16 June 2024

I am not big on running stock screens primarily because it is one of the easiest tools available for everyone thanks to numerous databases and online tools.

I am also generally skeptical about investing in banks. They are heavily regulated, yet often lack transparency on the asset side. Earnings are quite sensitive to macro and hence cyclical. Historical returns have been poor.

I wrote a more detailed piece on Banks last year here.

Nevertheless, I also think that being open-minded and flexible is one of the most important qualities investors can have and strive for. Being dogmatic is not helpful. At least not in investing.

For that reason, I don’t like calling sectors or countries ‘un-investable’. In fact, such labels often act as a trigger for me to dig deeper.

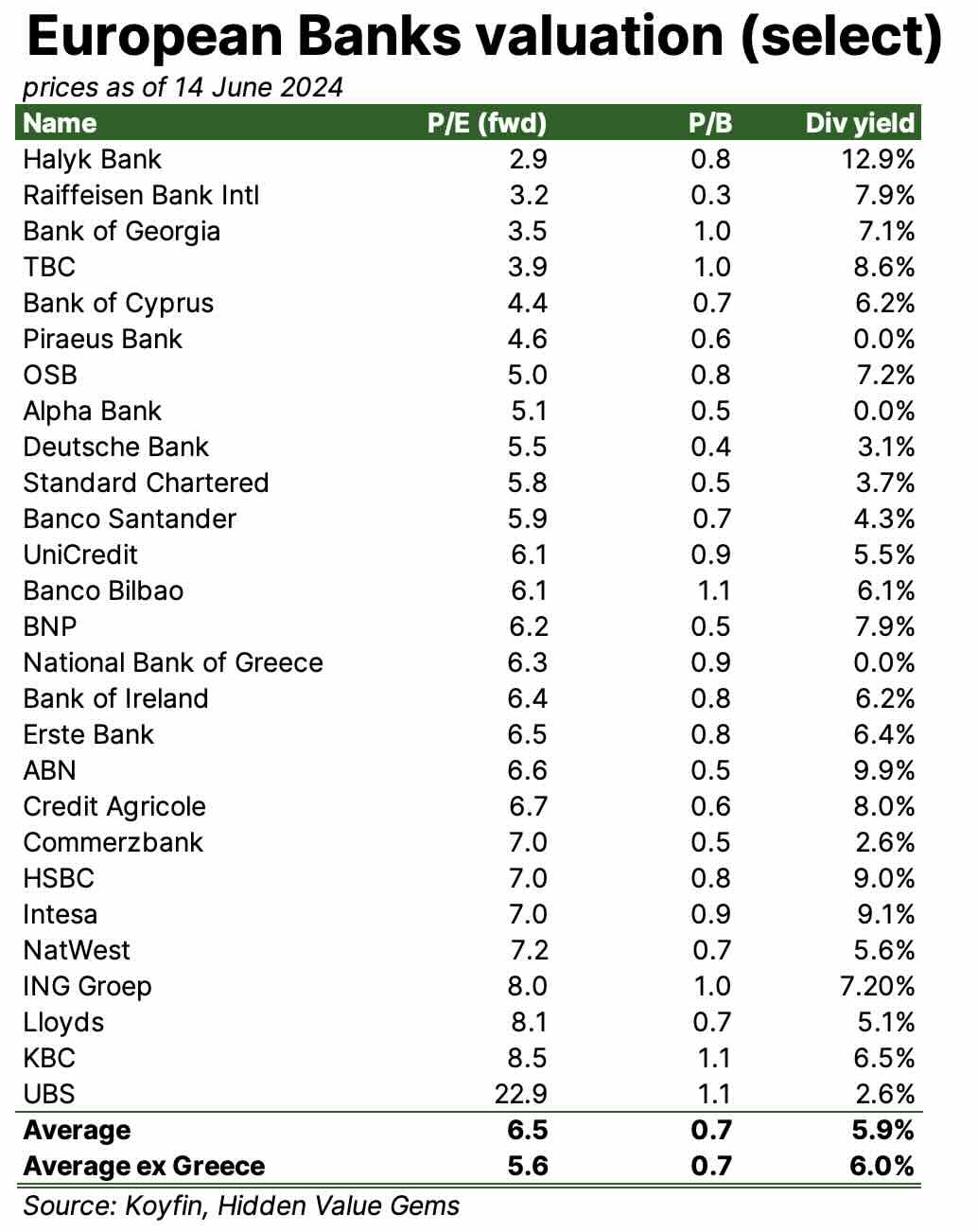

So today I just wanted to share the valuation screen of European (and some EM) banks. It is very basic. An experienced banking analyst would point out the missing ROE, Tier 1, Cost-to-Income, Interest Margin, EPS growth, and a few more critical parameters.

But it is a first step to put valuation into perspective and start the debate.

I hope it is also useful for your process.

I am also generally skeptical about investing in banks. They are heavily regulated, yet often lack transparency on the asset side. Earnings are quite sensitive to macro and hence cyclical. Historical returns have been poor.

I wrote a more detailed piece on Banks last year here.

Nevertheless, I also think that being open-minded and flexible is one of the most important qualities investors can have and strive for. Being dogmatic is not helpful. At least not in investing.

For that reason, I don’t like calling sectors or countries ‘un-investable’. In fact, such labels often act as a trigger for me to dig deeper.

So today I just wanted to share the valuation screen of European (and some EM) banks. It is very basic. An experienced banking analyst would point out the missing ROE, Tier 1, Cost-to-Income, Interest Margin, EPS growth, and a few more critical parameters.

But it is a first step to put valuation into perspective and start the debate.

I hope it is also useful for your process.

Source: MSCI

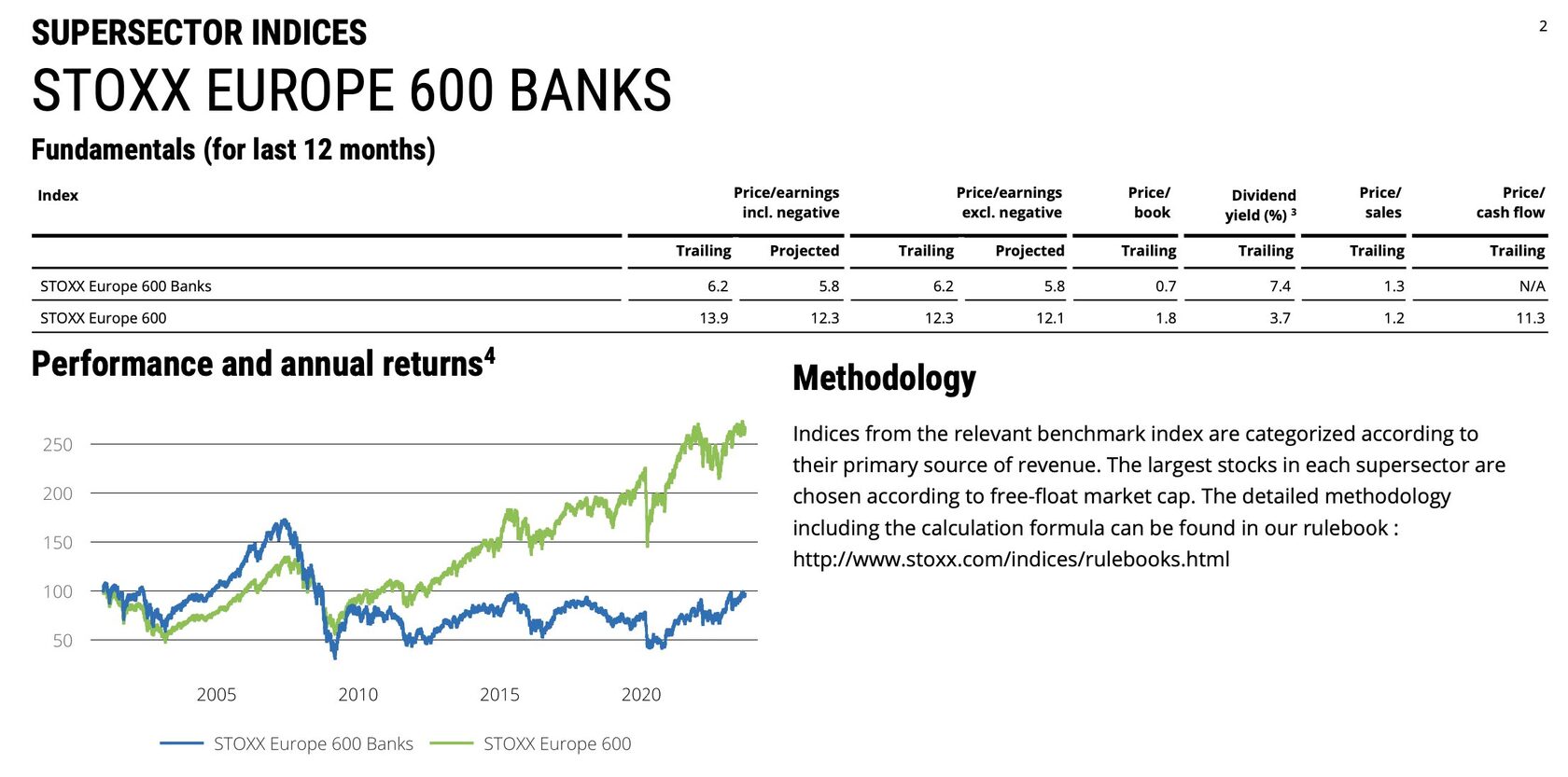

It's intriguing that despite rising 100%+ in the past 4 years European Banks have only reached the level where they were in the 2000s.

Thank you for reading this piece. I hope it was useful. Please consider sharing it with your friends who may also benefit from this.