17 December 2023

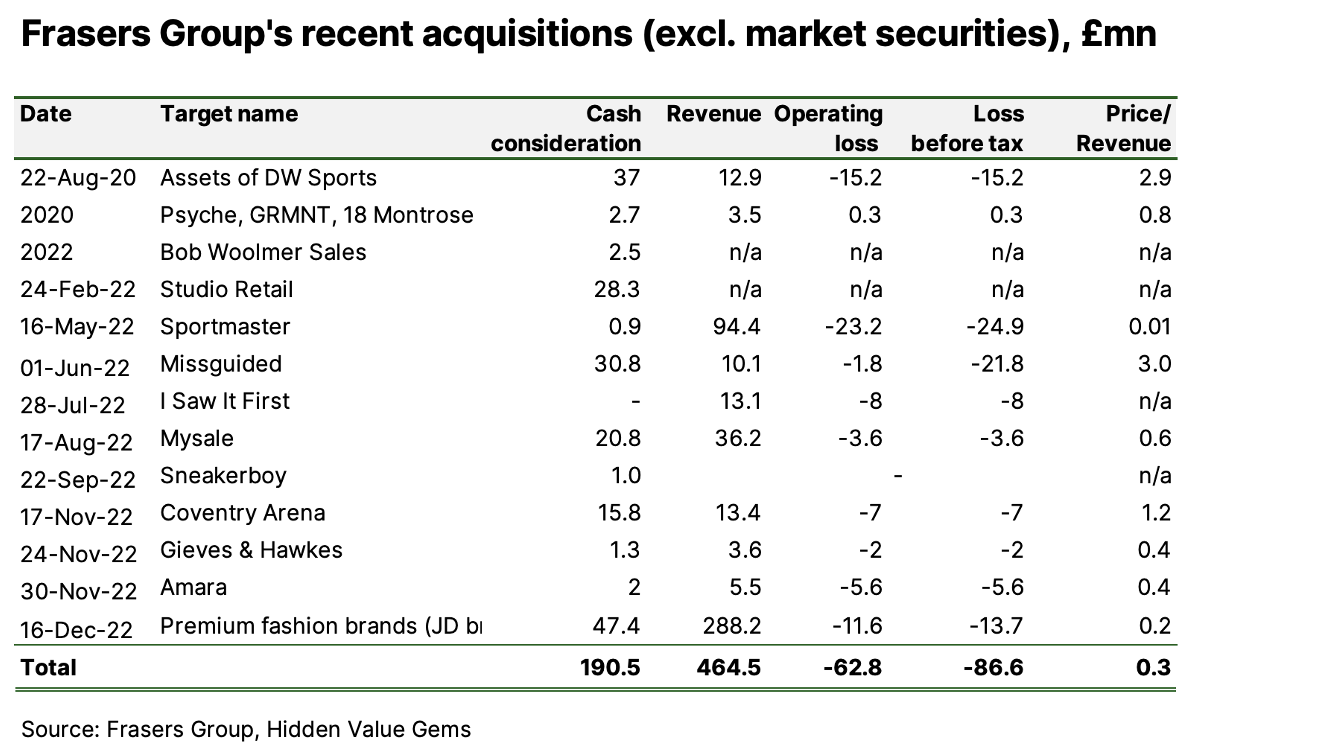

Like many UK investors, I noted that Frasers Group has been on a spending spree recently. It did not just disclose minority stakes in one or two publicly-listed retailers but has been continuously increasing stakes in various online and offline retailers in different segments, as well as buying distressed private assets.

To understand how best to play this theme (e.g., whether it is worth buying stocks Fraser is purchasing, like Boohoo or ASOS), I decided to review recent and past deals and look at the company’s overall performance.

Is Mike Ashley a British Warren Buffett pursuing a counter-cyclical, opportunistic investment strategy? Or rather, is he more like the notorious Masayoshi Son, the founder of SoftBank and Vision Fund, drawing lots of media attention and not afraid to make bold and unexpected moves? One can even find traces of a billionaire, Eddie Lambert, who kept conviction in traditional bricks-and-mortar retail format, putting more capital into it until eventually his largest asset (100-year-old Sears) went bust.

Here are my conclusions and the best way to capture the upside here.

To understand how best to play this theme (e.g., whether it is worth buying stocks Fraser is purchasing, like Boohoo or ASOS), I decided to review recent and past deals and look at the company’s overall performance.

Is Mike Ashley a British Warren Buffett pursuing a counter-cyclical, opportunistic investment strategy? Or rather, is he more like the notorious Masayoshi Son, the founder of SoftBank and Vision Fund, drawing lots of media attention and not afraid to make bold and unexpected moves? One can even find traces of a billionaire, Eddie Lambert, who kept conviction in traditional bricks-and-mortar retail format, putting more capital into it until eventually his largest asset (100-year-old Sears) went bust.

Here are my conclusions and the best way to capture the upside here.