As Warren Buffett, arguably the world’s best investor, likes to say, ‘if you’ve got 160 IQ, sell 30 points to somebody else because you won’t need it in investing’.

This is one reason I try to pay less attention to macroeconomic developments in investing. Just like with politics, it is easy to grab somebody’s attention with a big headline on inflation or unemployment, but the long-term consequences for your investment results can be quite different, if any at all.

Nevertheless, completely ignoring the external environment in which businesses operate is also probably not worth it; this is why occasionally I focus on specific macro and political issues.

This week, a WSJ article drew my attention - it was called ‘Who Would Pay Biden’s Corporate Tax Increase Is Key Question in Policy Debate’. It is a good summary of the implications of higher corporate taxes on businesses and the broader economy.

Surprisingly, there is no consensus on this matter, and various studies point to different outcomes. The majority suggests that the burden is evenly split between business and labour in the long term. The idea that businesses can raise prices to offset extra costs and pass this tax hike to consumers is hard to prove as companies face competition from businesses of all kinds of tax status (including foreign ones).

There is also a widely held view (among Democrats) that rich individuals, shareholders of public companies, would bear the most burden from tax hikes as companies would reduce dividends and buybacks, which would reduce shareholder returns. The impact could be more meaningful on foreign investors, who, according to Democrats, have been the biggest beneficiaries of Trump’s tax cuts. There is also not enough evidence to support Republicans’ view that tax cuts under Trump benefited labour through increased investments and new jobs creation.

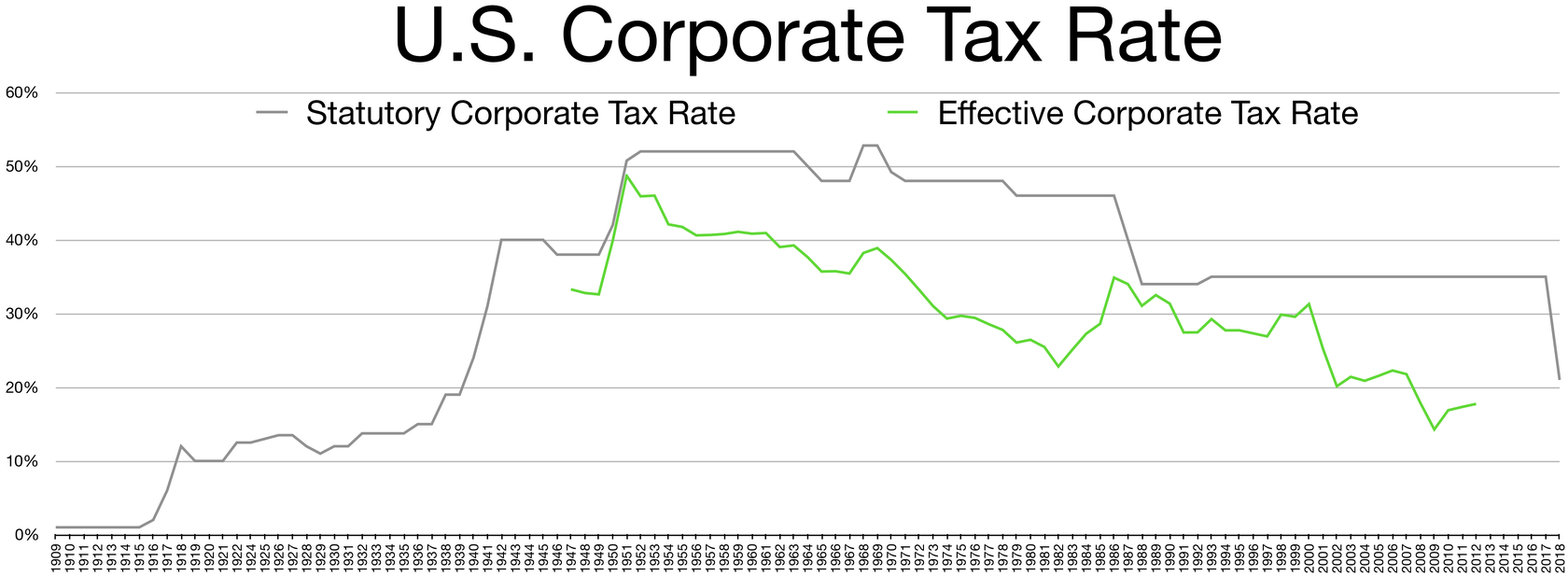

In my view, paying too much attention to macroeconomics can be dangerous because it is hard to get an edge. As an open system, the final results can differ considerably from the initial estimates. US stock market has generated about 10% on average in the past 100 years. During the past 100 years, US corporate tax rate varied from over 50% to less than 20%.

Source: Taxpolicycenter.org, Wikipedia

However, it is important not to get complacent about the current booming stock market. Governments around the world are looking for more funds to cover economic costs caused by lockdowns and the COVID pandemic. Higher taxes are one obvious source for that. Just as various state benefits boosted savings in 2020, which are now translating into higher spending, more taxation can lead to opposite results. If higher taxes are accompanied by additional infrastructure spending (in the US at least), this could partially offset the negative consequences. However, the more significant presence of the government in the economy is unlikely to make markets more competitive and businesses more productive. So it is important to remain prudent.

Did you find this article useful? If you want to read my next article right when it comes out, please subscribe to my email list.