31 March 2024

Reckitt Benckiser

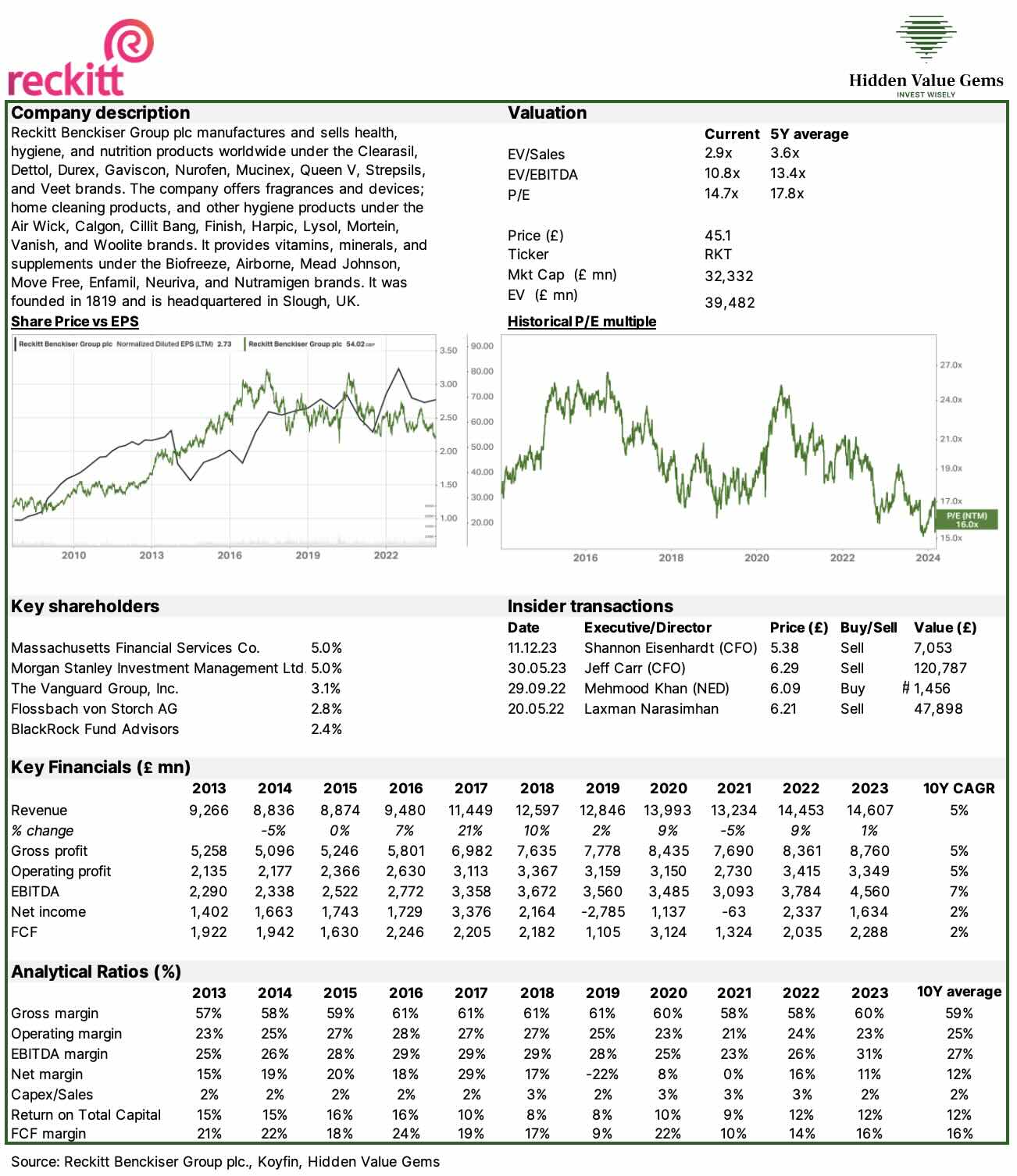

Reckitt is one of the top global FMCG companies with a 200-year history. Its easily recognisable brands are sold in more than 100 countries. Reckitt operates in three key segments: hygiene (42% of sales), Health (42% of sales), and Nutrition (16%).

Why is it interesting?

Reckitt is a typical quality company facing temporary issues, which happens to every business at some point. The difference between excellent and average companies is that the former usually recover primarily unchanged, while the latter suffer longer and may never recover.

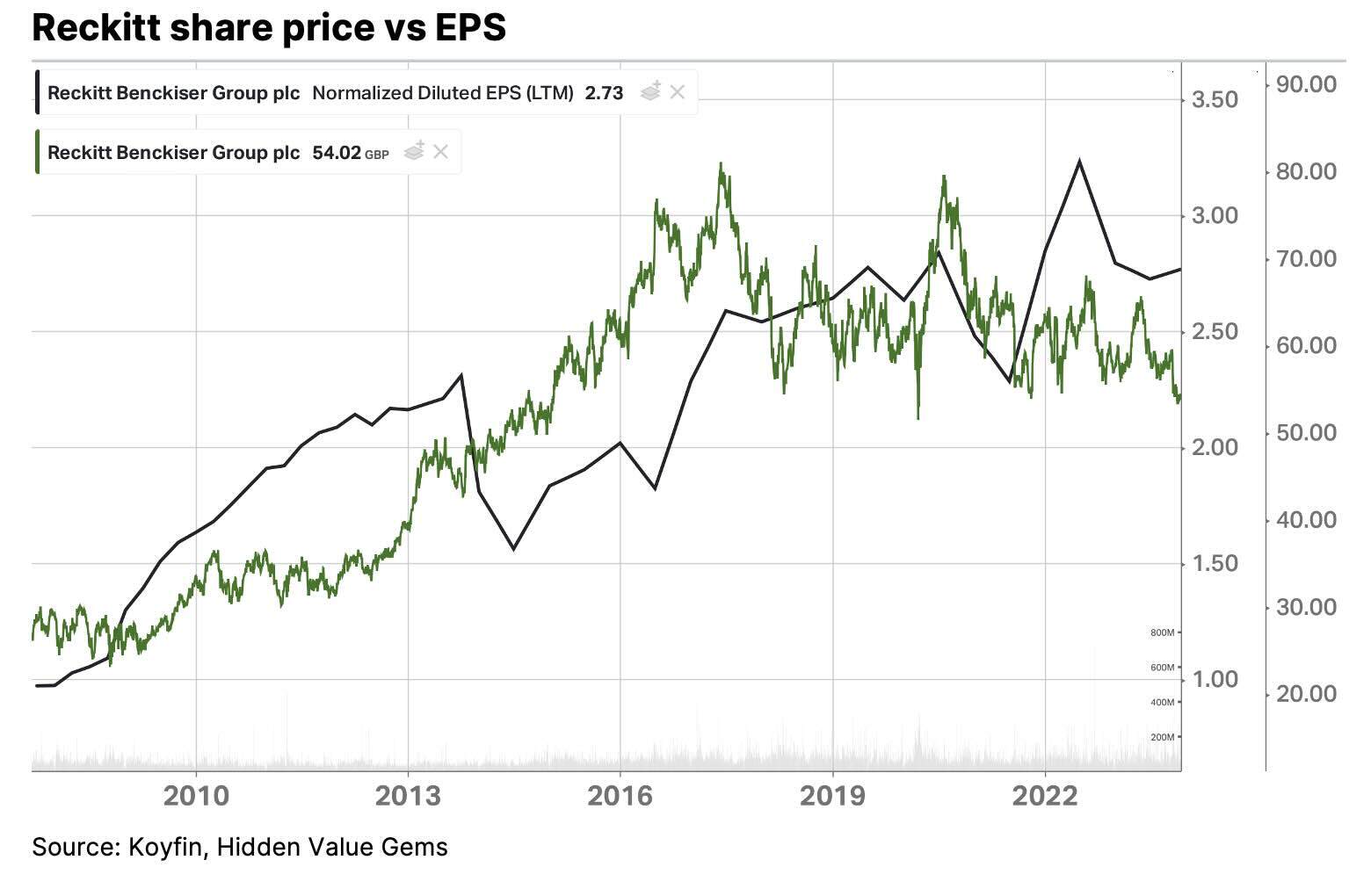

Reckitt’s stock is down 17% YTD and 42% since its 2020 peak.

Reckitt’s stock is down 17% YTD and 42% since its 2020 peak.

The company is facing three main issues, all of which are temporary.

A risk of a multi-billion liability

Firstly, on 13 March, a court in Illinois (US) instructed Reckitt to pay $60mn in damages to a mother whose child died after consuming one of Reckitt’s formulas for premature babies, Enfamil Premature 24. This has triggered concerns of a much larger liability as more than 450 cases have been filed with US courts in other states, and potentially, many more will be filed.

Analysts’ estimates of a potential liability range from £2bn to £7bn (6-22% of the company’s market cap). Management, on the other hand, is highly confident that the case has no legal base and that they can overturn the decision. Reckitt’s representatives point out that premature infants have a high risk of death unless they are breastfed, and baby formula improves their chances of survival but does not eliminate all the risks.

The judges could argue that Reckitt has not adequately flagged the risks of its products. The company, however, argues baby formula products were used under the supervision of doctors, who know the risks.

The legal process will likely be long and could last 1-2 years before the final liability is known unless the company agrees on the out-of-court settlement before that.

In the past, Reckitt agreed to pay up to $1.4bn to settle a long-running investigation into the sale and marketing of an opioid addiction treatment by its former subsidiary Indivior.

Whatever the outcome, the Nutrition segment accounts for 16.5% of group sales and even less for operating profits as it is a lower-margin product compared to other brands in Reckitt’s portfolio. With its two core brands (Enfamil and Nutramigen), the US contributes c. 50% to the segment’s sales.

Reckitt entered the Nutrition business in 2017 when it acquired US Mead Johnson for $18bn. It wrote down some of the value in 2020, and in 2022, the media reported that the company was looking to sell the business.

If the sale is not feasible today, the company could spin off the business to isolate the risks and financial impact.

Reckitt’s two other segments (Health and Hygiene) generate £12bn in sales and £2.9bn in operating profits (24% margin). At 15x EV/EBIT (similar to peer multiple), this business could be worth £43.5bn or £36.2bn, excluding £7.3bn net debt. This is still more than Reckitt’s current market cap of £32bn.

Interestingly, the company’s share price drop this year (-17%) erased £6.6bn of market value, which is close to the high end of the potential liability (£2-7bn). In other words, the market may have been quick to price these risks already.

Analysts’ estimates of a potential liability range from £2bn to £7bn (6-22% of the company’s market cap). Management, on the other hand, is highly confident that the case has no legal base and that they can overturn the decision. Reckitt’s representatives point out that premature infants have a high risk of death unless they are breastfed, and baby formula improves their chances of survival but does not eliminate all the risks.

The judges could argue that Reckitt has not adequately flagged the risks of its products. The company, however, argues baby formula products were used under the supervision of doctors, who know the risks.

The legal process will likely be long and could last 1-2 years before the final liability is known unless the company agrees on the out-of-court settlement before that.

In the past, Reckitt agreed to pay up to $1.4bn to settle a long-running investigation into the sale and marketing of an opioid addiction treatment by its former subsidiary Indivior.

Whatever the outcome, the Nutrition segment accounts for 16.5% of group sales and even less for operating profits as it is a lower-margin product compared to other brands in Reckitt’s portfolio. With its two core brands (Enfamil and Nutramigen), the US contributes c. 50% to the segment’s sales.

Reckitt entered the Nutrition business in 2017 when it acquired US Mead Johnson for $18bn. It wrote down some of the value in 2020, and in 2022, the media reported that the company was looking to sell the business.

If the sale is not feasible today, the company could spin off the business to isolate the risks and financial impact.

Reckitt’s two other segments (Health and Hygiene) generate £12bn in sales and £2.9bn in operating profits (24% margin). At 15x EV/EBIT (similar to peer multiple), this business could be worth £43.5bn or £36.2bn, excluding £7.3bn net debt. This is still more than Reckitt’s current market cap of £32bn.

Interestingly, the company’s share price drop this year (-17%) erased £6.6bn of market value, which is close to the high end of the potential liability (£2-7bn). In other words, the market may have been quick to price these risks already.

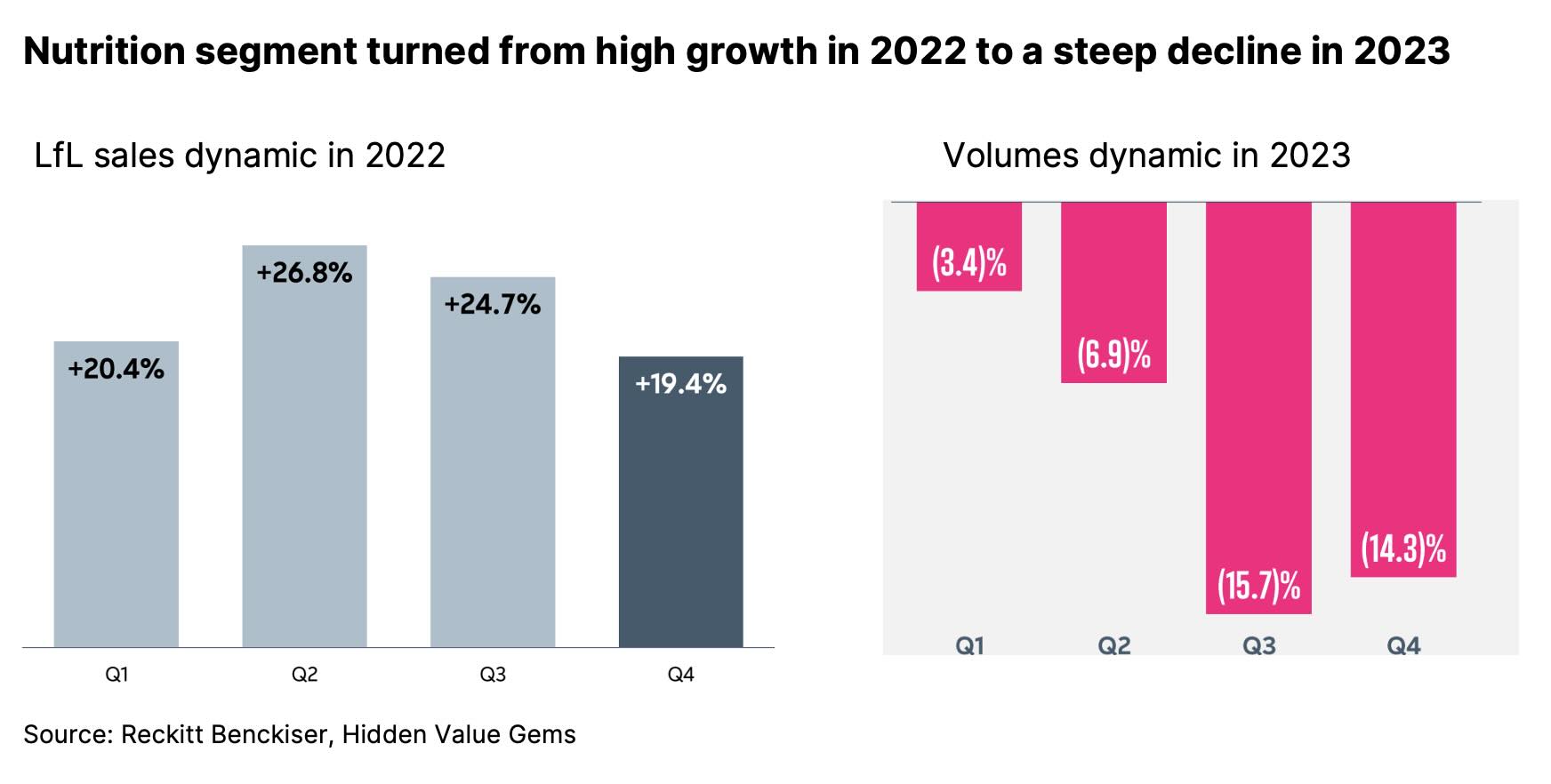

High base effects in Nutrition and Hygiene

Reckitt benefitted from the problems at its competitor, Abbott Laboratories, which had to temporarily close its plant in 2022 following reports of bacterial infections in babies. The shortage of baby formula products boosted Reckitt’s sales in the US during 2022, setting a high bar for future sales dynamics. Consequently, as Abbott restarted its factory in 2023, Reckitt’s volumes adjusted to reflect its usual market share of 40% (vs 45% in 2022).

Despite this recent drop in sales, Reckitt’s Nutrition brands are still the most popular in the US with the highest market share.

A similar situation has been with the Hygiene segment, which got a boost from extraordinary demand during the COVID pandemic in 2020-21 and then saw a subsequent decline in sales.

A similar situation has been with the Hygiene segment, which got a boost from extraordinary demand during the COVID pandemic in 2020-21 and then saw a subsequent decline in sales.

Accounting issues in the Middle Eastern operations

In its 2023 results announcement, Reckitt also disclosed that it had identified an understatement of trade spend in two Middle Eastern markets related to the fourth quarter and prior quarters of 2023. This has translated into a £55m reduction in Reckitt's full-year revenue and £35mn hit to the operating profit.

The company has carried out its own investigation and identified a small group of employees who had acted inappropriately. The company insists that this is an isolated incident specific to these two markets and has no implication for its 2024 or medium-term performance.

I probably agree in terms of direct financial impact in the future, but this incident is a sign of a weak culture in the company. It is more likely that other offices might have some issues, too, which is quite worrying.

As Warren Buffett says, “there's never just one cockroach in the kitchen”.

The company has carried out its own investigation and identified a small group of employees who had acted inappropriately. The company insists that this is an isolated incident specific to these two markets and has no implication for its 2024 or medium-term performance.

I probably agree in terms of direct financial impact in the future, but this incident is a sign of a weak culture in the company. It is more likely that other offices might have some issues, too, which is quite worrying.

As Warren Buffett says, “there's never just one cockroach in the kitchen”.

High management turnover

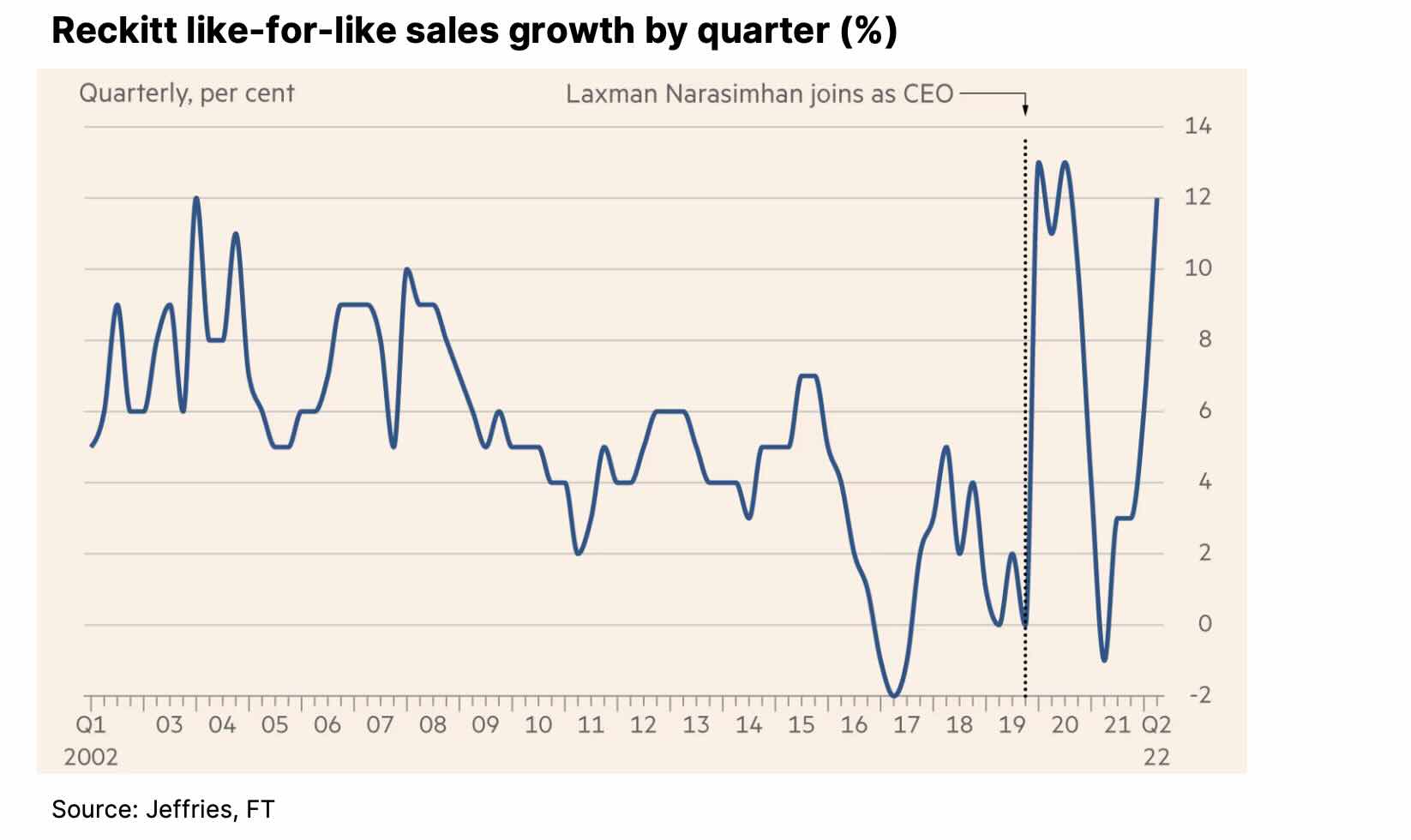

Over the past three years, the company had three CEOs and two CFOs. In 2019, Laxman Narasimhan succeeded Rakesh Kapoor as the CEO of Reckitt. Both executives had previously held senior roles at Pepsico. However, in 2022, Narasimhan announced his resignation for personal reasons, and shortly after, Starbucks announced that he would replace Howard Shultz as the new CEO of the company. Nicandro Durante became an interim CEO of Reckitt until Kris Licht (also a former Pepsico executive) replaced him in October 2023.

All these factors negatively impacted market confidence in the company and its future performance. However, if we zoom out, the business looks much better and should be able to recover from recent weaknesses, supported by its leading market positions and exceptional economics.

All these factors negatively impacted market confidence in the company and its future performance. However, if we zoom out, the business looks much better and should be able to recover from recent weaknesses, supported by its leading market positions and exceptional economics.

Big picture - still a solid business

While the company’s growth trajectory has indeed decelerated, it still remains a leading business in global categories with structural growth. Reckitt sells its products in over 100 countries.

If one reads the latest comments about the company, the impression they will get is that Reckitt’s business is under severe pressure with a bleak outlook. Indeed, company’s organic growth rate has decelerated from 8-10% in 2000s to low-single digit today as the effect from the EM consumer has faded.

If one reads the latest comments about the company, the impression they will get is that Reckitt’s business is under severe pressure with a bleak outlook. Indeed, company’s organic growth rate has decelerated from 8-10% in 2000s to low-single digit today as the effect from the EM consumer has faded.

However, most categories still have above-average growth potential. For example, only 13% of households own a dishwasher in markets where Reckitt operates (it sells a leading brand Finish for dishwashers). Only 20% of people use laundry additives such as strain removal. Other categories have similar levels of under-penetration (e.g. half of first-time sex happens without condoms).

Today, 70% of Reckitt’s revenue comes from brands that are #1 or #2 in their respective categories.

Today, 70% of Reckitt’s revenue comes from brands that are #1 or #2 in their respective categories.

Some of its brands have been on the market since the 19th century.

Source: Reckitt Benckiser

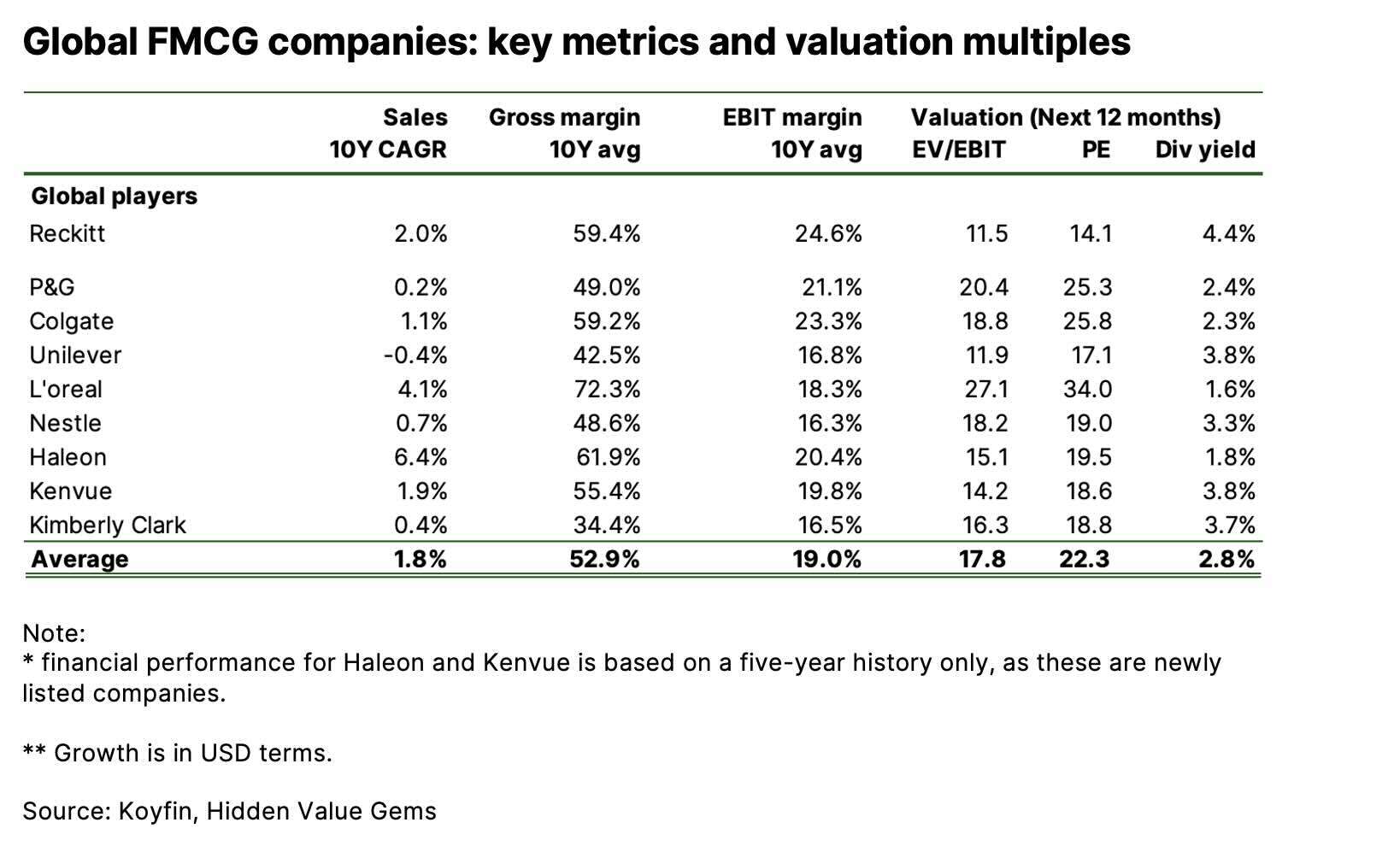

Above-average returns, but trading at a discount

Reckitt has historically earned higher margins and grown faster than its peers. Its 10-year gross margin is 59.4%, compared to the peer average of 52.0%. Reckitt's operating margin is 24.6%, higher than the 18.4% average operating margin for the peer group.

In terms of top-line growth, Reckitt's performance looks similar to peers (2.0% vs 1.9%). However, this is mainly due to a positive impact from Haleon, which has only a 5-year history as a public company and L'oreal, which benefited from higher exposure to the beauty segment.

More direct peers, like P&G and Unilever, have barely grown for the past ten years.

Despite this superior performance, Reckitt is trading at just 11.5x forward EV/EBIT and 14.1x P/E, based on consensus estimates. This is about a 33% discount compared to its peers, trading at 17.0x and 21.4x multiples, respectively.

In terms of top-line growth, Reckitt's performance looks similar to peers (2.0% vs 1.9%). However, this is mainly due to a positive impact from Haleon, which has only a 5-year history as a public company and L'oreal, which benefited from higher exposure to the beauty segment.

More direct peers, like P&G and Unilever, have barely grown for the past ten years.

Despite this superior performance, Reckitt is trading at just 11.5x forward EV/EBIT and 14.1x P/E, based on consensus estimates. This is about a 33% discount compared to its peers, trading at 17.0x and 21.4x multiples, respectively.

Potential upside and risks

If things normalise, I see Reckitt delivering over 60% of returns for shareholders in the next two years. The company is targeting a 2-4% organic sales growth rate and a higher growth rate for operating earnings. There will be higher interest expenses (£310mn in 2024 vs £247mn in 2023). There is an ongoing £1bn buyback programme launched in October 2023 that will be completed by July 2024, which will likely be replaced by a new one. The current programme accounts for almost 3% of the market cap.

All-in-all, I see Reckitt earning an EPS of c. 357p in 2025 which is equivalent to a 5% annual growth rate (2023 EPS was 323.4p). Consensus estimates for 2025 are 2.8% lower at 347p (for 2026, consensus expects an EPS of 378p).

If the company can put its recent problems behind and the market regains confidence in the business, there is no reason why Reckitt should not re-rate to a peer average level of 20x P/E. This would be in line with historical valuation and would reflect its quality business model with structural growth and high returns on capital (20% ROE).

Adding c. 200p annual dividends (400p for two years) to a potential price of 7,140p (357p EPS x 20 P/E) translates into a total price of 7,540, which is 67% higher than the latest price of 4,510p.

In a more conservative scenario, assuming the stock does not re-rate, Reckitt should be generating c. 7-8% annual return, which is a combination of 4% dividend yield +3-4% earnings growth (top-line + share count reduction).

In the downside scenario, the company may face up to £7bn liability related to its its baby formula sales in the US, weaker margins and growth for various reasons. This would probably translate into c. 10-20% downside, although this is just a guess. The stock is already down 17% this year and 42% from its 2020 peak, so a lot of negative expectations should have been priced in already.

The next company could be even more interesting. It is an emerging market player in a similar category, operating in 18 countries with leading positions in healthcare and personal care products. It is little-known and it does not have a US listing which partly explains its huge discount to global peers. It is trading at just 5.0x EV/EBIT and 7.2x PE (based on consensus 2024 estimates). However, investors do not need to wait until the market discovers this opportunity and its shares re-rate. Management owns more than 30% of the company and want to see a higher share price, so the company has launched a buyback programme. The company has reduced its share count by 5% over the past two years and will likely repurchase more shares in the future.

All-in-all, I see Reckitt earning an EPS of c. 357p in 2025 which is equivalent to a 5% annual growth rate (2023 EPS was 323.4p). Consensus estimates for 2025 are 2.8% lower at 347p (for 2026, consensus expects an EPS of 378p).

If the company can put its recent problems behind and the market regains confidence in the business, there is no reason why Reckitt should not re-rate to a peer average level of 20x P/E. This would be in line with historical valuation and would reflect its quality business model with structural growth and high returns on capital (20% ROE).

Adding c. 200p annual dividends (400p for two years) to a potential price of 7,140p (357p EPS x 20 P/E) translates into a total price of 7,540, which is 67% higher than the latest price of 4,510p.

In a more conservative scenario, assuming the stock does not re-rate, Reckitt should be generating c. 7-8% annual return, which is a combination of 4% dividend yield +3-4% earnings growth (top-line + share count reduction).

In the downside scenario, the company may face up to £7bn liability related to its its baby formula sales in the US, weaker margins and growth for various reasons. This would probably translate into c. 10-20% downside, although this is just a guess. The stock is already down 17% this year and 42% from its 2020 peak, so a lot of negative expectations should have been priced in already.

The next company could be even more interesting. It is an emerging market player in a similar category, operating in 18 countries with leading positions in healthcare and personal care products. It is little-known and it does not have a US listing which partly explains its huge discount to global peers. It is trading at just 5.0x EV/EBIT and 7.2x PE (based on consensus 2024 estimates). However, investors do not need to wait until the market discovers this opportunity and its shares re-rate. Management owns more than 30% of the company and want to see a higher share price, so the company has launched a buyback programme. The company has reduced its share count by 5% over the past two years and will likely repurchase more shares in the future.