25 February 2024

Why it is interesting

Share price: NOK 30.5 (VAR NO)

Shares outstanding: 2,496mn

Mkt Cap: $7,188mn

Net Debt: $4,534mn

EV: $11,721mn

Shares outstanding: 2,496mn

Mkt Cap: $7,188mn

Net Debt: $4,534mn

EV: $11,721mn

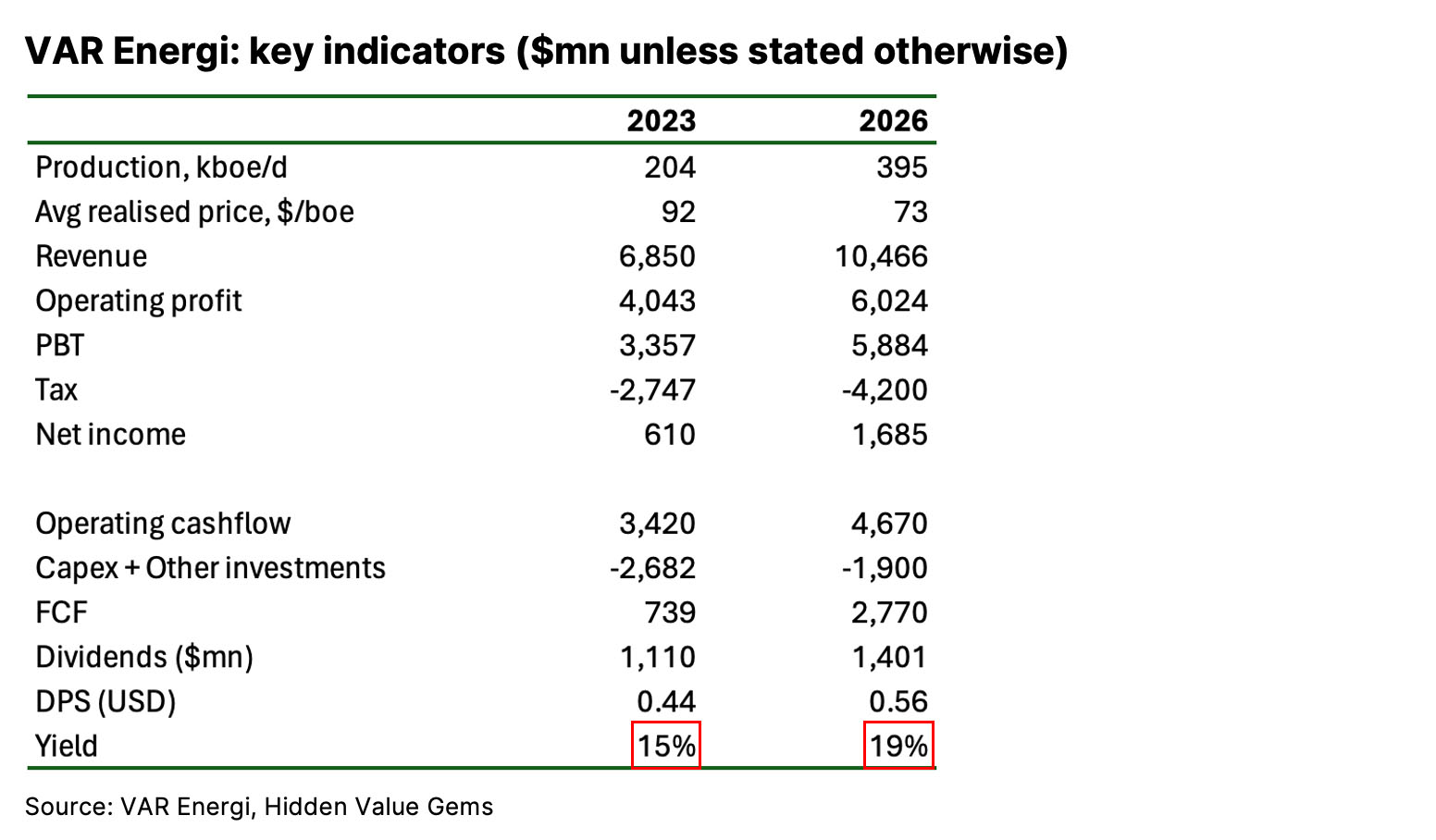

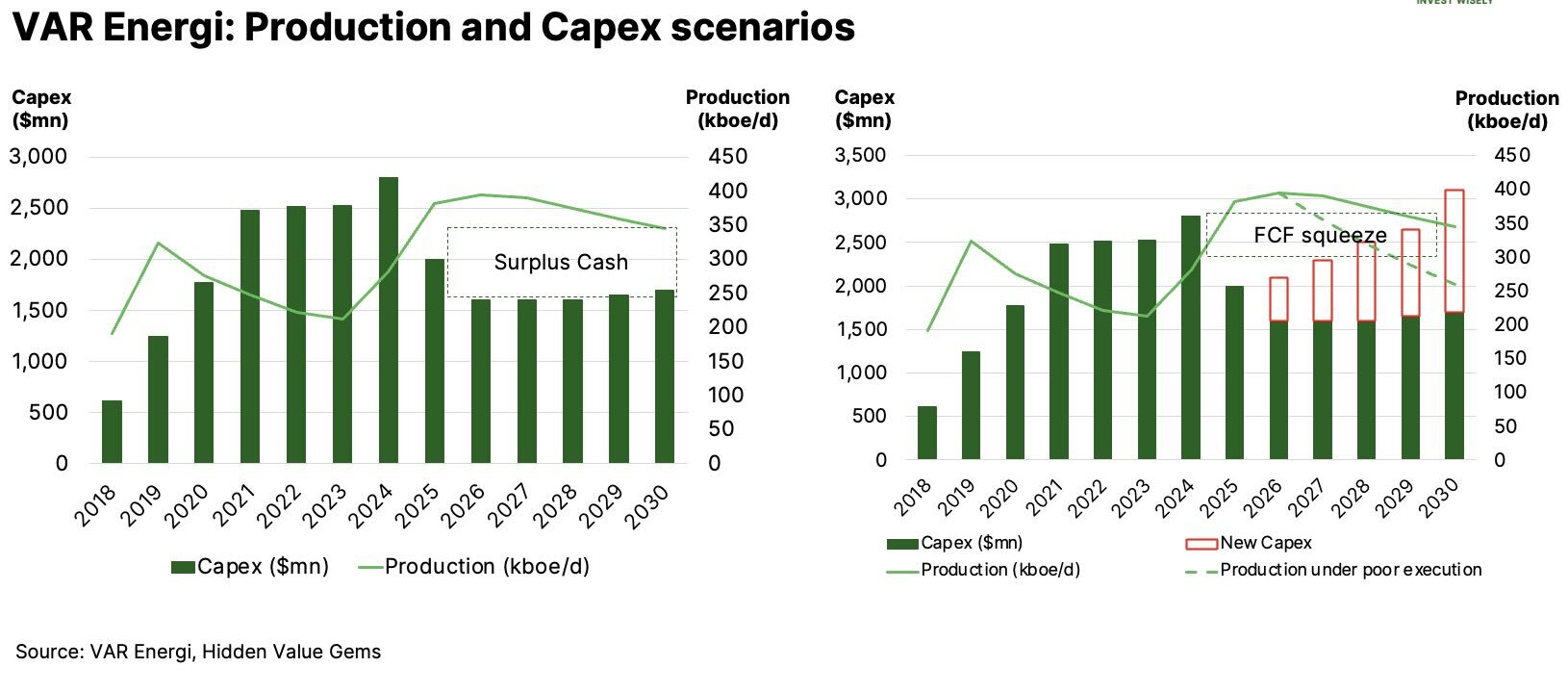

VAR Energi offers a 15% dividend yield and a two-year production growth of 100%. In the past three years, the company paid out $3.1bn in dividends, returning almost half of the current market cap back to shareholders. The company is at the peak of its investment cycle, having spent $2.6bn in both 2022 and 2023 and planning to spend $2.8bn this year.

From my experience, buying companies at the peak of their investment phase, just before a step change in FCF, often leads to quite attractive returns. If VAR achieves its production targets and the oil price remains at c. $80/bl, the company could generate c. 200% return, assuming an 8% dividend yield in 2026 (average peer yield). Shareholders will also receive a 15% dividend ‘coupon’ while waiting for the company’s new projects to be launched.

From my experience, buying companies at the peak of their investment phase, just before a step change in FCF, often leads to quite attractive returns. If VAR achieves its production targets and the oil price remains at c. $80/bl, the company could generate c. 200% return, assuming an 8% dividend yield in 2026 (average peer yield). Shareholders will also receive a 15% dividend ‘coupon’ while waiting for the company’s new projects to be launched.

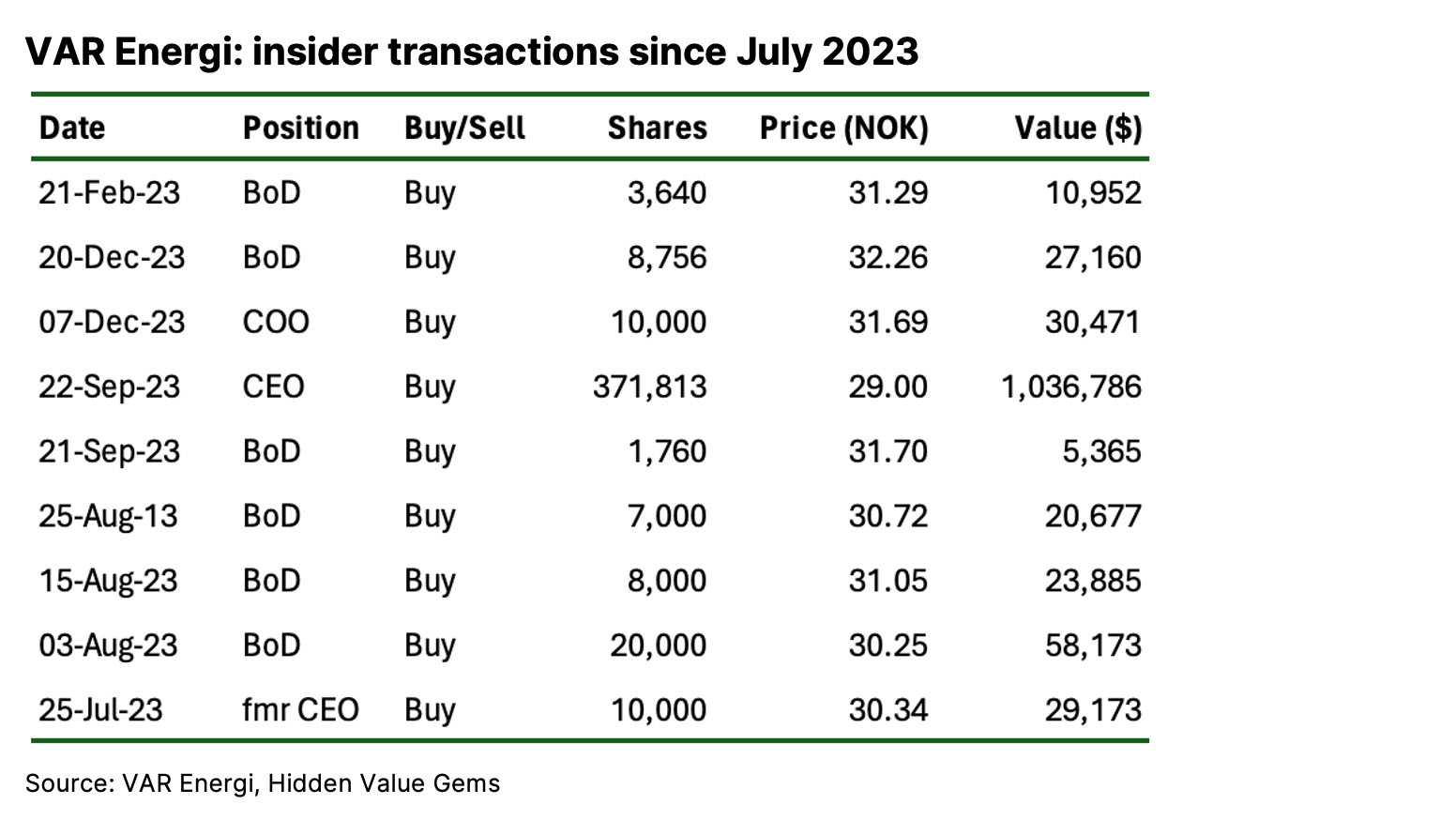

In addition to attractive valuation, VAR screens well on insider transactions. Since July 2023, insiders have purchased over $1.2mn worth of stock at c. NOK30 a share, close to the current spot price.

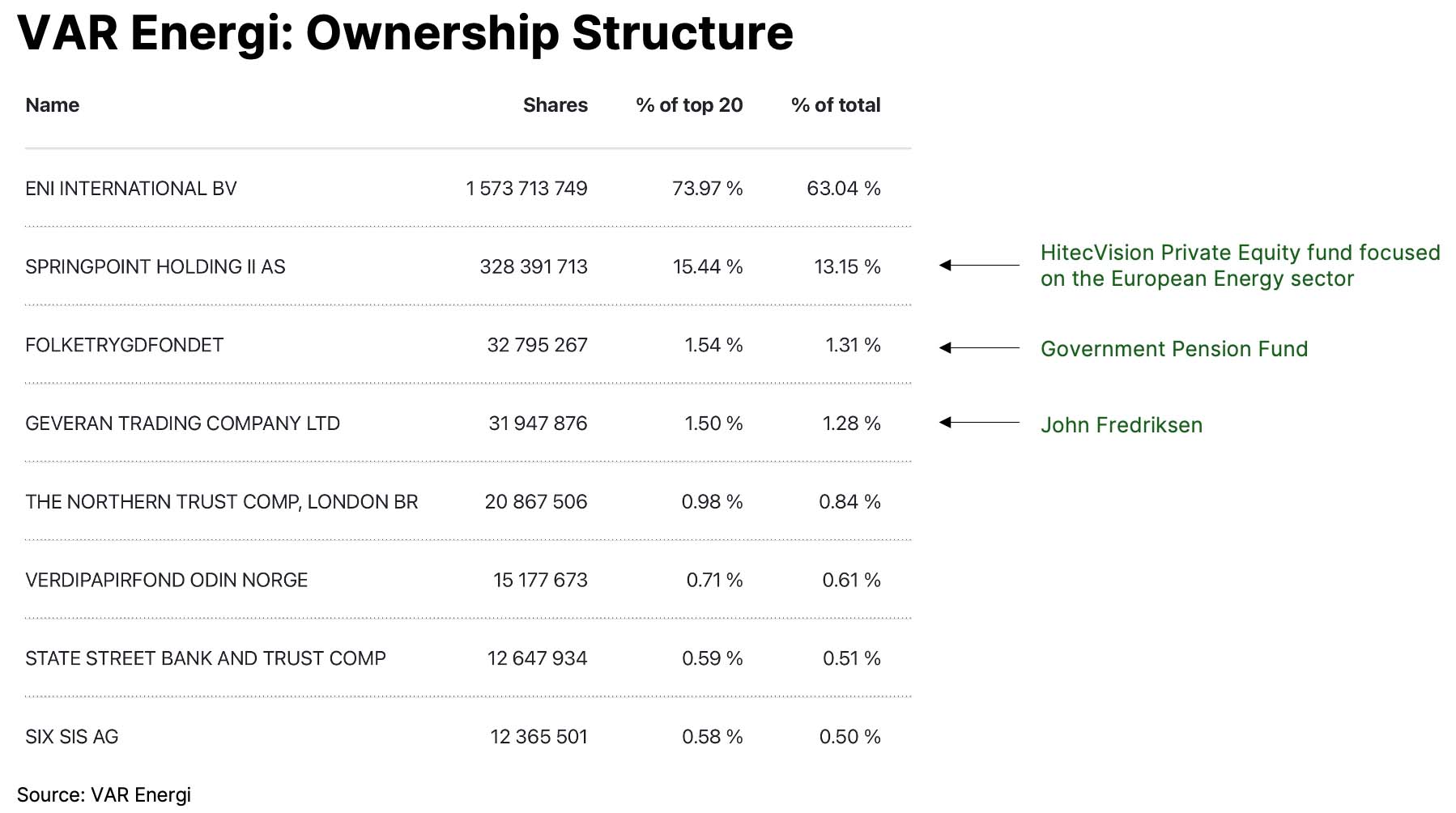

At the same time, the share price suffered from a share overhang as the second-largest shareholder (HitecVision) continued to sell its stake after the IPO, reducing it from 24% to 13%. The overhang risk is no longer present as HitecVision transferred its stake to a new entity which plans to hold the shares over the medium term.

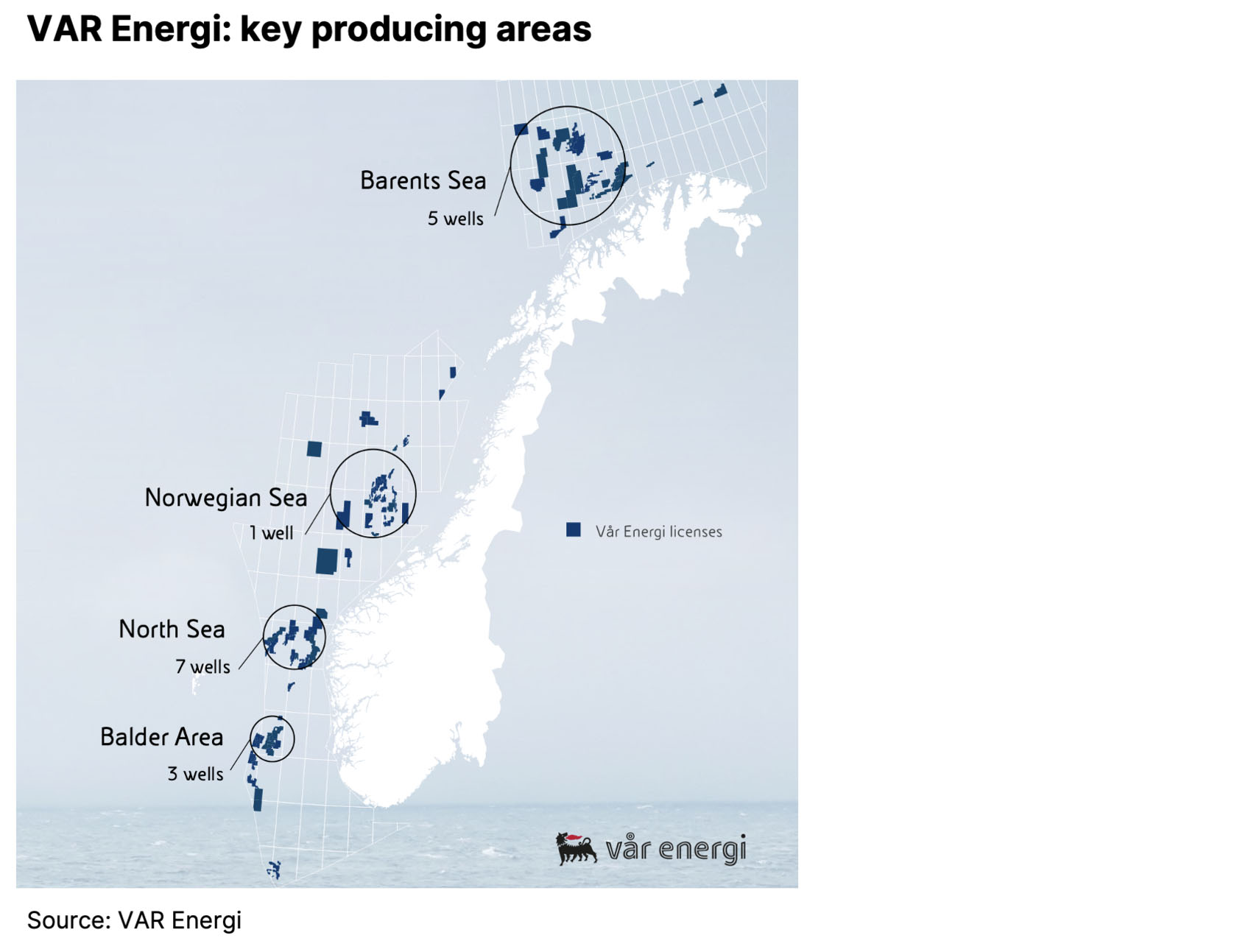

VAR operates in one country (Norway) and in one type of asset play (offshore oil fields) clustered around several production hubs. There is zero geopolitical risk and below-average operational risk.

Tell me more about it

Production and Reserves

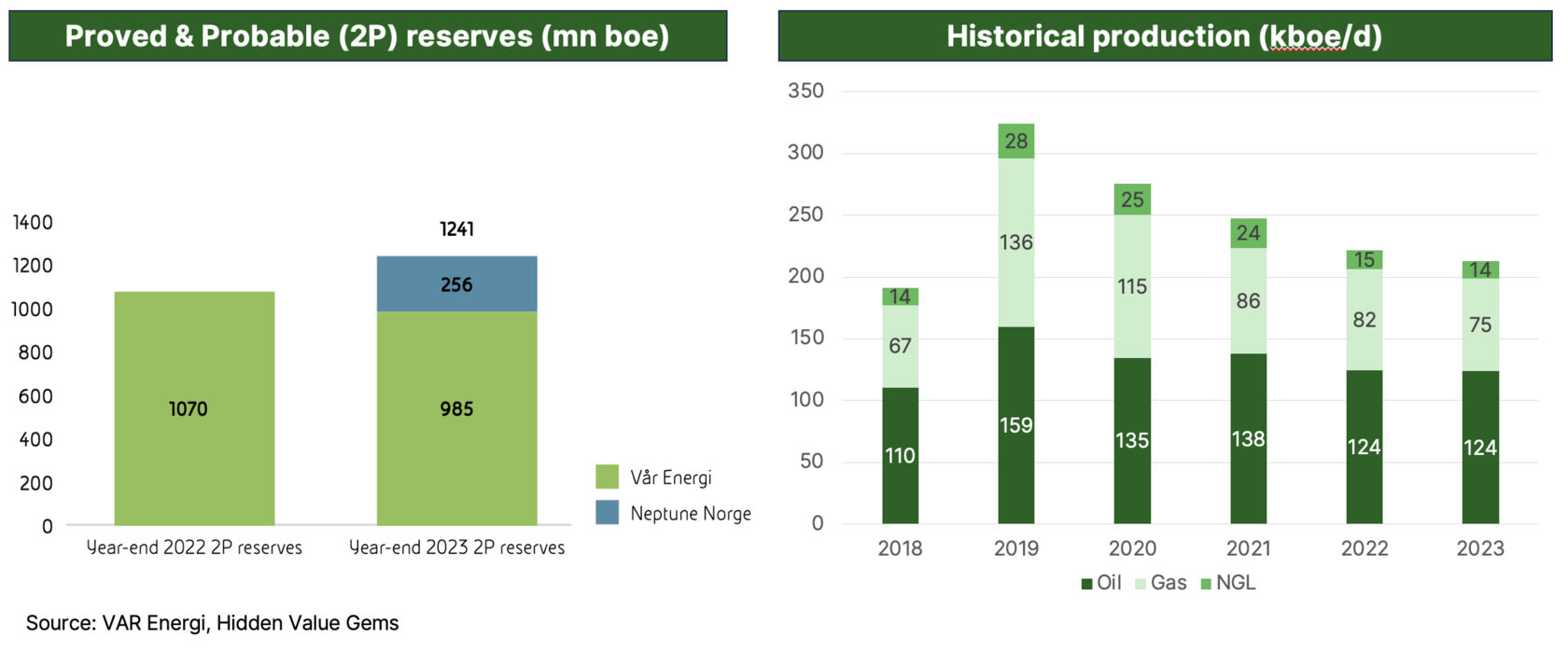

VAR Energi is a mid-sized player currently producing c. 300kboe/d of oil & gas (35% of production is gas). This is about 8% of what ExxonMobil is producing (3.8mboe/d) or 68% of Aker BP (the largest independent producer in the Norwegian shelf). VAR’s production is enough to meet the oil & gas demand of a large city like London.

Following the acquisition of Neptune Norway in January 2024, VAR’s proved & probable reserves reached 1.2bn boe (split 70/30 between oil and gas). At the current production rate, the company’s R/P ratio (reserves to production) stands at 11 years.

In addition to that, VAR holds 0.75bn boe of contingent resources (2C) that have similar geological certainty as 2P reserves but lack a concrete field development plan. VAR’s portfolio has an additional exploration upside from over 1bn boe of prospective resources that require additional studies and drilling to get more certainty.

VAR’s portfolio consists of 47 assets, of which only 7 are operated by the company (the rest are operated by Equinor, ConocoPhillips and others).

Following the acquisition of Neptune Norway in January 2024, VAR’s proved & probable reserves reached 1.2bn boe (split 70/30 between oil and gas). At the current production rate, the company’s R/P ratio (reserves to production) stands at 11 years.

In addition to that, VAR holds 0.75bn boe of contingent resources (2C) that have similar geological certainty as 2P reserves but lack a concrete field development plan. VAR’s portfolio has an additional exploration upside from over 1bn boe of prospective resources that require additional studies and drilling to get more certainty.

VAR’s portfolio consists of 47 assets, of which only 7 are operated by the company (the rest are operated by Equinor, ConocoPhillips and others).

Sources of Growth

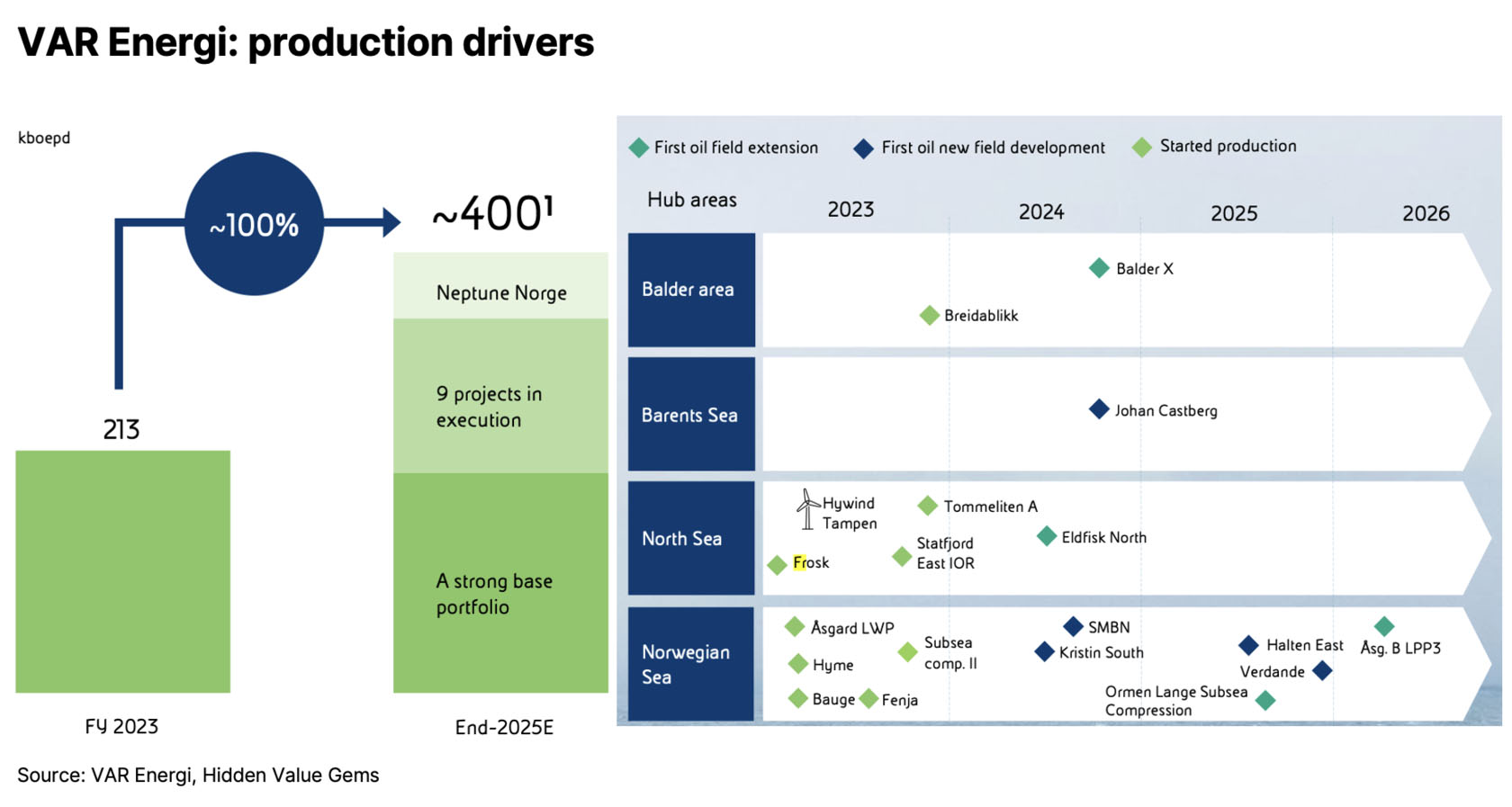

There are three main sources of growth of VAR Energi's cash flows and dividends.

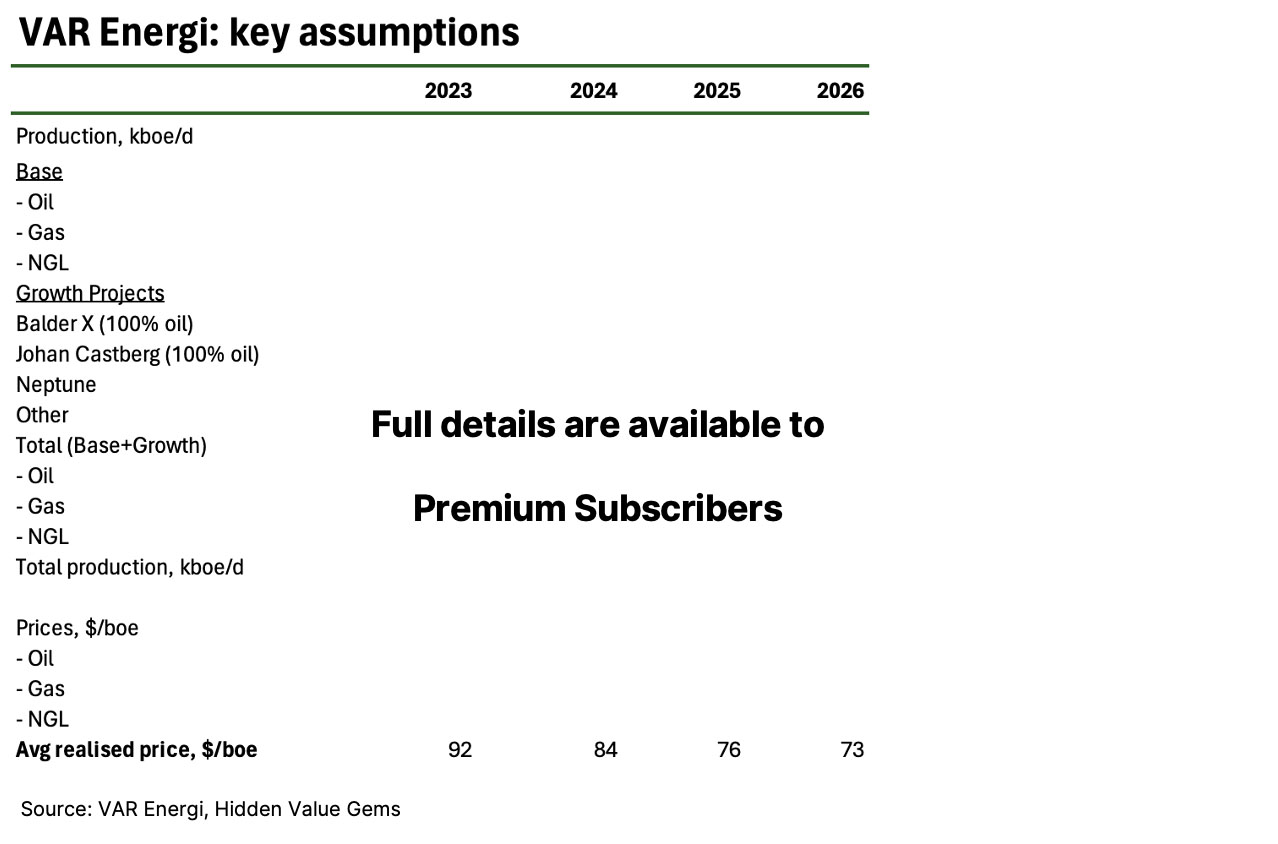

Firstly, a number of new projects have either been launched (e.g. Breidablikk) or are about to be launched. The two largest projects that will be launched this year are Balder X (peak output of 78kboe/d on a gross basis; VAR's share is 90%) and Johan Castberg (57kboe/d net peak capacity). There is a small risk that Balder X will be launched in 2025, but this should not impact 2026 production.

Secondly, VAR has just completed the acquisition of Neptune Norway for a net cash payment of $1.2bn. Neptune's current production of 65-70kboe/d will automatically boost VAR's output to c. 290kboe/d.

Thirdly, VAR should benefit from a reduced cost base as new projects have materially lower lifting costs ($5/boe) compared to VAR's current costs of c. $14/boe. Management targets $8/boe costs by 2026.

Some of the growth is offset by declining base production (c. 5-10%), potential disposals of smaller assets planned by management, inflation and reduced realised gas prices. The company benefited from higher fixed prices for its gas which it forward sold in a period of strong prices. In 2023, for example, VAR's average realised gas price was 33% above spot.

Firstly, a number of new projects have either been launched (e.g. Breidablikk) or are about to be launched. The two largest projects that will be launched this year are Balder X (peak output of 78kboe/d on a gross basis; VAR's share is 90%) and Johan Castberg (57kboe/d net peak capacity). There is a small risk that Balder X will be launched in 2025, but this should not impact 2026 production.

Secondly, VAR has just completed the acquisition of Neptune Norway for a net cash payment of $1.2bn. Neptune's current production of 65-70kboe/d will automatically boost VAR's output to c. 290kboe/d.

Thirdly, VAR should benefit from a reduced cost base as new projects have materially lower lifting costs ($5/boe) compared to VAR's current costs of c. $14/boe. Management targets $8/boe costs by 2026.

Some of the growth is offset by declining base production (c. 5-10%), potential disposals of smaller assets planned by management, inflation and reduced realised gas prices. The company benefited from higher fixed prices for its gas which it forward sold in a period of strong prices. In 2023, for example, VAR's average realised gas price was 33% above spot.

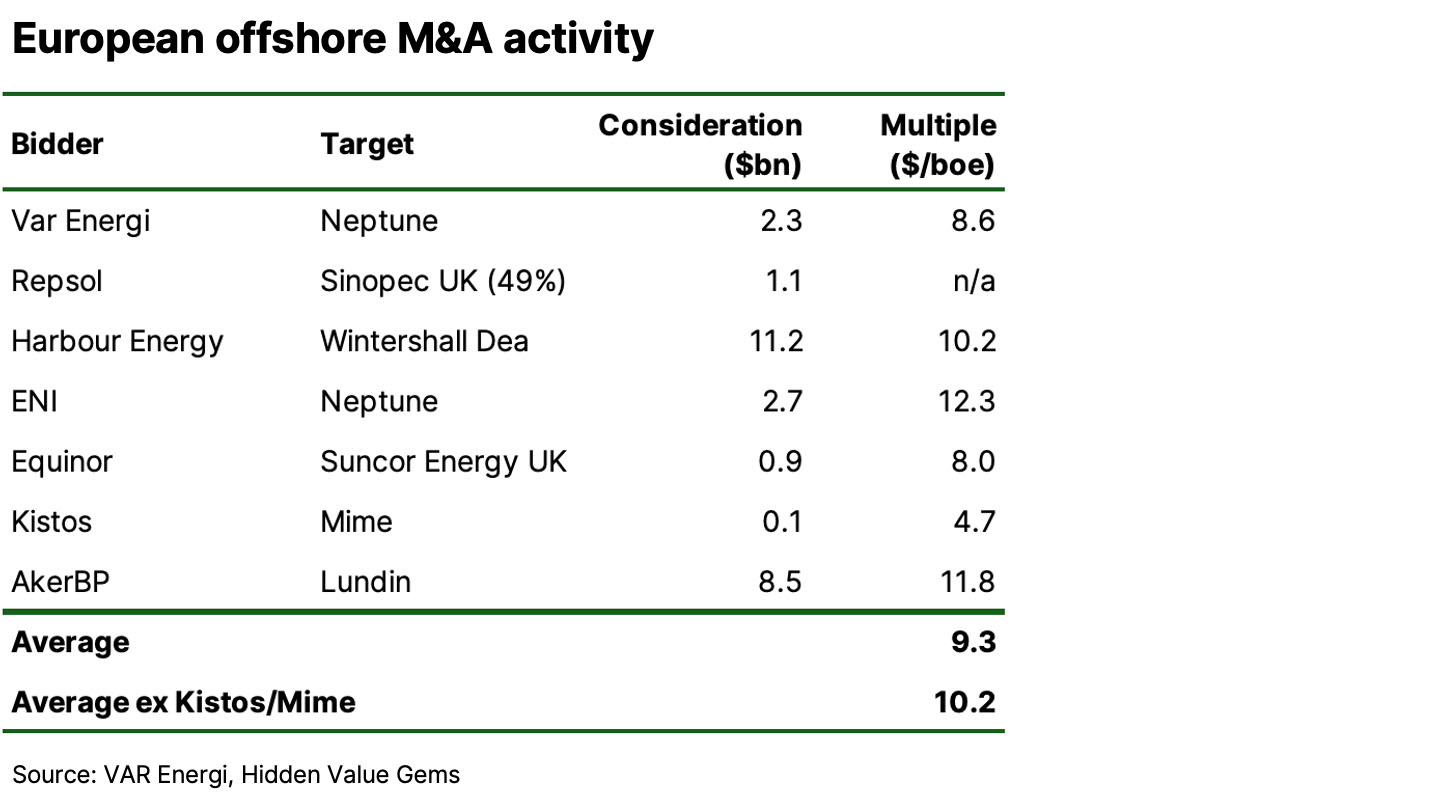

The sector has witnessed more consolidation as many companies are valued by the financial markets below the replacement cost of their reserves. M&A represents an additional source of value creation for VAR as it can either boost its reserves in a cost-efficient way (e.g., Neptune acquisition) or highgrade its portfolio by selling non-core assets. Here are the recent transactions in the European offshore sector.

Background, Shareholders and Management

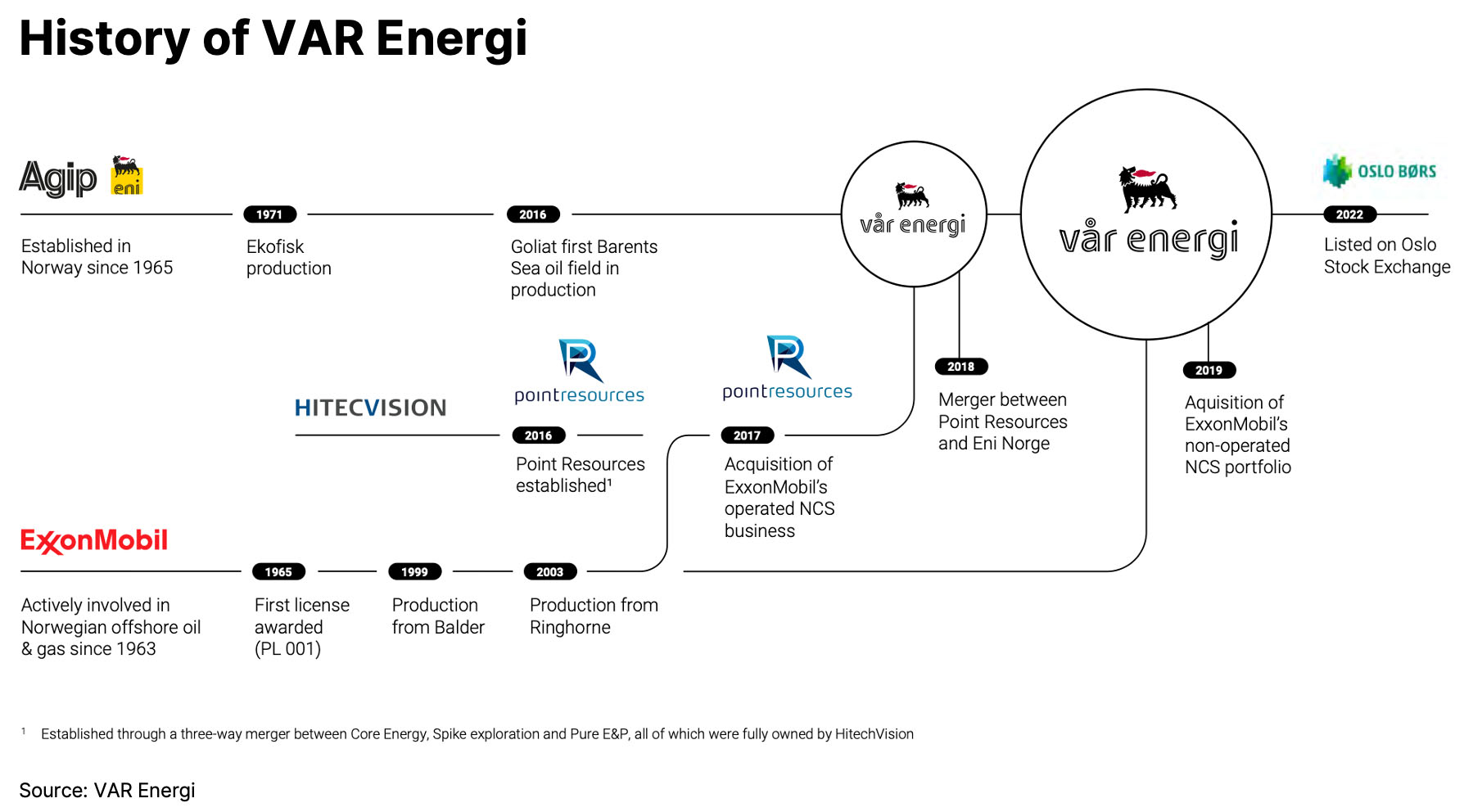

Vår Energi was established in December 2018 through the merger of Eni Norge AS and Point Resources AS, building on a legacy of more than 50 years of successful operation and exploration activity on the NCS. Eni Norge AS was founded in 1965, while Point Resources AS was created through the merger of the HitecVision portfolio companies in 2015, which then acquired the Norwegian operated upstream assets of ExxonMobil in 2017.

In December 2019, Vår Energi completed an agreement with ExxonMobil to acquire its partner-operated upstream assets in Norway.

In February 2022, the company was listed on the Oslo stock exchange at NOK 28 price.

In December 2019, Vår Energi completed an agreement with ExxonMobil to acquire its partner-operated upstream assets in Norway.

In February 2022, the company was listed on the Oslo stock exchange at NOK 28 price.

ENI remains the largest shareholder, with a 63% stake, while HitecVision, a private equity fund, owns 13% and is the second largest shareholder.

In September 2023, VAR announced the appointment of Nick Walker as its new CEO. Nick has a great track record, having worked as the CEO of Lundin Petroleum until mid-2022 when it was sold to BP. Having a mining degree from Imperial College and a computer science degree from UCL, Nick has over 30 years of industry experience, including top positions at BP, Talisman Energy, Africa Oil and Vedanta-Cairn Oil & Gas. He owns 481,185 shares in VAR, including 371K shares, which he purchased during the share placement by HitecVision in September 2023 (just as he assumed the role of the CEO).

The previous CEO, Torger Rod, has become the COO of the company. He is also a shareholder and bought shares on the open market.

The previous CEO, Torger Rod, has become the COO of the company. He is also a shareholder and bought shares on the open market.

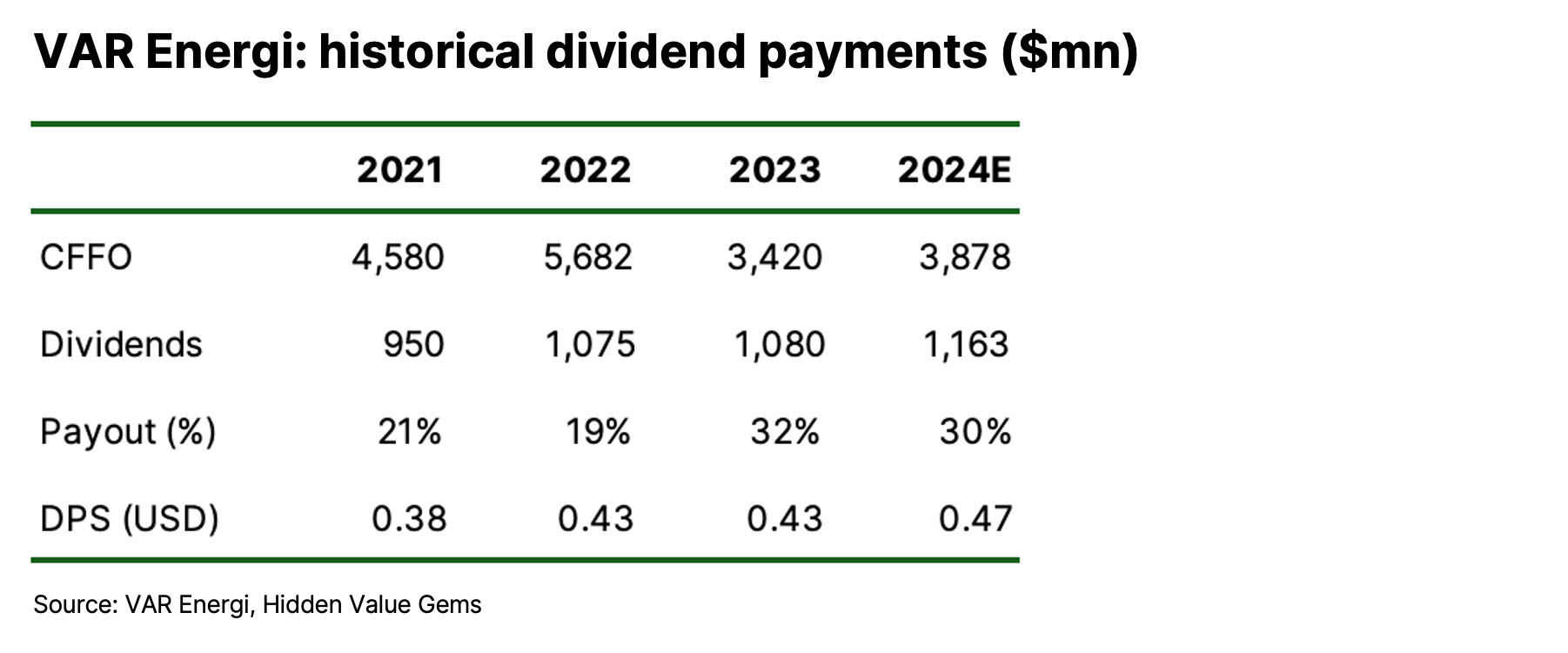

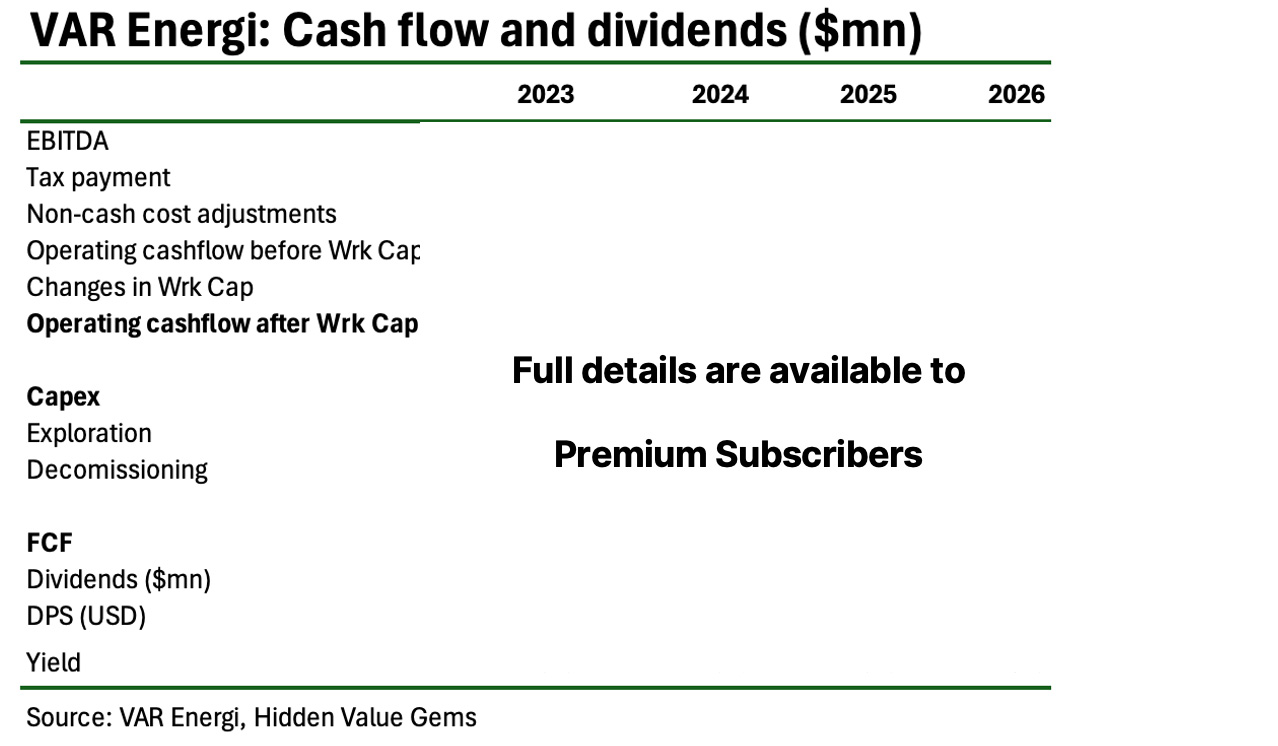

Dividend policy

The company pays quarterly dividends targeting a 20-30% payout ratio based on operating cash flow after tax (CFFO). This means that dividends do not depend on capital spending unless leverage reaches the critical level (currently at c. 0.5x Net Debt/EBITDA). The company targets 1.3x Net Debt/EBITDA over the cycle.

The company returned $3.1bn of cash to shareholders via dividends in the past three years, which represents almost half of the current market cap.

The company returned $3.1bn of cash to shareholders via dividends in the past three years, which represents almost half of the current market cap.

Valuation

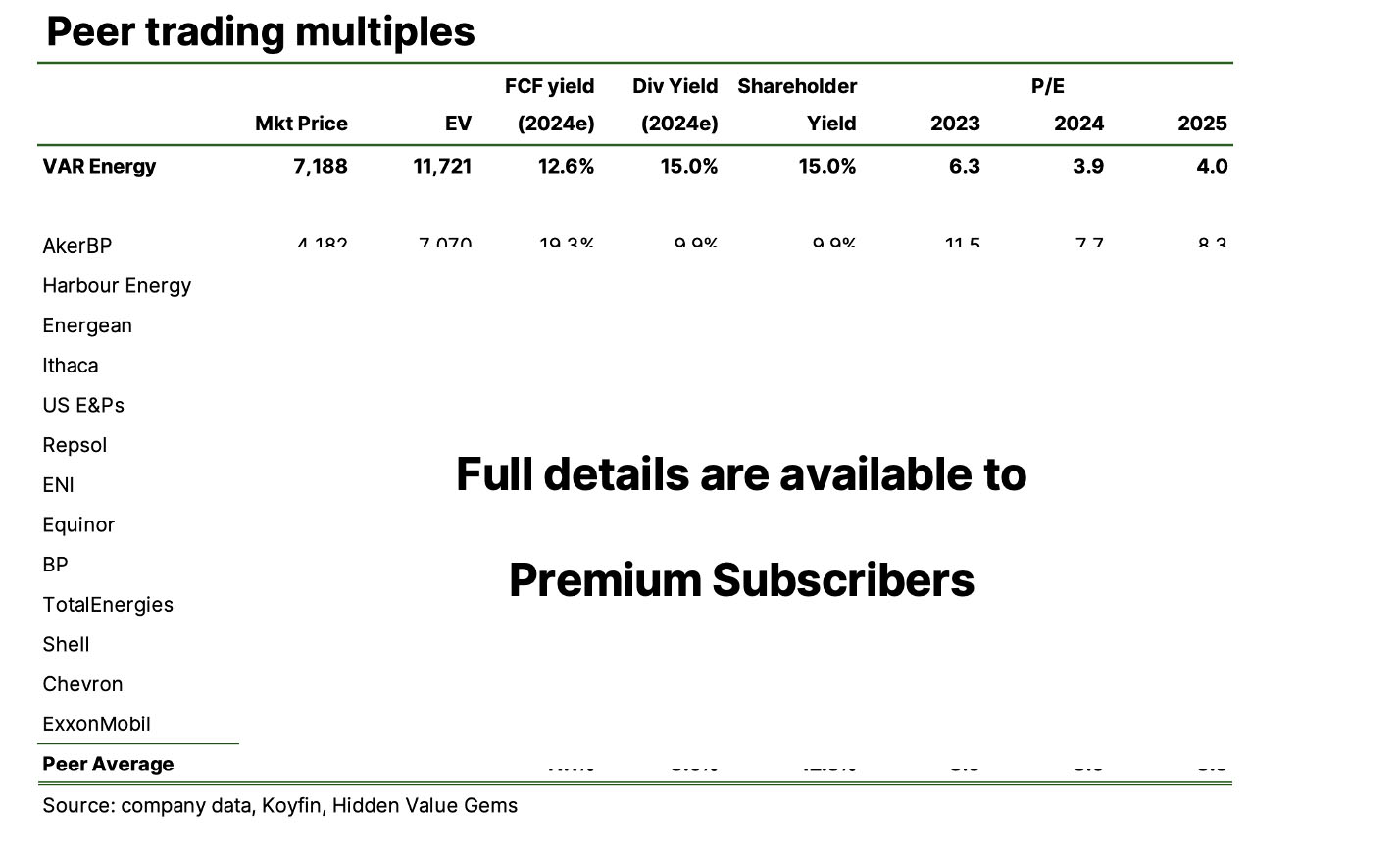

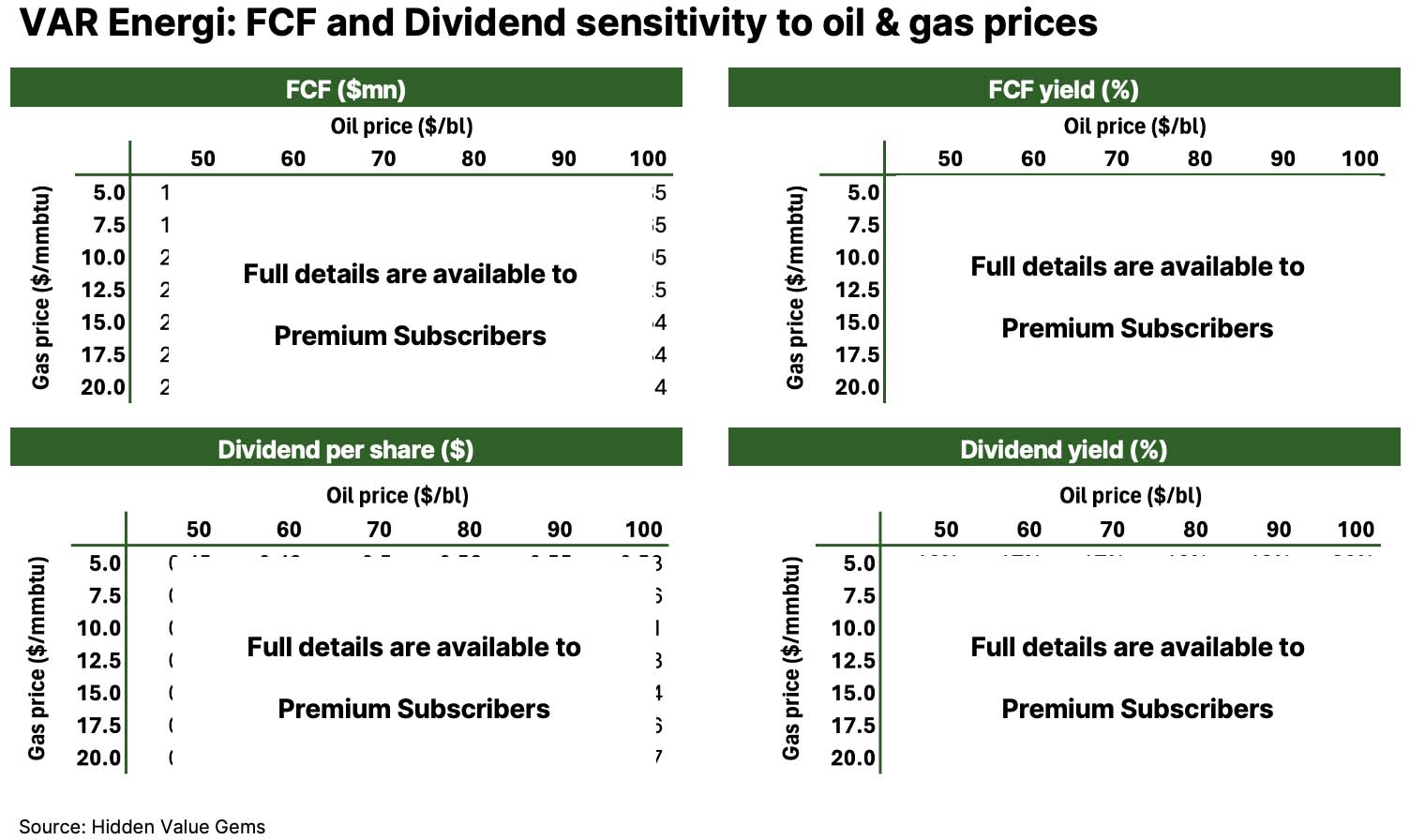

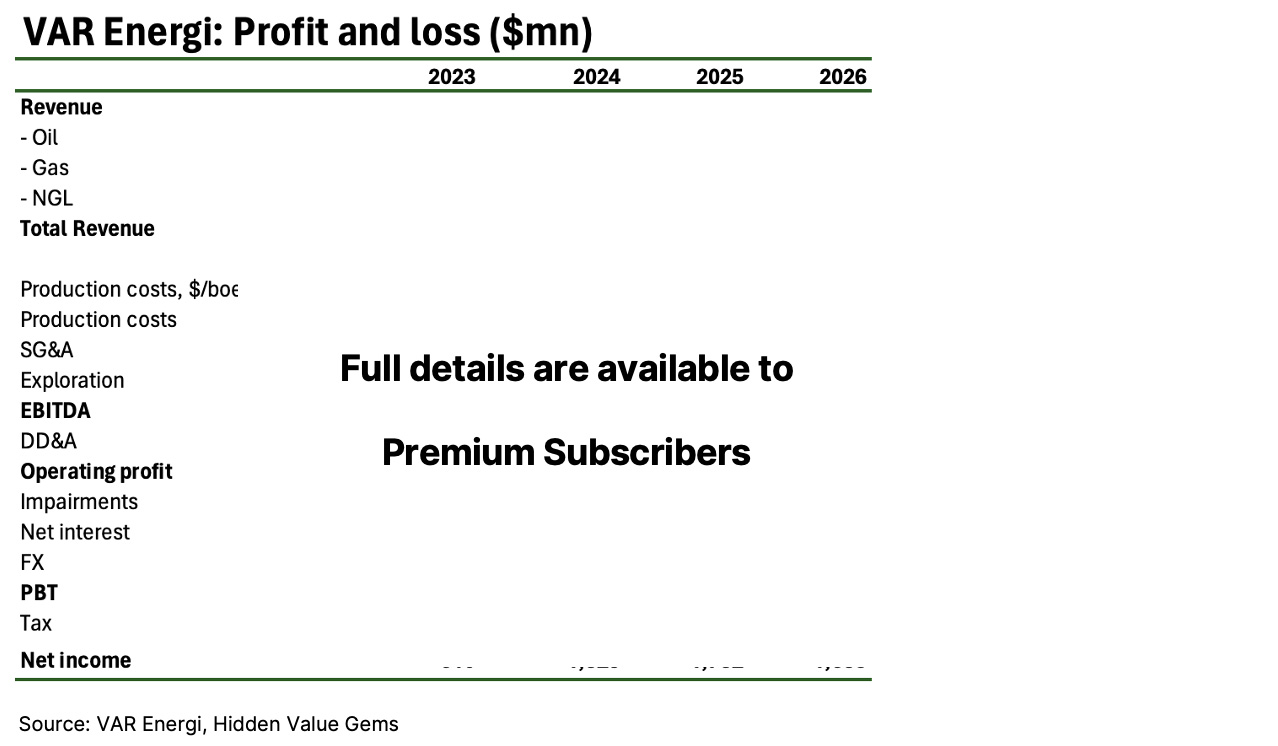

VAR Energi offers the second-highest dividend yield among peers. Its 2023 dividends amounted to $1.1bn ($0.43 per share), which represents a yield of 15%. While higher production should lead to an even higher operating cash flow, I assume broadly flat dividends as the company's FCF will be suppressed by higher capex.

VAR is trading at the lowest P/E multiple based on my 2024E estimates (3.9x) compared to a sector average of 8.0x.

More important is the transformation that will happen in 2025-25 once Balder X, Johan Castberg, and smaller projects come online, marking an end to the aggressive investment programme.

I expect the company to generate materially higher operating cash flow, which, coupled with falling capex, should boost FCF closer to $3bn (more than 3x higher than in 2023).

VAR should be in a position to boost its dividend to $0.56 per share (NOK5.9), on my estimates. Assuming the stock trades at an 8% yield (in line with peers), the price could rise to NOK 73.8 - 140% above the spot price. Combined with a 15% dividend yield, the three-year return could reach 200% (44% annualised).

VAR is trading at the lowest P/E multiple based on my 2024E estimates (3.9x) compared to a sector average of 8.0x.

More important is the transformation that will happen in 2025-25 once Balder X, Johan Castberg, and smaller projects come online, marking an end to the aggressive investment programme.

I expect the company to generate materially higher operating cash flow, which, coupled with falling capex, should boost FCF closer to $3bn (more than 3x higher than in 2023).

VAR should be in a position to boost its dividend to $0.56 per share (NOK5.9), on my estimates. Assuming the stock trades at an 8% yield (in line with peers), the price could rise to NOK 73.8 - 140% above the spot price. Combined with a 15% dividend yield, the three-year return could reach 200% (44% annualised).

Of course, this is far from guaranteed: there are a few risks, which I discuss in the next section.

What is the catch

The main issue with VAR is its historically poor execution. The best example of this is a delay of over a year of the launch of the Balder X field and significant cost overruns. Other issues included missing 2022 production targets.

Besides, Johan Castberg, operated by Equinor and the second crucial growth driver for VAR, is located in the far north, the Barents Sea, which creates additional execution risks.

The company has not provided enough guidance on its production trajectory beyond 2026. Taking into account a 10% natural decline rate at its fields and sector inflation as well as an unimpressive operational track record, there is a risk that the company will miss the long-awaited 'cash cow' phase. This could happen if peak production is lower than what the company expects; it lasts not as long, and management will have to ramp up spending on new projects that will not contribute until at least 2030. In that case, the company will struggle to raise its FCF above the current level, which means that dividends will likely be reduced to avoid the rise in leverage.

How likely is such a scenario? My best guess is that it is around 25%. But I also think a more moderate version of such an adverse scenario has about a 33% to 50% probability. This means moderate production decline post-2026 (5-10%) and capex spending above maintenance level (c. $17-2.2bn). The company should be able to raise dividends in such a scenario, although by only about 5% a year.

Besides, Johan Castberg, operated by Equinor and the second crucial growth driver for VAR, is located in the far north, the Barents Sea, which creates additional execution risks.

The company has not provided enough guidance on its production trajectory beyond 2026. Taking into account a 10% natural decline rate at its fields and sector inflation as well as an unimpressive operational track record, there is a risk that the company will miss the long-awaited 'cash cow' phase. This could happen if peak production is lower than what the company expects; it lasts not as long, and management will have to ramp up spending on new projects that will not contribute until at least 2030. In that case, the company will struggle to raise its FCF above the current level, which means that dividends will likely be reduced to avoid the rise in leverage.

How likely is such a scenario? My best guess is that it is around 25%. But I also think a more moderate version of such an adverse scenario has about a 33% to 50% probability. This means moderate production decline post-2026 (5-10%) and capex spending above maintenance level (c. $17-2.2bn). The company should be able to raise dividends in such a scenario, although by only about 5% a year.

Another risk is a relatively high leverage. The company misleadingly (in my view) uses Net Debt / EBITDA as a leverage measure. While the ratio is at a comfortable 0.5x level (as of year-end 2023), it does not reflect the real debt burden. Firstly, about half of EBITDA disappears after the company pays the income tax to the Norwegian government. Secondly, in November 2023, VAR issued a long-term bond ($808mn) at a 7.86% rate set until February 2029. The bond matures in 2083, which allows VAR to classify it as equity and not add to the overall net debt position. This year the company will also see its debt rise by $1.2bn following the payment for the Neptune assets and an additional $700mn tax liability related to the asset. Although, arguably, Neptune will also contribute to earnings and cash flow having generated c. $400mn of FCF in 2023.

Finally, there is a macro risk as oil and gas prices can fall in the medium term for whatever reasons (weaker economy or higher supply). This, of course, works both ways as prices can also be higher than in my base case (flat).

Finally, there is a macro risk as oil and gas prices can fall in the medium term for whatever reasons (weaker economy or higher supply). This, of course, works both ways as prices can also be higher than in my base case (flat).

Before jumping to conclusions, I should also note that there is a 25% withholding tax rate on dividends in Norway, which means that VAR will withhold 25% of the quarterly dividend it pays. So, the net dividend yield is around 11.25% rather than 15%. Certain countries that have a double taxation treaty with Norway may allow investors to claim those withheld taxes back. Investors will have to pay other taxes in their respective countries of residence on the dividends they receive. This is not investment advice, of course.

Conclusion

VAR Energi is a mid-sized offshore oil & gas producer operating in Norway. The country has one of the lowest political risks and a well-known geology with highly developed infrastructure and an oilfield service sector.

The company is on the verge of a material turnaround in FCF, which could more than triple as the key growth projects are launched, reducing the currently high investment needs.

Despite going through a peak investment phase, VAR has already been paying 20-30% of its operating cash flows as dividends. Over the past three years, it has returned almost half of its market cap as dividends to shareholders.

Due to the previous operational issues and uncertainty over future production profile, the market is highly cautious valuing the stock at a 15% dividend yield.

The company has enough resource base to sustain reasonable production and enjoy higher FCF over the medium term. The dividend yield is well above the sector average. If the stock does not rerate, investors should earn at least 15% gross return (per year) over the next 2-3 years.

Should VAR shares trade at a sector average yield of 8%, the stock will rise 140%, which, combined with a 15%+ dividend yield, would lead to a total return of 200% in three years.

The company is on the verge of a material turnaround in FCF, which could more than triple as the key growth projects are launched, reducing the currently high investment needs.

Despite going through a peak investment phase, VAR has already been paying 20-30% of its operating cash flows as dividends. Over the past three years, it has returned almost half of its market cap as dividends to shareholders.

Due to the previous operational issues and uncertainty over future production profile, the market is highly cautious valuing the stock at a 15% dividend yield.

The company has enough resource base to sustain reasonable production and enjoy higher FCF over the medium term. The dividend yield is well above the sector average. If the stock does not rerate, investors should earn at least 15% gross return (per year) over the next 2-3 years.

Should VAR shares trade at a sector average yield of 8%, the stock will rise 140%, which, combined with a 15%+ dividend yield, would lead to a total return of 200% in three years.

Appendix: detailed financial summary

Thank you for reading. I hope you enjoyed this post. Please share it with people who may find it useful.