28 April 2024

Clarkson Plc

High-return business in a volatile shipping market

As long-time readers of my newsletter know, I prefer high-quality businesses that generate high returns on capital and have many options for reinvesting that capital and compounding it over many years.

This focus leaves many sectors out in the search for the next opportunity since capital-intensive sectors with non-differentiated products and speculative behaviour do not allow market players to generate sustainably high returns.

Shipping is one of those sectors. Nevertheless, I have started following it a little more recently for a number of reasons.

I have been thinking about the best way to get exposure to the shipping industry to benefit from the above trends and minimise the risks.

Clarkson was a name that popped up a few times, but it was only recently that I decided to take a closer look.

Broking in a narrow market is a good business. Insurance brokers like Marsh & McLennan or Arthur J. Gallagher have proven that (just look at their stock performance).

It is generally a high-margin business that often provides significant value to its customers by securing a better deal they cannot find or execute otherwise. Ultimately, this saves clients’ money and incentivises them to return.

This focus leaves many sectors out in the search for the next opportunity since capital-intensive sectors with non-differentiated products and speculative behaviour do not allow market players to generate sustainably high returns.

Shipping is one of those sectors. Nevertheless, I have started following it a little more recently for a number of reasons.

- Cost of capital and funding. Financing new ships seems much more complicated today, as banks are generally reluctant to fund projects related to fossil fuels. In addition, interest rates are generally higher.

- Structural changes to global trade. Since COVID, most countries have started revisiting their supply chains, focusing more on logistics. The war in Ukraine and concerns over China-Taiwan have only accelerated reshoring trends.

- Valuation. Sometimes, you do not need a compounder to generate high returns. If you can buy a one-dollar bill for 50 cents, it is also a good trade. Many cyclical and low-return sectors now offer double-digit cash flow yields and return most of their cash to shareholders.

I have been thinking about the best way to get exposure to the shipping industry to benefit from the above trends and minimise the risks.

Clarkson was a name that popped up a few times, but it was only recently that I decided to take a closer look.

Broking in a narrow market is a good business. Insurance brokers like Marsh & McLennan or Arthur J. Gallagher have proven that (just look at their stock performance).

It is generally a high-margin business that often provides significant value to its customers by securing a better deal they cannot find or execute otherwise. Ultimately, this saves clients’ money and incentivises them to return.

Clarkson’s Business model

Clarkson’s main services (80% of revenue xxx) are brokering (facilitating deals) between potential shippers (cargo holders) and potential carriers (shipping companies). It was founded in 1852 and today is by far the largest shipbroker with 60 offices in 24 countries with over 2,000 employees. In addition to chartering vessels, Clarkson provides investment banking services (helping customers to buy and sell ships), valuation services and research (industry intelligence). Following the acquisition of the Netherlands-based DHSS in 2023, the company started providing port services to its customers.

Source: Clarkson 2023 Annual Report

Clarkson is the only broker with an integrated offering that provides a full-service range to its customers.

Due to its scale and business reach, Clarkson is essentially a charter exchange, facilitating transactions between the two sides through Clarkson. Exchanges benefit from network effects, with the value of their service rising as more market participants join it. This, in turn, improves the service even more (faster deal completion, better rates, better specification of vessels required, higher vessel utilisation), leading to more customers coming on the platform.

Unlike typical exchange-traded goods such as oil or financial instruments, shipping does not have standardised products as there are too many variations of ships with different capacities, environmental characteristics, jurisdictions, and other parameters.

Hence, a broker plays a more critical role in this less transparent market.

Besides, day rates for hiring a vessel can vary from just a few thousand dollars a day to several hundred thousand. These are high-cost decisions that can impact the financials of the parties involved, so paying a fee for accessing market intelligence or securing a better deal through Clarkson looks like an easy decision. Even more critical are the decisions to invest in a new vehicle. The value of the global fleet is over $1tn. The global order book is only 12% of the fleet, while the average age of a vessel is rising. Shippers face uncertainty over future fuel regulations and defer investment decisions.

Purchasing Clarkson’s services should help make better high-stakes decisions and, at minimum, provide executives with a hedge against potential critics for making the wrong call on the type of vessel ordered. In such a situation, the price for Clarkson services becomes less of an issue.

Clarkson is an asset-light business that does not require significant capital to run. Its principal investments are in IT.

For the past ten years, the company spent, on average, £5.9mn on capex annually, while revenue and operating profits averaged £373.9mn and £49.2mn, respectively. Besides low capital intensity, the company also benefits from revenue visibility as it earns specific revenue upfront (e.g. subscription services to its market intelligence portal and research access). At the end of 2023, for example, its forward order book secured $217mn of revenue (over 20% of 2023 sales). Consequently, Clarkson benefits from positive working capital and cash conversion (FCF/Net income), usually well above 100%.

Such a highly cash-generative model allowed Clarkson to build a substantial cash position of £398.9mn and cash deposits and bonds (classified as short-term investments) of £39.9mn (as of 31 December 2023), with no debt other than lease liabilities (£43.2mn).

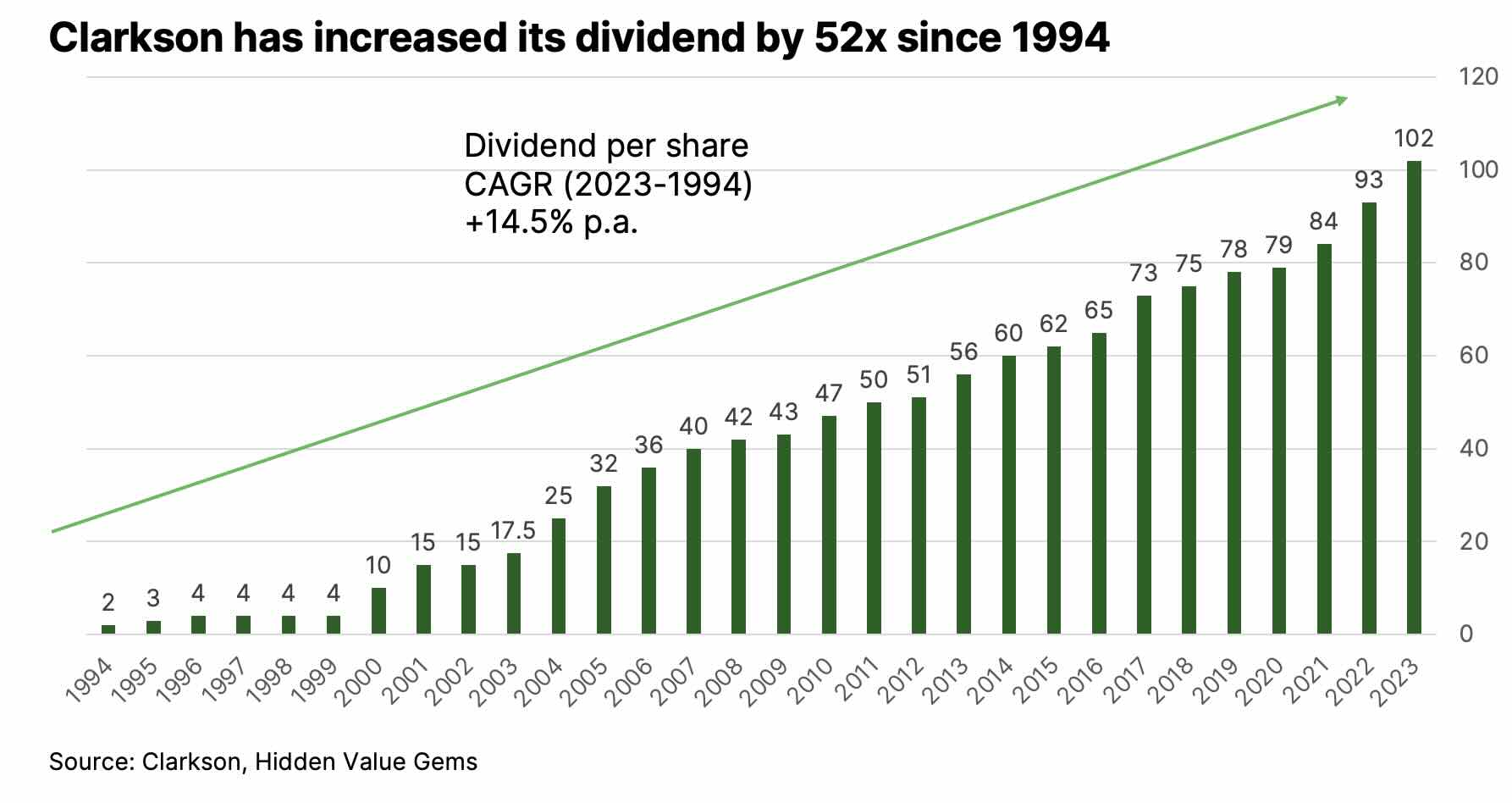

This is the main reason for the company’s 30-year track record of growing dividends (with just four years of flat dividends and not a single year of dividend cuts).

Due to its scale and business reach, Clarkson is essentially a charter exchange, facilitating transactions between the two sides through Clarkson. Exchanges benefit from network effects, with the value of their service rising as more market participants join it. This, in turn, improves the service even more (faster deal completion, better rates, better specification of vessels required, higher vessel utilisation), leading to more customers coming on the platform.

Unlike typical exchange-traded goods such as oil or financial instruments, shipping does not have standardised products as there are too many variations of ships with different capacities, environmental characteristics, jurisdictions, and other parameters.

Hence, a broker plays a more critical role in this less transparent market.

Besides, day rates for hiring a vessel can vary from just a few thousand dollars a day to several hundred thousand. These are high-cost decisions that can impact the financials of the parties involved, so paying a fee for accessing market intelligence or securing a better deal through Clarkson looks like an easy decision. Even more critical are the decisions to invest in a new vehicle. The value of the global fleet is over $1tn. The global order book is only 12% of the fleet, while the average age of a vessel is rising. Shippers face uncertainty over future fuel regulations and defer investment decisions.

Purchasing Clarkson’s services should help make better high-stakes decisions and, at minimum, provide executives with a hedge against potential critics for making the wrong call on the type of vessel ordered. In such a situation, the price for Clarkson services becomes less of an issue.

Clarkson is an asset-light business that does not require significant capital to run. Its principal investments are in IT.

For the past ten years, the company spent, on average, £5.9mn on capex annually, while revenue and operating profits averaged £373.9mn and £49.2mn, respectively. Besides low capital intensity, the company also benefits from revenue visibility as it earns specific revenue upfront (e.g. subscription services to its market intelligence portal and research access). At the end of 2023, for example, its forward order book secured $217mn of revenue (over 20% of 2023 sales). Consequently, Clarkson benefits from positive working capital and cash conversion (FCF/Net income), usually well above 100%.

Such a highly cash-generative model allowed Clarkson to build a substantial cash position of £398.9mn and cash deposits and bonds (classified as short-term investments) of £39.9mn (as of 31 December 2023), with no debt other than lease liabilities (£43.2mn).

This is the main reason for the company’s 30-year track record of growing dividends (with just four years of flat dividends and not a single year of dividend cuts).

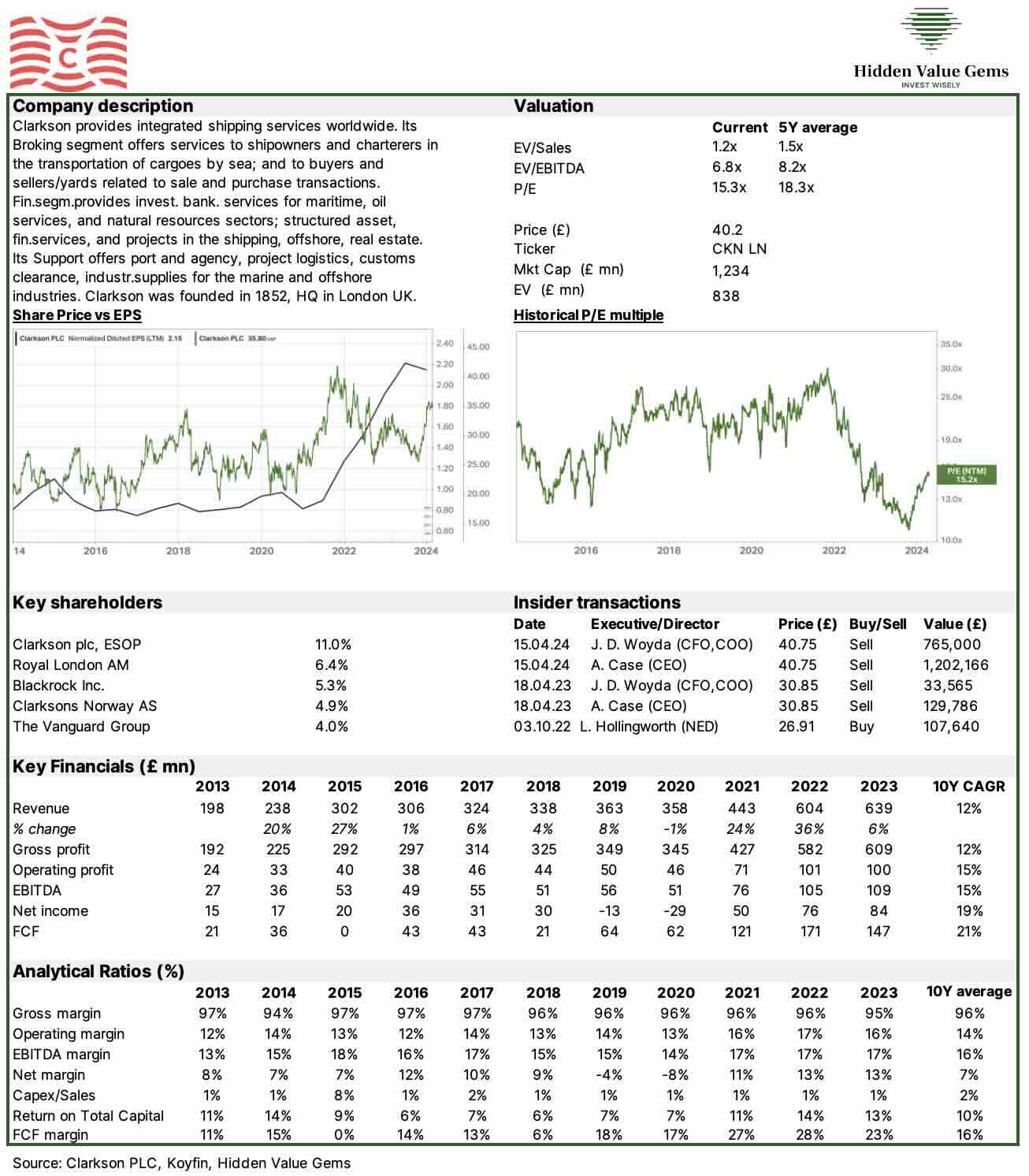

With just 1.7% and 2.2% of sales and profits going into capex (average for the past ten years), Clarkson has been generating solid returns on capital.

Its reported ROE is relatively small (around 10% on average), but this is because the company sits on excess cash that generates single-digit returns. Adjusted for excess cash, its ROE would be over 100%.

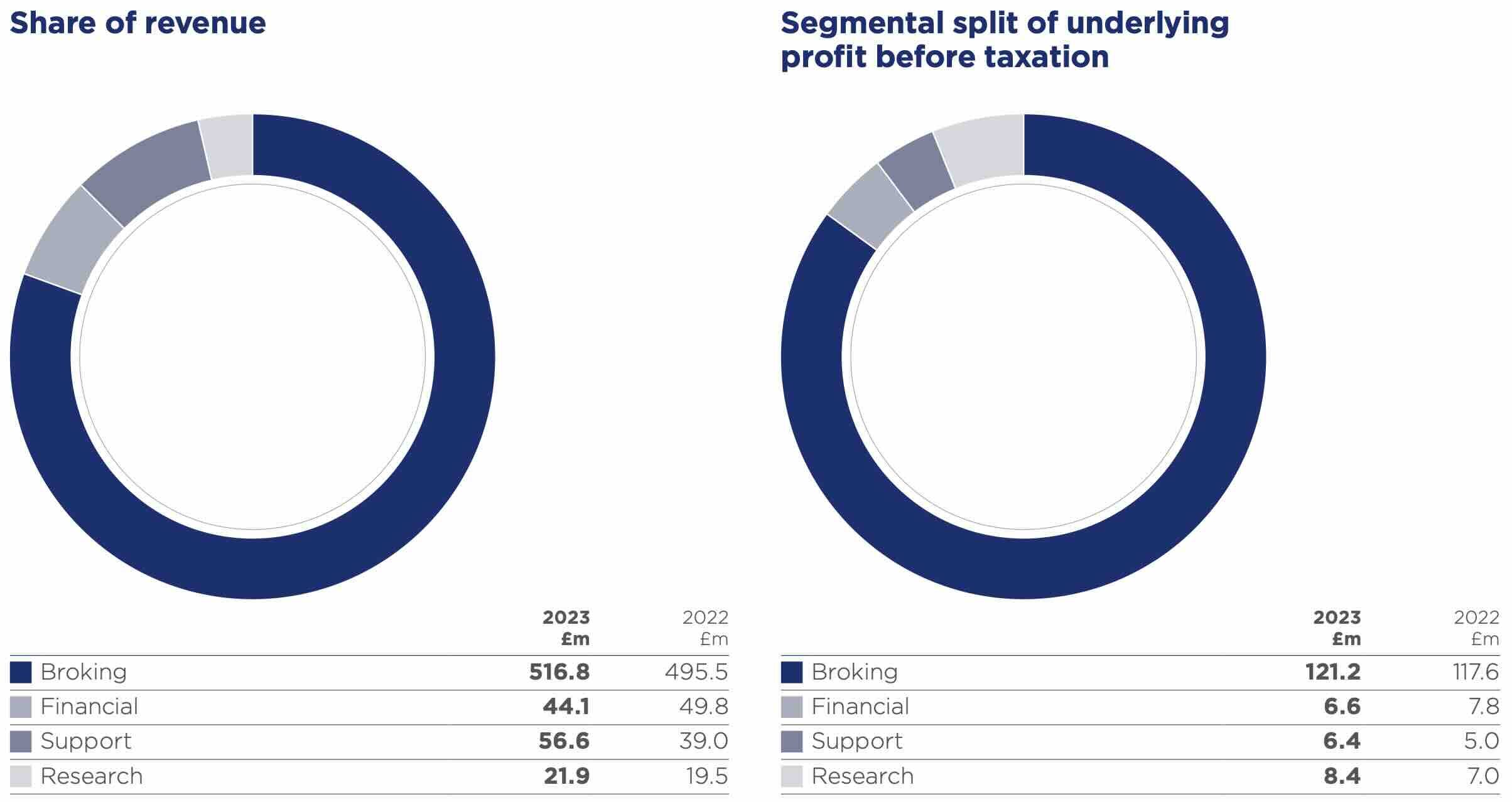

The company breaks down its revenue and profits into four segments: Broking, Financial, Support and Research.

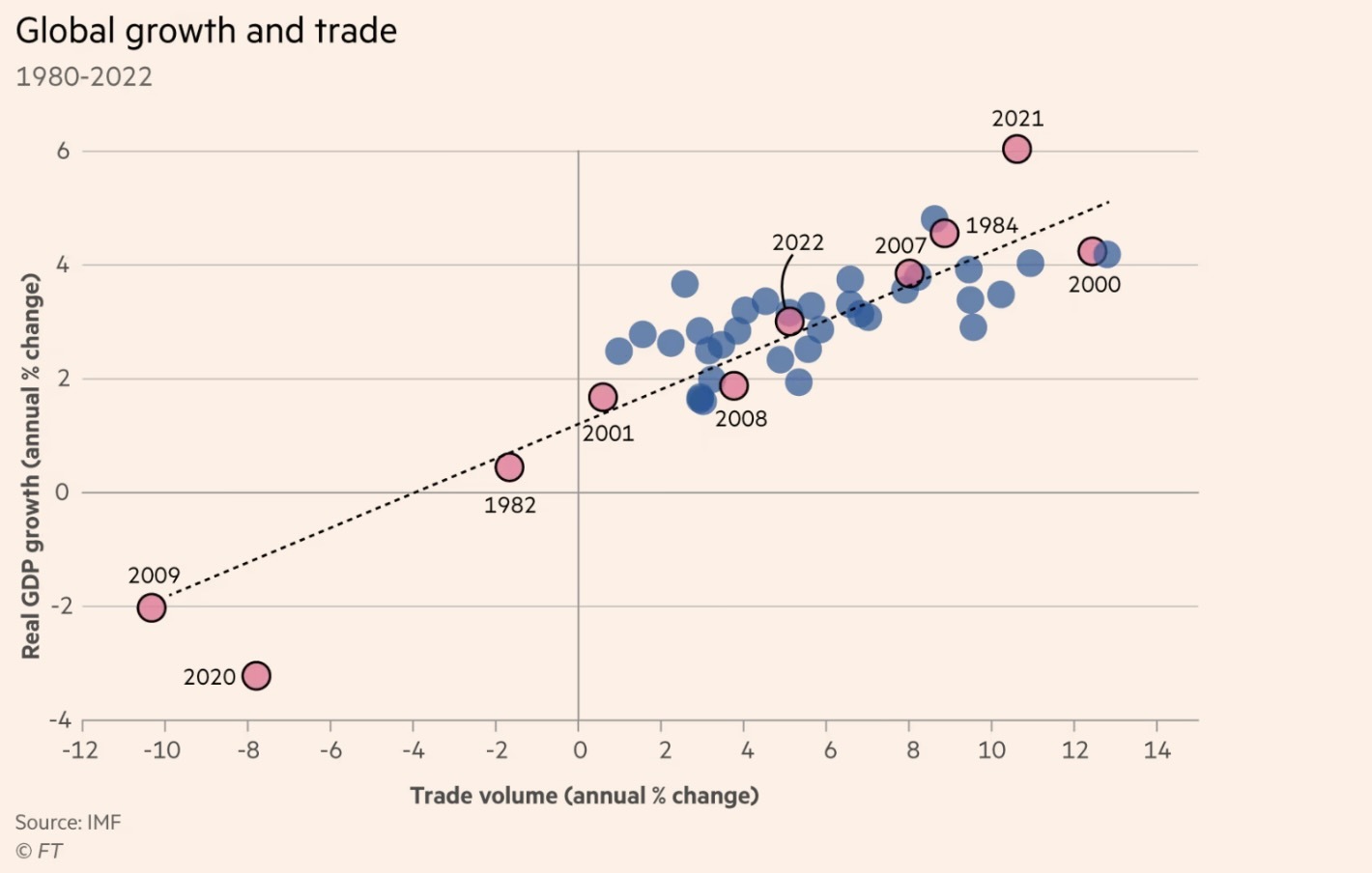

Broking accounts for over 80% of revenue and 86% of operating profits. The segment generates a 23% margin (24% in 2022) compared to the group’s average margin of 22% in 2023 (23% in 2022). It is a reasonably cyclical service which experienced a substantial decline in 2020. It generally correlates with global trade (85% of global trade is carried on ships), although the day rates, route changes and other factors may impact performance in a specific year.

Its reported ROE is relatively small (around 10% on average), but this is because the company sits on excess cash that generates single-digit returns. Adjusted for excess cash, its ROE would be over 100%.

The company breaks down its revenue and profits into four segments: Broking, Financial, Support and Research.

Broking accounts for over 80% of revenue and 86% of operating profits. The segment generates a 23% margin (24% in 2022) compared to the group’s average margin of 22% in 2023 (23% in 2022). It is a reasonably cyclical service which experienced a substantial decline in 2020. It generally correlates with global trade (85% of global trade is carried on ships), although the day rates, route changes and other factors may impact performance in a specific year.

The financial segment is generally a lower-margin and more volatile business. In 2023, it contributed 7% to revenue and 5% to profits. It earned an operating margin of 15% and 16% in 2023 and 2022, respectively.

Support is the most stable business, with a high share of recurring revenue but also a low margin (11-13%).

Finally, Research has the best margins (38% in 2023 and 36% in 2022), although it has the smallest sales (3% share). Its growth was over 10% (12% in 2023), supported by good retention (over 85%), pricing power, and the sale of additional services (e.g., valuation, market data, and on-demand reports).

The company regularly executes small bolt-on acquisitions as part of its strategic growth plan. These acquisitions not only contribute to top-line growth but also enhance its services, keeping customers more engaged with Clarkson.

Even if non-broking services seem small, they play a critical role in building customer relationships and Clarkson’s in-house intelligence and capabilities, further strengthening its market-leading positions.

Support is the most stable business, with a high share of recurring revenue but also a low margin (11-13%).

Finally, Research has the best margins (38% in 2023 and 36% in 2022), although it has the smallest sales (3% share). Its growth was over 10% (12% in 2023), supported by good retention (over 85%), pricing power, and the sale of additional services (e.g., valuation, market data, and on-demand reports).

The company regularly executes small bolt-on acquisitions as part of its strategic growth plan. These acquisitions not only contribute to top-line growth but also enhance its services, keeping customers more engaged with Clarkson.

Even if non-broking services seem small, they play a critical role in building customer relationships and Clarkson’s in-house intelligence and capabilities, further strengthening its market-leading positions.

Valuation

Clarkson has historically traded close to 20x PE. Its stock has been quite volatile, tracking the shipping market more than reflecting the underlying performance. This creates an excellent opportunity for investors as the business is much more stable, as evidenced by the steady rise of dividends and a substantial net cash position. Besides, being a UK-based company, it does not attract many investors and is consequently valued quite conservatively despite operating a highly cash-generative business with a dominant global position.

Its headline forward P/E is 15.3x, although if cash and deposits are removed from the market cap, then the P/E multiple drops to just 10x.

I am pretty sure that if this business had been listed in the US and positioned itself as an intelligence subscription service, its multiple would have been at least double the current level.

It also seems that the market is quite conservative in its future expectations. Consensus revenue estimates imply just 1.5-3% top-line growth in the next three years, whereas the historical 10-year revenue CAGR is 12%. I agree that after a strong performance in 2022 and 2023, near-term growth may be slower, but I think the company can grow at high single-digit rates in the medium term, supported by its pricing power and bolt-on acquisitions (on top of the structural growth of the industry).

My only two main concerns are that the stock is close to an all-time high, so the timing may not be the best (although what a value investor can really know about market timing). Another concern is sizeable share sale transactions by insiders (see the top table). Low insider ownership is also a negative factor.

Its headline forward P/E is 15.3x, although if cash and deposits are removed from the market cap, then the P/E multiple drops to just 10x.

I am pretty sure that if this business had been listed in the US and positioned itself as an intelligence subscription service, its multiple would have been at least double the current level.

It also seems that the market is quite conservative in its future expectations. Consensus revenue estimates imply just 1.5-3% top-line growth in the next three years, whereas the historical 10-year revenue CAGR is 12%. I agree that after a strong performance in 2022 and 2023, near-term growth may be slower, but I think the company can grow at high single-digit rates in the medium term, supported by its pricing power and bolt-on acquisitions (on top of the structural growth of the industry).

My only two main concerns are that the stock is close to an all-time high, so the timing may not be the best (although what a value investor can really know about market timing). Another concern is sizeable share sale transactions by insiders (see the top table). Low insider ownership is also a negative factor.