24 March 2024

Fiserv is one of the leading US-based payment providers, founded in 1984. The company has grown through lots of acquisitions, including one large all-share acquisition of First Data ($39bn total consideration) in 2019.

The company operates in three core segments:

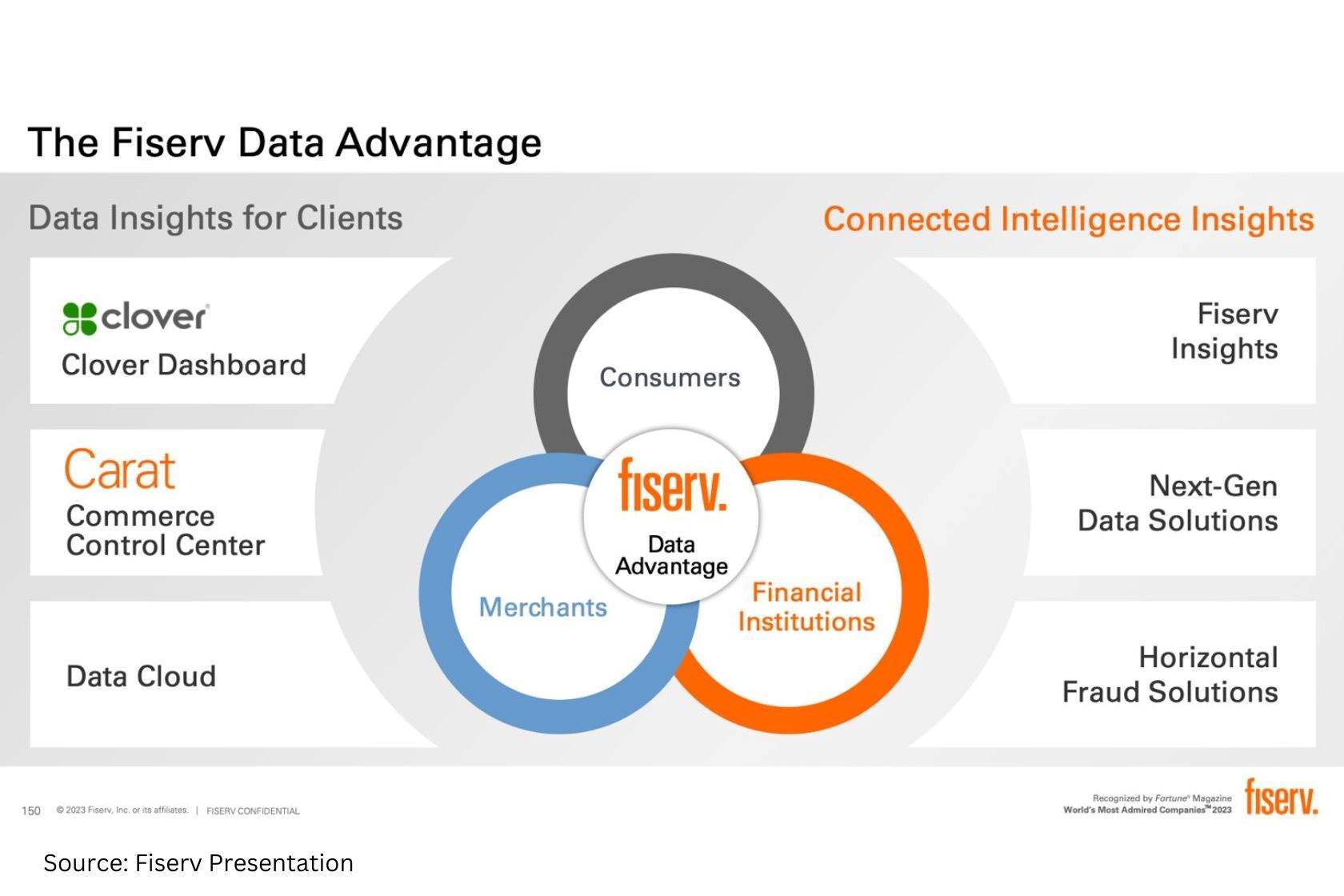

1. Merchant Acceptance (40% of revenue). Solutions allowing businesses to accept payments in the physical world and online. Fiserv serves SMEs with the Clover product (which was part of First Data) and large companies with Carat.

The company operates in three core segments:

1. Merchant Acceptance (40% of revenue). Solutions allowing businesses to accept payments in the physical world and online. Fiserv serves SMEs with the Clover product (which was part of First Data) and large companies with Carat.

Source: Clover website

Clover has a relatively low market share of 5-6% compared to Square’s 28%. Square focuses on even smaller merchants and has a free plan, while Clover allows for more tailored solutions for a slightly higher fee. Retail, restaurants and services account for almost 80% of Clover’s revenue.

2. Payments (35% of revenue). This segment helps clients process digital payment transactions, including card transactions, network services, security, and fraud protection. The segment also offers software and services for electronic billing, P2P transactions, and money transfers. Customers come from various sectors, including smaller banks that lack their own IT infrastructure and other sectors.

3. Fintech (25% of revenue). This segment focuses on financial institutions and provides them with technology to run some of their services, such as processing customer deposits and loan accounts, managing central information files, and managing the general ledger.

This year, Fiserv has consolidated the three segments into two: Solutions for Merchants (Clover + Carat) and Financial Solutions (including Banks and Credit Unions, as well as Card issuers and Lenders).

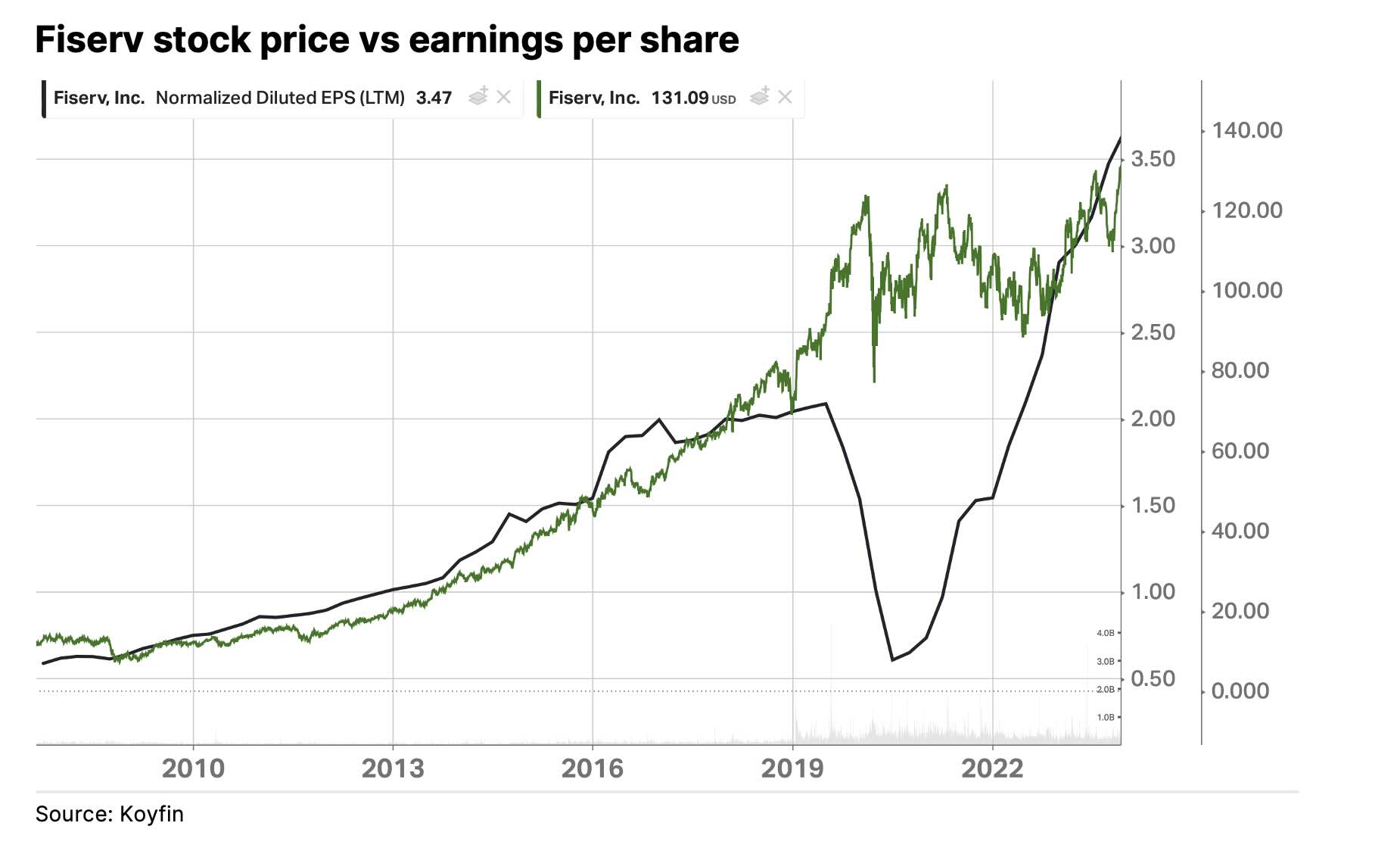

Strong track record

Fiserv stands out with its consistent 15% revenue and earnings growth for c. 30 years. The company is not expensive, trading at 15.6x P/E (2025 consensus) and 5.4% FCF yield. It has a strong commitment to shareholder returns with about $30bn five-year buyback programme (33% of the current market cap). The company repurchased $4.7bn and $2.5bn of shares in 2023 and 2022, respectively, reducing the share count by 8% in the past two years.

Competent management with 'skin in the game'

Fiserv has a strong leadership team. Its CEO, Frank Bisignano, joined the company in 2020 when Fiserv merged with First Data. Bisignano had been the Chairman and CEO of First Data since 2013. Before that, he held senior positions at JP Morgan and was called by Financial Times as “one of [JPMorgan]’s most influential, yet least visible, executives."

He owns 3.2mn shares in the company worth $0.5b (c. 0.5% interest).

He owns 3.2mn shares in the company worth $0.5b (c. 0.5% interest).

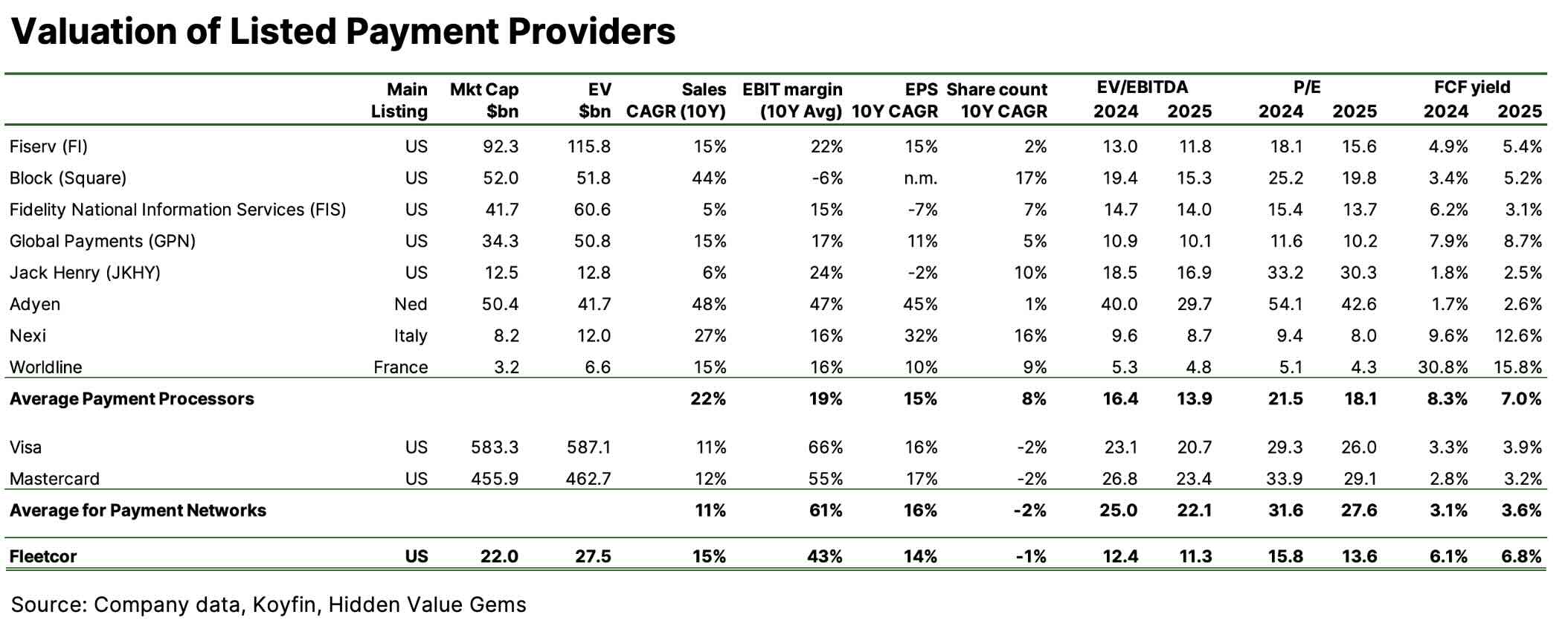

Relative valuation

I have compared Fiserv with its key US and European peers. Out of interest, I also put Visa and Mastercard in the same table as well as Fleetcor, since I currently own its shares and wanted to see if Fiserv was a better alternative.

Fiserv stands out from its US peers, delivering more profitable growth. It has increased sales by 15% over the past ten years, similar to US peers' (18% CAGR, primarily due to Block). But it has earned a 22% operating margin, compared to 19% for its US peers. Moreover, its competitors issue many more shares: about 10% more every year in the past ten years. Fiserv’s share count was driven mainly by the share deal with First Data. Since 2021, its share count has been consistently declining.

Despite delivering higher earnings growth with less dilution for shareholders, Fiserv trades at a c. 15% discount to its US peers.

European peers are a pretty diverse group. A highly indebted French Worldline has been issuing new shares at c. 10% every year. It is trading at quite appealing multiples, however, of 4.3x PE. The company has recently cut its sales outlook and announced an 8% layoff of its workforce.

Adyen, a much more successful peer, trades at 42.6x P/E (2025 consensus earnings).

Nexi, an Italian payment company, looks quite interesting. Although it has also aggressively issued new shares, this dilution was more than offset by spectacular per-share earnings growth (10-year EPS CAGR of 32%). The company is not highly levered and trades at just 8x PE and 12.6% FCF yield.

Visa and Mastercard have been growing at a slower rate of 11-12% a year but earned almost three times higher operating margins (61%). They are trading at a 77% premium on forward P/E (27.8x) and offer a lower FCF yield (3.6% vs 5.4%). I also think they have lower growth potential compared to more specialised payment processors, albeit with stronger visibility (more certainty).

When I looked at the growth profile, margins and valuation of Fiserv vs Fleetcor, I thought that Fleetcor was a better option. It has grown at exactly the same rate as Fiserv (15% top-line, 14-15% EPS). However, Fleetcor’s operating margin has averaged 43% over the past ten years, compared to Fiserv’s 22%. Fleetcor has been more aggressively reducing the share count despite also being an active acquirer. Fleetcor has a lower capex intensity with a Capex/Sales ratio of just 3-4.5% (last six years) compared to 7-8% for Fiserv. Fleetcor also seems to benefit from stronger operating leverage as its profit margins have historically increased as the business got bigger. Fiserv, on the other hand, maintained broadly flat margins.

Fleetcor trades at a discount to Fiserv (13% cheaper on 2025 P/E and 6.8% 2025 FCF yield vs 5.4% for Fiserv).

The two companies have slightly different models. Fiserv has a broader product offering and is more diversified. Fleetcor is a more niche operator with a historically strong focus on fuel cards. This may be the reason for the market to be cautious about Fleetcor, given the rapid rise of EVs.

I think this is why the opportunity exists. Fleetcor has been actively adding new verticals (e.g. lodging) and has a broader service of processing accounts payables payments for businesses, rather than just fuel cards. But even within the fuel cards segment, Fleetcor has successfully launched cards for EVs.

Despite delivering higher earnings growth with less dilution for shareholders, Fiserv trades at a c. 15% discount to its US peers.

European peers are a pretty diverse group. A highly indebted French Worldline has been issuing new shares at c. 10% every year. It is trading at quite appealing multiples, however, of 4.3x PE. The company has recently cut its sales outlook and announced an 8% layoff of its workforce.

Adyen, a much more successful peer, trades at 42.6x P/E (2025 consensus earnings).

Nexi, an Italian payment company, looks quite interesting. Although it has also aggressively issued new shares, this dilution was more than offset by spectacular per-share earnings growth (10-year EPS CAGR of 32%). The company is not highly levered and trades at just 8x PE and 12.6% FCF yield.

Visa and Mastercard have been growing at a slower rate of 11-12% a year but earned almost three times higher operating margins (61%). They are trading at a 77% premium on forward P/E (27.8x) and offer a lower FCF yield (3.6% vs 5.4%). I also think they have lower growth potential compared to more specialised payment processors, albeit with stronger visibility (more certainty).

When I looked at the growth profile, margins and valuation of Fiserv vs Fleetcor, I thought that Fleetcor was a better option. It has grown at exactly the same rate as Fiserv (15% top-line, 14-15% EPS). However, Fleetcor’s operating margin has averaged 43% over the past ten years, compared to Fiserv’s 22%. Fleetcor has been more aggressively reducing the share count despite also being an active acquirer. Fleetcor has a lower capex intensity with a Capex/Sales ratio of just 3-4.5% (last six years) compared to 7-8% for Fiserv. Fleetcor also seems to benefit from stronger operating leverage as its profit margins have historically increased as the business got bigger. Fiserv, on the other hand, maintained broadly flat margins.

Fleetcor trades at a discount to Fiserv (13% cheaper on 2025 P/E and 6.8% 2025 FCF yield vs 5.4% for Fiserv).

The two companies have slightly different models. Fiserv has a broader product offering and is more diversified. Fleetcor is a more niche operator with a historically strong focus on fuel cards. This may be the reason for the market to be cautious about Fleetcor, given the rapid rise of EVs.

I think this is why the opportunity exists. Fleetcor has been actively adding new verticals (e.g. lodging) and has a broader service of processing accounts payables payments for businesses, rather than just fuel cards. But even within the fuel cards segment, Fleetcor has successfully launched cards for EVs.

Conclusion: sticking with Fleetcor

My conclusion is that Fiserv is a quality company with strong growth and reasonable valuation, but it is still operating in a highly competitive sector. Stripe, for example, is a highly innovative company with faster growth. It used to be Fiserv’s customer in some markets but have been leaving Fiserv as it has developed more capabilities in-house.

Fleetcor is more niche and a cheaper stock despite businesses growing at a similar rate and earning much higher margins. Fiserv has a little better 2024 outlook guiding for 15-17% organic revenue growth and 14-15% EPS growth. Fleetcor expects its organic revenue to grow by only 8-10% this year and by 10% in the mid-term, but thanks to operating leverage its expects EBITDA to grow at ‘low-teens’ and cash EPS by 15-20% in 2024. Also, the impact from 2023 acquisitions should lead to the overall sales growth of 20%, according to management.

So I prefer to stay with Fleetcor.

Fleetcor is more niche and a cheaper stock despite businesses growing at a similar rate and earning much higher margins. Fiserv has a little better 2024 outlook guiding for 15-17% organic revenue growth and 14-15% EPS growth. Fleetcor expects its organic revenue to grow by only 8-10% this year and by 10% in the mid-term, but thanks to operating leverage its expects EBITDA to grow at ‘low-teens’ and cash EPS by 15-20% in 2024. Also, the impact from 2023 acquisitions should lead to the overall sales growth of 20%, according to management.

So I prefer to stay with Fleetcor.

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.