7 April 2024

I am not a big fan of discussing portfolio performance over short time periods. Not only is there a lot of ‘noise’ in such data, but such activity also encourages short-term thinking rather than focusing on what really matters.

Nevertheless, this could be a good opportunity to remind oneself of what one wants to achieve by investing in the stock market and how he or she plans to do that. Going through the portfolio positions and decisions behind buying or selling specific companies is also a great exercise.

In today’s post, I will focus on the first part and will focus on individual names in the following quarterly review.

Performance

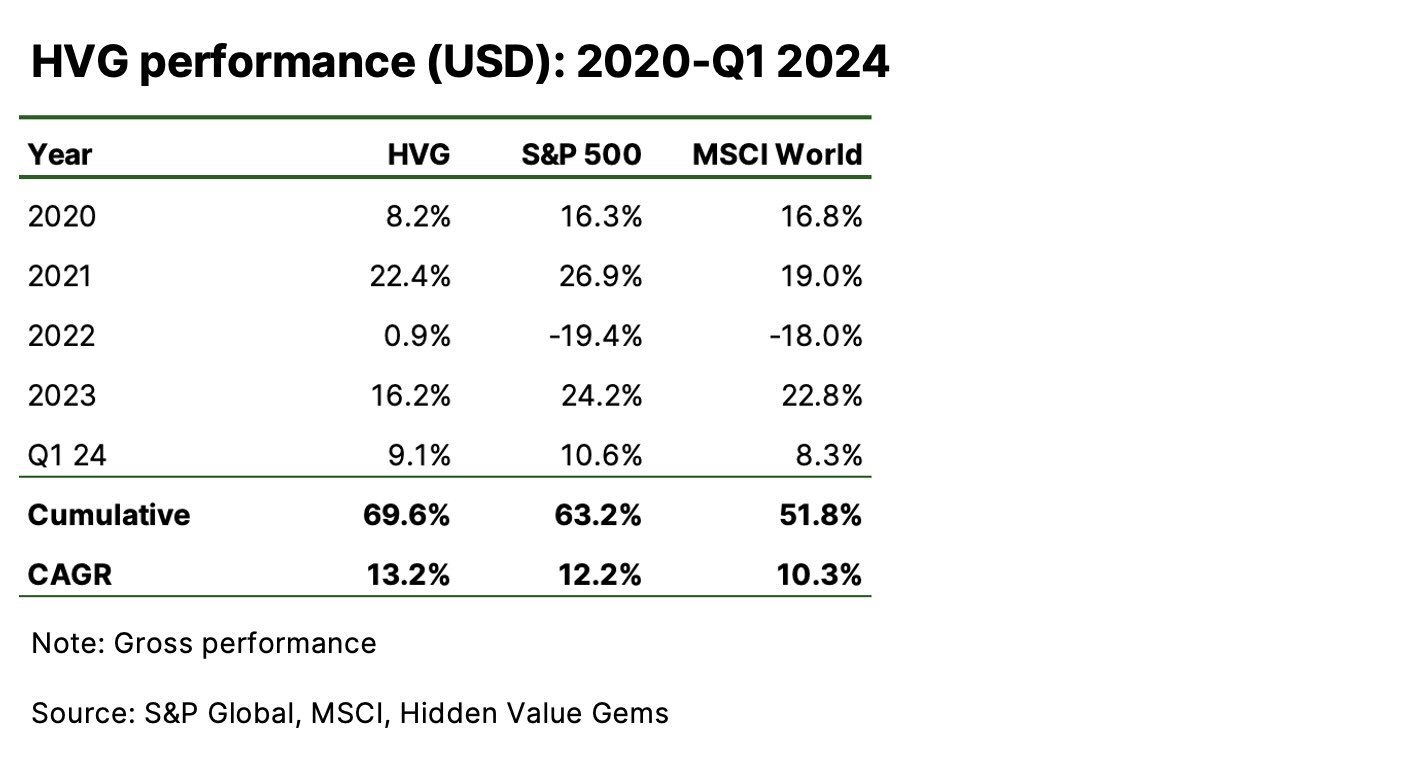

Hidden Value Gems (HVG) portfolio was up 9.1% in Q1 2024, slightly behind S&P500 (+10.6%) and ahead of MSCI World (+8.3%). Please note that performance is on a total return basis, which includes dividends. Transaction costs or taxes were not applied to the portfolio.

Since the start of 2020, the HVG portfolio has gained 69.6%, ahead of the S&P 500 (63.2%) and MSCI World (51.8%). Over the past 4 years and 3 months, my annualised performance (+13.2%) is 1 percentage point ahead of the S&P 500 (+12.2%) and 2.9 percentage points better than MSCI World (10.3%).

Since the start of 2020, the HVG portfolio has gained 69.6%, ahead of the S&P 500 (63.2%) and MSCI World (51.8%). Over the past 4 years and 3 months, my annualised performance (+13.2%) is 1 percentage point ahead of the S&P 500 (+12.2%) and 2.9 percentage points better than MSCI World (10.3%).

Why short-term performance has little relevance

To achieve the best results in the short term, you have to pick:

People may be (successfully or not) using other ways to maximise returns in the short term.

My approach is almost the exact opposite, so I expect to deviate considerably from the market in the short term but beat it over the long term.

The core idea behind the HVG portfolio is that when you buy a stock, you become a partner in a real business. Consequently, your investment results will depend on how well the business has performed. Of course, the entry and exit prices matter, but the longer you own a business, the more its performance drives your investment results.

Ultimately, the best long-term results should be achieved through owning great businesses that can reinvest their capital at 20-30% over many years. Avoiding permanent loss of capital and extending the period over which businesses can compound capital are two other significant drivers for overall portfolio returns.

Since business, unlike stocks, does not change overnight, my short-term portfolio performance does not say much about the underlying business performance. It may take many years before a decision made today starts contributing to the results.

- Stocks that will become more popular and attract more buyers at higher prices.

- Companies that will report exceptionally strong results, leading to material consensus upgrades.

- Use maximum leverage while following the first two steps.

People may be (successfully or not) using other ways to maximise returns in the short term.

My approach is almost the exact opposite, so I expect to deviate considerably from the market in the short term but beat it over the long term.

The core idea behind the HVG portfolio is that when you buy a stock, you become a partner in a real business. Consequently, your investment results will depend on how well the business has performed. Of course, the entry and exit prices matter, but the longer you own a business, the more its performance drives your investment results.

Ultimately, the best long-term results should be achieved through owning great businesses that can reinvest their capital at 20-30% over many years. Avoiding permanent loss of capital and extending the period over which businesses can compound capital are two other significant drivers for overall portfolio returns.

Since business, unlike stocks, does not change overnight, my short-term portfolio performance does not say much about the underlying business performance. It may take many years before a decision made today starts contributing to the results.

“All overnight success takes about 10 years.”

- Jeff Bezos, founder of Amazon

Three technical factors

I must point out two technical factors that drag my performance in the near term.

Firstly, I have opened new positions in the UK small caps. There are wide bid/ask spreads in these names and limited liquidity. This means that you often have to pay a few per cent above the quoted price to buy a meaningful position, and if you want to sell fast, you may need to accept bids that are 2-3% below the market. You can quickly lose a few per cent just trading even if the stock was “technically flat”. Since I recently added a few UK small-caps, a simple mark to market negatively affected my performance.

Secondly, I often seek opportunities in out-of-favour places, believing that there will be more inefficiency in those markets. This approach, while it can result in a typical stock suffering from negative momentum, also holds the potential for higher returns. So, the more new stocks I have in a portfolio, the more likely my portfolio will lag the broader market due to this negative momentum.

Finally, about 8% of the portfolio is in cash - an asset class which always underperforms the rising market. All else equal, I will lose a few percentage points against a strong market by simply holding cash. I explain the reason to hold cash later.

Firstly, I have opened new positions in the UK small caps. There are wide bid/ask spreads in these names and limited liquidity. This means that you often have to pay a few per cent above the quoted price to buy a meaningful position, and if you want to sell fast, you may need to accept bids that are 2-3% below the market. You can quickly lose a few per cent just trading even if the stock was “technically flat”. Since I recently added a few UK small-caps, a simple mark to market negatively affected my performance.

Secondly, I often seek opportunities in out-of-favour places, believing that there will be more inefficiency in those markets. This approach, while it can result in a typical stock suffering from negative momentum, also holds the potential for higher returns. So, the more new stocks I have in a portfolio, the more likely my portfolio will lag the broader market due to this negative momentum.

Finally, about 8% of the portfolio is in cash - an asset class which always underperforms the rising market. All else equal, I will lose a few percentage points against a strong market by simply holding cash. I explain the reason to hold cash later.

Portfolio construction principles

Goal

My main goal is not to lose money and to preserve my purchasing power over time. My second goal is to grow my portfolio at above market rate, ideally in the 10-20% range.

Position weight

I have 22 stocks in my portfolio with highly uneven weights. The top three positions account for 59% of the portfolio.

The prime reason is that my decision on how much of each stock to own is based on the downside risks. The lower the risks, the bigger the weight. The easiest way to grasp a business's risk is to ask yourself the following question: “Will this business be around in 20 years?”

This is an easy question to answer in the case of Berkshire, Exor or Loews.

Another technical reason is that I have an ISA account (similar to a Roth IRA in the US), which is smaller than my main brokerage account. Therefore, some positions held in the ISA will be automatically reduced since the ISA is smaller in absolute terms.

The prime reason is that my decision on how much of each stock to own is based on the downside risks. The lower the risks, the bigger the weight. The easiest way to grasp a business's risk is to ask yourself the following question: “Will this business be around in 20 years?”

This is an easy question to answer in the case of Berkshire, Exor or Loews.

Another technical reason is that I have an ISA account (similar to a Roth IRA in the US), which is smaller than my main brokerage account. Therefore, some positions held in the ISA will be automatically reduced since the ISA is smaller in absolute terms.

Organic investments

I also want to minimise trading activity, as it adds costs and leads to tax liabilities. Even high-dividend-yielding stocks can lose a considerable amount of returns if you have to pay taxes on dividends.

So, owning companies that can recycle capital inside their business and have a proven long-term track record, is a big advantage. Rather than finding a stock that goes up 50% in a year and then paying 20-30% tax on it (depending on your exact location and other circumstances), I would rather own a company that will reinvest profits on my behalf.

An additional advantage of owning a company like Exor is that its smaller size compared to Berkshire widens its investment options, while its strong network of contacts helps it to find new opportunities. I do not have the same knowledge of corporate decision-makers and industry insiders as John Elkann, who runs Exor.

So, owning companies that can recycle capital inside their business and have a proven long-term track record, is a big advantage. Rather than finding a stock that goes up 50% in a year and then paying 20-30% tax on it (depending on your exact location and other circumstances), I would rather own a company that will reinvest profits on my behalf.

An additional advantage of owning a company like Exor is that its smaller size compared to Berkshire widens its investment options, while its strong network of contacts helps it to find new opportunities. I do not have the same knowledge of corporate decision-makers and industry insiders as John Elkann, who runs Exor.

'Experiments'

The remainder of my portfolio (19 stocks) has weights between 1% and 3%. I treat them as “experiments.”

Sometimes, the price is too attractive (e.g. SEED Innovations), or the business model looks superior (e.g. Trustpilot, Keystone Law). But in most cases I still need to close the gaps in my knowledge and learn more about the business. I then add or get rid of those positions.

By starting with a smaller position, I aim to minimise timing risk (that I buy at the local peak), as I can add to the position later (often at more attractive prices).

I also think that not buying stock until you have complete knowledge and conviction creates the risk that you miss the opportunity altogether. If it is a great business, the price can rise while you do your research. Once you are done, you cannot force yourself to pay 30% more, thinking you could have bought it cheaper just 2-3 months ago.

This category of my portfolio represents a higher risk since I buy companies that I know less, and some of them have a limited history. Hence, I spread the bets across a few of those companies.

The idea is to find at least one multibagger that could pay for the rest of the stocks. So far, Trustpilot was the most successful investment generating close to 100% in less than a year. Most other names have this potential, although the time required is not known for sure.

It may look like “experiments” contradict the previous idea of owning a few compounders with great capital allocation to minimise trading costs and taxes. But do not forget that only about 30% of my portfolio is invested in this category; 59% is in just three stocks, and 8% is in cash.

Sometimes, the price is too attractive (e.g. SEED Innovations), or the business model looks superior (e.g. Trustpilot, Keystone Law). But in most cases I still need to close the gaps in my knowledge and learn more about the business. I then add or get rid of those positions.

By starting with a smaller position, I aim to minimise timing risk (that I buy at the local peak), as I can add to the position later (often at more attractive prices).

I also think that not buying stock until you have complete knowledge and conviction creates the risk that you miss the opportunity altogether. If it is a great business, the price can rise while you do your research. Once you are done, you cannot force yourself to pay 30% more, thinking you could have bought it cheaper just 2-3 months ago.

This category of my portfolio represents a higher risk since I buy companies that I know less, and some of them have a limited history. Hence, I spread the bets across a few of those companies.

The idea is to find at least one multibagger that could pay for the rest of the stocks. So far, Trustpilot was the most successful investment generating close to 100% in less than a year. Most other names have this potential, although the time required is not known for sure.

It may look like “experiments” contradict the previous idea of owning a few compounders with great capital allocation to minimise trading costs and taxes. But do not forget that only about 30% of my portfolio is invested in this category; 59% is in just three stocks, and 8% is in cash.

Cash: a free hedge and an option value

In theory, the more cash you hold, the more you underperform the market in the long run. However, from my experience, the easiest BUY decisions I made were during big crashes (2020 being the latest). The problem at this point is having enough funds to take advantage of the falling valuation. So, while cash may drag my performance down for a few years, I plan to actively deploy it when markets go through another period of turbulence (which happens every few years).

Also, cash allows me to add to the existing businesses if their stocks drop or buy a new company that I find through my research process.

Also, cash allows me to add to the existing businesses if their stocks drop or buy a new company that I find through my research process.

Final thoughts

I am excited about the businesses I own, either because of their potential (e.g. Trustpilot, Marks Electrical, Eurofins, Keystone Law, Games Workshop), price (e.g. VAR, Arrow Exploration, Frasers Group) or both (e.g. Corpay, CTT, AerCap).

However, I am actively thinking about how I can add more value (or destroy less) by managing position size, detecting value traps earlier, finding great companies earlier, and buying them at attractive prices.

However, I am actively thinking about how I can add more value (or destroy less) by managing position size, detecting value traps earlier, finding great companies earlier, and buying them at attractive prices.

Thank you for reading.