3 March 2024

This is the eleventh edition of the Monthly Stock Idea Lab (MSIL #11), where I highlight the most exciting companies I have come across recently.

As longtime readers know, the focus of this publication is on companies that meet the following five criteria:

Once a company appears on the list, it has to pass further filters to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

MSIL is one of the first steps in the stock selection process, but definitely not the final one. I hope it helps you in your investment process, but by all means, you should not rely solely on this publication. You should do your own research and/or seek professional advice.

As longtime readers know, the focus of this publication is on companies that meet the following five criteria:

- Quality of business

- Financial performance

- Low leverage

- Insider ownership

- Attractive valuation

Once a company appears on the list, it has to pass further filters to make it into a portfolio. Oftentimes, everything is great about the business apart from valuation, in which case it becomes a matter of time if and when the stock drops to a more attractive level.

MSIL is one of the first steps in the stock selection process, but definitely not the final one. I hope it helps you in your investment process, but by all means, you should not rely solely on this publication. You should do your own research and/or seek professional advice.

Keystone Law

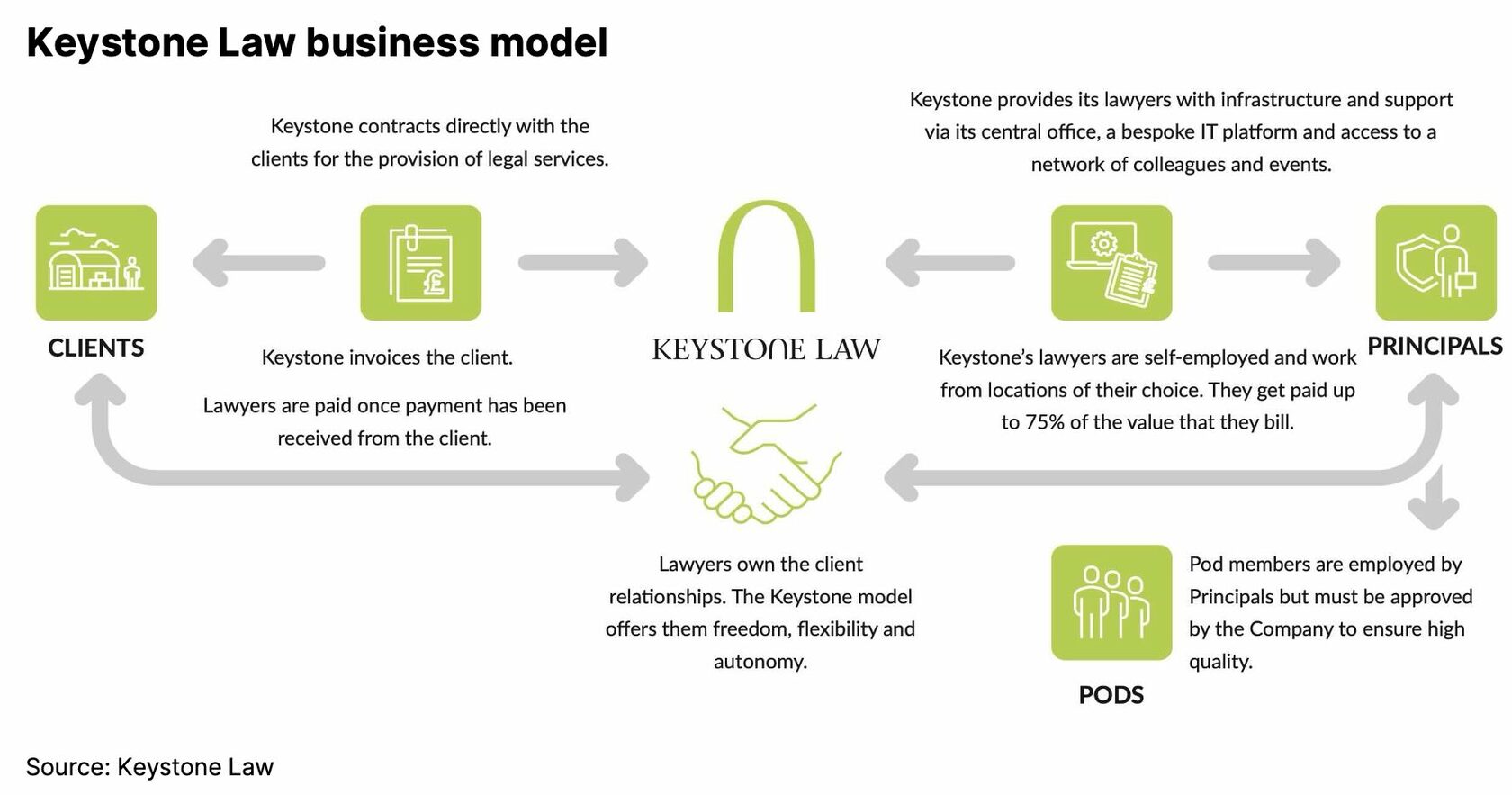

Keystone Law is a unique platform-type legal firm in the UK. It provides value to both sides of the market (supply and demand). On the supply side, the company focuses on senior lawyers working in mid-tier legal firms in the UK who face daunting tasks of growing revenue, managing admin and focusing on their core services. Keystone takes care of the admin side and lets the senior professionals focus on legal cases and client work. They enjoy flexibility regarding working hours and location and, in most cases, a higher share of revenue than traditional legal firms. In return, Keystone charges a 25% fee of the contract revenue, allowing lawyers to keep 75% as their share. If the lawyer does not introduce the client to Keystone, then Keystone keeps 40% of the revenue (60% goes to the lawyer).

Keystone also provides lawyers with a proprietary IT platform and access to a network of experienced colleagues and organises various events for networking and fostering corporate culture.

Keystone also provides lawyers with a proprietary IT platform and access to a network of experienced colleagues and organises various events for networking and fostering corporate culture.

On the demand side, Keystone focuses on the mid-segment estimated at over £10bn of the UK legal market (over £43bn). This segment is served by 185 law firms with c. 47K fee earners. The top 15 global firms represent the upper segment (£20bn), while the low end of the market comprises hundreds of smaller firms with less than £10mn annual revenue.

This middle segment of the market has been under pressure due to the ‘commoditisation’ of services, which has put pressure on fees while costs continue to rise. Keystone’s more efficient ‘platform’ business model could disrupt the market.

By providing its lawyers more flexibility and taking care of the admin issues, Keystone hopes that its customers (SMEs and entrepreneurs) receive a higher quality service (often bespoke) as lawyers take more responsibility and are directly in charge of the final result and income.

This middle segment of the market has been under pressure due to the ‘commoditisation’ of services, which has put pressure on fees while costs continue to rise. Keystone’s more efficient ‘platform’ business model could disrupt the market.

By providing its lawyers more flexibility and taking care of the admin issues, Keystone hopes that its customers (SMEs and entrepreneurs) receive a higher quality service (often bespoke) as lawyers take more responsibility and are directly in charge of the final result and income.

The company has been growing its revenue by a 21% compound rate over the past eight years, expanding the number of its lawyers from 244 (January 2018) to 398 (Jan 2023). This high growth rate is a testament to the company's successful business model. Notably, the growth has been achieved in a highly capital-light way as Keystone has spent less than 1% of its sales on capex and has achieved 110% cash conversion. It has a net cash position of £11.3mn and zero financial debt. The company pays its lawyers only after receiving the full payment from a client, which helps it maintain strong cash generation and minimise working capital needs.

Its revenue is highly diversified, with eight practice areas across 50 sectors, with no client or lawyer accounting for over 5% of the recurring revenue.

The company was founded in 2002 by James Knight and Charles Stinger. James Knight remains the CEO and the largest shareholder with a 28.5% interest.

It is pretty encouraging to see strong insider buying in the company, including purchases by the CEO and founder, James Knight, who is already the largest shareholder.

The company follows a progressive dividend policy, distributing earnings twice a year. Keystone distributes over 60% of its earnings in dividends and occasionally pays special dividends, like in H1 FY-24 when the company announced an interim dividend of 5.8p supplemented by a special 12.5p, bringing the interim yield to 3%.

The primary risk for the company is growing competition, as at least another 20 companies have started to copy Keystone’s model. They employ over 2,000 lawyers in aggregate, but Keystone remains the largest and is the only company among them to be included in the UK's Top 100 law firms.

Its revenue is highly diversified, with eight practice areas across 50 sectors, with no client or lawyer accounting for over 5% of the recurring revenue.

The company was founded in 2002 by James Knight and Charles Stinger. James Knight remains the CEO and the largest shareholder with a 28.5% interest.

It is pretty encouraging to see strong insider buying in the company, including purchases by the CEO and founder, James Knight, who is already the largest shareholder.

The company follows a progressive dividend policy, distributing earnings twice a year. Keystone distributes over 60% of its earnings in dividends and occasionally pays special dividends, like in H1 FY-24 when the company announced an interim dividend of 5.8p supplemented by a special 12.5p, bringing the interim yield to 3%.

The primary risk for the company is growing competition, as at least another 20 companies have started to copy Keystone’s model. They employ over 2,000 lawyers in aggregate, but Keystone remains the largest and is the only company among them to be included in the UK's Top 100 law firms.

Three more ideas

Premium Subscribers can continue reading about three more stock ideas. One of them is a $4.5bn market cap investment company in the insurance sector with a compound growth rate of 13% since 1985. The most exciting thing about it is that it has zero coverage on Wall Street (perhaps because it is not issuing new stock; in fact, it is an active buyer of its own shares).

Another company is the world's leader in a niche segment, serving premium winemakers. It has a history of over 100 years and is run by the fourth generation of the founding family, who continues to hold a controlling stake.

Finally, a micro-cap that generated a 33% compound revenue growth, offering an innovative solution that could disrupt this large (£30bn+) and conservative sector.

Let's start with the investment company. It is a US-listed stock. Below is the total return achieved by its shareholders since its IPO.

Another company is the world's leader in a niche segment, serving premium winemakers. It has a history of over 100 years and is run by the fourth generation of the founding family, who continues to hold a controlling stake.

Finally, a micro-cap that generated a 33% compound revenue growth, offering an innovative solution that could disrupt this large (£30bn+) and conservative sector.

Let's start with the investment company. It is a US-listed stock. Below is the total return achieved by its shareholders since its IPO.

The company has a strong expertise in one specific sector. It follows four investment principles laid out by its founder.

Investment strategy

Investment strategy