17 March 2024

It has been an important week for VAR. On 13 March, management presented its 2030 outlook, and on 15 March, one of its founding shareholders, HitecVision fund, sold 220mn shares (c. 8.8% of outstanding shares) at NOK31. I did not expect Hitec to sell so soon after its previous disposal of 157mn shares (6.3%) last September (2023). After that transaction, Hitec transferred the remaining shares from one fund to a new entity. It explained that such a transfer would allow Hitec to own VAR shares longer.

While it is never great to see long-term investors exit the business, on the positive side, there was strong demand for the shares. The placement happened within a day and was increased from 164mn to 220mn. The discount to the closing share price was moderate (7%). Now, Hitec has a smaller interest of 4.3% (108mn shares), which it will likely dispose of later this year (although not in the next 90 days due to the lock-up period).

The company's free float has increased to 33% (from 24% before). Higher liquidity in the shares should broaden the investor base and make VAR more relevant for larger investment funds.

With the share overhang issue resolved during the year, VAR shares could start performing much better.

Now, let's move on to the more important question of the key targets presented by management in Oslo this Wednesday.

While it is never great to see long-term investors exit the business, on the positive side, there was strong demand for the shares. The placement happened within a day and was increased from 164mn to 220mn. The discount to the closing share price was moderate (7%). Now, Hitec has a smaller interest of 4.3% (108mn shares), which it will likely dispose of later this year (although not in the next 90 days due to the lock-up period).

The company's free float has increased to 33% (from 24% before). Higher liquidity in the shares should broaden the investor base and make VAR more relevant for larger investment funds.

With the share overhang issue resolved during the year, VAR shares could start performing much better.

Now, let's move on to the more important question of the key targets presented by management in Oslo this Wednesday.

Capital Markets Update

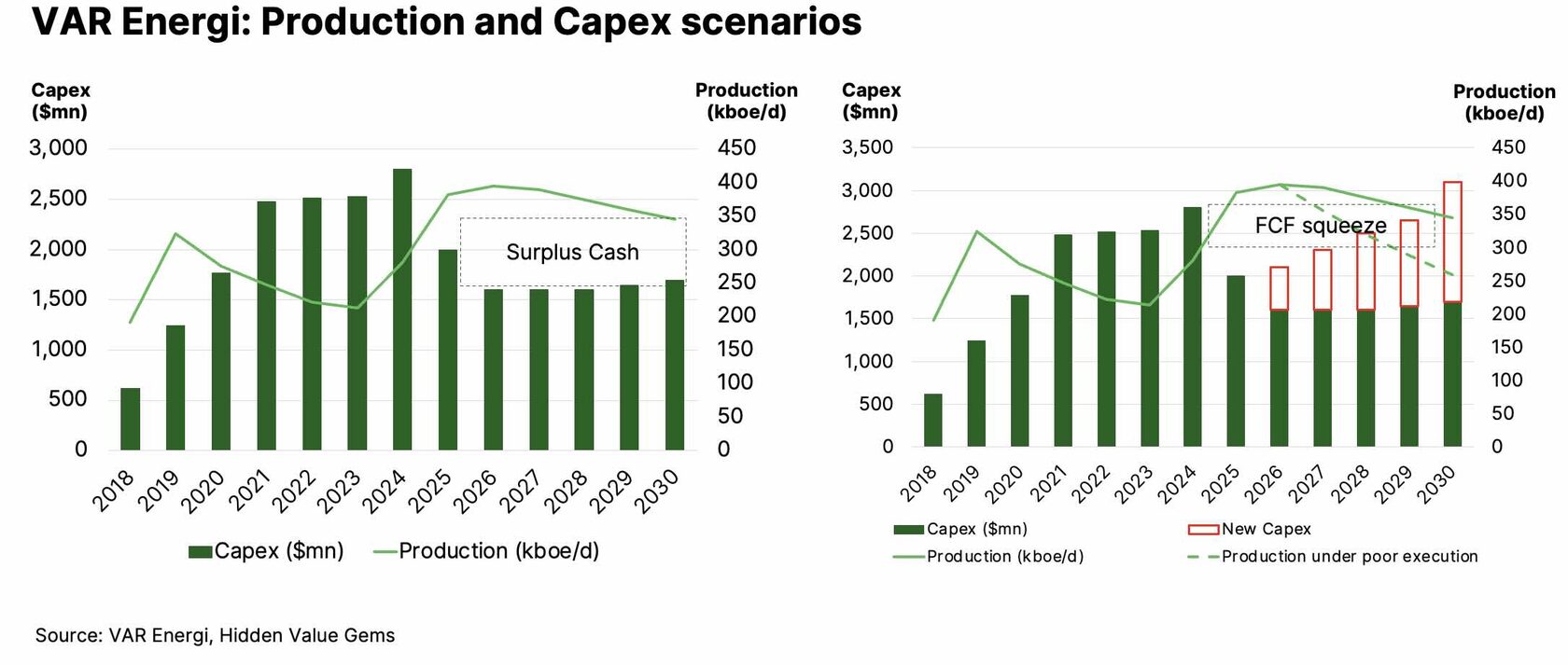

My main takeaway from the Investor Day of VAR is that the company is broadly on track to deliver on the targets that I was expecting for 2030. In my previous write-up, I showed this chart.

The chart on the left-hand side was the ‘good’ case when capex declines with a corresponding decline in production due to falling reservoir pressure and natural depletion (c. 8-10% annual decline).

There was also a risk that the company would follow the second (‘bad’) scenario (the right-hand side), increasing capex in the near term without a corresponding uplift in production, at least not until 2030.

The good news is that so far, the risk of the ‘bad’ scenario is low, although not zero.

There was also a risk that the company would follow the second (‘bad’) scenario (the right-hand side), increasing capex in the near term without a corresponding uplift in production, at least not until 2030.

The good news is that so far, the risk of the ‘bad’ scenario is low, although not zero.