10 December 2023

Exor management hosted an annual Investor Day on 30 November 2023.

My main takeaway is that the market continues to focus on the short-term and does not look at Exor as a compounder that can run for many decades ahead.

Granted, none of us (not even John Elkann) can be 100% certain that Exor will repeat the success of Berkshire Hathaway, growing their book value per share at 20% annually so that $1,000 invested in Berkshire 1965 would rise to c. $30,000,000 by 2023.

But if the market is not pricing this scenario, then the potential upside is tremendous.

I have listened to each recording of the Berkshire meeting since 1994 more than once (including the two I have physically attended). Back in the 1990s, most questions were very detailed and often focused on a particular transaction that had happened in the previous 12 months. Gradually, investors started to ask broader questions (sometimes too broad).

I see a similar pattern at Exor. Most questions investors have been asking (at least at public events) were around specific deals. Many of the questions at the latest event were about the valuation discount and potential steps to unlock it.

As a shareholder of Exor, I also want the stock to go higher sooner. Even if I am not planning to sell it, it would create a nice feeling. But at the same time, it is much better if Exor makes a new value-accretive investment and supports existing companies in their value-creation.

The art of investing is to maintain confidence in management’s ability to create value, especially since the results of most actions become visible in the long run. If there is one lesson I have learnt from being a shareholder of Berkshire Hathaway, it is that 1000%+ returns generated over decades do not come from closing the valuation discount. Berkshire never looked cheap in the past 35 years at least.

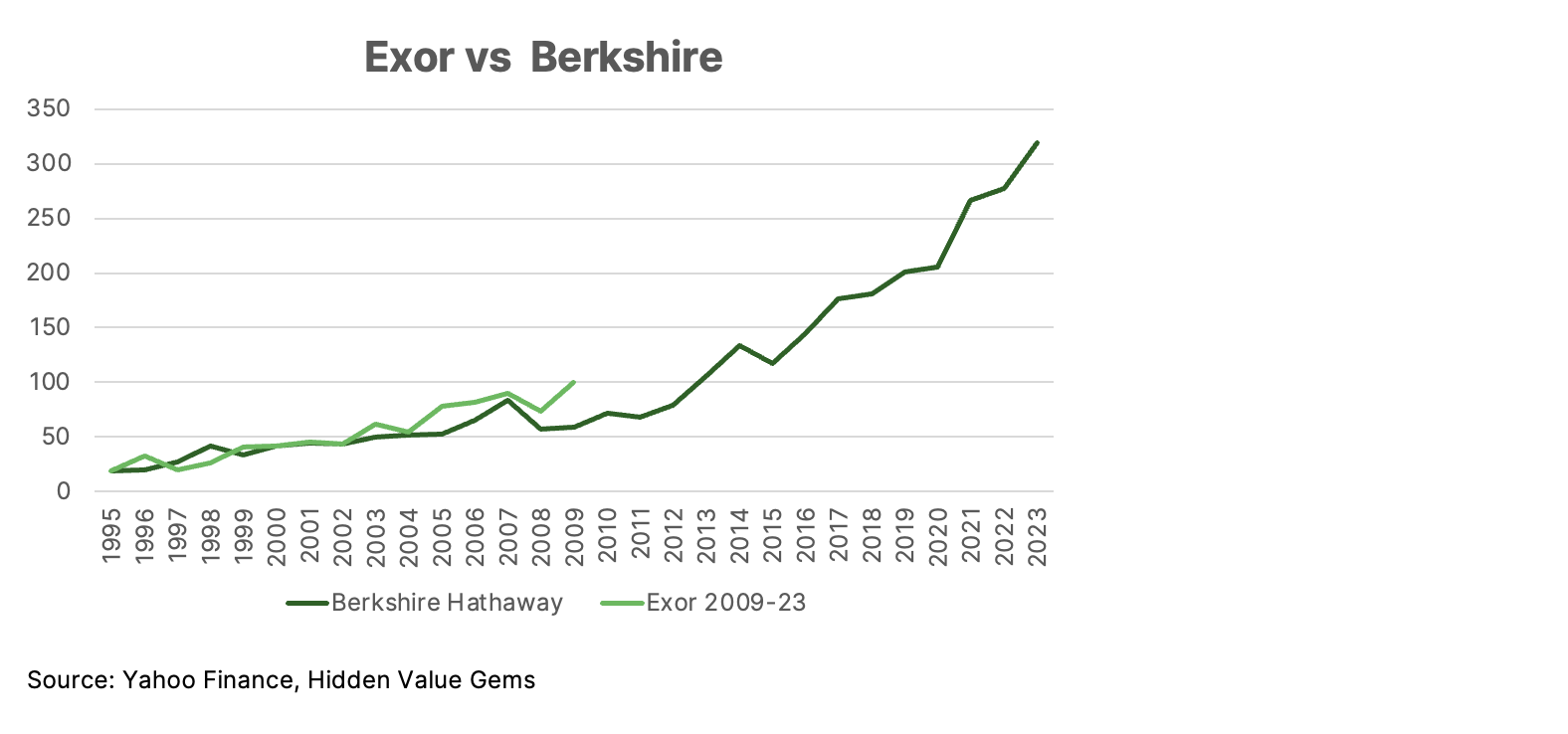

I have compared Exor's share price from 2009 to Berkshire from 1995. I initially wanted to use Berkshire's performance since 1980, but I then realised that its market cap was just $420mn, way too small compared to Exor.

My main takeaway is that the market continues to focus on the short-term and does not look at Exor as a compounder that can run for many decades ahead.

Granted, none of us (not even John Elkann) can be 100% certain that Exor will repeat the success of Berkshire Hathaway, growing their book value per share at 20% annually so that $1,000 invested in Berkshire 1965 would rise to c. $30,000,000 by 2023.

But if the market is not pricing this scenario, then the potential upside is tremendous.

I have listened to each recording of the Berkshire meeting since 1994 more than once (including the two I have physically attended). Back in the 1990s, most questions were very detailed and often focused on a particular transaction that had happened in the previous 12 months. Gradually, investors started to ask broader questions (sometimes too broad).

I see a similar pattern at Exor. Most questions investors have been asking (at least at public events) were around specific deals. Many of the questions at the latest event were about the valuation discount and potential steps to unlock it.

As a shareholder of Exor, I also want the stock to go higher sooner. Even if I am not planning to sell it, it would create a nice feeling. But at the same time, it is much better if Exor makes a new value-accretive investment and supports existing companies in their value-creation.

The art of investing is to maintain confidence in management’s ability to create value, especially since the results of most actions become visible in the long run. If there is one lesson I have learnt from being a shareholder of Berkshire Hathaway, it is that 1000%+ returns generated over decades do not come from closing the valuation discount. Berkshire never looked cheap in the past 35 years at least.

I have compared Exor's share price from 2009 to Berkshire from 1995. I initially wanted to use Berkshire's performance since 1980, but I then realised that its market cap was just $420mn, way too small compared to Exor.

This is quite an encouraging chart, especially for Exor's shareholders.

I purchased my first Exor stock in 2020 after COVID. This position is now up over 100% and is the third largest in my portfolio.

Below are the key reasons for optimism as well as some areas of concern. You will also see my take on Games Workshop and Watches of Switzerland operating results and one small portfolio change that I made this week.

I purchased my first Exor stock in 2020 after COVID. This position is now up over 100% and is the third largest in my portfolio.

Below are the key reasons for optimism as well as some areas of concern. You will also see my take on Games Workshop and Watches of Switzerland operating results and one small portfolio change that I made this week.