24 November 2024

Investment conferences are often a great source of new ideas. The latest such conference I attended was the Sohn Investment Conference, held this week in London. There were 15 ideas presented, including three shorts.

One idea that caught my eye was Ubisoft. It has many characteristics that I look for in potential investment opportunities. It is a quality business with a proven long-term track record, led by the founders, one of whom, Yves Guillemot, is the company’s chairman and CEO. The founding family, the Guillemot, owns c. 20% of the company. Another 9.2% was acquired by Tencent in 2022 at much higher prices. Its initial purchase price was €66 for one Ubisoft share, which currently trades in the €10-14 range.

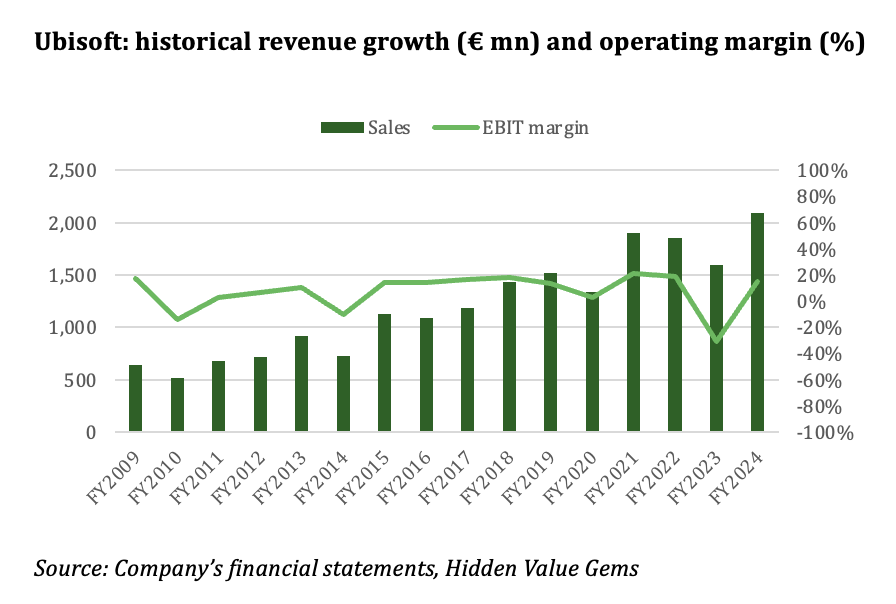

The company is a developer of video games, including some of the best-selling titles such as Assassin Creed, Prince of Persia, Tom Clancy, Rayman Legends and others. Since 2009, the company has increased its revenue at an annual compound rate of 8.2%. It has achieved an average operating margin of 7.3%, although it has been more volatile with a few loss-making years.

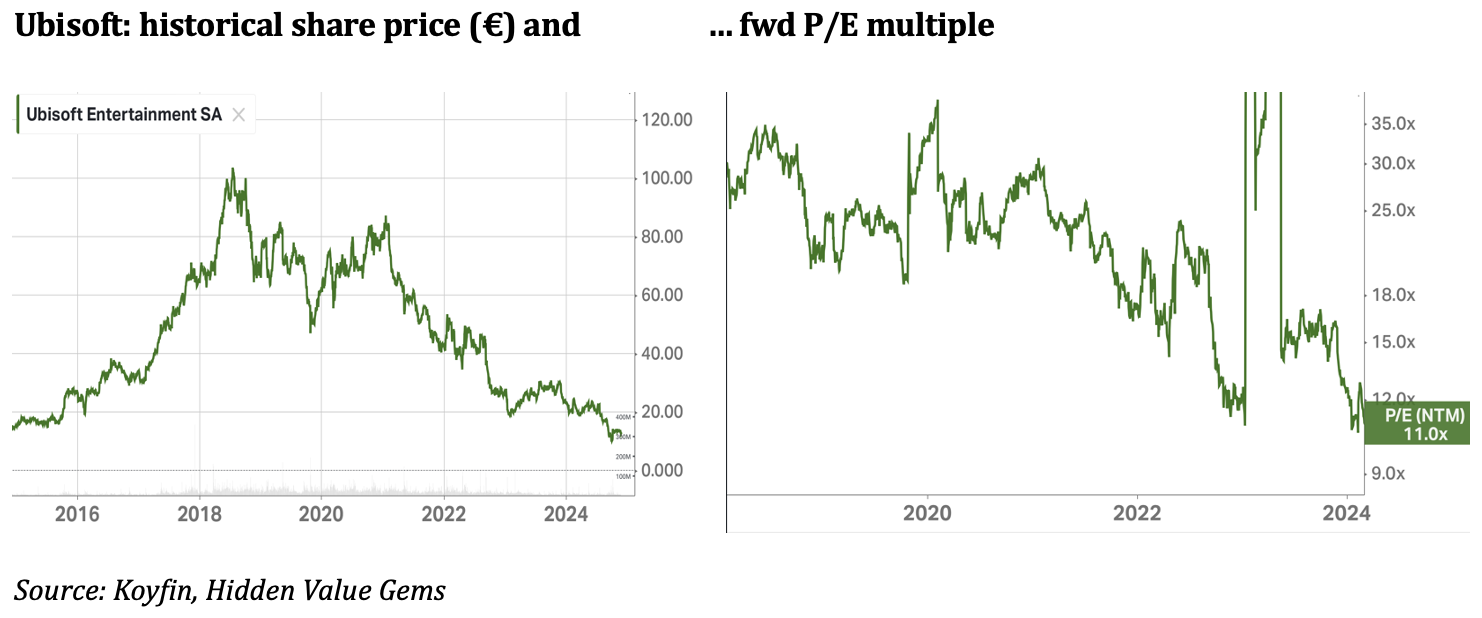

Still, looking at the chart below, it would be hard to expect a share price decline of almost 90% since 2018. Yet, that is exactly what happened.

One idea that caught my eye was Ubisoft. It has many characteristics that I look for in potential investment opportunities. It is a quality business with a proven long-term track record, led by the founders, one of whom, Yves Guillemot, is the company’s chairman and CEO. The founding family, the Guillemot, owns c. 20% of the company. Another 9.2% was acquired by Tencent in 2022 at much higher prices. Its initial purchase price was €66 for one Ubisoft share, which currently trades in the €10-14 range.

The company is a developer of video games, including some of the best-selling titles such as Assassin Creed, Prince of Persia, Tom Clancy, Rayman Legends and others. Since 2009, the company has increased its revenue at an annual compound rate of 8.2%. It has achieved an average operating margin of 7.3%, although it has been more volatile with a few loss-making years.

Still, looking at the chart below, it would be hard to expect a share price decline of almost 90% since 2018. Yet, that is exactly what happened.

The market has been concerned by poor execution related to the delayed release of several games and higher development costs.

As a result, the stock is now trading at a forward consensus P/E of 11x.

As a result, the stock is now trading at a forward consensus P/E of 11x.

A UK Fund Manager, who presented this idea, believes the market is too short-term focused and misses the point that the business is still solid and can overcome near-term issues. It is also encouraging to see strategic interest from Tencent, which has built a 9.2% stake at much higher prices. In October 2024, the media reported that Tencent and the Guillemont family mulled the buyout.

The red flag for me, however, is the increase in share count over time and practically zero cash returns to shareholders. This may indicate not only poor capital allocation but also a poor underlying economics of the business. In the end, it is not too hard to come up with games that will be highly popular globally if you spend billions on it. But it is much harder to make profitable games.

To prove this point, the company has generated €15.9bn of operating cash flow over FY19-FY24. It spent €15.8bn on games development (reported within the Cash flow from Investing section), paid zero dividends and spent a net amount of just €0.2bn on share buybacks.

However, the counterargument is that management is now divesting non-core games and is focused on the timely release of new games. The fund manager believes Ubisoft is on track to earn €500mn of FCF which at an 8% yield implies a c. 260% upside.

If you are a Premium Member, you can read the full review of 14 other ideas here.

The red flag for me, however, is the increase in share count over time and practically zero cash returns to shareholders. This may indicate not only poor capital allocation but also a poor underlying economics of the business. In the end, it is not too hard to come up with games that will be highly popular globally if you spend billions on it. But it is much harder to make profitable games.

To prove this point, the company has generated €15.9bn of operating cash flow over FY19-FY24. It spent €15.8bn on games development (reported within the Cash flow from Investing section), paid zero dividends and spent a net amount of just €0.2bn on share buybacks.

However, the counterargument is that management is now divesting non-core games and is focused on the timely release of new games. The fund manager believes Ubisoft is on track to earn €500mn of FCF which at an 8% yield implies a c. 260% upside.

If you are a Premium Member, you can read the full review of 14 other ideas here.