21 April 2024

This is a guest post by a long-time friend and a premium member of Hidden Value Gems, Artem Kvas. Artem is a Senior Vice President at Mubadala | UAE Investments. I am always on the lookout for less-covered parts of the market in search of new ideas. The Middle Eastern markets receive a lot of attention these days, but there is limited analysis and research coverage, which makes it more interesting.

So, I thought I should share Artem’s overview of the IPO market in the UAE, its recent performance and how private investors can participate in it.

I hope you enjoy the post.

Disclaimer: This is a free post, no commission or fee was earned or will be earned either by the author or the publisher of this post. This is not a recommendation to participate in the IPO deals. You may lose money if buy shares at the IPO or later. Please read the full disclaimer.

Setting the Scene

For someone looking at emerging markets, it is hard to miss the rise of the Falcon Economy, particularly the capital market activity across MENA and, specifically, in the UAE.

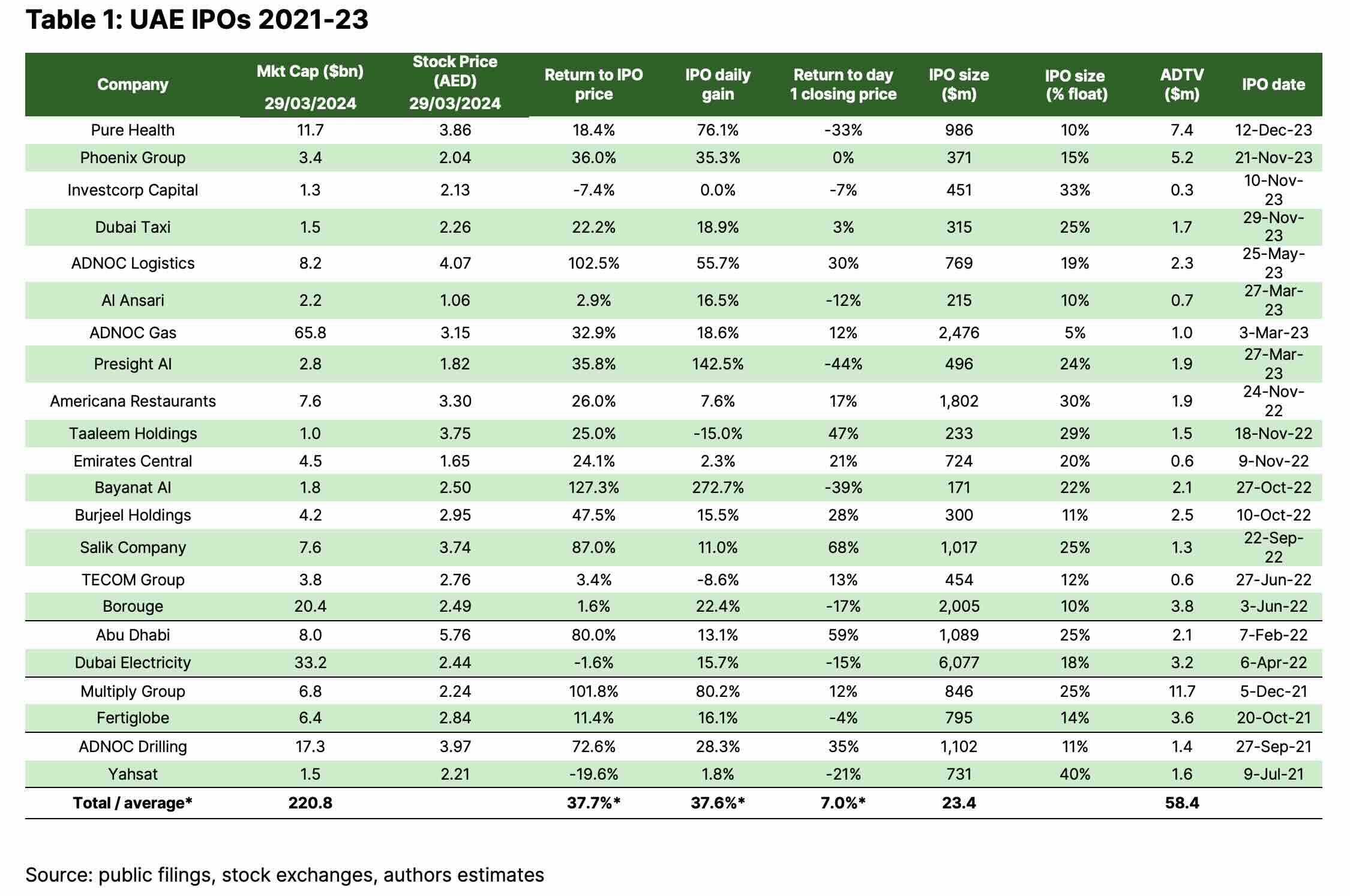

Over the past three years, UAE has seen 22 new listings across DFM and ADX exchanges, raising an overall total of $23.4bn. The latest public names were coming from a wide range of industries, including the traditional oil & gas (no surprise here) but also spanning to Healthcare, F&B, Technology and even Crypto industries with no single name dominating the bank in terms of capital raised.

But the best thing is the return: had you participated in every single UAE IPO since 2021, you would have made an average of +38% on the first day of trading (assuming equal weights), and 87% of companies have seen their share price increase vs IPO price.

Over the past three years, UAE has seen 22 new listings across DFM and ADX exchanges, raising an overall total of $23.4bn. The latest public names were coming from a wide range of industries, including the traditional oil & gas (no surprise here) but also spanning to Healthcare, F&B, Technology and even Crypto industries with no single name dominating the bank in terms of capital raised.

But the best thing is the return: had you participated in every single UAE IPO since 2021, you would have made an average of +38% on the first day of trading (assuming equal weights), and 87% of companies have seen their share price increase vs IPO price.

Investing in the UAE IPOs

The cynical, knee-jerk reaction to this is: “Good luck with the allocation!” Indeed, every IPO headline you see talks about oversubscription, with the average investor getting only 1/50th of the allocation.

The truth is, most of the UAE IPOs have been fairly generously priced, plus there is a preference towards domestic retail investors when it comes to allocations. In addition, several local banks offer leverage to their private HNW clients looking to participate in the IPO. As a result, regional investors are topping up in the market once the stock is already trading.

In addition – UAE stocks are generally not very well covered by research analysts, and many value gems may remain under the radar for large market participants offering mispricing opportunities.

The results speak for themselves when we see a number of prominent names, such as ADNOC Logistics gaining +50% on the first day of trading and then effectively doubling its market cap to over $8bn in just nine months since the IPO, which gets people excited to spend more time on the market.

The truth is, most of the UAE IPOs have been fairly generously priced, plus there is a preference towards domestic retail investors when it comes to allocations. In addition, several local banks offer leverage to their private HNW clients looking to participate in the IPO. As a result, regional investors are topping up in the market once the stock is already trading.

In addition – UAE stocks are generally not very well covered by research analysts, and many value gems may remain under the radar for large market participants offering mispricing opportunities.

The results speak for themselves when we see a number of prominent names, such as ADNOC Logistics gaining +50% on the first day of trading and then effectively doubling its market cap to over $8bn in just nine months since the IPO, which gets people excited to spend more time on the market.

Post IPO performance

If you didn’t manage to get (enough) allocation from your broker, think twice before topping up in the market.

While the return to the IPO price looks excellent, if you weren’t lucky with the allocation and had to invest during the first few days of trading, we are looking for an average return of 7% (equal-weighted) and only 2% (market cap weighted) as some names perform quite poorly, losing 20-40% from the first few days of the trading frenzy, especially in direct listings where only secondary shares are offered with no investor education.

The practical wisdom for a retail investor here is that timing is paramount: if you didn’t make it with allocation, it might be worth waiting it out.

Another peculiar characteristic of the listed names in the UAE is the liquidity: with relatively small IPO offerings (average of 11% offering size across Top 5 names by market cap), we are also looking at an average daily traded value of only $3.6m.

While the return to the IPO price looks excellent, if you weren’t lucky with the allocation and had to invest during the first few days of trading, we are looking for an average return of 7% (equal-weighted) and only 2% (market cap weighted) as some names perform quite poorly, losing 20-40% from the first few days of the trading frenzy, especially in direct listings where only secondary shares are offered with no investor education.

The practical wisdom for a retail investor here is that timing is paramount: if you didn’t make it with allocation, it might be worth waiting it out.

Another peculiar characteristic of the listed names in the UAE is the liquidity: with relatively small IPO offerings (average of 11% offering size across Top 5 names by market cap), we are also looking at an average daily traded value of only $3.6m.

Getting to invest

So, how do you invest in the UAE IPOs as a retail investor? – The process is fairly mechanical and straightforward: all you need is a local bank account (Wio bank is the most digital and hassle fee) that you can open with Emirates ID (there are many ways to get it from self-employment to buying real estate) and an investor account (NIN) that you automatically receive when registering with one of the exchanges such as ADX or DFM.

What is ahead

The pipeline of new IPOs looks relatively healthy with another $20-25bn of capital to be floated on the market. The next wave of listings is likely to be focused more on growth rather than set dividends, which will be testing how well the market takes in the TSR mentality (e.g. Noon, Tabby, Dubizzle, Pure Harvest) vs Div Yield, which has been prevailing historically. In addition, we might see several SPOs to add to the float that will provide plenty of opportunities for a shrewd investor.

Summary

- UAE capital markets are booming, with 22 new listings in the last three years that generated a 38% average return

- There is a wave of new IPOs getting ready for market in 2024-26 with predominantly tech, consumer and growth companies that will be raising up to $25bn in new capital

- While the mechanics of participating in the local IPOs is fairly straightforward, allocations can be challenging. Stay disciplined as there is plenty of opportunities to buy in the aftermarket.

- Focus on Reg S. / 144A fully marketed IPOs with investor education and try to steer clear from direct listings

- Stay conscious of the price dynamics post IPO as many speculative investors get into the IPOs just for that first pop

- UAE markets are not well covered by research analysts, hence with due work one can find real value gems with significant growth potential

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.