17 March 2024

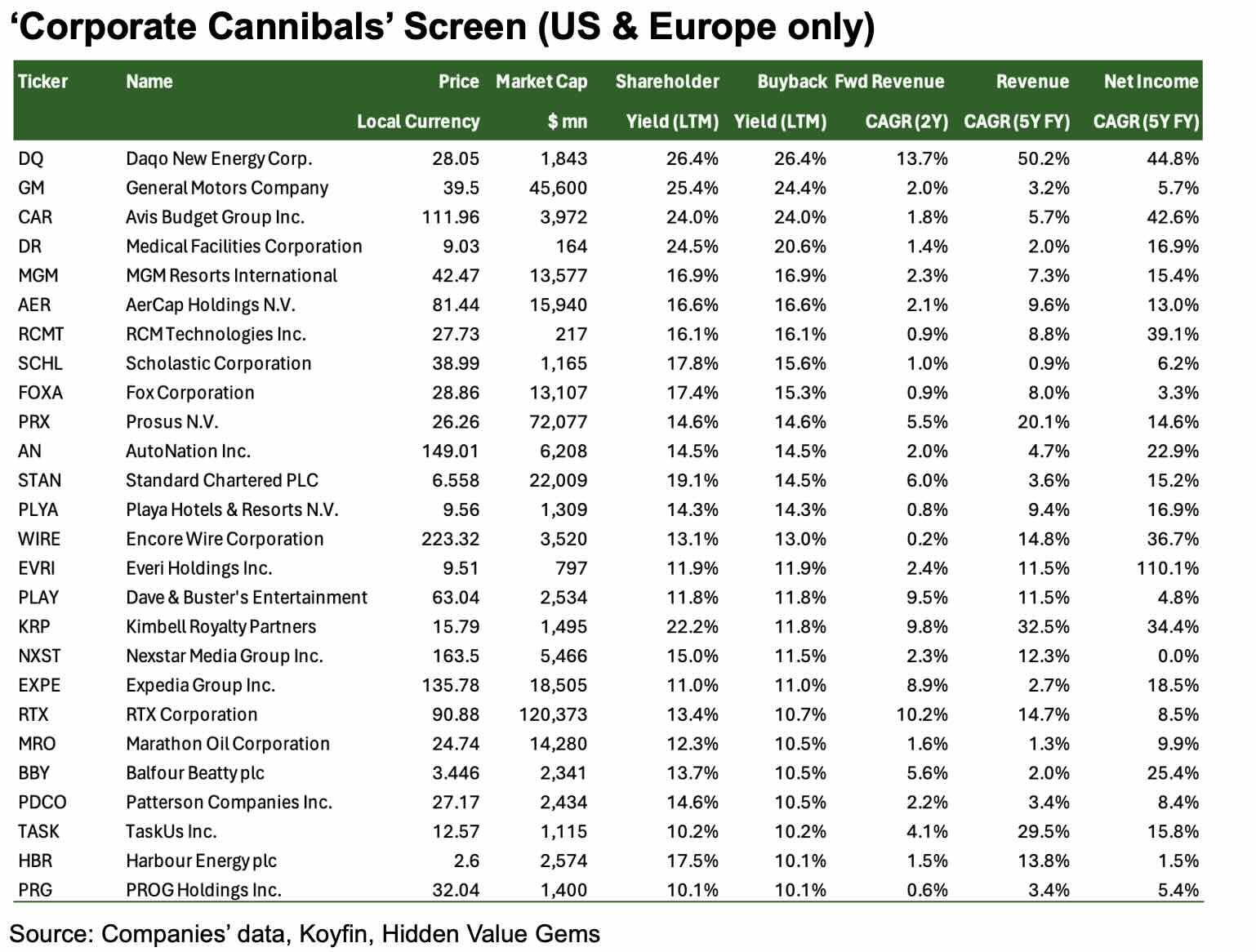

This is Part II of my Corporate Cannibals post. You can read Part I here.

In this post I review some other interesting names from the list of companies with the highest buyback yield.

In this post I review some other interesting names from the list of companies with the highest buyback yield.

MGM International

MGM is an operator of 16 casino resorts in the US and two in China (Macau). It is chaired by a famous media entrepreneur, Barry Diller, whose investment company, IAC, holds 20.42% interest in MGM.

Casinos and hotels are not my favourite businesses. They are quite cyclical, and hotels, in particular, have high fixed costs and operate in a competitive sector.

Nevertheless, MGM could be special because of its ‘trophy’ assets, which are themselves some form of moat. Among the most famous properties in MGM’s portfolio are Bellagio, MGM Grand Las Vegas, Mandalay Bay, The Mirage (all in Las Vegas). Building a new grand hotel and entertainment centre would take years and billions of investments that would need to be funded at higher rates than 5-10 years ago.

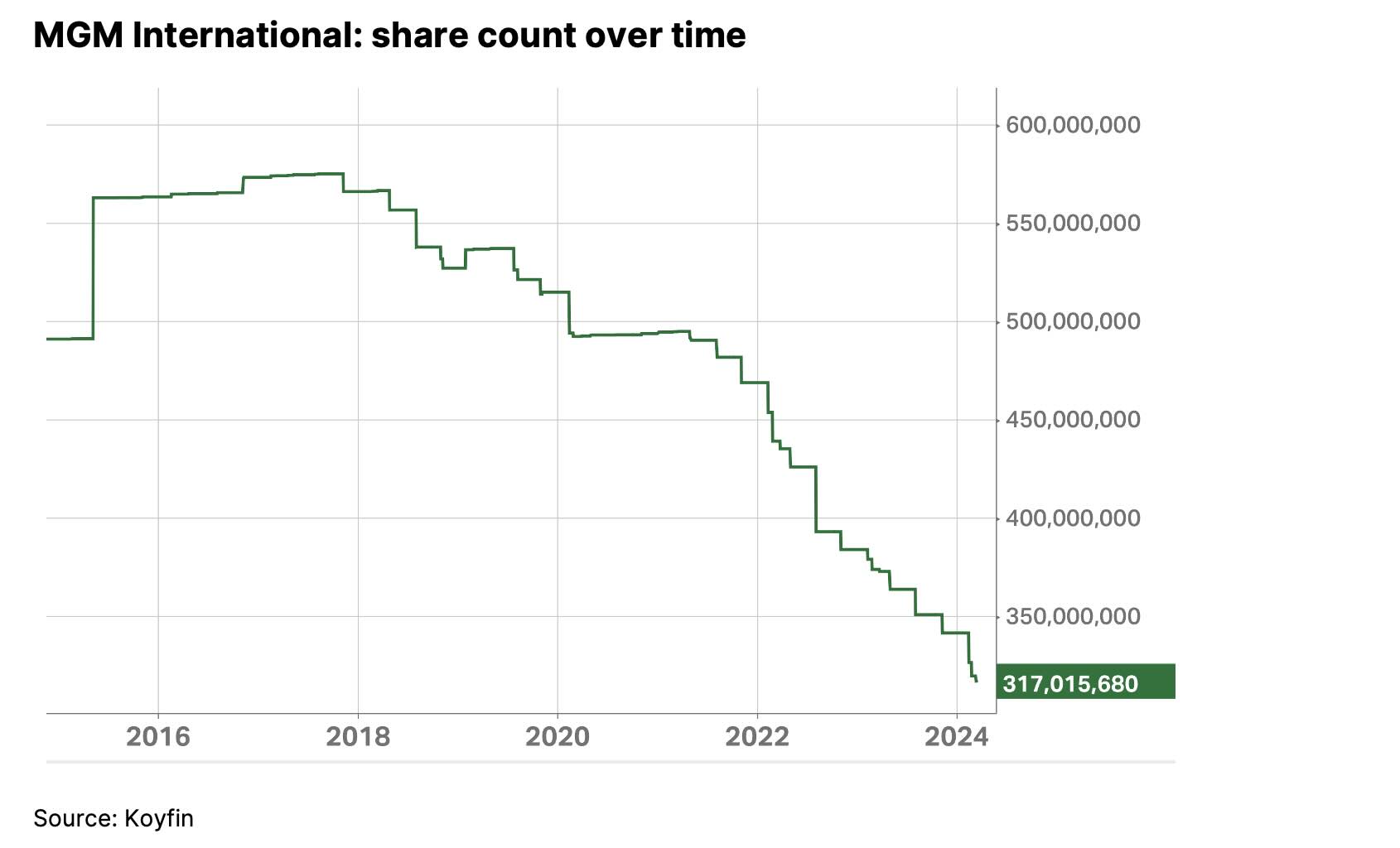

Almost ten years ago, the company switched to an asset-light business model by transferring its real estate portfolio to a separate REIT. At the same time, its main focus has been on gaming and entertainment experiences and services. The proceeds from the disposals of real estate and other non-core assets were used mostly on share repurchases. MGM repurchased $2.3bn and $2.8bn worth of shares in 2023 and 2022, respectively. In the past two years alone, the company has retired c. 26% of its shares. It suspended dividend payments in February 2023, announcing its intention to distribute cash to shareholders through its preferred method - share repurchases.

Casinos and hotels are not my favourite businesses. They are quite cyclical, and hotels, in particular, have high fixed costs and operate in a competitive sector.

Nevertheless, MGM could be special because of its ‘trophy’ assets, which are themselves some form of moat. Among the most famous properties in MGM’s portfolio are Bellagio, MGM Grand Las Vegas, Mandalay Bay, The Mirage (all in Las Vegas). Building a new grand hotel and entertainment centre would take years and billions of investments that would need to be funded at higher rates than 5-10 years ago.

Almost ten years ago, the company switched to an asset-light business model by transferring its real estate portfolio to a separate REIT. At the same time, its main focus has been on gaming and entertainment experiences and services. The proceeds from the disposals of real estate and other non-core assets were used mostly on share repurchases. MGM repurchased $2.3bn and $2.8bn worth of shares in 2023 and 2022, respectively. In the past two years alone, the company has retired c. 26% of its shares. It suspended dividend payments in February 2023, announcing its intention to distribute cash to shareholders through its preferred method - share repurchases.

The company is also interesting from the Sum-of-the Parts angle.

Its 56% interest in MGM China (listed in Hong Kong) has a market value of $3.2bn, which accounts for 23% of MGM’s parent market cap ($13.2bn). On top of this, MGM has a 50% stake in the betting JV, BetMGM - a leading online betting company in the US (launched in 2018 with the UK-listed Entain). Management targets $0.5bn EBITDA in 2026, which would imply c. $5bn value (at 10x EV/EBITDA based on peer multiples) or $2.5bn net to MGM.

There are other JVs, such as two large projects in the UAE and Japan, but they will not contribute to earnings for a few years.

The company has a moderate net debt of $0.9bn at its US entity. MGM China has a net debt of $2.6bn.

If MGM China and BetMGM values are removed from the MGM EV, the core business would have a residual value of $8.4bn. This business consists of Las Vegas Strip assets and Regional operations. Las Vegas assets earned $3.2bn EBITDA (before lease payments) in 2023, while Regional operations earned $1.1bn. The combined EBITDA of US operations was $4.3bn. If I deduct leasing costs ($2.3bn) and admin (70% of $0.6bn, assuming 30% of admin costs are related to Chinese operations), then the operating income of the US assets was $1.6bn, and its implied value is 5.3x EV/EBIT.

From the beginning of 2024 until 21 February, MGM repurchased approximately 7 million shares for a total cost of $320 million, reducing its share count by 2%.

Regarding future buyback activity, I think the company may slow it down as the share price rises and it has to spend more on new projects, including a new resort in Osaka (MGM’s share is approx. $2.2bn in the next five years), a potential commercial gaming facility in New York ($2bn total cost), and escalating annual rent costs ($1.8bn in 2024).

Its 56% interest in MGM China (listed in Hong Kong) has a market value of $3.2bn, which accounts for 23% of MGM’s parent market cap ($13.2bn). On top of this, MGM has a 50% stake in the betting JV, BetMGM - a leading online betting company in the US (launched in 2018 with the UK-listed Entain). Management targets $0.5bn EBITDA in 2026, which would imply c. $5bn value (at 10x EV/EBITDA based on peer multiples) or $2.5bn net to MGM.

There are other JVs, such as two large projects in the UAE and Japan, but they will not contribute to earnings for a few years.

The company has a moderate net debt of $0.9bn at its US entity. MGM China has a net debt of $2.6bn.

If MGM China and BetMGM values are removed from the MGM EV, the core business would have a residual value of $8.4bn. This business consists of Las Vegas Strip assets and Regional operations. Las Vegas assets earned $3.2bn EBITDA (before lease payments) in 2023, while Regional operations earned $1.1bn. The combined EBITDA of US operations was $4.3bn. If I deduct leasing costs ($2.3bn) and admin (70% of $0.6bn, assuming 30% of admin costs are related to Chinese operations), then the operating income of the US assets was $1.6bn, and its implied value is 5.3x EV/EBIT.

From the beginning of 2024 until 21 February, MGM repurchased approximately 7 million shares for a total cost of $320 million, reducing its share count by 2%.

Regarding future buyback activity, I think the company may slow it down as the share price rises and it has to spend more on new projects, including a new resort in Osaka (MGM’s share is approx. $2.2bn in the next five years), a potential commercial gaming facility in New York ($2bn total cost), and escalating annual rent costs ($1.8bn in 2024).

AerCap

The airline leasing business doesn't formally match the description of a quality business. It relies on high leverage and is capital-intensive. Black Swans can also put the whole business on the brink. On the other hand, leasing companies provide an important value to customers (airlines). Firstly, they minimise their capital needs and improve returns on capital. Owning aeroplanes on their balance sheets would increase airlines' business model risks. Besides, smaller airlines, especially in EM, cannot borrow at attractive enough rates.

Other benefits include the ability to operate only the new aircraft and the removal of the risk of the plane's residual value.

And the AerCap case shows that leasing can work if run well. In their case, shareholders have been well rewarded and can probably expect more in the future.

Following the acquisition of GECAS (GE Aviation Leasing business), AerCap has become the global market leader. There are two major benefits of scale. Firstly, AerCap's credit rating is better, which allows it to borrow at lower rates. Secondly, it has an advantage in negotiations with Boeing and Airbus on purchasing a new fleet at a more significant discount than smaller players.

Other benefits include the ability to operate only the new aircraft and the removal of the risk of the plane's residual value.

And the AerCap case shows that leasing can work if run well. In their case, shareholders have been well rewarded and can probably expect more in the future.

Following the acquisition of GECAS (GE Aviation Leasing business), AerCap has become the global market leader. There are two major benefits of scale. Firstly, AerCap's credit rating is better, which allows it to borrow at lower rates. Secondly, it has an advantage in negotiations with Boeing and Airbus on purchasing a new fleet at a more significant discount than smaller players.