1 October 2023

At the end of each month, I review five stocks that came on my radar (Monthly Stock Idea Lab, MSIL). Some of them are incredibly cheap; others look like a great business. I then do more work to understand the business for the first type of opportunities or work more on valuation and future returns for the second one. In most cases, the ideas are not executed. I either reject them or, more often, leave them on my watchlist until a better entry point arises.

This Sunday, however, I decided to postpone this publication until the following week because two more significant developments took place. I have finally sold VW shares after ten months of holding them. Kistos, one of my portfolio companies, reported its six-month results, which I wanted to comment on. The new MSIL will be published next Sunday (8 October).

VW: why I sold the shares

For reference, I purchased VW pref shares in November 2022 for approx. €136, received a special dividend following the Porsche AG IPO of €19.08 and an annual dividend of €8.74. I have sold them this week for €112. On a gross basis, I even made a small profit, but taking into account withholding taxes, FX conversion fees and transaction costs, the net result is a small loss. The overall position was about 1% of my portfolio.

The auto industry’s race to secure its place in the future EV/digital market reminds me of the video streaming business. Lots of capital is burnt to win market share, consumers are the winners at the expense of the shareholders. And quite importantly, it is the new generation of players (e.g. Netflix) who seem to be ahead in this game, leaving legacy firms little chance.

- The company is going through a peak of investments with unclear returns. It used to spend 9% of sales on capex and R&D, but this would peak at 14.5% this year and then gradually fall to 9% by 2030 (at least that is the current plan).

- At the same time, prices and demand for new cars have been strong mostly because of lost time in 2020. This extra demand should be met this year, so from next year, demand will likely soften, especially in light of high interest rates putting pressure on earnings.

- With 25-30% of Group profits coming from the Financial Services division and with softer sales and higher investments, VW’s capacity to pay dividends will be challenged. I do not think the high (8-9%) dividend yield is actually safe.

- VW is super cheap on sum-of-the-parts, with its stake in Porsche worth more than VW’s market cap. However, this argument can only work if management has the main goal of maximising shareholder value. In VW’s case, it looks more complicated. Workers’ unions control half of the Supervisory Board of VW, while Lower Saxony owns 20% of the voting rights (11.8% economic interest) and has two representatives in the 20-member Board. There are also two representatives of Qatar Investment Authority, which owns 17% of the voting rights (10.5% economic interest). Porsche SE technically controls VW (53.3% votes), but practically it needs to find consensus with other key shareholders and workers’ unions, which prolongs decision-making. I doubt a radical transformation would happen in the mid-term.

- VW is not a truly private business, given the strong voice of the unions. Being one of the largest employers, it probably has a special status in the country. While shrinking and becoming a more niche player may be the best course of action today to maximise shareholder returns, I think the company will indirectly support projects which generate more jobs for Germany. Even though the CEO did announce plans to reduce plant capacity in Europe by 10% by 2030 and overhead costs, given the corporate structure, there is a risk that it will be too little and too late.

- Perhaps, the biggest issue for VW is that it is behind in the ongoing EV revolution. Its domestic competitors (BMW and Mercedes Benz) seem to be ahead of VW, but even more important Asian players are way ahead of others. As a result, its position in China (an important source of profits for its premium brands like Audi as well as a stable dividend payer with over €2bn of dividends net to VW from the three JVs in China). What is really worrying is that based on the latest McKinsey surveys, new buyers place more emphasis on car connectivity and other software factors rather than the brand: 54% of Chinese car buyers are open to switching their car brand for a better digital car experience; in Germany and the United States, almost 40% would consider this move. While ICE car sales will not disappear overnight, the need to position the business for the new EV world would require higher-than-normal investments and still does not remove the risk of losing market share. Finally, there have been various studies that show how new entrants have an advantage over legacy auto producers as they start with the best technical solution rather than trying to make use of existing platforms. Having large existing plants producing old-technology cars may be a disadvantage.

- Another worrying signal showing the eroding brand power of the incumbents is that almost half of car buyers would not purchase a vehicle that lacked Apple CarPlay or Android Auto, according to McKinsey. Almost all (85%) car owners who have Apple CarPlay (or a similar service) prefer it over the OEM’s built-in system.

- While I was analysing VW in more detail, I once again noted the difference with Exor and its subsidiary company Stellantis. Unlike VW, Stellantis has been generating much higher operating margins, focusing on the most lucrative segments of the market (e.g. US trucks). They are severely underrepresented in China, but today this looks like an advantage. There seems to be a much stronger focus on shareholder value creation at Stellantis. This is just one example of how corporate structure and alignment of interests can lead to better results.

The auto industry’s race to secure its place in the future EV/digital market reminds me of the video streaming business. Lots of capital is burnt to win market share, consumers are the winners at the expense of the shareholders. And quite importantly, it is the new generation of players (e.g. Netflix) who seem to be ahead in this game, leaving legacy firms little chance.

Lesson learnt from VW investment

The last thought I want to share is the broader lesson from this relatively unsuccessful investment. The lesson is that for a private investor, trying to find alpha in a large and well-known company is almost impossible. There are many more opportunities in less-researched small caps if you are ready to do the work.

It doesn’t mean that you should not own large caps. Some of them have scale advantages and generate double-digit returns. I think they can be an alternative to owning the stock market through an ETF (my biggest position is Berkshire, for example).

But if you find a cheap large cap and think you can make a 50% return from it - the chances are quite low that you will succeed.

It doesn’t mean that you should not own large caps. Some of them have scale advantages and generate double-digit returns. I think they can be an alternative to owning the stock market through an ETF (my biggest position is Berkshire, for example).

But if you find a cheap large cap and think you can make a 50% return from it - the chances are quite low that you will succeed.

Kistos Plc

Source: Internet

Kistos released its H1 ’23 financial and operating results, which were somewhat disappointing. However, given strong underlying FCF generation, a number of one-off factors and strong growth potential in the next 24 months, I think the overall thesis remains. My original assumptions were a little more optimistic on the operational side (but not on macro so far as I expected $80-70-60/bl oil prices for 2023-24-25 and $9-10-10 per mcf gas price).

I have run a new set of more conservative assumptions and still get well above 20% IRR. I will try to publish an updated case on the company in the next couple of weeks.

I have run a new set of more conservative assumptions and still get well above 20% IRR. I will try to publish an updated case on the company in the next couple of weeks.

What exactly I did not like about the results

1. Delays in new field launches

- In its previous communications, Kistos indicated that an FID on the Orion oil field (Netherlands) could be made before the year-end (2023), while now management has guided for the FID in H1 ’24 and the first oil in late 2025 or early 2026.

- In May 2023, Kistos expected FID for the Glendronach field (GLA area in the UK) to be potentially made during H2 ’23, but in its latest statement (29 September) the management has referred to higher costs and adverse tax changes as the reason for prioritising Edradour West field (also in the GLA area). It did not mention when the field could receive FID or launched into production.

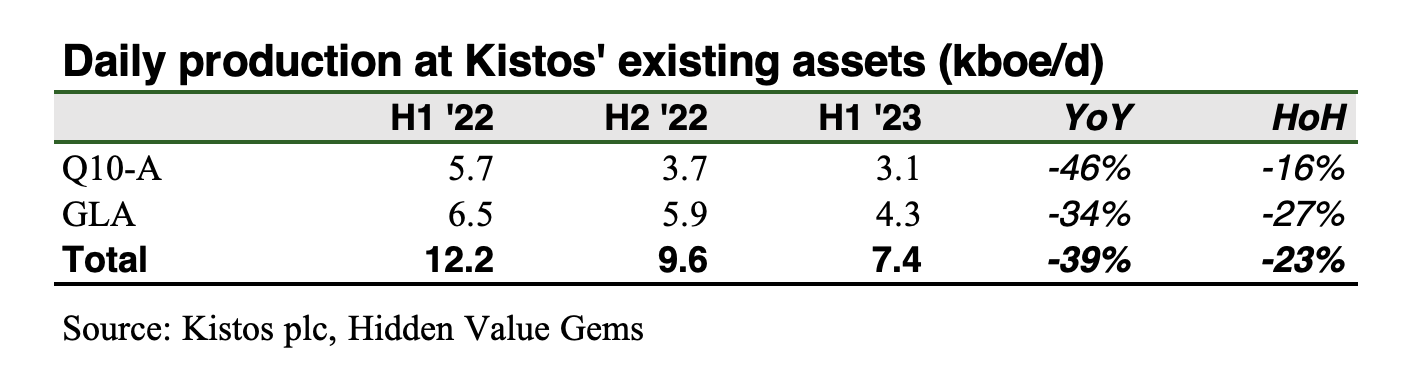

2. H1 '23 production was quite weak

Both Q10-A (Netherlands) and the GLA (UK) saw materially produced materially lower volumes.

In the case of Q10-A, management referred to a planned workover campaign during Q4 ’22 and Q1 ’23 and to a planned maintenance shutdown of the platform from June 2023.

The company explained weaker production at GLA also by a combination of planned and unplanned maintenance of the pipeline and the wells.

The natural decline was also a factor behind the decline at both assets.

Sadly, the company did not provide the impact of those factors individually. I would assume that probably around half of the decline came from natural depletion.

The company explained weaker production at GLA also by a combination of planned and unplanned maintenance of the pipeline and the wells.

The natural decline was also a factor behind the decline at both assets.

Sadly, the company did not provide the impact of those factors individually. I would assume that probably around half of the decline came from natural depletion.

3. Financial results were weak

With a weaker production dynamic, the company faced higher unit costs (almost €20/boe, on my estimates) compared to €10/boe in 2022. The company also incurred higher than usual capex (€46mn) related to the drilling campaign at Q10-A (€20mn), the Benriach exploration well (€12mn), and €13mn in Norway. The latter is not associated with the current production. 80% of costs on Benriach will be used to offset future tax liability making actual costs considerably lower (€3mn in H1 ’23).

For comparison, the company spent just €19mn on capex in 2022.

The good thing is that some of this capex will lead to materially higher production already next year (Norway should add 10kboe/d at peak). Certain capex (including all capex in Norway) will reduce tax payments, so the net impact on FCF is lower than the nominal amounts.

The company does not plan any drilling or intervention in the UK or in the Netherlands for the rest of 2023.

Kistos’ FCF in H1 ’23 was €47.4mn which benefited from €64mn of positive Worling Capital change. Without this effect, FCF would have been negative. However, this mismatch of higher spending and lower production should reverse in the future. The company should receive tax refunds related to the past capex, including €71.7mn in December 2023 related to Mime’s 2022 capex (Norway).

Importantly, the overall capex for 2023 has been maintained at 8.5-10.5kboe/d. I initially expected 10.5kboe/d, but now I think 8.5kboe/d (or just a little higher) is more likely.

For comparison, the company spent just €19mn on capex in 2022.

The good thing is that some of this capex will lead to materially higher production already next year (Norway should add 10kboe/d at peak). Certain capex (including all capex in Norway) will reduce tax payments, so the net impact on FCF is lower than the nominal amounts.

The company does not plan any drilling or intervention in the UK or in the Netherlands for the rest of 2023.

Kistos’ FCF in H1 ’23 was €47.4mn which benefited from €64mn of positive Worling Capital change. Without this effect, FCF would have been negative. However, this mismatch of higher spending and lower production should reverse in the future. The company should receive tax refunds related to the past capex, including €71.7mn in December 2023 related to Mime’s 2022 capex (Norway).

Importantly, the overall capex for 2023 has been maintained at 8.5-10.5kboe/d. I initially expected 10.5kboe/d, but now I think 8.5kboe/d (or just a little higher) is more likely.

Overall thoughts on Kistos

I still think the company can earn €100-200mn of FCF in 2025 when Baldex X reaches its capacity of around 10kboe/d (net to Kistos). The eventual recovery of 78% of capex in Norway should be a material boost to FCF.

There were also positive developments as well such as restoring ownership of M10/M11 licences in the Netherlands, although it will have a limited impact on the company’s operations in the near term.

Finally, capital allocation skills are extremely important in highly capital-intensive industries like oil & gas. And this is why I am invested in Kistos. It is not my only and biggest position in oil & gas, however.

It is not the cheapest and there are operational issues. Other names, like its Norwegian partner Var Energi, pay c. 14% dividend yield and are on track to deliver a 50% production growth in the mid-term. Harbour Energy has zero net debt, $2.5bn Market Cap and generates c. $1bn of FCF annually, distributing it via dividends and buyback. My other investment, Arrow Exploration, is growing production from c. 3kboe/d to 10kboe/d by 2026, generating around $40mn of operating cash flow annually. Its current market cap is around $60mn, while net cash is $10mn.

I plan to update my thesis with a new set of numbers in the next couple of weeks. Subscribe to receive the next update.

There were also positive developments as well such as restoring ownership of M10/M11 licences in the Netherlands, although it will have a limited impact on the company’s operations in the near term.

Finally, capital allocation skills are extremely important in highly capital-intensive industries like oil & gas. And this is why I am invested in Kistos. It is not my only and biggest position in oil & gas, however.

It is not the cheapest and there are operational issues. Other names, like its Norwegian partner Var Energi, pay c. 14% dividend yield and are on track to deliver a 50% production growth in the mid-term. Harbour Energy has zero net debt, $2.5bn Market Cap and generates c. $1bn of FCF annually, distributing it via dividends and buyback. My other investment, Arrow Exploration, is growing production from c. 3kboe/d to 10kboe/d by 2026, generating around $40mn of operating cash flow annually. Its current market cap is around $60mn, while net cash is $10mn.

I plan to update my thesis with a new set of numbers in the next couple of weeks. Subscribe to receive the next update.

PHSC

This week I attended my first-ever AGM in the UK. Moreover, it was the AGM of the smallest publicly-listed company I had ever owned - PHSC Plc.

This is, by all means, not a recommendation to buy the company. It is not exceptionally cheap, there are other high-dividend stocks with much better liquidity. Its growth profile does not look exciting either.

I bought a micro position in the company in August when I saw the news on the buyback (which turned out to be more or less priced in by the market since the actual decision for the buyback had been made by the board earlier this year). On 15 August 2023, the company announced the commencement of the buyback programme. The terms were quite interesting. The company planned to buy up to a maximum of 1,841,701 shares for not more than £200,000. The buyback programme was supposed to last until 27 September 2023. The company’s market cap was about £2.5mn with just 11.8mn shares outstanding. I thought that with shares being extremely illiquid, I could earn some good returns in a short period of time.

Besides, it is a company run by the co-founders, who are also the largest shareholders. It is a high cash-generative business with a net cash position of £0.7mn (cash accounts for over a third of the company’s market cap). It has fairly good business economics with gross margins of around 50% and a 7% net profit margin.

It turned out that the buyback announcement was widely anticipated, as the stock did not rise much further after the announcement. I like the dividend yield (c. 8% currently) with a possibility of extra cash returns via buybacks. So I plan to hold the stock and possibly add more if the stock drops lower.

This is, by all means, not a recommendation to buy the company. It is not exceptionally cheap, there are other high-dividend stocks with much better liquidity. Its growth profile does not look exciting either.

I bought a micro position in the company in August when I saw the news on the buyback (which turned out to be more or less priced in by the market since the actual decision for the buyback had been made by the board earlier this year). On 15 August 2023, the company announced the commencement of the buyback programme. The terms were quite interesting. The company planned to buy up to a maximum of 1,841,701 shares for not more than £200,000. The buyback programme was supposed to last until 27 September 2023. The company’s market cap was about £2.5mn with just 11.8mn shares outstanding. I thought that with shares being extremely illiquid, I could earn some good returns in a short period of time.

Besides, it is a company run by the co-founders, who are also the largest shareholders. It is a high cash-generative business with a net cash position of £0.7mn (cash accounts for over a third of the company’s market cap). It has fairly good business economics with gross margins of around 50% and a 7% net profit margin.

It turned out that the buyback announcement was widely anticipated, as the stock did not rise much further after the announcement. I like the dividend yield (c. 8% currently) with a possibility of extra cash returns via buybacks. So I plan to hold the stock and possibly add more if the stock drops lower.

Some thoughts post the AGM

1. While the formal process of casting votes on specific resolutions is boring and, in most cases, meaningless (management gets most resolutions passed thanks to wide ETF ownership and proxy votes), it is a great experience that reminds you that stocks are certificates of ownership of real businesses, run by real people who sell real products and services to customers for real money. You can forget this by doing your research in front of a computer and struggling to tune down the noise about macro, rates, FX and all other stuff that is almost impossible to predict and that has limited impact on a business over a really long period of time. Thinking like a business owner is important for successful investing. Physical AGMs are a great way to develop this practice.

2. There is a huge difference between owner-operator businesses and those that are run by professional managers. I have spoken to hundreds of management teams during my buy- and sell-side years, and there was one feeling I always had: that management tried to sell you something (their expertise, their vision, some bright ideas etc.). They tried to sell you something. Most often, it was the idea that the business would be fantastic at some point in the future. But also they tried to sell their own skills, experience and expertise. On the other hand, when I speak to owner-operators (founders who still run their companies or managers with a large interest in the company), the experience is entirely different. You are being treated as a partner, not as a customer. The dialogue is much more candid, with issues being openly discussed rather than being omitted or hidden. But even more important than how they treat you is how they treat the business. Managers often think the next 2-3 years ahead, business owners think much more long-term. The latter are much more conservative with how they fund their business. Owner-operators focus more on cash, unlike managers who prefer to talk about growth.

3. I also learnt some interesting facts about the business and had a chance to better understand how management thinks about future growth and opportunities. I will leave them to save you time.

2. There is a huge difference between owner-operator businesses and those that are run by professional managers. I have spoken to hundreds of management teams during my buy- and sell-side years, and there was one feeling I always had: that management tried to sell you something (their expertise, their vision, some bright ideas etc.). They tried to sell you something. Most often, it was the idea that the business would be fantastic at some point in the future. But also they tried to sell their own skills, experience and expertise. On the other hand, when I speak to owner-operators (founders who still run their companies or managers with a large interest in the company), the experience is entirely different. You are being treated as a partner, not as a customer. The dialogue is much more candid, with issues being openly discussed rather than being omitted or hidden. But even more important than how they treat you is how they treat the business. Managers often think the next 2-3 years ahead, business owners think much more long-term. The latter are much more conservative with how they fund their business. Owner-operators focus more on cash, unlike managers who prefer to talk about growth.

3. I also learnt some interesting facts about the business and had a chance to better understand how management thinks about future growth and opportunities. I will leave them to save you time.

If you enjoyed this post, please consider sharing it with friends or colleagues to help spread the word and support the creation of valuable content. Thank you for reading!