27 August 2024

In Part I, I discussed the inflexion point in electricity demand that could see a 2-3x increase in investments in grid and related segments. The key reasons include electrification, carbon reduction policies, the rise of renewables, and data centres. Climate change with more widespread extreme weather conditions forces utilities to consider replacing existing power lines with underground cables.

Under current Net Zero policies, electricity's share of the total energy supply is set to almost double from 39% in 2020 to 68% by 2050. Furthermore, renewables could contribute as much as 74% of total electricity generation in 2050, a significant leap from the current level of less than 30%.

Data centres already account for about 2% of total electricity consumption globally, similar to the annual demand of Germany. Combined with AI models, the new segment could add up to 1 TWh of electricity demand by 2030, the equivalent of two Germanies.

In Part II, I review the companies that could be the biggest beneficiaries of the growth. I have discovered five stocks that look particularly interesting.

Under current Net Zero policies, electricity's share of the total energy supply is set to almost double from 39% in 2020 to 68% by 2050. Furthermore, renewables could contribute as much as 74% of total electricity generation in 2050, a significant leap from the current level of less than 30%.

Data centres already account for about 2% of total electricity consumption globally, similar to the annual demand of Germany. Combined with AI models, the new segment could add up to 1 TWh of electricity demand by 2030, the equivalent of two Germanies.

In Part II, I review the companies that could be the biggest beneficiaries of the growth. I have discovered five stocks that look particularly interesting.

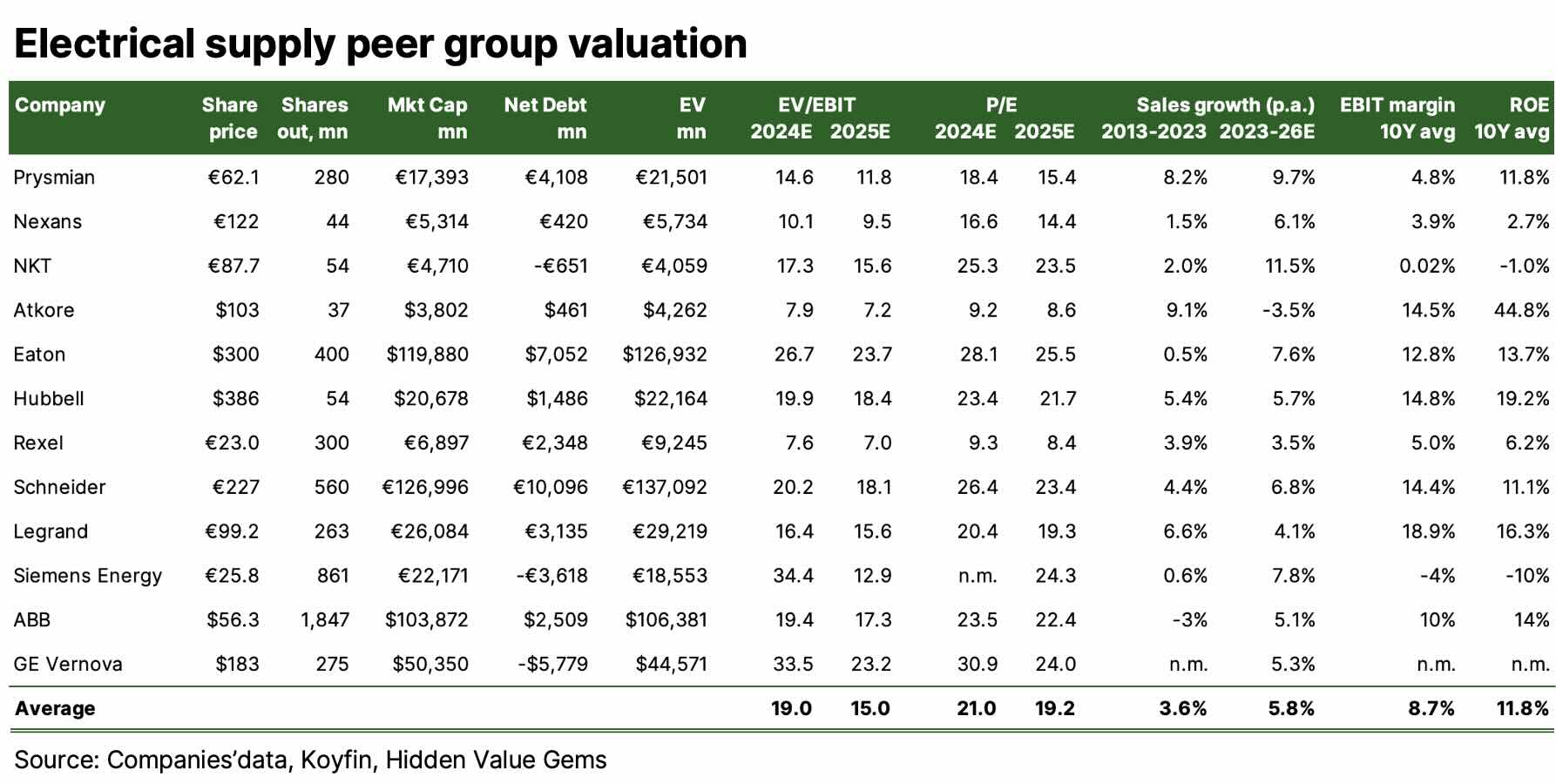

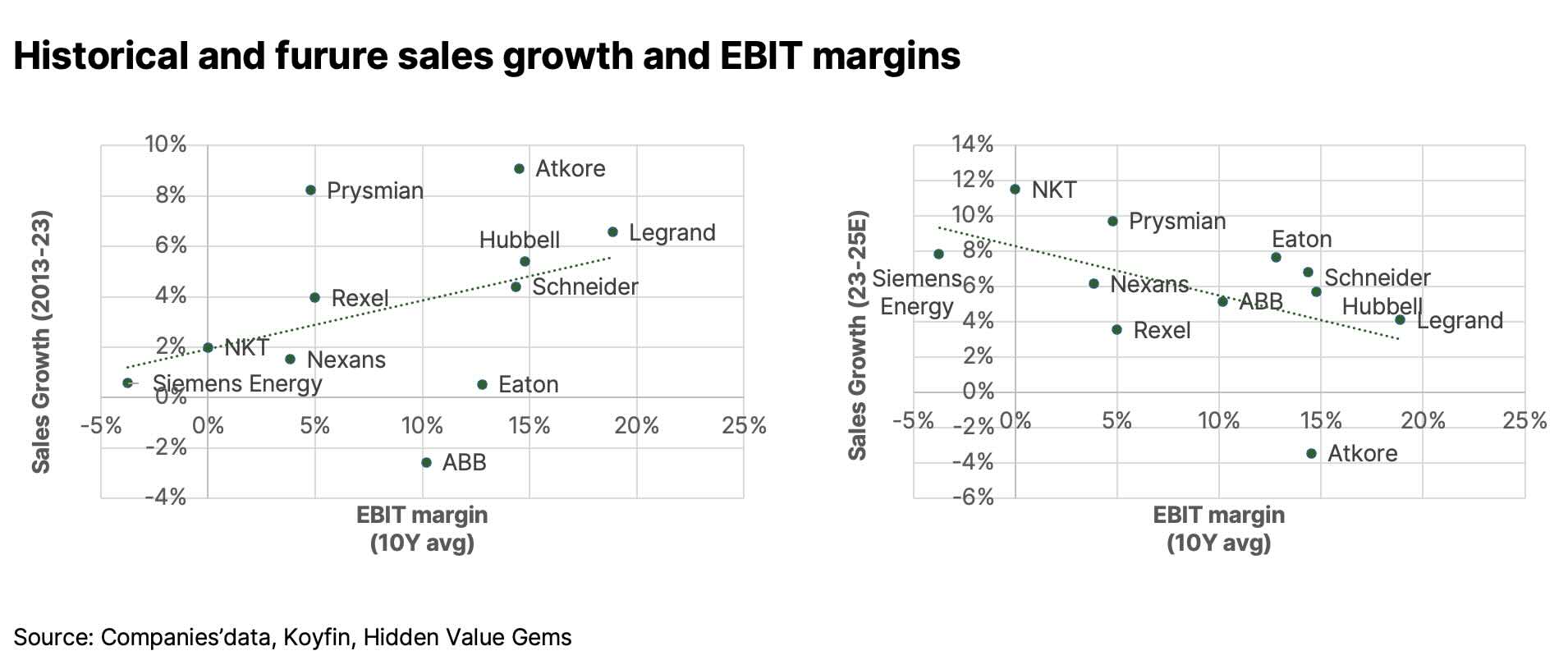

Historically, the sector delivered subpar financial results: single-digit growth (3.6% 10-year CAGR) and a single-digit operating margin (10-year average margin 8.7%), which resulted in a modest ROE of 11.8%.

However, these results have been achieved during a period of weak electricity demand and weak producer prices.

However, these results have been achieved during a period of weak electricity demand and weak producer prices.

Atkore has delivered the highest growth (9.1%) and Return on Equity (ROE) of 44.8%. However, management has reduced guidance for 2024E sales and the market now expects lower sales in the mid-term. As a result, Atkore is trading below 10x P/E, which is highly attractive, assuming that this is a temporary slowdown.

Siemens Energy is the opposite case. The company was spun off from Siemens AG in 2020 and has run into problems with an acquisition of the Wind turbines business (Gamesa). As a result, Siemens Energy had to make a few writedowns, which led to heavy losses and negative ROE. However, unlike Atkore, its outlook is much better thanks to its exposure to the Grid segment.

Another company that drew my attention is Legrand. It has historically earned high margins (18.9%) and ROE (16.3%). It is not cheap, trading at 19.3x next year's earnings, but the market may be underestimating future demand, especially post-2025.

Prysmian is another interesting opportunity. It is a world-leading cable manufacturer with over 140 years of history, focusing on the most complex products (e.g., high-voltage cables). It has consolidated the European market through various acquisitions, growing its sales by 8.2% over the past 10 years.

The lowest-rated stock in this group is the French distributor Rexel, trading at 8.4x forward earnings. The company has taken several steps to improve its profitability by expanding its online sales and adding value-added services, including repair and maintenance. As a result, the business has enjoyed improving margins and FCF, which is not reflected in the company’s valuation.

I discuss some of these names in more detail below.

Siemens Energy is the opposite case. The company was spun off from Siemens AG in 2020 and has run into problems with an acquisition of the Wind turbines business (Gamesa). As a result, Siemens Energy had to make a few writedowns, which led to heavy losses and negative ROE. However, unlike Atkore, its outlook is much better thanks to its exposure to the Grid segment.

Another company that drew my attention is Legrand. It has historically earned high margins (18.9%) and ROE (16.3%). It is not cheap, trading at 19.3x next year's earnings, but the market may be underestimating future demand, especially post-2025.

Prysmian is another interesting opportunity. It is a world-leading cable manufacturer with over 140 years of history, focusing on the most complex products (e.g., high-voltage cables). It has consolidated the European market through various acquisitions, growing its sales by 8.2% over the past 10 years.

The lowest-rated stock in this group is the French distributor Rexel, trading at 8.4x forward earnings. The company has taken several steps to improve its profitability by expanding its online sales and adding value-added services, including repair and maintenance. As a result, the business has enjoyed improving margins and FCF, which is not reflected in the company’s valuation.

I discuss some of these names in more detail below.

Prysmian

Introduction

Prysmian is the world’s largest supplier of cables for energy and telecommunication. It employs 30,000 workers in 50 countries, operates 108 factories, and has 26 R&D centres. The company’s roots go back 145 years, when a cable division was set up within the Pirelli Group in Italy. In 2005, the company was sold to a consortium of investors headed by Goldman Sachs. In 2007, it went public.

Since 2010, Prysmian has been consolidating the market by buying smaller European assets. The company has completed three strategic acquisitions for a combined $8.8bn.

Since 2010, Prysmian has been consolidating the market by buying smaller European assets. The company has completed three strategic acquisitions for a combined $8.8bn.

The company was listed at €15/share in 2007. At the current share price of around €61, Prysmian has delivered a c. 471% total shareholder return, translating into a c. 10.8% compound annual growth rate.

A leader in the consolidated market

Prysmian is the world’s largest cable producer, with a roughly 40% market share. The sector is highly consolidated. In Europe, the three largest players (Prysmian, Nexans, and NKT) dominate 75% of the market.

Unlike smaller rivals, Prysmian offers a full range of products and services that are particularly relevant for fast-growing segments like data centres. Prysmian can provide telecom cables, distribution cables to connect to the grid and other materials needed for normal operations.

Unlike smaller rivals, Prysmian offers a full range of products and services that are particularly relevant for fast-growing segments like data centres. Prysmian can provide telecom cables, distribution cables to connect to the grid and other materials needed for normal operations.

Strong barriers to entry

New entrants face high barriers to entry. Building new facilities in high-voltage cables takes 3-4 years. Besides, customers prefer to sign multi-year agreements, which new players cannot commit to. Suppliers with scale and a long track record have an advantage, especially in more complex segments of the market.

Under typical multi-year contracts, customers pay advance fees to secure future supply. This locks customers in, and favours established players with strong brands and reputation.

Prysmian is one of the oldest cable manufacturers globally. It has the most advanced R&D centres and high-quality products especially suited for complex segments with high-performance requirements (e.g., high-voltage subsea cables).

Under typical multi-year contracts, customers pay advance fees to secure future supply. This locks customers in, and favours established players with strong brands and reputation.

Prysmian is one of the oldest cable manufacturers globally. It has the most advanced R&D centres and high-quality products especially suited for complex segments with high-performance requirements (e.g., high-voltage subsea cables).

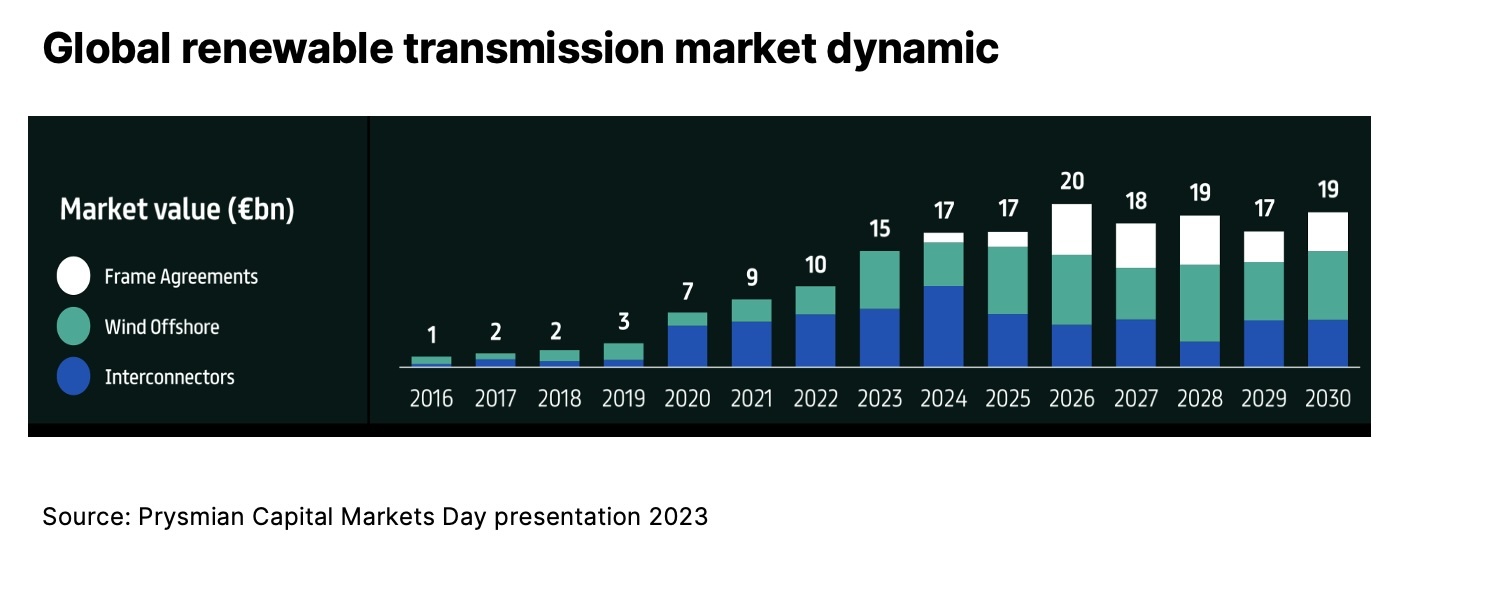

Beneficiary of rising demand

For the first time in 50 years, electricity demand is accelerating due to new secular trends: electrification (e.g., EVs, heat pumps, smart homes), climate change (higher peak demand during extreme weather), the rise of the middle class in emerging markets, and growth in data centres.

This new electricity demand comes at a time when power infrastructure in the US and Europe is rapidly deteriorating.

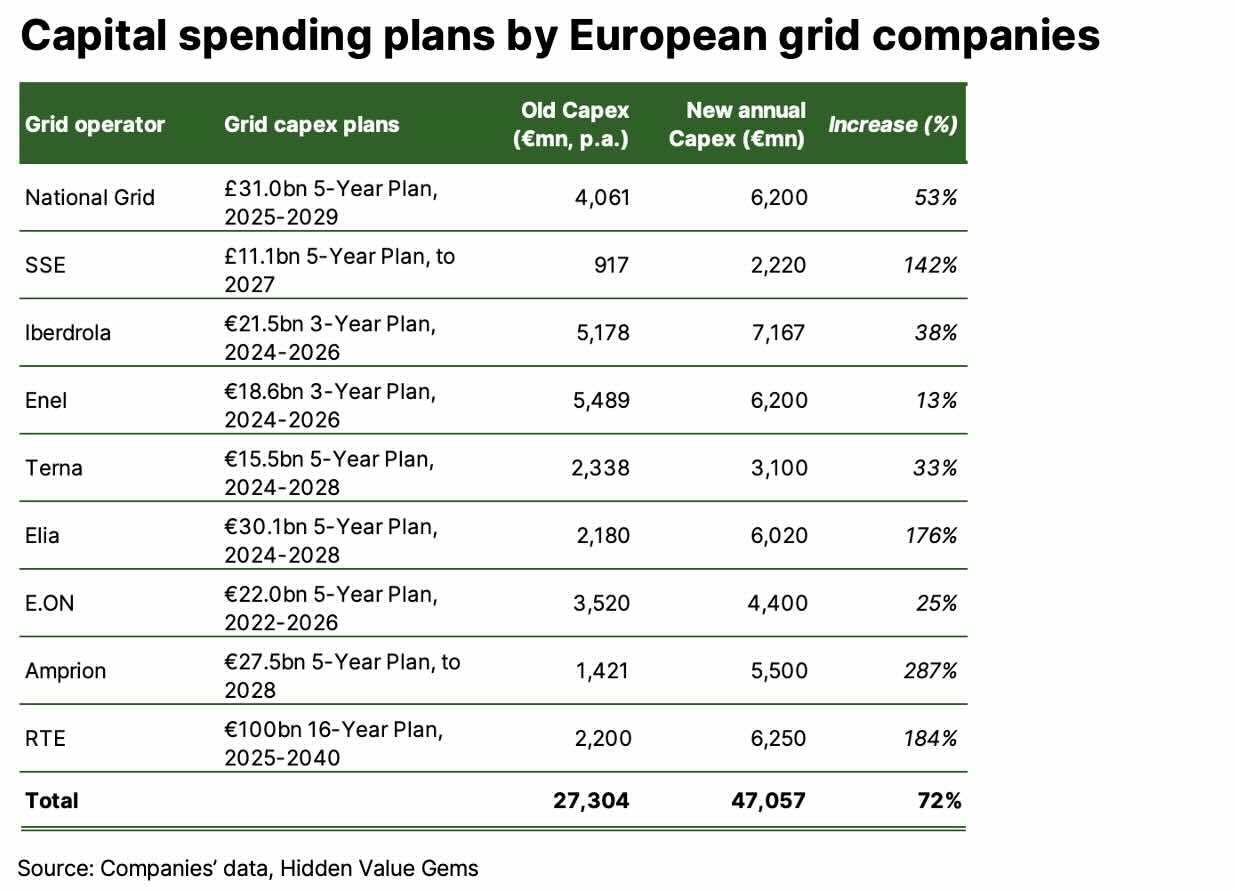

European grid operators have already raised their mid-term capex plans by over 70%.

This new electricity demand comes at a time when power infrastructure in the US and Europe is rapidly deteriorating.

European grid operators have already raised their mid-term capex plans by over 70%.

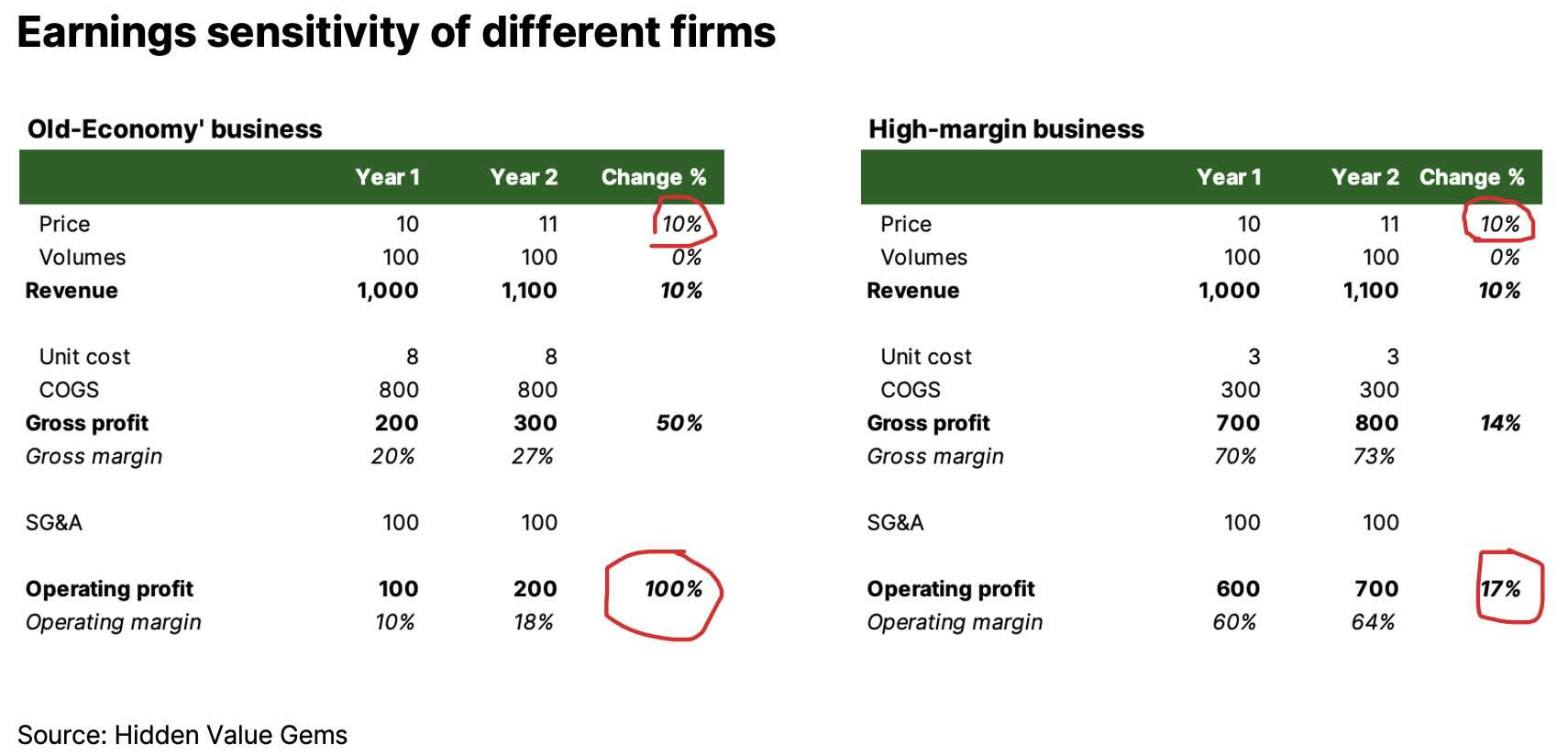

As a typical industrial company with relatively low margins, Prysmian is particularly sensitive to tighter market conditions and, consequently, higher prices. Below is an example of two companies: an ‘old-economy’ industrial firm and a high-margin software company.

If both companies provide the same products/services but raise their prices by 10%, the marginal change in profitability at an ‘old-economy’ firm is dramatically better than a high-margin company. In the example below, a company with a 10% operating margin will enjoy a 100% profit growth with a 10% price inflation (assuming all-else conditions equal). While a business with a 60% operating margin will see its earnings grow only 17% with the same 10% price increase.

If both companies provide the same products/services but raise their prices by 10%, the marginal change in profitability at an ‘old-economy’ firm is dramatically better than a high-margin company. In the example below, a company with a 10% operating margin will enjoy a 100% profit growth with a 10% price inflation (assuming all-else conditions equal). While a business with a 60% operating margin will see its earnings grow only 17% with the same 10% price increase.

High cash conversion

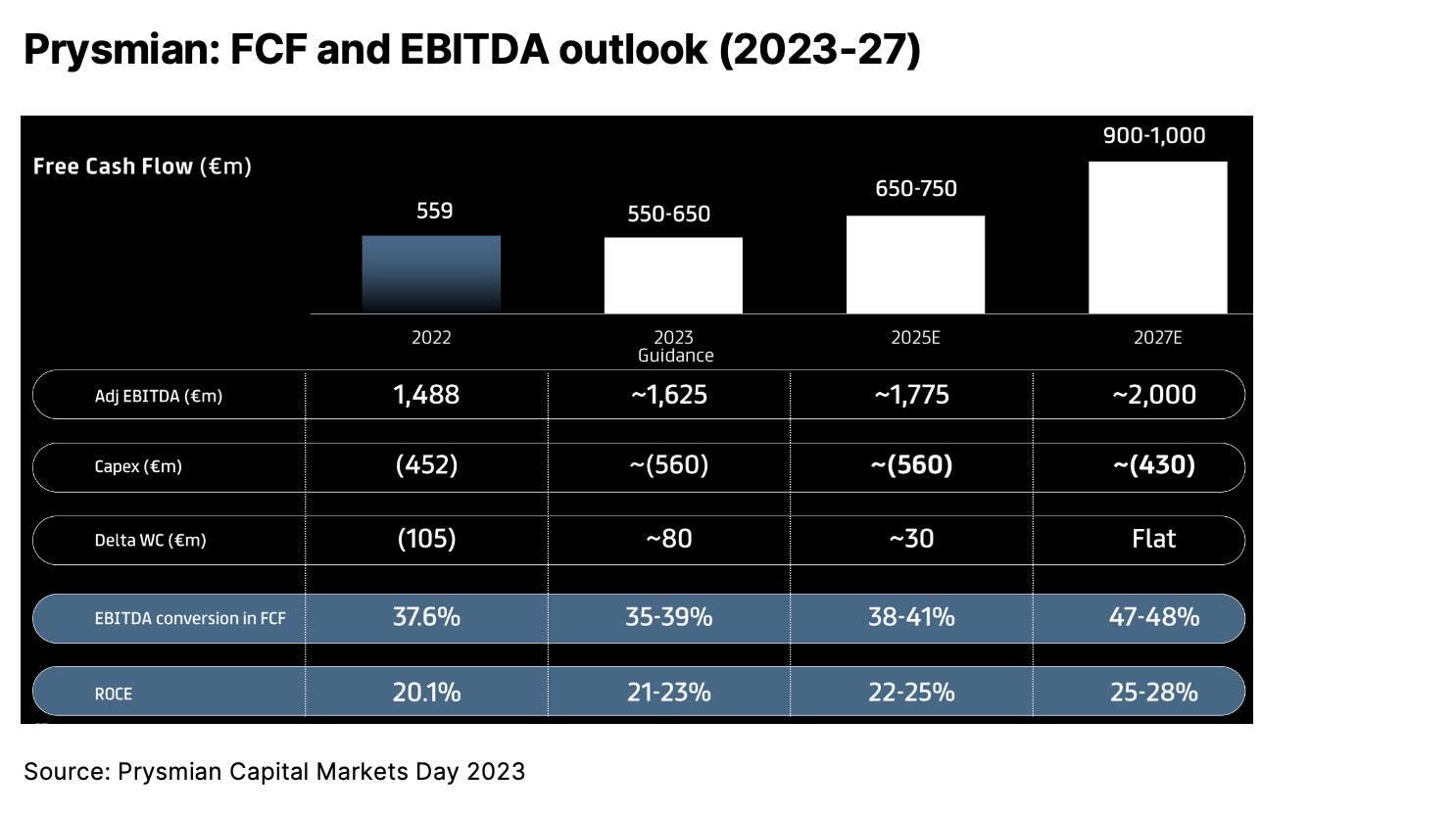

Prysmian is a cash-rich business with a FCF conversion ratio above 100%, supported by positive working capital inflows and low capital requirements.

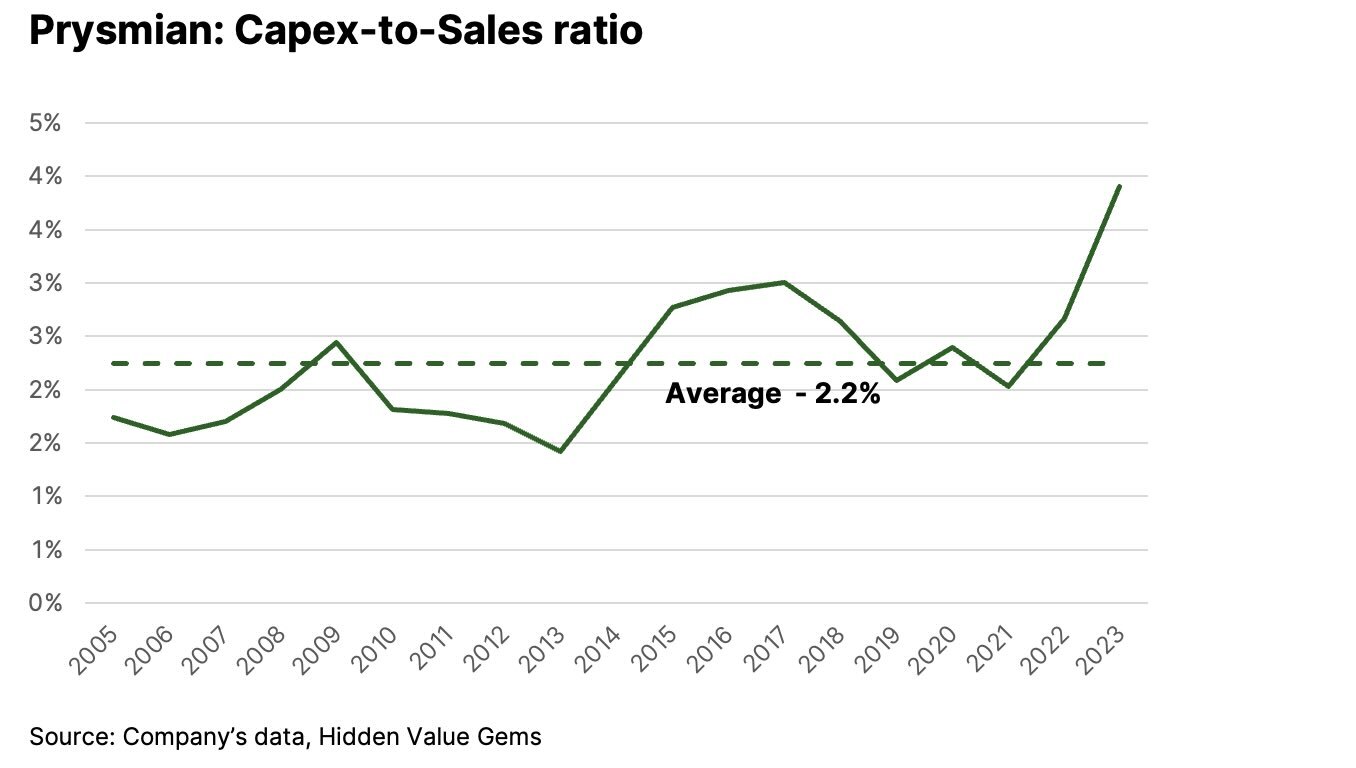

The company’s Capex/Sales ratio has averaged 2.2% over the past 19 years. The company has started to invest in new capacity to meet growing demand, which has temporarily lifted the Capex/Sales ratio to 4%. However, post 2025, this ratio will drop back to a long-term average of 2%.

Capital allocation

Historically, over two-thirds of cash flows were spent on growth through M&A and capex. Shareholder distributions accounted for about 15% of cumulative cash flows.

However, the company has now shifted its focus from asset growth to internal efficiencies and productivity. The majority of FCF (55-60%) is planned to be spent on buybacks and smaller bolt-on acquisitions. The company has also introduced a progressive dividend policy and intends to distribute a third of FCF in dividends.

Since the targets were announced, the company has made one other significant acquisition (Enore Wire) in 2024, which puts the chances for new deals close to zero. This suggests that close to 90% of future FCF could be returned to shareholders via buyback and dividends,

Since the targets were announced, the company has made one other significant acquisition (Enore Wire) in 2024, which puts the chances for new deals close to zero. This suggests that close to 90% of future FCF could be returned to shareholders via buyback and dividends,

Valuation

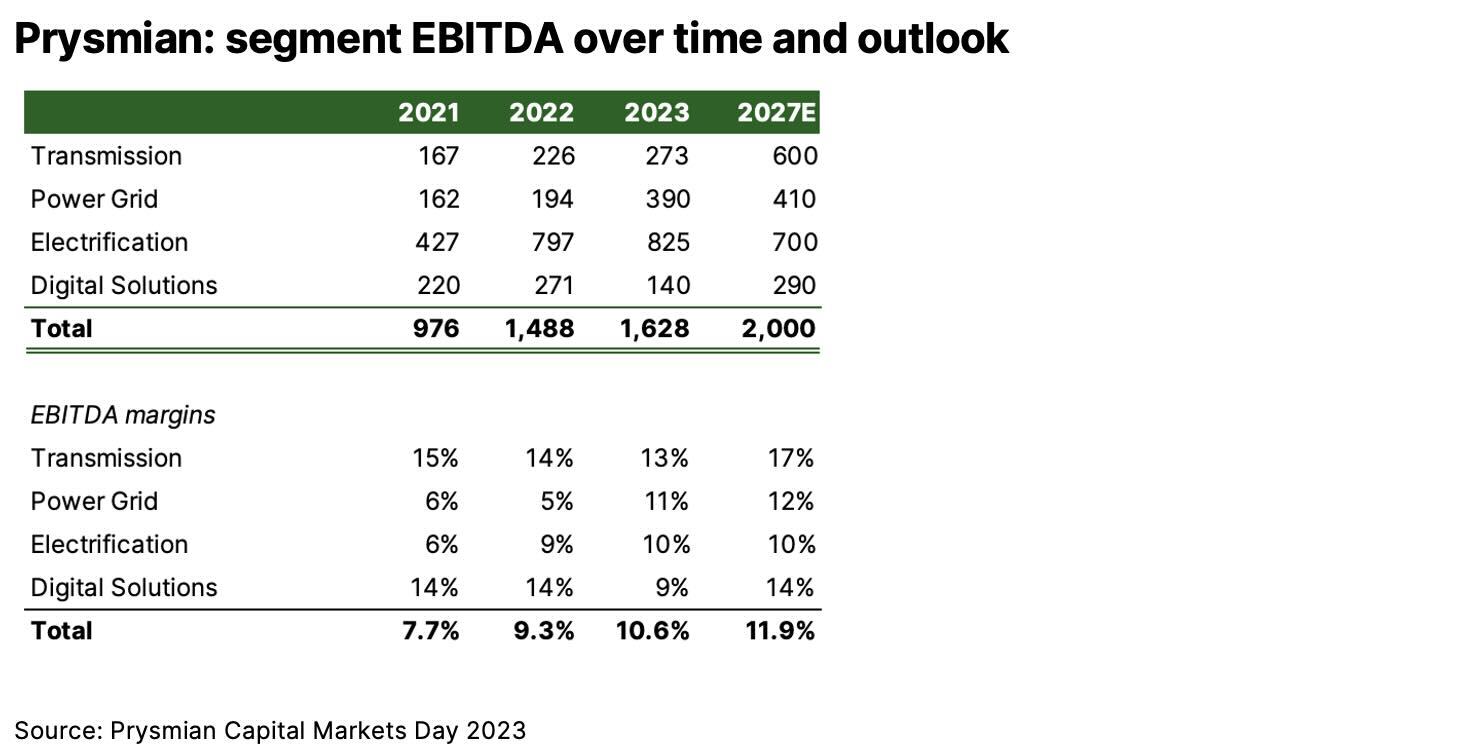

Prysmian is on track to deliver c. €1,925mn EBITDA in 2024 including €200mn contribution from Encore Wire for H2 ’24. Without any further growth, the company should generate €2,125mn of EBITDA in 2025 assuming full-year contribution of €400mn EBITDA from Encore Wire.

It is worth noting that 2023 is a lower base than 2022, when Prysmian earned €1,488mn EBITDA without Encore Wire.

During its 2023 Capital Markets Day, the company targeted €2bn EBITDA in 2027 which translated into low double-digit margins (c. 12%) and 5-7% annual growth. Since then, Prysmian added Encore Wire (€500 normalised EBITDA), so the new target should be at €2.5bn level. The actual demand has also strenghtened which was reflected in Prysmian's raised 2024E outlook this year.

It is worth noting that 2023 is a lower base than 2022, when Prysmian earned €1,488mn EBITDA without Encore Wire.

During its 2023 Capital Markets Day, the company targeted €2bn EBITDA in 2027 which translated into low double-digit margins (c. 12%) and 5-7% annual growth. Since then, Prysmian added Encore Wire (€500 normalised EBITDA), so the new target should be at €2.5bn level. The actual demand has also strenghtened which was reflected in Prysmian's raised 2024E outlook this year.

I expect the company to generate c. €3bn EBITDA in 2027. With a normalised capex of €500mn capex, Prysmian should generate over €2bn FCF (c. 10% FCF yield).

--

--