenomenally well over many decades.

This sector is insurance. Considered a boring sector, it helped some shrewd operators amass wealth over many decades.

Some of the well-known members of the insurance “billionaires club” include Warren Buffett, Prem Watsa, William Berkley, and the Greenberg family (Maurice Greenberg was the CEO of AIG, while his elder son, Jeffrey, was the CEO of Marsh & McLennan, and his younger son, Evan, is the CEO of Chubb).

Less known is the Davis family. Old-time readers of my newsletters may remember my post, where I wrote how a little-known Shelby Davis started investing at 38 with $50,000 and ended up with $900,000,000 by 1994. He has generated a 23% compound return.

I am even more excited today because the insurance sector is especially well-positioned for rising inflation and interest rates - the environment we find ourselves currently in.

Why Insurance is a unique business?

Reverse flow of cash

A traditional business manufactures a product first and then sells it. It has to spend money on production before it can recover its costs. A customer sees the product before he buys it and can assess its value.

In the insurance business, this process is reversed. An insurance company first receives the money but doesn’t know the final cost of the service it has sold until at least a year, maybe even a decade or two.

In the insurance business, this process is reversed. An insurance company first receives the money but doesn’t know the final cost of the service it has sold until at least a year, maybe even a decade or two.

Capital allocation skills have a disproportionate impact on insurance companies’ long-term results

What a company does with the money it receives upfront, before it needs to pay the claims (if at all), can make a big difference in the financial performance of an insurance company. This money, called ‘float’, can sit on a bank account with a 2-3% yield, or it could be invested in riskier assets to generate 10%. Hundred dollars in a bank at 3% would grow to $130 in ten years. But at 10%, it will be $236, $106 more (+81%).

Long term vs Short term

This long-term perspective also makes it harder to analyse current results. For example, a company may decide to insure a new customer at a lower premium (selling a cheaper insurance policy), which would result in a loss on its income statement in the current year. However, doing so can establish a long-term relationship, make a loyal customer and generate much more value over the long term.

Patience pays off

Such an approach requires patience and a culture that is not focused on beating next quarter’s earnings. This is easier to achieve in owner-operator businesses, where management’s interests are aligned with the company’s long-term performance.

Trust

A customer needs to have trust in the insurance company that it will be able to pay the claim in the future.

Old insurers have an edge

Companies with a long history benefit from their reputation and win trust easier. Their proprietary data on claims and customer behaviour gives them an edge when they need to price risk.

Balance sheet and ‘Float’

A strong balance sheet is essential to pay out future claims, even though it may reduce profitability in the near term.

The role of the insurance float is unique in funding the business. An accountant treats float as a liability. But for an intelligent businessman, the float provides an essential source of funding. How he uses the funds can have a considerable consequence on the value of the insurance in 10 years. Moreover, this funding can be free and even generate extra income as long as the insurance company prices risk reasonably. If the premiums received today (float) exceed future claims, then the underwriting result is a net profit, and it adds to the investment income generated by the float. If the company delivers an underwriting loss (future claims exceed premiums collected), the cost of the float is real. This loss is deducted from the investment income when estimating the net result of the insurance operations.

The role of the insurance float is unique in funding the business. An accountant treats float as a liability. But for an intelligent businessman, the float provides an essential source of funding. How he uses the funds can have a considerable consequence on the value of the insurance in 10 years. Moreover, this funding can be free and even generate extra income as long as the insurance company prices risk reasonably. If the premiums received today (float) exceed future claims, then the underwriting result is a net profit, and it adds to the investment income generated by the float. If the company delivers an underwriting loss (future claims exceed premiums collected), the cost of the float is real. This loss is deducted from the investment income when estimating the net result of the insurance operations.

Commercial insurance is generally better than personal

A business customer usually sees more value in insurance. Insurance costs are covered by the business (ultimately, shareholders), but the benefits of insurance coverage are fully captured by management. For example, if a hurricane destroys production facilities, a business with the appropriate insurance cover will be able to carry on. Management will not be sacked and will have funds to repair the facilities. Without the insurance, the prospects for managers look less clear.

A private customer often buys insurance because he has to or because everyone else is doing it. Consequently, he is more concerned about the price than the strength of the insurance company’s balance sheet. Hence, by just offering a little cheaper policy, start-ups can quickly enter this segment (e.g., auto insurance).

Therefore, the best long-term results are more likely to come from companies focusing on business customers, operating in a niche sector that they know better than an average insurer and with a long history of operations.

A private customer often buys insurance because he has to or because everyone else is doing it. Consequently, he is more concerned about the price than the strength of the insurance company’s balance sheet. Hence, by just offering a little cheaper policy, start-ups can quickly enter this segment (e.g., auto insurance).

Therefore, the best long-term results are more likely to come from companies focusing on business customers, operating in a niche sector that they know better than an average insurer and with a long history of operations.

Low correlation to economic cycle, benefits from higher rates

Finally, a word on the insurance and correlation with macro. Insurance is not a discretionary spending. Hence, the insurance sector is much less sensitive to macro. The industry has a strong ability to pass through inflation. Many Property and Casualty (P/C) insurance contracts run a twelve-month cycle, so insurers can adjust premiums to reflect higher inflation once the old contract ends. Besides, inflation impacts all segments of the economy, including property prices. So, when you want to insure your car or a house after a period of substantial inflation, the insurance premium will eventually reflect that inflation.

Higher inflation leads to higher interest rates, which in turn help insurers invest their “float” in higher-yield assets and earn an extra income.

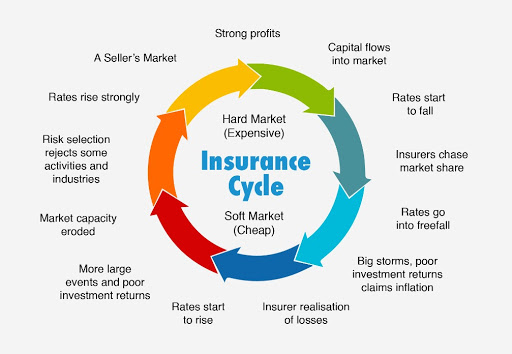

Insurance can still be cyclical, but fluctuations in premium prices are driven by the supply of capital, not the economic cycle. When it is easy to raise capital and industry players are optimistic about the future, they can try to win new customers by selling cheap policies. However, this is not sustainable in the long run.

Higher inflation leads to higher interest rates, which in turn help insurers invest their “float” in higher-yield assets and earn an extra income.

Insurance can still be cyclical, but fluctuations in premium prices are driven by the supply of capital, not the economic cycle. When it is easy to raise capital and industry players are optimistic about the future, they can try to win new customers by selling cheap policies. However, this is not sustainable in the long run.

Source: Internet

Why is it interesting now?

The following reasons make the insurance a particularly exciting sector now:

- Defensive nature. Owning an insurance company removes the headache of dealing with uncertain macro and constant recession risks. Insurance earnings do not directly correlate with the economic cycle.

- High interest rates boost the investment income of insurance companies. A typical P/C insurer used to earn 10% ROE, which was made of (in simple terms) interest income (1-2%) and underwriting profit (7-9%). With interest rates now 3-4 percentage points higher than in 2009-2021, companies can earn higher interest income and grow faster.

- “Hard market”. For almost a decade, the insurance sector has been viewed as “soft”. That meant that the policy price was insufficient to cover future claims. This was due to too many players competing for market shares and a series of unfavourable events (significant losses from catastrophes). The pressure from higher-than-usual claims, regulatory changes that increased capital requirements, more than a decade of low-interest rates, and other factors forced many players to leave the business. Now, the industry is broadly going through a period of rapid price increase, which should improve underwriting profits for the companies (in addition to higher investment income from higher yields).

- Rising complexity of the world. This is a subjective statement. However, I would argue that the world is more complex today than 10 or 20 years ago. Various changes in geopolitics, industrial policies, climate change initiatives, EGS and other factors add to the overall uncertainty and increase business risks. Such an environment should encourage executives to hedge risks by using various insurance policies more actively.

Interesting companies from the insurance sector

Insurance stocks in my portfolio

Berkshire Hathaway

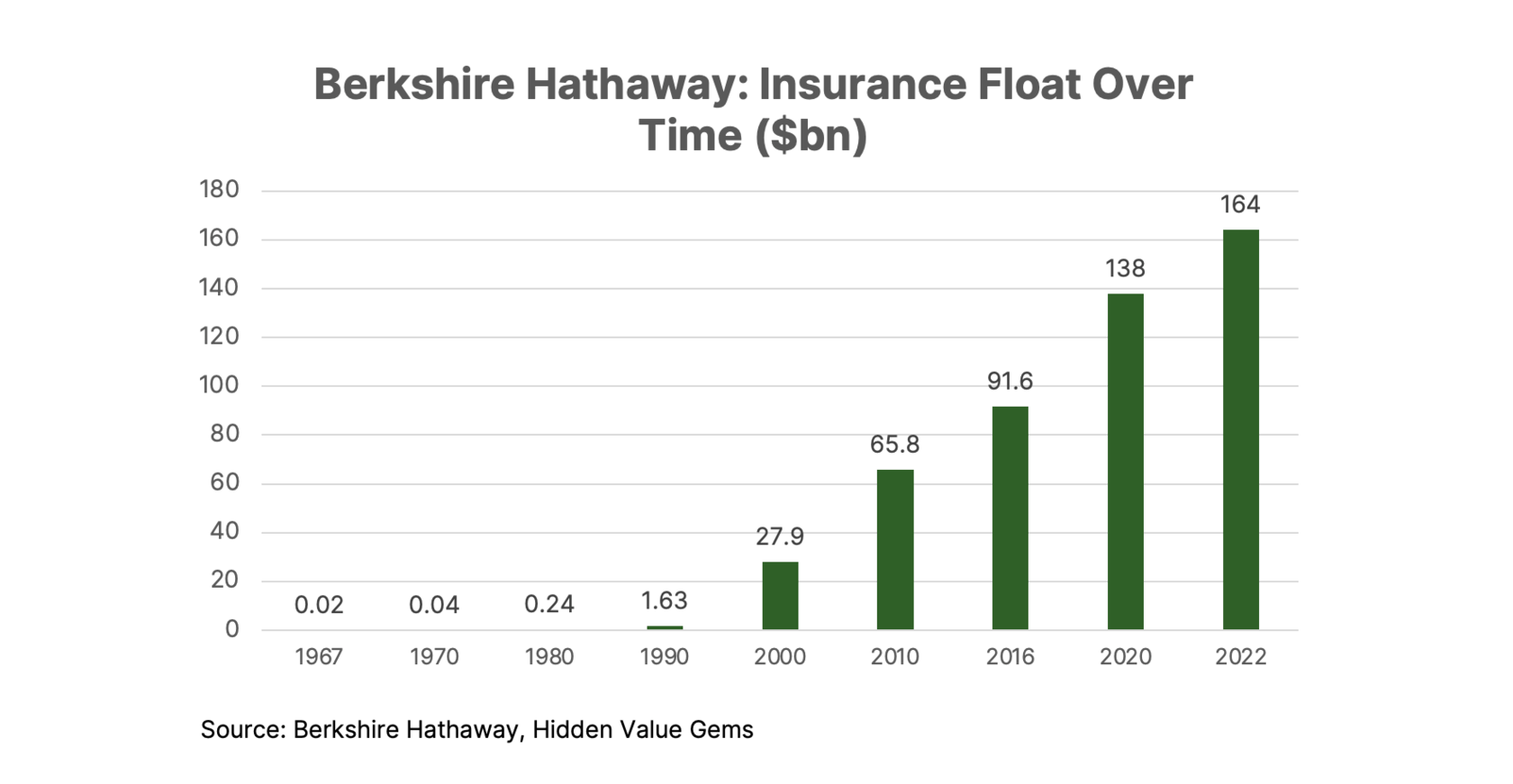

Berkshire is the most well-known insurance ‘conglomerate’. It is also my biggest position in the portfolio. The stock has roughly doubled in six years, but I think the exciting times are still ahead. Unlike traditional insurers, Berkshire is more active at investing the float in equities and private businesses. Buffett, the chairman and largest shareholder of Berkshire, famously insists that float is not a liability but a source of value. He likes to highlight how Berkshire’s float’ has increased over time.

What makes me particularly excited about Berkshire today is that it continues to have a record-high dry powder (cash pile of $157bn at the end of Q3 ’23). In the previous decade, Berkshire suffered from low-interest yields causing its float to underperform and from high asset valuations, which prevented it from deploying surplus capital in the best way. Most of the value at Berkshire has been created through exceptional capital allocation. The 2010s was not the best period for that.

Private Equity and other funds outcompeted Berkshire in bidding for businesses as they eagerly used cheap leverage. This group of competitors will likely leave the scene for a while. Moreover, rising rates and falling profit margins will likely push more companies to seek capital putting Berkshire in a strong bidding position.

You can read my Berkshire thesis here.

Private Equity and other funds outcompeted Berkshire in bidding for businesses as they eagerly used cheap leverage. This group of competitors will likely leave the scene for a while. Moreover, rising rates and falling profit margins will likely push more companies to seek capital putting Berkshire in a strong bidding position.

You can read my Berkshire thesis here.

Loews

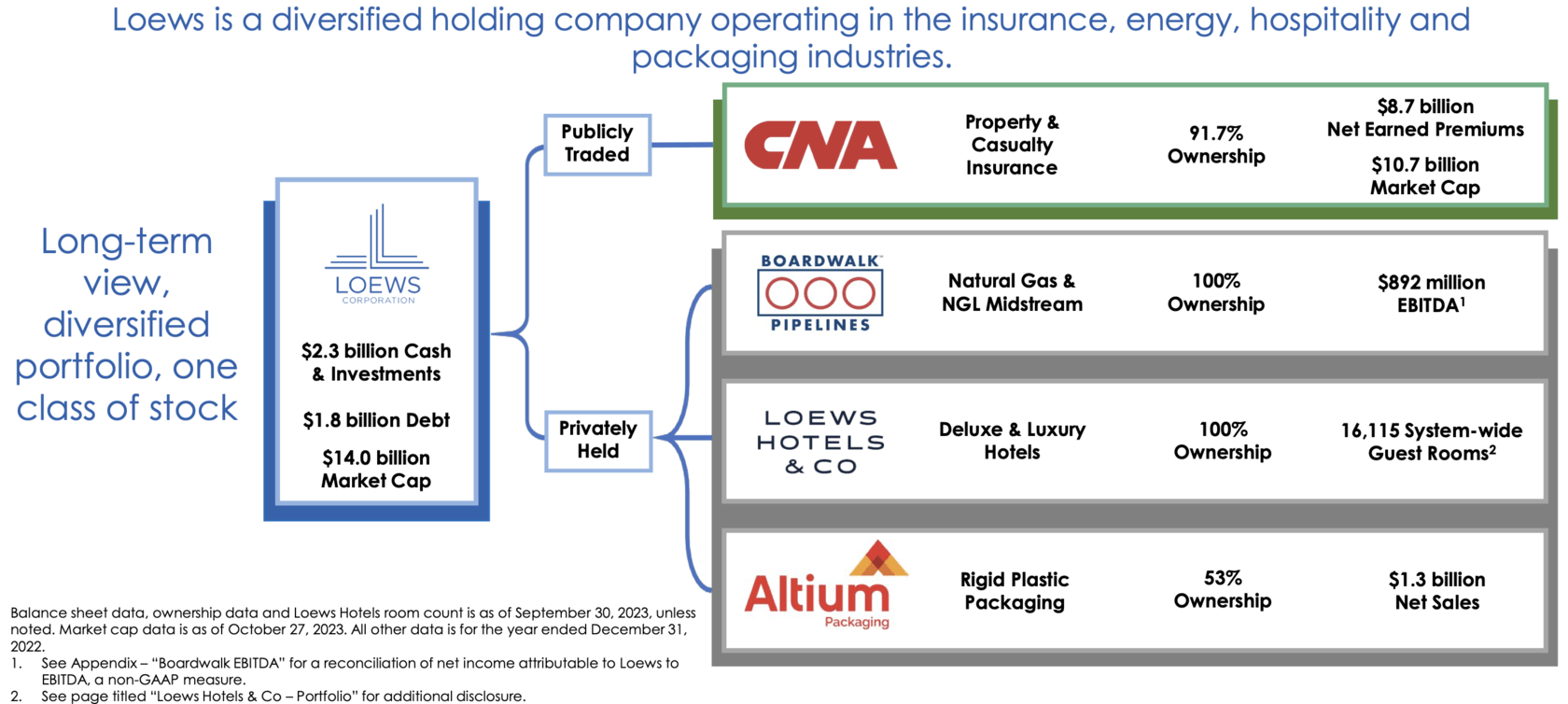

Loews is the least-known mid-cap in the US, in my view, despite its spectacular performance. It is a holding company of the Tisch family, which owns a 91.7% stake in a publicly-listed P/C insurer CNA Financial and 3 other businesses (Loews hotel chain, Boardwalk Pipelines, and Altium packaging company). Similar to Berkshire, it invests in stocks, although its equity portfolio is not as large relative to bonds as in the case of Berkshire.

You can read my original thesis on Loews here.

You can read my original thesis on Loews here.

Source: Loews Investor Presentation

Exor

Even though Exor sold its major reinsurance business (PartnerRe) for $9.3bn last year (2022), it still has an indirect exposure to the insurance's float. In 2022, Exor set up Lingotto, an asset management company that will manage the capital of both Exor and Lingotto ($2.4bn in 2022).

Admiral Plc

Last year I opened a small position in Admiral. I have not talked about it on this website because I did not have a strong conviction as I lacked sufficient knowledge about the UK insurance market. However, over time, I have learned more about the business and gained more confidence in the business.

The company was founded by Henry Engelhardt, who remains its largest shareholder. It is the largest auto insurance company in the UK. It is laser-focused on costs, having pioneered a direct-sales model by cutting insurance agents who took 10-15% commission. The business is based in Wales, where costs and wages are lower. Henry Engelhardt has put enormous emphasis on culture empowering employees. In order to grow faster, the company has been offloading part of its insurance risks to reinsurers, mostly to MunichRe, which remains its major shareholder.

The company has achieved 48% ROE over the past ten years and distributed £3.8bn in dividends (half of the current market cap). It doesn’t look particularly cheap at 20x forward-looking PE, but this is because it is still growing in other geographies (US auto, Europe) and segments (home, travel and pet insurance). New segments are currently barely profitable or losing money, which dilutes the overall profitability.

The company was founded by Henry Engelhardt, who remains its largest shareholder. It is the largest auto insurance company in the UK. It is laser-focused on costs, having pioneered a direct-sales model by cutting insurance agents who took 10-15% commission. The business is based in Wales, where costs and wages are lower. Henry Engelhardt has put enormous emphasis on culture empowering employees. In order to grow faster, the company has been offloading part of its insurance risks to reinsurers, mostly to MunichRe, which remains its major shareholder.

The company has achieved 48% ROE over the past ten years and distributed £3.8bn in dividends (half of the current market cap). It doesn’t look particularly cheap at 20x forward-looking PE, but this is because it is still growing in other geographies (US auto, Europe) and segments (home, travel and pet insurance). New segments are currently barely profitable or losing money, which dilutes the overall profitability.

Other insurance conglomerates (not in my portfolio)

Markel Group

Often referred to as a ‘baby Berkshire’, Markel is a family insurance company that has been transformed by Tom Gainer, who borrowed Buffett’s ideas on investing float into higher-return assets. As a much smaller player (market cap of just $17.8bn), Markel enjoys a wider choice of investment options and has a longer runway ahead compared to a giant Berkshire. However, I have not bought it yet. My main counterargument is that Tom Gainer is not Warren Buffett, especially in terms of stock-picking skills. I also realise this is not a strong argument because stock-picking is not the only driver for the growth of NAV. Definitely worth doing deeper work on this one.

Fairfax Financial Holdings

Another ‘mini Berkshire’ run by a ‘Canadian Warren Buffett’, Prem Watsa. It has historically traded at a much lower multiple (below 1x P/B), and the company has been an aggressive purchaser of its own stock. I used to own it, but not any longer. Two things made less positive on the company. Firstly, I did not like that Watsa took a strong market view in 2010 by buying stock market hedges, which dragged performance down (he removed them only in November 2016). I prefer management that focuses on fundamentals rather than making macro calls. Secondly, Fairfax has set up a few ventures with minority investors and Prem Watsa either owns interests in those entities or has a separate compensation arrangement with those entities. I prefer businesses where stakes are fully aligned and transparent.

Specialty Insurance

Unlike large insurance companies that try to operate in various segments (life, non-life, personal and business), these types of companies have a narrow focus and are usually the leading players in a particular niche. Such specialisation allows them to get an edge in pricing risks better and earning higher underwriting profits.

- Arch Capital (ACGL US) - specialty insurer with $15.6bn in capital, operating in the US, Europe and Hong Kong. It focuses on specialty lines, mortgages and reinsurance

- W.R. Berkley (WRB US) founder-led insurance holding company that is among the largest commercial lines writers in the US and operates worldwide in two segments of the property casualty insurance business: commercial insurance and reinsurance. The company had $5.7bn capital in 2022

- Chubb (CB US) - the largest publicly-listed P/C insurer

- Intact Financial Corp - the largest P/C insurer in Canada

- Essent Group - a leading US single-family mortgage insurer

- Trupanion - a leading pet insurer in North America

- Progressive Corp - the company revolutionised the US auto insurance by rolling out telematics and has overtaken Geico as the second largest car insurer in the US

Insurance brokers and consultants

These players have an advantage over traditional insurers. They do not take risks on their balance sheet while still benefiting from rising demand for insurance, not least due to the wealth effect, especially in Emerging Markets (which increases the share of the population and businesses that use insurance),

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.

- Ryan Specialty Group - provides distribution, underwriting, product development, administration and risk management services by acting as a wholesale broker and a managing underwriter

- Masrch McLennan - the world’s leading professional services firm in the areas of risk, strategy and people

- Aon - a British-American company that provides data and analytics services, strategy consulting and investment banking advisory to the insurance sector

- Verisk - data analytics and consulting services for the insurance sector

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.